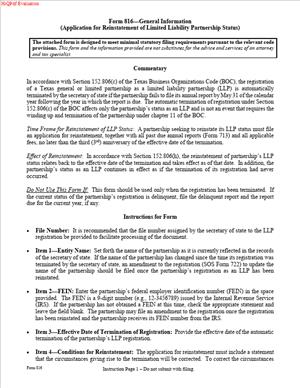

Form 816 – Application for Reinstatement of Limited Liability Partnership Status

Fill out nowJurisdiction: Country: United States | Province or State: Texas

What is a Form 816 – Application for Reinstatement of Limited Liability Partnership Status?

Form 816 is the filing you use to restore a Texas limited liability partnership (LLP) registration that has lapsed, expired, or been terminated. You submit it to the Texas Secretary of State. When accepted, the filing reinstates your partnership’s LLP status so your partners can regain the statutory liability shield going forward.

You use this form when the partnership itself is still alive, but its LLP registration is not. The LLP registration is separate from the existence of the partnership. A general partnership or a limited partnership can continue to exist even if its LLP or LLLP status ends. Reinstatement reactivates that limited liability status with the state.

Who typically uses this form

- Law firms, accounting firms, and other professional partnerships that operate as LLPs in Texas.

- Engineering, architecture, consulting, and other service partnerships that rely on the liability shield.

- Limited partnerships that previously elected limited liability limited partnership (LLLP) status and allowed it to lapse.

- Foreign LLPs that were registered to do business in Texas and lost their Texas LLP registration.

Why you might need this form

- You missed the annual renewal or a required periodic filing, and the LLP registration expired.

- You failed to maintain a registered agent and office in Texas, and the registration was terminated.

- You withdrew the LLP registration by mistake and want to correct it.

- You changed the number of partners, underpaid the required fee, and the filing office terminated the registration after notice.

- You discovered a gap in LLP status during diligence for financing, a merger, or a client RFP, and you need to restore it.

Typical usage scenarios

- Your law firm’s anniversary month passed, the renewal wasn’t filed, and the registration expired. You fix the lapse and reinstate so that partners regain liability protection.

- Your registered agent resigned. You didn’t appoint a replacement quickly, so the registration was terminated. You appoint a new agent and reinstate.

- Your limited partnership elected LLLP status two years ago. The renewal was overlooked, creating a gap. You reinstate LLLP status to align with lender requirements.

- You operate a foreign LLP that is registered in Texas. After a missed renewal, your Texas registration ended. You cure it and reinstate your authority to operate as an LLP in Texas.

Note: Reinstatement restores LLP status prospectively. It does not retroactively shield obligations incurred during the lapse. Partners may be personally liable for obligations the partnership incurred while the LLP registration was not in effect. That’s why timely reinstatement matters.

When Would You Use a Form 816 – Application for Reinstatement of Limited Liability Partnership Status?

You would use Form 816 any time your Texas LLP status is inactive, and you want it active again without forming a new entity or re-registering from scratch. For a domestic general partnership, LLP status can end if you do not file required renewals or maintain a registered agent and office. For a domestic limited partnership with LLLP status, the same concept applies. If you are a foreign LLP registered in Texas, your Texas authority can end for similar reasons.

Practical examples

- You run a five-partner boutique law firm. The partner who handled filings left. The renewal date passed. You discover the lapse when a banking partner requests a current certificate of fact. You file Form 816 to reinstate before closing on a new line of credit.

- Your engineering firm moved offices. Mail to the registered agent went undelivered. After the agent resigned, you didn’t appoint a replacement. The Secretary of State terminated the LLP registration. You engage a new agent and file Form 816 to restore the liability shield.

- Your limited partnership elected LLLP status, but after a reorganization, no one tracked the anniversary date. A surety underwriter flags the lapse while reviewing a bid bond. You reinstate LLLP status to meet bonding requirements.

- Your foreign LLP’s in-house counsel assumed Texas renewals were auto-billed. They weren’t. The Texas registration ended. You cure the cause, pay the fees, and file Form 816 to reinstate your Texas authority as an LLP.

Typical users include managing partners, firm administrators, general counsel, operations leaders, and outside corporate paralegals. In small partnerships, a partner often completes the filing. In larger firms, legal operations or compliance teams handle it. If your firm relies on insurers, lenders, or regulators who expect an active LLP status, you should use Form 816 as soon as you discover a lapse.

Legal Characteristics of the Form 816 – Application for Reinstatement of Limited Liability Partnership Status

Form 816 is a statutory filing that, when accepted by the Texas Secretary of State, restores the partnership’s registered LLP status under Texas law. It is legally binding because state law authorizes the Secretary of State to record and give legal effect to reinstatement filings that satisfy statutory requirements. The office issues evidence of filing, which is recognized by courts and third parties.

Enforceability rests on a few pillars

- Authority to file: A partner or duly authorized person signs the application on the partnership’s behalf. Texas law recognizes that a signature is the act of the partnership.

- Substantive compliance: The application confirms the facts required for reinstatement, including the partnership’s identity, the reason for termination or lapse, and that the grounds have been cured. You also provide a registered agent and office in Texas and pay applicable fees.

- Filing acceptance: When the Secretary of State accepts the filing, the reinstatement becomes effective as stated in the filing (either on filing or on a permitted delayed date). All statutory protections of LLP status resume prospectively.

General legal considerations

- Existence of the partnership: Reinstatement presumes the underlying partnership still exists. If the partnership dissolved and wound up, you generally cannot reinstate LLP status for a non-existent entity. You would instead form or re-register anew.

- Liability gap: LLP/LLLP protection does not cover obligations incurred during the lapse period. Partners risk personal liability for that window. Consider identifying the lapse dates and evaluating any contracts, debt, or claims from that period.

- Name issues: If your legal name is no longer available under Texas name rules, you may need to amend your name or adopt an assumed name for certain uses. Resolve that before or in tandem with reinstatement.

- Registered agent consent: Texas requires your registered agent to have consented to serve. You must obtain and maintain that consent with your records. You do not usually submit the consent with the filing, but you should be able to produce it if asked.

- Tax and reporting: If the Secretary of State’s records show delinquencies that legally block acceptance, you must resolve them before reinstatement. Resolve outstanding issues, then file Form 816.

- Foreign LLPs: If you are reinstating a foreign LLP’s Texas registration, ensure the home-jurisdiction entity is active and in good standing. If your home jurisdiction registration lapsed or changed, update that first.

Once reinstated, you can order evidence of status from the filing office to present to banks, clients, insurers, and counterparties. Keep that documentation in your minute book or electronic records.

How to Fill Out a Form 816 – Application for Reinstatement of Limited Liability Partnership Status

Set aside 30–45 minutes to prepare an accurate filing. You will need your partnership’s full legal name as on file, the Texas file number, current partner count for fee computation, registered agent details, and the date and cause of lapse or termination.

Step 1 — Confirm that reinstatement is the right path

- Verify that the partnership still exists. If the partnership dissolved, don’t use Form 816.

- Identify the exact date your LLP/LLLP status lapsed or was terminated and why (missed renewal, no registered agent, underpayment, or a mistaken withdrawal).

- Decide whether you need clean continuity for a lender, insurer, or regulator. If so, reinstatement is usually the fastest route.

Step 2 — Gather required information

- Legal name of the partnership exactly as it appears on prior filings.

- Texas Secretary of State file number (appears on prior registration or renewal).

- Entity type: general partnership (LLP) or limited partnership (LLLP). If you are a foreign LLP, confirm your home jurisdiction.

- Principal office address.

- Registered agent name and Texas street address. Obtain the agent’s consent to serve and retain it with your records.

- Number of partners as of the filing date. Count the partners in accordance with your partnership agreement and current records. This affects the fee.

- Date of termination or lapse and confirmation that the cause has been cured.

- Desired effective date (on filing or a delayed date within the permissible window).

Step 3 — Complete the entity identification section

- Enter the exact legal name of the partnership. Include the required designation if applicable (for example, “LLP” for a general partnership registered as an LLP; “LLLP” for a limited partnership with limited liability status).

- Add the Texas file number to reduce processing delays.

- If you are a foreign LLP, enter your home jurisdiction and the date of your original Texas registration.

Step 4 — Provide registered agent and registered office

- Appoint either a Texas resident individual or a Texas business organization authorized to serve as a registered agent.

- Enter the street address (no P.O. box) for the registered office in Texas. Ensure this location is open during normal business hours to receive service of process.

- Confirm you have the agent’s consent in your records.

Step 5 — State the number of partners and calculate fees

- Enter the number of partners as of the filing date. Use your most current partnership roster.

- Understand that the fee is calculated based on the number of partners. Include all partners if the form instructs you to do so.

- If your partner count changed during the lapse, use the present count unless the form instructs otherwise.

Step 6 — Describe the cause of termination and cure

- State the reason for losing LLP status. Keep it factual and concise: “Missed annual renewal,” “Registered agent resigned and was not replaced,” or “Withdrawal filed in error.”

- Confirm that you have cured the issue: “Renewal filed and fee paid,” “New registered agent appointed,” or “Error corrected.”

- Provide the date the LLP status terminated or lapsed, if requested.

Step 7 — Select the effective date

- Choose “upon filing” if you want protection to resume immediately on acceptance.

- If you need a coordinated effective date (for example, to align with an insurance binder or contract commencement), you can select a delayed effective date within the permitted period. Do not choose a date earlier than the filing date.

Step 8 — Review name and organizational consistency

- If your partnership changed its legal name during the lapse, make sure the name on Form 816 matches your current name on file, or file the necessary amendment first or concurrently.

- If you are a limited partnership reinstating LLLP status, confirm that your current general partner information on file is correct. If not, update it first.

Step 9 — Sign the application

- A partner or an authorized person must sign. Print the signer’s name and title (for example, “Partner,” “Managing Partner,” or “Authorized Representative”).

- Electronic signatures are acceptable if you file electronically. If filing by paper, use blue or black ink.

- By signing, you certify that the facts are true and that you are authorized to act for the partnership. False statements can carry penalties.

Step 10 — Prepare payment

- Calculate the filing fee based on the form’s instructions. Include any past-due amounts the office requires to clear the lapse.

- Pay using an accepted method. If you are expediting, include the additional expedite fee.

- If you are filing by mail or courier, include the payment instrument in the envelope with the application.

Step 11 — Attach supplemental pages if needed

- If the form’s space isn’t sufficient for your explanations (for example, a detailed cause and cure), add a separate page labeled “Attachment to Form 816 — Item [X].”

- If you are appointing a new registered agent, you do not usually attach the agent’s consent, but you must keep it in your records.

- If any organizational details have changed, consider filing the applicable amendment alongside reinstatement. Coordinate the effective dates to avoid gaps.

Step 12 — File and track

- Submit the completed Form 816 to the Texas Secretary of State with the fee.

- If using a courier, use a trackable method.

- Retain a full copy of everything you submitted, including attachments and payment proof.

Step 13 — Confirm acceptance and update stakeholders

- Obtain evidence of filing from the Secretary of State. Keep it with your partnership records.

- Notify your insurer, bank, surety, and key clients that your LLP status is active again.

- Update your website footer, engagement letters, proposals, contracts, and signature blocks to reflect the active LLP or LLLP designation.

- If you were in a bid or financing process, provide the updated evidence immediately.

Practical drafting tips

- Use exact names and addresses. Small discrepancies cause delays.

- Count partners carefully. The fee is partner-based, and undercounts can trigger rejection or later termination.

- Keep your registered agent consent form in your files. You may be asked for it later.

- If a lender or regulator is waiting, request expedited handling when available.

- If your lapse was lengthy, review your contracts for the lapse period and assess any liability exposure. Consider addenda that clarify representations going forward.

Common pitfalls to avoid

- Assuming reinstatement is retroactive. It generally isn’t. Do not promise counterparties that past actions are shielded.

- Ignoring related amendments. If you changed your name, agent, or principal address during the lapse, align those records now to avoid future rejections.

- Missing partner count changes. If new partners were admitted or others withdrew, update your count before you file. Your fee depends on it.

- Filing without curing the cause. If the underlying issue isn’t fixed (for example, no registered agent), the filing can be rejected.

What to keep after filing:

- A stamped or certified copy of Form 816 and the evidence of filing.

- The registered agent’s written consent.

- A copy of your current partnership agreement and partner roster used for the filing.

- Internal memo noting the lapse dates and any remedial steps taken (insurance, notifications, or contract updates).

If you follow these steps, you can restore your LLP or LLLP status efficiently and with minimal disruption. The key is accuracy, clear documentation, and prompt action to minimize any liability exposure from the lapse window.

Legal Terms You Might Encounter

- Limited Liability Partnership (LLP) means a partnership that has filed a registration that shields partners from certain partnership debts. When you file Form 816, you ask the state to restore that shield after it lapsed.

- Reinstatement is the process of restoring LLP status after it has terminated or expired. Form 816 is the application you use to bring the LLP status back into good standing.

- Termination (or Expiration) happens when the LLP registration ends, often because you did not renew on time. Form 816 addresses this by reactivating the registration so you can resume using LLP protections.

- State File Number is the unique identifier that the state assigned to your partnership. You list it on Form 816 to ensure the filing office updates the correct record.

- Registered Agent is the person or company that receives legal papers for your partnership. Form 816 asks you to confirm or update this if your agent has changed since termination.

- Registered Office is the street address where the registered agent accepts service. Form 816 relies on an accurate registered office, because bad addresses cause missed notices and filing rejection.

- Principal Office is your partnership’s main business address. Form 816 may request a business address for mailing or records. Use a reliable address where you can receive state mail.

- Authorized Partner is the individual who signs Form 816 on the partnership’s behalf. Your partnership agreement should identify who can bind the partnership. The state needs a valid signature to accept reinstatement.

- Effective Date is the date your reinstatement takes effect. Form 816 may allow you to choose an effective date. If not, the effective date is the date the filing office accepts the filing.

- Retroactive Effect describes whether reinstatement reaches back to the date your LLP status ended. Form 816 may allow or reflect a retroactive effect if state law provides it. Do not assume it cures liabilities from the gap unless the law clearly says so.

FAQs

Do you need to reinstate if you still operate as a partnership?

Yes, if you want the LLP liability shield back. Without an active LLP registration, partners may face broader personal liability exposure. Reinstatement restores your registration so you can operate with limited liability again.

Do you need unanimous partner consent to file Form 816?

Follow your partnership agreement for approval requirements. Many agreements authorize a managing partner or designated partner to sign state filings. The state expects the signer to have authority. Keep written approval in your records.

Do you have to clear taxes before reinstatement?

It depends on why your LLP status ended and any state compliance issues tied to your partnership. If your registration simply expired, you may only need to file the form and pay the required fees. If your entity lost privileges due to compliance issues, you may need to resolve those before the filing office accepts reinstatement.

Does reinstatement restore liability protection for the lapse period?

Do not assume it does. In some cases, reinstatement can relate back. In others, it only operates going forward. Treat the gap period as unprotected unless the law clearly provides retroactive coverage. Manage risk accordingly.

Can you change your partnership name on Form 816?

No. Reinstatement restores LLP status for the existing registered name. Name changes require a different filing. If your name is no longer available, plan an alternate name strategy before or after reinstatement, as allowed by state rules.

Can you update your registered agent or office on Form 816?

Often, yes. If Form 816 includes those fields, update them directly. If not, file a separate change of agent/office form. Your registered agent must consent to serve. Use a physical street address for the registered office.

How long does reinstatement take?

Processing times vary by workload and filing method. Expect a range from a few business days to a few weeks. You can usually request faster handling for an additional fee if the filing office offers expedited service.

What if your filing gets rejected?

You will receive a notice that explains the issue, such as a wrong fee, a missing signature, or a name conflict. Correct the error and resubmit with any required fees. Rejections delay protection, so respond quickly.

Checklist: Before, During, and After the Form 816 – Application for Reinstatement of Limited Liability Partnership Status

Before signing

- Identify your partnership’s exact legal name as last on record.

- Locate your state file number.

- Confirm the reason your LLP status ended and the termination date.

- Verify the current registered agent and registered office, or line up changes.

- Confirm the principal office and mailing address you will use.

- Check internal authority: who will sign, and what approval the agreement requires.

- Review any missed renewals or fees that might be due.

- Confirm whether you need to resolve compliance issues before filing.

- Decide on an effective date if the form allows selection.

- Prepare payment in an accepted form and the correct amount.

During signing

- Verify the legal name matches the state record character for character.

- Confirm the state file number is correct.

- Review the registered agent and registered office details for accuracy.

- Check that the principal office and mailing address are current and deliverable.

- Ensure the signer’s title and capacity match the partnership agreement.

- If choosing an effective date, confirm it meets form instructions.

- Review any statements about retroactive effect and understand their limits.

- Complete all required fields; do not leave gaps or write “N/A” where not allowed.

- Attach any required consents or additional pages the form requests.

- Sign and date in ink if paper filing; ensure electronic signature rules are met if filing electronically.

After signing

- Make a clean, legible copy for your records before submitting.

- Submit the form with the correct fee using an accepted payment method.

- If filing by mail or courier, use a trackable service and keep the receipt.

- If filing electronically, save the submission confirmation screen or email.

- Watch for acceptance or rejection notices and respond promptly.

- Once accepted, download or request the evidence of filing for your records.

- Notify your registered agent that reinstatement is complete.

- Tell your bank, insurers, landlords, key vendors, and clients that your LLP status is active again.

- Update invoices, contracts, letterhead, website, and signage to include the LLP designation.

- Calendar your next annual renewal date and set internal reminders.

- Store the stamped copy, approval evidence, and payment proof in your entity record book.

- Update any internal resolutions or meeting minutes to reflect reinstatement.

Common Mistakes to Avoid

Using the wrong entity name or file number

- Consequence: Rejection or misapplied filing. Your LLP status remains lapsed.

- Don’t forget to copy the name exactly as on record and verify the file number.

Assuming reinstatement cures the gap period

- Consequence: Unexpected personal exposure for acts during the lapse.

- Don’t rely on retroactive protection unless the law clearly provides it. Manage risk for the gap.

Submitting without a valid registered agent or address

- Consequence: Rejection or missed legal notices, which creates a serious risk.

- Don’t forget to secure agent consent and provide a real street address for the registered office.

Missing fees or wrong payment method

- Consequence: Rejection or processing delays that extend the unprotected period.

- Don’t forget to confirm the exact fee and acceptable payment types before submitting.

Having an unauthorized signer

- Consequence: Rejection and avoidable delays.

- Don’t forget to confirm the signing authority under your partnership agreement and record that approval.

What to Do After Filling Out the Form

File the form and pay the fee

- Submit Form 816 through your preferred channel with the correct fee. Keep your submission proof.

Track the filing

- Monitor confirmation from the filing office. If you receive a rejection, fix the issues and resubmit quickly.

Resolve related updates

- If you need a new registered agent or office, file the change if not included in the reinstatement.

- If your name conflicts with another on record, prepare an alternate name strategy.

Update stakeholders and documents

- Notify your bank, insurers, payroll provider, and key vendors that your LLP status is active.

- Update your contracts, proposals, and invoices to reflect the LLP designation.

- Refresh your website, signage, and letterhead to use the correct name suffix.

Revisit internal governance

- Record a resolution authorizing the filing and acknowledging acceptance.

- Update your compliance calendar with the next renewal deadline.

- Reconfirm who maintains the entity record book and state filings.

Address the lapse period

- Identify transactions and obligations during the lapse.

- Consider whether to adjust indemnities, insurance notifications, or contract amendments for that period.

Maintain good standing going forward

- Renew the LLP registration on time each year.

- Keep your registered agent and office current and monitored.

- Keep your principal office and mailing address up to date with the filing office.

- Save acceptance notices and stamped copies in a secure, organized record system.

Retain proof of reinstatement

- Keep the stamped Form 816 and any approval certificate with your permanent records.

- Provide copies to partners and key advisors so everyone operates with current information.

Review insurance and contracts

- Tell your insurer about reinstatement and confirm any coverage conditions tied to entity status.

- Review any contracts that require you to maintain LLP status and provide updated evidence if asked.

Plan for future changes

- If you expect changes to the partnership name, registered agent, or structure, map the required filings now.

- Use checklists and calendar reminders so you do not face another lapse.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.