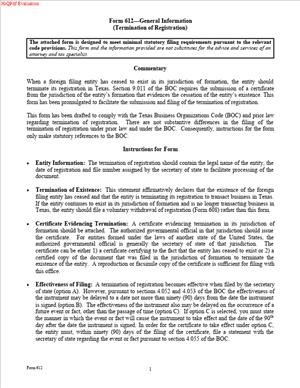

Form 612 – Termination of Registration

Fill out nowJurisdiction: Country: United States | Province/State: Texas

What is a Form 612 – Termination of Registration?

Form 612 is the filing you use to end a prior Texas registration on the public record. You submit it to the Secretary of State to formally stop an out‑of‑state business from being registered to transact business in Texas. You also use it to end certain registrations that confer status or authority, such as a registered partnership status, after you no longer need it. In plain terms, the form tells the state that your prior registration on file should no longer be active.

You typically use this form if your organization is registered in Texas to conduct business and now plans to stop doing so. The form applies when your entity already has a Texas file number and a current registration on record. If you never registered in Texas, this is not the right form. If your entity is domestic to Texas, this form is also not the same as dissolving or terminating a Texas entity. It only ends a registration that allowed you to operate in Texas based on a filing made earlier.

Business owners, in‑house counsel, and outside counsel file this form most often. Common users include out‑of‑state corporations, limited liability companies, limited partnerships, and registered partnerships that obtained authority to operate in Texas. Law firms use it in connection with mergers, exits from the state, compliance cleanups, or at the end of a finite project. Accounting teams use it to align registrations with tax and licensing needs. Operations and real estate teams may ask for it when closing a facility or ending a local footprint.

You need this form when you want to stop the legal authority that the Texas registration provides. If you continue to hold a registration, you must maintain a registered agent and meet filing and fee requirements tied to that registration. If you no longer plan to do intrastate business in Texas, keeping the registration can create needless risk and cost. Filing the form ends the authority going forward and updates the public record. It also signals that service of process should follow post‑termination rules for pre‑existing claims.

Typical usage scenario

Your Delaware company is registered in Texas to open a sales office. You are closing the office and shifting all activity out of state. You file Form 612 to end the registration, so you no longer need a Texas registered agent or ongoing corporate filings tied to that registration. Another scenario involves a registered partnership that no longer wants or needs its registered status in Texas. Filing Form 612 ends that particular registration and the benefits tied to it on a go‑forward basis.

The form is administrative, but the stakes are real. It controls whether your registration is active. Ending the registration helps keep your public profile current and prevents future compliance notices tied to an inactive Texas presence. It also helps avoid allegations that you are doing business without the correct authority by clarifying the official end date of your Texas registration.

When Would You Use a Form 612 – Termination of Registration?

You use Form 612 when your entity will no longer conduct intrastate business in Texas, and you want to surrender the Texas registration that allowed you to do so. You might also use it when a time‑bound project ends. A construction joint venture that registered to complete a Texas project is a good example. Once the project is complete and the close‑out is finished, you file the form to terminate the registration tied to that temporary activity.

Mergers and reorganizations often trigger this filing. If your registered entity merges into another entity that will not continue business in Texas, you file Form 612 to end the registration of the disappearing entity. If a different affiliate will remain in Texas, you must make sure that the affiliate holds its own registration. You use Form 612 only for the entity whose Texas registration you want to end.

Conversions and changes in structure can also prompt this filing. If you converted to a different entity type and no longer need the prior entity’s registration, you file Form 612 for the prior registration. If the converted entity will remain in Texas, you confirm that it has proper authority under its own filing. This avoids gaps in authority during or after the changeover.

Sometimes the reason is practical. You registered during market expansion but shifted strategy. You no longer solicit or fulfill Texas orders in a way that rises to transacting business in the state. You no longer keep staff, property, or a warehouse in Texas. In that case, you end the registration because the costs and duties of maintaining it no longer make sense for your footprint.

Compliance cleanup is another common situation. You discover legacy registrations for entities that no longer operate in Texas. You file Form 612 for each legacy registration to align records with reality. This helps reduce stray notices and clarifies who can accept service for old claims. It also supports clean representations during financings or a sale process.

Finally, a registered partnership may choose to end its registered status because it no longer seeks the related liability shield in Texas or has ceased operations in the state. In that case, Form 612 ends the registration so the partnership’s future Texas activities, if any, occur without that status until a new registration is filed.

Legal Characteristics of the Form 612 – Termination of Registration

Form 612 is a formal filing with the Secretary of State. It is legally binding because the filing updates the state’s official records for your entity. Once accepted, the public record reflects that your registration is no longer active. That change has legal consequences. Your authority to transact business in Texas under that registration ends as of the effective date in the accepted filing.

Enforceability comes from three mechanics. First, the Secretary of State acts as the filing office and updates the index upon acceptance. Second, the filing contains required statements from an authorized person on behalf of the entity. Third, the filing sets an effective date that controls the forward‑looking status of your registration. The Secretary of State issues evidence of filing, which you should keep with your records in case you need to show the end date.

The filing does not erase obligations or liabilities that arose before the effective date. You remain responsible for debts, contracts, and claims tied to your Texas activities while registered. Post‑termination, service of process for pre‑termination claims can still reach you under the rules that apply after a termination filing. You should provide a current mailing address in the form so notices can reach you during that period.

The filing is not a substitute for winding up a domestic Texas entity. It is also not a tax clearance request. Termination of registration affects public record status, not tax obligations. You should make sure you handle any final tax returns or reports that apply to the period you were registered. If your entity continues to have Texas‑source income after termination, other rules may still apply, separate from registration status.

Only a person with authority may sign the form. For a corporation, that is usually an officer. For an LLC, it is a manager or authorized member. For a limited partnership, it is a general partner. For a partnership with a registered status, it is a partner. The signer declares that the statements are true. False statements can carry civil or criminal consequences. The Secretary of State relies on that declaration when accepting the filing.

If you terminate but continue intrastate business in Texas, you risk penalties for doing business without registration. You may face limits on access to Texas courts until you cure the failure to register. You also put your contracts and collections at risk. For a registered partnership, ending the registration ends the associated liability shield on a going‑forward basis under Texas law. You should confirm that continued operations will not occur until you re‑register if you need that protection.

Effective date rules matter. Your termination is effective on filing unless you choose a delayed effective date. You can pick a later date to line up with a lease end, a final payroll, or the last shipment. That helps with clean cutoff points for contracts and insurance. If you need that buffer, select a delayed effective date in the form and plan accordingly. After the effective date, remove Texas addresses and agent references from your public materials.

How to Fill Out a Form 612 – Termination of Registration

Step 1: Confirm you are terminating the right thing

Make sure your entity currently has a Texas registration that you intend to end. If you formed the entity in Texas and wish to shut it down, you need a different process. If your organization never registered in Texas, do not file this form. You only use Form 612 to end a registration already on the Secretary of State’s records.

Step 2: Gather identification details

You need the exact legal name of your entity as it appears on Texas records. You also need the Texas file number assigned when you first registered. Confirm your jurisdiction of formation and current principal office address. If your name changed outside Texas, list the current true name. If your name on Texas records is different, include the Texas name as well so the filing can be matched quickly.

Step 3: Provide the registered agent and address information

List your current Texas registered agent and registered office street address as they appear on the state’s records. The form will include language ending the registration and addressing service of process after termination. You also provide a mailing address where the state can send legal notices that may arrive after the termination is effective. Use a reliable address that your organization will monitor.

Step 4: Make the required statements

The form requires you to state that the entity is terminating its Texas registration. You also state that the entity is not transacting business in Texas, or will cease before the chosen effective date. You confirm that the entity revokes the authority of its registered agent in Texas as of the effective date. You must agree that service for pre‑termination claims can be forwarded to your designated mailing address. Keep these statements concise and accurate. They are part of what makes the filing enforceable.

Step 5: Choose the effective date

Decide whether the termination should be effective on filing or on a later date. An immediate effective date works if operations have already ended. If you need a buffer to finish open orders or vacate a premises, choose a delayed effective date. The delay cannot be indefinite. Pick a date that aligns with your final Texas activity and your internal closeout plan. Note the effective date clearly in the form.

Step 6: Handle tax and account wrap‑up in parallel

The form itself does not close your tax accounts. Close or update state tax and employer accounts tied to your Texas operations. File any final returns for periods in which you were registered. Cancel or update permits and licenses that list your Texas presence. Do not rely on the termination filing to do this for you. These steps help avoid later notices or assessments after your registration ends.

Step 7: Complete the execution block

Have an authorized person sign the form. For a corporation, an officer signs. For an LLC, a manager or authorized member signs. For a limited partnership, a general partner signs. For a registered partnership, a partner signs. Type or print the signer’s name and title, and date the signature. Make sure the signer understands the statements in the form. Some submission methods allow electronic signatures. If you sign electronically, follow the instructions for that method.

Step 8: Add any necessary explanations

Most terminations do not need attachments. If your effective date is tied to a future date, you will list that date in the form. If any name or identification detail may cause confusion, include a short statement that connects your current name to the name on Texas records. Keep any internal resolutions or approvals in your minute book. You do not need to attach them unless you want them on record.

Step 9: Submit the filing and pay the fee

File the signed form with the Secretary of State. You can submit by the available methods offered by the filing office. Include the filing fee. If you need faster processing, request expedited handling when you submit and pay the extra fee. Provide a return email address or mailing address for the evidence of filing. Keep a copy of what you submitted, the payment proof, and the acknowledgement you received.

Step 10: Confirm acceptance and update third parties

Watch for the filing acknowledgement. Check the effective date to confirm it matches your selection. Once accepted, tell key parties that your Texas registration ended. Notify insurers, banks, contract counterparties, and landlords as needed. Update your website, invoices, and letterhead to remove Texas registered agent details. If you maintain a compliance calendar, remove future reminders tied to the ended registration.

Practical examples

A software company registered in Texas to support a regional sales team. It is now centralized from another state. You choose a delayed effective date that matches the office lease end. You file Form 612, close tax accounts for the final period, and keep the filing evidence. The company’s Texas registration ends on the chosen date.

A construction partnership registered to complete a highway project. The project closeout is done, and warranties are handled by a different entity. The partnership files Form 612 to end its registered status. It lists a corporate parent’s legal department as the mailing address for post‑termination notices. The partners keep a copy of the filed form with the project records.

A private equity fund merged a portfolio company into a parent entity. The disappearing entity still shows an active Texas registration. You file Form 612 to terminate that registration. You align the effective date with the merger closing date to keep the record consistent. You then confirm the surviving entity holds the proper Texas authority before any new Texas activity.

Common pitfalls to avoid

Do not file the termination before you finish activities that require authority. If you will still have employees, property, or contract performance in Texas after the effective date, adjust the date. Do not assume the filing cancels permits or licenses. Close those accounts separately. Do not leave the mailing address blank or outdated. If you move after termination, arrange mail forwarding or designate a stable address. Do not let an unauthorized person sign. If needed, adopt a simple internal resolution to delegate signature authority and keep it on file.

Records to keep

Save a conformed copy of the accepted filing with the acknowledgement page. Keep proof of submission and payment. Retain any internal approvals. Keep copies of the last filed reports and any final tax filings for the period you were registered. Store this packet with your corporate records. It will help if questions arise later, especially during due diligence or audits.

By following these steps and using accurate information, you can terminate your Texas registration cleanly. You reduce ongoing compliance obligations and keep the public record current. You also set a clear line between past Texas activity and any future plans. If you later return to the Texas market, you can register again under the appropriate filing for your entity.

Legal Terms You Might Encounter

You will see a foreign filing entity on this form. That means an entity formed outside Texas that registered to do business here. Registration is the authority that lets a foreign entity lawfully operate in Texas. Termination of registration ends that authority because the entity ended, merged, or converted. Jurisdiction of formation is the state or country where the entity was originally created. A merger is when two or more entities combine, and one survives. The surviving entity is the company that remains after the merger. Conversion is when an entity changes its type or its home jurisdiction. A registered agent is the person or company designated to receive lawsuits and official notices. Registered office is the Texas street address where the agent accepts those documents. The file number is the unique number assigned to your registration by the filing office. The effective date is when the termination takes effect, which may be the event date or a later permitted date. An authorized person is someone with legal authority to sign, such as an officer, manager, partner, or fiduciary. Evidence of an event means acceptable proof that the foreign entity ended, merged, or converted in its home jurisdiction. Winding up is the process of closing affairs after the entity ends. It includes collecting assets and paying debts, not new business. Service of process refers to how lawsuits can still be delivered for past activities. You may still receive service after termination for pre‑termination acts.

FAQs

Do you use this form or a withdrawal form?

Use this form when the foreign entity no longer exists in its home jurisdiction, or it merged or converted. Use a withdrawal form when the foreign entity still exists but will stop doing business in Texas. When in doubt, confirm what happened to the entity in its home records.

Do you need a tax clearance to file?

A termination due to ending, merger, or conversion generally does not require a Texas tax clearance. You may still owe taxes through the event date. A withdrawal filing commonly needs clearance. Check your facts and speak with your tax advisor. File all final reports as required.

Can you set a delayed effective date?

You can usually request a future effective date if the form allows it. A delayed date can help align with accounting cutoffs. If your merger or conversion already took effect, use that actual date. Do not pick a date that conflicts with the underlying event.

What supporting documents should you include?

Include evidence that the foreign entity ended, merged, or converted in its home jurisdiction. Examples include a certified termination, merger, or conversion filing. A certified or file‑stamped copy is commonly acceptable. If your entity merged, identify the surviving entity. If it converted, state the new entity type or jurisdiction.

Who can sign the form?

An authorized person must sign. That can be an officer, manager, general partner, or fiduciary. If the entity no longer exists, a liquidator or the surviving entity’s officer can often sign. The signer must know the facts and certify accuracy. Use the title that reflects the authority.

What happens to assumed names?

Assumed name filings tied to the terminated registration stop covering the foreign entity. If the surviving or converted entity will continue using a name in Texas, it must file its own assumed name. Do not rely on the old filing after termination.

What if the entity still has lawsuits or debts?

Termination does not erase liabilities. Claims for pre‑termination acts can continue. Service can often be made through the last registered agent for a limited period. It can also be delivered through the filing office in some cases. Keep a plan to handle claims after termination.

How long does processing take, and can you expedite?

Processing time varies with volume and filing method. You can usually request expedited review for an additional fee. Expedited service shortens review time, not mailing time. Track your filing and keep proof of submission. Allow extra time if you include attachments.

Can you undo a termination if you change your mind?

You cannot undo an accepted termination of registration. If you need to operate in Texas again, file a new foreign registration. Confirm name availability before you apply. Do not continue business in Texas without a valid registration.

Checklist: Before, During, and After the Form 612 – Termination of Registration

Before signing

- Confirm what happened to the entity: ended, merged, or converted.

- Identify the exact event date, as shown in home records.

- Gather the legal name of the foreign entity, exactly as formed.

- Confirm the Texas file number tied to the registration.

- Confirm the home jurisdiction (state or country) of formation.

- Gather the surviving entity’s name and jurisdiction, if merged.

- Gather the converted entity’s new type or jurisdiction, if converted.

- Obtain evidence of the event from the home jurisdiction.

- Choose the effective date you intend to use.

- Select the authorized signer and confirm their title and authority.

- Decide the preferred filing method and processing speed.

- Prepare a payment method for the filing fee.

- Set a plan to notify the registered agent after acceptance.

- List any assumed names to address post‑filing.

During signing

- Verify the entity name is spelled exactly as on formation records.

- Confirm the Texas file number matches the registration.

- Select the correct reason: ended, merged, or converted.

- Enter the accurate event date from the home filing.

- Provide the surviving entity details if a merger occurred.

- Provide the converted entity details if a conversion occurred.

- Add a delayed effective date only if appropriate.

- Complete the address for return correspondence.

- Confirm the email or phone for questions, if requested.

- Ensure the signature is original if filing on paper.

- Include the printed name and title of the signer.

- Attach certified evidence of the event.

- Check that all pages and exhibits are included.

- Review the fee and include the correct payment.

- Make a clean copy for your records before submitting.

After signing

- File the form with the filing office using your chosen method.

- Keep proof of submission and any tracking number.

- Monitor status until you receive an acceptance or a rejection notice.

- If rejected, correct the issue and refile promptly.

- After acceptance, stop using the Texas registration immediately.

- Notify your registered agent to close the engagement.

- Notify banks, insurers, customers, and vendors as needed.

- Close local permits, licenses, and tax accounts tied to Texas.

- Address final tax filings and payments, if any, through the event date.

- Update assumed names if a successor will continue operating in Texas.

- Store the filed document and evidence with your minute book.

- Update internal systems and compliance calendars to reflect termination.

Common Mistakes to Avoid

Filing the wrong form

- Mistake: You file a termination when the entity still exists and will simply leave Texas.

- Consequence: Rejection, or worse, a gap in compliance.

- Tip: Use termination only for ending, merger, or conversion. Use withdrawal for leaving while active.

Missing or unacceptable evidence

- Mistake: You do not include proof of the event from the home jurisdiction.

- Consequence: Rejection or costly delays.

- Tip: Include certified or file‑stamped evidence that matches your stated event.

Wrong entity name or file number

- Mistake: The name or number does not match state records.

- Consequence: Rejection or misapplied filing.

- Tip: Confirm the exact legal name and correct Texas file number before you sign.

Unauthorized signature

- Mistake: A person without proper authority signs the form.

- Consequence: Rejection and possible internal liability.

- Tip: Use an officer, manager, general partner, fiduciary, or surviving entity officer as appropriate.

Ignoring open obligations

- Mistake: You file but ignore taxes, contracts, or permits tied to Texas.

- Consequence: Penalties, collections, or litigation post‑termination.

- Tip: Close accounts, settle taxes, and notify counterparties promptly.

What to Do After Filling Out the Form

Submit the filing

- File the completed form with the required fee. Choose standard or expedited review. Keep a copy of the signed form, payment proof, and all attachments. Record the date and method of delivery.

Track the status

- Watch for an acceptance or a rejection note. If rejected, fix the stated issue and refile. Respond quickly to avoid lapse risks. Save the final stamped copy for your files.

Cease activities requiring registration

- Stop transacting business in Texas under the terminated registration. Do not sign new contracts that require a valid registration. If a successor will operate, ensure it has authority in place before acting.

Notify your registered agent

- Inform the agent that the registration ended. Confirm how they will handle any late‑arriving service. Keep an updated address for future legal notices tied to past acts.

Close related accounts and permits

- Cancel Texas permits, licenses, and local registrations tied to the entity. Close sales tax, employer, and other state or local accounts, as applicable. Confirm final filings and dates to avoid penalties.

Settle contracts and obligations

- Notify landlords, lenders, vendors, and customers. Assign or wind down contracts tied to Texas operations. Secure releases or amendments where needed.

Address taxes and reports

- File final returns as required. Pay amounts due through the effective date. Coordinate with your accounting team to align books and records.

Handle assumed names

- If the successor will continue business in Texas, file any needed assumed name for the successor. Do not rely on the old filings tied to the terminated registration.

Manage ongoing disputes and claims

- Keep a plan for existing or potential claims. Identify who will accept service after termination. Maintain insurance if claims exposure remains.

Update internal records

- Store the filed termination, evidence of the event, and proof of acceptance. Update compliance calendars and internal databases. Keep records under your retention policy.

Plan for future operations

- If you later need Texas authority, file a new foreign registration. Check name availability before applying. Do not conduct business in Texas until approved.

Prepare for audits or due diligence

- Keep a clean file with the form, evidence, approval, and notices. Document how you handled taxes, contracts, and accounts. This file simplifies audits and transaction diligence.

Seal communication gaps

- Inform internal teams about the termination date and impact. Sales, finance, and legal should know not to use the old registration. Provide a point of contact for any post‑termination issues.

Finalize banking and insurance steps

- Update banks and insurers with the termination status. Adjust authorized signers and addresses if a successor will continue operations. Confirm policy coverage for tail risks.

Confirm data and privacy issues

- Review how customer and employee data will be stored or transferred. Follow your policies and any applicable requirements when you wind down systems.

Prepare a brief summary memo

- Draft a one‑page memo noting the event, effective date, and key actions taken. Share it with leadership and auditors. File it with the termination documents.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.