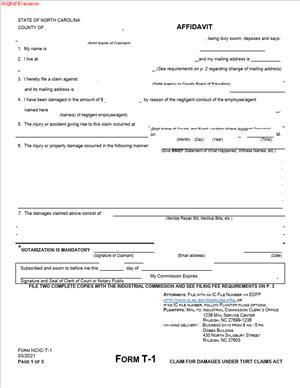

Form T-1 Affidavit (North Carolina)

Fill out nowJurisdiction: Country: United States | Province or State: North Carolina

What is a Form T-1 Affidavit (North Carolina)?

A Form T-1 Affidavit is a sworn statement used in North Carolina real estate closings. You sign it at or near closing to confirm key facts about the property. Title insurers and closing attorneys rely on it to issue title insurance and finalize the transaction. You make statements about ownership, occupancy, recent repairs, unpaid work, liens, judgments, taxes, and other risks that could affect title.

You will usually see a T-1 when you sell or refinance real property in North Carolina. Sellers, owners, and borrowers sign it. In most deals, the closing attorney acts as the title agent and requires the T-1 before issuing policies. The form helps the title insurer remove or limit exceptions in the policy. It can also provide “gap” coverage assurances between the last title update and the moment the deed or deed of trust records.

You need this form because the title insurer must gauge risk. Public records alone may not show recent repairs, unfiled liens, or people in possession. Your statements fill that gap. If you have done work on the property, the insurer needs to confirm whether anyone remains unpaid. If tenants occupy the property, the insurer wants to know their rights. If you face judgments or bankruptcy, that also matters. The T-1 packages these facts in a sworn affidavit so the insurer can safely insure title.

Typical usage:

- A seller affirming there are no unpaid contractors within the recent period. You also confirm no one else claims rights to the property. You state your correct legal name and marital status. You identify whether you have filed bankruptcy or face any suits. You confirm taxes, assessments, and association dues status. If something exists, you disclose it so the attorney can address it before closing. If you disclose unpaid work, the closing may require lien waivers or holdbacks. If you disclose tenants, the policy may include an exception unless the lease is addressed.

You may see slight variations of the T-1 depending on the title company or attorney. The core content remains similar. It targets the same risks and serves the same purpose. It sits in the closing file. It is not usually recorded. The form protects title insurers and lenders. It also protects buyers by making sure hidden risks are examined and resolved before closing.

When Would You Use a Form T-1 Affidavit (North Carolina)?

You use the T-1 when you sell or refinance a home or commercial property in North Carolina. If you are the seller, you sign it to help the buyer receive an owner’s policy. If you are the borrower in a refinance, you sign it so the lender receives a loan policy and the attorney can disburse funds. If you own land held by an entity, the entity’s authorized signer completes it.

Here are common situations. You sell your home, and the buyer’s title policy needs to omit mechanics’ lien risks. You sign the T-1 to state there is no recent unpaid work. You also confirm no one else lives there with rights that could survive the sale. The closing attorney uses your statements to finalize the title commitment. If work was done, you disclose it and provide receipts or lien waivers.

You refinance a rental duplex. The lender’s title policy requires confirmation of tenant rights and improvements. You sign the T-1, list tenants, and disclose any work. The attorney may gather estoppels or address the leases. The title policy may include a tenants’ rights exception if not curable.

You own a vacant parcel through an LLC. You sign the T-1 as manager of the LLC. You confirm there is no construction underway and no unpaid contractors. You also confirm no option holders or unrecorded contracts. The attorney attaches the legal description as an exhibit and issues the policy at funding.

You are an estate executor selling a decedent’s home. You sign the T-1 in your fiduciary capacity. You confirm the estate has not authorized any new work. You disclose known claims or suits against the estate. The title company relies on your statements and probate documents to insure the sale.

In all these cases, you use the T-1 because records do not capture recent, unrecorded risks. The affidavit answers those questions. It lets the attorney close on time, record documents, and issue coverage without unnecessary exceptions.

Legal Characteristics of the Form T-1 Affidavit (North Carolina)

The T-1 is a sworn affidavit. You sign it under oath before a notary. That gives it legal weight. False statements can have serious consequences. You can face civil liability for losses caused by false or incomplete information. You can also face criminal penalties for perjury. The form often includes an indemnity agreement. That means you agree to reimburse the title company or closing attorney for losses they suffer because they relied on your statements. This contractual promise is enforceable.

Enforceability rests on several features. You sign voluntarily with knowledge of its purpose. Your signature is acknowledged by a notary. The title insurer issues a policy in reliance on your sworn statements. That reliance is part of the closing consideration. The form’s language usually includes representations, warranties, and indemnities. These obligations survive closing. The title company can pursue you if a later claim ties back to a false statement or a concealed risk.

The T-1 is not a deed or a mortgage. It does not transfer title or create a lien by itself. It supports underwriting and risk allocation. It can affect the coverage granted in the title policy. If you disclose a risk, the insurer may require a fix or list an exception. If you deny a risk, and that denial proves false, the insurer may pay the claim then seek repayment from you. Courts take sworn affidavits and indemnities seriously, especially when a party relied on them to complete a transaction.

You should complete the T-1 with care. Read each statement. Do not guess. If you are unsure, pause and ask the closing attorney. Provide documents when requested. Do not strike out statements without approval. If a statement does not apply, write “N/A” clearly. Do not leave blanks. Use your legal name as it appears on your ID and deed. If you sign for an entity, include your title and authority. The notary must witness you sign and complete the acknowledgment.

How to Fill Out a Form T-1 Affidavit (North Carolina)

Follow these steps to complete the T-1 accurately and efficiently.

1) Gather your documents.

- Get your current deed or prior title policy. This helps with your legal name and legal description.

- Collect contractor invoices, receipts, and lien waivers for any recent work.

- Pull payoff statements for any mortgages or home equity lines.

- Have HOA statements or contact details.

- Bring your government-issued photo ID.

- If signing for an entity, bring operating agreements and resolutions.

- If signing as executor or trustee, bring letters or a certificate of trust.

2) Complete the header and property identification.

- Enter the county where the property sits. Use the correct North Carolina county.

- Include the property address. Write it exactly as used for mail.

- Add the title commitment number if the attorney provides one.

- Insert the parcel or tax ID if requested. You can find it on tax bills.

- Attach the full legal description as Exhibit A if the form calls for it.

3) Identify yourself and your capacity.

- Write your full legal name. Match your ID and deed.

- State your marital status. Include spouse’s name if married.

- If you own with your spouse, both of you usually sign.

- If an entity owns the property, write the entity’s full name. Then add your title, like “Manager” or “President.”

- If a trust owns the property, write the trust name and your role as trustee.

4) Confirm your ownership and authority.

- Affirm that you own the property and have the right to sign.

- If others hold interests, list them or have them sign as co-affiants.

- If you sign under a power of attorney, attach a copy. The POA may need recording.

5) Address occupancy and possession.

- State whether you occupy the property. If not, identify who does.

- If tenants occupy, list names or attach a rent roll. Include lease dates if requested.

- Note any parties with unrecorded rights, like options or contract buyers. Attach copies if any exist.

6) Disclose recent work, repairs, or improvements.

- State whether anyone provided labor or materials recently.

- If yes, list the contractor names and dates. Attach invoices and lien waivers.

- Confirm whether all parties are fully paid. If not, disclose unpaid amounts.

- If work is ongoing, state that. The attorney may require a holdback or waivers.

7) Confirm taxes, assessments, and HOA dues.

- State whether property taxes are paid through the current period.

- Disclose any special assessments you know about.

- Identify the HOA or POA and the status of dues. Provide contact details if asked.

8) Address liens, judgments, and lawsuits.

- State whether you have filed bankruptcy or have any pending case.

- Disclose any judgments against you or your entity.

- Disclose liens you know about, recorded or unrecorded. Include municipal liens or code fines if known.

- If the attorney already has payoff letters, reference them.

9) Identify mortgages and payoffs.

- List current lenders with loan numbers if requested.

- Confirm any home equity lines. Note whether they are open or closed.

- Match payoff statements to the listed loans. Provide contact details if missing.

10) Acknowledge the gap period and recording.

- Confirm you will not create new liens or encumbrances before recording.

- Agree that no new work will be started before closing.

- Agree to notify the attorney if anything changes before funds disburse.

11) Review indemnity and hold harmless language.

- Read the indemnity carefully. You agree to repay losses caused by false statements or omissions.

- Ask questions if you do not understand any clause.

- Do not sign if information is incomplete. Resolve open items first.

12) Add exhibits and schedules.

- Attach Exhibit A with the legal description if required.

- Attach a tenant schedule if there are leases.

- Attach contractor lists, invoices, and lien waivers if work occurred.

- Attach entity authority documents, POA, or fiduciary letters, as needed.

- Label each exhibit clearly and reference it in the form.

13) Fill dates and notary venue.

- Enter the date you sign. Do not predate or postdate.

- Confirm the notary acknowledgment lists the correct county and state.

- If signing in a different state, use that venue on the notary block.

14) Sign in front of the notary.

- Sign your name exactly as printed in the form.

- Initial any corrections. Do not use white-out.

- Each affiant must appear before the notary. Spouses must sign as required.

- The notary completes the acknowledgment and affixes the seal.

15) Return the affidavit to the closing attorney.

- Give the signed original to the attorney or closer.

- Keep a copy for your records.

- Do not share personal data beyond the closing team.

16) What to do if something changes before closing.

- Contact the attorney at once. Do not wait until the table.

- Provide updated information or documents.

- Be prepared to sign a new T-1 if the closing date moves.

17) Special instructions for entities and trusts.

- Entities: Sign with your title and the entity’s full name. Example: “ABC, LLC, by Jane Smith, Manager.”

- Trusts: Sign as trustee and include a short form certificate of trust if requested.

- Estates: Sign with your fiduciary title and attach letters of authority.

18) Remote or in-person notarization.

- Follow the closing attorney’s instructions on notarization method.

- If remote notarization is allowed and arranged, use the approved platform.

- If not, plan an in-person signing with a North Carolina notary or as directed.

19) Avoid common mistakes.

- Do not leave blanks. Use “N/A” where something does not apply.

- Do not guess. If unsure, ask the closing attorney for guidance.

- Do not omit tenants or recent work, even if minor.

- Do not forget spouses or co-owners. They usually must sign.

- Do not mismatch names. Use the same spelling across the form and ID.

20) Understand how disclosures affect closing.

- Honest disclosures allow the attorney to fix issues. That keeps the deal on track.

- You might need lien waivers, payoffs, or small holdbacks.

- The title commitment may change. Some exceptions may remain if an issue cannot be cured.

21) After closing.

- The T-1 stays in the file. It is not usually recorded.

- Your indemnity and representations continue after closing.

- If a claim arises due to a covered issue, the insurer may contact you.

By following these steps, you complete the T-1 correctly and reduce delays. Be direct and complete with your answers. Bring supporting documents. Sign in front of a notary. If you have a unique situation, raise it early so the attorney can handle it. This approach protects you, the buyer or lender, and the title company, and helps the closing proceed smoothly.

Legal Terms You Might Encounter

- Affiant: You are the affiant. That means you are the person making the sworn statement on the Form T-1 Affidavit. When you sign, you confirm the facts are true based on your personal knowledge or review of records you rely on.

- Oath or affirmation: You must swear or affirm that your statements are true. An oath refers to a religious or solemn promise; an affirmation is a non-religious promise. Either works. On this form, you will take an oath or affirmation in front of a notary.

- Jurat: The jurat is the notary block that states when and where you appeared, that you swore or affirmed, and that you signed in the notary’s presence. The Form T-1 Affidavit will have a jurat that the notary completes. Do not fill out the notary’s section yourself.

- Venue: The venue shows the state and county where you sign. The jurat usually begins with the venue. On the Form T-1 Affidavit, make sure the county shown is the county where you actually appear before the notary.

- Personal knowledge: Personal knowledge means you know the facts because you saw, did, or directly managed them. If you rely on business records or files you maintain, say so clearly. On this form, avoid guessing. State only what you know or can confirm with records.

- Capacity or authority: Capacity is the role in which you sign, such as individual, manager, officer, or attorney-in-fact. If you sign for a company or someone else under power of attorney, the Form T-1 Affidavit should show your capacity. Add your title next to your name and attach proof if needed.

- Exhibit or attachment: Exhibits are documents you attach to support your statements, like a deed, contract, letter, or timeline. When the Form T-1 Affidavit references an exhibit, label it clearly (Exhibit A, Exhibit B) and mark each page. Refer to the exhibit by label in the text.

- Legal description: A legal description is a precise property description beyond a street address. If your Form T-1 Affidavit involves real property, you may need the full legal description (metes and bounds, lot and block, or other recorded description). Copy it exactly from the prior deed or survey.

- Acknowledgment vs. verification: Some forms use an acknowledgment (you confirm you signed) while others require a verification or jurat (you swear the contents are true). The Form T-1 Affidavit uses a sworn statement, so expect a jurat or verification. Follow the notary’s instructions.

- Perjury: Perjury is knowingly making a false statement under oath. It can lead to penalties and harm your case or transaction. When you sign the Form T-1 Affidavit, you confirm the facts are true to the best of your knowledge. Review every line before you swear.

FAQs

Do you have to sign the Form T-1 Affidavit in front of a notary?

Yes. You must appear in person (or by an approved remote process if allowed) before a notary. Bring a government-issued photo ID. The notary watches you sign and completes the jurat. Do not sign in advance.

Do you need witnesses in addition to the notary?

Usually, no. A notary’s jurat is enough. If the instructions for your situation require witnesses, follow them. Do not add extra witness lines unless the instructions tell you to.

Do you need to attach supporting documents?

Attach only what the form or instructions require, or what is needed to support key statements. Label each exhibit (Exhibit A, B, C). Reference each exhibit in the affidavit text. If you refer to a document but do not attach it, explain where it is recorded or stored.

Can you correct a mistake after you signed?

If the mistake is minor and you catch it at the notary table, correct it before you sign, then initial near the change. If you discover an error after notarization, prepare a corrected or supplemental affidavit. Sign and notarize it again. If you already filed the original, file or record the correction as directed and reference the earlier affidavit.

Do you need the original with wet ink?

If you will file or record the affidavit, plan to submit a signed, notarized original with wet ink. Some offices accept electronic notarization and e-filing if allowed. If you are unsure, prepare both a wet-ink original and a high-quality scan.

What if you do not know an exact date or figure?

Use only facts you can support. If you must estimate, say “on or about” with a reasonable window, or “to the best of my knowledge.” If the form requires exact dates or amounts, pause and confirm the data from records before signing.

Can you sign for a company or another person?

Yes, if you have authority. Use your title if you sign for a company (for example, “Manager,” “President”). If you sign under a power of attorney, write “Attorney-in-Fact for [Name]” and attach the power of attorney or have it available. Make sure the authority covers the statements you make.

Where do you file or record the Form T-1 Affidavit?

Follow the instructions on your version of the form. Affidavits tied to property often get recorded with a local recording office. Affidavits tied to a case may be filed with the court clerk. If the form is requested by a lender, title professional, or agency, return it as directed by them.

How many copies should you keep?

Make at least two copies after notarization—one for your records and one for the party who asked for the affidavit. If you file or record, request a stamped or certified copy for your files.

Checklist: Before, During, and After the Form T-1 Affidavit (North Carolina)

Before signing: Information and documents you may need

- Your full legal name and address as they appear on your ID.

- Names, addresses, and roles of other involved parties.

- Dates and timelines of relevant events.

- Property details, including the full legal description if property is involved.

- Case numbers, instrument numbers, or file references, if any.

- Supporting documents: deeds, contracts, letters, emails, invoices, or logs.

- Authority documents: corporate resolutions, titles, or power of attorney.

- Contact details for the recipient, filing office, or recording office.

- A government-issued photo ID that matches the name on the affidavit.

- A notary appointment, including time buffer to review the form.

- Payment method for any filing or recording fees.

- A plan for exhibits: labels, page numbers, and cross-references in the text.

During signing: Sections to verify

- Caption or title: Confirm the form title is “Form T-1 Affidavit” and your version matches the request.

- Venue: Verify the correct county and state in the notary jurat.

- Affiant name: Ensure your name matches your ID and your role is shown.

- Facts: Confirm every date, amount, address, and name. Avoid vague language.

- Exhibits: Check each label (Exhibit A, B, C) and reference them in the text.

- Cross-outs: Make corrections before you sign. Initial any minor edits near the change.

- Blank fields: Do not leave blanks. Write “N/A” where a question does not apply.

- Notary block: Leave the notary section for the notary. Do not pre-fill the jurat.

- Signature: Sign in the notary’s presence, using the same name format shown above your signature line.

- Initials: If the form has initial lines on each page, initial them as you review.

- Date: Use the date you sign before the notary, not a prior date.

- Copies: Check the scan quality after notarization if you will e-file or email.

After signing: Filing, notifying, and storing

- Filing or recording: Submit the original to the office or recipient named in your instructions. Pay any fee and request a receipt.

- Proof of submission: Ask for a stamped or certified copy if available. Save the receipt or confirmation number.

- Distribution: Send copies to any party who requested or relies on the affidavit. Include exhibits if they are part of the submission.

- Calendar follow-ups: Note any deadlines tied to the affidavit, such as response dates or closing milestones.

- Secure storage: Store the original or certified copy in a safe place with your related documents. Keep digital copies in a secure, searchable folder.

- Corrections: If you discover an error later, prepare a corrected or supplemental affidavit. Sign and notarize it, then file or record it as instructed.

- Related tasks: If the affidavit affects a transaction (such as a closing or claim), confirm next steps with the parties involved so they can proceed.

Common Mistakes to Avoid

- Leaving blanks or vague statements: Don’t leave fields empty or use unclear terms like “various” or “sometime last year.” Blanks can cause rejection. Vague statements invite disputes or requests for clarification.

- Signing outside a notary’s presence: Don’t sign before you meet the notary. If you do, you will likely need to redo the form. A notary must witness your signature and administer the oath or affirmation.

- Mismatched names or capacity: Don’t use a nickname or omit your title if you sign for a company. Mismatched names or missing capacity can lead to rejection or questions about your authority.

- Missing or mislabeled exhibits: Don’t reference a “contract” or “deed” without attaching it if the form expects an exhibit. Missing exhibits can delay filings, closings, or approvals.

- Incorrect venue, date, or county: Don’t let the jurat list the wrong county or date. An incorrect venue or date can cause recording or filing problems, leading to resubmission.

- Using white-out or heavy edits: Don’t use correction fluid or make messy changes. Strikethrough, clean replacement text, and initials are better. If the error is significant, reprint a clean page.

- Overstating facts or including hearsay: Don’t guess or quote others as fact. If you rely on records, say so. False or unsupported statements can trigger penalties and harm your position.

What to Do After Filling Out the Form

- Confirm where to deliver it. Check your instructions for filing or recording. If the affidavit supports a property record, you may need to record it with a local recording office. If it supports a case or administrative process, file it with the clerk or agency named in your instructions. If a private party requested it, return it directly to them.

- File or record the original. Submit the signed, notarized original. Pay any fee. Ask for a stamped or certified copy. If e-filing is allowed and you choose it, keep the digital confirmation.

- Notify affected parties. Send copies to the person or office that requested the affidavit, and to any other party who needs it to act. For transactions, that may include counterparties or professionals involved in the process.

- Track the impact. If the affidavit is part of a closing, claim, or compliance step, confirm that the next step proceeds after filing. Update any checklists tied to your deal or case.

- Store your documents. Keep the original or a certified copy with your related records. Retain proof of filing or recording. Save a digital scan for quick reference. Use consistent file names so you can find it later.

- Plan for corrections, if needed. If you discover an error, prepare a corrected or supplemental affidavit. Reference the original by date, title, and any file or recording number. Sign and notarize again. File or record the correction in the same place and notify the same parties.

- Monitor deadlines. If the affidavit triggers deadlines—such as a response or objection period—calendar those dates. Check for confirmations or objections and respond on time.

- Maintain consistency. If you use the same facts in other documents, keep the information consistent. Use the same names, dates, and property description to avoid conflicts.

- Prepare for future updates. If facts change, prepare a new affidavit that explains what changed and why. Sign and notarize it. File or record it, and distribute it to the same parties who received the original.

- Stay organized. Create a simple index of what you filed, when, and where, including receipt numbers. You will save time if you need to retrieve the affidavit later.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.