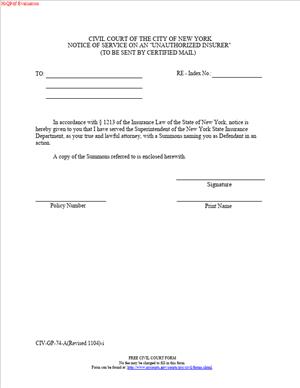

CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

Fill out nowJurisdiction: Country: United States | Province or State: New York

What is a CIV-GP-74-A – Notice of Service on an Unauthorized Insurer?

This is an official Civil Court of the City of New York form. You use it when you sue an insurer that is not authorized to do business in New York. The law lets you start your case even if the insurer has no New York office or agent. But you must follow special service steps. This form is one of those steps. It tells the insurer that you served the case through the state’s designated insurance authority. It also lists what you served and when. You then mail this notice and a copy of the legal papers to the insurer’s main address. You keep the proof for the court.

Think of it as a formal notice letter with a fixed format. It is not a complaint. It is not a summons. It is part of your service of process package. It shows the court that you gave the insurer real notice. It helps you prove jurisdiction. It helps you protect against any default judgment later.

Who typically uses this form?

Plaintiffs in Civil Court. That includes self-represented individuals and attorneys. You might be a policyholder suing for unpaid benefits. You might be a small business suing for covered losses. You might be a provider suing as an assignee. You might be a subrogating party that paid a claim and seeks recovery. You could also be a third party with a direct claim after judgment, where direct action is allowed. In each case, you believe the insurer is not authorized in New York. Yet the insurer wrote or delivered a policy covering risks here. Or it solicited business here. The court allows service through the insurance regulator in those cases. This form completes the notice portion of that service.

Why would you need this form?

Because serving an out-of-state or foreign insurer is different. If the insurer lacks a New York agent, normal personal service may fail. New York procedure supplies a substitute. You deliver your summons and pleadings to the state insurance authority. Then you must mail this notice and a copy of the papers to the insurer. The notice satisfies due process. It warns the insurer that a New York case is underway. It tells them how you served. It directs them to respond in the Civil Court.

Typical usage scenarios include these. Your apartment suffered water damage. Your surplus lines carrier denied coverage. You sue in Civil Court for the loss. The carrier has no New York agent. You serve the regulator and mail this notice to the carrier’s headquarters. Or your small store lost inventory in a storm. The non-admitted property insurer did not pay. You file in Civil Court. You serve the regulator. You mail this notice and papers to the insurer’s main office overseas. Or a health provider has an assignment of benefits. The insurer is not authorized here. The provider sues for the bill. The provider follows the same service path and sends this notice.

In short, this form memorializes that you gave the insurer notice after service through the state. It is mandatory when the defendant insurer is unauthorized. It supports your proof of service and compliance.

When Would You Use a CIV-GP-74-A – Notice of Service on an Unauthorized Insurer?

You use this form after you deliver your summons and complaint to the state’s insurance authority. That delivery is your initial service. You use this form to notify the insurer itself. You send it with a copy of the papers you served. You use registered or certified mail. You send it to the insurer’s last known principal place of business. You then track delivery. You will later file proof of your mailing and delivery with the court.

Here are practical situations where you would use it. You are a tenant with a renters policy dispute. The carrier operates out of another state and is not licensed in New York. You serve through the insurance authority. Then you complete and mail this notice to the insurer. Or you are a contractor with a claim under a liability policy. The insurer is a non-admitted surplus lines company. You sue in the Civil Court because the damages fall within its limit. You serve the regulator. You send this notice to the insurer’s home office. Or you are a small importer. Your cargo insurance carrier sits abroad. It wrote a policy covering New York deliveries. It refused payment. You file suit. You serve the regulator and send this notice to the foreign office. The same approach applies to travel policies, event policies, and specialty policies placed outside New York.

Typical users include individuals, small businesses, medical providers, and subrogating insurers. Landlords and property managers may also use it when pursuing property claims. Collection firms use it when enforcing assigned claims. In each case, you confirm the defendant is an insurer and is not authorized here. You then use this form to complete the notice step. Timing matters. Do not wait. Mail the notice promptly after serving the regulator. The court expects diligence. You will need the mailing proofs to support any default.

Legal Characteristics of the CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

This is an official court form used in a statutory service process. It is not a contract or agreement. It does not bind the parties like a settlement. Its legal effect flows from proper service rules. When you use it correctly, it helps establish a valid service on an unauthorized insurer. That gives the court power over the insurer for your case. It meets due process by giving actual notice.

What ensures enforceability?

Accuracy, method, and proof. First, accuracy. The caption must match your case. The insurer’s legal name must be exact. The address must be current. The date you served the state authority must be correct. The list of papers served must match what you filed. Second, the method. You must mail the notice and papers in a way that records delivery. Use registered or certified mail. Request a return receipt or other delivery record. For foreign addresses, use a method that tracks delivery. Third, proof. Keep the stamped receipts. Keep the tracking pages. Keep signed delivery cards. Keep documents that show refusal or unclaimed status if that occurs. You will attach these to your later compliance affidavit. The court relies on these to confirm service.

Filing follow-up papers helps enforceability. After you mail the notice, you will prepare an affidavit of compliance. That affidavit states what you did and attaches your proofs. Courts require this before they allow a default judgment. Without it, the court may reject your default application. The defendant may later move to vacate a default if you missed steps. Defects may include wrong address, wrong entity, missing return receipt, or missing attachments. This is why this notice matters so much. It closes the loop on service.

There are other legal considerations. Confirm that the defendant is an insurer and is unauthorized in New York. Confirm that your case belongs in the Civil Court. The Civil Court has a monetary limit. Your demand must fit within that limit. Confirm that the venue is proper in one of the city’s counties. Use the form version issued for this court. Follow its instructions. Use plain, consistent case details across all papers. Sign the notice. Send it promptly. Keep a full copy set. If the defendant has multiple known addresses, consider mailing to each. If the insurer uses a third-party administrator, still mail to the insurer’s principal office. You can also mail a courtesy copy to the administrator. But do not skip mailing to the insurer itself.

If the mail is returned unclaimed or refused, keep all documents. The court will look at those papers closely. They can still support the service. The key is that you mailed properly to the last known principal address. You cannot fix a wrong address with later mailings. Do your homework on the address before you send.

How to Fill Out a CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

Follow these steps. Work carefully. Keep everything short, exact, and consistent.

1) Get your case information ready.

- Find your Civil Court index number. Use the exact number on your summons.

- Confirm the county for your case. It will be one of the city’s counties.

- Confirm your full name and address. If you have counsel, use counsel’s information.

- Confirm the insurer’s exact legal name. Use the policy and any claim letters.

- Confirm the insurer’s principal business address. Use the most reliable source you have.

2) Complete the court caption.

- At the top, list “Civil Court of the City of New York.”

- Add the county name.

- List your name as “Plaintiff” in the same format as your summons.

- List the insurer’s full legal name as “Defendant.”

- Enter your index number exactly.

3) Identify the defendant as an unauthorized insurer.

- The form will state that the defendant is an unauthorized insurer.

- Do not change that language.

- You do not need to prove it on this form.

- You will prove it through your compliance affidavit and attachments.

4) State the method of initial service.

- Enter the date you served the state insurance authority.

- Enter the city where you made that delivery, if the form asks.

- List the documents you delivered at that time.

- Typical documents include a summons and complaint, or a summons with an endorsed complaint.

- If you served additional papers, list them as well.

5) List the documents you are mailing with the notice.

- You must mail a copy of each paper you served.

- List them by exact title. For example, “Summons and Complaint.”

- If you included exhibits, note that. For example, “Exhibit A (Policy).”

- Keep the list clean and complete.

6) Enter the insurer’s mailing address.

- Use the insurer’s principal place of business.

- Include the full street address, city, state, and postal code.

- For foreign addresses, include the country and postal codes.

- If you know multiple main addresses, choose the most authoritative. You can mail to others as a backup, too.

7) Choose a mailing method with tracking.

- Use registered or certified mail with a return receipt.

- Ask the clerk for the correct forms and receipts at the post office.

- Keep the mailing receipt with the tracking number.

- If the address is outside the United States, use a tracked international service.

- Ensure the service can confirm delivery or attempted delivery.

8) Fill in the date of mailing.

- Enter the date you deposit the notice and papers in the mail.

- It is best to mail on the same day you complete the notice.

- If you cannot, mail the next business day.

9) Complete the signature block.

- Sign your name. Print your name below the signature.

- If you are represented, your attorney signs.

- Add your address, phone, and email in the fields provided.

- Use the same contact details shown on your summons.

10) Prepare your proof set for later filing.

- Photocopy the signed notice.

- Keep a copy of each paper you mailed.

- Staple the post office receipt to your copy set.

- When you receive the green card or delivery confirmation, add it to the set.

- If the mail is refused or returned, keep the envelope and any notations.

11) Consider courtesy mailings.

- If the insurer uses a third-party administrator, you can mail a courtesy copy.

- If the policy lists a claims office, mail a courtesy copy there as well.

- Do not skip mailing to the principal office. That is the required mailing.

12) Double-check names and addresses.

- Compare your notice to the policy and claim correspondence.

- Make sure the insurer’s name is not the broker’s name.

- Do not use a group name if the policy lists a specific company.

- Do not use a brand name if the legal entity is different.

- List the exact legal name on the policy declarations page.

13) Attach a schedule if the form allows one.

- Some versions include a schedule for documents served.

- Use it if you have many attachments.

- Number each document. Keep the numbering consistent with your complaint exhibits.

14) Keep timelines in mind.

- Mail the notice promptly after serving the state authority.

- Do not wait for weeks. Delay creates risk.

- The court may question a long gap between service and mailing.

- Prompt mailing helps your case move forward.

15) Address common errors before they happen.

- Do not leave the index number blank.

- Do not guess the insurer’s address. Verify it.

- Do not forget to list every document you served.

- Do not use ordinary mail with no tracking.

- Do not sign in the wrong capacity. Use your role as plaintiff or attorney.

16) Coordinate with your affidavit of compliance.

- You will later prepare an affidavit of compliance.

- That affidavit shows that you served the regulator and mailed this notice.

- It will include your mailing receipt and delivery proof.

- File that affidavit with the court when ready.

- Keep this notice and all proofs together for that filing.

17) If the mail is returned.

- Do not discard the envelope. Keep it sealed if possible.

- Photograph the envelope and labels, including any postal marks.

- Note whether it was refused or unclaimed.

- Prepare to include these materials in your compliance filings.

- Consider a second mailing to an alternate known address as a backup.

18) If the insurer’s name is uncertain.

- Review the policy declarations page carefully.

- Confirm the exact underwriting company name.

- If the policy lists multiple companies, identify the issuer.

- You can also check claim letters for the legal entity name.

- Do not rely on a name used only in marketing.

19) If more than one insurer is named.

- Prepare a separate notice for each insurer defendant.

- Do not combine multiple insurers on one notice.

- Mail each notice and document set separately.

- Keep separate mailing proofs for each defendant.

20) Final review before mailing.

- Read the notice out loud once.

- Confirm dates, names, and the index number.

- Confirm the list of documents matches your service to the regulator.

- Sign and date. Make your copy set.

- Go to the post office and select a tracked method.

Example entries can help. For the service date, you might write: “On May 3, I delivered a copy of the Summons and Complaint to the state insurance authority.” For the document list, you might write: “Summons and Complaint; Exhibit A (Policy); Exhibit B (Denial Letter).” For the address, you might write: “Global Coverage Insurance Company, 100 Market Street, Suite 500, Chicago, IL 60601.” Keep each field plain and exact. Avoid explanations or arguments in the notice. This is not the place to describe your claims. It is a formal notice of service only.

After mailing, track delivery daily until it completes. Print the tracking logs if available. Attach them to your proof set. When the delivery record arrives, place it with your return receipt or digital confirmation. If you plan to seek a default later, you will need all of this. If the insurer appears and answers, you have still met your duty. The form did its job.

One final point. Use only the Civil Court version of this notice. The Civil Court has its own form format and codes. Using the correct form prevents filing delays. It aligns your case with court expectations. It helps the clerk recognize your compliance when you file your later papers.

Legal Terms You Might Encounter

- Unauthorized insurer: This is an insurance company not licensed to conduct insurance business where your case is filed. On this form, you identify that company as the party you served. Use the exact legal name from the policy or claim papers.

- Service of process: Service is how you give formal notice of a case or filing. This form records that you completed service on an unauthorized insurer through approved methods. Your entries should match your actual service steps.

- Statutory designee for service: Some laws let you serve an unauthorized insurer by delivering papers to a designated public office. That office acts as the insurer’s agent for service. On this form, you state that you used that route, if you did, and include the date and method.

- Affidavit of service: An affidavit of service is a sworn statement by the person who served the papers. It lists who was served, when, where, and how. This form is not the affidavit itself. It is the court notice that service occurred. You still attach or keep the separate affidavit.

- Proof of mailing: Many service rules require you to mail copies after delivery to a designee. Proof of mailing includes receipts and certificates that show when and where you mailed the papers. This form should reference those mailings and the addresses used.

- Jurisdiction: Jurisdiction is the court’s legal power to hear the case. Serving an unauthorized insurer through a statutory designee can help establish jurisdiction. This form shows the court how you satisfied the service requirements tied to that power.

- Venue: Venue is the location of the court within the state. This form does not select a venue. It documents service within a case already filed in the Civil Court of the City of New York. Make sure the case caption on the form matches your case’s venue.

- Party designation: Parties are labeled plaintiff, claimant, petitioner, defendant, or respondent. Use the same designations that appear on your case papers. This form must mirror the caption and party roles already on file.

- Default: A default can occur if a party does not respond or appear after proper service. This form supports any later request tied to a default by showing that the insurer received notice as the rules require. Accurate dates and methods here are critical.

- Return of service: Return of service is the complete record of how service was carried out. It includes the server’s affidavit and mailing proofs. This form functions as the court-facing notice and summary of that return of service for an unauthorized insurer.

FAQs

Do you need to serve the unauthorized insurer directly?

Not always. Many rules let you serve a designated public office instead. You may also need to mail copies to the insurer. This form tells the court which route you used and when. Always match the form to your actual service steps.

Do you attach proof of service to this form?

Yes. Attach the server’s affidavit and any mailing receipts. If you used certified or registered mail, include those slips. If you obtained tracking or delivery confirmations, include printouts. Keep originals safe and file legible copies.

Do you need a separate form for each unauthorized insurer?

Yes. File a separate notice for each insurer you served. Each insurer may require different addresses, dates, and mailings. Mixing multiple insurers on one notice can cause confusion and delay.

Do you have to list the policy or claim number?

It helps. Include the policy and claim numbers if you have them. They make it easier to identify the insurer and the matter. Use the numbers exactly as they appear on the policy, denial, or correspondence.

Do you need to pay a filing fee for this form?

A fee may apply depending on your case and local practice. Ask the clerk when you file or when you submit the notice with your other papers. If a fee applies, bring payment in an accepted form.

Do you need to serve the insurer’s lawyer too?

If you know the insurer’s lawyer is authorized to accept service, reflect that in your service documents. If not, follow the service path required for an unauthorized insurer. You can still mail a courtesy copy to known counsel, but note it as a courtesy, not formal service.

Do you need a new notice if you re-serve the insurer?

Yes. If you attempt service again, complete a new notice for the later service. Attach the new affidavit and mailing proofs. The court needs a clear record for each completed service attempt.

Do you file this form before or after service?

File it after you complete the service. The form reports that the service happened and explains how. If the court gave you a deadline to serve, file the notice promptly so the docket shows you met the deadline.

Checklist: Before, During, and After the CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

Before signing: Information and documents you need

- Case caption exactly as it appears on your pleadings.

- Index or docket number for your case.

- Full legal name of the unauthorized insurer.

- Last known business address of the insurer.

- Policy number and claim number, if available.

- Name and address used for service on the statutory designee, if used.

- Date, time, and place of service.

- Method of service used (personal delivery, mail type).

- Name of the individual who performed the service.

- Affidavit of service from the server.

- Proof of mailing (receipts, tracking, delivery confirmations).

- Any cover letters should be sent with the mailing.

- Calendar or deadline notes for the case.

During signing: Sections to verify

- Caption: Check party names and spelling.

- Docket number: Verify every digit and letter.

- Insurer name: Use the exact legal name, not a brand name.

- Service details: Confirm the service date and exact method.

- Addresses: Match the address on your proof of mailing and service.

- Attachments referenced: List each affidavit and receipt you will attach.

- Signer identity: Use the correct person to sign (you or your attorney).

- Signature date: Match the date you are signing the notice.

- Contact information: Provide a working phone and email if the form asks.

- Certify accuracy: Read the certification language before you sign.

After signing: Filing, notifying, and storing

- Make two complete copies of the signed form and all attachments.

- File the original notice with the Civil Court clerk for your case.

- Bring or include your attachments with the filing.

- Ask the clerk to stamp your copies as filed for your records.

- Serve a courtesy copy on opposing parties or known insurer counsel, if helpful.

- Update your calendar with any response or appearance dates.

- Store the stamped copy, affidavit, and mailing proofs together.

- Keep digital scans of everything in a dated folder.

- Monitor the docket for the court’s acknowledgment of filing.

- Be ready to present these documents at conferences or hearings.

Common Mistakes to Avoid CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

- Listing the wrong insurer name. Using a trade name or affiliate can break your chain of service. Don’t forget to match the exact legal name from the policy or claim.

- Leaving out the service date or method. Missing details make the service hard to verify. The court may reject your filing or delay your case. Always enter the date, time, and method as shown on the affidavit.

- Using the wrong address for mailing. A bad address can void service by mail. Cross-check the address used by the server and on your receipts. Confirm it matches the service rules that apply.

- Failing to attach proof. Without the affidavit and mailing receipts, the notice looks unsupported. The court may require resubmission. Attach legible copies and keep originals safe.

- Mismatched case caption or docket number. A wrong number can send your notice to the wrong file. That can trigger missed deadlines. Verify the caption and number before filing.

- 9. What to Do After Filling Out the Form CIV-GP-74-A – Notice of Service on an Unauthorized Insurer

- File the notice with the court. Bring the signed form and all attachments. Ask for a stamped copy for your records. If you are e-filing, upload clear, readable PDFs in the correct document categories. Label each attachment so the clerk can find it quickly.

- Confirm the docket reflects your filing. Check the case entry after filing. Make sure the notice and proofs appear. If something is missing, contact the clerk and ask how to correct it.

- Track the insurer’s response deadline. Service triggers the insurer’s time to respond. Note the date you completed service. Calculate the response deadline based on the service method you used. Calendar a follow-up a few days after that deadline.

- Prepare for the next procedural steps. If the insurer responds, be ready to attend scheduling conferences or motion dates. Bring your stamped notice and proofs. If there is no response by the deadline, consider what relief you may seek. Your notice and proofs will support that request.

- Handle corrections promptly. If you spot an error, prepare an amended notice. Fix the caption, dates, or method details. Reattach all proofs. File the amended version and note what you corrected. Keep both versions in your file.

- Share courtesy copies when strategic. Send a copy of the filed notice and proofs to the insurer’s known contacts or counsel. Mark it as a courtesy, not a formal service. This can reduce disputes about notice.

- Organize your evidence file. Keep the server’s affidavit, receipts, delivery confirmations, and cover letters together. Arrange them by date. Add a short index for quick reference. Bring this packet to any appearance where service may be discussed.

- Monitor mail and email. Watch for any return mail, delivery failures, or insurer correspondence. Save envelopes that show returned mail. They may matter if you need to show diligent efforts.

- Plan for testimony, if needed. Sometimes the server must testify about service. Make sure you can reach the server quickly. Keep the server’s contact details and availability on hand. Share a copy of the affidavit with the server before any hearing.

- Maintain consistent details across filings. Future motions should recite the same service facts you recorded here. Use the same dates, addresses, and methods. Inconsistent details invite challenges.

- Archive at case milestones. After key events, archive a complete service packet. Include the filed notice, affidavit, receipts, and any court orders referencing service. This archive helps if you move to enforce a judgment later.

- Verify compliance before seeking relief. Before you ask the court for any remedy based on service, reread your notice and proofs. Confirm every step meets the applicable service rules for unauthorized insurers. Fix gaps now, not at a hearing.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.