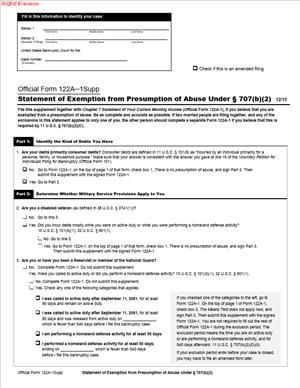

Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

Fill out nowJurisdiction: Country: USA | Province or State: Federal

What is a Form 122A-1Supp – Statement of Exemption from Presumption of Abuse?

This is a federal bankruptcy form you use in a Chapter 7 case to claim that the “presumption of abuse” does not apply to you. In plain terms, the form tells the court you do not have to complete the Chapter 7 means test because you qualify for a statutory exclusion. You file it with your Chapter 7 petition, or shortly after filing, to show why you are exempt.

Chapter 7 has income screening rules designed to flag cases where the filer might afford to repay creditors through a different chapter. That screening is the “means test,” usually done on separate forms. Form B 122A-1Supp lets you bypass that test if one of several narrow circumstances applies. The most common are: your debts are not primarily consumer debts, you are a disabled veteran whose debts arose primarily during active duty or homeland defense, or you are a qualifying member of the Reserve or National Guard called to active duty or homeland defense for a qualifying period.

Who typically uses this form?

Individual debtors filing Chapter 7 who fall into one of those categories. Many filers are small business owners with mostly business or tax debt. Some are veterans whose financial problems arose during service. Others are reservists or National Guard members who served on active duty after September 11, 2001, for a qualifying duration and time frame.

You would use this form to avoid the time and complexity of the means test when the law already excludes you from it. This can streamline your filing, reduce documentation burdens, and prevent disputes over income calculations that do not apply to your case.

Typical usage scenarios

- You run a sole proprietorship that failed. Most of your debt is trade debt, business credit cards used for inventory, vendor payables, and tax liabilities. Those are not consumer debts. You check the non-consumer debt exclusion.

- You are a disabled veteran. Your debts were incurred primarily while you were on active duty or performing homeland defense activities. You check the disabled veteran exclusion.

- You are a member of the National Guard or a reservist. You were called to active duty for at least 90 days after September 11, 2001. You file while on duty or within the protected period after your service ends. You check the reservist/Guard exclusion.

If you qualify, you complete and sign this short form under penalty of perjury. In many cases, you will not need to file the means test forms. Trustees can request supporting proof, so you should keep records ready, such as deployment orders, a discharge record, a VA determination letter, business records, or debt summaries that show the type and purpose of each debt.

When Would You Use a Form 122A-1Supp – Statement of Exemption from Presumption of Abuse?

You use this form when you are filing Chapter 7, and one of three conditions fits your situation.

First, your debts are not primarily consumer debts. “Consumer debt” generally means debt incurred for personal, family, or household purposes. Common examples are personal credit cards used for living expenses, personal car loans, medical bills, and home mortgages on your residence. “Non-consumer debt” includes business or investment debt, taxes, certain tort liabilities, and similar obligations not taken out mainly for personal use. If more than half of what you owe by dollar amount is non-consumer, you are outside the means test framework. A typical example is a restaurant owner who closed after losses. The owner may owe vendors, a commercial landlord, equipment lenders, and payroll or income taxes. If those business and tax debts comprise most of the total, the owner can claim the non-consumer debt exclusion on this form.

Second, you are a disabled veteran, and your debts were incurred primarily during your service. This applies when your debts arose while you were on active duty or performing homeland defense activities, and you meet the definition of a disabled veteran. This path is relatively narrow. You still need to show that the debts you now carry were primarily incurred during your qualifying service. An example is a service member injured during deployment who returns with a service-connected disability. While deployed, the member incurred debts through relocations, interrupted family income, and necessary expenses tied to service. If those debts comprise most of the total, you can claim the exemption as a disabled veteran.

Third, you are a member of a reserve component or the National Guard. You were called or ordered to active duty or a homeland defense activity for at least 90 days after September 11, 2001. You file your Chapter 7 case while on that duty or within a limited period after it ends. During that window, the means test does not apply to your case. For instance, a reservist deployed overseas for 180 days returns stateside and experiences a difficult transition. If you file while deployed or soon after release and within the allowed post-service window, you can claim the exemption on this form.

These users are individuals, not corporations or partnerships. They include sole proprietors, gig workers with business-heavy debts, veterans with service-incurred debt profiles, and Guard or Reserve members within the qualifying service timeframe. If you are filing jointly with a spouse, you can use this form in a joint case. You will indicate which debtor claims the exemption and on what basis.

In practice, you complete this form early in the filing process. It typically accompanies the petition or arrives within the initial deadline. You would not use it in Chapter 13. It is designed for Chapter 7 only.

Legal Characteristics of the Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

This form is an official federal bankruptcy form. It is part of your sworn filings. When you sign it, you declare under penalty of perjury that the information is true and correct to the best of your knowledge. That signature gives the form legal weight. The court and the trustee rely on it to determine whether the income screening rules apply to your case.

Is it legally binding?

Yes. Your statements on this form have the same force as testimony. If you misstate facts, you risk court sanctions, dismissal of your case, loss of discharge, or other penalties. Because it is a sworn declaration, accuracy matters. If you are unsure about a category, you should verify before you file.

What ensures enforceability?

Several checks do. You sign under penalty of perjury. The court reviews your filing for compliance. The trustee and the U.S. Trustee’s office may examine your debts, service records, income, and timing to confirm you qualify. Creditors can raise concerns if they believe the exemption does not apply. If your claim is valid, the presumption of abuse does not arise. If it is not valid, the court can require you to complete the means test or can entertain a motion to dismiss based on abuse.

There are important legal considerations even if you qualify. The exemption removes the means test presumption, but it does not insulate your case from all scrutiny. The court can still review your budget and overall situation. If evidence shows bad faith or a clear ability to repay, a trustee can still seek dismissal under other standards. That is rare when you qualify squarely for an exemption, but you should still present clean, consistent financial disclosures across all your schedules.

The timing of your filing can also affect your status, especially for the Guard and Reserve exclusion. That exemption depends on length of service, the date of service, and the filing date. If you file after the protected period ends, the exemption may no longer apply. For the disabled veteran exclusion, the focus is on whether you are a disabled veteran and whether your debts were incurred primarily during the qualifying service period. For the non-consumer debt exclusion, the court looks at your debts by dollar amount and their primary purpose when incurred.

Finally, this form does not eliminate other filing duties. You still must file your petition, schedules, statements, and other required documents on time. You must attend your meeting of creditors and cooperate with the trustee. This form only addresses the narrow question of whether the presumption of abuse applies.

How to Fill Out a Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

Follow these steps to complete the form accurately and avoid delays. Keep your answers simple, factual, and consistent with your other filings.

1) Gather your information before you start.

- Identify the basis for your exemption. Decide whether you qualify as a non-consumer, disabled veteran, or Guard/Reserve.

- Pull supporting documents. For non-consumer debt, list your debts with amounts and purposes. For disabled veteran status, locate your VA or DoD determination and any records showing when and how you incurred your debts. For Guard/Reserve, have your orders and dates of active duty or homeland defense service.

- If you are filing jointly, confirm whether the exemption applies to one or both spouses.

2) Complete the caption at the top of the form.

- Enter the district where you are filing, your names exactly as on the petition, and your case number if you have one. If you are filing the form with the petition, the case number may be assigned later. If you file it after your petition, add the case number from the notice you received.

3) Identify the debtors.

- The form has spots for Debtor 1 and Debtor 2. Debtor 1 is the person whose name appears first on the petition. In a joint case, Debtor 2 is your spouse. Make sure the names match your petition to avoid mis-indexing.

4) Select your exemption category by checking the correct box.

- Non-consumer debts: Check this if more than half of your total debt is non-consumer. This is a dollar-based test. Add up all your debts as of the filing date. Categorize each as a consumer or non-consumer based on the purpose at the time you incurred it. Examples of non-consumer debts include business trade payables, commercial leases, business credit lines used for operations, tax debts, and investment-related debts. If the sum of non-consumer debts exceeds the sum of consumer debts, you qualify.

- Disabled veteran: Check this if you are a disabled veteran and your debts were incurred primarily during active duty or while performing homeland defense activities. “Primarily” means more than half by dollar amount. You do not need to list every debt on the form, but you should confirm the timeline and the sources of the debts in your records.

- Reservists/National Guard: Check this if you were called or ordered to active duty or homeland defense for at least 90 days after September 11, 2001. You must file while on duty or within the post-service window for the exclusion to apply. You will need the start and end dates of your qualifying service. If you are still serving when you file, note that.

5) Provide any requested dates or clarifying details for your category.

- For Guard/Reserve, enter your activation dates. The form may prompt you for the date you were released from active duty. If you are on duty when you file, write that you remain on active duty and provide the start date.

- For disabled veterans, be prepared to state that you are a disabled veteran and that your indebtedness arose primarily during qualifying service. You do not need to disclose your rating on the form. Keep your documentation in case the trustee asks.

- For non-consumer debt, you usually do not attach a separate worksheet to this form. But you should have a simple breakdown ready by debt type and amount. You can point to your schedules, which already list debt amounts and categories.

6) Review consistency with your bankruptcy schedules.

- Schedule D, E/F, and other schedules show your debts, amounts, and secured/unsecured status. Review them to ensure the totals support your exemption claim. For non-consumer claims, double-check that tax debts, business guarantees, and commercial obligations are listed and described correctly. For consumer debts, confirm that personal loans, household credit cards, medical bills, and mortgages are accurately labeled.

- If a debt served mixed purposes, use its primary purpose. For example, a credit card used 70% for inventory and 30% for groceries is primarily a business debt.

7) Sign and date the form under penalty of perjury.

- You must sign. In a joint case, both spouses should sign if both are debtors, even if only one debtor qualifies for the exemption. Use wet ink if filing on paper or the electronic signature format approved by the court if filing through counsel.

- By signing, you declare that the information is true and correct. Read it once more before signing.

8) File the form on time.

- File the form with your Chapter 7 petition if possible. If you did not file it at the start, file it within the standard deadline set for your initial documents. If you need more time, you can request an extension from the court, but do not assume it will be granted.

- Serve copies as required by local practice. Your attorney can handle electronic filing and service.

9) Keep your backup documents close at hand.

- Trustees often ask for proof. For Guard/Reserve, which includes activation orders and the release date. For disabled veterans, that includes your VA or DoD determination and service dates. For non-consumer debt, that includes business records, tax notices, commercial leases, or vendor statements.

- If the trustee asks for clarification, respond quickly and provide organized, legible copies.

10) Understand what happens next.

- If your exemption is accepted, you do not need to file the means test calculation. Your case will proceed to the usual steps, including the meeting of creditors and any trustee requests for information.

- If your exemption is questioned, the trustee or the U.S. Trustee may ask you to provide support, file the means test forms, or amend your filing. Address issues early to avoid a motion to dismiss.

Practical examples help illustrate how to apply these steps. Say you have $220,000 total debt: $140,000 in unpaid payroll and income taxes, $50,000 owed to suppliers, and $30,000 on a personal credit card. More than half is business and tax debt. You qualify for the non-consumer exclusion. You check that box, sign, and file. Your schedules will show the tax and vendor debts, which align with your claim.

Consider a disabled veteran with $90,000 total debt: $60,000 in obligations incurred during active duty through relocations, emergency travel, and family support while deployed, and $30,000 in debts after separation. More than half arose during active duty. You check the disabled veteran box. Keep your service records and a simple list of those debts.

For a reservist, assume you were mobilized for 120 days and file within the protected period after release. You check the Guard/Reserve box and provide your orders’ start and end dates. If you file years later, the window may have closed, and you would not check this box.

Common pitfalls to avoid are straightforward. Do not assume a debt is non-consumer just because it is large. Look at the purpose. A home mortgage is often a consumer debt, even if it is your biggest debt. Do not ignore timing in Guard/Reserve cases. If you miss the window, the exemption does not apply. Do not overstate or guess. If you are uncertain, pause and verify. You are signing under penalty of perjury.

If you are filing jointly, pay attention to how the form displays Debtor 1 and Debtor 2. If the non-consumer exclusion applies, it applies at the case level because your combined debts drive the analysis. If the disabled veteran or Guard/Reserve exclusion applies, the form allows you to identify which debtor qualifies. Complete that carefully and ensure your supporting facts match.

Finally, remember what this form does and does not do. It helps you avoid the means test when the law clearly excludes your case from the presumption of abuse. It does not decide dischargeability, exemptions, or other case outcomes. It does not prevent the trustee from asking questions about your finances. Keep your entire filing consistent, and you will set your case on a solid footing from the start.

Legal Terms You Might Encounter

- Presumption of abuse means the court assumes a Chapter 7 filing is not appropriate because your income appears high compared to allowed expenses. This form asks the court to skip that assumption because you qualify for an exemption.

- Means test is the calculation that measures your income against certain expense standards to decide if Chapter 7 may be abusive. When you file Form B 122A-1Supp – Statement of Exemption from Presumption of Abuse, you claim you do not need to complete that calculation.

- Consumer debt is personal, family, or household debt. Credit cards for living expenses, medical bills, and personal auto loans are common examples. This form matters if your debts are not primarily consumer debts.

- Non-consumer debt, often called business debt, is debt tied to a business, profit motive, or investment. Taxes and certain business guarantees can also fit. If most of your debt is non-consumer, you can use this form to claim an exemption.

- Disabled veteran refers to a veteran with a qualifying disability rating whose debts were mostly incurred during active duty or homeland defense activity. If you meet that description, this form allows you to claim an exemption from the presumption of abuse.

- Active duty means you served full-time under orders for a qualifying period. Certain Reserve or National Guard service on active duty for at least 90 days can trigger a temporary exemption. This form captures that status and the dates.

- Demobilization date is the date your qualifying active duty ends. A temporary exemption can extend for a limited time after this date. On this form, you will list the date so the court can see your exemption timeframe.

- Primarily means “more than half.” For this form, it matters whether more than half of your debts are consumer or non-consumer. If more than half are non-consumer, you can claim the non-consumer exemption.

- Joint case is when you and your spouse file together. For this form, each spouse’s basis for exemption matters. If you claim a military-based exemption, the service member’s spouse’s status controls. If you claim the non-consumer debt exemption, the overall debt mix for the case controls.

- Penalty of perjury means you swear the information is true to the best of your knowledge. You must sign this form under penalty of perjury. False statements can lead to dismissal, sanctions, or worse.

FAQs

Do you need to file this form with your Chapter 7 petition?

Yes, if you claim you are exempt from the presumption of abuse. File Form B 122A-1Supp – Statement of Exemption from Presumption of Abuse with your initial paperwork. This alerts the court and trustee that you believe the means test does not apply.

Do you still complete the means test forms if you file this form?

Usually, no. If you qualify for an exemption, you generally do not need to complete the standard means test forms. You still must complete the rest of your Chapter 7 packet. If the court or trustee disputes your exemption, you may later need to complete the means test forms.

Do you qualify if your debts are mainly business-related?

You may. If more than half of your total debt is non-consumer, you can claim an exemption. Review each debt. Look at why you incurred it, not just who the creditor is. If more than half are business or profit-motivated, you likely qualify under the non-consumer category.

Do you qualify if you are a disabled veteran?

You may. You must have a qualifying disability rating. Your debts also must be mostly from the time you were on active duty or involved in homeland defense. If both are true, you can claim the exemption using this form.

Do you qualify if you are a reservist or in the National Guard on active duty?

You may. If you served on active duty for at least 90 days, you can claim a temporary exemption. That exemption extends for a limited time after you leave active duty. You will enter your activation and demobilization dates on the form.

Do you need to attach proof to this form?

The form itself does not require attachments. Still, keep proof ready. Examples include activation orders, demobilization records, a disability rating letter, and a debt breakdown. The trustee can ask for these. Provide them promptly if requested.

Do both spouses need to qualify in a joint case?

Not always. If you claim the non-consumer debt exemption, the case looks at total debt, not each spouse. If you use a military-based exemption, it depends on the service member spouse’s status. If both claim the exemption for different reasons, list each basis clearly.

Do you need this form for Chapter 13?

No. This form only applies to Chapter 7 and the presumption of abuse. If you are filing Chapter 13, you will complete different forms. This exemption does not apply in a Chapter 13 case.

Do you need to refile this form if your status changes?

Maybe. If your temporary exemption ends, you may need to complete the means test forms or amend your filing. If you discover an error, file an amended form. Notify the trustee of changes promptly.

Do you risk dismissal if you skip this form by mistake?

Yes. If you are not exempt and you fail to complete the means test, your case can face delay or dismissal. If you are exempt and you fail to file this form, you lose the benefit of the exemption. File it on time with your petition.

Checklist: Before, During, and After the Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

Before signing

Identify your exemption basis:

- Non-consumer debt (more than half of total debt).

- Disabled veteran with debts mostly incurred during active duty or homeland defense.

- Reserve or National Guard member with at least 90 days of active duty, within the temporary window.

Gather proof:

- Debt list with amounts, purpose, and classification (consumer vs. non-consumer).

- Business records, tax notices, or guarantees that show a non-consumer purpose.

- Activation orders and demobilization records, if claiming a service-based exemption.

- Disability rating decision, if claiming the disabled veteran exemption.

Confirm dates:

- Activation date, demobilization date, and current status, if applicable.

- Date ranges when debts were mostly incurred for veteran claims.

Check your totals:

- Calculate whether more than half of the debt is non-consumer.

- Note secured vs. unsecured amounts to support your breakdown.

Prepare your petition packet:

- Petition, schedules, statements, and this form are ready for filing together.

- Credit counseling certificate as required for the case.

During signing

Confirm case caption:

- Debtor name(s) exactly as on the petition.

- Correct district and division.

- Use the case number if you already have one.

Select the correct exemption box:

- Non-consumer debt.

- Disabled veteran.

- Reserve or National Guard temporary exemption.

Enter accurate dates:

- Activation and demobilization dates, if applicable.

- Make sure they match your records.

Verify the debt mix description:

- Your short explanation should match your debt list.

Check joint case details:

- Clarify if one or both spouses qualify.

- Do not assume both qualify unless the facts support it.

Read the declaration:

- Understand you are signing under penalty of perjury.

- Sign and date. Both spouses sign in a joint case.

After signing

File the form:

- Submit it with your Chapter 7 petition.

- If you already filed the petition, file it as a supplement.

Keep your proof handy:

- Have copies of orders, ratings, and debt analysis ready for the trustee.

Calendar follow-ups:

- If claiming a temporary exemption, note when it could expire.

- If it expires during your case, be ready to complete the means test if needed.

Monitor the docket:

- Watch for any trustee or court requests.

- Respond on time to avoid delays.

Store records securely:

- Keep a full copy of the signed form and your support file.

- Retain records for several years after discharge.

Common Mistakes to Avoid Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

- Misclassifying debt as non-consumer. Don’t assume a credit card is business debt because it paid a business expense once. Consequence: The trustee can challenge your exemption, which can lead to added costs or dismissal.

- Missing the 90-day active duty threshold. Don’t claim the temporary military exemption without meeting the minimum service. Consequence: The court may deny the exemption and require immediate means test forms.

- Skipping dates or leaving blanks. Don’t omit activation or demobilization dates. Consequence: Processing delays and requests for correction or proof.

- Failing to sign under penalty of perjury. Don’t forget required signatures, especially in a joint case. Consequence: The court may reject the filing as incomplete.

- Not keeping proof ready. Don’t wait for a request to gather orders, ratings, or debt evidence. Consequence: Missed deadlines, credibility issues, and possible denial of the exemption.

What to Do After Filling Out the Form 122A-1Supp – Statement of Exemption from Presumption of Abuse

- File with your petition:

Submit the signed form with your Chapter 7 packet. If you have already filed, submit it as soon as possible.

- Confirm the exemption’s effect:

If accepted, you generally do not need to complete the means test forms. If challenged, be ready to complete them promptly.

- Provide information on request:

If the trustee asks, provide activation records, demobilization proof, disability rating, and your debt breakdown.

- Track temporary exemptions:

If yours is temporary, note when it ends. Be prepared to complete the means test forms if the case requires it after the window closes.

- Amend if needed:

If you discover an error, file an amended form. Briefly explain what changed and why the exemption still applies.

- Coordinate in a joint case:

Make sure both spouses understand which exemption applies. Keep your debt analysis current for the whole case.

- Keep organized records:

Store a complete copy of your petition, this form, and all support documents. You may need them at your meeting with the trustee.

- Watch for deadlines:

Respond quickly to any notices. Missing a deadline can delay your case or risk dismissal.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.