Form 122A-1 – Chapter 7 Statement of Your Current Monthly Income

Fill out nowJurisdiction: Country: USA | Province/State: Federal

What is a Form 122A-1 – Chapter 7 Statement of Your Current Monthly Income?

Form 122A-1 is the official federal bankruptcy form that calculates your current monthly income for a Chapter 7 case. You use it to report the income you received during the six full calendar months before you file. The form averages that income to determine your “current monthly income” and then annualizes it. You compare that annualized number to your state’s median income for a household of your size. This threshold check is the first part of the “means test” for Chapter 7.

In simple terms, this form helps the court decide whether your household income is low enough to proceed in Chapter 7 without a presumption of abuse. If your annualized income is at or below the state median, the presumption of abuse does not arise. If it is above the median, you usually must complete a second form (the means test calculation) to show your allowable expenses and further test eligibility.

Who typically uses this form?

Individual debtors filing Chapter 7. If you are filing alone, you complete it for yourself, and in many cases, you must also include your non-filing spouse’s income, then adjust for amounts that do not support your household. If you are married and filing jointly, you and your spouse report combined income. If your debts are primarily business debts, or you qualify for a specific statutory exemption, you may not need to complete the full means test. In those situations, you use an exemption statement instead of this form. Most consumers with primarily personal debts will complete Form 122A-1.

Why would you need this form?

Because Chapter 7 requires it. The form is part of your initial filing package. The trustee and the U.S. Trustee Program review it to confirm whether the presumption of abuse applies. It is also a transparency tool. It aligns what you report about your income across your case. If you omit income or use the wrong time period, you risk delays, objections, or dismissal.

Typical usage scenarios

- You lost your job three months ago, but had steady wages before that. You must average the full six-month window. The drop in income will show in the average.

- You received a one-time bonus in the look-back period. You include it because you must count all income received during that window, even if it will not recur.

- You own a small business as a sole proprietor. You report net business income, not gross receipts, for the six-month period.

- Your spouse is not filing, but lives with you and earns income. You must include the spouse’s income that supports the household, and you can exclude income used solely for your spouse’s separate expenses through a marital adjustment.

- You receive Social Security benefits. Those are excluded from the means test income calculation. You do not count them on this form.

The form does not decide your case by itself. It only determines whether you must complete the second part of the means test, or whether the presumption of abuse does not arise at this stage. The court can still review your case for abuse based on your overall circumstances.

When Would You Use a Form 122A-1 – Chapter 7 Statement of Your Current Monthly Income?

You use this form when you file a Chapter 7 bankruptcy case, unless you qualify for a statutory exemption from the means test. Most consumer debtors must complete it at filing. It accompanies your petition or is filed shortly after, depending on local practice. If you are filing jointly, you complete one combined form. If only one spouse files, you still report relevant household and spouse information as the form requires.

You would use it if your debts are primarily consumer debts, such as credit cards, personal loans, auto deficiencies, or medical bills. Even if you have some business debts, the form still applies if consumer debts are the majority. If your debts are primarily non-consumer (for example, most of your debts arise from business activities), you may qualify for an exemption from the presumption of abuse. In that case, you normally file a short exemption statement instead of the full means test. Disabled veterans and certain National Guard and reserve members may also claim an exemption in specific circumstances. If an exemption applies, you do not need to complete the detailed income calculation on this form.

Here are practical situations:

- You are a salaried employee who wants a fresh start after job loss. You include six months of wage data. This shows the recent drop in income that may place you below the median.

- You own a service business with fluctuating income. You report net business income for each of the six months. The average smooths out spikes or dips.

- You and your spouse both work, but only you are filing. You include your spouse’s income that supports the household, then subtract your spouse’s separate expenses through the marital adjustment.

- You recently started receiving unemployment. You include unemployment benefits received in the look-back period.

- You receive child support. You include support received during the six-month window.

- You receive Social Security. You exclude those benefits from the means test income calculation.

You do not use this form for a Chapter 13 case. Chapter 13 uses a different set of forms and calculations. You also do not use it if you are not filing for bankruptcy. It is a bankruptcy-specific disclosure tool used inside Chapter 7.

Legal Characteristics of the Form 122A-1 – Chapter 7 Statement of Your Current Monthly Income

This is a sworn statement filed with a federal court. It is not a contract between private parties. It is part of the official record in your bankruptcy case. You sign it under penalty of perjury. That signature makes it legally binding as to the truthfulness of the information you provide. Federal law requires accurate, complete disclosure. The bankruptcy trustee and the U.S. Trustee rely on this form to assess eligibility and potential abuse.

What ensures enforceability? Several features:

- The Bankruptcy Code and Rules require you to file it when you file Chapter 7, unless an exemption applies.

- You declare under penalty of perjury that the information is true and correct. False statements can lead to denial of discharge, dismissal, conversion to another chapter, sanctions, or criminal referral.

- The trustee and the U.S. Trustee can request pay records, tax returns, and bank statements to verify your numbers. If the numbers do not match, they can challenge your filing.

- The form uses objective time frames and categories. You must use the six-month look-back period and include specific types of income. This structure reduces ambiguity.

General legal considerations:

- The form addresses only the “presumption of abuse” under Chapter 7. Even if the presumption does not arise, your case can still face dismissal based on bad faith or totality of the circumstances.

- The form requires household analysis. Courts evaluate household size and marital adjustments on a case-by-case basis. Use consistent, supportable reasoning.

- Certain income types are excluded by law. For example, benefits under the Social Security Act are not part of the current monthly income for the means test.

- Privacy rules apply. Do not include full Social Security numbers on the form. Redact protected information. Use only the last four digits when required.

- Timing matters. Filing date controls the six-month look-back period. If your income is trending down, timing your filing can affect the outcome of the threshold test.

In short, this is a formal, sworn disclosure. Accuracy and documentation are critical.

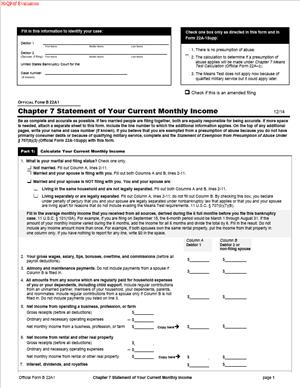

How to Fill Out a Form 122A-1 – Chapter 7 Statement of Your Current Monthly Income

Follow these steps to complete the form accurately and avoid delays.

1) Confirm you need this form

- Identify your debt type. If your debts are primarily consumer debts, you must complete the form.

- Check for exemptions. You may be exempt if your debts are primarily business debts, or you meet a specific military or veteran exemption. If exempt, you typically file a short exemption statement instead of this form. If not exempt, proceed.

2) Define the six-month look-back period

- Use the six full calendar months before the month you file. Do not include the filing month.

- Example: You file on October 15. Your look-back period is April 1 through September 30.

- You must include income received during those six months, even if you no longer receive it.

3) Gather documents

- Pay stubs or payroll reports for each of the six months.

- Bank statements showing deposits for wages, tips, and side income.

- Profit-and-loss records if self-employed.

- Rental ledgers, if you receive rental income.

- Statements for pensions, annuities, or retirement distributions.

- Proof of unemployment compensation or workers’ compensation.

- Documentation for alimony or support received.

- Notes on cash contributions to household expenses from roommates or family.

- Prior-year tax return for cross-checking. Use it to avoid missing income sources.

4) Identify your household and filing status

- If married filing jointly, combine both spouses’ income on the form.

- If married filing separately, include your spouse’s income that supports the household. Exclude your spouse’s separate expenses through the marital adjustment later in the form.

- Determine household size. Count yourself, your spouse if living with you, and dependents you support and who live in your household. Use a consistent, good-faith approach.

5) Complete Part 1: Marital and filing status

- Indicate whether you are single, married filing jointly, or married filing separately.

- If married, filing separately but living together, confirm you will report your spouse’s income and later take any marital adjustment.

6) Complete Part 2: Calculate your current monthly income (CMI)

Report the income you received during the six-month period. For each category, total the six months and divide by six to get the monthly average. Use gross amounts before deductions, unless the category calls for net.

- Wages, salaries, tips, overtime, and bonuses

- Use gross pay before taxes, insurance, and retirement withholding.

- Include overtime and bonuses received during the look-back period.

- Use payroll records to avoid errors.

- Business, profession, or farm income (self-employed)

- Report net income only: gross receipts minus ordinary and necessary business expenses.

- Do not deduct your own draws. Draws are not expenses.

- Keep a simple profit-and-loss summary for each of the six months.

- Rental and real property income

- Report net rental income: gross rents minus ordinary operating expenses like utilities, repairs, and management fees.

- Do not deduct mortgage principal payments as an expense here; handle debt service carefully and consistently.

- Interest, dividends, and royalties

- Include earnings credited during the six-month period, even if you left them in the account.

- Pensions, annuities, and retirement income

- Include taxable retirement distributions and private pension income.

- Do not include benefits under the Social Security Act.

- Alimony, maintenance, and support you receive

- Include child support and spousal support received in the six-month period.

- Use payment histories from the payor or agency if available.

- Unemployment compensation

- Include unemployment compensation received in the look-back period if your jurisdiction treats it as part of CMI. Follow the form’s instructions for your case.

- If any portion is excluded by law, adjust accordingly.

- Other income

- Include contributions to household expenses from roommates or family.

- Include side gigs, tips not captured on pay stubs, and any regular payments that support the household.

- Exclude benefits under the Social Security Act and other legally excluded categories.

Be consistent. If you treat an item as excluded income on this form, treat it the same way throughout your case.

7) Include your spouse’s income when required

- If you are married and living together, include your spouse’s income in the income categories above, even if only one spouse is filing.

- Track which portions of your spouse’s income pay for household expenses and which portions are used for your spouse’s separate obligations.

8) Apply the marital adjustment (if applicable)

- If only one spouse is filing, you may subtract your non-filing spouse’s income that is not used to pay household expenses.

- Examples of separate expenses: your spouse’s separate debt payments, personal savings contributions, support paid to someone outside the household, or expenses exclusively for your spouse’s personal use.

- Document this adjustment. Keep a simple schedule listing each separate expense and the monthly amount.

9) Sum and average your income

- Add all the included income for each category across the six months.

- Divide the total by six to reach your current monthly income for that category.

- Sum the category averages to get the total current monthly income (CMI).

10) Complete Part 3: Annualize and compare to the median

- Multiply your total CMI by 12 to get your annualized income.

- Determine your household size and state. The form guides you to compare your annualized income to the median income for a household of your size in your state.

- If your annualized income is at or below the median, the presumption of abuse does not arise under the means test. You usually do not complete the next means test form.

- If your annualized income is above the median, you must usually complete the detailed means test calculation to see if the presumption applies after allowed deductions.

11) Complete Part 4: Determine your next step

- The form will direct you to stop if below the median, or proceed to the next means test form if above the median.

- If an exemption applies that you did not claim earlier, address it now with the correct exemption statement.

12) Sign the declaration

- Read the declaration carefully. You certify under penalty of perjury that the information is true and correct.

- Sign and date the form. If you are filing jointly, both spouses must sign.

13) File the form with your Chapter 7 petition

- File it on the petition date or within any permitted follow-up period. Local rules vary slightly on timing. The safest practice is to file it with your petition.

- Keep copies of all documents you used to prepare the form. The trustee may ask for them.

14) Align with your other filings

- Your reported income on this form should align with your schedules and statement of financial affairs.

- If your Schedule I (current income) differs from the six-month average, include a simple explanation in your records. The six-month average reflects past income, while Schedule I shows current income. Both can be accurate.

15) Avoid common mistakes

- Wrong time period: Use the six full months before the filing month, not the last 180 days by count.

- Excluding income received: Include all income actually received during the look-back period unless excluded by law.

- Mixing net and gross: Use gross wages, but net income for business and rental categories.

- Missing spouse income: If living together, include your spouse’s income and then use the marital adjustment as needed.

- Unsupported marital adjustment: Keep a list and proof of your spouse’s separate expenses to support the adjustment.

- Household size errors: Use a consistent approach based on who lives with you and whom you support.

- Math errors: Double-check each line total and the final annualized figure.

16) Understand what happens after filing

- The trustee reviews the form. If you are below the median, you typically do not complete the second means test form.

- If you are above the median, you must complete the detailed means test calculation. That form may still show no presumption of abuse after allowed deductions.

- If the trustee questions your numbers, you may need to provide pay records or a revised form. Corrections are common and better than defending a flawed filing.

17) Practical examples

Single wage earner, recent pay cut:

- Filing in October. Look-back is April–September.

- April–June were higher-paid months. July–September reflect the pay cut.

- Averaging the six months captures both periods. Annualizing may still place you at or below the median.

Married, one filer, separate spouse expenses:

- You file alone. Your spouse lives with you and pays their own student loans, personal credit cards, and some discretionary expenses.

- Include your spouse’s gross wage income. Then subtract those separate expenses through the marital adjustment.

- Keep statements showing those payments. List each amount used for separate expenses monthly.

Self-employed contractor:

- Use the monthly profit-and-loss statement to show net income. Deduct ordinary and necessary business expenses only.

- Do not treat personal draws as an expense. They are distributions, not deductions.

- If income fluctuates, the six-month average smooths highs and lows.

Retiree with Social Security and a pension:

- Exclude Social Security benefits.

- Include pension distributions received in the six-month period.

- Annualize the combined included income and compare to the state median for your household size.

Roommate contributions:

- You share rent with a roommate who pays you their half each month.

- Include the roommate’s contributions as “other income.” They reduce your expenses but are still income that supports the household.

Unemployment benefits:

- Include unemployment compensation received during the look-back period, unless excluded by the form’s instructions for your case.

- If employment resumes before filing, you still include the unemployment paid during the six months.

18) Keep your support file ready

- A simple binder or folder with six months of pay stubs, bank statements, P&L summaries, support ledgers, and notes on marital adjustments will save time.

- Label each category to match the form. If asked, you can show how each line was calculated.

19) Consider timing if your income is changing

- If your income recently decreased, waiting a month may change the six-month window and lower the average.

- If your income recently increased, filing before the higher-income months enter the look-back may matter. Make sure the timing is consistent with your overall legal strategy.

20) Final check before signing

- Compare totals to your bank deposits for the six months. Resolve differences.

- Confirm that excluded income types are not included in your totals.

- Ensure the marital adjustment has support and is limited to non-household expenses.

By following these steps, you can complete Form 122A-1 accurately. The form is a snapshot of your past six months, not a forecast. Be precise, document your numbers, and make the comparison to your state median. If you are below the median, you are finished with the means test at this stage. If you are above the median, you move to the detailed expense analysis on the next form.

Legal Terms You Might Encounter

- Current Monthly Income (CMI) is the average of your income over a six-month period before you file. On Form B 122A-1, you list each income source for those months. The form then averages them to get your CMI. You use that number to compare with the median income.

- The six-month look-back period is the exact window the form uses. It covers the six full calendar months before the month you file. If you file in July, you look at January through June. The form relies on that window, even if your current pay has changed.

- Median income is the benchmark for your comparison. It depends on your household size and where you live. Form B 122A-1 uses your CMI and your household size to see if you fall below or above that median. The result tells you what you must file next.

- Household size means the number of people you support or share income with in your home. It is not always the same as the number of dependents on your tax return. On this form, household size affects your median income comparison. Count carefully and be consistent across your case.

- The means test is the two-step process that screens Chapter 7 eligibility. Form B 122A-1 is step one. It asks for your CMI and your household size. If your CMI is below the median, you usually stop there. If it is above, you complete the second means test form.

- Presumption of abuse is a red flag that the means test can trigger. It suggests your budget might support a different chapter. Form B 122A-1 itself does not make that finding. It starts the analysis. If your CMI is high, you continue to the next form to see if the presumption applies.

- Marital adjustment is the deduction for a non-filing spouse’s income that does not support the household. If your spouse is not filing with you, their income often belongs on this form. You can adjust it for what they spend on their own separate obligations. This helps reflect true household income.

- Gross versus net income matters on this form. You list gross pay from employment before any withholdings. Do not subtract taxes, insurance, or retirement contributions here. If you are self-employed, you list net business income after ordinary business expenses.

- Self-employment income is what remains after ordinary and necessary business costs. Do not list just your gross receipts. Deduct rent, supplies, and other standard business costs first. The form uses your net as part of your six-month average.

- Means test exemptions allow some filers to avoid the full means test. If you qualify, you complete the exemption statement instead of the long calculation. Form B 122A-1 will still record your basic income picture. The exemption statement explains why the presumption should not apply.

FAQs

Do you count Social Security benefits on this form?

No. You do not include Social Security benefits paid under the Social Security Act. Leave them out of your CMI. Keep records anyway, because they may be relevant elsewhere in your case.

Do you include your spouse’s income if you file alone?

Usually, yes, if you live together. The form captures the household’s income. You can take a marital adjustment for your spouse’s separate expenses. Document those items so the trustee can follow the math.

Do you use gross pay or take-home pay?

Use gross pay. List it before deductions for taxes, insurance, and retirement. For self-employment, use net business income after ordinary expenses. Do not deduct personal taxes or household bills here.

Do you include overtime, commissions, or bonuses?

Yes, if you received them in the six-month window. The form averages all income from that period. If your overtime was heavy in those months, it will raise your CMI. You cannot substitute a different average.

Do you include child support or alimony?

Yes, if you receive it and use it for household expenses. Include it in the six-month totals. If you pay support, you do not subtract it on this form. That type of deduction appears on the next means test step.

Do you include the month in which you file?

No. Count back six full calendar months that end before your filing month. If you file in October, count April through September. Do not include partial months or estimates.

Do you still need the long means test form if your income is below the median?

No, usually not. If your CMI is below the median for your household size, you often stop after this form. If an exemption applies, you complete the short exemption statement instead of the long form.

Do you need documents to back up the numbers?

Yes. Keep pay stubs, benefit letters, bank statements, and profit-and-loss records. You may need to give them to the trustee. Accurate documents help you avoid follow-up requests.

Do you amend the form if you discover an error?

Yes. Prepare an amended Form B 122A-1 and file it promptly. Fixing the error reduces delays and questions. Serve copies if required and keep proof of filing.

Checklist: Before, During, and After the Form B 122A-1 – Chapter 7 Statement of Your Current Monthly Income

Before you sign

- Identify your filing month so you know the six-month window.

- Gather pay stubs for each of the six months.

- Collect statements for any side, gig, or contract work.

- For self-employment, prepare a six-month profit and loss summary.

- Get records for rental income, royalties, or business distributions.

- Pull statements for alimony or child support you receive.

- Collect documentation of regular help from family or roommates.

- If you live with a spouse who is not filing, gather their income records.

- List your spouse’s separate expenses for the marital adjustment.

- Confirm your household size for the median income comparison.

- Confirm your state of residence for the same comparison.

- Have bank statements ready to tie out deposits if needed.

- Bring your most recent tax return for context (do not rely on it for averages).

- Review the latest pay periods to ensure you have complete months.

- Decide on rounding rules and apply them consistently.

During completion and signing

- Confirm your name, address, and any case number match other papers.

- Check the six-month dates at the top to avoid a wrong window.

- Enter income from all sources for each month. Do not skip irregular items.

- Use gross pay for wages and net figures for self-employment.

- Include your spouse’s income if you share a household.

- Apply a marital adjustment only for true separate expenses.

- Include regular contributions to household expenses from others.

- Exclude Social Security benefits from your totals.

- Double-check math for each month and the six-month average.

- Verify your household size and state selection.

- Review the below-median or above-median outcome.

- Read the declaration. Sign and date where indicated.

- If represented, make sure your attorney’s information is complete.

- Keep a copy with all supporting documents stapled or clipped.

After you sign

- File Form B 122A-1 with your Chapter 7 petition.

- If you already filed, check the deadline to submit missing forms.

- If below the median, you usually do not complete the long means test.

- If above the median, complete the next means test form promptly.

- If you claim an exemption, complete the exemption statement as well.

- Provide income documents to the trustee upon request.

- Monitor court notices for any deficiencies or requests for proof.

- If you find an error, file an amended form without delay.

- Keep a full copy of what you filed and all backup records.

- Store the package securely for the life of the case and beyond.

Common Mistakes to Avoid Form B 122A-1 – Chapter 7 Statement of Your Current Monthly Income

- Don’t forget to exclude Social Security benefits. Including them inflates your CMI. That can push you above the median and trigger extra forms you may not need. It can also raise questions from the trustee.

- Don’t use take-home pay for wage income. Using net pay understates your CMI. That can cause amendments or worse, accusations of inaccuracy. Always use gross wages before deductions.

- Don’t count the filing month in your six-month window. Adding the current month skews your average. The trustee may reject your numbers. You will need to refile the form and correct the dates.

- Don’t ignore your spouse’s income if you live together. Omitting it makes your CMI incomplete. The trustee can object and delay your case. Use the marital adjustment for separate expenses instead.

- Don’t list gross receipts as self-employment income. You must subtract ordinary business costs first. Reporting gross revenue overstates your income. Expect document requests and a revised form if you do.

What to Do After Filling Out the Form B 122A-1 – Chapter 7 Statement of Your Current Monthly Income

- File the form with your Chapter 7 petition or by the court’s deadline. Confirm that your case caption matches across all documents. Keep a stamped copy for your records.

- If your form shows you are below the median, your means test step is usually complete. You should not need the long calculation form. Proceed with the rest of your case tasks.

- If your form shows you are above the median, complete the second means test form. That form works through allowed expenses and deductions. It decides whether a presumption applies.

- If you qualify for an exemption from the means test, complete the exemption statement. File it with your petition or as soon as possible. Keep documents that prove the exemption.

- Provide support for your numbers when asked. Trustees often ask for pay stubs, bank statements, and business records. Send complete copies for the exact six-month window.

- Review your court notices after filing. If the court flags a deficiency, cure it by the stated deadline. Fixing small issues fast keeps your case on track.

- Amend the form if you discover an error. Prepare a corrected version and file it as an amendment. Update any affected figures on related documents. Serve the required parties if the rules call for it.

- Track any timing issues that could affect your six-month window. If your case gets dismissed and you refile, your six-month period changes. Recalculate your CMI for the new filing.

- Keep your records organized. Store the filed form, your backup documents, and any amendments. Maintain them until your case ends and for a period after closure.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.