Form B 121 – Your Statement About Your Social Security Numbers

Fill out nowJurisdiction: Country: USA | Province or State: Federal

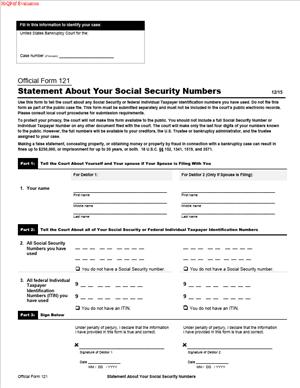

What is a Form B 121 – Your Statement About Your Social Security Numbers?

Form B 121 is a federal bankruptcy court form. You use it to give the court your full Social Security number. The court uses it to identify you and send accurate notices. The form is not part of the public case file. The clerk keeps it in a restricted record.

This form prevents identity mix-ups. Creditors often know you by your Social Security number. The trustee also needs it to confirm your identity. The court prints only the last four digits on public notices. Your full number stays protected in court records.

This form is short. It asks for your name and Social Security number. It also provides a certification under penalty of perjury. You sign to confirm the number is correct. In a joint case, each spouse completes a section.

You file this form with your bankruptcy petition. It applies in Chapters 7, 11, 12, and 13 for individual filers. Companies do not complete this form. Corporations and LLCs use employer identification numbers. This form is only for individuals.

Who Typically Uses This Form?

You use this form if you are an individual filing for bankruptcy. That includes consumer debtors and sole proprietors. It includes spouses filing a joint case. It also includes individuals in a small business case.

Your attorney files it with your petition. If you file without an attorney, you will file it at the clerk’s office. The trustee expects you to complete it. The court may flag your case if it is missing.

Why would you need this form?

You need this form because the court requires it. The court must match you to your creditors’ records. Your Social Security number is the most reliable match. The form allows the clerk to show the last four digits on notices. That alerts creditors to the right person while protecting your privacy.

The trustee also uses your number to confirm your identity. At your first meeting of creditors, the trustee checks your ID. The trustee will compare your documents with the court record. This form provides that record. It helps prevent fraud and errors. It also prevents creditors from missing your case due to a mismatch.

If you do not have a Social Security number, you still file this form. You check the box that says you do not have one. You then bring proof to your trustee meeting that aligns with your status. The trustee will tell you what documents will suffice.

Typical usage scenarios

You file this form when you open your bankruptcy case. A Chapter 7 filer includes it with the petition and schedules. A Chapter 13 filer includes it when starting a repayment case. An individual Chapter 11 filer uses it when seeking reorganization. A family farmer in Chapter 12 also files it with the petition.

If you file a joint case with your spouse, you include both numbers. Each spouse completes a separate section on the same form. You both sign the certification.

If you discover a mistake after filing, you correct it. You file an amended Form B 121 as soon as possible. You should tell the trustee of the correction. Prompt action reduces notice problems and delays.

If your case converts to another chapter, you do not usually need a new form. But if your number was wrong or missing, fix it right away. The trustee cannot proceed without a valid number or a clear statement that you do not have one.

When Would You Use a Form B 121 – Your Statement About Your Social Security Numbers?

You use this form on the day you file your case. You attach it to your petition when you open the case. If the clerk receives your petition without Form B 121, you may get a deficiency notice. The court can dismiss a case that fails to supply the required information. Avoid that risk and file it with your opening package.

Imagine these situations:

You are a consumer filing Chapter 7 to discharge credit cards. You file your petition, schedules, and this form on the same day. Your notices go out with your masked number. Creditors can match you to their files. The trustee confirms your identity at the meeting. Your case moves forward without a hitch.

You are a wage earner filing Chapter 13 to stop a foreclosure. You file the petition to trigger the automatic stay. This form goes in with the initial filing. Your employer may receive a wage order. The trustee needs your number to coordinate records. Your plan payments start, and your identity is clear.

You are an individual running a sole proprietorship. You file Chapter 11 as an individual. You still use your personal Social Security number. You do not list a business EIN on this form. The form is about you, not the business entity. The court uses your individual number for identity and notice.

You and your spouse file a joint case. You both must provide your full numbers. Each of you signs the declaration on the form. Trustees will ask both of you to show proof of your numbers at the meeting.

You do not have a Social Security number. You still file the form and check the “do not have” box. You then bring approved identification to your trustee meeting. The trustee will advise you on alternative documents. You must prove your identity and your status clearly.

You filed and later found a transposed digit on the form. You immediately file an amended form. You notify the trustee. If any notice went out with the wrong last four digits, you correct that in the record. Quick action minimizes confusion.

Typical users include consumers, sole proprietors, gig workers, landlords filing personally, and family farmers. The form is for the individual who is the debtor. Landlords or tenants use it only if they, as people, file bankruptcy. Businesses do not use it unless the owner files as an individual.

Legal Characteristics of the Form B 121 – Your Statement About Your Social Security Numbers

This form carries legal weight. You sign it under penalty of perjury. That means you declare the number is true and correct. A false statement can result in fines, dismissal, or worse. The court treats identity misstatements very seriously.

The form’s enforceability rests on your sworn declaration. The court and trustee rely on it to conduct your case. The clerk limits access to protect your privacy. By design, the form is not part of the public docket. Only the last four digits appear on notices and public filings.

The form also supports due process. Creditors must receive proper notice. An accurate notice allows creditors to file claims and protect their rights. If your number is wrong, a creditor might miss your case. That can lead to objections and delays. Correct information keeps the process fair and efficient.

Your privacy is a key legal consideration. You should never put your full Social Security number in other filings. Do not type it in your schedules or motion papers. If a mistake happens and you expose your number, act quickly. Ask the clerk how to restrict that entry and replace it. Use this form as the only place for your full number.

Carrying identification to your trustee meeting is also a legal requirement. The trustee must verify your identity. Bring an original, unexpired photo ID and a document that shows your full name. The trustee compares them to this form. If you cannot present acceptable proof, the trustee may continue the meeting. That can delay your case.

If you do not have a Social Security number, the court still requires clarity. You must state that you do not have one on this form. You must also be prepared to substantiate your identity. Follow the trustee’s guidance on acceptable documents. Failure to clarify your status can stall the case.

If you filed the wrong number, fix it at once. Until corrected, notices may be wrong. The trustee may hold off on key steps. Courts often require an amended form to cure the error. Do not wait for a hearing to correct it. Submit the amended form and alert the trustee.

How to Fill Out a Form B 121 – Your Statement About Your Social Security Numbers

You can complete this form in minutes. Take care to avoid errors. Follow these steps.

Prepare before you start:

- Gather your Social Security card or a document with your full number.

- Confirm the exact spelling of your name as it appears on the petition.

- If married and filing jointly, confirm your spouse’s full number as well.

Step 1: Complete the caption.

- At the top, write the court name and division, if known.

- If you have a case number, write it. If not, leave it blank. The clerk will fill it in.

- Enter your name exactly as it appears on your petition. Use “Debtor 1” for yourself.

- If this is a joint case, enter your spouse as “Debtor 2.”

Step 2: Provide Debtor 1’s full Social Security number.

- Locate the field for Debtor 1’s Social Security number.

- Enter all nine digits. Do not mask it. Do not use only the last four.

- Write legibly if you complete it by hand. Print clearly in black ink.

- Check each digit for accuracy. Confirm you did not transpose numbers.

Step 3: If you do not have a Social Security number.

- Check the box that states “I do not have a Social Security number.”

- Do not enter an employer identification number on this form.

- Follow the trustee’s instructions for the documents you must bring to the meeting.

Step 4: Provide Debtor 2’s number in a joint case.

- If filing jointly, complete Debtor 2’s section.

- Enter the spouse’s full nine-digit number, or check the “do not have” box.

- Each spouse must have their own entry. Do not swap the numbers.

- Confirm both names match the petition.

Step 5: Review the declaration.

- The form contains a declaration under penalty of perjury.

- You state that the number you listed is true and correct.

- Read it carefully before signing. Do not sign if unsure.

Step 6: Sign and date.

- Debtor 1 signs and dates the form. Print your name below your signature.

- Debtor 2 signs and dates in a joint case. Print the name below the signature.

- Use the date you actually sign. Do not pre-date or post-date.

- The attorney does not sign this form. Only the debtor(s) sign.

Step 7: File the form with your petition.

- File it the same day you open your case.

- If you e-file through counsel, your attorney files it under the sealed event.

- If you file on paper, hand it to the clerk with your petition packet.

- Do not attach this form to other documents. Keep it as a separate filing.

Step 8: Protect your privacy.

- Never place your full Social Security number in other filings.

- On any other form, use only the last four digits if required.

- If you accidentally disclose your full number elsewhere, act quickly.

- Ask the clerk how to restrict and correct the entry.

Step 9: Bring ID to the trustee meeting.

- Bring an original photo ID and a document that shows your full number.

- Acceptable documents include those that show the full number clearly.

- If you cannot produce them, the trustee may continue the meeting.

- Keep your case moving by preparing these documents early.

Step 10: Correct errors immediately.

- If you discover a digit error, file an amended Form B 121.

- Notify the trustee. Ask if any further steps are needed.

- Confirm the docket reflects the corrected last four digits.

- Retain proof of filing and any trustee communications.

Parties

The parties are the individual debtor(s) and the court. The form labels you as Debtor 1. In a joint case, your spouse is Debtor 2. Each debtor provides a separate Social Security number. Each debtor signs their own declaration.

Your attorney is not a party on this form. The attorney files it but does not sign it. The trustee and creditors are not signatories. They rely on the court’s handling of the form.

Clauses

The key clause is the declaration under penalty of perjury. It states you have examined the information. It states the number is true and correct. This clause gives the form legal effect. It exposes you to penalties if you lie. It also assures the trustee and the court of your identity.

The form may include a warning about privacy. It explains the restricted nature of the filing. It explains that only the last four digits appear on public notices. This clause reminds you to keep full numbers off other documents.

Signatures

Your signature is mandatory. Debtor 1 must sign and date. In a joint case, Debtor 2 must also sign and date. Your signature verifies the number. Without a signature, the form is incomplete.

Use your normal legal signature. If you cannot sign by hand, follow the court’s rules for electronic signatures. Your printed name must match the petition. Date the form on the day of signing.

Schedules and attachments

This form has no schedules or attachments. You should not attach your Social Security card. You should not attach pay stubs or tax records. Keep it to the form only.

Your bankruptcy “Schedules” are separate documents. Do not include your full number in any Schedule. Use redaction standards for all filings. If a schedule requires the last four digits, provide only those digits.

Practical tips to avoid mistakes

- Match your name to the petition exactly. Consistency matters.

- Double-check each digit against your card. Slow down and verify.

- Do not guess if you cannot find your number. Wait until you confirm it.

- Do not use an employer identification number on this form.

- If joint, confirm you did not swap spouse numbers.

- If handwriting, print clearly and avoid stray marks.

- Keep a copy of the completed form for your records. Store it securely.

What happens after you file

The clerk records the form in a restricted area. The docket will show that the form was filed. Public notices will show only the last four digits. The trustee will receive what is needed to verify identity. Creditors will see the last four digits on notices. That helps them match their records to your case.

If there is a mismatch, the trustee may contact your attorney. You may be asked to file an amended form. You may also need to provide extra proof at the meeting. Address any issues before the meeting if possible. That reduces delays.

If you truly do not have a Social Security number

Mark the “do not have” option for your entry. Do not leave the field blank. You must clearly state that you do not have a number. Then bring acceptable documents to prove your identity. The trustee will instruct you on what to bring.

This status must be truthful. Filing a false statement invites penalties. If you later obtain a number, that does not change past filings. You still must ensure current records are accurate.

Common pitfalls and how to fix them

- Transposed digits: File an amended form as soon as you notice. Alert the trustee.

- Missing signature: Refile the form with proper signatures. Do this immediately.

- Filed in the wrong case: Contact the clerk and your attorney. Correct the docket.

- Full number on another document: Seek to restrict that entry. File a corrected document.

- Joint case with one number missing: File an amended form with both numbers complete.

Bottom line

Form B 121 is simple but vital. It confirms your identity and protects your privacy. It provides an accurate notice to creditors. It supports a smooth trustee meeting. Complete it carefully, sign it, and file it with your petition. If you make a mistake, correct it fast. Doing this right keeps your case on track.

Legal Terms You Might Encounter

- Debtor: You are the debtor if you are the person filing the bankruptcy case. Form B 121 captures your Social Security number so the court can match your identity to your case and send notices correctly.

- Joint Debtor: If you file with a spouse, your spouse is the joint debtor. Each of you completes and signs your own Form B 121. The court needs both Social Security numbers to track both parts of the case.

- Petition: This is the document that starts your case. Form B 121 travels with the petition at the time of filing, but it is kept off the public record. Your petition will show only the last four digits of your Social Security number.

- Case Number: The court assigns this number after your petition is filed. You should place the case number on Form B 121 if you file the form after the petition. It helps the clerk link the form to your file.

- Docket: The docket is the public list of documents in your case. Form B 121 does not appear on the public docket because it contains your full Social Security number. This protection reduces the risk of identity theft.

- Redaction: Redaction means masking sensitive numbers. In bankruptcy, only the last four digits of your Social Security number appear publicly. Form B 121 holds the full number and stays private within the court.

- Personally Identifiable Information (PII): This is data that can identify you, like your full Social Security number and date of birth. Form B 121 contains PII, so handle it carefully and submit it only as the court instructs.

- Penalty of Perjury: When you sign Form B 121, you swear the number is correct. A false statement can bring serious consequences. Treat the form like a sworn declaration.

- Trustee: The trustee administers your case. The trustee uses the last four digits of your Social Security number to confirm your identity and send notices. The trustee may compare your form against your ID at the meeting of creditors.

- Meeting of Creditors (341 Meeting): This is the required meeting where you show identification. The trustee verifies your identity against the last four digits of your Social Security number. Form B 121 supports that process behind the scenes.

- Amendment: An amendment is a correction to a filed document. If you discover an error in your Social Security number after filing, you should submit an amended Form B 121 quickly so your case records match your true identity.

- Clerk: The clerk receives and manages filings. The clerk takes Form B 121, restricts access, and feeds your last four digits into the court’s noticing system to ensure accurate mailings and matching.

FAQs

Do you need to file Form B 121 in every individual bankruptcy case?

Yes. If you are an individual debtor, you must either provide your full Social Security number on Form B 121 or state that you do not have one. This is required even if you already put the last four digits on your petition.

Do you include an Individual Taxpayer Identification Number if you do not have a Social Security number?

No, not unless the court specifically instructs you to do so. If you do not have a Social Security number, you should check the box that says you do not have one. Do not substitute an employer number. If you later receive a Social Security number while your case is open, you should update the court with an amended Form B 121.

Do you file one form for both spouses in a joint case?

No. Each debtor completes and signs a separate Form B 121. The court needs both Social Security numbers for accurate records and notification.

Do you attach Form B 121 to the petition on the public docket?

No. Do not file it as a public exhibit. Follow the court’s instructions for submitting the form so it remains restricted. The petition and other public filings should show only the last four digits.

Do you have to serve Form B 121 on creditors or anyone else?

No. You submit it to the court, not to creditors. The court uses it to populate internal systems and to verify your identity. You should not share the form with third parties unless you are specifically instructed.

Do you list a business tax number on Form B 121?

No. Form B 121 is only about an individual’s Social Security number. A business employer number is not requested. If you are a sole proprietor, you still provide only your personal Social Security number on this form.

Do you need to amend the form if you notice a digit is wrong?

Yes. File an amended Form B 121 as soon as you catch the error. A mismatch between the petition’s last four digits and the court’s internal record can delay notices and tax reporting and can trigger deficiency warnings.

Do you need to bring anything related to Form B 121 to the meeting of creditors?

Bring government-issued photo ID and proof of your Social Security number, such as a Social Security card or a recent tax document that shows the full number. The trustee uses these to verify the last four digits against the court’s records.

Checklist: Before, During, and After the Form B 121 – Your Statement About Your Social Security Numbers

Before signing

- Find your Social Security card. If you cannot locate it, use a recent W‑2, 1099, or tax return that shows the full number. Avoid guessing.

- Confirm the exact spelling of your legal name as it appears on your petition.

- If you are filing jointly, gather your spouse’s Social Security number as well. Each of you completes a separate form.

- Verify that the last four digits on your petition match the last four digits of your Social Security number.

- If your case number is already assigned, have it ready to place on the form.

- Review your filing packet to ensure Form B 121 is included and will be handled as a restricted document.

During signing

- Enter your full nine-digit Social Security number. Do not enter only the last four digits on this form.

- If you do not have a Social Security number, check the box stating that you do not have one.

- Print clearly if you are handwriting. If possible, type to avoid misreads.

- Match your name exactly to the petition, including middle name or initial if used there.

- Add your case number if you are filing the form after the petition is filed.

- Read the penalty of perjury statement. Sign and date the form. Your spouse must sign a separate form in a joint case.

- Double-check every digit. A single error causes mismatches and delays.

After signing

- File the form with the court following the court’s restricted-filing instructions. Do not upload it to the public docket.

- Do not serve the form on creditors or attach it to public filings.

- Store a copy in a secure place. Avoid emailing unredacted copies.

- Check the first notices you receive. Confirm the last four digits on the notices match your Social Security number.

- Bring proof of your Social Security number to the meeting of creditors for identity verification.

- If you later discover an error, file an amended Form B 121 immediately and confirm the correction appears in subsequent notices.

- If you did not have a Social Security number at filing and later obtain one while your case is open, submit an amended form to update the court’s records.

Common Mistakes to Avoid Form B 121 – Your Statement About Your Social Security Numbers

- Providing only the last four digits on Form B 121. The form requires your full nine-digit number or a clear statement that you do not have one. Consequence: The court may issue a deficiency notice or delay processing. Don’t forget to enter the complete number on this private form.

- Listing a tax identification or employer number instead of a Social Security number. Form B 121 is only for your personal Social Security number. Consequence: Notices may be wrong, tax reporting may misfire, and your case can be flagged. Don’t enter any number that is not your Social Security number.

- Uploading the form to the public docket. Form B 121 must be restricted because it contains sensitive data. Consequence: Your Social Security number could be exposed, requiring urgent redaction and corrective filings. Don’t attach this form as an exhibit to any public document.

- Mismatched last four digits between the petition and Form B 121. Your petition displays only the last four digits, and they must match the court’s internal record. Consequence: Identity checks can fail, mailings may be delayed, and the trustee may require correction before moving forward. Don’t assume; verify the match.

- Illegible handwriting or transposed digits. A common error is swapping numbers or writing unclearly. Consequence: The court may record the wrong number, causing ongoing issues. Don’t rely on memory; compare the form to your Social Security card or a reliable tax document.

What to Do After Filling Out the Form B 121 – Your Statement About Your Social Security Numbers

- File it with your petition. If you are filing your case now, submit Form B 121 at the same time as your petition and other opening documents. Follow the court’s instructions so the form is restricted from public view.

- If your case is already open, add the case number. Then file the form as a restricted document. This helps the clerk link your number to the right case and correct any temporary placeholder entries.

- Do not share the form publicly. You do not serve it on creditors. Keep it off the public docket. Treat it as confidential and store your copy securely.

- Confirm accuracy on notices. When you receive the first court or trustee notices, look for the last four digits shown. They should match your Social Security number. If they do not, contact your filing contact and correct the court record with an amended Form B 121.

- Prepare for identity verification. Bring photo ID and proof of your Social Security number to the meeting of creditors. The trustee will compare the documents with the last four digits in the court’s system. If the trustee cannot verify your identity, the meeting can be continued or the court may require follow-up.

- Correct errors quickly. If you realize you entered an incorrect digit, file an amended Form B 121 right away. Do not wait for the trustee to flag it. Early correction avoids mismatched tax reporting and misdirected notices.

- Update if your status changes. If you did not have a Social Security number when you filed but later obtained one while the case is still open, submit an amended form to update the record. This keeps future notices and any reporting aligned with your identity.

- Keep a clean paper trail. Note the date you filed Form B 121 and keep proof of submission. Retain your stamped copy or confirmation in a secure folder. This record helps resolve any later questions about what the court received.

- Monitor for privacy concerns. If you ever see your full Social Security number appear in a public filing or notice, act promptly to address it through the appropriate correction process. Move quickly to limit exposure and request redaction if needed.

- Close out at discharge or dismissal. When your case ends, retain your copy of Form B 121 with your closing documents in a secure place. Keep it for your records. Do not discard it loosely or share it, even after the case is closed.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.