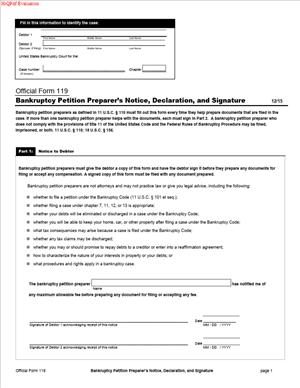

Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

Fill out nowJurisdiction: USA — Federal

What is a Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature?

Form F119 is the required notice and declaration used by a bankruptcy petition preparer. A bankruptcy petition preparer is a non-lawyer who helps type your bankruptcy forms for a fee. This form tells you that the preparer is not your attorney. It also lists what the preparer did, how much they charged, and how you received your copies. The preparer signs this form under penalty of perjury.

This form exists to protect you. It makes the preparer state clear, specific facts. It forces transparency about services and fees. It prevents the preparer from holding your filing fee. It reminds you that the preparer cannot give legal advice. It also gives the court a record of who prepared your papers.

You will see Form 119 in individual bankruptcy cases where a non-attorney helped you prepare the petition and schedules. It applies across all chapters that individuals file, including 7, 11 (subchapter V does not change this duty), 12, and 13. The form must be filed when the petition is filed, or promptly after. If you hired a petition preparer, the court expects this form.

Who typically uses this form?

The direct user is the preparer. They complete and sign it. You will receive a copy. If you did not use a preparer, you do not need this form. If you have a lawyer, your lawyer does not use it. Lawyers follow a different fee disclosure process.

Why would you need this form?

You need it if a non-attorney helped you for pay. Many people choose a typing service because the forms feel overwhelming. You might be between jobs and want to save attorney fees. You might have simple debts and think you can handle the case yourself. If so, the preparer you hired must complete Form 119. Without it, the court may impose fines on the preparer or delay your case.

Typical usage scenarios

You met a local typing service that offered to “prepare the packet.” They typed your petition, schedules, and statements using your information. They charged a flat fee. They did not represent you in court. They did not answer legal questions. They give you Form 119 to file with your petition. Another scenario: An online document assistant helped you generate forms from a questionnaire. They are a petition preparer. They must give you Form 119 and sign it. A third scenario: A friend offered to help for free. That friend is not a preparer if they accepted no money at all. If any compensation changed hands, they are a petition preparer and must complete this form.

In short, this form is the accountability piece. It confirms the preparer’s role is limited. It documents their fee. It provides their full identity. It also certifies that you received copies of the documents they prepared for you.

When Would You Use a Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature?

You use this form when a non-attorney helped prepare your bankruptcy papers for a fee. You would attach it with your petition filing. The most common time is the day you file the case. If your preparer finished the packet earlier, they should have given you the signed form then. You include it with your petition, schedules, and statements.

Practical examples help. Suppose you are a wage earner with credit card debt. You hire a storefront typing service for $250. They enter your information into the forms. You sign your petition and schedule yourself. The preparer signs Form 119 and any forms they prepared. You file everything together. Another example: You are a small sole proprietor with business debts. You use a non-lawyer to organize your income and expenses on the forms. That person took payment. They must complete Form 119. If they do not, the court can require it and may fine them.

Who typically uses it?

Bankruptcy petition preparers complete and sign the form. Debtors who hired them must file it. Typical debtors include individuals, married couples filing jointly, and sole proprietors. Landlords, tenants, and consumers use it when filing as individuals. Corporate entities must appear through counsel, so a preparer cannot stand in for a company. If you are a company, this form does not solve that issue.

You would not use this form in two situations. First, you have an attorney. Your attorney will not file this form. They will file their own fee disclosure. Second, you filed pro se and received no paid help. There is no preparer, so you skip this form. If you worked with a non-profit counselor who did not charge you for typing, that is not a preparer under this form.

Timing matters. The preparer should give you a signed copy before filing. You should file it with your petition. If it is missing, the clerk may note the omission. The court can set a deadline to cure. The preparer can face sanctions if they fail to complete it. The court can also order the preparer to return fees and pay fines.

Legal Characteristics of the Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

This form is legally required when a paid, non-attorney prepares your bankruptcy documents. Federal bankruptcy law regulates petition preparers. The law restricts what they can do. It also requires them to disclose their identity and fees. The form puts those required disclosures in one place.

Is it legally binding?

Yes. The preparer signs under penalty of perjury. That means the statements can be enforced. If the preparer lies, the court can sanction them. Sanctions can include fines for each violation. The court can order the preparer to return fees. The court can also prohibit the preparer from working in bankruptcy cases.

What ensures enforceability?

Several features do. The form requires the preparer’s name, address, and phone number. It also requires the preparer’s identifying number. That number is the preparer’s full Social Security number. The court uses it to track compliance across cases. The form requires an itemized statement of services performed. It includes the total fee charged. It also includes a certification that the debtor received copies of prepared documents. These disclosures let the court verify compliance with the law.

The form also includes a required notice to you. It states that the preparer is not an attorney. It explains the limits on what they can do. It warns that they cannot give legal advice. The notice lists common legal questions the preparer cannot answer. Examples include which chapter to file, what property is exempt, and what debts are dischargeable. If a preparer crosses that line, the court can act.

There are two more important legal points. First, a preparer cannot collect or handle your court filing fee. You must pay the filing fee directly to the court. You can request to pay in installments or, in some cases, request a waiver. The preparer cannot take your filing fee and deliver it. Second, the preparer must sign every document they prepared. They must place their identifying number on each document they prepare. That identifies their involvement on the record.

General legal considerations for you are simple. You remain responsible for the accuracy of your filings. A preparer can type, but you sign your petition and schedules. You must review everything carefully. If you have legal questions, talk with a lawyer. If a preparer offers legal advice, be cautious. That advice may be wrong. It can expose you to risk. If the form is incomplete or missing, expect the court to question the preparer. This does not replace your duty to provide complete, truthful information.

How to Fill Out a Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

Follow these steps if you are the bankruptcy petition preparer. If you are the debtor, use this as a checklist for what to expect.

1) Confirm whether the form is required.

- Ask: Did you receive any compensation for preparing bankruptcy documents for this debtor?

- If yes, you are a petition preparer. You must complete Form 119.

- If you received zero compensation, the form is not required.

2) Gather your identifying information.

- Use your full legal name.

- List your business name, if any, as “doing business as.”

- Include your complete mailing address and a phone number where you can be reached during business hours.

3) Provide your identifying number.

- Use your full Social Security number as your identifying number.

- Do not use a business EIN or a tax ID in place of your Social Security number.

- The court limits public access to this information, but you must supply it.

4) Complete the required notice to the debtor.

- The form contains a notice that you are not an attorney.

- It explains that you cannot give legal advice or represent the debtor in court.

- Ensure the notice section is complete and printed on the copy you give the debtor.

5) Itemize the services you performed.

- List each document you prepared, such as the petition, schedules, and statements.

- Use the common names of the forms. For example: “Voluntary Petition,” “Schedules A/B, C, D, E/F,” “Statement of Financial Affairs,” “Chapter 13 Plan.”

- If you typed a credit counseling certificate or means test, list that too.

- Be specific. Vague entries like “paperwork” are not sufficient.

6) Disclose the fee you charged.

- State the total amount paid by the debtor for your services.

- If the debtor paid in installments, show the total and the amounts received to date.

- If you charged for copies, postage, or delivery, list those amounts separately.

7) Certify you did not handle the court filing fee.

- The form requires you to acknowledge that you did not collect any court filing fee.

- Confirm that the debtor will pay the court directly.

- Do not accept cash to deliver to the clerk. That violates the law.

8) Certify delivery of copies to the debtor.

- You must give the debtor a copy of every document you prepared.

- You must give the debtor a signed copy of Form 119.

- Do this no later than the time the documents are presented for filing.

- On the form, confirm that you delivered these copies and the date you did so.

9) Sign and date the declaration.

- Read the perjury statement carefully.

- Sign your name in ink if filing on paper. If filing electronically, follow local e-sign rules.

- Date the form on the day you sign it.

- Your signature certifies that the information is true and complete.

10) Ensure your identifying number and signature appear on each prepared document.

- On each document you prepared, place your name, address, and identifying number.

- Sign each prepared document in the space indicated for a preparer’s signature.

- This includes the petition, each schedule, the statement of financial affairs, and any other prepared forms.

11) Handle multiple preparers properly.

- If more than one person prepared the documents for compensation, each preparer must be identified.

- Each preparer must place their identifying number and sign each document they prepared.

- As a best practice, each preparer completes their own Form 119. Alternatively, one form can list each preparer with full details if permitted by the court.

12) File the form with the petition.

- Give the debtor the signed original for filing with the petition and schedules.

- If you file on the debtor’s behalf with their permission, include Form 119 in the filing packet.

- Keep a copy for your records.

13) Review for accuracy and completeness.

- Check that your name, address, and number are correct.

- Confirm that fees and services are fully itemized.

- Verify that copies were delivered to the debtor.

- Make sure all prepared documents bear your identifying information.

14) Avoid prohibited conduct.

- Do not choose the chapter for the debtor. Do not advise exemptions.

- Do not tell the debtor which debts are dischargeable.

- Do not negotiate with creditors for the debtor.

- Do not appear in court or sign for the debtor.

- If the debtor asks legal questions, direct them to an attorney.

15) Address corrections quickly.

- If a mistake is found, prepare a corrected Form 119 immediately.

- Provide the corrected copy to the debtor.

- File the corrected version with the court as needed.

Practical tips for debtors:

- Ask for Form 119 before you pay. Review the services and fees.

- Make sure you receive copies of everything you sign.

- Confirm the preparer did not take your filing fee.

- Check that the preparer signed each document they prepared.

- If the preparer refuses to sign, do not file those documents. That is a red flag.

Common pitfalls and how to avoid them:

- Missing identifying number: The form is incomplete without the preparer’s full Social Security number. Provide it.

- Vague service descriptions: Itemize each document and task. Transparency prevents disputes.

- Handling the court fee: Never accept the filing fee. Tell the debtor to pay the court directly.

- Late delivery of copies: Give copies at the time of signing or before filing. Certify the delivery date on the form.

- Overstepping into legal advice: Keep your role to typing and transcribing. Do not choose legal options for the debtor.

How this form relates to the petition and schedules:

- Your itemization should match the debtor’s filed packet. If you typed Schedules A/B, say so.

- If the debtor later amends a schedule and you prepare the amendment, sign that document as the preparer as well.

- If you did not prepare a document, do not sign it as the preparer.

If you follow these steps, you will create a complete, compliant Form 119. You will also give the debtor clear information about your role. The court will have the disclosures it needs. That protects you and the debtor, and keeps the case on track.

Legal Terms You Might Encounter

- Bankruptcy petition preparer (BPP). A BPP is a person paid to type or prepare your bankruptcy forms. They are not a lawyer and cannot give legal advice. Form 119 is the BPP’s promise to the court and to you that they followed the rules.

- Debtor. You are the debtor if you are filing for bankruptcy. This form is not your signature. It is the preparer’s signature. You should still review it to confirm it is accurate and complete.

- Case number. The court assigns a case number after filing. If you complete Form 119 before filing, you may not have it yet. If a number exists, the BPP should include it so the form links to your case.

- Identifying number (Social Security number). The BPP must list their Social Security number on this form and on every document they prepare. This identifies who prepared your papers. It also helps the court enforce the rules for BPPs.

- Declaration under penalty of perjury. This is a sworn statement. The BPP confirms they followed the law, told you they are not a lawyer, and gave you a copy of every document they prepared. Lying on this form has serious consequences.

- Notice to debtor. The law requires the BPP to give you a written notice that they are not an attorney and cannot give legal advice. Form 119 confirms that notice was given. You should receive and keep that notice.

- Fee disclosure. The BPP must disclose the total fee you paid them for preparing documents. Court filing fees and credit counseling fees are separate. Form 119 records the BPP’s fee so the court can review it.

- Document preparer’s signature. The BPP must sign and date Form 119. The signature is the BPP’s confirmation that the information is true and complete. Unsigned forms can cause delays or penalties.

- Section 110 compliance. The law sets strict rules for BPPs. These include giving the required notice, listing their identifying number, and not giving legal advice. Form 119 is where the BPP states they complied.

- Copies and delivery. The BPP must give you a copy of every document they prepared for filing. Form 119 confirms that you received those copies. Keep them in your records.

FAQs

Do you need Form 119 if you prepared your own papers?

No. You only use Form 119 when a paid non-attorney helped prepare your bankruptcy documents. If you did everything yourself or got free help from a friend, you do not file this form.

Do you have to disclose the preparer’s Social Security number?

Yes. The preparer must list their full Social Security number on this form and on each document they prepared. This is required. It helps the court identify the preparer and enforce the rules. The court’s system protects this information from public view.

Do you file one Form 119 or one for each document?

You file one Form 119 with your petition. The BPP must also put their name, address, and identifying number on each document they prepare. If the BPP later prepares more documents or charges more fees, file an updated form.

Do you have to attach proof that the preparer gave you the required notice?

Form 119 itself is the preparer’s sworn statement that they gave you the notice and a copy of your documents. You do not need to attach the notice to the form. Keep your copy of the notice and any receipts in your records.

Can a bankruptcy petition preparer tell you which exemptions to claim or which chapter to file?

No. A BPP cannot give legal advice. They cannot tell you what to file, what to claim, or how to handle your case. They can only type the information you provide and provide blank forms or publicly available instructions.

How much can a preparer charge?

A BPP may charge a reasonable fee for typing and document preparation. The court can review the fee and order a refund if the amount is excessive or if the BPP broke the rules. The fee you paid must appear on Form 119.

What happens if you forget to file Form 119?

The court may issue a deficiency notice and delay your case until you file it. The court can also fine the preparer, order fee refunds, or take other enforcement actions. File the form promptly to avoid problems.

What if more than one person helped prepare the paperwork?

Each individual who was paid to prepare your documents must complete and sign their own Form 119. If a business prepared the documents, the individual preparer still must list their name and Social Security number, and may include the business name.

Checklist: Before, During, and After the Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

Before signing

- Confirm whether a paid preparer helped with your documents.

- Get the preparer’s full name, business name (if any), address, phone, and email.

- Obtain the preparer’s Social Security number for the form.

- Identify each document the preparer worked on.

- Gather all receipts showing the fee you paid to the preparer.

- Get the required written notice that the preparer is not an attorney.

- Ensure the preparer gave you copies of every document they prepared.

- If you already have a case number, provide it to the preparer.

- Agree on the total fee and what it covers. Exclude court filing fees.

- Set aside time to review the form line by line.

During signing

- Check the spelling of the preparer’s name and the address.

- Verify the Social Security number is complete and accurate.

- Confirm the fee amount matches your receipt.

- Make sure the form lists all documents the preparer worked on, if requested.

- Confirm that the declaration states the required notice was provided to you.

- If a case number exists, confirm it is correct.

- Ensure the preparer signs and dates the form where indicated.

- If more than one preparer was paid, each preparer signs their own form.

- Confirm that the preparer’s name, address, and identifying number appear on every document they prepared.

- Ask for a copy of the signed Form 119 for your records.

After signing

- File Form 119 with your bankruptcy petition and other opening documents.

- If you file later documents prepared by the same BPP, ensure their name and identifying number appear on those documents.

- If the preparer charges additional fees later, file an updated Form 119.

- Keep copies of the signed form, the notice, and all receipts in a safe place.

- Monitor your case for any fee review or deficiency notices and respond quickly.

- If the court orders a refund or correction, comply by the stated deadline.

- If you discover an error on the form, file an amended Form 119 promptly.

- Do not let the preparer communicate with the court for you. They cannot represent you.

Common Mistakes to Avoid Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

- Leaving out the preparer’s Social Security number. Don’t forget to include the full number. Missing SSNs can trigger fines, fee refunds, and delays.

- Mixing court fees with the preparer’s fee. List only what you paid the preparer for document preparation. If you bundle court fees into the preparer’s fee, the court may order a refund.

- Not giving the required notice to the debtor. The preparer must give you a written notice that they are not an attorney. If this is skipped, the court can impose penalties and reduce or disgorge fees.

- Failing to sign and date the form. An unsigned form is incomplete. The court can issue a deficiency notice, pause your case, and review the preparer’s conduct.

- Omitting the preparer’s name and identifying number on other documents. The preparer must put their identifying information on every document they prepare. If not, the court can impose fines and order fee refunds.

What to Do After Filling Out the Form 119 – Bankruptcy Petition Preparer’s Notice, Declaration and Signature

- File Form 119 with your petition. Submit it with your initial filing package. This allows the court to confirm who prepared your paperwork and what fee you paid.

- Ensure the preparer’s info appears on every document they prepared. Check your petition, schedules, statements, and any later amendments. The BPP’s name, address, and identifying number should appear on each document they prepare.

- Keep records of delivery. Keep copies of the signed form, the written notice, and all receipts. Keep proof that the preparer gave you copies of the documents they prepared.

- Watch for court notices. The court or trustee may review the preparer’s fee or request clarifications. Respond by the deadlines. If the court orders a fee refund, follow the order.

- File an amended Form 119 if anything changes. Amend if the preparer prepares additional documents, changes their fee, or corrects any mistake. Make the correction clear and file it promptly.

- Do not rely on the preparer for legal advice or court contact. Handle your own communications with the court and trustee, or consult an attorney if you choose. A BPP cannot represent you.

- Store everything safely. Keep the original signed Form 119, the notice, receipts, and any amendments with your bankruptcy file. You may need them for questions later in the case.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.