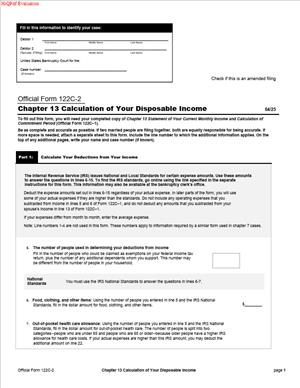

Form 122C-2 – Chapter 13 Calculation of Your Disposable Income

Fill out nowJurisdiction: Country: USA | Province or State: Federal

What is a Form 122C-2 – Chapter 13 Calculation of Your Disposable Income?

Form 122C-2 is the Chapter 13 means test expense form. You use it to calculate your monthly disposable income. The court and trustee use that number to test your plan. They check whether you promise enough income to your unsecured creditors. The number also helps confirm your plan length and feasibility.

You complete Form 122C-2 only after Form 122C-1. Form 122C-1 figures your current monthly income. It compares your income to the median for your household size. If your income is above the median, you must complete Form 122C-2. If your income is below the median, you may not need it. Some courts still ask for it in special cases. Your attorney will know local practice.

This form does not ask what you actually spend on everything. It uses a mix of standardized and actual expenses. Many expense amounts come from fixed standards. These include housing, food, and transportation allowances. For some categories, you claim your actual monthly expense. These include taxes, insurance, and court-ordered payments. The form then subtracts all allowed expenses from your income. The result is your monthly disposable income under the means test.

Who typically uses this form?

Any Chapter 13 debtor with income above the median. Joint debtors in a household complete it together. Self-employed debtors complete it as well. Small business owners who file Chapter 13 also use it. Their business income flows into the household income calculation.

Why would you need this form?

Chapter 13 requires a plan that pays your projected disposable income. If the trustee or a creditor objects, the court will test your plan. The test uses your Form 122C-2 calculation. That makes this form central to your case. You also use it to set realistic payment plans. You avoid underfunding or overpromising.

Typical usage scenarios

You are a wage earner with steady pay and a car loan. Your household income is above the median. You need to show how much you can pay each month. Or you run a small business with fluctuating income. Your household still earns above the median. You need to prove your allowed expenses and set a plan term. Or you and your spouse file jointly. One of you has overtime. The form helps normalize income and expenses. It supports a payment you can sustain.

Think of Form 122C-2 as a structured budget for the law. It sets uniform expense allowances. It treats secured debts and priority debts in a defined way. The math creates a baseline for your plan. The court can adjust for known changes, if needed. But you start here.

When Would You Use a Form 122C-2 – Chapter 13 Calculation of Your Disposable Income?

You use this form early in your Chapter 13 case. You usually file it with your petition. If you file a bare-bones case, you have a short deadline to file it. The court expects it soon after your case begins. The trustee reviews it before your meeting of creditors. The review informs plan confirmation.

You also use it when you amend your income or expenses. If your paycheck data was off, amend both forms. If your household size changes, update it. If you discover an error in a deduction, fix it. An accurate Form 122C-2 reduces objections. It supports a smoother confirmation.

Typical users include wage earners and salaried professionals. Many own homes or cars and need to manage arrears. Joint filers use it to capture combined numbers. Self-employed debtors also use it. They include business income on income forms. They still claim household expenses on this form. Small business owners, gig workers, and contractors fall into this group. Government or union employees also use it. Their payroll deductions often include required items.

You use this form if your Form 122C-1 shows above-median income. That triggers the longer commitment period and this expense test. You will also use the results in planning talks. If your disposal number is high, your plan payment may rise. If it is low, you still must cover your secured and priority debts. So the calculation matters either way.

You may also use the form to address trustee concerns. For example, a trustee may question your tax withholding. You can show the actual tax owed and correct the number. Or the trustee may query your car costs. You can confirm ownership costs and secured payments. The form gives a place to prove each part.

Legal Characteristics of the Form 122C-2 – Chapter 13 Calculation of Your Disposable Income

This is an official bankruptcy form. The Bankruptcy Rules require you to use it when applicable. You sign your bankruptcy forms under penalty of perjury. That makes your entries sworn statements. The court relies on these statements. The trustee tests them against your documents. False statements carry serious consequences.

The form is not a contract. It does not bind creditors by itself. It feeds into a legal test that the court applies. The Bankruptcy Code sets that test. If a trustee or creditor objects, the court uses your numbers. The court decides if you commit enough income to the plan. That decision affects plan confirmation. Once confirmed, the plan binds you and your creditors.

What ensures enforceability?

Several things do. First, the form is mandatory when your income is above the median. Second, you must provide accurate support for your entries. Pay stubs, tax returns, and loan statements matter. Third, the trustee reviews your numbers closely. The trustee can object or seek more data. Fourth, the court can hold hearings and make findings. The judge can adjust the disposable income if facts demand it. You must follow the court’s ruling in your plan.

General legal considerations include several points. Use standardized expense amounts where required. Do not substitute your actual spending for a standard. Claim actual expenses only where the form allows it. For secured debts, include both ongoing payments and cure amounts. Spread those over 60 months on the form. For priority debts, divide the total by 60 months as well. Include chapter 13 administrative expenses as the form directs. Do not double-count any expense. Do not mix gross income with net income in the calculation. Keep clear records for each line.

Accuracy matters. An error can raise your plan payment or delay confirmation. Omissions can cause objections or even dismissal. If your situation changes, amend the form. The law allows the court to consider known changes at confirmation. So update your numbers when needed. That protects your case and your plan.

How to Fill Out a Form 122C-2 – Chapter 13 Calculation of Your Disposable Income

Follow these steps to complete the form correctly. Keep your entries clear, accurate, and well supported.

1) Confirm you need this form.

- Complete Form 122C-1 first. That form calculates your current monthly income. It also sets your household size.

- If your income is above the median for your size, complete Form 122C-2. If below the median, check local practice. Some courts may still request it in limited cases.

2) Gather your documents.

- Recent pay stubs for the past six months.

- Proof of other income for that period.

- Most recent tax return.

- Mortgage statements showing payment and arrears.

- Car loan or lease statements.

- Statements for other secured debts.

- Proof of insurance premiums.

- Statements for mandatory payroll deductions.

- Records of child support or alimony paid.

- Records of child care or dependent care costs.

- Documents for priority debts, such as taxes or support arrears.

- Any documentation that supports claimed expenses.

3) Understand standardized versus actual expenses.

- Many living expenses are set by standards. The form uses fixed allowance amounts. You do not enter your household’s actual spending for those lines.

- Other lines take your actual monthly costs. You must support those with records. Follow the form’s instructions for each line.

4) Start with the standardized living expenses.

- Enter the national standard amounts for food, clothing, and personal care. Use your household size to select the correct amounts.

- Enter the standard out-of-pocket health care amounts. These vary by age group and household size.

- Do not adjust these numbers to match your spending. Use the standard amounts.

5) Complete housing and utilities allowances.

- Enter the local standard allowance for housing and utilities. This includes a non-mortgage component and a mortgage or rent component.

- The allowance is based on your county and household size. Use the correct local standard amounts.

- You will also list your secured mortgage payments later. The form accounts for both, as directed.

6) Complete transportation allowances.

- Enter the local standard operating cost for vehicles. Use the correct number of vehicles you operate.

- If you have a car loan or lease, enter the ownership cost allowance. This is a standardized amount.

- If you do not have a loan or lease, you generally cannot claim an ownership allowance. You can still claim operating costs.

- Public transportation users can claim the standard public transit allowance, if applicable.

7) Add other necessary expenses allowed by the form.

- Taxes. Enter your monthly federal, state, and local taxes. Use a realistic number. Base it on your actual tax liability, not just withholding.

- Social Security, Medicare, and mandatory retirement. Enter only mandatory payroll deductions. Voluntary retirement contributions generally are not included here.

- Insurance. Enter term life insurance premiums for you and your spouse, if applicable. Enter health insurance premiums not paid by your employer. Include dental and vision if separate.

- Court-ordered payments. Enter the monthly child support or alimony you pay under an order.

- Child care or dependent care. Enter reasonable monthly costs needed for work.

- Education for job requirements. Enter the costs required for your job or to maintain a license.

- Disability insurance or health savings account contributions. Enter actual monthly amounts if applicable.

- Care for elderly or disabled family members. Enter the reasonable monthly support needed for their care.

- Charitable contributions. Enter reasonable monthly charitable giving if you have a consistent pattern.

- Telecommunication services are needed for health or safety. Enter only necessary amounts not already covered by standards.

8) Calculate secured debt payments.

- List all debts secured by property, such as your home or car.

- For each, determine the average monthly payment due in the next 60 months. Add up the amounts due and divide by 60.

- Include cure amounts for arrears. Divide the arrears you will cure by 60 and add that to the monthly amount.

- Enter the average monthly payment total for secured debts on the form.

- Follow the form’s directions to avoid double-counting with standardized allowances.

9) Calculate priority debt payments.

- List priority claims, such as recent taxes and support arrears.

- Add the total amount you must pay for these to your plan.

- Divide the total by 60. Enter that monthly average on the form.

10) Add Chapter 13 administrative expenses.

- The form includes an administrative expense calculation.

- Use the current multiplier or percentage provided in the form instructions.

- Enter the resulting monthly administrative expense. This estimates trustee fees and related costs.

11) Review any special adjustments.

- Some lines allow “special circumstances.” Use them only with strong support.

- Examples include necessary expenses for a serious medical condition.

- Attach a detailed explanation and documents if you claim special circumstances.

12) Total all allowed expenses.

- Add all standardized and actual expenses you entered.

- Check your math. Confirm you used monthly amounts, not annual totals.

- Keep your work papers. The trustee may request them.

13) Determine your monthly disposable income.

- Start with your current monthly income figure from Form 122C-1.

- Subtract your total allowed expenses from this form.

- The difference is your Chapter 13 disposable income.

- This is not always your final plan payment. It is the baseline the court uses.

14) Check plan implications.

- If your disposable income is positive, your plan must commit at least that amount. The commitment usually lasts the required plan term.

- If your number is low or negative, you still must pay secured and priority debts. You also must pay administrative costs and any required fees.

- Your plan term is often five years if you are above the median. The court can confirm a shorter plan only in limited cases.

15) Complete the signature and declaration.

- Review every entry for accuracy. Make sure names and case numbers are correct.

- Sign and date the form as required. Your signature is under penalty of perjury.

- If you filed jointly, both spouses must sign where required.

16) File the form on time.

- File it with the court by the deadline. Keep a copy for your records.

- Provide copies of documents to the trustee when requested.

- If you amend the form, file the amended version and serve the required parties.

17) Prepare for trustee review.

- Be ready to explain each entry. Show your support documents.

- Clarify how you computed secured payment averages. Explain any arrears in the math.

- Be ready to adjust tax numbers to reflect actual liability.

18) Avoid common mistakes.

- Do not use actual spending for standardized allowances.

- Do not claim vehicle ownership costs without a loan or lease.

- Do not overstate tax withholding. Use your true tax liability.

- Do not forget to divide annual or total amounts by 12 or 60 when required.

- Do not double-count mortgage or car costs across different lines.

- Do not include voluntary retirement contributions in mandatory deduction lines.

- Do not ignore known changes. Update the form if facts change.

Practical examples help make this clear.

Example 1: You have one car with a loan. You claim the standard vehicle ownership allowance. You also list the average monthly car payment by dividing the next 60 months of payments by 60. You include any arrears in that average. You also claim the standard operating cost. You do not add any extra for gas beyond the standard.

Example 2: You pay child support under a court order. You enter the monthly support as a court-ordered payment. You also list any support arrears as a priority debt. You divide the arrears by 60 and include that monthly amount.

Example 3: You owe recent income taxes. The tax is a priority claim. You enter the total tax to be paid in the plan. You divide by 60 and include the monthly result. You also enter your current monthly tax withholding as an expense. Make sure the withholding matches your actual tax liability.

Example 4: Your home loan is in arrears. You plan to cure the arrears through the plan. You list your average monthly ongoing mortgage payment as a secured debt payment. You also divide the total arrears by 60 and add that to the secured payment section. You still claim the standardized housing allowance as directed by the form.

Example 5: You have consistent charitable giving. You enter a reasonable monthly amount. You support it with past records. You keep the amount within typical limits.

Treat the form like a precise worksheet. Use the standards where required. Support each actual expense with clear proof. Keep your records handy. The trustee will expect a clean file.

Finally, remember this form sets a baseline. The court may consider known changes at confirmation. If your income drops or rises, explain it early. Provide proof, such as a job change letter or new lease. Update your forms if needed. That helps you deliver a realistic, confirmable plan.

Legal Terms You Might Encounter

- Disposable income means the money left after allowed expenses. This form calculates that number using standardized allowances and certain actual costs. The result helps set how much you must pay unsecured creditors.

- Current monthly income is your average monthly income over a six‑month lookback. It includes most of the income you received during that period. This form uses that figure, carried over from your companion income form, to start the calculation.

- Projected disposable income is what the court expects you to pay during your plan. This form translates your income and expenses into a monthly projection. Your plan must at least commit this amount to unsecured debts.

- Commitment period is how long you must make plan payments. It is either three or five years in most cases. The number ties to your income level and this form’s outcome. A higher income often means a longer commitment period.

- Priority claims are debts the law puts first in line for payment. Examples include certain taxes and support obligations. This form does not list the creditors, but it reserves room in your budget. Your plan must pay priority claims in full unless the creditor agrees otherwise.

- Secured claims are debts tied to collateral, like a car or home. On this form, you deduct payments tied to property you will keep. You do not deduct payments on property you will surrender. Be consistent with your plan.

- Nonpriority unsecured claims are credit cards, medical bills, and similar debts. They get paid after priority and secured debts. This form’s disposable income figure drives how much these creditors receive.

- Standardized expense allowances are preset amounts for common living costs. Think food, clothing, and out‑of‑pocket health care. This form uses those allowances, not your actual spending, for many categories. You can claim extra only when the rules allow and you document it.

- Administrative expenses are the costs of running your case. This includes approved fees paid through the plan. This form lets you reserve a standard monthly amount for those costs so your plan can function.

- Special circumstances are necessary expenses that fall outside the standard limits. You can claim them on this form with a clear explanation and proof. Common examples include unusual medical costs or caregiving needs. You must show why the expense is reasonable and unavoidable.

FAQs

Do you have to complete this form if your income is below the median?

Often, you do not. If your household income is below the median, you usually do not need this form. You still must complete the companion income form. If your income is above the median, you complete this form to calculate disposable income.

Do you use actual expenses or standard amounts?

You use both. Many living expenses follow standard allowances. Some expenses use your actual numbers, like secured debt payments, taxes, insurance, and certain care costs. Read each line closely. Claim only what the form allows, and keep proof.

Do you include your spouse’s income on this form?

In a joint case, yes. In a single case, you include household income used to pay household expenses. You may exclude a spouse’s separate expenses with a proper adjustment on the income form. Be consistent across both forms.

Do you account for changes you expect after filing?

Yes, but carefully. The form anchors to your six‑month income average and allowed expenses. You can explain special circumstances if you expect reliable, necessary changes. Document the change and why it should apply going forward. The trustee will review it.

Do you list car and mortgage payments here?

Yes, if you will keep the property. Include the regular monthly payments and any needed cure amounts as allowed. If you will surrender the property, do not deduct those payments. Make sure your plan and this form match.

Do you need to attach proof for the expenses you claim?

Attach proof for any nonstandard or variable expense. This includes health insurance, childcare, education tied to work, extra medical costs, taxes not withheld, and care of elderly or disabled family members. For standard allowances, you do not need receipts, but keep them anyway in case of questions.

Do you round numbers on this form?

Yes. Round to the nearest dollar unless the form says otherwise. Be consistent. Double‑check totals after rounding.

Do you have to amend this form if your income changes?

You may need to. If your income or expenses change before plan confirmation, expect questions. The trustee can request updates. If your change is significant, amending the form and plan helps avoid delays.

Checklist: Before, During, and After the Form 122C-2 – Chapter 13 Calculation of Your Disposable Income

Before signing

- Six full months of income detail for everyone contributing to the household.

- Health insurance and life insurance premium statements.

- Payroll deductions for taxes, Social Security, union dues, and retirement.

- Proof of childcare, dependent care, or education expenses tied to work.

- Documentation of ongoing medical costs not covered by insurance.

- Mortgage statements showing principal, interest, taxes, and insurance.

- Car loan or lease statements showing the monthly payment and payoff.

- Statements for any other secured debts you will keep.

- Proof of domestic support obligations and current payment amounts.

- Proof of charitable contributions, if regular and documented.

- Utility bills, if you claim higher‑than‑standard expenses allowed by the form.

- Documentation for special circumstances you will claim, with a written explanation.

- Your draft plan so that expense choices match the plan treatment of collateral and arrears.

- A calculator and time to review the math without rushing.

During completion and signing

- Verify your current monthly income matches the income form.

- Confirm household size is correct and used consistently.

- Check each expense category for standard vs. actual rules.

- Include secured debt payments only for the property you will keep.

- Avoid double‑counting escrowed taxes and insurance in mortgage payments.

- Make sure business expenses are not deducted twice across forms.

- Enter tax amounts actually owed, not over‑withholding you plan to change.

- Attach proof for any nonstandard or special circumstance entries.

- Confirm the commitment period aligns with your income level and plan design.

- Recheck all totals after rounding to the nearest dollar.

- Read the declaration. Sign and date where required.

After signing

- File the form with your case as directed by local procedure.

- Provide a copy to the trustee if required.

- Keep a complete copy with all attachments for your records.

- Calendar your plan payment start date. Pay on time each month.

- Prepare for questions at your meeting with the trustee. Bring proof.

- Watch for deficiency or clarification requests. Respond quickly.

- If income or expenses change before confirmation, consider amending.

- Update your plan if the trustee requests changes based on this form.

- Store the final, confirmed plan and this form together for easy reference.

Common Mistakes to Avoid

Using gross income instead of the defined current monthly income.

- Consequence: Your disposable income will be wrong. Expect objections and delays.

- Don’t forget: Use the six‑month average from the income form, not a guess.

Double‑counting expenses that are already in another line.

- Consequence: Payments look inflated. The trustee may cut them and raise your projected disposable income.

- Don’t forget: If escrow covers taxes and insurance, do not add them again.

Claiming actual amounts where the form uses standard allowances.

- Consequence: The trustee may reduce your expense claims. Your unsecured payment may increase.

- Don’t forget: Use the standard amounts unless a line allows an actual figure.

Deduct secured payments for the property you plan to surrender.

- Consequence: Your budget will understate disposable income. The plan will not match and may draw objections.

- Don’t forget: Only deduct payments for collateral you will keep and pay through the plan or directly.

Skipping documentation for special circumstances.

- Consequence: The extra expense may be denied. Your payments may go up.

- Don’t forget: Provide receipts, statements, and a short written explanation.

What to Do After Filling Out the Form

- File the form as part of your case file. Follow your court’s filing method and timing. Ensure the trustee receives a copy if required.

- Align your plan with the form. Your plan should show the same secured payments, arrears, and priority treatment reflected in your expenses. If the numbers differ, fix them before filing or amend quickly.

- Start making plan payments on time. Most cases require payments to start soon after filing. Pay the exact amount, even if confirmation is pending.

- Prepare for the trustee’s review. Be ready to explain any nonstandard expenses, special circumstances, or recent income changes. Bring the documents you used to prepare the form.

- Respond to any objections or requests. If the trustee or a creditor challenges a line item, answer promptly. Provide updated proof or revise the form if needed.

- Amend when circumstances change. If income increases, a loan pays off, or a major expense ends, your disposable income may change. Amending the form and plan can avoid disputes later.

- Track plan milestones. Watch for the confirmation hearing. After confirmation, the trustee will distribute payments to creditors under the plan.

- Keep records current. Save pay stubs, tax returns, and proof of ongoing expenses during the case. You may need them for annual reviews or plan modifications.

- Ask about modifying the plan if needed. If your situation changes for a good reason, a plan modification may help. That process will consider updated disposable income using the same framework as this form.

- Close the loop at discharge. When you finish planning payments and meet all requirements, the court will process your discharge. Keep your final plan, this form, and the discharge order together.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.