Form 122B – Chapter 11 Statement of Your Current Monthly Income

Fill out nowJurisdiction: USA — Federal

What is a Form 122B – Chapter 11 Statement of Your Current Monthly Income?

Form 122B is the official bankruptcy form you use to report your current monthly income in an individual Chapter 11 case. It captures your average income from all sources over the six full calendar months before you file. The court, the U.S. trustee, and creditors use this form to assess your ability to fund a Chapter 11 plan. In short, it sets the baseline for the income side of your plan’s feasibility and disposable income analysis.

This form is not a budget. It does not ask what you spend. It asks what you received. It looks back, not forward. It is based on an average over the six months before you file. That fixed window is called your “current monthly income” for bankruptcy purposes. It excludes Social Security benefits by law—most other income counts.

You will complete Form 122B if you are an individual in Chapter 11. That includes joint individual cases. It includes individuals who own or operate businesses as sole proprietors. It also includes individuals proceeding under the small business or Subchapter V path. If you are a corporation, LLC, partnership, or other non-individual, you do not file this form. Non-individual debtors report financials in other required documents.

You need this form to move your case forward. Without it, your filing is incomplete. The court can issue deficiency notices and set deadlines. The trustee will expect it. Creditors will review it. Your plan obligations can turn on the numbers you report here. You want the figures to be accurate, consistent, and supported.

Typical usage scenarios include professionals with mixed income, owners of closely held businesses, landlords with rental income, or W-2 employees who need Chapter 11 flexibility. If you are married and filing a joint Chapter 11, you report income for both of you. If you are married and filing alone, you usually must report your spouse’s income if you live together. The form then allows an adjustment for the income your spouse does not use for household expenses.

When Would You Use a Form 122B – Chapter 11 Statement of Your Current Monthly Income?

You use Form 122B any time you are an individual filing Chapter 11. You file it with your petition or within 14 days after filing. If the court sets a different deadline, follow that deadline. If you convert from another chapter to Chapter 11, you file it soon after conversion. If you amend income information, you file an amended form.

Consider a solo consultant who had a strong summer but a weak fall. You still average the six full months before filing. If you file in October, you average April through September. That average may exceed your current run rate, but the form still uses it. The trustee knows that reality. The form is a fixed snapshot. You can explain seasonality later in your plan and Schedules I and J.

You also use this form if your income is irregular. That includes gig workers, sales professionals with commissions, and business owners with variable draws. You include the income received during the six-month window. You do not adjust because the payment relates to work before that window. The receipt date controls.

If you receive rental income, you use the form to show net rental income. If you run a small business, you show net business income. The form treats those categories differently from wages. You subtract ordinary business expenses to reach net income for the average. The court wants your income after the cost of producing it.

If you are married and file a single case, you include your spouse’s income if you live in the same household. If you are separated or maintain separate households, you generally do not include it. If you include your spouse’s income, the form lets you subtract amounts your spouse spends that do not support your household. That is the “marital adjustment.”

If you are a non-individual debtor, you never use this form. If you are in Chapter 7 or 13, you use different forms. If you are an individual in Chapter 11, you use Form 122B.

Legal Characteristics of the Form 122B – Chapter 11 Statement of Your Current Monthly Income

Form 122B is a sworn statement filed with the bankruptcy court. You sign it under penalty of perjury. That makes it legally significant. It is not a contract, but it is an enforceable declaration in a federal case. The court and trustee rely on it. Creditors can rely on it. Your attorney relies on it to prepare your plan. False statements can lead to serious consequences.

Enforceability comes from your signature and the rules that govern court filings. Your signature certifies that the information is true and correct to the best of your knowledge. The court can sanction you for material errors. The trustee can question figures and demand support. Intentional misstatements can lead to dismissal, conversion, denial of discharge, or allegations of fraud. Keep records. You want backup for each line item.

This form also ties into other parts of your case. It feeds into the analysis of disposable income for plan confirmation. It supports the feasibility of your plan. It complements Schedules I and J, which show your projected income and expenses at filing. The two sets of documents can differ because they measure different things. Form 122B uses a six-month historical average. Schedule I shows the current projected income. Differences are fine, but be ready to explain them.

There are privacy rules for filings. Do not include full Social Security numbers, full birth dates, or full account numbers. The form itself does not ask for those details. For income documents you provide to the trustee, follow redaction rules. Assume your filings are public records. Only include what the form asks for.

Form 122B excludes Social Security benefits from current monthly income by statute. It includes most other income, taxable or not. Regular contributions from others to your household must be included. If your spouse is not filing but lives with you, include their income. Then subtract the amounts they spend that do not benefit the household. You must be able to document those amounts.

The court can require amendments if discrepancies arise. If you find an error, fix it. Prompt amendments show good faith. Consistency across your petition, schedules, and plan helps you build credibility. Your case progresses more smoothly when your numbers line up.

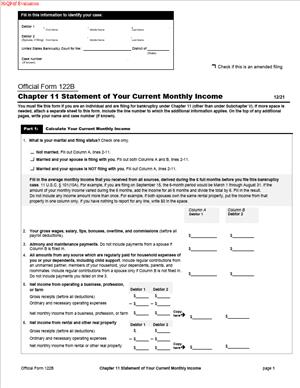

How to Fill Out a Form 122B – Chapter 11 Statement of Your Current Monthly Income

1) Gather six months of income records

Collect pay stubs, bank statements, business ledgers, rental ledgers, and proof of other income. Gather the six full calendar months before the month you file. If you file on October 20, pull records for April 1 through September 30. Do not include income received in October. Create a folder for each income category. Create separate folders for you and, if applicable, for your spouse.

2) Identify your case and filing status

Complete the caption at the top. Enter your name exactly as on the petition. Add the case number if you have one. Check whether you are filing jointly with your spouse. If you are married and not filing jointly, indicate whether you live in the same household. This choice drives whether spouse income appears on the form. If you are separated or live apart, you usually exclude your spouse’s income.

3) Understand the six-month averaging method

You will report the average monthly income for the window. For each category, total all receipts during the six-month window. Then divide by six to get the monthly average. Use gross amounts for wages. Use net amounts for business and rental income. Use the amount you received, not the amount earned. If money hits your account in the window, it counts unless excluded.

4) Report wage and salary income (gross)

Enter your gross wages, tips, bonuses, overtime, and commissions. Use the gross amount before tax or benefit deductions. Use year-to-date figures on pay stubs to reconcile totals. If you get paid bi-weekly, add all checks received in the window. Then divide by six to reach the monthly average. If your spouse’s income must be included, repeat the process for your spouse.

Example: You received 13 bi-weekly checks between April and September totaling $54,600 gross. Divide by six. Your average monthly wage income is $9,100.

5) Report net business or self-employment income

If you operate a sole proprietorship, report net business income. Start with gross receipts received in the window. Subtract ordinary and necessary business expenses paid in that window. Do not subtract depreciation. Do not subtract your personal draws again. The result is your net business income. Divide by six for the monthly average.

Example: Your gross receipts were $180,000 in six months. Expenses paid were $132,000. Net income is $48,000. Divide by six. Report $8,000 average monthly net business income.

6) Report net rental or real property income

Add all rent received in the six-month window. Subtract ordinary operating costs. Include taxes, insurance, utilities you pay, repairs, management fees, association dues, and similar items. Do not subtract depreciation. If you escrow for taxes and insurance, include the escrow payments as expenses when paid. The result is net rental income. Divide by six for the monthly average.

If you have multiple properties, compute each one and sum the net amounts. If a property ran at a net loss, that loss lowers your total net rental income.

7) Report interest, dividends, and royalties

Add interest and dividend payments received. Include distributions from taxable accounts. Include royalties from intellectual property or mineral rights. If amounts vary by month, use the six-month total and divide by six. If you received nothing in the window, enter zero.

8) Report pension, retirement, and annuity income

Include private pension payments, employer retirement distributions, and annuities. Exclude Social Security retirement and disability benefits. Those benefits are excluded by law. If you rolled over funds from one account to another, do not count the rollover as income. Count only distributions you actually received for spending.

9) Report unemployment compensation and other benefits that are not Social Security

Include unemployment compensation received in the window. Include workers’ compensation wage replacement benefits if paid to you. Include short-term disability payments from private policies. If the payment source is not Social Security, it generally counts. If unsure, gather documents and consult your attorney.

10) Report domestic support received

Enter alimony, maintenance, and child support that you received. If payments were sporadic, include only the amount you actually received in the window. Do not include amounts owed but unpaid. Divide by six to get the average.

11) Report regular contributions from others

Include amounts others regularly pay toward your household expenses. Common examples are rent from a roommate, money from a family member toward groceries, or payments of your utilities. If a friend paid your rent for three months, include those amounts. If you received one small gift unrelated to household costs, enter it under “other income” if material.

12) Report farm income and other income

If you operate a farm, report net farm income. Use the same net method as business income. For other income, list items that do not fit earlier lines. Examples include trust distributions, recurring stipends, or prorated tax refunds. If you received a tax refund during the window, include the portion that relates to that period. Many filers prorate an annual refund across the months in the window.

13) Calculate spouse income and apply the marital adjustment if needed

If you are married, not filing jointly, and living together, you must include your spouse’s income. Enter your spouse’s income by category. Then subtract the portion your spouse does not use for household expenses. That subtraction is the marital adjustment.

Typical marital adjustments include your spouse’s separate debt payments, child support your spouse pays to someone else, and professional expenses paid by your spouse that do not benefit the household. Document each item. The adjustment should be specific and supported.

14) Exclude Social Security benefits

Do not include Social Security retirement, SSDI, or SSI. These are excluded from the current monthly income. If your bank statements mix deposits, label the Social Security items and remove them from your totals. Keep the award letters and deposit records in your file.

15) Add all income categories to reach the total current monthly income

Add your average monthly income across all categories. Add any required spouse income after the marital adjustment. The sum is your total current monthly income. The form will ask you to annualize this number. Multiply by 12 to get your annualized figure.

16) State your household size and compare it to the median income

The form asks for your household size. Count yourself, your spouse if living with you, and your dependents. The form then asks you to check whether your annualized income is above or below the median for your household size. Your attorney will guide you on the comparison. The court uses this to decide whether you must complete further calculations of disposable income.

17) Review for consistency with Schedules I and J

Compare your Form 122B results with Schedule I. Expect differences, but they should make sense. Form 122B is a six-month average. Schedule I shows current income at filing. Explain any large swings in notes or in your plan. Seasonal work, a recent job change, or a business contraction are common reasons.

18) Sign and date the form under penalty of perjury

Read the declaration carefully. Sign and date the form. If you are filing a joint case, both of you must sign. Your signature certifies that the information is true and correct. Do not sign until you have checked the math and the entries. Your attorney may also review and prepare the filing.

19) File the form on time and keep your records

File the form with the court by the deadline. If you filed the petition without it, the court sets a short deadline. Ask for an extension only if necessary. Keep the documents you used to prepare the form. The trustee may request proof. Organized records speed up the review.

20) Common pitfalls and how to avoid them

Do not mix gross and net across categories. Wages are gross. Business and rental income are net. Do not double-count funds. Your business draw is not extra income if it came from net business income already counted. Do not include Social Security benefits. Do not forget to include regular support from others. Do not omit rare but significant income received in the window. If the number exists and is not excluded, include it.

If your income is highly irregular, use clear workpapers. Create a simple spreadsheet. Show deposits by category and month for the six-month window. Label outliers with short notes. That helps the trustee follow your math. It reduces questions and delays.

21) Special notes for business owners and professionals

Use your accounting records to prepare net business income. Reconcile the six-month window to your profit and loss statements. Exclude depreciation. Exclude owner draws that are not additional income. Confirm that your expense payments align to the six-month window. If you batch pay vendors, that timing affects net income. Use the amounts actually paid in the period.

22) Special notes for landlords

Tie your rental ledger to bank deposits. Count rent when received. Record operating expenses when paid. Repairs can cause swing months. That is fine. The average handles it. If a tenant paid a lump sum to cure arrears, include it if received in the window. Label it so the trustee understands the spike.

23) Amending the form if needed

If you find a material error, file an amended form. Mark it as amended. Update the math and attach a short explanation. Prompt corrections build credibility. They reduce disputes at confirmation.

You now have a clear path to complete Form 122B. Follow the six-month rule. Use the correct gross or net method by category. Document your numbers. Sign with confidence.

Legal Terms You Might Encounter

- Current monthly income means the average of your income from all sources over the past six full months. Form 122B uses this number to measure your ability to fund a plan. You average what you actually received, not what you expect to earn.

- The six-month look-back period is the exact window you use to total income. It includes the full six calendar months before your filing date, not partial months. The form relies on that specific period only.

- Gross income is your income before taxes or deductions. The form asks for gross amounts for wages and many other categories. Do not use take-home pay in those lines.

- Household size is the number of people you financially support in your home. It guides how some parts of your case may be evaluated. Form 122B does not determine household size, but it uses income that supports that household.

- A non-filing spouse is your spouse who is not in the case. The form may require you to include the spouse’s income if it supports your household. You can also claim a marital adjustment for amounts your spouse spends on their separate expenses.

- A marital adjustment is the portion of a non-filing spouse’s income you can subtract. It applies only to income your spouse uses for their own debts or separate expenses. It does not cover shared household expenses.

- Business income means net income from a sole proprietorship or gig work. You list gross receipts and subtract ordinary business expenses to reach net income. You then average that net number over six months for the form.

- Irregular income includes bonuses, commissions, overtime, and seasonal work. If you received it in the look-back period, you include it. The form averages irregular income the same as regular pay.

- Social Security benefits refer to retirement or disability benefits under federal law. These are excluded from the current monthly income. Do not include those benefits on Form 122B.

- The petition date is the day you file your Chapter 11 case. It fixes your six-month look-back period and sets the deadline to file Form 122B. Everything you report on the form ties back to that date.

FAQs

Do you have to file Form 122B if you are not an individual?

No. Form 122B is for individual Chapter 11 filers. If you are a company or other non-individual, you do not file this form.

Do you include your spouse’s income if your spouse is not filing?

Yes, if you share a household. You include the portion that supports household expenses. You may subtract a marital adjustment for your spouse’s separate expenses.

Do you count Social Security benefits as income on this form?

No. Social Security benefits are excluded from the current monthly income. Do not list those payments on Form 122B.

Do you include bonuses, overtime, and commissions?

Yes. If you received them during the six-month period, include them. The form averages these along with your regular wages.

Do you use gross pay or take-home pay?

Use gross pay for wages and many other items. Do not subtract taxes, insurance, or other payroll deductions on those lines.

Do you include income from side gigs or self-employment?

Yes. Report net business income. List gross receipts and subtract ordinary business expenses to reach net income, then average it.

Do you include rental income and interest income?

Yes. Include net rental income after ordinary rental expenses. Add the interest and dividend income you received during the six months, then average it.

Do you need to amend the form if your income changes after filing?

Not for routine changes. But if you discover an error or a material change, amend promptly. You want the court and trustee to have accurate figures.

Do you need to attach pay stubs or bank statements?

The form itself does not require attachments. Still, keep proof of every number. You may be asked to provide backup to the trustee or the court.

Do you round the numbers?

Yes. Round to the nearest dollar unless the form instructs otherwise. Be consistent across all pages.

Checklist: Before, During, and After the Form 122B – Chapter 11 Statement of Your Current Monthly Income

Before signing:

- Confirm your petition date. This fixes your six-month look-back period.

- List the six full months by name to avoid missing one.

- Gather pay stubs for every pay date in that period.

- Collect profit-and-loss summaries for any side business or gig work.

- Obtain bank statements for all accounts for those six months.

- Pull records for recurring deposits, like alimony or child support received.

- Gather rental ledgers, leases, and proof of rental expenses.

- Print statements for retirement distributions or pensions.

- Note unemployment or short-term disability benefits received.

- Identify interest and dividend statements.

- If married, gather your spouse’s pay stubs and expense records.

- Identify amounts for a marital adjustment, with proof of separate expenses.

- Prepare a simple worksheet to total each category by month.

- Check that Social Security benefits are separated from other income.

- Verify your legal name and case number match your petition.

During signing:

- Confirm the six-month totals match your source records.

- Verify you used gross wage numbers, not net.

- Double-check that business income is net of ordinary expenses.

- Make sure rental income is net of ordinary rental expenses.

- Confirm irregular income, like bonuses and overtime, is included.

- Review the marital adjustment and its supporting amounts.

- Ensure you did not include Social Security benefits.

- Check your rounding is consistent across the form.

- Confirm the final average equals the totals divided by six.

- Review all signatures and dates on the form.

- Make sure your contact information is complete and legible.

After signing:

- File the form by the deadline for your case.

- Keep a complete copy with all supporting documents.

- Provide a copy to the trustee if requested.

- Note any numbers that also appear on other schedules. Keep them consistent.

- If you find an error, prepare an amended form promptly.

- Document who received your filed form and when.

- Store evidence for each line item for the entire case.

- Calendar any follow-up requests for backup documents.

- Update your plan budgets to reflect the same income methodology.

Common Mistakes to Avoid Form 122B – Chapter 11 Statement of Your Current Monthly Income

- Don’t forget the correct six-month window. Using the wrong start or end month skews your average. Consequence: objections, delays, and credibility issues.

- Don’t use take-home pay for wages. The form expects gross income for wage lines. Consequence: underreporting, forced amendments, and possible sanctions.

- Don’t omit irregular income. Include bonuses, overtime, and commissions received in the look-back period. Consequence: challenges to the feasibility of your plan.

- Don’t misstate business income. Use net income after ordinary expenses, with proof. Consequence: disputes over disposable income and plan payments.

- Don’t ignore your spouse’s role. Include shared household support and apply a proper marital adjustment. Consequence: inaccurate totals and increased scrutiny.

What to Do After Filling Out the Form 122B – Chapter 11 Statement of Your Current Monthly Income

- File the form with the court by your case deadline. Confirm the docket shows the filing. If the court requires paper, follow any format rules. If electronic, verify the upload.

- Share the numbers with your team. Align your schedules, budget, and plan with the same income method. Use the averaged income for projections, not a single high or low month.

- Prepare to substantiate every line. Keep pay stubs, statements, and ledgers organized by month. Flag any months with unusual spikes and keep an explanation ready.

- Respond quickly to inquiries. If the trustee or any party asks for backup, provide it promptly. Fast responses avoid hearings and delays.

- Amend if needed. If you discover an error or a material omission, file an amended form. Update affected schedules so all filings stay consistent.

- Track changes after filing. Your income may change during the case. Keep a monthly log. While the form uses a fixed window, material shifts can affect your plan.

- Coordinate with your plan development. Your average income informs feasibility and payment calculations. Use it to set realistic payment plans and timelines.

- Keep your records current. Maintain a copy of the filed form and all support through case closure. Store digital and hard copies in separate secure locations.

- Confirm service as required. If you must provide copies to parties, do so and keep proof. Record the date, method, and recipients.

- Reconcile with your budgets. Cross-check that operating reports and monthly budgets use compatible figures. Explain any variances clearly.

- Finalize your next deadlines. Calendar upcoming hearings and reporting dates. Include reminders to refresh income records if anyone requests updates.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.