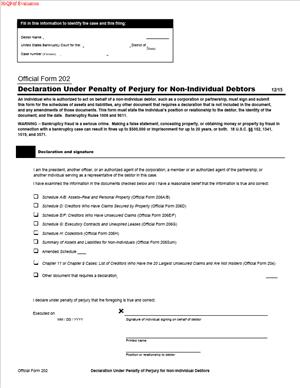

B 202- Declaration Under Penalty of Perjury for Non-Individual Debtors

Fill out nowJurisdiction: Country: USA | Federal Bankruptcy Context

What is a Declaration Under Penalty of Perjury for Non-Individual Debtors?

This form is a sworn statement required in U.S. bankruptcy cases when the debtor is not an individual but a business entity (such as a corporation, partnership, or LLC). It confirms that the information in the bankruptcy petition, schedules, and other filings is true and correct.

The declaration is signed by an authorized representative of the debtor—usually an officer, director, or manager. It carries the same legal weight as testimony in court. By signing under penalty of perjury, the representative accepts legal responsibility for the truth of the filing. False statements can lead to dismissal of the case, sanctions, or even criminal prosecution.

This form is essential for transparency. Bankruptcy judges, trustees, and creditors rely on it to ensure that financial disclosures are accurate. It creates a clear record of accountability for business debtors.

Who typically uses this form?

-

Corporations filing under Chapter 7, Chapter 11, or other bankruptcy chapters.

-

Partnerships or LLCs filing petitions or financial schedules.

-

Trustees or authorized officers filing on behalf of debtor organizations.

-

Attorneys representing non-individual debtors, who prepare the form for the client’s authorized signer.

Only an individual with proper authority may sign—such as a CEO, CFO, managing member, or trustee. Unauthorized signatures can invalidate the filing.

When would you use a Declaration Under Penalty of Perjury for Non-Individual Debtors?

-

Initial Bankruptcy Petition – When filing Form B101 (Chapter 7) or B201 (Chapter 11) for a business.

-

Schedules and Statements – To verify detailed lists of assets, liabilities, income, and financial affairs.

-

Amended Filings – Any time previously filed documents are corrected or updated.

-

Court or Trustee Requests – If a bankruptcy judge or trustee requires sworn confirmation of certain information.

Example: A small business filing Chapter 11 must submit schedules of assets and liabilities. An officer signs this declaration to confirm the schedules are truthful.

Legal Characteristics of the Declaration

-

Binding Statement – Signed under penalty of perjury (18 U.S.C. § 1621). False statements may bring criminal penalties.

-

Required by Federal Rules – Must comply with the Federal Rules of Bankruptcy Procedure (FRBP) and local court rules.

-

Accountability Tool – Ensures business entities cannot submit bankruptcy filings without personal responsibility from a representative.

-

Consequences for Non-Compliance – Failure to file may delay or dismiss a case. False information may lead to sanctions or prosecution.

How to Fill Out a Declaration Under Penalty of Perjury for Non-Individual Debtors

-

Complete the Case Caption

-

Enter the name of the debtor entity (corporation, LLC, partnership).

-

Include the bankruptcy court district and case number.

-

-

Identify the Declarant

-

Provide your full legal name.

-

State your title or role (e.g., President, CFO, Managing Member).

-

Confirm your authority to act for the debtor.

-

-

State the Declaration

-

Affirm that the attached petition, schedules, or documents are true and correct to the best of your knowledge.

-

Use the exact affirmation language provided on the form.

-

-

Acknowledge Penalty of Perjury

-

Understand that false statements may result in fines or imprisonment.

-

The declaration functions like sworn testimony.

-

-

Sign and Date

-

Provide your handwritten signature (or approved electronic signature in ECF).

-

Print your name, title, and date of signing.

-

Follow local court rules about notarization if required.

-

-

File with the Bankruptcy Court

-

File electronically through the court’s Electronic Case Filing (ECF) system, or in paper form if permitted.

-

Keep a stamped or electronic confirmation of filing.

-

Practical Usage Scenarios

-

A corporation files Chapter 11. Its CFO signs the declaration verifying the schedules of assets and liabilities.

-

A partnership amends its bankruptcy petition. The managing partner signs a new declaration affirming the revised information.

-

A trustee requests confirmation of accuracy in a financial statement. The debtor’s authorized officer files this declaration to satisfy the request.

Legal Terms You Might Encounter

-

Declarant – The person signing the declaration on behalf of the debtor.

-

Penalty of Perjury – A legal standard making false statements punishable as a crime.

-

Schedules – Required bankruptcy forms listing property, debts, and financial information.

-

Statement of Financial Affairs (SOFA) – A form summarizing the debtor’s financial history.

-

Petition – The initial filing that starts the bankruptcy case.

-

Trustee – Court-appointed official overseeing the bankruptcy process.

FAQs

-

Do I need a notary for the Declaration Under Penalty of Perjury for Non-Individual Debtors?

No. This form does not typically require notarization. The signature under penalty of perjury is legally binding on its own. However, you should always check your local bankruptcy court rules, as some districts may have additional requirements.

-

Who is allowed to sign the Declaration Under Penalty of Perjury for Non-Individual Debtors?

Only an authorized representative of the business debtor can sign this form. This includes officers (CEO, CFO), directors, managing members, or trustees. An unauthorized person cannot sign, and doing so may cause the filing to be rejected by the bankruptcy court.

-

Do I need to file a new Declaration if I amend bankruptcy schedules or statements?

Yes. Anytime you update or amend bankruptcy filings—such as schedules of assets and liabilities or a Statement of Financial Affairs—you must file a new signed Declaration Under Penalty of Perjury to confirm the accuracy of the revised documents.

-

What happens if a business files a false Declaration Under Penalty of Perjury?

Filing a false declaration is a serious offense. It can lead to dismissal of the bankruptcy case, monetary sanctions, or criminal prosecution for perjury under federal law (18 U.S.C. § 1621). Business officers and representatives can be held personally responsible.

-

Do creditors receive a copy of the Declaration Under Penalty of Perjury for Non-Individual Debtors?

No. The declaration is filed directly with the bankruptcy court, not served on creditors. Once filed, it becomes part of the official public record. Creditors, trustees, and other interested parties can access it through the court’s electronic filing system (ECF) or clerk’s office.

-

When is the Declaration Under Penalty of Perjury due in a bankruptcy case?

The declaration must be filed with the bankruptcy petition and schedules, or within the deadlines set by the Federal Rules of Bankruptcy Procedure (FRBP). For example, under Chapter 11, some schedules are due within 14 days of the petition. Missing deadlines can cause delays or dismissal of the case.

-

Can a lawyer sign the Declaration Under Penalty of Perjury for the debtor?

No. While attorneys prepare the forms, only the debtor’s authorized officer or representative may sign the declaration. The signer must have personal knowledge of the truth of the information and authority to act on behalf of the debtor.

Checklist: Before, During, and After Completing the Declaration

Before signing

-

Case caption and number.

-

Bankruptcy chapter (7, 11, etc.).

-

Name and role of declarant.

-

All documents being verified (petition, schedules, amendments).

-

Authority to sign on behalf of debtor.

During signing

-

Match the case caption exactly.

-

Read the affirmation clause carefully.

-

Confirm documents listed are attached.

-

Sign and date in black or blue ink.

-

Use the correct title (e.g., CEO, CFO).

After signing

-

File promptly using ECF.

-

Save a stamped copy or electronic receipt.

-

Keep copies in your business’s case file.

-

File a new declaration if you submit amendments.

Common Mistakes to Avoid

-

Wrong case number – Leads to misfiled documents.

-

Unauthorized signatory – May invalidate filings.

-

Failure to re-file after amendments – Each change requires a new declaration.

-

Incomplete caption – Must match court records exactly.

-

Late filing – Can delay or jeopardize bankruptcy proceedings.

What to Do After Filing

-

Verify the declaration appears correctly in the court docket.

-

Monitor for any objections from the trustee or creditors.

-

Keep the original signed copy in your records.

-

If errors are found, prepare and file a corrected declaration immediately.

-

Continue to file updated declarations with any amended filings.

If you follow these steps, your declaration will provide reliable proof of truthfulness in bankruptcy proceedings. Judges and trustees will recognize the filing as valid, and your case will move forward without unnecessary delays.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.