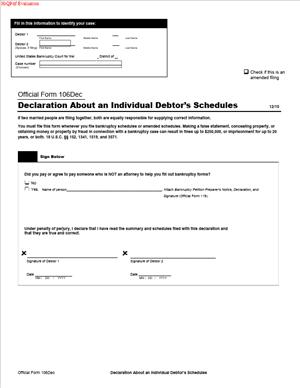

B 106 – Declaration About an Individual Debtor’s Schedules

Fill out nowJurisdiction: Country: USA | Province or State: Federal

What is a B 106 – Declaration About an Individual Debtor’s Schedules?

This form is your sworn statement about your bankruptcy schedules. It is part of the official set of forms for individual debtors. You use it to confirm that your Schedules A/B through J and your summary are accurate. You also confirm that they are complete to the best of your knowledge. In short, this is your oath that your paperwork is true.

Bankruptcy relies on full, honest disclosure. The court, the trustee, and your creditors depend on your schedules. The Declaration makes your disclosures official. It shows that you have read your schedules. It also shows that you stand behind them.

Who typically uses this form? Individual debtors in Chapters 7, 11 (including subchapter V for individuals who qualify), 12, and 13. That includes consumers, wage earners, and sole proprietors. Married couples in a joint case each use it and both must sign. Businesses, like corporations or LLCs, do not use this form. They use the corporate versions instead.

Why would you need this form? Because you cannot file your schedules without it. Your schedules are not complete unless you sign this Declaration. Without it, the court will flag your filing as deficient. That can delay your case, trigger notices, or cause dismissal if not fixed.

You use this form when you file your schedules. You also use it when you file amended schedules. If you correct an error, add a creditor, or update values, you file a new signed Declaration with the amended pages. The Declaration covers the schedules you are submitting with it at that time.

Typical usage scenarios:

- You filed a skeleton petition to stop a wage garnishment. You now submit the full schedules within the deadline. You attach this Declaration and sign it to verify your schedules.

- You discover you forgot a small savings account. You file an amended Schedule A/B and an updated Declaration on the same day.

- You are in a joint case. You and your spouse both review the schedules. You each sign this Declaration, even if one of you did most of the paperwork.

- You are a sole proprietor. You list both personal and business assets on your individual schedules. You sign the Declaration once to verify all schedules.

This is not a form you can skip. It is the legal bridge between your facts and your oath. It is short, but it has serious weight. Treat it like you would any sworn testimony.

When Would You Use a B 106 – Declaration About an Individual Debtor’s Schedules?

You use the Declaration any time you submit schedules in your individual bankruptcy case. Most commonly, you file it with the initial set of schedules. That is either on the petition date or within the allowed window after an emergency filing. If you file only the minimum documents to start the case, you will have a deadline to file the rest. When you file the rest, you sign and attach this Declaration.

You also use it with amendments. Life is messy. Mistakes happen. If you find an error after filing, you fix it by filing an amended schedule. You then sign a new Declaration at that time. This confirms that the amended information is also true and correct.

Here are practical situations where you will use it:

- Chapter 7 consumer debtor. You list all property, debts, contracts, income, and expenses. You read the schedules and sign the Declaration before filing.

- Chapter 13 wage earner. You complete the same schedules and also file a plan later. You sign the Declaration with your schedules. If you update income or expenses, you file an amended Schedule I or J with a new Declaration.

- Sole proprietor. You include business tools, inventory, receivables, and business contracts in your personal schedules. You sign the Declaration after checking both personal and business items.

- Married couple filing jointly. You both sign. If one spouse is unavailable, you cannot simply sign for them. You must either wait, seek an extension, or discuss options with counsel. Both signatures are required for a joint case.

- You convert your case to a different chapter. The court might require updated schedules due to changed circumstances. You file updated schedules and a new Declaration.

- The trustee requests clarification. You amend a schedule to fix a valuation or add missing detail. You sign a new Declaration with that amended filing.

You do not use this form if you are a creditor, a landlord, or a business entity. Only individual debtors use it. Creditors do not sign debtor declarations. Landlords do not sign it either. The Declaration belongs to the person filing bankruptcy.

Legal Characteristics of the B 106 – Declaration About an Individual Debtor’s Schedules

This Declaration is legally binding. It is an unsworn declaration made under penalty of perjury. When you sign, you swear that your schedules and summary are true and correct. You also swear that they include all information known to you. The court treats this like testimony. The trustee can rely on it. Your creditors can rely on it too.

What ensures enforceability? Federal bankruptcy rules require individual debtors to verify schedules. The Declaration is the approved way to verify. The form language ties your signature to penalties for false statements. Those penalties include fines, imprisonment, or both under federal law. The court can also deny or revoke a discharge if you lie or conceal assets. It can dismiss a case for failure to file verified schedules. These consequences give the Declaration real weight.

The Declaration also supports efficient case administration. The trustee will examine you at your meeting of creditors. They use your signed schedules to frame their questions. If you later claim the schedules were incomplete, the Declaration will be key. It shows that you reviewed the papers and swore to their truth. It also creates a clear record of your intent and knowledge at the time of filing.

General legal considerations:

- Accuracy is critical. If you are unsure about a value, disclose your method. Use good-faith estimates where needed. Avoid guessing without basis.

- Completeness is required. List all property, claims, and creditors. Include even small or inactive accounts. Include contingent claims and potential lawsuits.

- Updates are your job. If you discover an error, amend quickly. File a new Declaration with the amended schedules. Provide notice when required.

- Each debtor must sign. In a joint case, one spouse cannot waive the other’s signature. Both must read and sign. If you use an attorney, you still must review and sign.

- Electronic signatures are regulated. If you file with an attorney, local rules may allow approved electronic signatures. Your attorney will keep an original signed copy. If you file on paper, sign in ink.

- The Declaration covers only what you file with it. If you later file more schedules or amendments, sign a new Declaration for those filings.

- The Declaration does not replace your duty to testify. You still answer questions at your meeting of creditors. Your testimony should match your signed schedules.

Think of this as your oath that anchors the case. It helps the court trust your disclosures. It also gives you protection, because a complete, honest filing supports your fresh start.

How to Fill Out a B 106 – Declaration About an Individual Debtor’s Schedules

Follow these steps. Take your time, but do not miss deadlines.

1) Gather the documents you are verifying.

- Pull together every schedule you are filing now. That includes Schedules A/B, C, D, E/F, G, H, I, and J. If you have a separate household budget for Debtor 2, include that as well. Include your summary of assets and liabilities. Have all pages in order.

- Confirm that each schedule is complete. Check attachments, addenda, and continuation sheets. Make sure totals carry across pages correctly.

- Cross-check entries for consistency. Your Schedule A/B assets should match the property you claim exempt on Schedule C. Your secured debts on Schedule D should link to collateral listed on A/B. Co-debtors on Schedule H should match the debts they share.

2) Complete the caption at the top.

- Court name. Enter the correct federal bankruptcy court for your case. Use the same district you used on your petition. Do not guess. Your petition shows the proper district.

- Debtor 1 name. Use your full legal name exactly as on your petition. Keep the same order and spelling.

- Debtor 2 name. In a joint case, list your spouse’s full legal name exactly as on the petition. Leave this blank if you are filing alone.

- Case number. If known, enter your assigned case number. If this is filed with your initial schedules after a skeleton filing, you will have a case number by then. Match the number format used by the court.

3) Read the Declaration language slowly and carefully.

- The text states that you read the schedules and summary you are filing with this Declaration. It states they are true and correct. It states they are complete to the best of your knowledge.

- Treat this like an oath in court. Do not sign until you have read every schedule. Do not rely on memory alone. Review document by document.

4) Verify each schedule before you sign.

- Schedule A/B. Confirm all assets. Check bank accounts, cash, vehicles, household goods, electronics, jewelry, tools, tax refunds, claims, and business interests. Use reasonable values. If you used an online value guide, note the source for your files. Do not list “unknown” without a reason.

- Schedule C. Confirm you claimed exemptions for each asset you intend to protect. Check that asset descriptions match Schedule A/B. Make sure totals do not exceed the allowed amount. Correct any spelling or description errors that might cause confusion.

- Schedule D. Confirm secured creditors, balances, and collateral. Ensure the lien description matches the asset.

- Schedule E/F. Separate priority debts from nonpriority unsecured debts. Include taxes, support obligations, medical bills, personal loans, credit cards, and judgments. Add collection agencies and original creditors when known. Verify addresses for proper notice.

- Schedule G. List all executory contracts and unexpired leases. Include car leases, apartment leases, service contracts, timeshares, and gym contracts if still in term. If you plan to reject a lease, list it anyway.

- Schedule H. List co-debtors for joint obligations. This includes co-signers and joint account holders. The co-debtor is not your spouse in a joint case. Your spouse is already a debtor.

- Schedule I. Confirm your income sources and amounts. Include wages, tips, commissions, business income, rental income, benefits, or support received. Use current monthly figures. Check pay dates and frequency. If self-employed, attach a summary that supports net income.

- Schedule J. Confirm your actual reasonable expenses. Include rent or mortgage, utilities, food, transportation, insurance, childcare, taxes, support, and other needs. Make sure totals reflect your household. If you and your spouse keep separate households, use the separate expense form if required and check alignment.

- Summary. Make sure the summary totals match your schedules. Errors here can trigger questions or delays.

5) Confirm consistency with other filings.

- Statement of Financial Affairs. While the Declaration does not cover that form, data should align. Transfers, lawsuits, and business history should not contradict your schedules. Spot and correct any conflict.

- Means test and pay records. Your Schedule I monthly income should make sense next to your means test history. They measure different time frames, but they should not be wildly inconsistent without explanation.

6) Sign and date.

- Debtor 1 signs and dates the Declaration. Use your usual legal signature. Write the full date.

- Debtor 2 signs and dates too, in a joint case. You cannot sign for your spouse. If one of you cannot sign today, do not file this form until both can sign. If a deadline is near, seek help on timing.

- If you file on paper, sign in ink. If you file through an attorney, follow the allowed electronic signature method. Your attorney will keep the original signed copy as required.

7) File the Declaration with the schedules.

- Attach the Declaration to the schedules you are submitting. File them together as one package.

- If you are filing amended schedules, label the schedules as amended. File a new Declaration with them. Use the same caption details and the current date.

- Serving other parties. The Declaration itself does not require service. But amended schedules often require notice to the trustee and any affected creditors. Follow the notice requirements when you change creditor information, claim exemptions, or valuations in a way that affects others.

8) Keep copies and proof.

- Keep a full copy of the filed schedules and the signed Declaration. Save your supporting documents. This includes bank statements, pay stubs, tax returns, valuations, and contracts. You may need them at your meeting of creditors or later.

- Bring your documents to your trustee meeting if instructed. Expect questions based on your signed schedules.

9) Avoid common mistakes.

- Do not sign before you finish your schedules. The Declaration must cover complete schedules.

- Do not use nicknames or different name formats. Match the petition precisely.

- Do not leave the case number blank if it is already assigned.

- Do not forget the second signature in a joint case.

- Do not sign an outdated form version if a newer one is required. Use the current official form.

- Do not rely on someone else’s memory. Review the actual numbers and documents.

- Do not sign if someone changed your schedules without your review. Read the final draft.

10) If you find an error after filing, fix it fast.

- Prepare the amended schedule. Highlight or note the changes where required.

- File the amended schedule with a new signed Declaration. Date it the day you file.

- Provide notice to the trustee and affected creditors if required. Keep proof of service.

- Bring the changes to the trustee’s attention at your meeting if the timing overlaps.

Practical tips:

- Treat your schedules like a detailed inventory. Use bank and credit reports to catch missing items or accounts. List even closed accounts if they hold data you disclosed elsewhere.

- Value personal items realistically. Use fair market value, not original cost. Consider what a willing buyer would pay today.

- For income and expenses, be honest and current. Use real figures you can support.

- For leases and contracts, include all that are not expired. Even if you plan to end them, you must list them.

- For sole proprietors, gather business records. Include receivables, equipment, and inventory. Include any business leases and contracts.

- Ask yourself, “If I was a trustee, would this make sense?” If not, add detail or clarify.

What happens if you do not file the Declaration? The court will mark your schedules as incomplete. You may receive a deficiency notice. You may face dismissal if you do not cure by the deadline. You also risk delays in your case. The trustee cannot meaningfully examine unverified schedules. Do not put your case at risk. File the Declaration on time with accurate schedules.

Lastly, remember what you are signing. This is a sworn statement. It has the same force as testimony under oath. Be thorough. Be truthful. If you are unsure, disclose and explain. Then file with confidence.

Legal Terms You Might Encounter

Debtor means you, the individual who filed the bankruptcy case. This declaration is your sworn statement that the facts in your schedules are true and complete. If you filed a joint case with your spouse, each of you is a debtor and each must sign a separate signature line on this form.

Schedules are the set of documents where you list what you own, what you owe, your co-debtors, your unexpired leases and contracts, and your income and expenses. This declaration is the signature page that validates those schedules. By signing here, you confirm that every schedule you filed is accurate to the best of your knowledge.

Summary of Your Assets and Liabilities is the short overview that totals the numbers from your schedules. The declaration covers that summary too. If the totals on the summary don’t match the underlying schedules, your signature still binds you to the accuracy of all of it, so you should reconcile any mismatch before you sign.

Penalty of perjury is the legal standard that makes your signature more than a formality. When you sign this declaration, you swear that the information is correct under oath. False statements can lead to fines, case dismissal, denial of discharge, or criminal charges.

Joint case means you and your spouse filed together in one case. In a joint case, both spouses must sign the declaration because both are responsible for the accuracy of the schedules. If only one spouse signs, the court may issue a deficiency notice and delay the case.

Amended schedules are corrected or updated versions filed after the original schedules. If you amend, you typically file a fresh declaration to cover the amended schedules. Your new signature extends your sworn statement to the changed information.

Case number is the unique number the court assigns to your bankruptcy. It must appear on the declaration so the clerk can match it to the right file. Using the wrong number can send your declaration to the wrong docket and create avoidable delays.

Trustee is the person appointed to review your case. The trustee relies on your signed declaration to assess your finances and prepare questions for your meeting of creditors. Your signature gives the trustee confidence that the schedules are your official story, not a draft.

Electronic filing refers to submitting documents through the court’s electronic system. If your documents are filed electronically through an attorney, your handwritten signature is still required on this declaration, though you may use an approved signature format for the version that is uploaded. The key point: you must personally review and authorize the exact schedules being filed.

Notarization is the process of having a notary certify your signature. This declaration is not notarized. Your signature under penalty of perjury replaces notarization. That makes it faster to sign but carries the same legal weight as a sworn statement.

FAQs

Do you need to sign this if you filed everything electronically?

Yes. Even if your case is filed electronically, you must personally sign the declaration. Your attorney can file a scanned copy or use an approved electronic signature format, but you must review the final schedules and authorize your signature. Do not let anyone sign for you.

Do you need to notarize the declaration?

No. The declaration is signed under penalty of perjury and does not require notarization. Simply sign and date it. If you are filing on paper, use a handwritten signature. If filing electronically, follow the accepted signature format.

What if you find an error after you sign?

File amended schedules to correct the error. Then sign and file a new declaration that covers the amendments. Do this promptly. Leaving incorrect information on the docket can cause issues with the trustee, creditors, and your discharge.

Do you need to attach your schedules to the declaration?

No. The declaration stands on its own. It references your schedules and your summary. The court will already have them as part of your filing. If you are filing amendments, make sure the new declaration is filed with the amended schedules so the record is complete.

What if your spouse is out of town in a joint case?

Both spouses need to sign. If one spouse cannot sign right away, you can file once both signatures are obtained. If timing is tight, speak with your attorney about practical options. Don’t file a joint case declaration with only one signature unless instructed by the court.

Can you change the date to match your filing day if you signed earlier?

Don’t backdate. Use the actual date you sign. If your schedules change after you sign, sign again on the new date after reviewing the updated documents. Your goal is to ensure the signature reflects the final versions you filed.

Does your attorney sign the declaration for you?

No. Only the debtor (and spouse in a joint case) signs this form. Your attorney signs other documents in the case, but not this declaration. The point of the declaration is to capture your personal oath about your financial information.

What happens if you don’t file the declaration?

The court can enter a deficiency notice and set a deadline to fix it. If you fail to correct the deficiency, your case can be delayed or dismissed. Creditors may keep collecting until your case is properly on file. Don’t leave this form out.

Checklist: Before, During, and After the B 106 – Declaration About an Individual Debtor’s Schedules

Before signing

- Gather the final, complete versions of your schedules and summary:

- Assets and liabilities schedules

- Secured and unsecured debts schedules

- Executory contracts and unexpired leases

- Co-debtors

- Income and expenses

- Summary of Your Assets and Liabilities

- Confirm your full legal name matches what’s on your petition.

- Confirm your case number and the division of the court.

- Make sure you have incorporated all last-minute corrections.

- Verify totals on the summary match the underlying schedules.

- If it’s a joint case, ensure your spouse has reviewed the same final versions.

- If you used any draft notes, dispose of them so you don’t confuse drafts with the final filing.

- If filing electronically through counsel, confirm the exact PDF you reviewed will be filed.

During signing

- Read the declaration language slowly. Confirm you understand that you are signing under penalty of perjury.

- Check that the case caption and number at the top are correct.

- Sign using your usual handwritten signature if filing on paper.

- If filing electronically, use the signature format accepted by the court and ensure the filed document reflects your authorization.

- Date your signature. Use the actual date you signed.

- For joint cases, have your spouse sign and date on the correct line.

- Avoid stray marks or edits on the page. If you must correct something, use a clean reprint.

- Confirm page order and that no pages are missing.

After signing

- File the declaration with the court along with your schedules, or promptly file it if the court flagged a deficiency.

- If you amended any schedules, file the amended schedules and a new signed declaration together.

- Keep a copy of the signed declaration with your personal records and share a copy with your attorney.

- Monitor your court docket for any notices about missing signatures or mismatched documents.

- Bring or be prepared to provide copies to the trustee if requested.

- Protect your privacy: if you included any personally identifying information in the case caption, confirm that it complies with redaction rules used across your case.

- Store your copy securely for the duration of the case and for several years after discharge for reference.

Common Mistakes to Avoid B 106 – Declaration About an Individual Debtor’s Schedules

Signing before the schedules are final.

If you sign and then change your schedules, your signature no longer covers the current version. Consequence: the court may view your filing as incomplete or inconsistent. You will need to sign and file a new declaration, which can cause delays. Don’t forget to sign again after any updates.

Missing a spouse’s signature in a joint case.

One signature is not enough when both spouses filed together. Consequence: deficiency notices, potential continuances, and extra trips to the clerk’s office. Don’t forget both signatures and dates.

Using the wrong case number or wrong name.

Mismatched captions confuse the court docket. Consequence: misfiled documents, delays, or the appearance that you did not file at all. Don’t forget to check the caption carefully before you sign.

Leaving the date blank or backdating.

An undated signature can be treated as defective; backdating can raise credibility concerns. Consequence: deficiency notices and potential questions from the trustee. Don’t forget to use the real, current date.

Assuming your attorney’s review replaces your own.

Your signature is your personal oath. Consequence: if something is wrong, you—not just your attorney—are responsible. Don’t forget to read every schedule and the summary yourself before you sign.

What to Do After Filling Out the Form B 106 – Declaration About an Individual Debtor’s Schedules

File the declaration with your schedules. If your attorney is filing electronically, confirm that the exact document you signed is what gets filed. If you filed your petition first and the court issued a notice that your declaration is missing, file it as soon as possible to clear the deficiency.

Verify the docket. After filing, check that the declaration appears in your case docket and is linked to your schedules. Make sure the entry shows your name correctly and that the court’s system recognizes the filing as complete.

Respond to deficiency notices quickly. If the court or clerk flags a missing signature, wrong case number, or an incorrect form version, correct it fast. File a corrected declaration and, if needed, corrected schedules so the case stays on track.

Coordinate with the trustee. The trustee examines your schedules and relies on your sworn declaration. If you file any amendments, notify your attorney so the trustee receives the updated information. Be prepared to answer questions at your meeting of creditors based on the final, signed schedules.

Amend when facts change or errors surface. If you discover an omission or an inaccuracy, prepare amended schedules. Then sign and file a new declaration that covers the changes. Do not wait for the trustee to find the issue. Timely amendments demonstrate good faith and help avoid complications with your discharge.

Keep organized copies. Maintain a complete set of the schedules you signed, the declaration, and any amendments. Keep both electronic and paper copies if possible. Label each with the filing date so you can track the chronology if questions come up later.

Protect sensitive information across the case. The declaration itself should not include full account numbers or unredacted personal data. Make sure redaction practices match what you used in your other schedules to maintain consistency and protect your privacy.

Stay aligned with all other deadlines. The declaration is one part of the larger filing. Make sure your credit counseling certificate, pay stubs, tax returns, and any other required documents are addressed on time. A solid, complete record helps the trustee and the court process your case without delay.

Prepare for your meeting of creditors. Review your signed schedules and declaration again before the meeting. Refresh your memory on values, creditors, and income figures. Consistency between your sworn documents and your answers at the meeting builds credibility.

Plan for the future record. After your case closes, retain your signed declaration and schedules. You may need them for loan applications, tax questions, or future financial planning. Storing them securely makes later requests easier to handle.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.