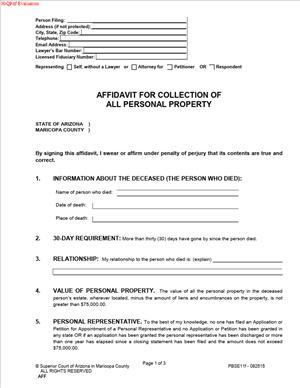

Affidavit for Collection of all Personal Property

Fill out nowJurisdiction: Country: The United States | Province or State: Arizona | County: Maricopa

What is an Affidavit for Collection of all Personal Property?

An Affidavit for Collection of all Personal Property is a sworn statement you use to collect a deceased person’s personal property without a full probate case. It lets you claim assets like bank accounts, vehicles, refunds, wages, and household items when the estate is small. You sign the affidavit under oath and present it to the person or company holding the property. You do not file it with the court. You use it as proof of your right to collect and distribute the property.

This affidavit is meant for small estates. In Arizona, you can use it when the total value of the decedent’s personal property, after subtracting liens, is within the small estate limit. You must also wait at least 30 days after the date of death. There cannot be a personal representative appointed by any court for the estate. No probate application can be pending. If any of those things exist, you cannot use this form.

Who typically uses this form? The most common users are a surviving spouse, adult child, parent, or sibling of the person who died. Anyone named in a valid will can also use it, if they have priority under the will. A conservator, guardian, or trustee with proper authority may sign if the person entitled to inherit is a minor or lacks capacity. Sometimes a business partner or company officer uses the affidavit to access a decedent’s business bank account, if they are a rightful successor to that asset.

Why would you need this form? You use it to avoid the time and cost of a probate case when the estate is small and simple. It helps you collect assets fast so you can pay final bills and distribute what remains to the heirs. It also helps when the decedent left only a few accounts or a vehicle, and you need to transfer title or close accounts. If you try to close an account without this affidavit or court letters, a bank or employer will often refuse to release funds. The affidavit gives them legal protection to pay you.

Typical usage scenarios include closing a checking account held only in the decedent’s name, transferring a car title, collecting a final paycheck, or getting refunds from utilities, insurance, or tax authorities. You might also use it to open a safe deposit box, retrieve personal items from a storage unit, or access a small investment account. It does not cover real estate. If you need to transfer land or a home, a different process applies. For personal property, this affidavit is often all you need in Maricopa County if you meet the legal limits and timing.

When Would You Use an Affidavit for Collection of all Personal Property?

You would use this affidavit when the person died at least 30 days ago and left only personal property within the small estate cap. The cap applies to property that would pass through probate, not to assets that pass by designations. You can exclude assets with a payable-on-death beneficiary, transfer-on-death designation, or joint ownership with right of survivorship. You also exclude life insurance with a named beneficiary and retirement accounts with beneficiaries. The affidavit covers what is left after those non-probate transfers.

Practical examples help. If your spouse died leaving a small bank account and a paid-off car, you can likely use this affidavit after 30 days. You can go to the bank with the affidavit and a certified death certificate. The bank can issue you a check made payable to you as successor. You can also retitle the vehicle using the affidavit and the current title. If your adult parent died with a modest savings account and some personal items, you can use the affidavit to collect the account and distribute it to all siblings according to the law or the will. If a small business owner died with a business account held in their name only, a rightful successor can use the affidavit to move funds and pay remaining business expenses. If your partner died with a utility refund owed to the estate, you can present the affidavit to get that refund paid.

You would not use the affidavit if a probate case is open or pending. You would not use it if the personal property value, minus liens, exceeds the limit. You would not use it for real estate, even vacant land. If the decedent owned a home in their name only, this form is not the right tool. If assets are all non-probate (for example, joint accounts with survivorship, or all assets have named beneficiaries), you do not need the affidavit at all. Those assets transfer outside probate.

Typical users include a surviving spouse who needs to close accounts and transfer a vehicle. An adult child who needs to collect a parent’s last paycheck and bank funds. A parent who needs to collect a dependent child’s small savings account and personal items. A business partner who needs to collect a small merchant account balance owed to the decedent’s business. A person named in a will who needs to gather a small brokerage account. A trustee or court-appointed guardian who needs to act for a minor heir. A landlord is not a typical user, but a landlord may release the decedent’s property to you after you present the affidavit and proof that you are the proper successor.

3. Legal Characteristics of the Affidavit for Collection of all Personal Property

The affidavit is a sworn, legally binding statement. You sign it under oath before a notary. You affirm the decedent’s identity, date of death, and where they lived. You state that at least 30 days have passed since the death. You confirm the personal property value is within the small estate limit after subtracting liens. You state there is no personal representative appointed and no probate pending. You identify your relationship to the decedent and your right to receive the property. You list the property you seek to collect. Your signature carries legal weight. If you knowingly make a false statement, you risk civil and criminal penalties.

The affidavit is enforceable because Arizona law allows a holder of property to rely on it. When you present a proper affidavit with a certified death certificate and identification, the bank, employer, or agency can release funds to you. They can rely on your sworn statements without needing a court order. That is why the affidavit must be complete, truthful, and notarized. A notary confirms your identity and that you swore the contents are true. This formal step gives the affidavit evidentiary strength.

Using the affidavit shifts responsibilities to you. You must distribute the property to the rightful heirs or devisees under the law or the will. If you collect funds, you must pay known debts of the estate to the extent of the property you received. Keep records of what you collected and how you paid expenses and heirs. If a creditor or heir challenges your actions, your records will protect you. If multiple people have equal rights, you should include them as co-signers or share property as the law requires. If a minor is entitled to property, you may need to hold it under a custodial account or obtain proper authority to manage it.

General legal considerations include timing, valuation, and proper asset classification. You must wait at least 30 days from death. You must calculate the net value of personal property on the date of death, subtracting liens and encumbrances. You should not include assets that pass outside probate by beneficiary or joint ownership. You cannot use this affidavit for real estate. You should check whether anyone has already applied to open a probate case. If so, you must stop and address that case instead. Third parties may set internal requirements, such as a certified death certificate and reliable identification. They may also request more detail, like an inventory or proof of mailing to other successors. Be ready to provide reasonable support.

4. How to Fill Out a Affidavit for Collection of all Personal Property

Follow these steps to prepare and use the affidavit in Maricopa County.

Step 1: Confirm you qualify

- Wait at least 30 days from the date of death.

- Add up the value of personal property on the date of death.

- Subtract liens and encumbrances, like an auto loan balance.

- Exclude non-probate assets with beneficiaries or survivorship.

- Ensure no personal representative has been appointed.

- Ensure no probate application is pending in any court.

If you do not meet these points, you cannot use this form.

Step 2: Gather documents and information

- Certified death certificate for the decedent.

- Your government-issued photo ID.

- The decedent’s last known address and county of residence.

- The will, if one exists, and any codicils.

- Account statements showing balances on the date of death.

- Vehicle titles, VINs, and any lien payoff letters.

- Safe deposit or storage unit details.

- Employer information for final wages.

- Receipts or estimates for final expenses, if known.

Organize these by asset. Create a simple inventory list with values.

Step 3: Identify the successors and shares

- Identify who is entitled to inherit under the will or law.

- Note each person’s full name, address, and relationship.

- Determine the share each should receive.

- If there are multiple equal successors, consider co-signing.

- If a successor is a minor or lacks capacity, note that.

- Identify any guardian, conservator, or trustee who may act.

Clarity here will prevent disputes later.

Step 4: Complete the decedent information

- Enter the decedent’s full legal name, including any aliases.

- Enter the date of death from the death certificate.

- Enter the last residence address and county.

- Confirm the decedent lived in Arizona, if applicable.

- If the decedent lived elsewhere, list Arizona assets you will collect.

Use exact names as they appear on asset records.

Step 5: Complete your information as claimant

- Enter your full legal name and mailing address.

- State your relationship to the decedent.

- State whether you are named in a will or are an heir at law.

- If you act for someone else, state your authority.

- Attach proof of your authority if you act as guardian or trustee.

Use contact information where you will receive notices or checks.

Step 6: Make the required legal statements

- Check the statement that 30 days have passed since death.

- Check the statement that the net personal property is within the limit.

- Check the statement that no personal representative exists or is pending.

- Check the statement that you are entitled to the property as successor.

- Affirm no one has a superior right to the property you claim.

These are core elements. Do not skip any required statement.

Step 7: Describe the property to be collected

- List each item of personal property you seek to collect.

- For bank accounts, list bank name, account number, and balance.

- For vehicles, list year, make, model, VIN, and title number.

- For investments, list account type, broker, and account number.

- For wages or refunds, list the payer and estimated amount.

- For tangible items, describe the item and its fair value.

Be specific. This helps holders verify and release the correct property.

Step 8: Prepare a schedule of personal property and values

- Create Schedule A: Personal Property List.

- List each probate asset and its date-of-death value.

- Subtract liens tied to specific assets, like vehicle loans.

- Show net total to confirm you are within the legal limit.

- Do not list assets with beneficiaries or survivorship.

- Do not list real estate, even if it is vacant land.

Attach Schedule A to the affidavit. Keep a copy for your records.

Step 9: Address multiple successors

- If others share the right, ask them to co-sign the affidavit.

- If you will collect and distribute, state that clearly.

- Consider written consents from other successors.

- Attach consents or waivers to avoid confusion later.

- If a successor is a minor, involve the legal guardian.

- If there is disagreement, do not use the form. Consider legal advice.

Aligning successors up front prevents holds by banks or agencies.

Step 10: Prepare asset-specific supporting papers

- For bank accounts, bring the death certificate and your ID.

- For vehicles, bring the title, lien release, and mileage.

- For safe deposit boxes, ask the bank about access steps.

- For employer wages, bring the affidavit and death certificate.

- For refunds or rebates, attach supporting account numbers.

- For securities, check if a medallion signature guarantee is required.

Holders may have their own checklists. Call ahead and confirm.

Step 11: Sign before a notary

- Do not sign until you are before a notary public.

- Bring your ID and all pages, including schedules and consents.

- Sign the affidavit in the notary’s presence.

- If others are co-signers, each must sign before a notary.

- Ensure the notary completes the acknowledgment, with date and county.

In Arizona, notarization is essential for acceptance.

Step 12: Make copies and organize a packet

- Keep the signed original affidavit with wet signatures.

- Make several copies of the affidavit and Schedule A.

- Attach a certified death certificate to each packet.

- Include copies of your ID if the holder requests it.

- Tab each asset packet by holder name for quick use.

Present a clean, complete packet to speed release.

Step 13: Present the affidavit to each holder

- Visit the bank branch or contact the asset holder.

- Ask for the department that handles deceased accounts.

- Provide the affidavit packet and answer identity questions.

- Ask how funds will be made payable and the expected timeline.

- For vehicles, follow the title transfer instructions carefully.

- For securities, follow any signature guarantee steps promptly.

Be polite but firm. You have legal authority with a proper affidavit.

Step 14: Receive and safeguard property

- Deposit funds into a separate estate collection account, if possible.

- Do not mix collected funds with your personal funds.

- Record the date and amount received from each holder.

- Safeguard physical items and maintain an inventory.

- For vehicles, complete title transfer and update registration.

Good stewardship now avoids later problems.

Step 15: Pay known debts and final expenses

- List known creditors and final expenses, such as funeral costs.

- Use collected funds to pay legitimate debts up to the amount collected.

- Keep invoices, receipts, and proof of payments.

- Note which debts are tied to specific assets, like auto loans.

- Do not pay lower-priority debts before higher-priority expenses.

You are responsible to the extent of property you receive.

Step 16: Distribute the remainder to rightful recipients

- Follow the will’s instructions, if valid.

- If no will, follow Arizona intestacy rules.

- Document each distribution with a receipt.

- If a minor is entitled, use a lawful custodial or trust method.

- Keep copies of checks and transfer confirmations.

Equal shares must be equal in value, not necessarily in kind.

Step 17: Keep records and close out

- Maintain a ledger of collections, payments, and distributions.

- Keep copies of the affidavit, schedules, and consents.

- Store bank statements and title transfer receipts.

- Retain records for at least two years from the date of death.

- Be ready to show records if a creditor or heir asks.

Good records reduce risk and protect you from claims.

Common mistakes to avoid

- Using the affidavit before 30 days have passed.

- Including real estate or trying to transfer a home with this form.

- Overvaluing or undervaluing property to meet the limit.

- Forgetting to subtract liens when calculating net value.

- Ignoring non-probate transfers and double-counting assets.

- Omitting co-successors or failing to get consents.

- Signing outside a notary’s presence or with missing pages.

- Presenting incomplete packets to banks or agencies.

Fix errors before you present the affidavit. Corrected, complete packets get faster results.

Practical tips for Maricopa County users

- Use the county name “Maricopa” in the notary acknowledgment.

- Bring extra certified copies of the death certificate.

- Banks often prefer the original; ask for it back after review.

- Vehicle transfers may require an odometer disclosure and lien release.

- Call holders in advance to confirm any extra requirements.

- If a holder resists, ask to speak with their legal department.

Follow these steps, and you can collect and distribute personal property without a probate case. You save time and money while honoring legal duties.

5. Legal Terms You Might Encounter

Affidavit. This is a written statement you sign under oath. In this case, you swear you can collect the decedent’s personal property. You also accept legal responsibility for what you claim.

Decedent. This is the person who died. The form asks for the decedent’s full legal name, date of death, and last address. Make sure these match the death certificate.

Personal property. These are assets other than land or buildings. Think bank accounts, vehicles, stocks, or personal items. This form covers only personal property.

Estate. This means everything the decedent owned at death. Your affidavit deals only with the personal property portion. Real estate needs a different process.

Successor. You are the successor if you have a right to inherit from the estate. That can be under a will or under default inheritance rules. The form asks you to state how you qualify as a successor.

Will. A will is a written plan for who gets property. If there is a valid will, you must follow it. You use the affidavit to collect items listed for you, if allowed.

Intestate. This means the decedent died without a valid will. If so, default inheritance rules apply. You must identify who the legal heirs are before you collect.

Personal representative. This is the person appointed to handle the estate. If a court has appointed one, you usually cannot use this affidavit. The court process takes priority.

Creditor. A creditor is someone the estate owes money to. You must address valid debts before you distribute property to heirs. Keep records of every payment you make.

Notary public. This is an official who verifies your identity and watches you sign. You will likely sign the affidavit before a notary. Bring valid ID and sign only in the notary’s presence.

Perjury. This is knowingly lying under oath. Your affidavit includes a perjury warning. If you make false statements, you face penalties and civil liability.

Holder of property. This is the person or company that has the decedent’s assets. It could be a bank, finance company, or employer. You present the affidavit to them to release funds.

Inventory. This is a list of the estate’s personal property and debts. You should prepare a simple inventory before you sign. It helps you distribute assets correctly.

Receipt and release. A receipt shows someone received their share. A release confirms they have no further claims. Use these when you distribute to heirs or pay creditors.

6. FAQs

Do you need to wait before using the affidavit?

Yes. You usually must wait a short period set by law. This allows time to see if anyone opens a probate case. It also helps confirm no personal representative is appointed. Check local rules before you sign.

Do you file this form with a court?

Not usually. You present the affidavit to the holder of the property. For bank accounts, you give the form and a death certificate to the bank. Some holders have their own internal forms. Ask first and follow their instructions.

Do you need a notary?

Yes in most cases. Plan to sign before a notary. The notary confirms your identity and witnesses your signature. Bring government ID and do not sign until the notary tells you to sign.

Do you need the original death certificate?

Yes. Most holders require an original or certified copy. Order multiple copies if there are several accounts or companies. Keep one copy for your records.

Do you use this form if there is real estate?

No. This form is only for personal property. Real property requires a different process. Ask about the correct process for real estate if needed.

Do you still use the affidavit if there is a will?

Yes, if the estate qualifies and no personal representative has been appointed. You collect only the items that pass to you under the will. You must follow the will’s terms for distribution.

Do you need every heir to sign?

It depends on how the assets pass. If you are the only successor for a specific asset, you may sign alone. If multiple successors share an asset, all may need to sign or consent. Some holders require all successors to sign. Confirm with the holder before you submit.

Do you need to pay debts before distributing to heirs?

Yes. Valid debts and expenses come first. Pay funeral costs, last medical bills, and known debts before you distribute. Keep receipts and records for each payment.

Do you need to list every asset on the affidavit?

You should identify the personal property you seek to collect. Name accounts, policy numbers, or vehicle details when possible. Attach pages if you need more space. Clear identification avoids delays.

Do you have to notify creditors?

You are not always required to send notice under this process. But it is wise to identify known creditors and address valid claims. If you distribute without paying debts, you could be responsible later.

Do you need a tax ID number for the estate?

Often you can use a separate estate account to hold funds. That account may require a tax ID number. Ask the bank what it needs. Using a separate account helps you track transactions.

What if a bank refuses to honor the affidavit?

Ask for the reason in writing. Provide any missing documents. Escalate to a supervisor if needed. If the bank still refuses, consider legal guidance on your options.

What if someone contests your right to collect?

Stop and resolve the dispute before you collect. Ask the person to provide their basis. If you cannot agree, get advice. Do not distribute while a dispute is active.

Can you amend the affidavit if you forgot an asset?

You usually cannot alter a signed affidavit. Prepare a new affidavit if you need to include more items. Use the same facts and attach supporting documents.

7. Checklist: Before, During, and After the Affidavit for Collection of all Personal Property

Before signing:

- Certified death certificate for the decedent.

- Your government-issued photo ID.

- Decedent’s full legal name, date of birth, and date of death.

- Decedent’s last address and county of residence.

- Proof you are a successor (will excerpt or family relationship).

- Copy of any will and any codicils.

- List of known heirs and contact details.

- Inventory of personal property to collect.

- Account numbers, policy numbers, and institution contacts.

- Recent statements or balance confirmations, if available.

- Vehicle information (VIN, title number, plate).

- Documentation for securities or brokerage accounts.

- Unpaid bills, last medical and funeral invoices.

- Known creditor list and amounts due.

- Notes on any safe deposit box contents.

- Confirmation that no personal representative is appointed.

- Any releases or consents from co-successors, if needed.

- Notary appointment arranged and location details.

- Extra copies of the affidavit for each institution.

During signing:

- Verify the decedent’s name matches the death certificate exactly.

- Confirm the date of death is correct.

- Check your name and address for errors.

- Confirm your relationship or right to inherit is accurate.

- Review that no personal representative has been appointed.

- Ensure you selected only personal property, not real estate.

- List each asset clearly. Include account or policy numbers.

- Attach additional sheets if you need more space.

- Read the perjury statement. Do not sign if anything is wrong.

- Sign only in front of the notary.

- Initial any pages that require it.

- Make sure the notary completes all fields and stamps the form.

- Ask the notary for extra notarized copies, if permitted.

After signing:

- Make a master copy and several working copies.

- Keep the original in a safe place.

- Present the affidavit and death certificate to each holder.

- Ask each institution what else it requires.

- Complete any internal claim forms they provide.

- Open an estate bank account if you will handle multiple payments.

- Deposit received funds into the estate account, not your own.

- Log every receipt and disbursement in a ledger.

- Pay valid debts and expenses from the estate account.

- Request receipts and payoff letters from creditors.

- Distribute remaining property to the rightful recipients.

- Collect signed receipts and releases from recipients.

- Update your inventory and ledger to show zero balances.

- Store all documents together: affidavit, inventory, bank records, receipts.

- Keep records for several years after final distribution.

- Notify co-successors when distributions are complete.

- If you discover new assets, prepare a new affidavit and repeat the steps.

- If an institution refuses, document the reason and your follow-up.

8. Common Mistakes to Avoid Affidavit for Collection of all Personal Property

- Using the affidavit for real estate. This form is for personal property only. Using it for land or a home causes rejection and delays. Don’t forget to confirm asset types before you list them.

- Skipping debts and expenses. Distributing funds without paying valid debts can backfire. Creditors can seek repayment from you. Don’t forget to clear known debts before any distributions.

- Guessing asset details. Vague descriptions make holders say no. Missing account numbers or VINs cause delays. Don’t forget to collect exact identifiers for each asset.

- Leaving out co-successors. If others share the right to inherit, some holders may require their signatures or consent. Ignoring them can lead to disputes. Don’t forget to coordinate and get written releases when needed.

- Signing outside a notary’s presence. Institutions often reject un-notarized forms or improper notarizations. Don’t forget to sign only in front of the notary and verify the seal.

- Relying on outdated information. Old addresses, obsolete account numbers, or closed accounts waste time. Don’t forget to verify each asset and contact the holder to confirm procedures.

- Altering pre-printed language. Cross-outs or handwritten edits can void the form. Don’t forget to use attachments for extra details and leave boilerplate wording intact.

9. What to Do After Filling Out the Form Affidavit for Collection of all Personal Property

Present the affidavit to each holder. Bring your ID and a certified death certificate. Ask the holder for its process and any extra forms. Some will require their own affidavit or claim form. Complete those and keep copies.

Collect and consolidate the assets. Ask the holder to transfer funds to an estate account. Avoid deposits to your personal account. If you receive a check, endorse it as the successor. Keep copies of all checks and transfers.

Secure non-cash items. For vehicles, arrange for title transfer under the holder’s rules. For securities, ask the brokerage to retitle or liquidate as directed. For safe deposit boxes, request an inventory appointment if required.

Create and maintain an accounting. Track money in and money out. Record every item collected and every bill paid. Update your asset list as you go. This protects you if questions arise.

Address debts and expenses. Identify valid claims and pay them from estate funds. Keep invoices, statements, and proof of payment. If funds are tight, pay essential expenses first and seek guidance on priorities.

Distribute to the rightful recipients. Follow the will if one exists. If there is no will, follow default inheritance rules. When in doubt, pause and confirm the correct shares before paying out.

Use receipts and releases. When you distribute, ask each recipient to sign a receipt and release. This confirms they received their share and have no further claim. File these with your records.

Set a holdback if needed. Consider holding a small reserve for final bills or corrections. After a reasonable time with no new claims, distribute the holdback. Document your decision and timing.

Resolve disputes promptly. If an heir or creditor objects, stop and address it. Share your records and try to find agreement. If you cannot, seek guidance before you continue.

Handle taxes as needed. Ask the bank about any tax forms it will issue. Keep statements and 1099 summaries with your file. Mark the calendar for any deadlines.

Amend when you find new assets. Prepare a new affidavit to collect newly found property. Present it to the holder with a death certificate. Add the asset to your accounting and repeat the steps.

Close out and store records. When you finish distributing, finalize your ledger. Note that the estate has no remaining personal property. Store the original affidavit, receipts, releases, and bank records together. Keep them secure for several years.

Plan for unclaimed property. If an institution cannot locate certain funds, ask about next steps. You may need to search for unclaimed property later. Keep a note in your file to follow up.

Communicate with co-successors. Send a simple summary of what you collected and how you distributed. Attach copies of the accounting as needed. Clear communication reduces questions and risk.

Know when to step back. If a court appoints a personal representative later, stop using the affidavit. Transfer collected items and records to that person. Ask for a receipt for your handoff.

Maintain professionalism with holders. Be patient with verification steps. Provide requested documents quickly. Keep names, dates, and notes for every call. Organized follow-up speeds release of property.

Finalize and archive. Once all debts are paid and distributions complete, close the estate account. Save the final statement. Archive your records and secure digital copies in a private drive.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.