Form 20I – Financial Information Form

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

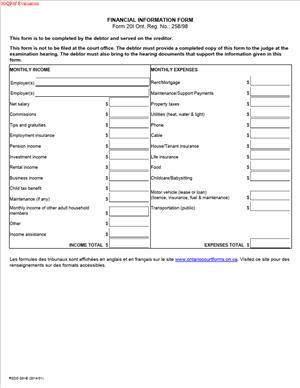

What is a Form 20I – Financial Information Form?

Form 20I is a court form used in Ontario Small Claims Court. It gathers detailed financial information from a person or business that owes money on a court order. You use it to show your income, expenses, assets, and debts. The court and the creditor rely on this form to assess your ability to pay.

You typically complete this form after a judgment or order for money. You may also be asked to complete it before or for a payment hearing or an examination hearing. In many cases, the court expects you to bring the completed form and documents to your hearing. Sometimes you must serve and file it in advance.

Who usually fills it out?

Judgment debtors do. That includes individuals, sole proprietors, partners, and corporations. If the debtor is a corporation, an officer or director completes it based on corporate records. You may also prepare one voluntarily to support a payment plan proposal. Creditors do not complete it. They use the information to decide next steps.

Why would you need this form?

Because the court can order you to complete it. The court needs reliable financial details to set a fair payment schedule. The form also helps avoid surprise at a hearing. If you provide a complete picture, the court can make informed orders. You also reduce the chance of enforcement that does not fit your situation.

Typical usage scenarios

You receive a Notice of Examination. The notice tells you to bring financial records. You complete Form 20I to organize your information and comply. You receive a Notice of a Payment Hearing. The notice tells you to serve a completed Form 20I before the hearing. You gather pay stubs, bank statements, and bills to support your entries. You are behind on a judgment, but can make monthly payments. You complete Form 20I and attach a payment proposal. You send it to the creditor to reach a plan and avoid garnishment. Your corporation lost a claim and owes money. The creditor schedules an examination. A director completes Form 20I using the company’s books and bank records. The form guides the discussion and next steps.

Form 20I is practical. It asks for standard categories: who you are, where you work, what you earn, what you spend, what you own, and what you owe. You sign the form to confirm accuracy. If you include clear documents, you strengthen your position. If you leave gaps, the court may order more disclosure. Non-compliance can lead to costs or further orders.

When Would You Use a Form 20I – Financial Information Form?

- You use Form 20I after a Small Claims Court order for money. The form supports information gathering during enforcement. It appears most often before payment hearings and examination hearings. The court or creditor may tell you when to serve or bring it. If no instruction appears, ask the creditor or the court office.

- You use the form when a creditor schedules a payment hearing. The court needs your budget and assets to set an affordable plan. The form lets the court weigh your income and essential expenses. It also shows if assets or non-exempt funds exist.

- You use the form when a creditor schedules an examination. The creditor wants to understand your financial picture. That includes employment, bank accounts, vehicles, real estate, and other assets. The form streamlines the questions. It reduces time and disputes at the appointment.

- You use the form when you want to propose payments. For example, you are a contractor who lost a claim. You can pay $250 each month. You complete Form 20I and attach proof of income and expenses. You send it with a written proposal. The creditor may accept and stop enforcement.

- You use the form if the court warns of a contempt hearing. You failed to attend a payment hearing or examination. The court sets a new date and requires Form 20I. You complete it to show good faith and avoid further penalties.

- Typical users include individual debtors and small business owners. Landlords or tenants may also use it if their dispute went through Small Claims Court and resulted in a money order. Corporate debtors use it through a knowledgeable officer. Self-employed people use it to report variable income. Retirees use it to report pension and benefits. People on social assistance use it to explain exempt income.

- In short, you use Form 20I whenever you must disclose financial facts to help the court or creditor decide how you will pay a judgment.

Legal Characteristics of the Form 20I – Financial Information Form

Form 20I is an official court form under the Small Claims Court rules. When the court orders you to complete it, you must do so. It is not a contract. It is a formal disclosure document filed in your court case. Your signature confirms the information is true to the best of your knowledge.

The form itself is not a judgment. It does not create liability. Your existing court order creates the liability. The form supports enforcement steps. The court and creditor use it to evaluate payment options and enforcement measures. The court can rely on it to make orders at a payment hearing. It can also inform garnishment, seizure, or continued examination.

Enforceability comes from the court’s authority. If you do not complete the form as required, the court can make further orders. That can include adjournments with costs, new hearing dates, or contempt proceedings. If you do not attend a scheduled hearing after proper service, a warrant may issue. If you provide false information, you risk serious consequences. The court can impose sanctions for contempt. You may also face liability for misrepresentation.

Accuracy and completeness matter. The court expects you to disclose all income sources, assets, and debts. That includes assets held jointly and accounts used for your expenses. You should also disclose your monthly commitments and dependents. The court weighs essential living costs. It does not accept inflated or unsupported numbers.

Privacy matters as well. The form contains sensitive information. The court file is generally public, but you should not include full account numbers. Use the last four digits. Do not include your Social Insurance Number. If you need protection for specific information, you can ask the court for directions. You should still comply with disclosure requirements.

Supporting documents help enforceability. If you state an expense or loan, attach proof. Pay stubs, bank statements, leases, and loan statements show reliability. Clear attachments reduce disputes and speed decisions. Weak or missing documents may delay your hearing or harm your request.

In summary, Form 20I is a required disclosure tool. It is legally significant because the court uses it to make enforcement decisions. Your certification and the attached evidence give it weight. Non-compliance invites penalties.

How to Fill Out a Form 20I – Financial Information Form

Follow these steps to prepare a complete, credible form. Work from current information. Gather documents before you start.

1) Identify the court file and parties.

- Enter the court file number exactly as on your judgment.

- Write the court location that heard your case.

- List the creditor as “Plaintiff” or “Creditor.”

- List yourself as “Defendant” or “Debtor.”

- If you are a corporation, use the full legal name.

2) Provide your personal or corporate details.

- For individuals, list your full name, address, phone, and email.

- Include your date of birth for identification only.

- Do not include your Social Insurance Number.

- For corporations, list the registered office and principal place of business.

- Provide contact for the officer completing the form.

3) Describe your household situation.

- State marital status and number of dependants.

- Identify any support obligations you pay or receive.

- Note who lives with you and contributes to expenses.

- If your spouse or partner contributes, estimate the monthly amount.

- Do not include the spouse’s private income details unless relevant.

4) Set out your employment and income.

- Provide your employer’s name, address, and phone number.

- State your job title, start date, and status (full-time or part-time).

- Give your gross pay and net pay per pay period.

- List overtime, bonuses, and commissions separately.

- Attach your three most recent pay stubs.

5) Report self-employment or business income.

- State your business name, type, and start date.

- Describe what you do and the typical gross monthly revenue.

- List the average monthly expenses needed to earn income.

- Provide recent bank statements for business accounts.

- Attach a recent profit and loss summary if available.

- Include HST collected and HST owing, if applicable.

6) Disclose government and other income.

- List pensions, CPP, OAS, disability, employment insurance, or WSIB.

- Include child tax benefits and spousal or child support received.

- Identify any rental income, dividends, or interest.

- Note if any income is exempt from garnishment.

- Attach award letters or statements for each income source.

7) List all bank and cash holdings.

- Provide the name of each bank or credit union.

- Identify account types and the last four digits of account numbers.

- State approximate current balances.

- Include joint accounts used for your expenses.

- Add prepaid cards or stored balances, if any.

- Attach the last three months of statements for each account.

8) Describe real estate and other property.

- For real estate, list the address and type of property.

- Provide the current market value and source of value.

- State the mortgage balance, lender, and monthly payment.

- Include property tax amount and arrears, if any.

- Attach a recent mortgage or tax statement if available.

- For vehicles, list make, model, year, and estimated value.

- State any loans on the vehicle and monthly payments.

- Include other property with resale value, such as tools or equipment.

- Identify any liens or security interests.

9) Report investments, savings, and insurance.

- List RRSP, TFSA, RESP, or other investment accounts.

- State the approximate value and account provider.

- Note any locked-in retirement accounts or pensions.

- Identify life insurance with a cash value component.

- Attach recent statements where possible.

10) List your debts and monthly obligations.

- Include credit cards, lines of credit, and personal loans.

- Provide creditor names, balances, and minimum payments.

- List student loans and tax debts.

- Include child or spousal support you pay.

- State arrears and any existing payment plans.

- Attach statements that confirm balances and terms.

11) Set out your monthly living expenses.

- List rent or mortgage, utilities, and property taxes.

- Include phone, internet, and insurance premiums.

- Add transportation, fuel, and car maintenance.

- List groceries, childcare, and medical costs.

- Include debt payments and support payments.

- Use realistic averages based on recent months.

- Attach proof for significant items such as rent, insurance, and loans.

12) Explain your payment proposal, if any.

- Suggest a monthly payment you can sustain.

- Base it on your net income after essential expenses.

- Identify the date each month you can pay.

- Consider seasonal or fluctuating income if you are self-employed.

- If you can make a lump sum, state the amount and timing.

- Explain how you calculated the proposal in one or two sentences.

13) Attach supporting documents as schedules.

- Label each document clearly, such as “Schedule A: Pay Stubs.”

- Include only copies, not originals.

- Redact full account numbers, leaving only the last four digits.

- Keep the package organized and readable.

- Typical schedules include pay stubs, bank statements, leases, loan statements, tax notices, and insurance.

14) Review for accuracy and completeness.

- Check that all sections are filled or marked “N/A” if not applicable.

- Confirm totals make sense and match statements.

- Ensure names and account details are accurate.

- Make sure your contact details are up to date.

15) Sign and date the form.

- Read the certification language carefully.

- Sign to confirm the contents are true and complete.

- Print your name and add the date and location.

- If an officer signs for a corporation, state the office held.

16) Make copies, serve, and file.

- Make at least two copies of the completed form and schedules.

- Serve a copy on the creditor or the creditor’s representative.

- Use an accepted method of service for the form and documents.

- Keep proof of service, such as an affidavit of service if required.

- File the original or a copy with the court office, as directed.

- Follow any deadline in your notice. If none, aim for at least seven days before the hearing.

17) Prepare for your hearing or meeting.

- Bring your copy and all attachments to the hearing.

- Bring extra copies for the creditor and the court.

- Be ready to explain any unusual entries.

- Be ready to update with newer statements if the hearing is delayed.

18) Special notes for corporate debtors.

- Provide corporate banking details and financial statements, if available.

- Identify the nature of business and revenue sources.

- List accounts receivable and aging, if relevant.

- List major assets and any security interests.

- Explain cash flow constraints and upcoming receivables.

- Attach a recent general ledger or summary reports if possible.

19) Special notes for self-employed individuals.

- Separate business and personal accounts where possible.

- Show gross revenue and necessary business expenses.

- Keep invoices and receipts available to support averages.

- Explain seasonality and expected upcoming projects.

- Include HST details and installment obligations.

20) Understand how the information may be used.

- The court can use your form to set a payment schedule.

- The creditor can consider garnishment or seizure based on assets.

- Wage garnishment is limited by law to protect basic income.

- Many social assistance payments are exempt from garnishment.

- Full and frank disclosure improves your credibility and outcome.

Common mistakes to avoid

- Leaving bank accounts off the form.

- Overstating expenses without proof.

- Guessing values without notes or ranges.

- Hiding assets or joint accounts used for your expenses.

- Missing deadlines for service and filing.

If your circumstances change, update the creditor. If you cannot meet a set payment, act early. Propose a revised amount with current proof. The court prefers realistic plans supported by documents.

Keep everything you submit. Retain a complete copy of your form and schedules. Keep your proof of service. You may need them at your hearing or later.

Legal Terms You Might Encounter

- Judgment creditor means the person or business owed money under a court order. This form gives the judgment creditor your financial picture. They use it to decide how to collect.

- Judgment debtor means you, if the court order says you owe money. If you received this form, you likely are the judgment debtor. You complete it fully and honestly.

- Enforcement means the legal steps used to collect a court-ordered debt. Your answers may guide which enforcement method the creditor pursues. Be accurate to avoid unnecessary steps.

- Notice of Examination is a court notice requiring you to attend and answer questions under oath. This form helps prepare for that hearing. It often must be delivered before the examination date.

- Garnishment is a court process to take money from wages or bank accounts. Income details and bank information on this form can be used to request garnishment. Accurate entries matter.

- A writ of Seizure and Sale is a court order that allows the seizure and sale of assets. The property information on this form helps assess whether a writ is worth pursuing. List assets carefully.

- Exempt property or exempt income means income or assets that the law may protect from seizure. This could include certain benefits or tools of your trade. You still list them on this form for clarity.

- Gross income means income before deductions. Net income means income after deductions. This form may ask for one or both. Label each amount clearly to avoid confusion.

- Dependant means someone who relies on you for financial support. You disclose dependents because they affect your budget. This context may support a payment schedule.

- Affidavit of Service is a sworn statement confirming how and when you delivered documents. You may need one after delivering this form to the creditor. Follow the delivery instructions you received.

FAQs

Do you have to complete Form 20I if you cannot pay right now?

Yes. You still complete it. Use exact figures. Explain your constraints. The court considers your real situation when setting terms.

Do you send the form to the court or only to the creditor?

Follow the directions on your notice. Many cases require delivery to the creditor and bringing a copy to the examination. Some require filing with the court. If your notice says to file, do so.

Do you need to attach proof, like pay stubs or bank statements?

Attach proof if the notice asks for it. Even if not required, bring proof to any examination. Proof makes your figures credible and avoids delays.

Do you include your spouse’s income?

Include only the information the form asks for. If it asks for household income, include your spouse’s income. If unsure, state what you included and why. Be consistent.

Do you list joint accounts and assets?

Yes. Disclose joint accounts and assets. Identify them as joint. State your share if you know it. Transparency reduces follow-up requests.

Do you include business assets if self-employed?

Yes. List business income, accounts, tools, and receivables. Separate business from personal items. Provide averages if income fluctuates, and note the period used.

Do you need to provide your social insurance number?

Provide only what the form requests. Do not add sensitive numbers that the form does not ask for. If requested, ensure the number is accurate.

What happens if you do not complete or deliver the form on time?

You risk a court order compelling compliance. The court may award costs or schedule an examination. Non-compliance can lead to stronger enforcement steps.

Can you propose a payment plan on this form?

Yes. Use the income and expense sections to support a realistic plan. Include timing and amounts. Be specific, not vague.

Can you update the form if your finances change before the hearing?

Yes. Prepare an updated version. Mark it clearly with the new date. Deliver it again as directed. Bring the latest copy to any hearing.

Checklist: Before, During, and After the Form 20I – Financial Information Form

Before you sign and complete

- Gather personal details: full name, address, phone, email, and date of birth.

- Case details: court file number, names of parties, judgment date, amount owing.

- Income proof: recent pay stubs, benefit statements, pension slips, business income summaries.

- Bank details: institution names, branch locations, account types, and recent balances.

- Employment details: employer name, address, job title, start date, pay schedule.

- Expenses: rent or mortgage, utilities, insurance, transportation, childcare, medical, and loan payments.

- Assets: vehicles, real estate, equipment, investments, cash on hand, and valuables.

- Debts: credit cards, lines of credit, loans, tax arrears, support obligations.

- Dependants: names, ages, relationship, support amounts.

- Prior orders or payment plans related to this judgment.

- Notices you received about how and where to deliver the form.

During completion and signing

- Confirm the court file number matches your case.

- Use the exact legal names for all parties.

- Enter gross and net income separately and label each.

- List every income source, even small or irregular amounts.

- Use average monthly figures for variable income. State your averaging period.

- Itemize regular expenses. Do not group unrelated costs.

- Identify each bank by name and branch. Note account type and balance.

- Identify assets with make, model, year, or legal description where possible.

- Mark joint accounts and assets as “joint” and state your share, if known.

- Separate business from personal income and assets.

- Double-check math. Totals should match line items.

- Do not leave blanks. Write “N/A” if not applicable.

- Add explanations where a figure may raise questions.

- Attach the requested proof. Label attachments with section references.

- Read any declaration carefully. Sign and date where indicated.

- If a commissioner or witness is required, arrange that step before delivery.

After signing

- Make at least three copies: one for you, one for the creditor, and one for the court if required.

- Deliver the form as instructed. Note the method and date of delivery.

- If a hearing is scheduled, bring the form and all proof.

- If required, file the form with the court. Keep your stamped copy.

- Prepare an Affidavit of Service, if directed. Keep a copy.

- Store your copy securely. Include proof and delivery records.

- Calendar all deadlines and hearing dates. Set reminders.

- Update the form if your information changes before the hearing.

- Prepare a realistic payment proposal backed by your numbers.

Common Mistakes to Avoid Form 20I – Financial Information Form

Leaving out a bank account or income source.

- Consequence: The court may doubt your disclosure. You may face additional orders or costs. Don’t forget small or dormant accounts.

Mixing gross and net income in the same line.

- Consequence: Your budget appears inaccurate. The court may discount your figures. Label each amount and be consistent.

Guessing without noting it is an estimate.

- Consequence: Your figures may be challenged. Add a note if you used averages or estimates. State the time period used.

Skipping joint assets or debts.

- Consequence: The creditor may seek further disclosure. This delays resolution. Identify joint items and your share.

Missing signatures, dates, or attachments.

- Consequence: The form may be treated as incomplete. You could face an adjournment or new deadlines. Review the signature block and checklist before delivery.

What to Do After Filling Out the Form 20I – Financial Information Form

- Review for completeness. Confirm every section is filled or marked “N/A.” Check totals and attachments.

- Make copies. Keep an original signed copy for your records. Prepare copies for delivery and filing, if needed.

- Deliver as directed. Follow the method and timeline stated in your notice. Record how and when you delivered.

- File if required. If your notice requires filing, submit the form to the court office. Keep the court-stamped copy.

- Prepare for the examination. Bring the form, proof of income, bank records, bills, and any supporting documents.

- Draft a payment plan. Use your budget to set a clear schedule. State amounts, dates, and payment method.

- Communicate early. Share your plan with the creditor before the hearing if allowed. Document all communications.

- Update if things change. If income or expenses change, prepare an updated form. Deliver and bring the latest version.

- Correct errors promptly. If you spot a mistake, complete a corrected form. Mark it with the new date and “Amended.” Deliver it again and bring it to the hearing.

- Keep records. Store delivery receipts, Affidavit of Service, and court-stamped copies. Keep these with your budget and proof.

- Track next steps. Note any orders made at the hearing. Calendar payment dates or follow-up filings.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.