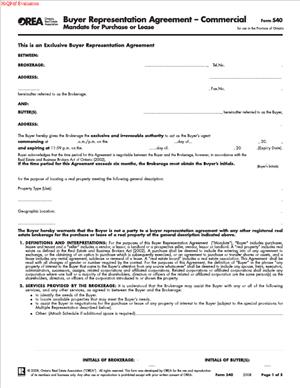

OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

Fill out nowJurisdiction: Canada — Ontario

What is an OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)?

This form is a written contract between you and a real estate brokerage. You authorize the brokerage to act as your representative to buy or lease commercial property in Ontario. It sets the scope of the relationship, the services, the fee, and your obligations. It also explains what happens if the brokerage represents more than one client in the same deal.

You use this agreement when you want a brokerage to search, evaluate, and negotiate for you. It is the standard way to make the relationship formal and enforceable. It works for purchases, leases, or both, depending on what you need.

Who typically uses this form?

Commercial buyers and tenants. Examples include a numbered company, a franchisee, an investor group, a manufacturer, a charity, or a startup. Landlords and sellers do not use this form. They use separate listing agreements.

You need this form if you want exclusive help finding and securing space or assets. It gives you a defined service team and protects your interests in negotiations. It also lays out how the brokerage gets paid. If a landlord or seller pays the fee, the agreement explains how that works. If they do not, it states what you owe.

Typical usage scenarios

- You plan to buy an industrial building for your own operations.

- You want to lease retail space for a store expansion.

- You are hunting for office space with specific parking or power needs.

- You are acquiring land for development or investment.

- You want a tenant rep to negotiate lease economics and terms.

- You want to pursue subleases or assignments and need guidance.

In each case, the agreement defines the area, property type, exclusivity, and the fee formula. It also sets a “holdover” period. The holdover protects the brokerage if you complete a deal soon after expiry with a property they introduced.

When Would You Use an OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)?

Use this form when you want a brokerage to represent you for commercial real estate. That includes searching for properties, arranging tours, analyzing options, drafting offers, and negotiating terms. The agreement should be signed before meaningful services begin. Brokerages usually require it before sharing confidential data or booking tours.

If you are a tenant, use it when you need a tenant representative. A tenant rep works only for you and cannot act for the landlord in the same transaction without consent. The agreement makes that duty clear. It also clarifies whether the landlord will pay the brokerage fee, and what happens if not.

If you are a buyer, use it when you want to acquire income property, land, or an asset for your business. The agreement lets you define the search area, property types, and budget range. You can also list excluded properties if you already have active talks.

If you are part of a corporate group, sign when you want the brokerage to represent your entire group. You can name affiliates, subsidiaries, and nominee buyers. That prevents fee disputes if a related entity ends up on the offer.

If you need both purchase and lease options open, the form handles both. You can authorize the brokerage to search for either path and outline the fee for each outcome. This is common when you are undecided between buying and leasing.

If timing is tight, sign a short-term contract with a focused area, then renew. Short terms help you test the working relationship and adjust the scope without risk. Longer terms suit broad searches, multi-market reviews, or complex builds.

You should also use the form when you want strict confidentiality. The agreement obligates the brokerage to protect your confidential information within the law. This is essential for roll-ups, relocations, and stealth expansions.

Legal Characteristics of the OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

This is a legally binding contract once signed and dated. It creates an agency relationship for commercial real estate. The brokerage owes you duties, including loyalty, confidentiality, and full disclosure. You agree to work with the brokerage on the agreed scope and pay the stated fee if it becomes payable.

Enforceability comes from clear terms in writing. The agreement identifies the parties, area, property type, term, services, and fee. It states when the fee is earned and payable. It also covers key consents, like multiple representation. Your signature confirms informed agreement. If you are signing for a corporation, you must have actual authority. If not, you can expose yourself and the entity to risk.

The agreement is typically exclusive. That means you work only with the named brokerage for the covered property types and area during the term. If you buy or lease a covered property through anyone else during the term, the fee can still be owed under the contract. You can include carve-outs for active files or named properties.

The holdover clause extends the brokerage’s fee protection for a set number of days after expiry. If you complete a purchase or lease of a property the brokerage introduced during the term, the fee can be payable within the holdover. The holdover only applies if you were introduced to the property during the term and complete it during the holdover. Read the clause, as your actions during the holdover matter.

The fee section can require you to top up a shortfall. If a seller or landlord pays less than the agreed fee, you may owe the difference. If they pay nothing, you may owe the entire fee. The agreement also states that applicable taxes are added to the fee. Make sure you budget for this.

The agreement addresses multiple representations. Multiple representation occurs if one brokerage represents you and the other party in the same transaction. You must consent in writing for that to happen. If you do not consent, the brokerage must avoid multiple representation or adjust the relationship. The agreement explains the limits on advice and confidentiality in that situation.

The agreement may permit designated representation. With designated representation, different registrants in the same brokerage each act for their client. This can preserve advocacy if allowed by the brokerage and the agreement. Review the clause and check the consent boxes as needed.

You can amend or terminate the agreement by written mutual consent. Unilateral termination is not always available. Even if you terminate, some obligations may continue. The holdover and fee clauses can survive. Keep records of any amendments.

Compliance with all applicable laws is expected. That includes fair dealing and required disclosures. You should receive the mandated information about representation options before signing. Keep a copy with all initials and schedules.

How to Fill Out an OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

Follow these steps to complete the form accurately. Use legal names, clear scope, and exact numbers. Initial every page and any consent boxes.

1) Identify the parties

- Insert the full legal name of the brokerage. Use the exact registered name.

- Record the brokerage address, phone, and email.

- Add the name(s) of your primary salesperson or broker of record if the form provides space.

- Insert the full legal name of the buyer or tenant. For a corporation, use the legal name, not a trade name.

- If you are signing for a company, add your title and confirm you have authority. If you use a nominee or affiliate, list them or add a schedule.

2) Define the term

- Enter the start date. Use today’s date if signing now.

- Enter the expiry date and time. Many forms use 11:59 p.m. on a specific date.

- Pick a realistic term. Use shorter terms for targeted searches. Use longer terms for complex or wide-area searches.

3) Set the scope: property types and geographic area

- Describe the property types covered. For example: office, industrial, retail, land, or investment.

- Add key parameters like size range, power, loading, ceiling height, zoning, or unit count, if important.

- Define the area clearly. Name municipalities, neighborhoods, or use street boundaries.

- Keep the scope as broad as needed, but not vague. Clarity reduces disputes.

4) State exclusive authority and any carve-outs

- Confirm the representation is exclusive for the defined scope. This is normal on this form.

- If you have ongoing talks for specific properties, carve them out. List exact addresses or parcel IDs.

- If you want freedom to self-procure certain assets, state that limit in a schedule.

5) Describe the services (if the form provides a section or schedule)

- Outline expected services. Examples: needs assessment, site search, tours, financial analysis, offer drafting, and negotiation.

- Include timelines or milestones if helpful. For example, “present the top five options within 30 days.”

- Confirm if you want regular status reports. For example, “weekly update on active listings and inquiries.”

6) Choose the fee structure for a purchase

- Select how the fee is calculated. Common methods:

- A percentage of the purchase price.

- A flat fee.

- A hybrid: minimum fee plus percentage.

- Specify who is expected to pay. Often, the seller pays through the listing brokerage. If no seller payment, the buyer pays.

- Add a minimum fee if used. This protects the brokerage on low-price purchases.

- Confirm when the fee is earned. It is usually on acceptance or completion of a binding agreement. Check the form’s language.

- State that applicable taxes are extra. The form usually already says this, but clarity helps.

7) Choose the fee structure for a lease

- Select how the fee is calculated. Common methods:

- A percentage of the total base rent over the term.

- A number of months of gross or base rent.

- A flat fee or retainer plus a success fee.

- Define “rent” for the calculation. State if it includes only base rent or also fixed additional rent.

- Address options, renewals, and expansions. Decide if the fee applies on exercised options or expansions. Use a schedule for clarity.

- Confirm who pays. Many landlords pay tenant rep fees. If the landlord pays less than the agreed amount, you may owe the shortfall.

- State when the fee is earned. This is often on lease execution. If there are staged payments, spell them out.

8) Add any retainer or success-fee arrangement

- If you pay a retainer, insert the amount and timing. State if it will be credited to the success fee.

- If the retainer is non-refundable, say so. If refundable, define how.

- Align the retainer invoice with your procurement rules if you are a larger organization.

9) Fill in the holdover clause

- Pick a holdover period. Common ranges are 30 to 180 days, depending on the search.

- Ensure the clause ties to properties introduced during the term. That is the usual rule.

- Decide if an offer made during the term that closes after expiry is covered. It usually is.

10) Confirm multiple or designated representation

- Review the multiple representation section. Understand the limits on advice in that case.

- If you consent, check the consent box and initial. If you do not consent, mark that clearly.

- If the brokerage uses designated representation, review and consent as needed. Initial where required.

11) Privacy and use of information

- Read the privacy section. It permits the collection, use, and disclosure of your information for the transaction.

- Confirm if you allow advertising of your acquisition after closing. If not, state limits in a schedule.

- Ensure confidentiality obligations meet your needs. Add a stricter NDA as a schedule if needed.

12) Acknowledgements and required disclosures

- Acknowledge that you received and reviewed the mandatory information about representation choices.

- Confirm that you understand your rights and duties under the agreement.

- If the form includes risk acknowledgements, read and initial them.

13) Special terms and schedules

- Use a Schedule A for any additional terms. Keep language clear and consistent with the main form.

- Typical schedule items:

- Affiliate and nominee coverage.

- Fee examples and staged payment timing.

- Exclusions for named properties.

- Option, renewal, and expansion fee rules.

- Confidentiality upgrades or NDAs.

- Early termination by mutual consent process.

- Reporting cadence and decision protocols.

- If you require board or investment committee approval, note that condition in a schedule.

14) Electronic signatures and delivery

- If the form allows, agree to electronic signature and delivery. Check the box and initial.

- Confirm contact emails for notices. One for you, one for the brokerage.

- If you need wet ink for internal records, arrange it now.

15) Signatures and authority

- Each buyer or tenant must sign. Use full legal names.

- For corporations, sign with name and title. Example: “ABC Inc. by Jane Smith, President.”

- If two signatories are required under your bylaws, have both sign.

- The brokerage signs through an authorized signing officer or the designated salesperson, as the form permits.

- Date the signatures. Initial every page and any handwritten changes.

16) Provide copies and keep records

- Give a fully signed copy to all signers immediately.

- Save a PDF with all schedules, initials, and timestamps.

- Keep a copy for your records for at least the holdover period and beyond.

17) Practical tips while completing the form

- Use exact numbers for fees. Avoid ranges or “to be negotiated.”

- State the calculation for lease fees precisely. For example, “X% of aggregate base rent over the initial term.”

- Define the area with boundaries or a list of municipalities. Avoid vague terms like “Greater Region” without detail.

- For industrial or specialized assets, list critical specs. Power, loading, clear height, or zoning can be decisive.

- If you have a strict budget or cap, include it as a search parameter. This helps align expectations.

18) After signing: how the agreement operates

- The brokerage begins the search and outreach within the defined scope.

- They send you options and arrange tours. You provide prompt feedback.

- When you choose a property, they draft and negotiate offers under your direction.

- If a seller or landlord pays the fee, confirm the payment arrangement early. Make sure the listing brokerage recognizes your representation in writing.

- If no third party is paying, plan the fee payment schedule with your finance team.

19) Avoid common pitfalls

- Do not leave the fee section blank. If it is blank, disputes will follow.

- Do not rely on verbal carve-outs. Put them in a schedule.

- Do not forget the holdover. Set a fair period and understand its effect.

- Do not sign without authority if you are acting for a company. Get proper resolutions if needed.

- Do not assume multiple representation is automatic. Consent must be express.

20) Example fee wording you might adapt

- Purchase: “Brokerage fee is X% of the purchase price, plus applicable taxes. Minimum fee $Y. If a third party pays less than this amount, Buyer pays the shortfall.”

- Lease: “Brokerage fee is X% of aggregate base rent over the initial term, plus applicable taxes. If a third party pays an amount less than this, Tenant pays the shortfall.” Adjust to your deal.

21) Final review checklist before signing

- Parties correctly named and authorized.

- Term dates and times are set.

- Property types and area are clear.

- Fee method, amounts, and payer are exact.

- Holdover period is filled in.

- Multiple/designated representation consents are checked and initialled.

- Schedules are attached, labeled, and referenced in the form.

- All pages are initialled and dated by all parties.

By completing these steps carefully, you set clear expectations and reduce risk. You empower your brokerage to act for you with defined authority. You also protect your budget with a precise fee structure. This clarity helps you move faster when the right opportunity appears.

Legal Terms You Might Encounter in the OREA Form 540

- Agency means the legal relationship between you and the brokerage. In OREA Form 540, you authorize the brokerage to act for you in a commercial search and negotiation. This creates duties the brokerage owes you.

- Brokerage is the real estate firm that represents you under this agreement. The form sets out what the brokerage will do and how it will be paid.

- Designated representative refers to the salesperson or broker assigned to you. OREA Form 540 identifies who will speak and negotiate for you. You can request a specific representative.

- Client means you receive full loyalty and confidentiality from the brokerage. Under Form 540, you are a client, not a customer. You get advice and advocacy.

- Multiple representation occurs when the brokerage also represents the other side. Form 540 addresses this and requires your informed consent. You choose whether to allow it.

- Remuneration is the brokerage’s payment. In Form 540, it may be a commission, a fee, or both. It applies if you buy or lease a property that fits the agreement.

- Holdover period is the time after expiry when remuneration can still be owed. It applies if you buy or lease a property introduced during the term. Form 540 sets the length.

- Exclusive authority means the brokerage is your only representative for the defined scope. Under Form 540, exclusivity limits who can represent you. It also affects how payment is triggered.

- Scope of the mandate defines what you want to do. Form 540 can cover purchase, lease, or both. It also covers property type, size, use, and geography.

- Property introduction means the brokerage brought a property to your attention. Form 540 links payment to this concept. Keep a clear list of introductions.

- Term means the start and end dates of the agreement. Form 540 requires exact dates. Changes must be made in writing and signed.

- Consent to collect and use personal information allows the brokerage to perform services. Form 540 includes this consent. It covers your identification and your business details.

- Assignment refers to transferring rights in the agreement. Form 540 usually restricts assignment without consent. You should know whether the transfer is allowed.

- Indemnity means you agree to protect the brokerage from certain claims. Form 540 can include this protection. Read what you are agreeing to cover.

- Notice provisions explain how each party must deliver notices. Form 540 sets allowable methods and addresses. Use those methods for changes or termination.

- Confidential information includes your strategy, price, and financial details. Under Form 540, the brokerage must protect this information. You can set extra limits if needed.

FAQs

Do you need OREA Form 540 to get representation?

Yes. This agreement confirms the brokerage’s duties and your obligations. Without it, the brokerage may not provide full advice or advocacy. You also may not be protected as a client.

Do you have to pay if a seller or landlord offers commission?

Often, the listing side offers a cooperating fee. Form 540 explains whether that amount covers your obligation. If not, you may owe the difference. Always confirm the fee before you proceed.

Can you work with more than one brokerage at the same time?

OREA Form 540 is usually exclusive. That means you cannot hire another brokerage for the same scope and area. If you want non-exclusive terms, discuss that before you sign. Put any exceptions in writing.

What if you find a property yourself?

Payment can still be owed if the property falls within the scope and term. OREA Form 540 may require payment even if you first saw the property on your own. Use exclusions for properties you already know.

How do you end the agreement early?

You need a signed amendment or mutual termination. Some agreements also allow termination with written notice. Review the clause in OREA Form 540 and follow the notice method exactly. Keep proof of delivery.

What is multiple representation, and should you consent?

It happens when the same brokerage represents you and the other party. That reduces your representative’s ability to advocate fully. You can refuse, consent case by case, or consent in advance. Make your choice explicit.

Does the holdover period apply to lease renewals or expansions?

It can. If the form ties payment to leases and subsequent changes, renewals, or expansions may trigger payment. Clarify this in writing if you want renewals excluded. Use precise language and dates.

Can you switch from a purchase search to a lease search mid-term?

Yes, but update the scope in writing. Use an amendment that changes the property type or use. Confirm how remuneration will apply to lease terms versus purchase price.

How is remuneration calculated on a lease?

It is usually a percentage of total or net rent, or a flat fee. OREA Form 540 should specify the base rent used and which periods count. Confirm how free rent, abatements, and escalations are treated.

Who signs if you buy or lease through a company?

An authorized signing officer should sign on behalf of the company. Include the full legal name and capacity. Attach any corporate resolution if required by your internal policy.

Checklist: Before, During, and After the OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

Before signing

- Confirm your exact legal name and capacity.

- Identify the signing officer and the authority to bind.

- Prepare corporate details: address, registration number, and contact.

- Clarify your business use and zoning needs.

- Define property size, location, and must-have features.

- Set a budget range and timing for occupancy.

- Decide whether you want to buy, lease, or consider both.

- Gather proof of funds or financing comfort.

- List any properties you already know or have toured.

- List landlords, sellers, or agents you contacted recently.

- Decide on the territory and any excluded areas.

- Choose whether you will permit multiple representation.

- Decide on exclusivity and acceptable exceptions.

- Agree on the remuneration structure and who pays.

- Align internal policies on conflicts and confidentiality.

- Align with your tax and accounting team on fee treatment.

- Identify any third-party approvals you will need.

- Set preferred communication and notice details.

During signing

- Verify names and addresses match your legal records.

- Confirm the term start and end dates and times.

- Check the defined territory and allowable property types.

- Confirm whether purchase, lease, or both are covered.

- Review the services the brokerage will provide.

- Confirm the remuneration amount and calculation method.

- Clarify free rent, inducements, and escalation treatment for leases.

- Confirm when remuneration is earned and payable.

- Review the holdover period length and scope.

- Add specific property and area exclusions, if any.

- Review multiple representation consent and your choices.

- Confirm confidentiality and information use clauses.

- Check indemnities and any liability limitations.

- Confirm notice methods and addresses for each party.

- Review assignment and termination provisions.

- Ensure all schedules are attached and initialed.

- Ensure any handwritten changes are initialed by all.

- Obtain a fully signed copy at the table, if possible.

After signing

- Save a clean digital copy in your contract system.

- Distribute the signed agreement to decision makers.

- Calendar the expiry date and holdover deadline.

- Send written instructions to your representative on the search criteria.

- Provide documents needed for identification and onboarding.

- Set a check-in cadence and reporting format.

- Notify your finance team about possible fees and timing.

- Prepare proof of funds or comfort letters for offers.

- Keep a property introduction log with dates and who sent them.

- Update internal teams on contact protocols with landlords or sellers.

Common Mistakes to Avoid OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

Leaving the territory or scope too vague

- Consequence: You may owe fees for deals you never intended to include.

- Don’t forget to define area, property type, and size in clear terms.

Ignoring holdover language and introductions

- Consequence: You may owe after expiry for a property introduced during the term.

- Don’t forget to track introductions and shorten holdover if needed.

Assuming the listing side always covers your fee

- Consequence: You may face an unexpected shortfall at closing or lease start.

- Don’t forget to confirm the offered fee and who tops up any difference.

Missing exclusions for known properties or relationships

- Consequence: You could owe fees for deals you sourced independently.

- Don’t forget to list known properties, landlords, and in-progress talks.

Letting multiple representations default without a plan

- Consequence: Your advocacy can be limited at key points in negotiation.

- Don’t forget to choose your consent approach and set safeguards.

Using the wrong signing authority or legal name

- Consequence: The agreement can be challenged, or delays can arise.

- Don’t forget to use the exact legal entity and capacity on the signature.

What to Do After Filling Out the Form OREA Form 540 – Buyer Representation Agreement – Commercial (Mandate for Purchase or Lease)

Distribute copies

- Share the fully signed agreement with your representative.

- Send copies to your legal, finance, and operations leads.

- Store an original or certified copy in your contract repository.

Confirm onboarding items

- Provide identification and corporate documents requested by the brokerage.

- Share your search brief, budget, and timing in writing.

- Establish a single point of contact and response times.

Plan the search workflow

- Set weekly or biweekly update calls.

- Decide how property summaries will be delivered.

- Use a shared list to track tours, feedback, and shortlist status.

Track introductions and timelines

- Log each property introduction with the date and source.

- Note expiry and holdover dates in a shared calendar.

- Review the log before issuing letters of intent or offers.

Coordinate financing and diligence

- Prepare proof of funds or financing letters for offers.

- Assemble your team for inspections, environmental, and zoning checks.

- Line up legal review for offers and closing documents.

Align remuneration expectations deal by deal

- For each property, confirm the cooperating fee in writing.

- If a shortfall exists, agree on who pays and when.

- Keep the fee terms with your offer file.

Manage consent choices in real time

- If multiple representations arise, decide on a case-by-case basis.

- Put your consent or refusal in writing for that property.

- Adjust your strategy if consent is not granted.

Amend when your needs change

- Use a written amendment to adjust the term, territory, or scope.

- Update remuneration terms if you switch from purchase to lease.

- Have all parties sign and exchange the amendment.

Terminate if the relationship ends

- If permitted, deliver written notice in the form required.

- Seek a mutual termination if you want a clean end.

- Keep proof of delivery and confirm any remaining obligations.

Prepare for negotiation and closing

- Set pricing or rental targets and walk-away points.

- Decide on key conditions and timelines you need.

- Assign roles for offer drafting, review, and signatures.

After a deal is done

- Confirm the brokerage’s invoice and calculation method.

- Verify payment timing in the purchase or lease context.

- Archive the deal file with the agreement and all amendments.

Renewals and expansions

- Review whether the agreement or holdover touches renewals.

- If you want renewals excluded, document that early.

- Track renewal windows and negotiate terms accordingly.

Continuous improvement

- Conduct a debrief after each major milestone.

- Update your checklist and templates with lessons learned.

- Decide if you will renew or change representation before expiry.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.