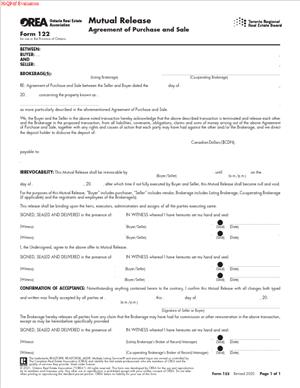

OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is an OREA Form 122 – Mutual Release – Agreement of Purchase and Sale?

OREA Form 122 is the standard Ontario real estate document used when the buyer and seller agree to cancel an accepted Agreement of Purchase and Sale (APS). It records that mutual decision, releases each party (and typically the involved brokerages) from claims related to the cancelled deal, and provides the deposit holder with clear, written direction on how to disburse the deposit and any interest. Ontario brokerages, buyers, sellers, and lawyers commonly use this form to conclude transactions that will not proceed.

In a typical deal, the APS governs the transaction’s terms, timelines, and conditions. If a condition fails, a dispute arises, or circumstances change such that proceeding is no longer desirable, both sides may choose to terminate. A properly executed Mutual Release replaces informal emails or verbal understandings, which are not sufficient to authorize a trust deposit payout or to extinguish contractual obligations. The form ensures a clean, final conclusion and avoids the deposit remaining in limbo.

Typical reasons for using the form include a failed financing or inspection condition, title or encroachment issues that cannot be resolved, an appraisal shortfall that undermines financing, a missed waiver deadline, or a negotiated settlement after a dispute. Sometimes personal circumstances change (job transfer, illness, timing concerns), and both parties prefer to walk away. Regardless of the reason, the Mutual Release documents the final outcome and authorizes deposit disbursement.

Key features

- Identification of the parties and property, matching the APS.

- Reference to the APS by date of acceptance.

- A mutual release of claims related to the transaction.

- Release of brokerages and their representatives (as applicable).

- Directions to the deposit holder specifying recipients, amounts, and interest allocation.

- Space for additional terms (e.g., a deposit split, settlement payment, confidentiality, deadlines).

Without a fully executed mutual release (or a court order), deposit funds generally remain in the brokerage trust account. For this reason, Form 122 is central to ending a deal cleanly and directing funds without delay.

When Would You Use an OREA Form 122 – Mutual Release – Agreement of Purchase and Sale?

Use the Mutual Release when there is an accepted APS and both buyer and seller agree the deal will not close. Common situations include:

- Financing or inspection conditions are not satisfied within the requisite period, and both parties agree to terminate and release funds.

- Title, encroachment, or easement issues cannot be cured within the required timelines.

- An appraisal shortfall impairs financing, and the parties do not wish to renegotiate.

- A key deadline (e.g., condition waiver) is missed, and both sides prefer to settle rather than litigate.

- Property insurance cannot be obtained on acceptable terms.

- The parties settle after a dispute about representations, repairs, or deliverables and want to combine payment terms with a final release.

You also use the form to direct the deposit holder: to pay the deposit to one party, to split it, to remit interest, or to send funds to a lawyer’s trust account. If the deposit is in an interest-bearing trust account, the form should specify who receives the interest.

You would not use this form when:

- No APS was accepted (no contract exists).

- The deal continues, but the terms need to be changed (use an amendment).

- One party wants a unilateral termination (the Mutual Release requires all required parties’ signatures).

- More time is needed for an active condition (use an extension amendment).

If needed, lawyers may add concise terms or a schedule (e.g., confidentiality, non-disparagement, tax treatment of interest). The form is flexible but focused on one outcome: end the contract and direct the deposit.

Legal Characteristics of the OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

The Mutual Release is a binding agreement supported by consideration: each party’s promise to release the other is typically sufficient value to make it enforceable. If a deposit split or additional payment is negotiated, that too is consideration and should be recorded precisely.

Core legal elements

- Parties and property: Names and capacities must match the APS exactly. Corporate parties should sign via authorized officers with titles; attorneys under a power of attorney or estate trustees must show capacity.

- Reference to the APS: The date of acceptance identifies the specific transaction being released.

- Mutual release language: Standard wording releases all claims, demands, and causes of action “arising from” the APS and transaction, creating a final break, subject only to any expressly preserved obligations.

- Brokerage releases: The form typically releases the listing and cooperating brokerages (and their representatives) from claims related to the transaction. Acknowledgements from the brokerages support smooth deposit disbursement.

- Deposit direction: As trustee of the deposit, the holder requires clear, written, mutually agreed instructions before disbursing funds. If parties cannot agree, money usually remains in trust until resolution or a court order.

Signatures are critical. All named buyers and sellers must sign in the same capacities as in the APS. Missing any signature can stall the release and block the deposit payout. Where corporations or estates are parties, ensure proper signing authority and titles are shown; provide supporting documentation if asked.

Electronic signatures are generally accepted, and counterparts allow parties to sign separate copies. Ensure the final compiled version includes all signatures, initials (if applicable), and schedules.

Deposit mechanics:

- The holder will not release uncleared funds (e.g., pending cheques, transfers under bank holds).

- If interest accrued, the form must specify allocation. If the trust account is non-interest-bearing, state that no interest is payable or that any minimal interest is waived.

- Accuracy matters: use the correct APS date, exact names/capacities, and a precise property address. Keep authorizations handy (e.g., corporate resolution, power of attorney) in case the deposit holder requests confirmation.

Scope and finality

The release extinguishes claims arising from the cancelled deal. If preserving a specific right (e.g., a post-dated settlement payment), expressly carve it out in additional terms or a schedule. Avoid overbroad wording that could unintentionally waive preserved obligations.

How to Fill Out an OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

1) Gather the deal details.

- Confirm the exact legal names of all buyers and sellers as on the APS.

- Verify the full municipal address (include unit/level for condos).

- Note the APS date of final acceptance.

- Identify the deposit amount(s), how paid, and who holds the funds in trust.

- Determine whether the deposit is interest-bearing and the status of any accrued interest.

2) Identify the parties.

- Enter names precisely as in the APS (spelling, punctuation, suffixes).

- For corporations, use the legal name and have an authorized officer sign with their title.

- For attorneys under power of attorney or estate trustees, state capacity and keep proof available.

3) Identify the property.

- Insert the complete municipal address, including city/town and postal code when available.

- Include unit/level for condos or multi-unit properties.

- Only include a legal description if accurate and complete or if the form specifically requires it.

4) Reference the original agreement.

- Insert the APS date of acceptance that binds the parties.

- If multiple offers exist, confirm you reference the correct APS.

- Keep any amendments handy to verify party names or deposit amounts, even if not cited on the face of the form.

5) Complete the mutual release clause.

- Review the preprinted wording to understand its scope (buyers, sellers, and brokerages).

- If you must preserve a specific obligation (e.g., staged payment due after signing), state that carve-out clearly in additional terms or a schedule.

- Add concise confidentiality or non-disparagement wording only if required, without altering standard release language.

6) Direct the deposit.

- State the total deposit currently held (aggregate all deposits, if more than one).

- Name the deposit holder precisely (e.g., ABC Realty Inc., Brokerage).

- Specify recipient(s) and exact dollar amounts; avoid “split evenly” without figures.

- Address interest explicitly (all to buyer, all to seller, split, waived, or none accrued).

- If paying to a lawyer’s trust account or by EFT, include the payee name and method in additional terms or a separate direction consistent with brokerage procedures.

7) Add any additional terms, if needed.

- Use clear, concise wording for settlement details (e.g., partial release now, balance upon event; confidentiality; timeline for payout; fee responsibility).

- Define amounts, payees, deadlines, and conditions precisely.

- If more space is needed, attach a labeled Schedule (e.g., Schedule A) and reference it on the form.

8) Confirm no outstanding obligations.

- Consider whether keys, access devices, documents, or lockbox access must be returned.

- If nothing remains outstanding, no extra language is required.

9) Signatures and dates.

- All buyers and all sellers must sign and date, matching APS names/capacities.

- Corporate signatories include titles; a corporate seal is typically not required.

- Witnesses are not always mandatory, but may be requested by parties or the deposit holder.

10) Brokerage acknowledgements.

- Obtain signatures for the listing and cooperating brokerages if their release is contemplated.

- Confirm correct brokerage names, particularly if there has been a merger, closure, or rebranding.

- Acknowledgements help avoid administrative holds and expedite release.

11) Initial any handwritten changes.

- All parties should initial handwritten edits or additions on the form and any schedules.

- Ensure legibility; if edits are messy, reprint for clarity.

12) Deliver the completed form.

- Send a fully executed copy (and schedules) promptly to the deposit holder via their preferred method.

- Provide copies to all parties, brokerages, and lawyers.

- Keep proof of delivery.

13) Use electronic signing properly.

- Distribute the complete document (including schedules) to each signer.

- Ensure signature blocks match legal names and capacities.

- Circulate the final compiled version showing all signatures and initials.

14) Follow up on deposit release.

- Request written confirmation of release timing and payment method.

- Obtain receipts or remittance confirmations once funds are sent.

- If delayed, ask for the reason (e.g., bank holds, missing instructions) and supply what’s needed.

Practical tips

- If a party refuses to sign, funds typically remain in trust until agreement or adjudication.

- If timing is critical, include a firm signing and payout deadline in additional terms.

- Do not use a Mutual Release if the parties intend to amend and proceed; use an amendment instead.

- Maintain version control to avoid signing the wrong draft.

Legal Terms You Might Encounter (OREA Form 122 – Mutual Release – Agreement of Purchase and Sale)

- Mutual release: Each party agrees not to pursue claims arising from the cancelled transaction; intended to be final and comprehensive.

- Consideration: The value supporting the contract. Mutual promises to release are sufficient; deposit splits or payments also constitute consideration.

- Deposit holder: The stakeholder (often the listing brokerage) holding the buyer’s deposit in trust; requires precise written direction to pay out.

- Trust account: A segregated account for client funds; the holder cannot release without proper instructions or a binding decision.

- Direction to pay: The written instruction setting out recipients, amounts, and payment method.

- Interest on deposit: Any interest earned while funds are in trust; the form should state who receives it or that none is payable.

- Conditions: Requirements (e.g., financing, inspection, insurance, condo status certificate) that had to be fulfilled for the APS to proceed.

- Counterparts: Each party can sign separate copies; together they form a single agreement.

- Capacity: The legal role of the signer (individual, corporate officer, attorney under POA, estate trustee). Must match the APS.

- Without prejudice: Label for settlement communications that are not admissions; once Form 122 is signed, its terms are binding.

- Entire agreement: The release typically captures the full understanding of termination unless additional terms are set out in a schedule.

- Indemnity: A promise to protect against third-party claims; if used, draft clearly and include it in a schedule.

FAQs (OREA Form 122 – Mutual Release – Agreement of Purchase and Sale)

Do all parties need to sign?

Yes. All named buyers and sellers must sign in the same capacities used in the APS. Missing even one can block the release and deposit payout.

Are brokerage acknowledgements required?

They are best practices when the form releases brokerage claims. Acknowledgements reduce administrative delays tied to commission issues or office policy.

Must we state a reason for termination?

No detailed narrative is needed. It is sufficient that both sides agree that the deal will not proceed and wish to release each other and direct the deposit.

Can we set a signing deadline?

Yes. Include a clear date and time by which signatures must be delivered. If missed, the offer to release can lapse.

Can the deposit be released without this form?

Usually not. The deposit holder needs clear, written instructions signed by all necessary parties or a binding decision (e.g., court order).

Can we undo the release after signing?

Generally no. It is intended to be final. Clerical errors can be corrected with a new or supplemental direction signed by all affected parties. A change of heart is not grounds to reverse a release.

Are electronic signatures acceptable?

Yes, commonly. Ensure the complete document (with schedules) is circulated and that names/capacities match the APS.

What if the deposit cheque hasn’t cleared?

The holder won’t release uncleared funds. If a cheque is returned NSF, there may be nothing to pay out.

How do we handle multiple deposits or top-ups?

List the total on the form and detail components in a schedule if helpful. The direction must clearly state the payout of the total and any interest.

Can we release part of the deposit now and hold back the rest?

Yes, if both parties agree. Specify exact amounts, the holdback conditions, and dates for subsequent release.

Can we add confidentiality?

Yes, if both sides agree. Include a simple clause in the additional terms or a schedule, with reasonable exceptions (e.g., disclosures to advisors or as required by law).

Who pays bank or transfer fees?

Clarify in additional terms. Otherwise, the deposit holder may apply standard practices that could reduce the payout if allowed.

Does the Mutual Release affect commissions?

The form often includes a brokerage release, but commission obligations come from listing/co-operating agreements. Brokerage acknowledgements help avoid deposit holds.

What if one party refuses to sign?

Funds remain in trust absent mutual direction or binding adjudication. Consider further negotiation, mediation, or legal remedies.

Checklist: Before, During, and After the OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

Before signing

- Confirm exact legal names/capacities as per the APS; obtain proof for corporations, estates, or POA signers.

- Verify the property address and any unit/level identifiers.

- Confirm the APS date of acceptance and review amendments affecting parties or deposits.

- Confirm deposit amount(s), holder, and whether interest has accrued.

- Agree in principle on deposit and interest allocation; outline any settlement terms.

- Determine payment logistics required by the holder (cheque, bank draft, EFT to a lawyer’s trust account).

- Draft concise additional terms or prepare a Schedule if needed.

- Plan signing sequence (e-sign or in-person) and set deadlines.

- Compile contact details for parties, brokerages, and lawyers.

During signing

- Ensure names, capacities, and property details match the APS.

- Insert the correct APS acceptance date.

- Review the release scope (buyers, sellers, brokerages); add carve-outs only if necessary.

- State precise deposit payouts and interest allocation.

- Reference any Schedule clearly; define deadlines.

- Obtain all required signatures and dates (including brokerage acknowledgements if used).

- Initial handwritten edits and each page of any Schedule.

- For e-signing, verify that the final compiled document shows all signatures and initials.

After signing

- Deliver a fully executed copy (and schedules) to the deposit holder with payout instructions.

- Provide final copies to parties, brokerages, and lawyers.

- Request and retain written confirmation of payment initiation/completion.

- Track staged releases or follow-on obligations and collect proof of completion.

- Update records to show that the APS has been released, and the file is closed.

- Archive the full package securely according to your retention policy.

Common Mistakes to Avoid OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

- Missing signatures or wrong capacities.

- Vague payout instructions (e.g., “split evenly” without amounts).

- Ignoring interest or failing to state how it is allocated.

- Mismatched names or incomplete property details.

- Overstuffing complex settlement terms into the form instead of a schedule.

- Incorrect APS acceptance date.

- Unclear payout method or payee.

- Missing brokerage acknowledgements when the form releases brokerage claims.

- Version confusion leading to signing the wrong draft.

- Poorly defined holdbacks without triggers and deadlines.

What to Do After Filling Out the Form OREA Form 122 – Mutual Release – Agreement of Purchase and Sale

- Circulate for signatures: Follow the planned sequence and deadline; ensure all signers receive the complete document and any schedules.

- Deliver to the deposit holder: Provide the fully executed form and required payout details (payee names, method, account info for a lawyer’s trust).

- Confirm funds flow: Obtain written confirmation of payment timing and retain remittance receipts.

- Close out the file: Notify parties and professionals that the deal is released; cancel any pending services (inspections, appraisals).

- Handle follow-on obligations: Calendar deadlines for staged releases or payments; follow up and collect proof of completion.

- Correct clerical errors promptly: Use a corrected release or supplemental written direction signed by all affected parties.

- Address tax/interest considerations: Record who received any interest for future reference.

- Update internal systems: Mark the transaction as released and remove closing task reminders.

- Archive securely: Store the signed form, schedules, confirmations, and receipts together for easy retrieval.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.