Information from your Landlord about Utility Costs

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is the Information from your Landlord about Utility Costs?

It is a disclosure form. Your landlord uses it to explain utility costs for a rental unit. It tells you what utilities are included in rent and what are extra. It shows how each utility is measured and billed. It can also estimate future monthly costs. In short, it helps you see what you will actually pay.

This form is common in Ontario residential rentals. Landlords and property managers prepare it. Tenants and prospective tenants read it before signing a lease. It may be attached to the lease. It may also appear as a separate schedule or appendix. You should receive it before you agree to pay any utility directly.

The form covers electricity, gas, and water. It can also mention heat, hot water, and air conditioning. It may include rental equipment charges. Examples are hot water tank rentals or heat pump rentals. It can also list admin fees, delivery charges, and connection deposits. It clarifies who pays for each item. It explains whether costs are included in rent or billed to you.

Why do you need it?

You want to avoid surprises. You want to budget for monthly costs. You want clarity on billing and metering. You also want a written record. If a dispute arises later, you can point to this disclosure. It protects both sides.

Typical usage scenarios

You plan to rent a one-bedroom. The listing says “utilities extra.” You ask for the form. The landlord provides last year’s electricity usage for the unit. It also shows the average monthly cost. It confirms that water is included in rent. It shows that gas heat is extra and billed by a utility. It also confirms there is a hot water tank rental. You review the numbers. You decide if the total fits your budget.

Another scenario. You live in a building that is switching to sub-metered electricity. The landlord must disclose new billing terms. The form explains the new meter, who bills you, and the estimated costs. It details any admin fee. It shows how to dispute a bill. You can compare this to your current costs. You can make an informed choice before agreeing.

Co-tenancy is another case. You rent with roommates. The form helps you split costs fairly. It shows which utilities are shared. It clarifies if any utility is on a shared meter. It can describe the allocation method. You can then set a clear payment plan.

This form fits other needs, too. You may renew a lease, and utility responsibility changes. The form sets out the new terms. You may rent a unit in a home with separate basement meters. The form confirms which meter is yours. It confirms how heat and water are shared. It can also state winter heating expectations.

In each case, the form’s job is simple. It gives you plain language, upfront facts about utility costs. It supports a clear, fair lease agreement.

When Would You Use Information from your Landlord about Utility Costs?

You use it before you sign a lease. This timing matters. You need the cost picture to decide if the unit is affordable. Ask for the form as soon as utilities come up. Do not wait until move-in.

It is also used when a landlord proposes a change. For example, they want you to take on electricity costs. Or they want to remove a utility from “included in rent.” You should receive full disclosure in writing first. That includes any cost history and fees.

You use the form when a unit has sub-metering. Sub-metering means a separate meter for your unit. A sub-metering company often bills you. In that case, the disclosure should explain the company’s role. It should show how rates, fees, and deposits work. It should explain how to set up your account.

You also use it when utilities are on shared meters. Shared meters are common in older homes. In that case, the disclosure should state the allocation method. It should explain how your portion is calculated. It should disclose any fixed monthly amount. It should explain what happens if usage changes.

If you are a landlord or property manager, you use the form at first contact. Share it with your rental listing or during showings. You protect yourself with clear, written facts. You reduce disputes later. You also show professionalism and fairness.

If you are a tenant, you use the form to compare units. Take two similar apartments. One includes water and heat. The other bills everything. The form turns that guess into numbers. It helps you make a sound decision.

If you are a co-signer or guarantor, you should also review it. You can assess risk based on total housing costs. You can see whether utility exposure is capped or variable.

In short, you use this form whenever utility responsibility is unclear, shifting, or significant. It is most effective before you sign. It also matters any time a change in utility billing occurs during a tenancy. Get it in writing. Keep a copy.

Legal Characteristics of the Information from your Landlord about Utility Costs

This form is a disclosure. By itself, it is not a full lease. It does not replace your rental agreement. However, it has legal weight when used properly. If it is attached to the lease or referenced in it, it becomes part of your agreement. Clear, written terms support enforceability.

Ontario law expects rent and services to be clear. If the lease says a utility is included in rent, the landlord cannot charge again. If you agree to pay a utility, the lease should say so. A separate meter or a clear allocation method should exist. The disclosure form helps prove that understanding.

Accuracy matters. If the landlord provides usage history or cost estimates, they must be reasonable. They should reflect the unit’s actual consumption when available. For new or renovated units, the estimate should follow a clear basis. For example, similar unit size and occupancy. If information is missing, the form should say so. It should explain why. It should tell you how the estimates were calculated. Reasonable estimates reduce disputes.

If a landlord gives false or misleading information, there can be consequences. You can seek remedies through Ontario’s dispute process. Written disclosures help you prove your case. They show what you were told when you signed. They also show if fees were undisclosed.

Fees must be lawful and disclosed. Examples include sub-metering admin fees, late fees, and deposit amounts. If a fee is not in the lease or disclosure, the landlord risks a dispute. If a fee is not permitted, it may not be enforceable. Clear, lawful fee terms support enforceability.

Signatures also matter. If both parties sign and date the disclosure, it gains weight. It shows shared understanding. It proves timing. It shows you had the information before agreeing. If the form is part of the lease package, keep it with your copy.

Consistency is vital. The disclosure must match the lease. If the lease says “heat included,” and the form says otherwise, the lease controls. Resolve inconsistencies before signing. Ask for a corrected form that matches the lease.

Privacy rules apply to past tenants. The landlord may give unit-level usage without naming anyone. The disclosure should avoid personal information. Keep the focus on the unit, not prior occupants.

In summary, the form supports clear contract terms. It is strongest when accurate, signed, and attached to the lease. It must align with the law and the lease. Proper use reduces risk and disputes.

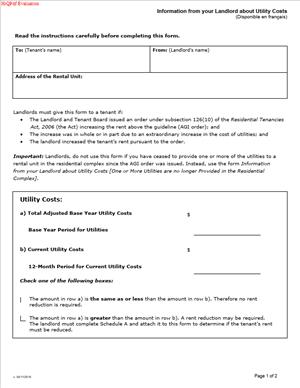

How to Fill Out an Information from your Landlord about Utility Costs

Use these steps to prepare a complete, clear disclosure. Tailor details to the unit and building. Keep your language plain and specific.

1) Identify the rental unit and parties.

- State the full civic address and unit number.

- Name the landlord or property management company.

- Name the prospective tenant, if known.

- Add contact information for both sides.

- Include the intended lease start date, if known.

2) Describe the building and heating systems.

- State the building type. For example, a house, a duplex, or an apartment.

- Identify the main heating source. For example, a gas furnace, electric baseboards, or a boiler.

- Note any cooling equipment. For example, central AC or window units.

- List any rental equipment tied to the unit. For example, hot water tank rental.

3) List each utility and who pays.

Create a clear entry for each item below. Use “Included in rent” or “Tenant pays” with details.

- Electricity.

- Natural gas or other fuel (propane or oil).

- Water and sewer.

- Space heating (if separate from electricity or gas line items).

- Hot water heating (if separate).

- Air conditioning electricity surcharge (if any).

- Internet and cable (optional, for clarity).

- Rental equipment charges and who receives the bill.

4) Explain metering and billing for each utility.

- State whether the utility is separately metered, sub-metered, or bulk.

- If separately metered, list the meter number if available.

- If sub-metered, name the billing company and any admin fee.

- If bulk-billed and the tenant pays a fixed amount, state the amount and frequency.

- If shared meter allocation is used, explain the formula. For example, a 50/50 split with Unit B or based on square footage.

5) Provide cost history or estimates.

- For existing units, show the last 12 months of usage and total cost for each utility the tenant will pay.

- Present monthly averages and note seasonal swings.

- Explain the basis for any estimate. For example, a similar adjacent unit, same floor plan.

- If data is not available, say so. Provide a reasonable estimate and explain your method.

6) Disclose all fees and deposits.

- List connection deposits required by any utility or billing company.

- List admin fees, statement fees, or late fees, if any.

- List rental equipment charges. Include the current monthly cost.

- Identify who charges each fee and who receives payment.

7) Explain how to set up accounts and billing.

- State whether the tenant must open an account with a utility or sub-metering company.

- Provide the contact phone number or process description. Do not include promotional content.

- State the date when the tenant becomes responsible for charges. Usually, the lease starts on the date.

8) Clarify terms for changes and maintenance.

- State who maintains heating and cooling equipment.

- Explain filter changes or thermostat rules, if relevant.

- Explain what happens if service providers change. For example, a new sub-metering company.

- Confirm the landlord will notify the tenant in writing if billing terms change.

9) Address shared services and common areas.

- If laundry is shared, confirm how its energy use is covered.

- If common areas affect the meter, confirm that the tenant’s meter is separate. If not, explain the allocation method.

- State whether snow melt, hallway lighting, or exterior plugs are on the tenant’s meter. Normally, they should not be.

10) Include special notes and assumptions.

- State the occupancy assumption used for estimates. For example, two adults.

- Note unusual features that increase or reduce costs. For example, a large aquarium, server racks, or a continuous dehumidifier.

- Note any time-of-use rate assumptions for electricity.

11) Align with the lease.

- Make sure the disclosure matches the utilities section in the lease.

- If the lease says “water included,” the form must say the same.

- Remove any conflicts before anyone signs.

12) Add signatures and date.

- Provide signature lines for the landlord and the tenant.

- Include printed names and the date of signing.

- Clarify whether the form is an attachment to the lease.

13) Attach supporting schedules.

- Attach the unit’s usage and cost summary for each utility, if available.

- Attach a photo of the meter label, if useful.

- Attach any rental equipment agreement summary that affects costs.

14) Provide copies and keep records.

- Give the tenant a complete copy before they sign the lease.

- Keep a copy with supporting schedules in your files.

- If changes occur later, issue an updated form and get acknowledgment.

Practical tips for accuracy:

- Use real bills for the unit when possible. Redact personal information.

- For new builds, ask installers for equipment specs to improve estimates.

- Reflect seasonal patterns. Heating spikes in winter. AC spikes in summer.

- Avoid lowball estimates. Tenants rely on your numbers to budget.

- State what you do not know. Explain how you will update once data exists.

Practical tips for clarity:

- Use simple statements. For example, “You pay for electricity by sub-meter.”

- Group items by who pays. This reduces confusion.

- Use numbers, not ranges, when you can. For example, “$45 average monthly electricity.”

- Add a note on rate variability. For example, “Costs vary with time-of-use rates.”

What tenants should double-check before signing:

- Do the disclosure and lease match on included utilities?

- Is each utility separately metered for your unit?

- Are all admin fees and deposits listed?

- Does the cost history cover the correct unit and time period?

- Are shared meter allocations clear and fair?

Final check before you sign:

- You know exactly which utilities you pay.

- You understand how each is measured and billed.

- You have seen the cost history or reasonable estimates.

- You agree to any fees and deposits listed.

- The lease and the disclosure align.

When you complete these steps, you create a clear picture. You protect your budget and reduce risk. You start the tenancy with a shared understanding. That is the purpose of this form.

Legal Terms You Might Encounter (Information from your Landlord about Utility Costs)

- Sub-metering means your unit has its own meter for a utility, such as electricity or water. Your usage is measured separately from other units. On this form, sub-metering shows up in the meter number, who bills you, and how rates apply to your readings.

- Bulk metering means the building has one master meter, and the landlord or a service provider splits the total bill among units. If your building uses bulk metering, the form should explain the allocation method. Look for the formula used to divide costs and whether common areas are excluded.

- Consumption charge is the part of a bill that changes with how much you use, such as cents per kilowatt-hour or per cubic metre. The form should state the unit price and how it can change. This lets you estimate monthly costs based on your habits.

- Fixed service charge is a flat fee you pay each billing cycle, regardless of usage. It can cover metering, account administration, or infrastructure costs. The form should list any fixed charges and their amounts, so you are not surprised by a minimum bill.

- Allocation method explains how costs are shared if your unit is not individually metered. It can use formulas based on unit size, occupants, or a ratio. The form should describe the method clearly and confirm that common area consumption is not included in your share.

- Estimated bill is a bill produced without an actual meter reading. This happens if a meter is inaccessible or malfunctioning. The form should explain when estimates are used, how they are calculated, and how adjustments occur after an actual reading.

- True-up or reconciliation is the adjustment made when actual usage replaces estimates. If you paid too much, you get a credit. If you paid too little, you get a catch-up charge. The form should describe how and when reconciliations happen and how they appear on your bill.

- Administrative fee is any extra charge for billing, processing payments, late payments, or account changes. The form should list each fee, the dollar amount, and when it applies so you can avoid avoidable charges.

- Opening and closing readings mark your start and end usage during your tenancy. They define what you pay for, not the previous or next tenant’s usage. The form should capture the meter read on move-in and the process for a final read on move-out.

- Security deposit is money held to secure payment for utility charges. The form should state if a deposit is required, the amount, how interest is handled, and when it will be returned. This helps you plan cash flow and know how to recover funds when you move out.

FAQs

Do you have to sign this form if you do not want to pay utilities separately?

You do not have to agree until you understand your obligations. Ask for a clear breakdown of charges, rates, and billing practices. If utilities were advertised as “included,” ask how this form aligns with the rent you were quoted. Do not sign until you know exactly what you are paying and to whom.

Do you pay the utility provider directly, or do you pay your landlord?

It depends on how your building is set up. The form should state who bills you. If you will receive bills from a provider, you may need to open an account. If the landlord bills you, confirm the billing cycle, due date, and payment methods. Clarify where you send payments and how receipts are issued.

Do you need to provide meter access?

Yes. If your unit has a meter inside, you must allow safe access for readings or maintenance. If access is not possible, bills may be estimated. Ask how to schedule access and what happens if a reading is missed. Keep a record of provided access to address future billing disputes.

Do you pay for common area usage?

You should pay only for consumption tied to your unit. If the building uses bulk metering or allocation, ask how the method excludes common areas. The form should describe the formula. If it is not clear, request a written example bill that shows how your share is calculated.

Can the rate or fee change after you sign?

Rates and fixed charges can change. The form should explain how you will be notified and what triggers changes. Ask for written notice and a breakdown of any new amounts. Keep all notices with your lease documents so you can track changes over time.

What if you never receive a bill, or the numbers look off?

Contact the biller immediately and ask for a copy. Confirm your account number, unit number, and meter number. If the usage seems too high, request the meter reading, billing period, and rate details. Take photos of your meter and compare it to the billed read. Keep all communications in writing.

What if you dispute a charge?

Pay the undisputed portion by the due date to avoid late fees. Send a written dispute that explains the issue, includes photos or readings, and requests an investigation. Ask when you will receive a response and how adjustments will be shown. Save proof of delivery and follow up if deadlines pass.

Do you need a security deposit?

Sometimes. The form should say if a deposit is required, the amount, and how it will be held and returned. Ask whether interest applies and what conditions must be met to receive a refund. Keep the deposit receipt and plan for the return at move-out with a final meter reading.

Checklist: Before, During, and After the Information from your Landlord about Utility Costs

Before signing

- Confirm what utilities are included in rent and what are extra.

- Ask for the rate structure: unit price per usage, fixed fees, and taxes.

- Request a sample bill for your building or unit type.

- Ask for the last 12 months of usage for your unit or a similar unit, if available.

- Get the billing cycle, due dates, grace periods, and late fee amounts.

- Verify the meter type and location. Note the meter number and serial number.

- Ask how opening and closing readings are recorded and verified.

- Confirm who bills you: the landlord or a utility/service provider.

- If opening an account, get the account setup steps and any deposit amount.

- Ask how estimates work and how reconciliations appear on future bills.

- Confirm how common areas are excluded from your charges.

- Request the fee schedule: administrative, paper bill, payment processing, disconnection, and reconnection.

- Clarify the dispute process, response timelines, and points of contact.

- Confirm notification rules for rate or fee changes.

- Verify the start date for your utility responsibility.

- Photograph current meter readings and note the timestamp and location.

- Align the utility obligations with your lease dates.

- Ask how roommates or additional occupants affect the allocation, if relevant.

During signing

- Check your name, unit number, and rental address for accuracy.

- Verify the meter number(s) match your photos and the device labels.

- Ensure the list of utility services matches what you discussed.

- Confirm the rate unit (e.g., per kWh, per cubic metre) and the fixed service charge amount.

- Review the billing frequency, due date, and accepted payment methods.

- Verify the security deposit amount and return conditions, if any.

- Look for the opening meter reading, the read date, and who recorded it.

- Confirm the policy for estimated bills and when a true-up occurs.

- Review the allocation method if your unit is not individually metered.

- Ensure common area usage is excluded or addressed in the formula.

- Check the fee schedule for late payment, paper bills, or account changes.

- Confirm the process to update your contact and mailing information.

- Review the dispute steps and where to send written disputes.

- Confirm how you will receive notices of rate changes.

- Make sure both parties sign and date the form. Keep a complete copy.

After signing

- Save a PDF or scanned copy in your lease folder with a clear file name.

- Share copies with any co-tenants who share the bill.

- If you must set up an account, complete registration and confirm activation.

- Send confirmation of your opening meter reading with photo evidence.

- Add billing due dates and read dates to your calendar with reminders.

- Store credentials for any online billing portal in a secure place.

- Keep all bills, notices, and payment proofs for at least one year.

- Review your first three bills to confirm rates and fees match the form.

- If something is wrong, send a written request for correction right away.

- Update your address and email if they change, so you do not miss bills.

- Plan your move-out: schedule a final meter reading and keep a record.

- Track deposit returns and follow up with a written request if needed.

Common Mistakes to Avoid

- Not recording the opening meter reading. If you skip this, you can be charged for usage before your move-in. Don’t forget to take clear photos with timestamps and send them in writing on day one.

- Overlooking fixed fees. You might budget for usage but miss a monthly service charge. That creates shortfalls and late fees. Don’t forget to add all fixed charges to your monthly budget.

- Agreeing to an unclear allocation method. If you accept a vague formula, you risk paying for common areas or other units’ usage. Don’t forget to ask for a plain example bill and a written formula before you sign.

- Ignoring estimated bills. If you do not challenge repeated estimates, you may face a large catch-up charge later. Don’t forget to request actual readings and the reconciliation details in writing.

- Letting the lease dates and utility responsibility dates drift. A mismatch can leave you paying after move-out or not covered at move-in. Don’t forget to align start and end dates and confirm them in writing.

What to Do After Filling Out the Form

- Submit the form to the correct party. If the landlord collects it, deliver it as instructed and ask for a stamped or emailed confirmation. If a utility provider requires it, follow their account setup steps and confirm your account number in writing.

- Confirm your opening position. Send your move-in meter photos with the read date and time. Include your unit number and meter number. Ask for written acknowledgment that these will be used for your first bill.

- Set up billing and payment. Create your online account if available. Choose your preferred billing method. If you use pre-authorized payments, verify the withdrawal date and set low-balance alerts with your bank. Keep a backup plan in case of a failed payment.

- Calendar your obligations. Add billing due dates, read dates, and notice periods for rate changes. Set a quarterly reminder to review your usage trend and adjust your budget.

- Monitor the first three bills. Check the rate per unit, fixed charges, and taxes. Compare the meter reads against your photos. Confirm that any deposit, credit, or promotion appears correctly. Flag discrepancies quickly.

- Address problems promptly. If a bill seems high or includes unfamiliar fees, send a written request for itemization. Attach photos, note any access issues, and ask for a timeline for resolution. Pay the undisputed amount to avoid late fees while the issue is reviewed.

- Keep your records organized. Store the signed form, your photos, all bills, and payment confirmations in a single folder. Use consistent file names with dates so you can find what you need fast.

- Manage changes. If a roommate joins or leaves, notify the biller in writing and update contact details. If rates or fees change, save the notice and compare the next bill to confirm the correct application.

- Plan your move-out early. Schedule a final meter reading for your last day. Take closing photos with timestamps. Provide a forwarding address for the final bill and any deposit return. Ask for a final statement that shows a zero balance after payment.

- Request amendments if something material changes. If your billing party, allocation method, or service list changes, ask for an updated form. Review the changes, sign if you agree, and keep the updated version with your lease.

- Distribute copies as needed. Give co-tenants the billing details and due dates. If you receive mailed bills, make sure the right person collects them. Clarify who pays what and how you will settle shared costs.

- Stay proactive. Small issues become expensive if ignored. Read each bill, track usage trends, and keep your documents current. Clear records and quick follow-up help you resolve problems without stress.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.