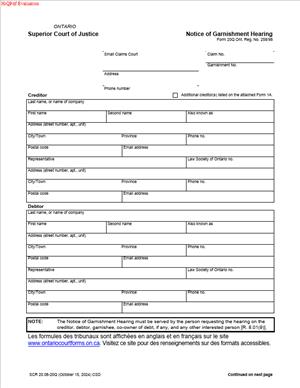

Form 20Q – Notice of Garnishment Hearing

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20Q – Notice of Garnishment Hearing?

Form 20Q is an official Small Claims Court notice. It tells the parties that the court has scheduled a garnishment hearing. The hearing deals with problems or questions about an active garnishment. It also addresses disputes about how much is payable and who must pay it. The form is part of the enforcement process under the Rules of the Small Claims Court.

You use this form after a judgment has been made and a garnishment is in place or requested. Garnishment is a court process that redirects money owed to the debtor to the creditor. A common example is wage garnishment through an employer. Another is a bank garnishment against funds in a debtor’s account. A garnishment hearing can resolve disputes about liability, amounts, exemptions, and compliance. The court can make orders to clarify, vary, suspend, or enforce the garnishment.

Judgment creditors typically trigger this form. They do so when there is non-payment under a Notice of Garnishment. They also use it when the garnishee denies owing the debtor. Judgment debtors use it to ask for relief for hardship or to claim an exemption. Garnishees use it when they want directions from the court. The court clerk may also issue it after receiving a dispute or a request for directions.

You may need this form if the garnishee stops paying, pays the wrong amount, or ignores the notice. You may also need it if the debtor’s situation changes. A layoff, new employer, or new address can affect wage garnishment. The form is also needed if there are multiple garnishments and you need the court to set priorities. It is the tool that gets everyone before a deputy judge to resolve enforcement issues.

Typical usage scenarios include a creditor whose employer-garnishee is not remitting deductions. It also includes a bank that denies it holds the debtor’s funds. A debtor might use it to argue that the garnishment takes more than the law allows. Wage garnishment usually cannot exceed a set portion of net wages. Exempt funds, like certain social assistance payments, may not be garnishable. The hearing is the place to raise these issues. The notice ensures proper attendance and procedural fairness.

When Would You Use a Form 20Q – Notice of Garnishment Hearing?

You use this form when you need the court to make a decision about a garnishment. You would not use it at the start of the case. You use it after judgment and after a garnishment is issued or requested. If you are a creditor and the garnishee has not paid, the form brings the garnishee to court. The court can hear why the garnishee has not complied. The court can then order payment or give directions. This helps you enforce your judgment without filing a separate claim.

If you are a debtor and the garnishment causes undue hardship, you can ask for a hearing. You might have other dependants who rely on your income. You might have medical expenses or a sudden loss of hours. You might receive exempt funds that have been mixed in a bank account. The hearing lets you show the court your budget and circumstances. The court can then assess if a variation or suspension is warranted. It can also confirm exemptions set by law.

If you are a garnishee and you dispute that you owe money to the debtor, you can ask for a hearing. You might be an employer who never employed the debtor. You might be a business that no longer owes the debtor any amounts. You might be a bank that has a right of set‑off. You might hold a joint account that complicates entitlement. The hearing lets you put those facts before the court. The court can then decide if the garnishment applies to you. The court can also limit your obligations or dismiss you from the process.

Landlords, tenants, sole proprietors, and small businesses often use this form. Landlords may seek to garnish wages after a judgment for rent arrears. Tenants may face a wage garnishment and seek to vary it for hardship. Small businesses may be named as garnishees and need clarity about their duties. A bank named as a garnishee might also attend to address account details. The hearing gives a structured forum for all these issues.

You also use this form when there are competing claims. For example, there may be a family support deduction and a Small Claims garnishment at the same time. The hearing can address a priority. It can also ensure deductions stay within legal limits. You may use it to confirm when garnishment should end. Payment in full, a discharge in bankruptcy, or a settlement can all trigger a termination. The court can make a final order to stop deductions and release remaining funds.

Legal Characteristics of the Form 20Q – Notice of Garnishment Hearing

Form 20Q is part of a court process. It is not a private agreement. It is legally significant because it compels attendance and provides notice. It sets a hearing date and outlines what the court will consider. When properly served, it ensures the parties have a fair chance to be heard. The court’s authority comes from the Rules of the Small Claims Court and related statutes. That framework makes the notice and the resulting orders enforceable.

The hearing can produce binding orders against any party. The court can order the garnishee to pay funds into court. It can set or vary the amount to be deducted. It can confirm or cancel a garnishment. It can decide whether specific funds are exempt. It can rule on the garnishee’s liability to the debtor. Failure to attend can have serious consequences. The court can proceed in the party’s absence. It can accept the other side’s evidence and make orders accordingly. If a garnishee ignores its duties, the court can order payment up to the amount owed.

Enforceability depends on proper completion and service. Names and addresses must match the case file. The court file number must be correct. The notice must set out the court location and hearing details. Service on each party must follow the Rules. The party that serves must file proof of service. The court clerk’s issuance of the notice confirms the hearing. The court relies on the materials filed and the evidence at the hearing. You should bring original records and organized copies. These include pay records, bank statements, and the judgment.

There are important legal limits in garnishment law. Wage deductions are capped by statute. Usually, only a portion of net wages can be garnished. Certain funds are exempt by law. Common examples include some social assistance and specific pension benefits. The court will look at the source of funds and the timing. The court may also consider hardship. It will balance the creditor’s right to enforce with the debtor’s ability to meet basic needs. Interest and costs may be addressed at the hearing. The court may award costs for unreasonable conduct or missed payments.

Privacy and accuracy matter. You should not include unnecessary personal identifiers in the form. Use legal names for businesses and employers. Use full addresses, including unit numbers. Use precise amounts and dates from the judgment and payments. Clerical errors can delay the hearing. They can also cause service defects. Keep your information current. Tell the court if any address or employer has changed. This reduces adjournments and wasted attendance.

How to Fill Out a Form 20Q – Notice of Garnishment Hearing

The goal is clear, accurate, and complete information. You want the clerk to issue the notice without delay. You also want the other parties to understand the issues. Follow these steps.

1) Confirm you are using the right form.

- Use Form 20Q. It is the Notice of Garnishment Hearing.

- Check that you have the most recent version.

- If you are a creditor’s representative, confirm authority to act.

2) Gather your documents.

- Have the judgment or order and any assessment of costs.

- Have the issued Notice of Garnishment and any payment records.

- Gather pay records, bank records, or correspondence relevant to the issue.

- Prepare a simple running total that shows what remains owing.

3) Complete the court header.

- Enter the correct court location. Use the same court that issued the garnishment.

- Enter the Small Claims Court file number exactly as on the judgment.

- List the parties as they appear in the case: plaintiff(s) and defendant(s).

4) Identify the enforcement roles.

- Clearly name the judgment creditor. Use the same name as on the judgment.

- Clearly name the judgment debtor. Use the same name as on the judgment.

- Identify each garnishee by legal name. Include any “operating as” if used.

- Include the full mailing address for each garnishee and party.

5) Reference the underlying judgment.

- State the date of judgment and the type of order.

- State the total judgment amount, including costs if awarded.

- State the applicable post‑judgment interest rate, if any.

- Note any payments received and the current outstanding balance.

6) Reference the garnishment.

- State the date the court issued the Notice of Garnishment.

- Identify whether it is a wage, bank, or other garnishment.

- If known, state the payroll cycle or account ending digits for clarity.

- Note any prior orders that affect this garnishment.

7) Set out why a hearing is needed.

- Provide a short, factual description of the issue.

- Examples: “No payments received since issuance.” “Garnishee denies liability.” “Hardship request.” “Competing garnishments.”

- Identify the decision you want. Examples: “Order directing payment.” “Order varying deduction to X%.” “Order terminating garnishment.”

8) Propose or leave scheduling to the clerk.

- Some forms allow you to propose dates. Others do not.

- If the form has a blank for date and time, leave it for the clerk unless directed.

- Always complete your contact details so the clerk can reach you.

9) State any documents to bring.

- Use the space to list records the court should see.

- For employers: pay stubs, payroll ledger, employment dates, ROE if applicable.

- For banks: account statements, hold notices, set‑off notices, and account terms.

- For debtors: income proof, expense proof, details of dependants, proof of exempt funds.

10) Review the service requirements.

- The notice must be served on the creditor, the debtor, and the garnishee.

- If there are multiple garnishees, serve each one.

- If there are known competing claimants, consider serving them as well.

- Check the Rules for timelines and acceptable service methods.

11) Complete the service details section.

- If the form has a section for service, fill it in after service.

- Include the name of the person served, the address, and the date.

- State the method of service used. Be precise and truthful.

- Prepare and swear an Affidavit of Service for each party served.

12) Sign where required.

- If the form has a “Prepared by” or “Requesting party” signature, sign and date it.

- Print your name, role, address, and phone number.

- The clerk will complete the issuance portion and sign or stamp the notice.

13) File the form with the court.

- File the completed form with the Small Claims Court office on the file.

- Pay any required filing fee. Ask about fee waivers if needed.

- Leave space for the clerk to insert the hearing date and time.

- Ask for issued copies for service once the clerk completes them.

14) Serve the issued notice.

- Serve the issued Form 20Q on each required party.

- Use a method of service allowed by the Rules.

- Serve well before the hearing date so parties can prepare.

- Keep detailed records of service for your affidavit.

15) File proof of service.

- File the Affidavit(s) of Service with the court before the hearing.

- Attach a copy of the served notice and any enclosures to each affidavit.

- Confirm with the clerk that the court file shows proper service on all parties.

16) Prepare for the hearing.

- Organize your documents in chronological order.

- Prepare a short outline of what you will tell the court.

- Bring three sets of key documents: for you, the other side, and the court.

- Mark amounts clearly. Show how you calculated the outstanding balance.

17) Attend the hearing.

- Arrive early and check in with the clerk.

- Be ready to answer questions about the judgment and payments.

- Focus on facts and documents. Keep answers concise.

- Ask for the precise order you seek at the end of your submissions.

18) After the hearing, act on the order.

- Get a copy of the endorsed order before you leave or as directed.

- If the court varies the garnishment, notify payroll or the bank at once.

- If the court terminates the garnishment, send a written notice to the garnishee.

- Update your ledger—track compliance with any new terms.

19) Avoid common mistakes.

- Do not list the wrong employer or wrong bank branch. Verify details first.

- Do not guess amounts. Use the judgment and payment proof.

- Do not omit addresses or unit numbers. Service will fail.

- Do not ignore changes in employment. Update the court and the garnishee.

20) Use attachments wisely.

- If the form space is too small, attach a schedule.

- Label each schedule clearly. Example: “Schedule A – Payment Ledger.”

- Refer to the schedule in the main form. Keep attachments concise and relevant.

These steps keep the form clear and complete. They also show the court what decision you want and why. Precision helps the clerk issue the notice without back‑and‑forth. Good service avoids adjournments. Preparation improves your chances of a prompt, fair order.

If you are unsure whether to request a hearing, review your goal. If you seek payment from a non‑responsive garnishee, this is the right path. If you seek relief from a harsh deduction, this form gets you before a judge. If you need directions on liability, this form gives you a forum to resolve it. Work through the steps, keep records, and stay factual.

Legal Terms You Might Encounter

- Judgment creditor: This is you if you won the case and are owed money. You use this form to move the garnishment forward and to explain what you want the court to do at the hearing. You may ask to continue, change, or end the garnishment. You should be ready to show the balance owed and any payments made.

- Judgment debtor: This is the person or business that owes the judgment. If you receive this form, a hearing is set to review the garnishment. You can ask the court to reduce, suspend, or end the garnishment. Bring proof of your income, expenses, and any payments you made. You should also gather documents showing any exempt income.

- Garnishee: This is the third party holding the debtor’s money. It is often an employer or a bank. The form notifies the garnishee of the hearing. The garnishee may need to explain what funds were withheld and why. If the garnishee is an employer, the order can continue until the judgment is paid. If it is a bank, the order is usually for a one‑time payment.

- Notice of garnishment: This is the court document that starts the garnishment process. It is separate from this form. The notice tells the garnishee to hold or pay funds. The Notice of Garnishment Hearing (Form 20Q) deals with what comes next. It brings everyone to court to review how the garnishment works or whether it should change.

- Garnishment hearing: This is the court review triggered by issues with the garnishment. The hearing can address hardship, exemptions, calculation errors, or non‑compliance. The judge can make orders to adjust amounts, timelines, or procedures. Form 20Q sets the hearing date and tells you where to attend and what to bring.

- Exempt income: Some income may be protected by law and cannot be garnished. Examples often include certain benefits or assistance programs. Bring proof if you claim an exemption. This form alerts everyone that the court will consider these issues. The judge will rely on documents and testimony at the hearing.

- Continuing wage garnishment: This is a garnishment that applies to wages on an ongoing basis. The employer withholds a part of each pay. It continues until the judgment is paid or the court ends it. If wages are garnished, the hearing may address the percentage withheld. The judge can set a different amount or payment plan if you show hardship.

- Lump‑sum garnishment: This usually applies to bank accounts or a single payment. The bank freezes funds and pays once. The hearing may review whether the bank held the right funds and in the right amount. If the funds were exempt, the judge can order a release. Form 20Q is the vehicle to bring those issues before the court.

- Affidavit of service: This is a sworn statement proving you served documents. After you deliver Form 20Q to all parties, you usually file an affidavit confirming service. Without proof of service, the hearing may be delayed or orders may not bind the parties. Keep copies of what you served and how.

- Installment order: This is a court order that sets a payment schedule for the debtor. At the hearing, the judge might replace or modify a garnishment with installments. If you seek installments, bring a clear budget and pay schedule. If you oppose installments, bring evidence of ability to pay more or a history of non‑payment.

FAQs

Do you have to attend the garnishment hearing?

Yes. If you are named on the form, you should attend. The court may make orders that affect your rights. If you cannot attend, ask the court about options to reschedule or appear remotely. Do not ignore the notice.

Do you keep paying during the hearing process?

Yes. The garnishment remains in effect until the court changes it. The garnishee should continue to withhold funds as ordered. The judge can adjust or suspend amounts at the hearing. Any change takes effect only when ordered.

Do you need to serve Form 20Q on everyone?

Yes. Serve all listed parties: the creditor, the debtor, and the garnishee. Follow the service instructions on the form or the court’s rules. File proof of service. If service is late or missing, the hearing can be adjourned.

Do you need to file a financial statement?

If you claim hardship or exemptions, bring proof. Courts often expect a detailed budget with income, expenses, dependents, and debts. Include pay stubs, benefit statements, rent, utilities, and receipts. The judge needs numbers, not just explanations.

Do you need to bring proof of payments or settlements?

Yes. Bring receipts, cancelled cheques, bank statements, and emails confirming agreements. If you paid part of the judgment, show when and how much. If you agreed on a plan, show the terms. Documents help the court set accurate balances.

Do you have to notify your employer or bank after the hearing?

Yes. If the order changes the garnishment, give a copy to the garnishee. Employers and banks need the final order to adjust withholdings. Do this quickly to avoid over‑ or under‑withholding. Keep proof that you delivered the order.

Do you need to pay a fee for the hearing?

A fee may apply to schedule or file associated documents. Check current fees before you file or serve. If you cannot afford fees, ask about fee relief. Confirm payment methods accepted by the court.

Do you need an interpreter or accessibility help?

If you need language or accessibility support, request it early. Tell the court as soon as you receive the notice. The court needs time to arrange support. Do not wait until the hearing day.

Checklist: Before, During, and After the Form 20Q – Notice of Garnishment Hearing

Before signing

- Confirm the correct court location and address.

- Confirm the Small Claims Court file number.

- Verify the legal names of all parties and the garnishee.

- Confirm the current balance of the judgment.

- Gather proof of payments and credits.

- Gather income and expense documents if a hardship is claimed.

- Gather documents showing exempt income, if any.

- Confirm the garnishee’s contact details and position (employer or bank).

- Check deadlines for serving the notice.

- Prepare an affidavit of service template for later use.

During signing

- Verify the hearing date, time, and room or method.

- Confirm your contact information is correct.

- Ensure all required sections on the form are complete.

- Check that the service list includes all parties.

- Review any instructions printed on the form.

- Sign and date in the correct spot.

- Make sure the form is legible and free of edits.

After signing: filing, notifying, and storing

- Make copies for you and each party before serving.

- Serve the form on the creditor, debtor, and garnishee.

- Use a service method allowed by the court rules.

- Note the service deadline on your calendar.

- Complete and swear an affidavit of service.

- File the affidavit of service with the court.

- Organize a hearing binder with all the proof and notes.

- Diarize the hearing date and plan travel time.

- Store stamped copies in a secure, labeled file.

Common Mistakes to Avoid

- Serving late or not at all. The court can adjourn the hearing. It can also refuse to make orders. Don’t forget to serve every party and file proof.

- Using wrong or incomplete party names. Orders may not bind the correct employer or bank. Use full legal names and current addresses.

- Forgetting to bring financial documents. The court cannot assess hardship without proof. Bring pay stubs, bills, and bank records.

- Ignoring exempt income issues. Protected funds can be held by mistake. Flag exemptions early and bring evidence.

- Misstating the balance owed. Overstating or understating the debt delays outcomes. Reconcile the balance with proof of payments.

What to Do After Filling Out the Form 20Q – Notice of Garnishment Hearing

- Serve the notice. Deliver the signed form to the creditor, debtor, and garnishee. Use an approved service method. Track dates and methods.

- File proof of service. Complete an affidavit of service. Swear or affirm it. File it before the hearing to avoid delays.

- Prepare your evidence. Build a clear package of documents. Include a summary page that totals income, expenses, and payments. Tab each section.

- Plan your brief statement. Write the key points you will say first. Focus on the order you seek and why it is fair. Keep it concise.

- Confirm attendance details. Check if the hearing is in person or remote. Test your device if remote. Confirm how to submit documents.

- Attend the hearing. Arrive early. Bring two extra copies of documents. Be ready to answer simple questions about amounts and dates.

- Get and share the order. Ask for a copy of the signed order. Give it to the garnishee, debtor, and creditor, as needed. Keep proof of delivery.

- Update calculations. If the order changes amounts, update your balance sheet. Adjust future payments or withholdings right away.

- Follow up on compliance. Confirm the garnishee changed withholding as ordered. If not, contact them promptly. Escalate through the court if needed.

- Consider the next steps. If the order sets installments, track payments. If the debt is paid, request steps to end the garnishment. Keep records.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.