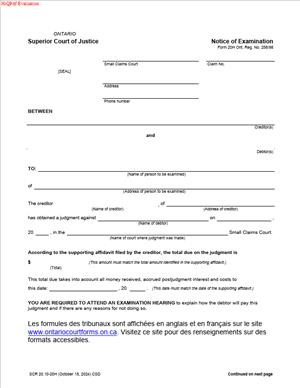

Form 20H – Notice of Examination

Fill out nowJurisdiction: Canada | Ontario

What is a Form 20H – Notice of Examination?

Form 20H is a Small Claims Court form. You use it after you have a court order for money. It tells the debtor to attend an examination. The examination is about the debtor’s income, assets, and debts. The goal is to help you collect your judgment. You ask questions under oath. The court can also make payment orders. The form sets the date, time, and place for the examination.

You typically use this form as the creditor. You might be a landlord with an unpaid rent judgment. You might be a contractor owed for work. You might be a small business with an unpaid invoice. You might be an individual who won damages. If the debtor is a person, you examine that person. If the debtor is a company, you examine a representative. That person must know the company’s finances. A director or officer is often required.

You need this form when you lack asset information. You may not know where the debtor works. You may not know which bank the debtor uses. You may suspect hidden assets or recent transfers. The examination helps you map the debtor’s finances. It helps you target the right enforcement tools. Those tools include garnishment or writs. The hearing can also lead to an instalment order. That can set a realistic payment plan.

Typical usage scenarios

A contractor gets a default judgment. The client will not pay and avoids calls. You schedule an examination to uncover employment details. A retailer wins a claim for unpaid goods. The debtor claimed hardship at trial. You request documents to test that claim. A landlord wins arrears and damages. The tenant moved and changed jobs. You use the examination to find a new employer. A small company wins against another company. You examine a director to get banking and receivable details.

Form 20H is a court-backed notice. The court issues the document after you file it. The notice orders the debtor or representative to attend. It also orders them to bring records. The list of records appears on the form. The examination often takes place in court. It may also proceed by video or phone. The court will confirm the format.

When Would You Use a Form 20H – Notice of Examination?

You use Form 20H after you have a judgment. You do not need to try other enforcement first. You do not need to wait for a default on a payment schedule. You may proceed to the examination as a first enforcement step. Many creditors do this. It saves time and cost. It also avoids blind garnishments that fail.

Use it when you lack key details. You need an employer’s name to garnish wages. You need a bank branch to garnish an account. You need proof of property for a writ. The examination gives you that information. You can also test the debtor’s budget. You can ask about income swings. You can ask about government benefits. You can ask about dependent needs. This helps the court set fair terms. Fair terms are easier to collect.

Typical users include landlords, tenants, tradespeople, and small businesses. Landlords use it after eviction or arrears judgments. Tenants use it to collect deposits or repair costs. Contractors use it for unpaid work. Retailers use it for bounced cheques or unpaid accounts. Professional firms use it for fees. Individuals use it for small tort judgments. Insurers and subrogated parties also use it. If the debtor is a corporation, you will examine a human. You will name a director, officer, or controller. The person must be able to answer financial questions.

You may also use it when you suspect avoidance. The debtor may have moved money. The debtor may have transferred a car to a relative. The debtor may claim no income. The examination allows probing questions. You can request statements and records. You can test credibility. The judge can order more disclosure if needed.

You also use it to resolve payment terms. Some debtors cannot pay at once. The court can set instalments. The court can adjust terms based on the budget. This can avoid costly enforcement. It can also set clear consequences for default. Many files settle at the examination. That saves you time.

Legal Characteristics of the Form 20H – Notice of Examination

Form 20H is a court form under the Small Claims Court Rules. It is not a private letter. It is issued by the court clerk. It orders attendance at a set date and place. It also orders the person to bring documents. The person is examined under oath or affirmation. A judge or court staff member oversees the process. The questions focus on the ability to pay. The process is part of judgment enforcement.

The notice is legally binding when properly issued and served. Service rules must be followed. If the service is not proper, the court may not proceed. The notice must go to the right person. For a company, serve the named representative. If the proposed person lacks knowledge, the court can order another. Service timing must give fair notice. The court will look at the affidavit of service. If the debtor was not served, the hearing will likely be adjourned.

Enforceability rests on three pillars. First, the court issues the notice and sets the hearing. Second, you complete proper service and file proof. Third, the person appears and answers questions under oath. The court can make orders at the hearing. Those orders can include payment schedules, document production, and costs. Orders are enforceable like any Small Claims Court order.

If the debtor does not attend, the court can take steps. The court may set a new date and give a warning. The court may order a contempt process for disobedience. That can lead to serious consequences. The court prefers compliance. You must show proper service. You must show clear non‑attendance. If the debtor attends but refuses to answer, the court can direct answers. Persistent refusal can trigger contempt steps.

The examination is not a trial. You are not relitigating the claim. You are not seeking new damages. You must focus on enforcement. You may ask about assets, income, debts, and expenses. You may ask about recent transfers. You may ask about bank relationships and account numbers. You may ask about vehicles, real estate, tools, and shares. You may ask about support obligations. You may not press for privileged information. You should stay respectful and focused.

The court expects proportionality. Do not demand burdensome production without reason. Tailor your requests. Ask for recent pay stubs, bank statements, tax slips, and property records. If the debtor is a company, ask for statements, receivables, payables, leases, and equipment lists. The judge will curb fishing expeditions. Keep questions tied to the collection.

Privacy concerns apply. Financial information is sensitive. Use information only for enforcement. Do not post or share it. Keep documents secure. Return originals as directed. Follow any confidentiality directions the court gives.

How to Fill Out a Form 20H – Notice of Examination

Follow these steps. Prepare carefully. Accuracy matters.

Step 1: Confirm you have a judgment

Make sure you have a Small Claims Court order for money. Confirm the amount owing. Subtract any payments and costs paid. Bring a ledger to the hearing. If you have no judgment, do not use this form. Use it only for the enforcement of a money order.

Step 2: Decide whom to examine

Identify the debtor. If the debtor is an individual, you will examine that person. Use the exact legal name from the judgment. If the debtor is a corporation, choose a representative. A director, officer, or controller is best. If you know a specific person with knowledge, name them. If you do not know, state that you want a representative with knowledge. The court can direct who must attend.

Step 3: Contact the court for a date

Call or attend the Small Claims Court office where the case is filed. Ask for an examination date. Confirm if the hearing is in person, by video, or by phone. Get the address or connection details. Note the date, time, and courtroom or platform. Ask about the filing fee. Ask about any lead time the court needs. Courts book examination dates in advance.

Step 4: Complete the top of the form

Enter the court file number exactly as on your judgment. Enter the court location and address. Enter the parties as listed in the case. Identify who the creditor is and who the debtor is. If roles have changed since filing, use the judgment roles. Accuracy helps the clerk issue the notice.

Step 5: Identify the examinee

On the form, name the person who must attend. If a corporate debtor, identify the representative and their role. Example: “John Smith, Director of ABC Inc.” If unknown, write “A representative of ABC Inc. with knowledge of its assets and debts.” Include the examinee’s address if known. This helps with service.

Step 6: Fill in date, time, and place

Insert the date and time given by the clerk. Insert the court address or remote link details as directed. If the court will fill in these fields, leave them blank. Ask the clerk for their process. Some offices complete the scheduling details after filing.

Step 7: List documents to bring

Use clear, specific requests. For individuals, request:

- Government-issued ID.

- The completed financial information form.

- Last three pay stubs or proof of income.

- The past three months of bank statements for all accounts.

- Most recent tax return and latest notice of assessment.

- Records of benefits, pensions, or support.

- Vehicle ownership and insurance.

- Lease or mortgage statements and property tax bills.

- Titles or registrations for real or personal property.

- Credit card and loan statements.

- Records of any recent asset transfers.

- Proof of monthly expenses.

For corporations, request:

- Corporate banking statements for the past three months.

- Accounts receivable and payable listings.

- Most recent financial statements or tax filings.

- Payroll records showing owners’ compensation.

- Lease agreements and loan documents.

- Vehicle and equipment lists and registrations.

- Customer and supplier summaries.

- Any recent asset transfers?

You can attach a schedule if the form’s space is limited. Label it “Schedule A – Documents to Bring.” Refer to it on the form.

Step 8: Add language or accessibility needs

If you know the debtor needs an interpreter, note the language. If accessibility support is required, notify the court office. Give details early. The court needs time to arrange services. If you do not know, state “Interpreter may be required” only if there is a real need.

Step 9: Include your contact information

Enter your name, address for service, phone, and email. If you have a representative, include their details. This helps the other side contact you to discuss payment or logistics. Use the same address for all future filings.

Step 10: File the form and pay the fee

Bring the completed form to the court office. Pay the filing fee. The clerk will issue the notice. The clerk will sign and seal it. Keep several copies. You will need one for service. Keep one for your records. If filing electronically, follow the court’s directions. Download the issued copy with the court seal.

Step 11: Serve the notice properly

Personal service is usually required. Arrange for proper service for the examinee. Do not serve by regular mail unless the rules allow it. Use a process server if needed. Serve the notice well before the hearing. Include the financial information form with the notice. Include any attached schedule of documents. Record how and when the service occurred. Keep receipts and notes.

Step 12: File proof of service

Complete an affidavit of service. Set out the date, time, place, and method of service. Attach the served documents as exhibits if required. File the affidavit with the court before the hearing. The court needs proof to proceed. Without proof, the examination may be adjourned.

Step 13: Prepare your questions and goals

Plan your examination. List the information you need. Focus on employment, bank accounts, property, vehicles, and debts. Ask about support obligations and dependents. Ask about recent transfers to family or friends. Prepare a draft payment schedule if you will propose one. Bring your judgment, costs, and payment ledger. Bring extra copies of documents for the court and the debtor.

Step 14: Attend the examination

Arrive early or log in on time. Check in with the clerk. When called, the debtor will be affirmed or sworn. Ask clear, focused questions. Be polite but firm. Keep questions tied to the collection. Ask for missing documents. Ask about locations and account details. Take notes. If discussions lead to terms, ask the judge to make an order.

Step 15: Seek orders as needed

At the end, ask for what you need. You can ask for:

- An instalment payment order with dates and amounts.

- A document production order with deadlines.

- An update hearing if information is missing.

- The costs of the examination were appropriate.

If the debtor did not attend, ask for the next steps. The court may set a new date. The court may direct a contempt process. The court will look at service. Be ready to prove proper service.

Step 16: Use the information gathered

After the hearing, act quickly. If you learned the employer, prepare a wage garnishment. If you learned the bank branch, file a bank garnishment. If you learned of property, consider a writ of seizure and sale. Calendar any payment dates. If payments default, return to court if needed.

Common completion tips

Use names exactly as on the judgment. Do not guess at corporate suffixes. Confirm “Inc.” or “Ltd.” before filing. Use the correct court location. Do not list a different court. Ensure the hearing date is available for you and your witness, if any. List documents that exist and are relevant. Avoid vague demands. If service fails, try again early. Keep records of attempts. If you need to change the date, contact the court quickly. Get any change approved before serving an amended notice.

Signing and issuing

You do not sign the notice on behalf of the court. The clerk issues the notice and signs it. You may sign the “prepared by” section if present. Always keep the issued copy with the court seal. Only serve an issued and sealed notice.

Schedules and attachments

Use schedules for longer document lists or special directions. Label them clearly. Refer to them in the body text. Paginate your package. Make it easy for the debtor to understand what to bring.

Remote or in‑person format

If the court sets a remote examination, include access details. Confirm they appear on the issued notice. If they do not, include a separate page titled “Hearing Access Details.” Serve that page with the notice. Test your connection before the date. If in person, confirm the room number. Bring printed copies.

What to do if information changes

If you learn better contact details for the debtor, update your service plan. If the debtor’s name or representative is wrong, fix the form before service. Ask the court to reissue if changes affect the person to attend. Do not alter an issued notice yourself.

Costs and fees

There is a filing fee for the notice. You can ask for those costs at the hearing. Keep receipts. The court may add them to the amount owing. If you hire a process server, track those costs too. The court may award reasonable service costs.

With careful preparation, Form 20H works well. You get facts from the source. You turn a paper judgment into real recovery steps. Follow the rules, serve properly, and stay focused on collection.

Legal Terms You Might Encounter

- Judgment creditor means the person or business who won the case and is owed money. You use Form 20H to call the debtor to an examination. It helps you learn about income, assets, and payment options.

- Judgment debtor is the person or business who owes the money under the court’s order. They receive Form 20H and must attend the examination. They may need to bring documents about their finances.

- Examination in aid of enforcement is a formal question-and-answer session under oath or affirmation. You use Form 20H to set the time and place. You ask about income, assets, expenses, and ability to pay.

- Service means legally delivering a copy of Form 20H to the person who must attend. You must serve it the correct way and on time. You usually file proof of service before the examination date.

- Affidavit of service is a sworn or affirmed statement confirming how and when you served Form 20H. It names who was served and by whom. The court relies on it to confirm proper notice.

- Attendance means showing up for the examination at the set date, time, and place. Attendance can be in person or by remote method if allowed. Form 20H records how the person must attend.

- Oath or affirmation is the promise to tell the truth during the examination. The debtor or representative gives evidence under oath or affirmation. False answers can lead to serious consequences.

- Representative is the person who attends on behalf of a business or organization. For a corporation, it may be a knowledgeable officer or employee. Form 20H identifies who must appear.

- Production of documents means bringing the records named in the notice. You can list pay stubs, bank statements, tax slips, or contracts. The goal is to verify finances and locate assets.

- Costs are fees and expenses linked to issuing, serving, and attending the examination. The court may add reasonable costs to the amount owed. Keep receipts and records tied to Form 20H.

FAQs

Do you need a judgment before using Form 20H?

Yes. Form 20H is for examining a debtor after you have a court order for payment. It helps you learn how the debtor can satisfy the amount owed.

Do you have to get a date from the court before serving the notice?

Yes. You book the appointment through the court office first. Use that confirmed date, time, and location in Form 20H, then serve it.

Do you need to serve the debtor in a specific way?

Yes. Service rules apply to Form 20H. Many courts require personal service on the debtor or a proper representative. Build in enough time for service and filing proof.

Do you have to attend in person?

Not always. Some courts allow remote examinations. If remote attendance is permitted, note that method in Form 20H and give joining details. Confirm any technology needs in advance.

Can you examine a corporation or business using Form 20H?

Yes. You can require a knowledgeable representative to attend. Name the business and specify who must appear. Ask for documents that only the representative can access.

What if the debtor ignores the notice and does not attend?

Tell the court clerk right away. The court may set a follow-up hearing or issue further directions. You may need to prove proper service with your affidavit of service.

Can you ask the debtor to bring specific documents?

Yes. List the documents in Form 20H or in an attachment. Be clear and specific, like recent pay stubs or bank statements. This keeps the examination focused and productive.

How often can you examine the same debtor?

It depends on whether you have new information or a real need. Repeat examinations without a good reason may be refused. If circumstances change, the court may allow a new examination.

Checklist: Before, During, and After the Form 20H – Notice of Examination

Before signing: gather information and plan

- Court file number and court location details.

- Full legal names of all parties, exactly as on the judgment.

- Current addresses, phone numbers, and emails for service and contact.

- Amount owing, including interest and any prior costs.

- Three or more possible dates, in case scheduling shifts.

- Preferred attendance method: in person, phone, or video if available.

- List of documents you want produced at the examination.

- Any interpreter needs. Include the language and dialect.

- Availability of you and any representative who will question the debtor.

- Service plan: who will serve, how, and by which deadline.

- Funds for fees and reasonable service costs.

- A folder for exhibits and your question outline.

- A draft affidavit of service template for your server.

During signing: verify every section of Form 20H

- The court name and address are correct.

- File number matches the judgment.

- Your name and contact details are accurate.

- Debtor’s full legal name and address are correct.

- If examining a business, the named representative is suitable.

- Date, time, and place of examination are confirmed with the court.

- The attendance method is stated and practical (with joining details if remote).

- The list of documents to bring is clear and specific.

- Any accessibility or interpreter notes are included.

- Service instructions and deadlines are realistic.

- Signature and date are in the correct boxes.

- Space for court seal or issuance is left as required.

After signing: file, serve, and track

- Ask the court to issue Form 20H and confirm the booking.

- Make copies: one for the debtor, one for you, one spare for court use.

- Serve the debtor and any required representative on time.

- Swear or affirm the affidavit of service once service is complete.

- File the affidavit of service by the court’s deadline.

- Calendar reminders for the examination date and arrival time.

- Prepare your questioning outline and supporting documents.

- Test technology if the examination is remote.

- Arrange interpreter services in advance if needed.

- Pack photo ID, the judgment, proof of service, and your exhibits.

- Bring a notepad or device to record answers and exhibits.

- After the examination, update your enforcement plan based on findings.

Common Mistakes to Avoid

- Don’t forget to confirm the appointment with the court before serving.

- Consequence: The notice may be invalid, and you lose time and fees.

- Don’t serve late or use the wrong service method.

- Consequence: The court may cancel the examination or refuse the next steps.

- Don’t name the wrong person for a corporate debtor.

- Consequence: No useful answers, wasted time, and a likely adjournment.

- Don’t skip listing documents you need.

- Consequence: You get incomplete information and must rebook or delay enforcement.

- Don’t ignore remote attendance details when required.

- Consequence: Connection issues or no-show, and the court may reschedule.

What to Do After Filling Out the Form – Form 20H – Notice of Examination

1) Get the appointment issued

- Take your completed Form 20H to the court office.

- Confirm date, time, and location or remote details.

- Ask the clerk to issue and seal the notice.

- Note any filing deadlines tied to service.

2) Serve the notice

- Serve the debtor and any required representative.

- Include all pages and any attachments, listing documents to bring.

- Use a method that meets service rules.

- Allow enough time before the examination date.

3) File proof of service

- Complete an affidavit of service with the server’s details and the method used.

- Swear or affirm the affidavit before a commissioner or authorized person.

- File it with the court by the deadline.

- Keep a stamped copy for your records.

4) Prepare for the examination

- Review the judgment, payment history, and any prior enforcement steps.

- Finalize your question list: income, assets, debts, expenses, and dependents.

- Organize exhibits: invoices, contracts, or prior correspondence.

- Confirm interpreter and accessibility arrangements if needed.

- Test remote access if the examination is not in person.

5) Attend and conduct the examination

- Arrive early with photo ID and your file.

- Confirm the debtor’s identity and administer oath or affirmation as directed.

- Ask focused, plain-language questions.

- Mark and keep a list of any documents produced.

- Clarify payment ability and timelines before you finish.

6) Record outcomes

- Write down key answers on income, assets, and employer details.

- Note any new addresses, phone numbers, or banking information provided.

- Record any agreed payment plan terms and dates.

- Keep copies of documents and label them clearly.

7) Take follow-up steps

- If you reached a payment plan, confirm it in writing.

- If the debtor can pay now, arrange payment under the court’s rules.

- If the debtor cannot pay, choose the next enforcement step based on what you learned.

- Typical options may include a garnishment or a seizure-and-sale process, if available.

- Calendar follow-up dates to track compliance or initiate enforcement.

8) Handle problems promptly

- If the debtor missed the examination, contact the court right away.

- File your proof of service if not already filed.

- Ask the clerk about the next available steps to address non-attendance.

- Keep notes of all attempts to contact and resolve issues.

9) Amendments and rescheduling

- If you need to change the date or details, contact the court quickly.

- Serve an amended notice if required.

- File updated proof of service.

- Confirm interpreter or remote needs still match the new date.

10) Keep organized records

- Store the issued Form 20H, affidavit of service, and any court-stamped copies.

- Keep your notes, exhibits, and any payment plan agreements together.

- Track costs tied to the examination for possible recovery later.

- Update your file so you can act quickly on new information.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.