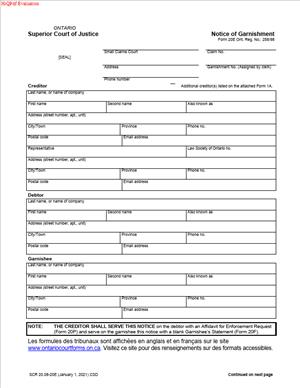

Form 20E – Notice of Garnishment

Fill out nowJurisdiction: Canada — Ontario

What is a Form 20E – Notice of Garnishment?

Form 20E is the Small Claims Court tool to collect on a judgment using garnishment. It tells a third party who owes the debtor money to pay the court instead. That third party is the garnishee. Common garnishees are employers and banks. The form comes from the Ontario Small Claims Court and is used under its enforcement rules.

You use this form after you win a money judgment. It enforces the judgment by redirecting money that would go to the debtor. The garnishee sends funds to the court. The court then pays you. You do not ask the debtor directly. You enforce payment through the court.

This is a post‑judgment enforcement step. You cannot file it before judgment. If the debtor appeals within the allowed window, there is a pause. Once enforcement is permitted, you can file this form.

Who typically uses this form?

Judgment creditors do. That includes self‑represented creditors, lawyers, paralegals, and collection staff. The debtor can be a person or a business. The garnishee can also be a person or a business. Employers and financial institutions are common garnishees.

Why would you need this form?

Use it when the debtor will not pay voluntarily. Use it when you have a judgment but need a reliable payment stream. It can be faster than seizing assets. It can be more predictable than waiting for the debtor to pay on their own. If the debtor has a steady job or an active bank account, garnishment is effective.

Typical usage scenarios include unpaid invoices, loans, or damages. A contractor wins against a homeowner and garnishes wages. A landlord wins against a former tenant and garnishes a bank account. A supplier wins against a small business and garnishes the business’s bank account. A professional wins against a client and garnishes a retainer account, if owed. All these use the same form.

The form covers both wages and other debts. With wages, the employer withholds a portion of each pay. With bank accounts, the bank freezes funds and pays the court up to the amount owing. With trade receivables, the customer of the debtor pays the court instead of paying the debtor. One form can address one garnishee. If you want to garnish more than one garnishee, you file separate notices.

When the court issues the Notice, it becomes an order to the garnishee. The garnishee must respond and pay as required. The court monitors payments. You track the balance and close the file when paid in full.

When Would You Use a Form 20E – Notice of Garnishment?

You use this form after you have a Small Claims Court judgment for money. You also use it after the appeal or stay period ends. If the judgment is payable by a schedule and the debtor defaults, you may garnish it. If the judgment allows immediate enforcement, you can proceed as soon as allowed.

Practical examples help. You are a tradesperson who won $9,800 for unpaid work. The debtor ignores your requests. You know the employer. You file a Notice of Garnishment against the employer. The employer then directs part of the debtor’s pay to the court. You receive payments until the judgment is paid.

You are a dentist owed $4,200 on a signed agreement. You win in Small Claims Court. The patient does not pay. You identify their bank and branch. You file a Notice of Garnishment against that branch. The bank pays funds from the account up to the amount owing.

You are a landlord with a judgment for $5,300 in rent and cleaning costs. The former tenant now works full-time. You file the Notice against the employer. You receive steady payments each pay period.

You are a wholesaler. A small business owes you $18,000. You discover a customer of that business who owes them $12,000. You file a Notice against that customer. The customer pays the court instead of the debtor’s business.

Typical users include landlords, contractors, professionals, retailers, and service providers. Self‑represented creditors can also use it. It is accessible and standard in Small Claims Court. It is also routine for paralegals and lawyers.

Use wage garnishment when the debtor has stable employment. Use bank garnishment when you know there are funds. Use receivable garnishment when you know a third party owes the debtor money. If you are unsure what assets exist, consider a debtor examination first. That can help you identify an employer or bank.

Legal Characteristics of the Form 20E – Notice of Garnishment

This form is legally binding once the court issues it. It becomes an order to the garnishee. The garnishee must respond and comply with it. If the garnishee does not comply, the court can take further steps. The court can order the garnishee to attend a hearing. The court can make a payment order against the garnishee. In serious cases, the court can enter judgment against a non‑compliant garnishee.

Enforceability comes from proper issuance and service. The court clerk issues the Notice after filing the required affidavit and fee. The Notice must then be served on the garnishee within strict timelines. It must also be served on the debtor soon after. Proof of service should be filed. Proper service puts the garnishee on legal notice and triggers obligations.

The Notice usually stays in force until the judgment is paid. It can remain active for several years from issuance. You can renew it if it nears expiry and money is still owing. You can also suspend, vary, or terminate it. The court can suspend or terminate it on motion. You can request a suspension if you agree to a payment plan. You must terminate it when the judgment is paid.

Wage garnishment has a cap. An ordinary creditor can receive up to 20% of the debtor’s wages. Wages are net of statutory deductions. Support orders follow different rules and higher caps. Ordinary creditors do not use those caps. The form itself does not set the percentage. The law sets the maximum. Employers apply the correct percentage and remit it to the court.

Not all income is garnishable. Social assistance is exempt. Many pensions and certain benefits are protected. Bank funds coming from exempt income can be complex. If you expect exemptions, consider legal advice. A debtor can bring a motion to reduce or stop garnishment. They can argue hardship, exemption, or error. The court can adjust the garnishment if appropriate.

You must name the correct garnishee. For banks, use the specific branch where the account is held. Using a head office when the account sits at a branch can fail. For employers, use the legal employer’s name and payroll address. For corporations, ensure proper legal names. For numbered companies, include the number. A mistake can render service invalid.

You must calculate the amount owing correctly. Include post‑judgment interest as the judgment sets out. Include court fees for issuing the Notice. Include reasonable service costs. Do not include unawarded legal fees. Keep a clear calculation so the clerk understands the total.

If there are multiple garnishments, priority rules apply. Earlier notices take priority over later ones. With wages, the total withheld cannot exceed the cap. The court may allocate funds by priority. Later notices may wait until the earlier one finishes. You can still file your Notice to hold your place.

Jurisdiction matters. The garnishee must be in Ontario for this Notice to bind them. An out‑of‑province garnishee is outside Small Claims Court reach. If the debtor banks at an out‑of‑province branch, this may fail. Focus on Ontario employers and Ontario bank branches.

Privacy matters as well. Serve only what the rules require. Do not include sensitive data beyond what is needed. Keep debtor identifiers secure. Use judgment details to support, not to embarrass.

How to Fill Out a Form 20E – Notice of Garnishment

Follow these steps. Work carefully. Accuracy speeds issuance and payment.

1) Confirm you can enforce now

- Check the judgment date. Confirm the appeal or stay period has passed.

- Confirm amounts paid to date. Update your balance.

- Confirm the debtor has wages, a bank account, or a receivable.

2) Identify the garnishee with precision

- For wages, confirm the employer’s exact legal name. Confirm payroll address.

- For banks, identify the branch where the account is held. Confirm the branch address.

- For trade receivables, identify the customer who owes the debtor. Confirm the amount they owe.

3) Gather required information and documents

- Court file number and court location from your case.

- Your name and address for service. Include email and phone if available.

- Debtor’s full legal name. Include any known aliases. Include the address for service.

- Garnishee’s correct legal name and address for service.

- Judgment details: date, amount, and interest rate stated in the judgment.

- A running balance. Include principal, interest to date, prior payments, and costs.

- Receipts for expected costs: court issuance fee and reasonable service costs.

4) Calculate the amount owing

- Start with the unpaid judgment principal.

- Add post‑judgment interest to today. Use the rate in your judgment.

- Subtract any payments received.

- Add the court fee to issue the Notice.

- Add reasonable process server or courier costs you plan to incur.

- Show a clean total. Keep a worksheet in case the clerk asks.

5) Complete the caption and parties

- Write the court file number exactly as on the judgment.

- Insert the correct court location.

- List you as the judgment creditor.

- List the debtor precisely as on the judgment.

- Insert the garnishee’s legal name and address.

6) Complete the money sections

- Enter the total outstanding amount on the date of issue.

- List the judgment date and interest rate.

- Set out the breakdown: principal, interest to date, and costs.

- If you expect ongoing interest, note that interest continues after issuance.

- Do not guess at wage percentages. The employer applies the legal cap.

7) Complete instructions to the garnishee

- For employers, the Notice tells them to pay a portion of wages to the court.

- For banks, the Notice tells them to pay funds in the account up to the total.

- For other garnishees, it tells them to pay amounts they owe the debtor.

- The form language sets this out. Ensure the court address for payment is correct.

8) Attach the Affidavit for Enforcement Request

- Complete and swear or affirm the affidavit. It supports issuance.

- Confirm the balance, interest, and costs in the affidavit.

- Attach a copy of the judgment if the clerk requires it.

- Sign before a commissioner for taking affidavits. Many court counters can assist.

9) File with the court and pay the fee

- File the Notice and the affidavit at the Small Claims Court that issued the judgment.

- Pay the issuance fee. Fees change, so check the current amount before filing.

- Ask the clerk when the Notice will be issued. Issuance creates the binding order.

10) Obtain the issued Notice and copies

- The clerk will issue and return copies to you.

- Make enough copies for service on the garnishee and the debtor.

- Keep one copy for your records.

11) Serve the garnishee promptly

- Serve the garnishee within a short deadline after issuance. Act within three days.

- Use a method allowed by the rules that proves delivery.

- Many creditors use personal service or a courier with tracking.

- Keep proof of service. Record the date and method.

12) Serve the debtor soon after

- Serve the debtor within a few days after serving the garnishee. Aim within five days.

- Use a permitted method for serving individuals or corporations.

- Keep proof of service. Record the date and method.

13) File proof of service

- File affidavits of service with the court for both parties.

- This helps the clerk track the file and deal with any disputes.

- Attach delivery confirmations or server affidavits.

14) Track and receive payments

- The garnishee pays the Small Claims Court office named in the Notice.

- The court records payments on your file.

- Request payment out from the court. Follow the court’s payout process.

- Update your balance after each payout.

15) Respond to garnishee statements or disputes

- The garnishee may send a statement of monies owed to the debtor.

- They may file a dispute note if they deny owing money.

- If they dispute, ask the court for a garnishment hearing.

- Prepare to prove the garnishee owes the debtor money.

16) Handle common issues

- If the debtor changes jobs, identify the new employer. File a new Notice.

- If the bank account is empty, try again later or target wages instead.

- If the debtor files a motion to reduce the garnishment, attend and respond.

- If you learn of exemptions, reassess your plan and consider alternatives.

17) Deal with multiple garnishments

- If another creditor has priority, your payments may wait.

- Your Notice still holds your place.

- Monitor the file and renew if needed before expiry.

18) Adjust, suspend, or terminate

- If you agree to a voluntary payment plan, consider a suspension of garnishment.

- If the judgment is paid in full, you must terminate the garnishment.

- File a notice of termination with the court and serve the garnishee.

- Confirm with the clerk that the file is closed.

19) Renew before expiry

- The Notice remains in effect for a long but limited period.

- If money is still owing near expiry, file for renewal.

- Do not let your Notice lapse if you still need it.

20) Keep records clean and current

- Keep a running ledger of principal and interest.

- Record every cost, service, and payment.

- This avoids disputes and speeds payouts.

Practical drafting tips help you avoid delays. Use full legal names. Avoid short forms for companies. For banks, attach a page with the branch address and account details you know. Do not include full account numbers if you do not have them. Describe the account type if possible. For employers, include the payroll or HR contact if known. For trade receivables, include the invoice number or contract reference.

Be realistic about costs. Add the court fee and reasonable service fees only. Do not add collection agency commissions unless the judgment awards them. Do not add interest beyond what the judgment allows. If you misstate the balance, the clerk may refuse to issue. Or the debtor may bring a motion to correct it.

Plan service before you file. Confirm how you will serve the garnishee and debtor. Book a process server if needed. Faster service leads to faster payments. Late service can delay or nullify your Notice.

Communicate with the garnishee when appropriate. After service, send a cover letter with your contact details. Clarify the court file and payment address. Do not negotiate a lower amount with the garnishee. They pay what the order requires. But you can help them remit correctly and on time.

Finally, stay professional. Garnishment is formal and structured. You are using a court order to get paid. Follow the steps and timelines. Keep your math clear. Serve properly. Monitor the file. Close it when paid. You can manage the process yourself if you prepare well. If the file becomes complex, consider getting legal help.

Legal Terms You Might Encounter

- Judgment creditor means you. You won an order for money. Form 20E lets you collect through a third party.

- Judgment debtor means the person or business who owes you money. You must list their exact legal name on the form. Spell it exactly as shown on the judgment.

- Garnishee means a third party that owes the debtor money. This is often an employer or a bank. You direct the garnishee to pay you instead.

- Notice of Garnishment is the court-issued form that starts garnishment. It tells the garnishee to pay money to the court. It also tells the debtor that money will be taken.

- Debt owing refers to money the garnishee owes the debtor. This includes wages, bank balances, or other sums payable. The form must describe what kind of debt you seek.

- Periodic debt is a repeating payment, like wages. Garnishments of periodic debts continue until the judgment is paid or the notice expires. The form must identify the pay cycle if known.

- Lump sum debt is a one-time amount, like a bank balance. Once seized funds reach the court, that payment can be applied to your judgment. You may still collect more if the balance remains.

- Exemptions mean amounts that the law protects from seizure. Some income or a portion of wages may be exempt. Your form should not overreach what the law allows.

- Priority means who gets paid first when there are competing claims. Certain orders may rank ahead of your garnishment. The garnishee must follow those priorities.

- Interest and costs are amounts added to the judgment. Your form should show the updated total, including interest and allowable costs. Use the current figures, not the original judgment only.

- Service means officially giving documents to the garnishee and the debtor. You must serve the issued notice as the rules require. Keep proof of service.

- Dispute or garnishee’s statement is the garnishee’s reply. The garnishee must confirm what money is owing, or explain why none is owed. Watch for this response after service.

- Expiry means the notice works only for a set period. The form will indicate its effective period. You may need to renew or reissue it if it expires.

FAQs

Do you need a judgment before filing a Notice of Garnishment?

Yes. You must have a money judgment or enforceable order first. The court will not issue Form 20E without it. Confirm the exact balance with interest and costs before you file. You will use that updated number on the form.

Do you have to know the debtor’s employer or bank?

Yes, for garnishment to work. You must name a specific garnishee, like an employer or bank branch. If you do not know this, gather that information first. You can review past cheques, invoices, or emails for clues. You may also request the debtor’s employment or banking details through other lawful steps in your case.

Do you serve both the garnishee and the debtor?

Yes. After the court issues the notice, you must serve both. The garnishee needs the notice to start paying the court. The debtor must receive a copy as well. Follow the service rules exactly. Keep proof of how and when you served each party.

Do wages and bank funds follow the same rules?

No. Wages are periodic and may be subject to exemptions. An employer pays overtime on paydays. Bank funds are usually lump sums available on service. Different timing, exemptions, and priorities can apply. Your form should identify the kind of debt for each garnishee.

Do you need to file anything after the service?

Often yes. You may need to file proof of service. You should also monitor the garnishee’s response. If the garnishee does not reply or pay, consider your options. You may request a garnishment hearing or take other permitted steps.

Do you have to stop garnishment when the judgment is paid?

Yes. Once paid in full, you must stop garnishment. Send a written notice to the garnishee to discontinue further deductions. Inform the court as required. Keep records of the final accounting.

Do support or government debts affect your garnishment?

They can. Some claims have statutory priority. The garnishee must follow priority rules. If there is a higher-priority deduction, your payments may be reduced or delayed. You should adjust your expectations and tracking.

Do you need to renew the Notice of Garnishment?

You may. The notice is effective for a defined period. If the judgment is not paid within that time, you can request a renewal or reissue. Check the form’s expiry and the rules before the deadline. Do not let it lapse if you still need it.

Checklist: Before, During, and After the Form 20E – Notice of Garnishment

Before signing:

- Confirm your judgment. Note the date and court file number.

- Calculate the current balance. Include interest and allowable costs.

- Identify the garnishee. Get the exact legal name and address.

- Confirm the type of debt. Wage, bank, or other money owing.

- Gather debtor details. Full legal name, addresses, and any known identifiers.

- Confirm any known priorities. Support orders or other deductions.

- Prepare your service plan. Choose valid service methods for each party.

- Set up your record-keeping. Create a ledger for amounts and dates.

- Have payment info ready. You will need to pay the filing fee.

During signing:

- Verify the names. Use the exact legal names for all parties.

- Check the court file number and judgment date.

- Confirm the total claimed. Match your interest and cost calculations.

- Specify the garnishee’s address. Use an address that can accept service.

- Describe the debt clearly. State wage, bank account, or other.

- Review the requested periodic deductions. Ensure they are lawful and realistic.

- Read the declaration. Confirm all details are true and complete.

- Sign and date where required. Use your correct contact information.

After signing:

- File the form with the court. Pay the required fee.

- Obtain the issued notice. Verify any court markings and the expiry.

- Serve the garnishee and the debtor. Follow accepted methods and deadlines.

- File proof of service if required. Keep originals in your records.

- Calendar follow-up dates. Track expected responses and payment dates.

- Monitor payments. Reconcile amounts received with your ledger.

- Respond to any disputes. Prepare for a hearing if needed.

- Update balances. Reduce the claim as payments arrive.

- Discontinue when paid in full. Notify the garnishee and the court.

Common Mistakes to Avoid Form 20E – Notice of Garnishment

- Listing the wrong garnishee. If you name the wrong employer or bank, you get no funds. Use exact legal names and correct addresses. Don’t guess.

- Overstating the claim. If you include the wrong interest or costs, the clerk may refuse it. Even if issued, the garnishee or debtor may challenge it. Calculate carefully.

- Ignoring exemptions and priorities. If you claim more than allowed, payments may be reduced or stopped. You could face delays or a hearing. Don’t forget protected amounts.

- Missing service steps. If you fail to serve properly, the garnishment stalls. The garnishee has no duty to pay. Serve both parties and keep proof.

- Letting the notice expire. If you do not renew or reissue, deductions end. You may lose momentum while collecting. Calendar the expiry and act early.

What to Do After Filling Out the Form 20E – Notice of Garnishment

- File the form and pay the fee. Get a court-issued notice with the court seal. Check the file number, amounts, and any expiry date on the notice.

- Serve the garnishee first. They need the notice to start holding money. Use a method the rules allow. Record the date and method of service. Then serve the debtor. They must receive a copy too.

- File your proof of service if required. Attach any affidavits or confirmations. Keep certified mail receipts or courier records if used. Store everything in a dedicated folder.

- Track the garnishee’s response. They should confirm whether money is owed to the debtor. For wages, expect deductions on the next pay cycle. For bank funds, expect a lump sum hold and remittance.

- Reconcile payments. The garnishee pays the court. The court applies funds to your file. You may receive the money after processing. Update your ledger after each payment. Deduct interest and costs as allowed. Keep a running balance.

- Address non-payment. If the garnishee ignores the notice, consider your options. You can request a garnishment hearing or seek further directions. Bring your proof of service and records. Be ready to show the balance owing.

- Handle disputes. If the garnishee says no money is owed, review their reasons. The debtor may also claim exemptions. You can ask for a hearing to resolve disputes. Bring payslips, bank statements, or other proof if you have them.

- Manage changing facts. If the debtor leaves the employer, deductions stop. If the bank account closes, you get no funds. You may need to identify a new garnishee. You can file a fresh notice to target a new source.

- Keep the notice current. Watch the expiry date on the notice. If the balance remains and the notice will expire, act early. Apply to renew or reissue as the rules allow. Do not let it lapse if you still need it.

- Stop when paid. When the judgment and interest are fully paid, discontinue. Send a written notice to the garnishee. Tell them to stop deductions. Inform the court that the judgment is satisfied. Keep proof of all final steps.

- Close out your records. Save the court receipts and payment records. Keep the ledger and final balance. Archive your proof of service and correspondence. Good records protect you if questions arise later.

- Amendments and corrections. If you made a clerical error, act quickly. Ask the court about correcting or reissuing the notice. Serve any corrected documents again if needed. Update the garnishee and debtor promptly.

- Distribute recovered funds. When funds are released to you, apply them to principal, interest, and costs as permitted. If multiple creditors exist, respect priority rules. Document every distribution.

- Contingency planning. If garnishment yields little, consider other enforcement tools. Review whether other assets or payors exist. Keep monitoring for employment changes or new accounts. Rotate your strategy as needed.

- Final audit. When the matter is complete, do a final review. Confirm the court balance shows zero. Confirm you sent the discontinuance. Store the file securely for your records retention period.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.