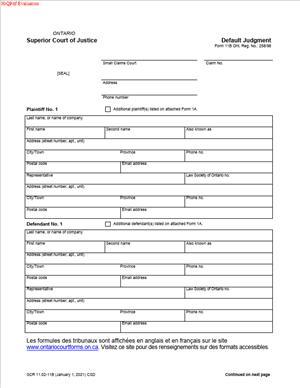

Form 11B – Default Judgment

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 11B – Default Judgement?

Form 11B is the document you use to ask the Ontario Superior Court of Justice to record a default judgment against a defendant who failed to defend your claim. In plain terms, it is the form that turns a defendant’s silence into a court order. If the defendant does not serve and file a defence by the deadline, you can proceed to default. This form captures the relief you want the court to grant when the other side has not responded.

Default judgment is a procedural step. It does not re‑argue your claim. It confirms that the defendant did not defend and records the result that flows from that failure. If your claim is for a fixed amount of money, the registrar can sign the judgment based on your paperwork. If your claim is for damages that need proof, you first get the defendant noted in default. Then the court schedules an assessment of damages. Form 11B is the instrument that records the default judgment at the end of those steps.

Form 11B belongs to the Ontario Superior Court of Justice. You use it in civil cases that start there, including cases on the ordinary civil list and matters under that court’s Small Claims branch when applicable practice permits. The form aligns with the court’s rules. It ensures your file contains a clear, enforceable order that other enforcement offices will act on.

Who Typically Uses This Form?

You use this form if you are the plaintiff and the defendant has failed to deliver a defence in time. You can be a business owner who sued for unpaid invoices. You can be a landlord suing on a commercial lease. You can be a contractor suing for a fixed contract balance. You can be an individual seeking damages after a defendant ignored your claim. Law firms use this form often. Self‑represented litigants use it as well, provided they follow the steps.

Why would you need this form?

You need Form 11B to convert a default into a binding order. Without a default judgment, you cannot enforce your claim. A noted default on its own is not a judgment. Form 11B, supported by the right proof, lets the registrar or a judge sign an order. Once signed, you can garnish wages, seize assets, or register a writ. If your claim is for unliquidated damages, Form 11B records the judgment after damages are assessed.

Typical usage scenarios

You sent a statement of claim for $45,000 to a customer who never paid. You served it properly. The defence deadline passed. You filed proof of service. You asked to note the defendant in default. Now you complete Form 11B to have the registrar sign a default judgment for the amount due, pre‑judgment interest, and costs.

You sued a former employee for breach of a restrictive covenant. The relief is not a fixed sum. The defendant did not defend. You had the defendant noted in default. You attended an assessment hearing to prove damages. The judge directed judgment for a set amount. You use Form 11B to record the default judgment consistent with that direction.

You sued for non‑payment under a promissory note with a clear interest rate. No defence arrived. You proceed by default. Form 11B sets out principal, interest under the note, and your filing costs. The registrar reviews your affidavit and signs the judgment.

When Would You Use a Form 11B – Default Judgement?

You use Form 11B after the deadline to defend has expired and the defendant has not delivered a defence. In Ontario, that defence deadline is usually 20 days if the defendant was served in Ontario. It is usually 40 days if served elsewhere in Canada or the United States. It is usually 60 days if served outside Canada and the United States. If the parties agreed to a different timeline or the court ordered one, use that instead. You should ensure the deadline has passed on the calendar before you proceed.

You also use Form 11B when the defendant has been noted in default. Noting in default is a separate administrative step. It confirms that the defendant did not defend in time. You should file proof that you served the claim and that the defence deadline passed. Once noted in default, the defendant loses the right to take most further steps unless the court sets the default aside. You can then seek a default judgment. If your claim is for a fixed sum and meets the requirements for registrar‑signed judgment, you include the needed proof and ask the registrar to sign. If your claim needs an assessment, you obtain a hearing date. After the hearing, you complete Form 11B to reflect the court’s decision.

Typical users include small businesses owed for goods or services. Landlords and commercial property managers seeking arrears and contractual charges. Lenders enforcing unpaid loans or guarantees. Homeowners suing contractors for deposits where the amount is clear. Professionals collecting fees under written retainers. Insurers and subrogated claims teams enforcing deductibles or contribution claims. Individuals seeking damages in tort may also proceed by default when a defendant ignores the claim, but they will often need an assessment of damages before judgment can be entered.

You should not use Form 11B if the defendant delivered a defence, even if late, unless the court orders otherwise. You should not use it if you did not serve the claim properly. You should not use it if your claim asks for relief that cannot be granted on default without evidence, such as certain declarations or injunctions. In those cases, seek advice and consider a motion for judgment instead.

Legal Characteristics of the Form 11B – Default Judgement

A default judgment signed by the registrar or judge is a binding court order. It has the same force as a judgment after a contested hearing. It becomes enforceable once issued and entered by the court office. You can enforce it through standard enforcement methods. These include garnishment, writs against land or personal property, and examinations in aid of execution. The enforcement office will require a certified copy or an electronic version from the court file.

Enforceability depends on strict compliance with the court’s rules. Proper service of the statement of claim is essential. The deadline to defend must have passed. The defendant must be noted in default before a default judgment is recorded, unless the court directs otherwise. Your affidavit evidence must support the amounts you claim. For a fixed amount, which includes invoices, contracts, or account statements. For interest, you must identify the rate and the period claimed. If the contract sets a rate, you state it and show how you calculated it. If not, you apply the standard court rate and show the calculation. For costs, you claim allowed fixed costs and your disbursements, such as filing fees and process servers.

For non‑monetary or unliquidated claims, the court will not sign a judgment without proof. You will need an assessment of damages or a motion with supporting affidavits. After the court assesses damages, Form 11B records the result. The judge may sign the judgment directly or endorse your form.

A default judgment can be set aside. The defendant can ask the court to undo the default and allow a defence. The court looks at the reason for the default, whether the defendant moved quickly, whether there is a possible defence, and any prejudice to you. This is a discretionary decision. You cannot prevent the defendant from bringing that motion. But you can reduce the risk by ensuring your service, timelines, and calculations are correct. Courts are less likely to set aside a default that followed proper procedure and clear notice.

You have duties of candour in default proceedings. You must provide fair and accurate information. You must not overreach on amounts. The court relies on your evidence. If you overstate amounts, the registrar can refuse to sign or seek a judge’s review. That delays enforcement. It also undermines credibility if the defendant later moves to set aside.

Finally, certain defendants require extra care. If the defendant is a person under disability, you cannot proceed by default without taking steps to protect their interests. If you sued a government body, special service and proof rules may apply. If there are multiple defendants, a default judgment against one may be limited where the relief is joint or dependent on others. Review your pleadings to ensure you frame the requested relief correctly.

How to Fill Out a Form 11B – Default Judgement

Follow these steps. Keep your sentences clear. Show your math. Attach the right evidence. If in doubt, ask the court office which supporting documents they expect in your location.

1) Confirm prerequisites

- Confirm proper service of the statement of claim. Have your affidavit of service ready.

- Confirm the defence deadline has passed. Count from the date of service.

- If the defendant did not defend, file a request to note the defendant in default. Get confirmation.

- Decide if your claim is for a fixed sum or needs an assessment.

- If a fixed sum, prepare your affidavit and calculation sheet.

- If unliquidated, complete your assessment first, then return to this form.

2) Complete the heading (top of the form)

- Court file no.: Enter the court file number exactly as on your claim.

- Court office address: Use the same court location where your claim was filed.

- Title of proceeding: List parties as “Plaintiff” and “Defendant” in the same order as your claim.

- Seal box: Leave space for the court’s stamp if the form has one.

3) Identify the parties and representation

- Plaintiff name and contact: Full legal name, address for service, phone, and email.

- Plaintiff’s lawyer: Name, firm, address, phone, email, and Law Society number, if applicable.

- Defendant name: Full legal name and last known address. If a corporation uses the corporate name.

- Defendant’s status: State that the defendant has not delivered a defence.

4) State the default basis

- Insert a paragraph like: “The defendant was served with the Statement of Claim on [date] by [method]. The time for delivery of a defence has expired. The defendant has not delivered a defence. The defendant was noted in default on [date].”

- Reference your proof: “See attached Affidavit of Service sworn [date]. See Registrar’s notation of default.”

5) Set out the relief you seek

- For fixed sum claims, list:

- Principal amount owed.

- Pre‑judgment interest rate and period.

- Costs (fixed costs and disbursements).

- Total as at the date of judgment.

- For non‑monetary relief or assessed damages:

- Recite the court’s direction from the assessment.

- Set out the damages amount and any specific orders.

Use clear, plain text. Example: “Judgement for the plaintiff in the amount of $27,540.00, being $25,000.00 principal, $1,740.00 pre‑judgment interest to [date], and $800.00 in costs and disbursements.”

6) Detail the monetary breakdown

- Principal: State the contract or invoice basis. Example: “Unpaid invoices dated [list dates] totaling $25,000.00.”

- Pre‑judgment interest: If your contract sets a rate, state it. Example: “Interest at 12% per annum from [date] to [date]. Total interest: $1,740.00. See Schedule A for calculation.” If no contract rate, state “at the court rate” and show your calculation.

- Costs: Claim the allowed fixed costs for default, plus disbursements. Common disbursements include:

- Issuing fee for the claim.

- Process server fees.

- Document copying and service costs.

- Noting in default fee, if any.

- Motion or assessment fee, if applicable.

State each item and amount. Attach receipts where helpful.

- Post‑judgment interest: Request post‑judgment interest at the applicable rate. State the rate and when it starts. Example: “Post‑judgment interest at [rate]% per annum from the date of judgment until paid.”

7) Attach supporting schedules

Create schedules to keep the form clean. Label them clearly.

- Schedule A: Interest calculation sheet. Show start date, end date, rate, and formula. If the rate changed during the period, split the periods.

- Schedule B: Costs and disbursements. List each item with amounts and dates.

- Schedule C: Account summary. Include invoices, statement of account, or loan statement showing the balance.

- Schedule D: Affidavit for default judgment. Sworn by you or someone with knowledge. Attach the claim, proof of service, proof of default, and any key exhibits.

8) Include the affidavit evidence

Your affidavit should cover:

- Your role and knowledge of the account or claim.

- How and when the defendant was served.

- That no defence was delivered by the deadline.

- That the defendant was noted in default.

- The amount owing, with a clear calculation.

- The basis for interest and the period claimed.

- The costs and disbursements you seek.

- That the amounts remain unpaid as of the swearing date.

If the claim is for unliquidated damages, refer to the court’s direction after assessment. Attach the endorsement or reasons if available.

9) Address multiple defendants, if any

- If there are multiple defendants and you seek judgment against one, say so. Example: “This judgment is sought only against [Defendant A]. Proceedings continue against [Defendant B].”

- If liability is joint and several, state that language in the relief.

- If you discontinued against some defendants, attach the notice of discontinuance.

10) Consider special defendants

- If the defendant is an individual under disability, pause and seek direction before default.

- If the defendant is a partnership, ensure you name and serve the firm and partners properly.

- If the defendant is a corporation, confirm that you used an accepted service method. Note the corporation’s legal name.

11) Fill in the signature and approval lines

- Plaintiff or lawyer signature: Sign and date where indicated. Print your name below your signature.

- Registrar or judge signature: Leave the signature line for the court. Ensure the form includes a line for the registrar or judge to sign and date.

- Order language: Include the standard “THIS COURT ORDERS THAT…” section if the form requires it.

12) Serve the default judgment after issuance

- After the court signs, serve a copy on the defendant. Use mail or email if permitted. Keep proof of service. This is not always required for enforceability, but it is best practice and may be required in some situations.

13) File for enforcement

- Request a certified copy if needed.

- Register a writ of seizure and sale against land if appropriate.

- Consider garnishment if you know the defendant’s employer or bank.

- If you need information on assets, schedule an examination in aid of execution.

14) Common pitfalls to avoid

- Wrong interest rate or period. Check your math.

- Claiming costs beyond what the default allows without a judge’s approval.

- Missing proof of service or incomplete affidavit.

- Seeking relief not pleaded in your statement of claim.

- Proceeding to default when a defence was delivered but not yet filed. Confirm the court file and your records.

15) Practical examples of properly completed sections

- Basis for default: “The Statement of Claim was served personally on the defendant on April 3, 2025. The time to deliver a defence expired on April 23, 2025. No defence was delivered. The defendant was noted in default on April 29, 2025.”

- Relief clause for liquidated claim: “Judgement for the plaintiff, ABC Supplies Inc., against the defendant, XYZ Retail Ltd., in the amount of $38,462.50, being $36,000.00 principal, $1,512.50 pre‑judgment interest calculated at 6% per annum from January 1, 2025 to May 1, 2025, and $950.00 in costs and disbursements. Post‑judgment interest at 6% per annum from May 1, 2025, until paid.”

- Relief clause after assessment: “Judgement for the plaintiff in damages of $75,000.00, as assessed on April 10, 2025, plus costs of $3,500.00 and pre‑judgment interest as directed.”

16) Formatting and submission tips

- Use the court’s current version of Form 11B.

- Type all entries. Avoid handwritten amounts if possible.

- Match party names exactly as on the claim.

- Include page numbers and headings on schedules.

- File electronically if your court location accepts e‑filing. Otherwise, bring paper copies and a USB if accepted.

- Bring an extra copy for your records. Have a copy that the registrar can sign and return.

17) After judgment: next steps and calendar reminders

- Diary the date you served the judgement on the defendant.

- Monitor for any set‑aside motion within a reasonable time. Keep your file organized for a quick response.

- Start enforcement promptly. Delay can reduce recovery.

- Update interest monthly. Keep a running total for enforcement forms.

By following these steps, you present a clean, supported Form 11B. You make it easy for the registrar or judge to sign. You also protect your judgment against later challenges. Focus on clarity, proper service, accurate calculations, and relief that matches your pleading. That is what gets default judgments granted and enforced.

Legal Terms You Might Encounter

- Default means the defendant missed a required step. Most often, they did not deliver a defence in time. Form 11B relies on the default. You use it only after the defendant’s deadline passes without a response.

- Noted in default means the court has recorded the defendant’s default. You usually request this before seeking judgment. Form 11B depends on that status. You confirm that the defendant is noted in default in your materials.

- Registrar refers to court staff who process filings and certain judgments. In some claims, the registrar can sign a default judgment. Form 11B directs the registrar to issue the judgment if you qualify.

- Liquidated damages are a fixed or easily calculable amount. Think invoices, a promissory note, or a set account balance. If your claim is liquidated, the registrar can often sign a default judgment using Form 11B.

- Unliquidated damages are not a fixed amount. Examples include pain and suffering or business losses. These require an assessment of damages. Form 11B can help you get a judgment on liability and set an assessment.

- Proof of service shows you delivered your claim properly. You attach an affidavit of service to confirm delivery details. Form 11B assumes valid service before default. The registrar will look for that proof.

- Affidavit is a sworn statement of facts. It supports your request for judgment. For money claims, your affidavit states the amount, interest, and costs. It also confirms the default facts tied to Form 11B.

- Requisition is a short request to the registrar. You use it to ask for an administrative step. In default cases, the requisition can accompany Form 11B. It frames what you want the registrar to do.

- Prejudgment interest compensates for the time until judgment. You calculate it from the date your loss began. Form 11B lists the amount you claim. You show your rate and the calculation period.

- Costs are your legal expenses allowable on judgment. They can include fees and some disbursements. Form 11B sets out the costs you seek. You include a short outline or bill of costs.

- Set aside the default judgment means undoing the judgment. A defendant can ask the court to reopen the case. They must show reasons, like a lack of notice or a real defence. Your Form 11B judgment can be challenged this way.

FAQs

Do you need to note the defendant in default first?

Yes. You usually need the court to note the defendant in default before seeking judgment. This confirms they missed the deadline. It also clears the way for Form 11B. Without that notation, the registrar may refuse your request.

Do you qualify for a registrar’s default judgment on a money claim?

You do if your claim is for a specific amount that is provable on paper. That includes set invoices, agreements to pay, or an account stated. You must attach evidence and your affidavit. If the amount is uncertain, you likely need an assessment.

Do you need to serve the defendant with Form 11B?

You do not normally serve Form 11B before the registrar signs. You do serve the resulting default judgment after filing. Service of the judgment starts the timelines for any response or motion. Keep proof of that service.

Do you include interest and costs on Form 11B?

Yes. You can include prejudgment interest and postjudgment interest if allowed. You can also claim costs. Keep calculations clear and attach working papers. The registrar may adjust amounts if they are not supported.

Do you use Form 11B for multiple defendants?

You can, but watch each defendant’s status. If one defendant defends, you cannot take a default judgment against that party. You may still proceed against a non‑responding defendant. Explain the status of each defendant in your affidavit.

Do you still file Form 11B if damages need assessment?

Yes. You can ask for judgment on liability and an assessment for damages. The registrar can note judgment and direct an assessment hearing. You provide evidence supporting the need for assessment. The court will schedule the next steps.

Do you need original documents to prove a liquidated claim?

You should file clear copies with your affidavit. Include contracts, invoices, and ledgers. If the registrar questions authenticity, you may need originals at hand. Keep them available in case the court requests them.

Do you lose your right if the defendant files late?

Not automatically. If a defence arrives before the registrar signs, you usually cannot take a default judgment. If the defence is late and you have already obtained judgment, the defendant must seek to set it aside. The court will decide based on the facts.

Checklist: Before, During, and After the Form 11B – Default Judgement

Before you sign

- Court file number and correct court location.

- Proof that the defendant was served with the claim.

- Affidavit of service with accurate dates and methods.

- Evidence that the deadline to defend has passed.

- Confirmation that the defendant is noted in default.

- Affidavit supporting the amount claimed.

- Contracts, invoices, statements, or payment schedules.

- Interest calculations with rate and calculation dates.

- Costs outline and receipts for disbursements.

- Draft judgment terms that match the claim.

- Current addresses for all parties for service of judgment.

- Any prior orders affecting default or timelines.

During signing

- Names of parties match the claim exactly.

- Defendant’s legal name and capacity are accurate.

- Amounts match your affidavit and exhibits.

- Interest start date, rate, and end date are correct.

- Postjudgment interest requested, if applicable.

- Costs amount reflected and supported by evidence.

- Relief language mirrors the pleaded claim.

- Details of any assessment hearing request are clear.

- Signature and date in all required places.

- If swearing an affidavit, ensure proper commissioning.

- All exhibits are labeled and referenced correctly.

- No blanks or conflicting numbers in the form.

After signing

- File Form 11B, affidavit, and exhibits with the court.

- Pay any required filing fees.

- Obtain the signed default judgment from the registrar.

- Serve the judgment on the defendant and any other party.

- File proof of service of the judgment.

- Calendar any assessment hearing for unliquidated damages.

- Record the judgment details in your file system.

- Store certified copies in secure digital and physical folders.

- Start enforcement planning if payment is not received.

- Monitor for any motion to set aside by the defendant.

- Track interest accrual and update the outstanding balance.

- Maintain a log of all post‑judgment steps and timelines.

Common Mistakes to Avoid

- Don’t forget to provide proper service. If the service was defective, the registrar can refuse the judgment. The defendant can also move to set it aside later.

- Don’t overstate interest or costs. Unsupported amounts invite reductions or refusal. Provide clear calculations and backup.

- Don’t mix liquidated and unliquidated amounts without clarity. The registrar may reject the request. Separate fixed sums from amounts needing assessment.

- Don’t ignore co‑defendant statuses. Proceeding against a defendant who defended can derail your request. Explain each defendant’s status.

- Don’t leave gaps in your affidavit. Missing dates or exhibits cause delays. The registrar needs a complete record to sign.

What to Do After Filling Out the Form

- File the form and your supporting affidavit with the court. Include all exhibits. Pay the filing fee. Ask the registrar to review and sign the judgment.

- If your claim is liquidated, the registrar can often issue the judgment. Confirm the signed judgment is complete. Check amounts, interest, and costs. Verify names and the court seal.

- If damages need assessment, request judgment on liability and an assessment. The court will schedule an assessment hearing. Prepare your evidence on quantum. Line up witnesses and documents.

- Serve the signed judgment on the defendant. Use a reliable method allowed by the court. File proof of service. This starts key timelines for any response.

- If you spot an error in the judgment, act quickly. Ask the court about the process to correct or amend. You may need a short motion or a correcting order. Do not alter a signed judgment yourself.

- If the defendant contacts you to pay, document all arrangements. Confirm amounts owing as of the payment date. Track interest and costs carefully. Provide receipts for any payments made.

- If payment does not come, consider enforcement options. You can choose one or more methods. Pick steps that match the defendant’s assets and location. Keep costs proportional to the amount owed.

- Watch for any motion to set aside. Gather your service proof and affidavits. Be ready to explain timelines and evidence. Keep your file organized for a quick response.

- Maintain a post‑judgment checklist. Update balances after each payment or cost. Record interest accrual monthly. Archive all correspondence and court steps. A clean record supports enforcement and any future court review.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.