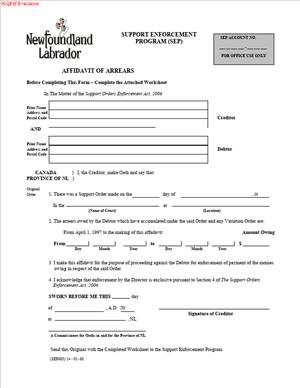

Affidavit of Arrears

Fill out nowJurisdiction: Country: Canada | Province or State: Newfoundland and Labrador

What is an Affidavit of Arrears?

An affidavit of arrears is a sworn statement. It sets out the amount of money unpaid under an existing legal obligation. In Newfoundland and Labrador, you most often see it in support cases. That includes child support and spousal support. The affidavit states how much is owed, how you calculated it, and the records you relied on. You sign it under oath or affirmation before a commissioner for oaths or a notary public.

You use this form to prove arrears to a decision-maker. That decision-maker might be a court or an enforcement office. The affidavit does not create a debt. The debt already exists under a court order or written agreement filed with a court. The affidavit organizes the facts and attaches the proof. It gives the court a clear ledger of what should have been paid and what actually was paid.

Who typically uses this form?

People who receive support use it often. Lawyers use it. Enforcement officers may use it, too. You might also use it as a payor who disputes the amount claimed. In that case, you swear your own affidavit and attach your records. The important part is that you have first-hand knowledge of the records or access to reliable business records.

Why would you need this form?

You need it to move enforcement forward. If the other party is behind, you must show the exact arrears. Courts and enforcement offices rely on sworn evidence for accuracy. The affidavit also helps avoid disputes. It lays out dates, amounts due, payments received, and the running balance. It helps everyone see the same numbers.

Typical usage scenarios

You are owed support and have not received it on time. You want a payment order, a default hearing, or a garnishment. The court asks for a sworn arrears figure as of a certain date. You prepare this affidavit and attach a ledger. Or, you are preparing to register arrears for civil enforcement. You need a clear statement and proof of the balance. You file the affidavit with the court registry. You serve it on the other party if required.

Although support cases are the most common, the concept is broader. You can use a similar form to confirm arrears under other enforceable orders. That might include periodic payments required by a judgment. The core idea is the same. You set out what the order says, what was due, what was paid, and what remains unpaid.

When Would You Use an Affidavit of Arrears?

You use this form any time you need to prove a past-due amount under an existing order or approved agreement. In family matters, use it when payments have fallen behind. For example, your order sets monthly child support at the start of each month. Payments stopped three months ago. You now want a hearing to address the default. The court wants a reliable total as of a date close to the hearing. You swear the affidavit with a schedule showing the three missed months, any partial payments, and the current balance.

You might also use it when you ask for specific enforcement steps. A garnishment of wages or bank funds usually needs a clear debt amount. You present the affidavit with your application. The affidavit shows your math and your proof. The enforcement officer or court can then act on the figure.

You could need it when arrears are old and complex. Maybe payments were on and off over the years. The order changed once or twice. You have receipts, bank statements, and records from an enforcement office. The affidavit lets you bring those records together in an organized way. You explain each change to the payment amount and show how you applied payments. You give a total as of a fixed date. That helps the court sort out the history.

If you are the person who pays support, you might use it to correct the record. Perhaps some payments were made directly and not recorded. You prepare your own affidavit. You attach receipts and bank proof. You show which months you paid and where credits should apply. The court compares the affidavits and the attached records.

Lawyers and paralegals use this form to support client applications. They ensure the content is complete and the exhibits are legible. Enforcement staff may also swear affidavits of arrears. They do so when they maintain official payment records. In those cases, they state how the records are kept and why they are reliable.

You might use an affidavit of arrears when you seek a variation. The court needs the arrears picture to decide how to deal with any change. The current arrears figure helps the court plan a payment schedule or set conditions. The affidavit keeps the record clear and current.

Legal Characteristics of the Affidavit of Arrears

An affidavit is sworn evidence. It is not a contract and not an order by itself. It becomes part of the legal record in your file. Because you swear or affirm it, the law treats it seriously. False statements can lead to penalties. The oath or affirmation and the commissioner’s jurat make the document valid as evidence.

What gives this affidavit legal weight?

It is how you prepare and swear it. You must tell the truth and rely on accurate records. You must swear before a person authorized to take oaths in Newfoundland and Labrador. That includes a commissioner for oaths or a notary public. The commissioner completes the jurat. The jurat states the place, date, and how you swore or affirmed. It also identifies the commissioner.

Enforceability does not mean the affidavit itself forces payment. Enforceability means the court or enforcement office can rely on it. They can use it to issue orders and writs. If the math is right and the records are attached, the court can order payment of the arrears. The same applies to garnishments. The affidavit supports the amount to be seized.

Courts look for a few basic features. First, the style of the cause and file number must match your case. Second, the order or agreement must be attached. That shows what was due and when. Third, the ledger must be clear and complete. It should show every due date in the period and every payment. Fourth, the affidavit must explain any changes to the payment amount. For example, if the order indexed support each year, explain how you applied the change.

Interest can be part of arrears only if allowed. That could be set in order or allowed under the law. If you claim interest, say so. State the rate and how you calculated it. Attach a calculation schedule. If no interest applies, say you are not claiming interest. Do not assume interest unless you are sure it applies.

Privacy matters. Include only what the court or enforcement office needs. Use full legal names and addresses as required. Do not include social insurance numbers in exhibits. Redact bank account numbers except for the last few digits if needed to identify a deposit.

Timing matters. The arrears total is always “as of” a date. Pick a clear date. Explain what payments, if any, came in after that date. Courts dislike moving targets. If time passes before the hearing, you may need an updated affidavit. You cannot edit a sworn affidavit. You must swear a fresh one with an updated schedule.

Finally, remember the limit of your knowledge. If you are the recipient, you know what you received directly. You may also have statements from an enforcement office. If you rely on those business records, say so. State that the records are kept in the normal course of business. Attach the records. If you are the payor, attach your bank proof or receipts. Identify each payment by date, amount, and method.

How to Fill Out an Affidavit of Arrears

Follow these steps to prepare a clear, complete affidavit:

1) Gather your documents

- Get the most recent court order or filed agreement. Include any later changes.

- Gather your payment records. Use bank statements, e-transfers, receipts, or enforcement statements.

- Collect any notices of credits or adjustments, such as tax intercepts or lump-sum offsets.

2) Confirm the file details

- Write the correct court file number. Check your last court document to confirm.

- Copy the style of the cause exactly. Use the same party names and order of names.

- Identify your role. State if you are the recipient, the payor, a lawyer, or an enforcement officer.

3) Identify the order and obligations

- State the date of the order or agreement. Include the court location.

- Quote the payment terms. State the amount, frequency, and due date for each payment.

- Note any special expenses or add-ons. For example, sectioned expenses that are shared.

- Note any indexation or review terms that changed amounts over time.

4) Set the calculation period

- Choose a start date. Often, the day after the last period is settled by the court.

- Choose an end date. Use a date close to your filing or hearing date.

- State “This affidavit sets out arrears as of [date].”

5) Build the arrears ledger

- Make a schedule that lists each due date and the amount due.

- Record each payment against the month or period it covers.

- Use a running balance. Start at zero. Add each due amount. Subtract each payment.

- Identify partial payments. Show how you allocated them to the oldest unpaid period first, unless the order says otherwise.

- Note any credits. For example, direct school fee payments are allowed by the order.

- Avoid adding future amounts. Only include amounts due as of the end date.

6) Deal with order changes

- If the amount changed, split the ledger into segments by date.

- For indexation, show the new amount and the date it took effect.

- Attach a short calculation note for each change.

7) Consider interest

- Check if interest is allowed by the order or by law.

- If you claim interest, show the rate, the period, and the method.

- Add a separate interest schedule. Do not mix it into the principal ledger.

8) Calculate the total

- State the “Total arrears (principal) as of [date].”

- If claiming interest, state “Interest as of [date].”

- State the “Total arrears claimed (including interest if any).”

9) Attach exhibits

- Exhibit A: a copy of the order or agreement and any amending orders.

- Exhibit B: the arrears ledger with running balance.

- Exhibit C: payment proof. Include bank statements, e-transfer confirmations, or receipts.

- Mark each exhibit with a letter. Put an exhibit stamp or a typed exhibit title on the first page. Refer to each exhibit in the body of the affidavit.

10) Draft the affidavit body

- Start with your name, address, and occupation.

- State your connection to the case and how you know the facts.

- Summarize the order terms with dates and amounts due.

- Confirm the calculation period.

- Refer to each exhibit. For example: “A copy of the order is attached as Exhibit A.”

- Explain any unusual items. For example, a lump-sum credit or a retroactive change.

- End with the totals as of the stated date.

11) Use clear, factual language

- Avoid argument. Stick to dates, amounts, and facts.

- Do not include conclusions or blame. The affidavit is about numbers and proof.

12) Review math and consistency

- Double-check the ledger math at each step.

- Confirm totals match the affidavit’s final figures.

- Confirm names, file numbers, and dates are consistent across all pages.

13) Swear or affirm the affidavit

- Do not sign until you are with a commissioner for oaths or a notary public.

- Bring ID and all pages, including exhibits.

- The commissioner will ask if you swear or affirm that the contents are true.

- Sign each page if requested. The commissioner will complete the jurat with the place and date.

- The commissioner will also sign and, if required, stamp each exhibit page or the first page of each exhibit.

14) File and serve as required

- If you are filing for a court hearing, file the affidavit with the court registry for your case.

- If you are providing it to an enforcement office, follow their submission instructions.

- If service is required, serve the other party and keep proof of service.

15) Update if needed

- If payments change after the affidavit date, prepare a new affidavit.

- Use a fresh end date and an updated ledger.

- File the updated affidavit before the hearing or enforcement step.

16) Avoid common mistakes

- Do not include estimates. Every figure must tie to a record or an order.

- Do not forget direct payments. If they happened, you must credit them.

- Do not claim amounts before the order took effect unless the order says so.

- Do not include costs or fees unless the order allows them.

- Do not alter a sworn affidavit. Use a new one for corrections or updates.

Practical example: Your order requires $400 on the first of each month. You received $400 in January and February. You received $200 in March. No payment in April or May. You are preparing the affidavit on June 10. Your ledger shows $400 due on Jan 1 and paid. The same for Feb 1. On March 1, $400 is due and $200 is paid, leaving $200 outstanding. On April 1, $400 is due and unpaid. On May 1, $400 is due and unpaid. Total principal arrears as of June 10 is $1,000. You attach your bank statements and copies of e-transfers. You attach the order. You swear the affidavit. You file it with your application for a default hearing.

Another example: The order increased support on July 1 last year. It went from $400 to $450. Your ledger splits the year. For January through June, the due amount is $400. For July through December, it is $450. You show payments received. You state the new total as of your end date. You attach a short note showing how you applied the increase.

One more example: You rely on an enforcement office statement. You say you reviewed the records kept in the normal course of business. You attach a certified statement of account. You build your affidavit around that statement. If you add direct payments, you can prove that they do not appear there. You explain those credits and attach proof.

With a well-prepared affidavit, the court can see the arrears picture at a glance. Your numbers are clear. Your records are organized. Your oath assures the court that the figures are trustworthy. That is what moves your matter forward.

Legal Terms You Might Encounter

- Affidavit means a sworn statement of facts. In this form, you swear the arrears amount is true to your knowledge. You sign in front of an authorized official who confirms your oath.

- Deponent is the person who swears the affidavit. If you complete and sign this form, you are the deponent. Your name must match the name on the court order or agreement.

- Arrears are unpaid amounts that were due under a support order or agreement. In this form, you list only amounts already due, not future payments. You also show any payments that reduce the arrears.

- Support order or agreement is the document that sets the payment terms. It may be a court order or a filed agreement. Your arrears calculation must follow that document’s amounts and start date.

- Payment schedule describes how often payments are due. It may be weekly, biweekly, monthly, or another schedule. Your arrears must reflect the schedule set in the order or agreement.

- Default occurs when a payment is missed or made late. Each default increases the arrears unless corrected by a later payment. You will track these defaults in your calculation.

- Statement of account is the ledger of charges and payments. It shows what was due, what was paid, and the balance. Your affidavit often summarizes this ledger for a specific time frame.

- Enforcement means steps to collect unpaid support. Your affidavit helps prove the arrears for enforcement action. It can support wages being attached or other collection steps.

- Garnishment or attachment is when money is taken from a source, such as wages. Your affidavit can support a request to garnish. It shows the amount owing as of a date.

- Interest on arrears may apply if allowed by a statute or an order. If interest is permitted, you calculate it as directed. If not, you leave it out of the total.

- Commissioner for oaths or a notary public is the official who witnesses your signature. You must sign in front of one of them. They will complete the jurat to confirm the oath.

- Jurat is the clause at the end of the affidavit. It records where, when, and before whom you swore or affirmed. It is completed by the commissioner or notary, not by you.

- Service is the formal delivery of documents to the other party. If required, you provide a copy after filing. Service rules can affect enforcement timelines.

- Perjury is the crime of lying under oath. Your affidavit is sworn, so accuracy is essential. Errors made knowingly can lead to penalties.

FAQs

Do you need to attach the support order or agreement?

Yes. Attach a clear copy of the current order or filed agreement. Include any amendments that changed amounts or dates. The affidavit relies on these documents to confirm the terms you applied.

Do you include payments made directly to the recipient?

Yes. Include all payments that reduce the arrears, even direct ones. List dates, amounts, and the method of payment. Attach proof, such as receipts, e‑transfers, or bank entries, when available.

Do you include interest in the arrears total?

Only if the order or governing rules allow interest. Check the text of your order first. If interest applies, show how you calculated it. If it does not apply, leave it out.

Do you need to swear the affidavit in front of an official?

Yes. You must sign in front of a commissioner for oaths or a notary public. Bring a valid ID and unsigned pages. The official will confirm your identity and administer the oath or affirmation.

Do you calculate future payments in the arrears total?

No. Arrears cover only amounts already due and unpaid. Do not include future installments. If more payments are missed later, you can complete a new affidavit for that period.

Do you have to serve the other party with the affidavit?

It depends on the process you are using. Some steps require service after filing. Check the filing instructions you received. If service is required, follow the method and timeline given.

Do you need a detailed payment ledger if you attach bank records?

You still need a clear calculation. Bank records support your entries, but do not replace the ledger. The affidavit should show the amounts due, the payments made, and the resulting balance.

Do you need to update the affidavit if payments come in after you sign?

If new payments affect the sworn balance, prepare an updated affidavit. File and serve the new one as the process requires. Do not alter a sworn affidavit after it is signed.

Checklist: Before, During, and After the Affidavit of Arrears

Before signing

- The most recent support order or filed agreement, plus any amendments.

- Any previous orders that affect the start date or amount.

- A complete payment history with dates and amounts due.

- Proof of payments: receipts, e‑transfer confirmations, bank statements.

- Proof of direct payments made outside any program.

- A running balance showing how payments reduced arrears.

- Any credited benefits or set‑offs, with proof and dates.

- Include interest details, if applicable, under the order or rules.

- Full names and current contact details for both parties.

- File or case numbers used in your matter.

- Your government‑issued photo ID for swearing.

- A calculator or spreadsheet printout for cross‑checks.

- Clean copies of any exhibits you plan to attach.

During signing

- Confirm the caption: court file number and parties’ names.

- Confirm the time period covered by your calculation.

- Confirm the payment schedule used (weekly, monthly, etc.).

- Verify the base amount due under the order for each period.

- Verify the total payments credited and their dates.

- Recheck the ending balance as of the affidavit date.

- Confirm interest lines are correct, or marked “not applicable.”

- Review any typed corrections. Make any initial small, necessary changes.

- Label exhibits in order (A, B, C) and refer to them in the text.

- Ensure the jurat shows the correct date and location.

- Sign only in front of the commissioner or notary.

- Ensure the commissioner signs, prints their name, and adds any stamp.

After signing

- File the affidavit where instructed (court or enforcement office).

- Pay any filing fee if required. Keep the receipt.

- Obtain a stamped or filed copy for your records.

- If service is required, serve the other party as instructed.

- Keep proof of service, such as an affidavit of service.

- Update your ledger for any payments after the sworn date.

- Calendar any hearing dates or response deadlines.

- Store originals in a secure, dry, accessible place.

- Keep digital scans with clear names and dates.

- Do not alter the filed affidavit. Prepare a new one if needed.

Common Mistakes to Avoid

Don’t forget to apply the correct payment schedule.

Using the wrong schedule skews the amount due. That can cause rejection or delay. Always follow the schedule in the order or agreement.

Don’t omit direct payments or credits.

Leaving out payments inflates the balance. That can undermine your credibility. Record and prove every payment you know about.

Don’t mix time periods or use vague date ranges.

Unclear time frames make it hard to verify your math. The filing office may refuse the affidavit. Use clear start and end dates.

Don’t include future installments.

Future amounts are not arrears. Adding them overstates what is owed. Include only amounts due on or before the sworn date.

Don’t sign without a proper witness.

If you sign without a commissioner or notary, the affidavit is invalid. You will have to redo the process. Always sign in front of an authorized official.

What to Do After Filling Out the Form

File in the right place

- Submit the sworn affidavit to the office that requested it. This may be a court registry or an enforcement office. Use the file number shown on your case documents.

- If a hearing is scheduled, file before the deadline. Late filing can delay enforcement or the hearing.

- Ask for a filed copy. Confirm the stamp or filing details are legible.

Serve copies if required

- If service is required, follow the method specified. That may be personal service, registered mail, or another approved method.

- Keep proof of service. If an affidavit of service is needed, complete it promptly and file it as instructed.

Track payments and new events

- Note any payments received after the sworn date. Those new payments do not change the filed affidavit.

- If the new payments affect the balance for a hearing, prepare a fresh affidavit for the updated period. File and serve it as required.

Prepare for a hearing or enforcement step

- If a hearing is set, bring your ledger, the order, and proof of payments. Bring copies of your exhibits.

- Be ready to explain your method and totals. Keep answers direct and based on the documents.

- If asked questions about credits or set‑offs, refer to your exhibits and dates.

Amend or correct when needed

- Do not handwrite changes on a sworn affidavit. Instead, prepare a new affidavit with the corrected figures.

- If you discover a missing payment, get documentation. Then swear and file a revised affidavit for the same period, if the process allows.

Keep your records organized

- Store the original affidavit, exhibits, and filed copy together. Add your proof of service if you served the other party.

- Keep your ledger current. Update it each time a payment is due or paid.

- Save digital copies in a secure folder. Use clear file names with dates and versions.

Communicate updates

- If you filed for enforcement, tell the office about material changes. Report new payments, changes in employment, or updated contact details.

- Provide only what the office requests. Keep sensitive data secure. Do not send originals by mail unless asked to.

Plan your next steps

- If arrears remain, ask what further documents are needed. Some steps require fresh affidavits at intervals.

- If the order no longer reflects current circumstances, consider your options. A change to the order needs a separate process from arrears enforcement.

Maintain accuracy and credibility

- Keep your calculations transparent. Use clear dates, amounts, and references to exhibits.

- Be consistent across all filings. Small inconsistencies can slow enforcement.

- Swear only to facts you know are true. Seek help if you are unsure about a figure.

Stay ahead of deadlines

- Diarize follow‑up dates and any future appearances.

- Allow buffer time for swearing and filing. Do not wait until the last day.

- If you cannot meet a deadline, contact the office promptly and ask about options.

Protect privacy

- Share only the required personal information. Redact account numbers if instructions allow.

- Avoid sending unnecessary documents that include sensitive data.

- If you deliver records electronically, use secure methods when available.

Resolve disputes efficiently

- If the other party disputes the arrears, ask for their proof. Compare their records to your ledger.

- Identify specific differences by date and amount. Prepare a short summary of variances.

- If needed, prepare a new affidavit that addresses the differences with supporting exhibits.

Know when to seek guidance

- Court staff can explain filing steps and forms. They cannot give legal advice.

- If you need help interpreting an order or calculating interest, consider getting legal guidance.

- Bring your order, ledger, and exhibits to any meeting. Clear records save time and cost.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.