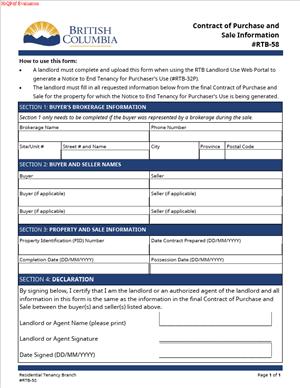

RTB-58 – Contract of Purchase and Sale Information

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is an RTB-58 – Contract of Purchase and Sale Information?

RTB-58 is a Residential Tenancy Branch form used in British Columbia. It captures key information from a Contract of Purchase and Sale when a tenanted property has been sold. You use it to show that the buyer, or the buyer’s close family member, intends to move into the rental unit. It supports a lawful two‑month notice to end a tenancy for the purchaser’s use.

The form does not replace the Contract of Purchase and Sale. It extracts the details that matter for tenancy law. It confirms that the sale has gone firm, who the purchaser is, and when they will take possession. It also includes a declaration of occupancy. That declaration confirms that the buyer or an eligible close family member will live in the unit for at least six months.

Who typically uses this form?

Sellers who are landlords. Property managers acting for sellers. Buyers who need the seller to serve notice before completion. Real estate professionals who coordinate the paperwork. Tenants who receive a two‑month notice also rely on it. They use it to check whether the notice is valid. They may also use it in a dispute.

You need this form when a sale is the reason for ending a tenancy. If the buyer wants vacant possession to live in the unit, the seller can serve a two‑month notice. RTB‑58 is the companion document that shows the notice has a lawful basis. It helps you avoid invalid notices and later disputes. It also protects everyone’s time by putting the key facts from the Contract of Purchase and Sale on one page.

Typical usage scenarios

You are selling a condo that is tenant‑occupied. The buyer plans to move in on possession. Once subjects come off the contract, you prepare RTB‑58. You record the buyer’s full legal name and the completion and possession dates. The buyer signs the occupancy declaration. You serve the two‑month notice on the tenant and attach RTB‑58. You also provide the required one month’s rent compensation. If there is a dispute, the RTB‑58 and supporting contract pages stand as evidence.

Another common scenario is a house sale where the buyer’s parent will move into the basement suite. The buyer is the purchaser named on the contract. The parent qualifies as an eligible close family member. You prepare RTB‑58 the same way. You ensure the declaration names the parent and confirms the plan to occupy for six months or more.

You do not use this form for demolition, major renovations, or conversions. It is specific to sales where the buyer or their close family will occupy. If the buyer is a corporation, this ground usually does not apply. A company has no “close family” for occupancy. RTB‑58 helps flag that early.

When Would You Use an RTB-58 – Contract of Purchase and Sale Information?

You use RTB‑58 when the basis for ending the tenancy is a sale with purchaser occupancy. You complete it after the sale is firm and before you serve the two‑month notice. “Firm” means all subjects are removed. You should not serve notice while the sale is still conditional. If the deal collapses, the notice would be invalid. The form prompts you to capture the subject removal date to avoid that mistake.

Landlords and property managers use RTB‑58 to support a notice that must be served well before completion. This matters if the buyer needs vacant possession on possession day. The notice period must be at least two months and must respect the tenancy cycle. By preparing RTB‑58 as soon as the sale is firm, you can align the notice with the possession date. For example, if completion is July 15 and possession is July 16, you work backward. You serve the notice on or before May 16 and choose a lawful move‑out date. The form documents the dates so you can plan the timing.

Buyers use RTB‑58 when they ask the seller to deliver vacant possession. They sign the occupancy declaration. They confirm they, or their spouse, or their or their spouse’s parent or child will live in the unit. This helps the seller prove the notice is proper. It also creates a clear record for the RTB if the tenant disputes the notice.

Tenants use RTB‑58 when they receive a two‑month notice linked to a sale. They review the form to check the purchaser’s name, the firm’s sale status, and the possession date. They confirm that the intended occupant fits the legal definition of a close family member. If anything is missing or incorrect, they can raise the issue or apply to dispute the notice. The form gives them clear facts to act on.

Real estate agents use RTB‑58 to coordinate between the parties. They can help obtain the right contract pages. They can confirm when subjects have been removed. They can manage signatures for the occupancy declaration. They can also help set a notice date that aligns with the tenancy rules and the buyer’s possession date.

You also use RTB‑58 during dispute resolution. If a tenant applies to dispute the notice, you submit RTB‑58 and contract excerpts as evidence. The form sets out the key sale details in a standard format that the decision‑maker expects. That saves time and reduces confusion.

Legal Characteristics of the RTB-58 – Contract of Purchase and Sale Information

RTB‑58 is not a contract. It is not a notice to end tenancy. It is an information and declaration form that supports a lawful two‑month notice for the purchaser’s use. It draws its legal weight from the Residential Tenancy Act and its regulations. Those laws allow a landlord to end a tenancy after a sale if the buyer or the buyer’s eligible close family will occupy the unit.

The form is part of the enforceability chain. For a purchaser‑use notice to hold up, several things must line up. The sale must be firm. The buyer must be an individual who will occupy, or whose close family will occupy. The intended occupant must be the buyer, the buyer’s spouse, or the parent or child of the buyer or the buyer’s spouse. The move‑out date must meet the minimum notice period and fall on a lawful date for that tenancy. The landlord must pay the required one month’s rent compensation or grant an equivalent rent‑free month. Service of the notice must follow the rules.

RTB‑58 helps document each of those elements. It records the subject removal date. It captures completion and possession dates. It identifies the purchaser by full legal name. It clarifies whether the purchaser is an individual or a company. It includes a declaration of occupancy for at least six months. It is designed to be attached to the two‑month notice so the tenant can see the basis. If the tenant disputes the notice, the form is admissible as evidence. If the information is false or incomplete, the notice may be set aside.

The form also helps prevent bad‑faith notices. A purchaser‑use notice must be given in good faith. The buyer or their eligible family must actually move in and use the unit as a home for at least six months. If they do not, the former tenant can claim compensation. That can include several months of rent and other costs. The occupancy declaration on RTB‑58 is a written record of intent. It can be compared later to what happened. That deters misuse and encourages accurate information.

Keep in mind that the form does not cure other defects. If you pick an invalid move‑out date, the notice can still fail. If you do not pay the one month’s rent compensation, enforcement can be denied. If you try to end a fixed‑term lease before the end of the term, the notice will not take effect early. The form is a tool, not a shield. Accuracy and timing remain critical.

Finally, the form interacts with privacy. You should not include more of the Contract of Purchase and Sale than needed. Price and other private terms can be redacted. RTB‑58 focuses on names, dates, and the occupancy plan. That is all the law requires for this ground.

How to Fill Out an RTB-58 – Contract of Purchase and Sale Information

Follow these steps to complete RTB‑58 correctly the first time.

1) Confirm the sale status

Make sure the sale is firm. Check the subject removal addendum or the subject removal notice. Do not proceed if financing, inspection, or other subjects remain. Record the subject removal date. You will use it in the form to plan the service of the notice.

2) Gather the core documents

Collect the Contract of Purchase and Sale, including:

- First page showing property address and buyer/seller names.

- Signature page.

- Subject removal addendum or notice.

- Completion and possession date addendum, if separate.

Redact unneeded information. You can black out price and deposit amounts. Keep names and dates visible. Keep copies for your records.

3) Identify the parties and the tenancy

Fill in the property address exactly as it appears on the Contract of Purchase and Sale. Include the unit number and postal code. List the full legal names of all tenants on the tenancy agreement. Note the type of tenancy (month‑to‑month or fixed‑term). Record the rent amount and the monthly rent due date. This helps you calculate a lawful move‑out date on the related notice.

4) Enter sale details

Enter the date the Contract of Purchase and Sale was accepted. Enter the subject removal date. Add the completion date and the possession date. Use the dates from the contract, not estimates. If completion and possession are different, list both. The possession date often drives when the buyer needs the unit vacant. Make sure the two‑month notice period can fit before that date.

5) Identify the purchaser

Write the full legal name of each purchaser exactly as shown on the contract. If the purchaser is an individual, check “individual.” If the purchaser is a corporation, check “corporation.” Add contact information for the purchaser or their authorized representative. If the purchaser is a corporation, pause. A corporation cannot claim “close family” occupancy. Purchaser‑use will not apply unless title will be taken by an individual who will occupy. Resolve that before proceeding.

6) Specify the intended occupant

Confirm who will live in the rental unit after completion. The options are:

- The purchaser.

- The purchaser’s spouse.

- The purchaser’s parent or child.

- The parent or child of the purchaser’s spouse.

Name the intended occupant. Use a full legal name. If more than one person will live there, list each occupant. Do not list siblings, cousins, roommates, or more distant relatives. They do not qualify for this ground. If none of the listed categories apply, do not use this form. Consider other legal options.

7) Complete the occupancy declaration

Have the purchaser sign the declaration that they, or the named close family member, will occupy the unit. The declaration must confirm good‑faith intent to live there for at least six months. It should also confirm that possession will align with the contract’s possession date. Include the buyer’s signature, printed name, and the date signed. If a close family member will occupy, best practice is to have both the purchaser and the intended occupant sign. That shows alignment and strengthens evidence of good faith.

8) Add the seller/landlord confirmation

As the seller/landlord or property manager, sign your portion. Confirm that the information was taken from the Contract of Purchase and Sale. Confirm that the sale is firm and the dates are accurate. Print your name and add your contact information. Add the date signed.

9) Attach supporting pages

Attach copies of contract pages that support the form:

- First page with property address and names.

- Signature page.

- Subject removal confirmation.

- Completion and possession date terms.

Redact pricing and other unrelated terms. Number the pages and keep them in order. Cross‑reference them on RTB‑58 if the form provides space for attachments.

10) Prepare the two‑month notice

Use the information from RTB‑58 to complete your two‑month notice for the purchaser’s use. Choose a lawful move‑out date. For month‑to‑month tenancies, the move‑out date must be at least two full months after service and must fall at the end of a rental period. For fixed‑term tenancies, the notice takes effect at the end of the term unless both sides agree otherwise. If the possession date does not allow a lawful notice period, speak with the buyer. You may need to adjust possession timing or negotiate with the tenant.

11) Calculate and provide compensation

You must provide the tenant with one month’s rent compensation for a purchaser‑use notice. You can pay it separately or credit it against the last month of rent. State your plan in writing when you serve the notice. Keep proof of payment or the credit on the tenant’s ledger. If you do not provide compensation, the notice can fail.

12) Serve the notice and the RTB-58 together

Serve the two‑month notice and attach the completed RTB‑58 and contract excerpts. Use a lawful method of service. Personal service is best. If you use another method, account for any deemed service rules when choosing the move‑out date. Complete a proof of service. Keep copies of everything.

13) Keep a complete file

Retain the signed RTB‑58, the served notice, proof of service, and proof of compensation. Keep the supporting contract pages. If a dispute arises, you will submit these documents. Good records support enforcement. They also protect you if someone later alleges bad faith.

14) Address common pitfalls before they happen

Check for these issues before serving:

- Subjects not yet removed. Wait until the sale is firm.

- Corporate purchaser with no qualifying individual. Do not use the purchaser‑use ground.

- Wrong move‑out date. Align with the tenancy cycle and service rules.

- Missing signatures. Ensure the purchaser has signed the declaration.

- No compensation. Pay or credit the one month’s rent at the right time.

- Misstated names or dates. Match the contract exactly.

15) Communicate timelines with everyone

Share the plan with the tenant in plain language. Explain the sale is firm, who will move in, and the target move‑out date. Confirm the compensation. Provide contact details for questions. Coordinate with the buyer and agents to ensure keys and possession align with the lawful move‑out date.

Example: How the dates line up

You remove subjects on March 2. The contract sets completion for May 10 and possession for May 11. Rent is due on the first of each month. You serve the notice in person on March 5. The earliest lawful move‑out date is April 30. That gives two full months’ notice ending on a rent period end. You attach RTB‑58 and the contract excerpts. You credit one month’s rent against April rent. The tenant moves out on April 30. The buyer takes possession on May 11 with vacant possession.

Example: Fixed‑term lease

You remove subjects on May 20. The fixed term ends August 31 and rolls to month‑to‑month. Completion is July 15, possession July 16. You can serve a two‑month notice after May 20. But the notice will not take effect before August 31. If the buyer needs possession earlier, you must negotiate an agreement with the tenant. RTB‑58 still documents the sale and occupancy intent. It does not override the fixed term.

What to do if plans change

If the buyer’s plans change, act quickly. If they no longer intend to occupy, withdraw the notice in writing. Do not proceed to end the tenancy. If the tenant has already moved out and the buyer or their close family does not occupy for at least six months, the former tenant can claim compensation. RTB‑58 will be part of that assessment. Accurate information and good‑faith action reduce your risk.

Using RTB‑58 this way keeps the process clear. It helps you issue a valid notice, inform the tenant, and meet the timelines tied to your transaction. It also creates a reliable record for the Residential Tenancy Branch if anyone challenges the notice.

Legal Terms You Might Encounter

- Unconditional contract means all conditions have been removed. The sale is firm. For this form, you should confirm the contract is unconditional before you rely on it. If the sale is still conditional, wait.

- Subject removal is when the buyer or seller removes conditions. Examples include financing, inspection, or insurance. The form asks for contract details that make sense only after subject removal.

- Completion date is when money and title change hands. Use the exact date from the contract. It anchors your timing and notice planning.

- Possession date is when the buyer gets the keys. It may differ from the completion date. Use this date to plan the earliest practical move-out.

- Adjustment date is when costs like taxes are prorated. It is an accounting date. Include it as shown in the contract so all dates match.

- Vacant possession means the buyer receives the home without occupants. If the buyer requires vacant possession, this form helps show that. It supports ending a tenancy linked to the sale.

- Purchaser’s use means the buyer or their close family plans to live in the home. This form captures that intention. It helps prove the reason for ending the tenancy.

- Effective date of the notice is when the notice period starts to count. It depends on how and when you serve the tenant. The dates on this form should allow enough time for a valid notice.

- Service of notice refers to how you deliver the notice to the tenant. Methods have rules. This affects when the notice takes effect. Plan your service date around the contract dates.

- Tenancy type refers to whether the rental is periodic or has a fixed term. Timing rules can differ. The form does not change those rules. It only records sales and occupancy facts.

- Authorized representative means a person allowed to sign or complete forms for another. A property manager can often complete this form. Make sure the authority is clear and documented.

- Redaction means blacking out sensitive details in a document copy. You may provide only the contract pages and details needed. Do not remove dates, names, or essential terms the form relies on.

FAQs

Do you need an unconditional contract to use this form?

Yes. You should only rely on a firm contract. If subjects are not removed, hold off. Using the form too early can undermine your notice.

Do you need the buyer’s signature on this form?

Yes, if the form includes a purchaser declaration. The buyer confirms they plan to occupy. Get that signature before serving any notice to end the tenancy.

Do you attach the entire contract or only key pages?

Attach only what is needed to show the sale details. Include names, property address, and the key dates. Redact sensitive financial details that are not required.

Do you copy names and dates exactly as in the contract?

Yes. Names, addresses, and dates must match the contract. Do not round dates. Do not estimate. If the contract changes, update the form.

Do you serve this form by itself or with a notice to end tenancy?

Serve it with the notice that relies on the purchaser’s use of reason. The form supports that notice. It shows the buyer’s intention and the sale dates.

Do you have to wait a specific time before serving the notice?

You must respect the required notice period. Work backwards from the possession date. Make sure the effective notice date gives enough time.

Do you need a separate form for each rental unit on the property?

Yes. Each tenancy is separate. Prepare and serve a form and notice for each affected tenancy. Tailor the dates for each unit’s situation.

Do you need a new form if the completion or possession date changes?

Yes. Re-issue an updated form if dates change. Serve a revised notice if needed. Do this as soon as the change is confirmed.

Checklist: Before, During, and After the RTB-58 – Contract of Purchase and Sale Information

Before signing

- Confirm the contract is unconditional. Get proof of subject removal.

- Gather the legal property address and unit number.

- Confirm the full legal names of the buyer and seller.

- Note the completion, possession, and adjustment dates from the contract.

- Confirm who will occupy and the planned occupancy start.

- Gather buyer contact details for the declaration.

- Confirm the tenancy details: names, address, and tenancy type.

- Choose a service method for the tenant and plan a service date.

- Check the required notice period against the possession date.

- Prepare contract pages to attach. Redact only non-essential details.

- Confirm who is authorized to sign for the landlord or seller.

- Prepare a clear cover page or labeling for attachments.

During signing

- Enter the property address exactly as in the contract.

- Enter buyer and seller names exactly as in the contract.

- Record completion, possession, and adjustment dates precisely.

- Confirm the buyer’s occupancy intention and minimum period.

- Get the buyer’s signature on the declaration, if included.

- Initial any corrections. Avoid blank fields. Write “N/A” if not applicable.

- Make sure contact details are legible and current.

- Cross-check the tenancy names and unit against the lease.

- Verify the notice timing calculation one more time.

- Attach the contract pages securely. Label attachments clearly.

After signing

- Make a clean copy of the completed form for your records.

- Serve the notice to end tenancy with this form attached.

- Use a valid service method. Record how and when you served it.

- Calendar the effective date of service and the move-out date.

- Calendar the completion and possession dates for coordination.

- If compensation is required, plan payment and keep proof.

- Share copies with the buyer and your representative as needed.

- Store everything in a secure, centralized file.

- Monitor for any dispute or response from the tenant.

- If dates change, update the form and re-serve promptly.

Common Mistakes to Avoid

Serving the notice before the sale is unconditional

- Consequence: The notice can be challenged and set aside. Don’t forget to wait for subject removal and a firm contract.

Using the wrong dates or mixing up completion and possession

- Consequence: The tenant’s move-out may not align with possession. This can delay closing. Double-check dates match the contract.

Missing the buyer’s occupancy declaration or signature

- Consequence: The reason for ending the tenancy looks unsupported. This invites disputes. Get the buyer’s signed confirmation.

Over-redacting the contract attachment

- Consequence: The form may not prove the key facts. A decision-maker could reject the notice. Redact only what is not required.

Improper service of the notice and form

- Consequence: The notice may take effect later than you think. You can miss the timeline. Use a valid method and record service details.

What to Do After Filling Out the Form

- Review for consistency. Check all dates, names, and addresses. Confirm they match the contract and the tenancy agreement.

- Attach the right contract pages. Include the pages that show the buyer and seller names, the property address, and the key dates. Redact only non-essential financial terms.

- Pair with the notice. Prepare the notice to end tenancy for the purchaser’s use. Attach this form and the contract pages.

- Choose a service method. Pick a valid method and plan the timing. Count the notice period from the effective service date.

- Serve the tenant. Deliver the notice with this form attached. Note the date, time, and method of service. Keep proof.

- Calendar all milestones. Track the effective service date, move-out date, completion date, and possession date. Build in buffers.

- Plan access and showings. Coordinate with the tenant for lawful access. Keep records of notice given for entry.

- Manage compensation, if required. Arrange payment on time. Keep receipts and confirmations.

- Monitor responses. If the tenant accepts, confirm the move-out plan in writing. If they dispute, prepare for a hearing.

- Prepare evidence if needed. Keep the signed form, the contract pages, proof of subject removal, proof of service, and correspondence. Organize them by date.

- Coordinate move-out logistics. Book cleaners, movers, and any repairs. Build a schedule that respects the tenancy and access rules.

- Update or amend if dates change. If completion or possession shifts, update the form. Serve a revised notice if needed. Do this quickly.

- Withdraw if the sale collapses. Notify the tenant in writing. Confirm that any notice relying on the sale is no longer in effect.

- Close the file. After possession, store the form, supporting documents, and service proof. Keep them for your records.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.