Form 4 REG 717 – Annual Report of Extraprovincial Association

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 4 REG 717 – Annual Report of Extraprovincial Association?

Form 4 REG 717 is the statutory annual report that an extraprovincial association must file to keep its British Columbia registration active. “Extraprovincial association” means your association was created outside British Columbia, but you operate or carry on business in the province. The form updates the public record with your current information and confirms that you continue to exist and are in good standing in your home jurisdiction.

You use this form to confirm key details each year. You verify your legal name, registration number, head office, and BC service addresses. You confirm your authorized representatives. You also confirm governance facts tied to your most recent year, such as the date of your annual general meeting, if applicable. The Registrar uses this filing to assess your compliance with BC law and to maintain an accurate register.

Who typically uses this form?

Corporate secretaries, compliance managers, and paralegals usually prepare and file it. Small associations may have an executive director or a board officer handle it. If you use an external corporate services provider, they may file on your behalf as your authorized representative or attorney for service in BC.

Why would you need this form?

Because your BC registration depends on it. Without an annual report, your association can fall out of good standing. That status can affect licenses, financing, government contracts, and court access in BC. Filing the annual report is a core governance task. It signals to the Registrar and the public that your association remains active, solvent, and properly managed.

Typical usage scenarios

- Your out‑of‑province cooperative association operates member services in BC. You file the annual report after your AGM to confirm your directors and BC service details.

- Your federally or out‑of‑province formed non‑share association runs programs in BC. You file to confirm the address for service and your authorized BC representative.

- Your trade or industry association opens a BC office. After registering extraprovincially, you file this report each year to maintain that registration.

- Your association has no fixed BC office but still conducts activities here. You file to keep your right to operate and to accept legal service in BC through your BC address or appointee.

Think of Form 4 REG 717 as the annual check‑in that keeps your BC record current and your operating status secure.

When Would You Use a Form 4 REG 717 – Annual Report of Extraprovincial Association?

You use this form once each year for as long as you are registered to carry on activities in British Columbia. The timing is set by statute and your registry profile. It is often tied to the anniversary of your BC registration or to your annual general meeting. The Registry sends reminders, but you should calendar your due date. Late filing can draw penalties and, if ignored, can trigger cancellation of your registration.

You file when your association’s reporting period ends for the year. Many associations file soon after their AGM, once members have received financial statements and elected directors, if applicable. Filing then lets you confirm current directors or officers and your service details in one step. If the form requires the AGM date, you will use the most recent AGM that approved the year’s financials.

Typical users

- A board chair, secretary, or treasurer of a small association. You gather the addresses, AGM date, and sign the certification as an authorized officer.

- A corporate secretarial team in a larger association. You coordinate with your home‑jurisdiction counsel to confirm continued existence and good standing.

- A BC attorney for service or agent. You assist with the filing if you hold delegated authority from the association.

- An external law firm or filing agent. You prepare, submit, and track filings across multiple jurisdictions for the client.

Use the annual report even if nothing changed during the year. The purpose is to confirm your details remain current and that you still exist and operate. If material details changed during the year, you may also need separate change filings. Examples include a change of legal name, a new attorney for service, or a change to your BC registered office. The annual report does not replace those event‑driven filings.

You also use this form when your work in BC is minimal but ongoing. For example, you may run online programs with BC members. You still need to maintain your BC registration and file the annual report every year.

Legal Characteristics of the Form 4 REG 717 – Annual Report of Extraprovincial Association

This is a statutory compliance filing, not a contract. It is legally required for every extraprovincial association that is registered to operate in BC. The form reinforces the accuracy of the public register. It also confirms that your association still exists and remains authorized to carry on its activities in BC.

The filing is legally binding because the governing legislation requires it and imposes penalties for non‑compliance. The person who signs certifies that the information is true and complete. False or misleading statements can lead to fines, personal liability, or other enforcement action. The Registrar can reject incomplete filings, require corrections, or request supporting documents. The Registrar may also note your non‑compliance on the public register.

What ensures enforceability?

The registry system records your submission, payment, and approval. Your status updates to “in good standing” only when the annual report posts successfully. If you do not file, the Registrar can flag your registration as not in good standing. Continued non‑compliance can lead to cancellation of your extraprovincial registration. Cancellation removes your legal authority to carry on activities in BC. It can impact licenses, insurance, and your ability to sue or defend in BC courts.

General legal considerations

- Public record: Most information you file becomes part of the public register. Plan for that. Use designated business addresses for directors or officers where allowed. Do not use a PO box for any address that must be a physical location.

- Home‑jurisdiction status: You must continue to exist and be in good standing where you were formed. If your home jurisdiction lists you as dissolved, discontinued, or struck, you cannot maintain your BC registration. The Registrar can require proof of continued existence.

- Consistency: Your legal name must match your home jurisdiction exactly, including punctuation and spacing. If BC approved an assumed name for you in BC, use that only where the form asks for it. Do not mix names across fields.

- Separate change filings: The annual report does not cure missed change notices. If your BC address for service or attorney for service changed during the year, file the proper change notice right away. The Registrar may reject your annual report if the underlying records are not current.

- Timing: File within the statutory window. Late fees can apply. If you miss the window by a long period, reinstatement may be required before you can resume activities in BC.

Treat the annual report as part of your annual governance cycle. Align it with your AGM, audit, and board succession calendar. That approach reduces risk and keeps your filings accurate.

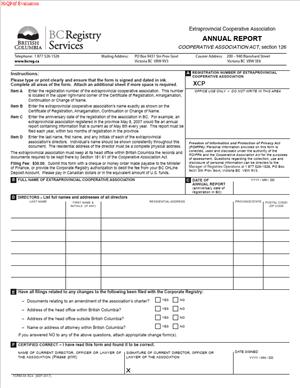

How to Fill Out a Form 4 REG 717 – Annual Report of Extraprovincial Association

Before you start, pull your most recent registry profile. Confirm your legal name, BC registration number, and current addresses. Gather your AGM date, the names of current directors or officers, and your authorized BC representative details. Have your payment method ready for the filing fee.

1) Identify the association

- Enter the full legal name of your association exactly as registered. Match case, punctuation, and any permitted BC assumptions.

- Enter your BC registration number. This is the number issued when you registered as an extraprovincial association in BC.

- Provide your home jurisdiction of formation. List the state, province, or country, along with your home‑jurisdiction registration or incorporation number if requested.

- Confirm continued existence. If the form asks, check the box or statement confirming you still exist and are in good standing in your home jurisdiction.

2) State the reporting year and key dates

- Select or enter the annual reporting year. This is the year for which you are reporting your information.

- Enter your most recent annual general meeting date if the form requests it. Use the date on which members received or approved the financial statements for the year.

- If the form asks for your financial year end, supply the month and day. This helps the Registrar track your annual cycle.

3) Provide registered office and records office details

- Registered office in BC: Enter a physical street address in British Columbia where legal documents can be served during business hours. No PO boxes. Include suite number, street, city, province, and postal code.

- Mailing address: If different, provide a mailing address for correspondence. A PO box is acceptable only if the field is clearly labeled as mailing.

- Records office: If your records office is different from the registered office, provide that physical address as well. Many associations use the same address for both.

4) Name your authorized BC representative

- Attorney for service or agent in BC: Provide the full name and residential or business address in BC. This is the person or firm authorized to accept legal documents on your behalf.

- Confirm consent: Ensure the person or firm has agreed to act. Some forms require a signed consent on file. If their address changed, file a separate change notice if required.

5) List directors or officers (if the form requires them)

- Enter the full legal names of all current directors as of the annual report date. Use their residential addresses or designated address type allowed by the form. If the form allows a service address, use a BC address for at least one director or your attorney for service to ensure reliable contact.

- Confirm that you meet the minimum number of directors required by your home jurisdiction and BC rules for extraprovincial associations.

- If directors changed during the year, check whether you need to file a separate Notice of Change. Do not rely on the annual report to update past changes unless the form permits it.

6) Business activity and BC operations (if requested)

- Describe your primary business or activity in BC in a short phrase. Example: “member services for a cooperative purchasing program.”

- If the form asks for the date you began carrying on business in BC, enter that date. Use your first day of active operations or program delivery in BC.

7) Confirm compliance statements

- Read each declaration carefully. Typical statements include continued existence, accuracy of information, and compliance with law.

- If the form includes a question about whether you held an AGM, answer truthfully. If you were exempt or deferred under your home jurisdiction’s rules, be prepared to support that status if asked.

8) Attach schedules if you need more space

- Use the schedule or attachment option to add director lists, address details, or explanatory notes. Label each page with your BC registration number and association name.

- Keep attachments concise and factual. Do not add promotional content.

9) Complete the certification and signature

- The signer must be an authorized person. Typically this is a director, officer, corporate secretary, attorney for service, or authorized agent.

- Print the signer’s name and title clearly. Add a phone number and email for contact if the form requests it.

- Sign and date the form. If filing online, follow the digital certification steps. For paper filings, ensure the signature is original and legible.

10) Pay the filing fee and submit

- Include the correct filing fee. Late filing can add a surcharge. If you are very late, check if reinstatement processes apply before filing.

- Submit the form through the accepted channel. Online filing posts faster. If you mail or deliver a paper form, allow extra processing time.

11) Keep proof and monitor status

- Save the submission receipt, a copy of the filed report, and any registry confirmation. File them with your corporate records and board minutes.

- Check your public profile within a few business days. Confirm your status shows in good standing and that your current details appear.

Practical tips and common pitfalls

- Match your legal name. Many filings fail because of name mismatches with the home jurisdiction. Use the exact official name.

- Use a physical BC address for service. Never list a PO box as the registered office. Add a mailing address if you need a PO box for correspondence.

- Keep your authorized BC representative current. If they retire, move, or change firms, file the change immediately, then file the annual report.

- Do not let the annual report substitute for required change notices. If your name, jurisdiction, or structure changed, complete the proper filings first.

- Coordinate with your AGM schedule. Set your internal deadline to gather director information and confirm your financial year end well before the filing due date.

- Respect privacy and accuracy. Director addresses become public if the form requires them. Where the form allows a service address, use it to protect privacy while remaining compliant.

- Track due dates across jurisdictions. If you operate in multiple provinces, align calendars. Late filings in one place can ripple into banking, grants, and insurance renewals.

Example

- A Saskatchewan cooperative registers in BC to serve members in the Lower Mainland. The board holds its AGM on April 20. The secretary prepares the annual report on May 1. She confirms the BC registered office at the Vancouver law firm’s address and lists the firm partner as attorney for service. She lists the current directors elected at the April AGM. She certifies that the co‑op remains in good standing in Saskatchewan. She files online, pays the fee, and receives confirmation the same day. The BC profile updates to show the 2025 annual report as filed.

- An Ontario non‑share association with no BC office conducts training in BC twice a year. It keeps a BC agent for service. After its September AGM, the operations manager files the annual report. He confirms that no addresses changed. He includes the AGM date and certifies accuracy. The filing posts the next day and the association remains in good standing.

If you discover an error after submission, file a correction or contact the Registry promptly. Corrections are easiest soon after filing. Keep your board informed and include the filed report in your next governance package.

Finally, build this into your annual governance checklist

- Confirm home‑jurisdiction good standing.

- Hold AGM or complete any authorized alternative.

- Update directors and officers.

- Confirm BC service addresses and attorney for service.

- Prepare and file the annual report.

- Record the confirmation and report to the board.

If you follow these steps, Form 4 REG 717 becomes routine. You protect your right to operate in BC. You maintain credibility with regulators, partners, and members. And you keep your administrative house in order for the year ahead.

Legal Terms You Might Encounter

- Extraprovincial association means your non-share corporation exists outside British Columbia but is registered to operate in the province. This form keeps your BC registration current. You confirm that your home entity details and your BC presence match the registry’s records.

- Annual report is a yearly confirmation filing. You verify core information about your association and its BC contact details. You also confirm the people responsible for governance, if the form requests it. This is not your financial report. It is an administrative filing that maintains your status.

- Anniversary date is the marker the registry uses to measure your annual cycle. Your report is due based on this date. You will find it on your registration record. Use it to plan your filing timeline each year.

- Registration number is the unique identifier assigned by the provincial registry when you registered in BC. The form uses this number to match your report to your entity record. Do not confuse it with your home jurisdiction number.

- Registered or records office refers to where your association keeps records and receives official mail. For extraprovincial entities, the form may ask for your address for service in BC. This must be a reliable address. Use a physical location where someone can accept documents during business hours.

- Address for service is the BC address where legal documents can be delivered. The registry relies on this address for official notices. A post office box usually does not satisfy delivery requirements. Keep this address accurate and monitored.

- Authorized signatory is the person who signs the form on behalf of the association. This is often a director or officer. The person must have authority under your internal rules. The registry expects their name, title, and signature to match your records.

- Directors are the individuals who govern the association. The form may ask you to confirm their names and service addresses. If your directors change, you usually file a separate notice. Do not use the annual report to hide or correct unfiled changes.

- Assumed name or operating name is any business name you use in BC that is different from your legal name. If you have one registered, you must keep it consistent across filings. Your annual report should reflect your legal name as it appears on the registry, not just your operating name.

- Good standing means your registration is active and up to date. Filing this annual report and paying the fee helps maintain that status. Falling out of good standing can disrupt contracts, permits, and banking.

- Amalgamation or continuance are structural changes in your home jurisdiction. If your entity merges or moves to a new jurisdiction, your BC registration data may need updates. The annual report is not a substitute for filing those change notices. Report major changes separately, then confirm them in your next annual report.

- Correction or amended filing is how you fix an error after you file. If you discover a mistake, contact the registry and use the method they require to amend. Do not wait for your next annual report if the error affects legal notice or director data.

FAQs

Do you still need to file if nothing changed this year?

Yes. You must file the annual report even when nothing changed. The report confirms that your information on record is still correct. Skipping the filing can lead to late fees and loss of good standing.

Do you need to hold an annual general meeting before filing?

Only if your governing law or bylaws require it. The annual report is a registry filing. It is not tied to your meeting unless your own rules set that sequence. If the form asks for your last meeting date, provide it based on your own requirements.

Do you list directors or officers on this form?

You confirm the people listed on the registry, if requested. If a director has changed, file the proper change notice before or along with your annual report, as the registry requires. The annual report should reflect the current, already-reported positions.

Do you need a BC address to file?

Yes. You must provide an address for service in British Columbia. Use a physical address where someone can accept deliveries during business hours. Monitor this address. Important notices go there.

Do you include financial statements?

No. The annual report confirms registration details. It does not include your financial statements. Keep those in your records and file them elsewhere only if required by your governing law.

Do you pay a fee with the annual report?

Yes. A prescribed fee applies. You must pay it at the time of filing. If you do not pay, the filing will not complete and your status can lapse.

Do you file if you stopped operating in BC this year?

Yes, unless you officially end your BC registration. If you ceased operations, file the cessation or cancellation paperwork that the registry requires. Until the registry accepts that filing, you must continue to file annual reports.

Do you need a wet signature or a digital signature?

Follow the signature instructions on the form. The registry accepts signatures in the formats it specifies. Include the signatory’s printed name and title. Make sure the date is correct and all mandatory fields are complete.

Checklist: Before, During, and After the Form 4 REG 717 – Annual Report of Extraprovincial Association

Before signing

- Your BC registration number.

- Legal name exactly as it appears on the registry.

- Any registered assumed name used in BC.

- Home jurisdiction details: legal name, number, and formation date.

- BC address for service (physical delivery address).

- Mailing address, if different.

- Names and service addresses of current directors, if requested by the form.

- Name and contact details of the authorized signatory.

- Date of your most recent meeting, if your rules require meetings and the form asks for it.

- Confirmation that all director or address changes have been filed using the proper change forms.

- Payment method for the filing fee.

- Internal approvals required by your bylaws or policies.

During signing

- Confirm the legal name matches the registry exactly, including punctuation and spacing.

- Verify the BC registration number, not the home jurisdiction number.

- Check every address for accuracy and deliverability. Use a street address for service.

- Ensure the signatory’s title matches your internal records and the registry’s expectations.

- Review director details for accuracy, if the form requests them.

- Make sure dates are correct and in the right format.

- Confirm you are not using the annual report to replace separate change filings.

- Read any declarations carefully. You are certifying accuracy.

- Check all mandatory fields. Do not leave blanks where “N/A” or “None” is required.

- Attach any required schedules specified by the form.

After signing

- File the form using the method specified on the form instructions.

- Pay the fee in full and obtain proof of payment.

- Save the registry’s confirmation or receipt with the filing date and time.

- Store a copy in your records book and digital records system.

- Send copies to your directors and your BC address-for-service contact.

- Calendar next year’s anniversary date and a reminder at least 30 days before it.

- If the registry rejects the filing, fix the issues immediately and resubmit.

- If a change occurs after filing, submit the appropriate change notice as soon as it happens.

- Review related compliance tasks in your home jurisdiction to ensure alignment.

- Update banks, insurers, grantors, and key partners if your official details changed.

Common Mistakes to Avoid in Form 4 REG 717 – Annual Report of Extraprovincial Association

Using the wrong entity number

- Mistake: Entering your home jurisdiction number instead of your BC registration number.

- Consequence: The registry cannot match your filing. Your report may be rejected or misapplied, causing delays and late fees.

- Tip: Don’t forget to pull your BC number from your registration record.

Listing a PO Box for the address for service

- Mistake: Providing only a PO Box where a street address is required for delivery.

- Consequence: The filing may be rejected, and you could miss legal notices.

- Tip: Use a physical BC address where someone is available during business hours.

Filing the annual report to update unreported changes

- Mistake: Trying to use the annual report to add or remove directors or change addresses without the proper change forms.

- Consequence: The registry may reject the filing or record inconsistent data. You risk non-compliance and penalties.

- Tip: File change notices first. Then submit your annual report with the updated information.

Signing without proper authority

- Mistake: A person signs who is not a director or authorized officer under your internal rules.

- Consequence: The registry may refuse the filing. Internally, the filing could be invalid and expose you to governance issues.

- Tip: Confirm signing authority in writing before you submit.

Using your operating name instead of your legal name

- Mistake: Entering a trade name where the form requires your legal name.

- Consequence: Misidentification, rejection, or misfiled records.

- Tip: Always use the exact legal name on the registry. You can include your operating name only where the form asks for it.

What to Do After Filling Out Form 4 REG 717 – Annual Report of Extraprovincial Association

Submit the filing and pay the fee

- File the signed form using the method indicated on the form. Pay the prescribed fee at the same time. Keep your payment confirmation.

Monitor your filing status

- Watch for acceptance or rejection. If accepted, save the confirmation with the filing date. If rejected, correct the issues promptly and resubmit to avoid late status.

Update internal and external records

- Store a copy in your records book and your digital compliance folder.

- Share the filed report with your directors and your address-for-service contact.

- Update banks, grant funders, government program files, insurers, and counterparties if your official information changed.

Handle post-filing changes

- If directors, addresses, or names change after your report, submit the required change filings immediately. Do not wait until next year. Your records must stay current year-round.

Plan next year’s compliance

- Record the anniversary date and due window. Set calendar reminders in advance. Assign a responsible person and a backup. Keep a checklist that mirrors this year’s successful filing.

Consider strategic updates

- If you plan to amalgamate, continue to a new jurisdiction, or stop operating in BC, map your filings. File the required change or cessation documents in the right order. The annual report does not replace these filings.

Maintain continuity at your address for service

- Ensure someone is available at the BC address during business hours. Train them to route registry notices quickly to your compliance lead. Missed mail can create avoidable risk.

Confirm consistency with your home jurisdiction

- Align director names, legal name, and formation details with your home registry records. If your home details changed, file those changes there first, then update BC, then confirm on your next annual report.

Document your process

- Keep a step-by-step record of what you filed, who signed, and when. This helps with audits, director transitions, and future filings.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.