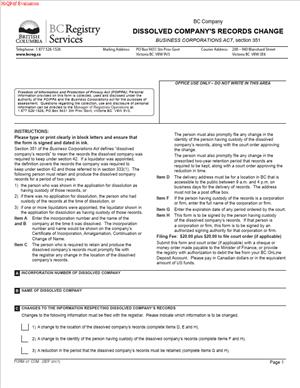

Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 27 COM – Notice of Change Respecting Dissolved Company’s Records?

Form 27 tells the corporate registry that something has changed about who holds a dissolved company’s records or where those records are kept. It applies after a company has been dissolved under British Columbia’s corporate law. Once a company is dissolved, it no longer has a registered office or records office. But its corporate and accounting records must still be kept by a custodian for a defined retention period. Form 27 updates the registry when the custodian changes, the location changes, or contact details change.

This is not the form you use to dissolve a company. It is also not the initial notice naming the first post‑dissolution custodian and location. You use Form 27 after the initial notice has been filed and something has changed. Think of it as a change‑of‑address or change‑of‑custodian notice for a dissolved company’s records.

Who typically uses this form?

Former directors or officers who kept the minute book. Liquidators or wind‑up trustees who managed the dissolution. Law firms or corporate service providers who hold client minute books. Accountants who maintain the books and ledgers. Successors to a deceased or retired custodian, such as an executor or a new firm. A buyer of a practice that acquires custody of legacy corporate records also uses this form to update the public record.

You would need this form anytime you become responsible for a dissolved company’s records or you move those records. If you took over a client portfolio and now hold their minute books, you need to update the registry. If the boxes moved from your downtown office to your storage facility, you need to update the registry. If your firm merged and your legal name and contact changed, you file this form. If the original custodian can no longer act, the new custodian files this form.

Typical usage scenarios

- Routine moves

- Firm name changes

- Mergers

- Custodian’s retirement

- Transfer of records to a new corporate records provider

When records move to a different city or to a different suite within the same building. If records are digitized and the practical location for access changes, the notice should be updated to reflect where the records are available on demand. If you discover errors in an earlier notice, you file this form with the correct information.

The purpose is simple. The registry and the public must know how to contact the person who holds the dissolved company’s records. This supports restoration applications, audits, tax inquiries, and legal processes. It also ensures compliance with post‑dissolution record‑keeping duties. When you keep the registry current, you reduce risk, avoid delays, and meet your statutory obligations.

When Would You Use a Form 27 COM – Notice of Change Respecting Dissolved Company’s Records?

You use Form 27 after dissolution, not before. The trigger is a change after the initial post‑dissolution records notice. You file it as soon as a material detail changes.

If you are a former director who took the minute book home and you move houses, you should file Form 27 with the new location. If a law firm held the records and the files move to the firm’s offsite warehouse, the firm files Form 27. If the firm closes and another firm assumes client records, the successor firm files the change. If your accounting firm merges and changes its legal name and contact, you file Form 27 to update the custodian’s name and contact details.

Executors and personal representatives often face this. If a sole practitioner who held records dies, the executor who now holds those records files Form 27. If a corporate services company sells its business to another provider, the buyer, now acting as custodian, files the change. If your company’s minute books were stored with a third‑party records office and that records office changes address, the records office files the notice, or you file it if you are the named custodian.

Digital transitions also trigger filings. If you convert to electronic records and now keep the official records on a server accessible from your head office, update the location to that office. If records move from your Vancouver office to your Victoria office, you file the change. If your custodian’s email or phone number changes, you update those fields so parties can reach you.

Typical users include former directors, liquidators, law firms, corporate secretarial providers, accountants, and successors in interest. Business owners rarely file this form themselves unless they personally hold the records. Property managers, landlords, or tenants do not use this form unless they also happen to be the records custodian. If you are an applicant seeking to restore the company, you do not use Form 27 to change the custodian. You instead rely on the current public record or contact the listed custodian to obtain records. The custodian is the person who files Form 27.

Time matters. File the change promptly once it occurs. Do not wait until someone needs the records. Restoration applications often stall if the custodian cannot be reached. Filing Form 27 ahead of time prevents those delays.

Legal Characteristics of the Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

Form 27 is a statutory notice. It is not a contract and does not transfer rights in the records. It serves a compliance and public notice function under corporate law. By filing it, you confirm who holds the dissolved company’s records and where they can be accessed. The filing becomes part of the public corporate record maintained by the registry.

Is it legally binding?

The obligations that sit behind it are binding. Corporate law requires that someone keep a dissolved company’s records for a set period. It also requires that changes in the custodian or the records’ location be reported. Form 27 is the vehicle to meet that obligation. The content of the form is a certified statement to the registrar. False or misleading statements can attract penalties. Timely and accurate filings help ensure that courts, regulators, and the public can locate the records when needed.

What ensures enforceability?

Several elements do. First, you must be the proper person to file. That is usually the current custodian or a person authorized by the custodian. Second, the form must identify the dissolved company by its exact name and incorporation number. Third, you must provide a physical location for the records. A civic address, not a PO box, is necessary for location. Fourth, you must sign the certification that the information is correct. The registry relies on that certification. If you sign on behalf of an organization, you must state your capacity. The registrar can reject incomplete or unclear filings.

General legal considerations include retention, access, privacy, and scope. Retention duties continue after dissolution. In practice, keep core corporate records and accounting records for the minimum statutory periods that apply. Corporate records are often kept for at least two years after dissolution. Tax records often must be kept longer, frequently six years. If litigation is reasonably anticipated, preserve records until the matter resolves. Destruction of records should be controlled and documented only after all retention periods expire.

Access is practical, not public. The custodian holds the records and must produce them to authorized parties when required by law or court order. Restoration applicants, former shareholders, tax authorities, and courts may request or compel access. The public cannot walk in and inspect. The registry needs the location to connect the right parties when required.

Privacy matters. The address you provide becomes part of the public record. Use a business address if you do not want to list a home address. If you hold digital records, list the place of business where the records can be accessed on demand. Do not include confidential details in the form. Keep confidential content within the records themselves.

Scope is specific. Form 27 does not revive the company. It does not vest property, and it does not resolve disputes about ownership of records. It simply updates contact and location details for the custodian. If there is a dispute about who should hold the records, resolve that first, then file the correct change.

If you make a mistake, file a new Form 27 with corrected information. Keep internal documentation that shows when the change occurred, who authorized it, and how you ensured completeness. This paper trail is valuable if questions arise later.

How to Fill Out a Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

Follow these steps. Work from current records and ensure accuracy before you file.

1) Confirm you need Form 27

- Use this form only if a change occurred after the initial post‑dissolution notice.

- If this is the first notice after dissolution, use the initial records notice form, not Form 27.

- If the company is not yet dissolved, you are using the wrong form.

2) Gather key identifiers

- Exact company name at dissolution.

- Incorporation number. Check prior filings or minute book.

- Date of dissolution. You will find it on the registry’s dissolution record.

3) Identify the type of change

- Change of custodian (the person or entity who holds the records).

- Change of physical location where records are kept.

- Change of contact details for the custodian.

- Multiple changes can be reported in one filing if they relate to the same dissolved company.

4) Set the effective date

- Use the actual date the change took effect.

- If the move occurred over several days, use the date the records became available at the new location.

- Do not future‑date the change.

5) Complete the dissolved company details

- Enter the exact legal name. Do not use a trade name.

- Enter the incorporation or registration number. Avoid transposed digits.

- Include the date of dissolution for clarity.

6) Complete custodian details (new custodian)

- If the custodian is an individual, list full legal name.

- If the custodian is an entity, list the exact legal name.

- Provide a phone number and email that will remain stable.

- State the custodian’s relationship to the company (for example, former director, law firm, accountant, liquidator, executor).

7) Enter the physical location of records

- Provide a civic address where the records are kept or can be accessed on demand.

- Do not use a PO box as the records location.

- Include unit, street, city, province, and postal code.

- If records are stored offsite with a third party, list that address.

- For digital records, list the custodian’s office where access will be provided.

8) Enter a mailing address (if different)

- Use this if you want correspondence sent elsewhere.

- A PO box is acceptable for mailing only, not for the records location.

9) Describe the records held (concise but informative)

- List the main categories: minute book, share registers, director and shareholder resolutions, financial statements, ledgers, tax filings.

- Note if records are paper, electronic, or both.

- If some records are missing or destroyed, state that briefly and maintain an internal memo explaining why.

10) State the previous custodian and location

- Include the name and address on the last notice.

- If those details are unknown or incorrect, state “unknown” and attach an explanation.

- This helps the registry link the change to the correct prior record.

11) Confirm retention period

- Note the expected retention end date based on your obligations.

- If multiple retention regimes apply, use the longest applicable period.

- Do not set arbitrary destruction dates that ignore tax or litigation holds.

12) Prepare supporting documents (if applicable)

- Authorization letter if you file on behalf of an entity custodian.

- Proof of capacity if you are an executor or liquidator.

- Any internal resolution or agreement transferring custody.

- You do not file confidential documents with the registry. Keep them in your file.

13) Review for accuracy and consistency

- Cross‑check names, numbers, and addresses against your internal records.

- Confirm the effective date matches the move or transfer date.

- Ensure email and phone are correct and monitored.

14) Sign the certification

- The current custodian or an authorized signing officer must sign.

- Print the name and state your capacity (for example, Partner, Director, Executor).

- By signing, you certify the information is true and complete.

- If the registry requires a wet signature or digital signature, follow the stated format.

15) File the form

- File through the accepted registry channel. Follow the required format.

- Pay any required fee, if applicable.

- Keep a copy of the filed form and the filing confirmation in your records.

16) After filing: confirm and communicate

- Verify the registry updated the public record correctly.

- Notify internal teams and stakeholders of the change.

- If you are the new custodian, send a courtesy notice to the prior custodian confirming the transfer.

Practical tips

- Use a business address if privacy is a concern. The location becomes public.

- If you manage multiple dissolved companies, file one form per company. Do not combine companies.

- If records are split between locations, consolidate them or list the primary location and maintain an internal index of secondary storage. The registry expects a single address for access.

- If you discover an error after filing, submit an updated Form 27 promptly. Do not wait for a request from the registry.

Common mistakes to avoid

- Using a PO box as the records location.

- Listing a name that does not match the custodian’s legal name.

- Omitting the incorporation number or using the business number instead.

- Future‑dating the change or using vague effective dates.

- Failing to sign in the correct capacity.

- Not updating contact details that actually changed during a move.

What to include in schedules or attachments?

- A brief inventory of record categories, if helpful for clarity.

- An authorization or capacity document if you are not the named custodian.

- A transition letter between the old and new custodian, confirming the transfer date and scope.

Who should sign?

- Individual custodian: the individual.

- Corporate custodian: an authorized signing officer.

- Law firm custodian: a partner or authorized manager.

- Executor or liquidator: the personal representative or appointed liquidator, with proof of appointment on request.

How does this connect to restorations and audits?

- Restoration applicants will check the registry for the custodian.

- If they contact you, respond promptly and provide access consistent with your duties.

- Keep a simple intake process for requests so you can verify identities and purposes.

- Maintain a log of access requests and what you provided. This protects you if questions arise.

Record‑keeping best practices

- Store paper records in labeled boxes with a simple index.

- For digital records, maintain secure backups and clear folder structures.

- Keep the minute book intact. Avoid splitting core records across sites.

- Record your retention schedule and diarize the planned destruction date, subject to holds.

- If you destroy records after the retention period, document the method and date.

By filing Form 27 accurately and on time, you meet your legal duty and make future processes smoother. You help courts, regulators, and stakeholders locate records fast. You also protect yourself by keeping the registry up to date with clear, accessible contact information.

Legal Terms You Might Encounter

- Dissolved company means the company has been struck from the register and no longer exists as a legal entity. This form deals only with records that remain after dissolution, not the affairs of an active company.

- Records mean the books, documents, and data the company kept during its life. Think minute book, registers, resolutions, financial statements, tax filings, contracts, and key correspondence. On this form, you identify who holds these records now and where they are kept.

- Custodian of records is the person or organization that holds and safeguards the dissolved company’s records. On this form, you name the current custodian and the new custodian, if changing.

- Delivery address means the physical location where someone can deliver documents in person. It is a street address, not a PO Box. The form asks for a delivery address for the custodian so anyone entitled to access can locate the records.

- Mailing address means the address where the custodian receives mail. It can be a PO Box. You may include a separate mailing address if it differs from the delivery address.

- Effective date is the date the change of custodian or records location takes effect. You enter this date on the form so the public record reflects when the new details became valid.

- Incorporation number is the unique number assigned to the company at formation. It helps the registry match your notice to the correct dissolved company. You include it along with the company’s full legal name.

- Dissolution date is the date the company ceased to exist on the register. The form often asks for this date to confirm you are reporting about a dissolved company, not an active one.

- Authorization means the custodian (or someone they authorize) has legal authority to sign and submit the notice. The signer declares the information is complete and accurate. You should only sign if you have that authority.

- Records retention period is the minimum time records must be kept after dissolution. This form does not set that period. It simply updates who holds the records and where. You remain responsible for keeping records as required.

- Transfer of custody means the handover of records from one custodian to another. The form records the new custodian’s details. It does not itself move the records; you still need to arrange the physical or digital transfer.

FAQs

Do you need to file this form if only your mailing address changed?

Yes. If the mailing address used for the dissolved company’s records changed, file this notice. The registry needs current contact details. You should also update the delivery address if that changed, even if the custodian stays the same.

Do you file this form for an active company?

No. Do not use this form for an active company. It is only for records of a dissolved company. Active companies use different filings to update registered or records office addresses.

Do you have to submit copies of the records with the form?

No. You do not submit the company’s records with this notice. The form updates the public record about who holds them and where. Keep the records securely and be able to produce them if lawfully requested.

Do you need the new custodian’s consent before you file?

Yes. Get clear, written consent from the new custodian before you file. The custodian will be responsible for safeguarding and producing the records. You should be ready to show evidence of consent if asked.

Do you file one form for each dissolved company if you hold several?

Yes. File a separate notice for each dissolved company. Use the correct legal name and incorporation number for each one. Do not combine multiple companies on one form.

Do you need to pay a fee to file the form?

Expect a standard filing fee. Fees can change. Prepare for payment at the time of filing. If you mail a paper form, include the required payment method as instructed on the current version of the form.

Do you backdate the effective date to when the boxes moved?

Use the actual date the change occurred. Do not guess or backdate. If you are unsure of the exact date, use the best documented date you can support, and keep your evidence on file.

Do you file another notice when you destroy records after the retention period?

If you dispose of records after the required period, record the destruction details. You may need to notify the registry if a further notice is required. Keep a clear paper trail of what was destroyed, by whom, and when.

Checklist: Before, During, and After the Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

Before signing: gather information and documents

- Legal name of the dissolved company, exactly as registered.

- Incorporation number and dissolution date.

- Previous custodian’s full name (or legal name if an organization).

- Previous custodian’s delivery and mailing addresses.

- New custodian’s full legal name and position or role.

- New custodian’s delivery address (street address, no PO Box).

- New custodian’s mailing address, if different.

- Effective date of the change of custodian or location.

- Contact details for the custodian (phone and email).

- Written consent from the new custodian to take custody.

- A simple inventory of the records being transferred.

- Any agreement covering custody, access, and retention.

- Payment method for the filing fee.

- Your signing authority proof, if you sign on behalf of a custodian.

During signing: verify key sections

- Company identifiers: Confirm the legal name and incorporation number match the registry.

- Dissolution details: Ensure the dissolution date is accurate.

- Custodian names: Use the full legal names, with no abbreviations unless part of the name.

- Addresses: Check the delivery address is a physical location. Add a mailing address if needed.

- Effective date: Enter the real change date, supported by your records.

- Contact information: Include a reachable phone and email for the custodian.

- Declarations: Read the certification. Sign only if you are authorized and the information is complete.

- Legibility: Print or type clearly if paper filing. Avoid corrections that cause rejection.

- Attachments: Include any required schedules if the form allows additional details.

- Payment section: Confirm fee amount and the accepted payment method.

After signing: file, notify, and store

- File the form using the registry’s accepted method (online or paper).

- Pay the filing fee in the required form.

- Save proof of filing and any receipt or confirmation number.

- File a copy of the signed form with the records of the dissolved company.

- Provide the new custodian with a complete copy.

- Notify anyone who needs access to the records (for example, former directors).

- Label boxes and digital folders with the new custodian details and effective date.

- Update your internal index of the company’s records and access rules.

- Set a reminder for the end of the retention period.

- Arrange secure storage and access procedures at the new location.

- Confirm mail forwarding so notices reach the custodian.

- If the filing is rejected, correct errors and resubmit promptly.

Common Mistakes to Avoid in Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

- Using a PO Box as the delivery address. Consequence: The registry may reject the filing because delivery requires a physical location. Don’t forget to list a street address for delivery and add a separate mailing address if needed.

- Entering the wrong incorporation number or company name. Consequence: The notice attaches to the wrong record or gets refused. Don’t forget to cross-check against past filings or a prior confirmation letter.

- Backdating or guessing the effective date. Consequence: Your public record will be inaccurate, which can cause disputes about who held the records and when. Don’t forget to use the documented date of transfer.

- Filing without the new custodian’s clear consent. Consequence: The custodian may refuse access or deny responsibility, exposing you to disputes. Don’t forget to secure written acceptance before filing.

- Failing to keep proof of filing and transfer. Consequence: You may not be able to show compliance during an inquiry. Don’t forget to save the filed form, receipt, and a transfer memo listing what changed and when.

What to Do After Filling Out Form 27 COM – Notice of Change Respecting Dissolved Company’s Records

- Submit the form and pay the fee. Use the registry’s accepted filing method. Keep the confirmation and any reference number.

- Confirm the public record. After processing, verify that the custodian name and addresses display as filed. If anything is wrong, file an amendment immediately.

- Complete the physical or digital transfer. Move all records to the new custodian. Include paper files, backups, external drives, and hosted data. Update labels and folder names to reflect the new custodian and date.

- Document the handover. Prepare a short transfer memo. List the records transferred, the effective date, and both parties’ contact details. Have both sides sign or acknowledge receipt.

- Set access rules and hours. Decide who can view the records, how to request access, and standard response timelines. Keep a log of all access requests and disclosures.

- Secure the records. Use locked storage, controlled access, and reliable backups. For digital files, confirm encryption, password control, and recovery processes.

- Update related parties. Notify former directors, officers, the company’s accountant, and any party with ongoing rights to inspect. Share the custodian’s delivery and mailing addresses and contact details.

- Calendar the retention period. Record the date the retention period ends. Plan for secure disposition or long-term archiving when allowed.

- Plan for restoration scenarios. If the company is later restored, follow the restoration process. Then update its office addresses through the correct filings. Do not use this form for updates to an active company.

- Record final disposition. When the retention period ends and disposal is permitted, document what you destroy, when, and how. File any required notice if applicable. Keep the destruction certificate with your compliance files.

- Maintain version control. Keep a current index of all Form 27 filings, with dates and confirmation numbers. This helps you prove continuity of custody over time.

- Review annually. Even if nothing changes, review addresses, contacts, and storage arrangements once a year. Fix gaps before they cause a missed notice or lost file.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.