Form 25 COM – Application for – Liquidation – Dissolution

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 25 COM – Application for (Liquidation) Dissolution?

Form 25 is the standard filing you use to formally end a British Columbia entity’s legal existence. You use it to request either liquidation and dissolution, or straightforward dissolution if liquidation is not required. In plain terms, this is the form that starts—or completes—the process of winding up a BC company, society, or cooperative so it no longer exists.

Liquidation is the orderly process of settling debts, converting remaining assets to cash, and distributing what is left to shareholders or members. Dissolution is the legal end of the entity. Some organizations need both steps. Others with no assets or debts may move straight to dissolution. Form 25 accommodates both paths.

Who typically uses this form?

Directors, authorized signing officers, or a liquidator. For member-based entities, a board member may sign after member approval. A lawyer or corporate service provider may complete it for you, but the authorized person for the entity must sign. In a court-supervised liquidation, the court-appointed liquidator usually signs and files it.

Why would you need this form?

Use it when you want to close your BC entity and stop ongoing obligations. Once dissolved, you no longer file annual reports, pay annual fees, or maintain a registered office. You also stop accruing liabilities tied to running an active entity. This is the right tool when you have finished business operations, paid debts, distributed remaining assets, and want a clean end.

Typical usage scenarios

- Your small BC company is dormant, has no assets or debts, and you prefer to dissolve rather than keep filing annual reports.

- You sold the business assets, paid all creditors, and want to distribute the remaining cash to shareholders and dissolve.

- Your society has completed its purpose, transferred remaining funds to a successor organization, and now seeks dissolution.

- Your cooperative needs a formal liquidation to settle member loans and patronage allocations before dissolving.

- A liquidator has completed a court-supervised liquidation and now applies to finalize dissolution.

Think of Form 25 as the official “shutdown” request. When approved, the registry records the dissolution, and the entity ceases to exist except for limited purposes allowed by law (such as certain post-dissolution claims or restoration options).

When Would You Use a Form 25 COM – Application for (Liquidation) Dissolution?

Use this form as the final step in closing down your BC entity, or at the start if liquidation is required. If you have no assets and no liabilities, you can often proceed directly to dissolution. If you still hold assets, owe debts, or must return capital to investors or members, you begin with liquidation and finish with dissolution once distributions are complete.

Practical examples

- You ran a consulting corporation that stopped operating last year. You paid your last invoices and closed the bank account. There are no employees, leases, or tax balances. You can likely file for dissolution without liquidation. Form 25 is the application you submit to request that outcome.

- You manage a tech startup that sold its IP, paid trade creditors, and now needs to return remaining funds to shareholders. You appoint a liquidator to handle claims and distributions. Once distributions finish, the liquidator uses Form 25 to apply for dissolution.

- Your society wound down its programs and transferred remaining funds to a like-minded charity, as members approved. With no outstanding obligations, you complete Form 25 to dissolve.

- Your cooperative owns equipment and has a member loan program. You need liquidation to sell assets, settle loans, and finalize member payments. The liquidator will file Form 25 at the end to dissolve.

- A court ordered liquidation due to a deadlock or fairness concerns. The appointed liquidator completes liquidation activities, then files Form 25 to dissolve when the court’s directions are satisfied.

Do not use this form if you intend to continue your entity under a different jurisdiction, amalgamate with another entity, or enter bankruptcy proceedings. Those are different legal processes. Use Form 25 when your goal is to wind up and finish.

Legal Characteristics of the Form 25 COM – Application for (Liquidation) Dissolution

Form 25 is a statutory filing. When accepted and recorded, it has binding legal effect: the entity is dissolved. That outcome affects property rights, ongoing contracts, litigation exposure, tax obligations, and the ability to carry on business. Because the consequences are significant, the law requires specific approvals, notices, and supporting documents to ensure accuracy and fairness.

Is it legally binding?

Yes. The registry relies on the information you certify. If you state there are no assets or liabilities and sign the form, you are making a formal declaration. If a liquidator applies, they confirm they have completed distributions and resolved creditor claims. False or misleading statements can lead to penalties and personal exposure for losses caused by the misstatement.

What ensures enforceability?

- Proper internal approval: For companies, a special resolution of shareholders is generally required. For societies and cooperatives, member approval is required. The resolution should authorize liquidation and/or dissolution and, if needed, appoint or authorize appointment of a liquidator.

- Statutory process: If liquidation is needed, the liquidator must notify creditors, call for claims, settle debts, and distribute remaining assets. Only after completing those steps should dissolution be requested.

- Accurate supporting materials: The form must be complete, signed by an authorized person, and filed with the required attachments and fee. If a court is involved, the court order guides what you must attach. The registry reviews your filing and records the dissolution if all requirements are met.

General legal considerations

- Asset and debt status: You must either have no assets and no liabilities, or you must use liquidation to settle them. Dissolving with unresolved debts can expose directors or liquidators to claims.

- Notices to creditors: In liquidation, creditors are typically given a fixed period to submit claims. Claims not proven in time may have limited recourse, subject to the law and any court directions.

- Contracts and leases: Review termination clauses, assignment limits, security deposits, and end-of-term obligations. Liquidation helps you deal with these in an orderly way.

- Employees: Comply with employment standards and any collective agreements. Wages, vacation pay, and termination pay must be addressed before dissolution.

- Tax and filings: File final returns and remit outstanding amounts. Plan for a final year-end. A clearance process is often prudent before distributions to reduce risk of post-dissolution assessments.

- Property on dissolution: Undistributed property can vest in the government on dissolution. Handle transfers before filing.

- Post-dissolution claims: Certain claims can still be brought for a limited time. Keep books and records accessible after dissolution for that period.

- Restoration: If you later discover an asset or need to resolve a claim, restoration may be possible within a statutory window. Restoration brings the entity back into existence to complete the task.

Treat Form 25 as the capstone to a compliant wind-up. If the groundwork is correct—approvals, notices, debt settlement, and distributions—the form will produce a clean legal end.

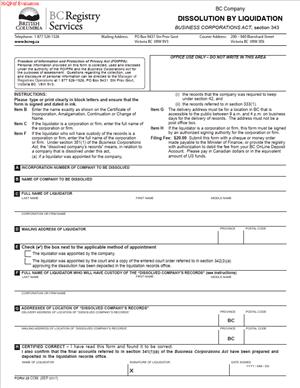

How to Fill Out a Form 25 COM – Application for (Liquidation) Dissolution

You want a frictionless filing. The key is to confirm your pathway (dissolution only or liquidation and dissolution), assemble approvals and evidence, and complete each field carefully. Below is a clear, step-by-step approach that mirrors how the form is typically structured.

Step 1: Confirm your pathway and eligibility

- If you have no assets and no liabilities: You can usually apply for dissolution without appointing a liquidator. Ensure bank accounts are closed and all returns are filed. Have a shareholder or member special resolution approving dissolution.

- If you have assets, liabilities, or distributions to make: You need liquidation. Appoint a liquidator (by resolution or court order). The liquidator manages creditor notices, asset realization, and distributions. Dissolution follows after liquidation is complete.

- If liquidation was court-ordered: Follow the court’s directions. You will attach the relevant order and any required reports when you apply for dissolution.

Decide who will sign. For dissolution without liquidation, a director or authorized officer usually signs. For liquidation, the liquidator signs.

Step 2: Gather required approvals and documents

Assemble the following before you start filling out the form

- Certified copy of the special resolution approving liquidation and/or dissolution.

- If a liquidator is appointed: the resolution or order appointing the liquidator and the liquidator’s consent to act.

- If liquidation occurred: the liquidator’s final accounts, statement of distributions, and a report on creditor claims.

- For dissolution without liquidation: a statement or affidavit confirming the entity has no assets and no liabilities.

- Any court order relevant to the liquidation or dissolution.

- Evidence of notices to creditors, if applicable.

- Final or near-final tax filings and remittances. Keep proof of filings and balances paid.

Having these on hand lets you complete the form accurately and attach the correct schedules.

Step 3: Complete the entity identification section

Provide the exact details that match the registry records

- Legal name of the entity.

- Incorporation or registration number.

- Entity type (company, society, cooperative).

- Jurisdiction of incorporation (British Columbia).

- Registered office address on record.

Accuracy is essential. Use the precise legal name and number to avoid processing delays.

Step 4: Select the type of application

The form usually requires you to choose one of two options

- Application for dissolution (no liquidation required).

- Application for dissolution following liquidation.

If you are at the start of a liquidation, indicate that you are applying for liquidation and dissolution, and complete the liquidator details. If you are at the end of liquidation, indicate you are applying for dissolution post-liquidation and attach the liquidator’s final materials.

Step 5: State the legal basis and approvals

Identify the internal approval that authorizes the action

- Date of the shareholder or member special resolution approving liquidation and/or dissolution.

- If court involvement exists, include the date of the order and the relevant file information requested on the form.

Attach a certified copy of the resolution and, if applicable, the court order as a schedule.

Step 6: Describe asset and liability status

For dissolution without liquidation

- Confirm the entity has ceased business.

- Confirm the entity has no assets and no liabilities.

- Confirm that final returns are filed and all known amounts are paid.

For dissolution after liquidation

- Confirm liquidation is complete.

- Provide a summary of distributions made to creditors and shareholders or members.

- Confirm there are no outstanding claims or liabilities, or explain how they were addressed under a court order.

If the form provides checkbox declarations, use them and ensure your statements match your attached materials.

Step 7: Complete liquidator information (if applicable)

If a liquidator is involved, provide

- Full legal name of the liquidator (person or firm).

- Address for service and contact details.

- Date of appointment and authority (resolution or court order).

- Confirmation that the liquidator consents to act.

- A brief statement that creditor notices were given and the claims process has concluded.

Attach the liquidator’s consent and appointment documents. If required, attach the liquidator’s final accounts and statement of distributions as schedules.

Step 8: Address creditor notices and claims (if liquidation)

The form or its schedules typically call for

- Confirmation of how and when creditors were notified.

- The claim deadline given to creditors.

- The total amount of claims received, admitted, and paid.

- Treatment of disputed claims, if any.

- Confirmation that reserves (if any) are held or released in line with the law or a court order.

If a court order modified standard notice steps, reference it in the form and attach the order.

Step 9: Tax and regulatory confirmations

State that

- All required tax returns are filed up to the final date.

- Payroll, sales taxes, and other levies are paid or provided for.

- Any required clearances have been obtained or requested.

You do not attach sensitive account details unless the form explicitly asks. Keep the proof in your records in case the registry or a creditor requests it later.

Step 10: Attach supporting schedules

Common schedules include

- Schedule A: Certified copy of the special resolution.

- Schedule B: Liquidator appointment and consent (or court order).

- Schedule C: Liquidator’s final accounts and statement of distributions.

- Schedule D: Creditor notice proof and claim summary.

- Schedule E: Statement or affidavit of no assets and no liabilities (for dissolution without liquidation).

Label schedules clearly and cross-reference them in the main form. Consistent labeling speeds review.

Step 11: Complete the declaration and signature

The form ends with a declaration section. The signatory confirms the information is true and complete. Sign and date as follows

- Dissolution without liquidation: a director or authorized officer signs.

- Dissolution following liquidation: the liquidator signs.

Print your name and title clearly. If the form allows, include a contact email and phone number for filing questions. A digital signature may be acceptable if the filing is electronic.

Step 12: Pay the filing fee and submit

Confirm the current fee and method of payment accepted for your filing channel. Submit the form with all schedules. Keep a complete copy with time-stamped proof of submission.

Step 13: After you file

Monitor for the outcome. If the filing is accepted, the registry records the dissolution. Save the confirmation and any certificate. Update your records and notify stakeholders who need to know the entity has been dissolved.

Practical tips to avoid delays

- Align every statement in the form with your schedules and approvals. Inconsistencies trigger questions.

- Use the exact legal name and number from the registry.

- If you changed the registered office recently, ensure the change is already recorded.

- If you used liquidation, wait until distributions and creditor matters are complete before applying for dissolution.

- Keep books and records safely stored for the post-dissolution period required by law.

Real-world examples

- You are the sole director of a BC consulting company. You stopped operating, have no assets or debts, and filed your final tax return. You pass a shareholder special resolution to dissolve. You complete Form 25 indicating “dissolution without liquidation,” attach the resolution, sign the declaration, pay the fee, and submit. The registry records the dissolution. You archive the minute book and keep tax records for future reference.

- You are a liquidator for a cooperative. You sold assets, satisfied creditors, and returned capital to members. You prepare final accounts and a distribution statement. You complete Form 25 for dissolution following liquidation, attach the appointment, consent, final accounts, and proof of creditor notices, sign as liquidator, pay the fee, and submit. Once recorded, the cooperative is dissolved.

If you follow the steps above and keep your documentation tight, Form 25 is straightforward. You confirm your status, attach the right proofs, and sign. That gives the registry what it needs to end the legal life of the entity cleanly.

Legal Terms You Might Encounter

- Applicant or Petitioner. This is the party starting the court process. On Form 25, you identify yourself as the applicant seeking liquidation and dissolution.

- Respondent. This is the party that may oppose or be affected. You list respondents on Form 25 if notice is required.

- Liquidation. This is the process of collecting and selling company assets. On Form 25, you ask the court to start liquidation.

- Dissolution. This is the legal end of the company. Form 25 includes a request for a court order to dissolve after liquidation.

- Liquidator. This person administers the liquidation under the court’s oversight. Your Form 25 can nominate a liquidator and attach their consent.

- Affidavit. This is a sworn statement of facts filed to support your application. You attach affidavits to Form 25 to explain why the court should grant orders.

- Service. This is the formal delivery of court documents to others. Form 25 triggers service on stakeholders, like creditors and shareholders.

- Court Registry. This is the Supreme Court location where you file. You list the correct registry on Form 25 and use its file number.

- Order. This is the court’s decision, set out in writing. Your Form 25 seeks an order appointing a liquidator and authorizing dissolution.

- Notice to Creditors. This invites creditors to file claims by a deadline. Your application may ask the court to approve a notice and a claim process.

- Proof of Claim. This is how a creditor states what they are owed. Your liquidator will manage proofs of claim after the court grants your application.

- Priority of Claims. This is the order in which creditors get paid. Your application should show how you plan to pay debts in the proper order.

- Surplus. This is what remains after paying debts and costs. Your application explains how any surplus will be distributed, usually to shareholders.

- Stay of Proceedings. This pauses lawsuits against the company. Your Form 25 can request a stay to protect the liquidation process.

- Security for Costs. This is money held as assurance of legal costs. The court may require security from a proposed liquidator in some cases.

FAQs

Do you need a court order to dissolve with Form 25?

Yes. Form 25 asks the court to start liquidation and authorize dissolution. The company does not dissolve just by filing the form. You need the court’s order and completion of the liquidation steps.

Do you use Form 25 for a voluntary administrative dissolution?

No. Form 25 is for court-supervised liquidation and dissolution. Administrative dissolution uses a different process. Use Form 25 when you need court oversight, creditor protections, or special directions.

Do you have to notify creditors after filing Form 25?

Yes. Creditors usually must get notice of the application and any claims process. Your materials should include a proposed notice, a claims deadline, and service plans. The court may also direct public notice.

Do you need shareholder or member approval before filing?

Often, yes. If the company is solvent or choosing a voluntary liquidation, approval is common. Attach the resolution to your affidavit. If a creditor is applying, you still file evidence showing why liquidation is justified.

Do you have to attend a hearing?

Usually, yes. The court hears your application and may ask questions. You or your lawyer should attend. Have draft orders, affidavits, and any consents ready.

Do you need a liquidator named on the form?

It helps. The court often wants a proposed liquidator who is willing and qualified. File the liquidator’s consent and resume. Be prepared to discuss fees and how they will be paid.

Do you have to file financial information with Form 25?

Yes, in most cases. The court expects a clear financial picture. Attach recent statements, a list of assets and liabilities, and known creditor claims. Explain any missing or estimated data.

Do you need to publish a notice to creditors?

Often, yes. The court may direct publication in a newspaper or online service. Propose a publication plan with dates and locations. This supports a fair claims process.

Checklist: Before, During, and After the Form 25 COM – Application for (Liquidation) Dissolution

Before signing: Information and documents you need

- Company identification. Exact legal name, incorporation number, and jurisdiction.

- Registered and records office addresses. Confirm they are current.

- Corporate records. Certificate of incorporation, articles, share structure, and minute book.

- Director and officer lists. Names, addresses for service, and any resignations.

- Shareholder approvals. Special resolutions authorizing liquidation and dissolution, if applicable.

- Creditor list. Names, amounts owed, security interests, and contact details.

- Asset list. Bank accounts, receivables, inventory, equipment, real property, and IP.

- Financial statements. Recent balance sheet, income statement, and cash position.

- Tax status. Outstanding returns, payroll, GST/HST, PST, and property taxes.

- Litigation summary. Active lawsuits, judgments, liens, or garnishments.

- Liquidator details. Proposed liquidator’s consent, qualifications, and fee terms.

- Insurance. Current policies, claims, and cancellation timelines.

- Employee information. Staff list, wages, severance, vacation pay, and ROE plans.

- Draft orders. Proposed wording for appointment, stay, and directions to the liquidator.

- Notice to creditors. Draft form, claims process, and publication plan.

- Affidavits. Sworn evidence covering financials, reasons, and stakeholder impacts.

- Registry choice. Correct Supreme Court registry for filing.

- Filing fees. Confirm amounts and payment method.

- Service list. Who must be served and how you will serve them.

- Timelines. Proposed hearing date, service deadlines, and claims cutoff.

During signing: Sections to verify on Form 25 COM

- Party names. Confirm spelling, roles, and capacities match corporate records.

- Court registry and file style. Ensure the correct location and format.

- Relief sought. List every order you want, including liquidation and dissolution.

- Liquidator details. Name, contact, and consent aligned with supporting materials.

- Hearing date. Leave blank or complete per registry practice and scheduling.

- Address for service. Provide accurate contact details for the applicant.

- Affidavit references. Match exhibits to paragraphs in the form and affidavits.

- Attachments. Include draft orders, consents, and schedules as needed.

- Signature and date. Ensure the authorized person signs and dates properly.

- Consistency check. Cross-check amounts, names, and dates across all documents.

After signing: Filing, notifying, and storing

- File at the registry. Submit Form 25 with affidavits and draft orders.

- Pay fees. Keep the receipt and file number for tracking.

- Calendar deadlines. Note the hearing date and service timelines.

- Serve respondents. Deliver filed materials to required parties.

- Publish notices. Follow any publication plan for creditors.

- Confirm service. Keep proofs of service and affidavits of service.

- Prepare for hearing. Bring extra copies, draft orders, and speaking notes.

- Get the order. Obtain entered copies once the court approves.

- Notify stakeholders. Send the order to creditors, shareholders, and the liquidator.

- File with corporate authorities. Submit required documents to complete dissolution.

- Close accounts. Follow the liquidator’s plan for assets and liabilities.

- Store records. Keep a complete file for the required retention period.

Common Mistakes to Avoid

- Don’t forget to name and get consent from the liquidator. Consequence: The court may delay or refuse the order. You lose time and increase costs.

- Don’t under-disclose creditors or debts. Consequence: Claims can surface later and disrupt distributions. You risk personal or director exposure.

- Don’t file in the wrong registry or with the wrong style of cause. Consequence: The registry may reject your filing or delay your hearing. You may need to refile.

- Don’t skip a publication plan for creditors. Consequence: The court may question fairness. You could face later challenges to the process.

- Don’t request dissolution before liquidation steps are set. Consequence: The court may refuse the order as premature. You must return with a new application.

What to Do After Filling Out the Form

- File your application package. Submit Form 25, affidavits, consents, and draft orders at the correct registry. Get a file number and confirm the hearing process.

- Serve and give notice. Serve all required parties. Follow timelines for service and keep proof. Start publication if your plan is already approved or expected.

- Prepare for the hearing. Organize a binder with Form 25, evidence, and draft orders. Be ready to explain why liquidation and dissolution are appropriate. Address creditor protection and fairness.

- Attend the hearing and get the order. Answer questions about assets, debts, and the claims process. If approved, the court will appoint the liquidator and set directions. Ask for a stay of proceedings if needed.

- Implement the order. Provide the order to the liquidator and stakeholders. The liquidator takes control of assets and records. Directors should cooperate and deliver company property.

- Run the creditor claims process. Publish notices and send notices to known creditors. Set and manage the claims deadline. Review proofs of claim and determine amounts.

- Realize assets and pay claims. Collect receivables, sell assets, and settle secured debts. Pay liquidation costs and priority claims. Follow the proper order of payment.

- Resolve disputes and seek directions if needed. If a claim is disputed, the liquidator can seek directions. You can return to court for clarification on complex issues.

- Handle employee and tax matters. Issue records of employment and pay statutory amounts. File required tax returns and obtain needed tax clearances. Keep evidence of compliance.

- Prepare final accounts. The liquidator prepares a final accounting and a report. Share it with stakeholders per the order. Address any objections.

- Distribute any surplus. After paying debts and costs, distribute remaining funds to shareholders. Document each distribution and obtain acknowledgments.

- Complete dissolution. File the court order and final documents with corporate authorities. Request the final confirmation of dissolution. Keep copies for your records.

- Close out and store records. Close bank accounts, cancel permits, and terminate leases. Store records securely for the required period. Keep a list of where records are held and who to contact.

- Plan for reinstatement risk. If a missed creditor appears, be ready with records. A clear paper trail reduces disputes. Consider insurance run-off coverage if applicable.

- Coordinate with professionals when needed. Accountants can assist with tax clearances. Insolvency professionals support claims and distributions. This helps keep the process efficient and compliant.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.