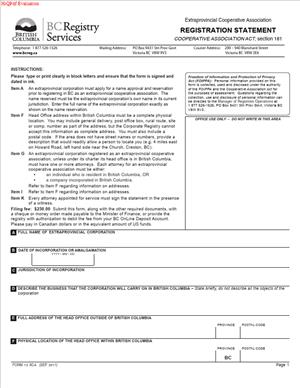

Form 13 – REG 754 – Registration Statement – Extraprovincial

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 13 – REG 754 – Registration Statement – Extraprovincial?

Form 13 – REG 754 is the registration statement you file to register an out‑of‑province or foreign entity so it can legally carry on business in British Columbia. “Extraprovincial” means your organization was formed somewhere else and now needs authority to operate in B.C. This filing creates your official presence in the provincial public register. It also sets up addresses for service, names your local agent for service, and discloses key information about your structure and leadership.

Who typically uses this form?

You do if you manage or advise an entity formed outside B.C. That includes corporations formed in other Canadian provinces or outside Canada. It also includes limited partnerships, limited liability partnerships, and non‑share corporations. Professional firms that are LLPs, charities registered elsewhere, and private companies expanding into B.C. all use this filing. In practice, the person who completes it is often an owner, in‑house counsel, corporate secretary, paralegal, or an external consultant.

You need this form when you plan to “carry on business” in B.C. Common triggers include opening an office, hiring employees, leasing space, owning or developing real property, or holding inventory in B.C. You may also need it if you repeatedly solicit business in B.C., enter ongoing contracts with B.C. clients, or need a B.C. registration number for banking, licensing, or procurement. If you are a federal corporation, you still file this registration to operate in B.C.

Typical usage scenarios

- You formed an Alberta corporation and want to open a Vancouver office.

- You run a Delaware company and plan to hire a B.C. sales team.

- You are an Ontario charity launching a program in B.C.

- You are a Washington State limited partnership buying B.C. property.

- Your professional LLP will serve clients in B.C.

Filing this form registers your entity, assigns a B.C. registration number, and allows you to operate within the province’s legal framework.

When Would You Use a Form 13 – REG 754 – Registration Statement – Extraprovincial?

You would use this form before you start doing business in B.C. or as soon as you realize your activities meet the threshold of “carrying on business.” Opening a physical location, placing staff in B.C., storing goods in a local warehouse, or establishing a regular presence all point to a need to register. Signing recurring service agreements with B.C. clients, bidding on public contracts that require a B.C. registration number, or applying for municipal or professional licences often triggers the filing as well.

Business owners use it when expanding across borders into B.C. Real estate investors use it before taking title to B.C. property in an extraprovincial company or partnership. Franchisors and franchisees use it when setting up B.C. outlets. Construction contractors use it when mobilizing B.C. projects. Professional firms organized as LLPs use it when their partners will practice in B.C. Non‑profit leaders use it when they open a B.C. office, run a program, or fundraise locally. In‑house legal teams use it to put proper compliance in place before onboarding B.C. employees. External counsel or paralegals may file it to meet a transaction closing condition.

Sometimes the trigger is indirect. A bank may require proof of B.C. registration to open a local account. A landlord may demand a B.C. registration number in a lease. A public authority may require registration for permits. Even if your team is remote, repeated in‑province activity can require registration. In each case, you file this form to avoid delays, penalties, or contract issues. The safest practice is to assess early, file before activity starts, and update the record as your B.C. footprint grows.

Legal Characteristics of the Form 13 – REG 754 – Registration Statement – Extraprovincial

This filing is legally binding because provincial law requires out‑of‑province entities to register before carrying on business in B.C. The registration statement is a statutory declaration of your entity’s identity, governing jurisdiction, local service details, and leadership. The provincial registry relies on it to create a public record. False or misleading statements can lead to refusals, fines, or future revocations. The information you submit becomes part of a public file, so accuracy and consistency matter.

What ensures enforceability?

Enforceability rests on three pillars. First, authority: only an authorized signatory of the entity can file. That person certifies that the information is true and that the entity agrees to maintain a presence for service of documents in B.C. Second, service of process: you must designate a local office and usually an agent for service (or attorney for service). That makes it possible for third parties and regulators to deliver legal notices. Third, registry approval: once accepted and the fee is paid, the registry issues a certificate and assigns a B.C. registration number. That certificate is proof of your legal status to operate in the province.

Consider a few legal points as you prepare. Your exact legal name must match your home records. If your name conflicts with B.C. naming rules, you may need an assumed name for use in B.C. If documents are not in English, provide certified translations. Some professional LLPs need confirmation from their regulator before registration. Many entities must show they are in good standing in their home jurisdiction. After registration, you have ongoing duties. File annual reports on time, keep your registered office and agent for service current, and report changes to directors, partners, or name promptly. If you stop operating in B.C., you should file to cancel or withdraw your registration to avoid ongoing obligations.

Treat the form as part of a broader compliance framework. Registration in B.C. does not replace licensing, tax registrations, privacy compliance, or employment obligations. It sets your legal footprint. Once you have it, you can enter contracts, sign leases, hire staff, and hold assets with clarity on where legal notices will land. If you are in a specialized sector, confirm any extra approvals you need in parallel. Clean, complete filings keep your path clear and reduce back‑and‑forth with the registry.

How to Fill Out a Form 13 – REG 754 – Registration Statement – Extraprovincial

Before you start, confirm the entity type and the activities you will conduct in B.C. Gather core documents and line up a local address for service. If you plan to operate under your home legal name, confirm it meets B.C. naming rules. If not, prepare an assumed name for B.C. Prepare to attach recent proof that your entity is active in its home jurisdiction.

1) Confirm the correct filing and entity type.

- Identify whether you are a corporation, non‑share corporation, limited partnership, or limited liability partnership. The registration statement captures different details based on type. For a corporation, you will list directors. For a partnership, you will list partners and their roles. For an LLP, you may need to confirm the profession and regulatory standing.

2) Secure your B.C. name.

- Decide if you will use your exact home name or adopt an assumed name for B.C. If your home name is taken or restricted in B.C., select an assumed name that meets naming rules. Use the name consistently across the form and attachments. If your name includes a foreign language or script, provide an English version and a translation certificate if needed.

3) Gather home jurisdiction details.

- Record your home jurisdiction (province, state, or country). Note your original formation date and registration or incorporation number. If your existence is time‑limited, capture the expiry date. If your entity was continued from one jurisdiction to another, note the most recent one. Keep the formatting of the legal name and number exactly as it appears on your home certificate.

4) Identify your business structure.

- For corporations, indicate whether you are share‑capital or non‑share. For limited partnerships, list the general partner(s) and limited partner(s). For LLPs, note the firm’s nature and any practice restrictions. If you have a parent entity or a general partner that is itself a corporation, be ready to provide its jurisdiction and number as well.

5) Provide head office information.

- Enter the principal office address in your home jurisdiction. Include street, city, region, postal or zip code, and country. This is your main address outside B.C. Use a physical address, not a P.O. box, for the delivery address. If you need a separate mailing address, include it as well.

6) Set up your B.C. registered and records office.

- Provide a B.C. delivery address for your registered office. This must be a physical location in B.C. where someone can be served during business hours. If your records are kept at a different B.C. address, provide a records office address too. Many entities use the same address for both. If you also want a mailing address, list it.

7) Appoint your B.C. agent for service (or attorney for service).

- Name an individual or firm located in B.C. who will accept service of legal documents for you. Enter the full name and a B.C. delivery address. Confirm that your agent has consented to act. The form will include a consent section or a separate appointment. If your agent is a firm, ensure an individual contact is listed. Do not leave this role blank. It is essential for enforceability and smooth operations.

8) List directors, officers, or partners as required.

- For corporations, list each director’s full legal name and an address for service. Follow formatting instructions for middle names or initials. For non‑share corporations, list directors or equivalent governing persons. For limited partnerships, list general partners and limited partners, including their addresses and jurisdictions. If a partner is an entity, include its jurisdiction and number. Use additional schedules if the space on the form is not enough.

9) Describe the nature of business in B.C.

- Provide a clear, concise description of your activities. For example: “Software development and sales,” “Residential property ownership and leasing,” or “Accounting services by LLP.” Avoid vague phrases. This description helps assess naming, licensing, and any special approvals.

10) Name your authorized filing contact.

- Provide a responsible person’s name, email, and phone number. This is who the registry will contact for questions. Use an address where you will see communications quickly. Many delays happen because no one monitors the inbox.

11) Attach required supporting documents.

- Certificate of status or good standing from your home jurisdiction. It should be recent. Check the current freshness window and aim to be well within it.

- Certified or notarized copy of your constating documents (for example, articles, charter, or partnership agreement). If your entity type requires a specific kind of extract, include that version.

- Certified translations if any document is not in English. Include the translator’s certificate.

- If you are a professional LLP, attach any required regulator confirmations.

- If you will use an assumed name in B.C., include any required name consent documentation.

- If an agent for service consent is separate, attach it signed and dated.

12) Review address and name rules carefully.

- Delivery addresses must be physical. Avoid P.O. boxes for delivery fields. Use the exact legal name throughout. Confirm that director and partner names match passports or home filings. Make sure all B.C. addresses are inside the province. Minor inconsistencies cause returns.

13) Sign the declaration.

- The form includes a declaration that the information is true and that you are authorized to file. A director, officer, general partner, or authorized attorney‑in‑fact can sign. Enter the signatory’s full name and title. Date the declaration. If the agent for service must also sign a consent, ensure they sign as well. Keep signing authority evidence on file in case of audit.

14) Pay the filing fee.

- Fees vary by entity type. Prepare a payment method that matches the registry’s accepted options. Confirm the amount before submission. Payment issues delay processing.

15) Submit and track.

- Submit the complete form and attachments through the accepted filing channel. Keep a copy of everything you submit. Track your submission until you receive confirmation. Respond quickly to any rejection notes or requests for clarification. Most corrections involve names, dates, or addresses.

16) Obtain and store your registration certificate.

- Once accepted, you receive proof of registration and a B.C. registration number. Save the certificate. Provide it to banks, landlords, procurement portals, and licensing bodies as needed. Update your letterhead and contract templates with the correct legal name and B.C. number if required.

17) Calendar ongoing compliance.

- Add reminders for your annual report filing. Track deadlines to report changes to directors, officers, partners, B.C. office addresses, or agent for service. If your home jurisdiction status changes, fix it quickly and consider notifying the registry if required. If you cease operations in B.C., file to cancel your registration to stop future obligations.

Schedules and attachments often deserve special attention. If you have many directors or partners, prepare a clean schedule that mirrors the form’s layout. Use consistent columns for names, addresses, and roles. Number each page and reference the entity’s legal name and home jurisdiction on every schedule. If you attach a translated document, staple the translation certificate directly to the source document to avoid separation. If your general partner is an entity, attach evidence of its existence and authority, especially if it is not formed in B.C.

Common pitfalls to avoid

- Do not use trade names where the form asks for the legal name.

- Do not mix delivery and mailing addresses.

- Do not let a certificate of status go stale before filing.

- Do not list a director or partner without their consent to act.

- Do not assume your agent for service role is honorary; choose someone reliable and reachable.

- Do not delay updates after material changes. The registry expects a current, accurate public record.

A few practical examples help bring this together. An Ontario corporation plans to lease a warehouse in B.C. It files the form with its exact corporate name, sets a B.C. registered office at its law firm’s address, appoints the firm as agent for service, lists its directors, describes “consumer goods distribution,” and attaches a recent certificate of status and articles. A Washington limited partnership buys an apartment building in B.C. It files with the LP legal name, lists its corporate general partner with jurisdiction and number, provides the B.C. property manager’s address as registered office, names a local agent for service, and attaches the partnership agreement and a certificate of status for the general partner. A professional LLP from Alberta registers to offer services in B.C. It confirms the profession on the form, provides regulator confirmations if required, names partners, and appoints a B.C. agent for service.

If you take the time to prepare, the filing is straightforward. Gather accurate data, line up a reliable B.C. service address, and attach clear, current proof of your good standing. Use consistent names and dates across every page. With those basics in place, your Form 13 – REG 754 will be accepted, and you can move ahead with hiring, contracting, and operating in B.C. with confidence.

Legal Terms You Might Encounter

- Extraprovincial company means your organization is formed in another jurisdiction but wants to carry on business in British Columbia. On Form 13 – REG 754, you identify your home jurisdiction and confirm you meet the requirements to operate in B.C.

- Home jurisdiction is where your company is originally incorporated, continued, or formed. The form asks for your home jurisdiction’s corporate number and exact legal name as it appears on that registry.

- Assumed name is the business name you will use in B.C. if your home name is not available or not compliant in this province. The form lets you state the assumed name once you have name approval.

- Attorney for service is the person in British Columbia authorized to accept court documents and official notices for your company. The form collects the attorney’s full name and a B.C. delivery address where documents can be served.

- Registered office (B.C.) is the physical address in British Columbia where your company’s records can be inspected and where notices can be delivered during business hours. The form distinguishes between delivery and mailing addresses for this purpose.

- Delivery address is a street address where personal delivery or courier can occur. You list this on the form for the registered office and for the attorney for service. A post office box does not satisfy a delivery address.

- Mailing address is where mail is received. It can be a P.O. Box. If different from the delivery address, you provide both on the form to ensure accurate contact.

- Date business begins in B.C. is the effective date your company starts carrying on business in the province. The form asks for this date to establish when registration obligations begin.

- Nature of business is a plain-language description of your main business activities. The form uses this to categorize your operations. Keep it specific and concise.

- Authorized signatory is the person who signs the form on behalf of your company. This can be a director, officer, or authorized agent. By signing, they certify the information is true and complete.

- Certificate of registration is the document you receive after the form is approved and filed. It confirms your company is registered as an extraprovincial company in British Columbia and includes your assigned corporate number.

FAQs

Do you need name approval before filing?

Usually, yes. If your home-name conflicts with a name already on record in British Columbia or doesn’t meet naming rules, you need an approved assumed name. You’ll include that approved name and the name approval reference on the form. If your exact home-name is available and acceptable, you may proceed under that name.

Do you need an attorney for service in British Columbia?

Yes. You must appoint an individual located in B.C. who can accept legal documents during business hours. You provide their full name and delivery address on the form. Choose someone responsive and stable, as missed service can lead to default judgments or compliance issues.

Can you list a P.O. Box for the registered office?

You can list a P.O. Box as the mailing address, but you need a street-level delivery address for service and inspections. The form separates delivery and mailing fields so you can provide both.

What supporting documents might be required with the form?

Expect to provide evidence that your company exists and is in good standing in its home jurisdiction. This can include a certificate of status and sometimes certified charter documents. If your company recently changed its name, include proof of the name change. Have English translations if originals aren’t in English.

Who can sign the form for the company?

A director, officer, or a properly authorized agent can sign. The signer certifies accuracy. If an agent signs, ensure they hold written authorization from the company and keep that authorization with your records.

How long does registration take after filing?

Processing time depends on how you file and current volumes. Online filings are typically faster. Paper or courier submissions take longer. Build in lead time if you need registration for a fixed deadline like a contract award or permit application.

Do you need to register before starting work in B.C.?

You should register before carrying on business in B.C. If you start first, you risk penalties or delays in permits, banking, or contract execution. The form asks for the date you begin business in B.C., so plan registration ahead of that date.

What happens after approval?

You receive a corporate number and a certificate of registration. You must display the registered name in B.C., maintain your attorney for service and registered office, and file ongoing updates and annual returns. Keep your records current to stay in good standing.

Checklist: Before, During, and After the Form 13 – REG 754 – Registration Statement – Extraprovincial

Before signing: Information/documents needed

- Exact legal name in home jurisdiction (as it appears on that registry).

- Home jurisdiction corporate number and incorporation/formation details (date, type).

- Name approval or assumed name details, including the approval reference if applicable.

- B.C. registered office delivery and mailing addresses (delivery address must be a street address).

- Attorney for service: full legal name and B.C. delivery address; written consent if you use one.

- Head office address (outside B.C.), if different from the registered office.

- Nature of business description (clear and specific).

- Date you plan to begin business in B.C.

- Authorized signatory information and signing authority documentation if an agent will sign.

- Supporting documents: certificate of status, certified charter documents, name change proof, and English translations if needed.

- Payment method for the filing fee and any name approval fee.

During signing: Sections to verify

- Company name and assumed name: spelling, punctuation, and capitalization match approvals.

- Home jurisdiction details: jurisdiction type, corporate number, and formation date.

- Address fields: delivery vs. mailing addresses entered in the correct fields.

- Attorney for service: full name and a B.C. delivery address suitable for service.

- Nature of business: concise and accurate description of core activities in B.C.

- Date business begins in B.C.: realistic and consistent with your project timeline.

- Certification statement: the signer understands and accepts responsibility for accuracy.

- Attachments: all required supporting documents are attached, current, and legible.

- Translations: included and certified where applicable.

- Contact email and phone number for filing correspondence and approvals.

After signing: Filing, notifying, storing instructions

- File the completed form and attachments with the corporate registry through the accepted channel (online, courier, or in person).

- Pay the filing fee in the accepted format. Retain proof of payment.

- Track the filing. Note any confirmation or transaction number.

- When approved, retrieve the certificate of registration and assigned corporate number.

- Notify internal teams: legal, finance, tax, sales, procurement, and project managers.

- Update external parties as needed: banks, insurers, landlords, government agencies, and contract counterparties.

- Register for any required tax accounts, permits, or industry licenses tied to B.C. operations.

- Post-registration obligations: calendar annual filing dates and change-notice deadlines.

- Store records in your corporate minute book: the filed form, certificate, supporting documents, translations, and signing authorization.

- Set reminders to monitor the attorney for service and registered office addresses for continued availability.

Common Mistakes to Avoid in Form 13 – REG 754 – Registration Statement – Extraprovincial

Using a P.O. Box as a delivery address

- Consequence: The filing can be rejected because service requires a street address. Don’t forget to provide a physical delivery address for the registered office and the attorney for service.

Mismatching the company name with the home registry

- Consequence: Name discrepancies trigger delays or refusals. Ensure the legal name matches the home jurisdiction exactly and use an approved assumed name if needed.

Missing or outdated supporting documents

- Consequence: The registry may place your filing on hold or return it. Check document currency and certification, and include translations when required.

Listing a start date already passed without prior registration

- Consequence: You risk penalties or compliance reviews. If you already started operations, expect questions about the start date. Be accurate and be prepared to address timing.

Incorrect or vague nature of business

- Consequence: Ambiguity can lead to follow-up questions, processing delays, or misclassification. Be precise and use plain language that aligns with your actual activities.

Unclear authorization for the signer

- Consequence: The registry may question the validity of the filing. If an agent signs, keep written authorization on file and confirm the agent’s details are accurate.

What to Do After Filling Out the Form Form 13 – REG 754 – Registration Statement – Extraprovincial

- Submit the filing promptly. Choose the filing method that meets your timing needs. Confirm that all attachments are included and legible. Keep a record of submission, including any confirmation number and the date filed.

- Monitor for approval. Watch for emails or notices about acceptance or required corrections. Respond quickly to any request for clarification or additional documents. If the filing is returned, fix the issues and resubmit with a cover note referencing the prior submission.

- Receive and circulate your registration. Once approved, save the certificate of registration and your assigned corporate number. Share these with teams that need them for banking, contracting, permits, and insurance. Update your invoices, letterhead, and customer-facing materials to show your registered name in B.C.

- Set up compliance routines. Add annual report due dates and change-notice deadlines to your calendar. Assign ownership for maintaining the attorney for service and the registered office addresses. Confirm that someone checks those addresses for official mail and service daily.

- Register for related accounts. If your business requires tax registrations, payroll accounts, or sector-specific licenses in B.C., complete those applications now. Some agencies will ask for your corporate number and proof of registration.

- Update internal systems. Add your B.C. registration number to vendor profiles, contract templates, ERP records, and banking mandates. Ensure procurement and sales teams understand when to use the B.C. assumed name versus your home name.

- Plan for amendments. If your company’s name, directors, attorney for service, or addresses change, you must file a notice of change within the required timelines. Keep template forms and instructions ready so you can move fast when changes occur.

- Maintain records. Keep the filed form, certificate, supporting documents, translations, and any agent authorization in your corporate minute book. Save digital copies with consistent naming and access controls. Record the date you began business in B.C. to support compliance checks.

- Prepare for renewals and audits. Ensure your corporate standing in your home jurisdiction remains current. If your standing lapses, it can affect your B.C. registration. Retain current certificates of status and schedule periodic reviews of your filing details to keep them accurate.

- Coordinate exits if needed. If you plan to cease carrying on business in B.C., file the appropriate cessation or cancellation documents. Close related tax accounts and notify stakeholders to avoid unnecessary annual filings or fees.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.