Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial

Fill out nowJurisdiction: Canada | Province: British Columbia

What is a Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial?

This form is the official notice to the British Columbia Corporate Registry that an extraprovincial company has changed its head office address outside British Columbia. An extraprovincial company is formed under another jurisdiction’s laws, but is registered to carry on business in British Columbia. The registry uses this filing to update the public record of where your company’s head office is located outside the province.

You use this form to report a change to the company’s head office address in its home jurisdiction or another location outside British Columbia. It does not change your registered office or records office in British Columbia. It also does not change your agent or attorney for service in the province. Those are separate filings. This form is focused on your head office outside B.C.

Who typically uses this form?

Corporate secretaries, in-house counsel, paralegals, and authorized officers of extraprovincial corporations. Law firms and corporate service providers also file it on behalf of their clients. It applies to both for-profit and non-share corporations that are extraprovincially registered in B.C., as long as the entity has a “head office” situated outside B.C.

Why would you need this form?

The law expects your public record to match your current corporate details. Government notices, regulatory correspondence, and many searches rely on the accuracy of that record. If your head office changes and you do not update the registry, you risk being out of compliance. That can lead to warnings, late fees, or even the cancellation of your extraprovincial registration in serious cases. It can also cause delays with permits, business licences, or due diligence checks. Updating the record is simple and protects your standing.

Typical usage scenarios

- Your company moves its headquarters from one city to another outside B.C.

- Your board approves a new head office address after a merger

- You consolidate offices in another province or country

- You update addressing details to reflect a new suite number or street address format

- You regularize the record after an internal reorganization that changed your head office address

- You may also use it if your head office returns to a previous address after temporary relocation, provided that address is still outside B.C.

In short, if you are an extraprovincial company registered in British Columbia and your head office outside the province has changed, this is the form you file to keep the registry current.

When Would You Use a Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial?

You use this form as soon as your head office address outside British Columbia changes. That includes changes within the same city, across provinces, or across borders, provided the new address remains outside B.C. For example, if your Alberta-based corporation moves its headquarters from Calgary to Edmonton, you file this change. If your Washington corporation moves from Seattle to Portland, you file it. If your Ontario not-for-profit moves from one Toronto address to another, you file it. Even minor address adjustments can trigger a filing, such as a change in unit number or street renaming, if the effect is a new official head office address.

You would not use this form if your company’s registered office or records office inside British Columbia has changed. That is a different filing. You also would not use this form to change your company name, your directors, or your agent for service. Use this form only to update the head office outside the province.

Typical users

- Directors

- Officers

- Corporate administrators,

- Legal teams responsible for entity management.

If you work in house, you likely track corporate changes and prepare filings across multiple jurisdictions. This form is part of that routine housekeeping. If you retain a law firm or corporate service provider, you will provide the new head office details and an authorized signatory, then the service provider will file on your behalf.

There are special moments when this filing becomes critical. During financings or M&A, buyers, lenders, and regulators examine your status. They look for consistency between your home jurisdiction and the B.C. registry. If you changed your head office months earlier and the B.C. record still shows the old address, you can trigger extra questions and closing delays. You also need the record updated when renewing provincial licences or permits that draw from Corporate Registry data. Making the filing promptly avoids friction.

If your company has redomiciled or continued to a new jurisdiction, take extra care. A new head office address may be part of that change. This specific form updates the address only. A change in your jurisdiction of formation is a separate process. Ensure you make the correct filings in the right order so the registry data remains consistent.

Legal Characteristics of the Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial

This is a statutory filing. It is not a contract between parties. It is a formal declaration to the British Columbia Corporate Registry that your extraprovincial company’s head office address outside the province has changed. The form is legally binding because the governing corporate legislation requires extraprovincial companies to keep their registered information accurate and to notify the registrar of changes. When you submit the form, an authorized person certifies that the information is true and complete. False or misleading statements can lead to regulatory action.

What ensures enforceability?

Enforceability stems from several points. First, the registrar has authority to keep an accurate public register and to require timely updates. Second, the filing becomes part of the official record upon acceptance by the registry. Third, the registry may assess administrative consequences for non-compliance, which can include late fees, notices of default, or cancellation of your extraprovincial registration in serious or prolonged cases. These measures encourage prompt compliance and protect the public record.

The filing also supports due process and service. While service of documents on an extraprovincial company often occurs at the B.C. registered office or agent for service, regulators and counterparties still rely on the head office address for corporate communications. Keeping it current ensures notices reach the right place. It also reduces disputes over whether a notice was sent to the correct address outside B.C.

General legal considerations apply. Use a complete, physical address for the new head office. Many registries do not accept a P.O. Box as the sole address for a head office. If your head office uses both a physical and a mailing address, include both if the form provides fields for that. Make sure the address is outside British Columbia. This form is not used to declare a head office within B.C. If your new head office is now inside B.C., speak with counsel. That situation may require a broader change to your registration status.

Be accurate and consistent with your home jurisdiction’s record. If your home registry shows a different head office address than the one you file in B.C., a discrepancy can trigger questions or a rejection. Align your filings across jurisdictions. Keep your board resolution or internal approval in your minute book, even if the registrar does not ask for it. You must be able to show how and when the company approved the address change.

Finally, note the effective date. The change takes effect on the date the registry records it or on the effective date you state, if the system allows a future effective date. Not all changes permit future dating. If you need the record to show a specific effective date, plan your submission accordingly.

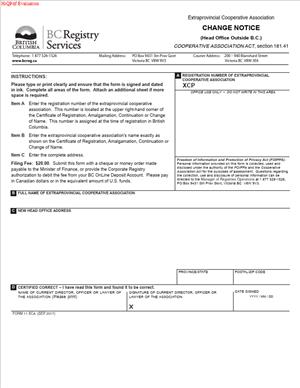

How to Fill Out a Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial

1) Confirm you are using the right filing

- Verify that your entity is extraprovincially registered in British Columbia. If you are a B.C.-formed company, this is not your form.

- Verify that the change relates to your head office address outside B.C., not your B.C. registered office or records office.

- Confirm that the new head office address is outside B.C. and is final. Avoid filing during a temporary move unless that is your official head office.

2) Gather the required information

Collect these details before you start. It saves time and prevents errors.

- Exact legal name of the extraprovincial company as it appears on the B.C. register.

- B.C. extraprovincial registration number.

- Home jurisdiction (for example, Alberta, Delaware, or Ontario).

- Existing head office address outside B.C. (for reference, if the form requests it).

- New head office physical address outside B.C. Include unit/suite, street, city, province/state, country, and postal/ZIP code.

- New head office mailing address, if different from the physical address.

- Effective date of the change, if the form allows you to set one.

- Name, title, email, and phone of the authorized signatory.

- Name and contact details of the filing contact, if different from the signatory.

3) Check address formatting and eligibility

- Use a physical street address for the head office. If your head office uses a P.O. Box for mail, list it as the mailing address only.

- Confirm the address is outside British Columbia. The system may reject a B.C. address entered in this form.

- Ensure the address matches your home jurisdiction record to prevent inconsistencies.

4) Complete the company identification section

- Enter the exact legal name. Match spelling, punctuation, and any legal ending (Inc., Ltd., Corp., ULC).

- Enter the B.C. extraprovincial registration number. This links the filing to your record in the registry system.

- Enter your home jurisdiction. Use the proper short name or full name as the form requests.

5) Complete the head office address change fields

- Enter the old head office address if the form requests it for confirmation.

- Enter the new head office physical address in full. Do not abbreviate city names. Use standard postal formatting for the country.

- Enter the mailing address if different from the physical address. This is useful if mail should go to a P.O. Box or central mailroom.

- If the form permits it, select or enter the effective date. If not, the change will take effect on registry acceptance.

6) Add the authorized signatory certification

- Identify the signing capacity. Typical options include director, officer, or authorized agent.

- Confirm the statement of truth. You are certifying the accuracy of the information.

- Provide the signatory’s name, title, email, and phone. The registry may use this for questions.

7) Review and proofread before submission

- Cross-check the legal name and registration number.

- Confirm the new address is correct, complete, and outside B.C.

- Verify the postal/ZIP code and country.

- Ensure the effective date (if any) is what you intend.

- Check that the signatory’s details are correct and that they are authorized.

8) Pay the prescribed filing fee

- A government fee applies. Have a payment method ready.

- If you use a service provider, confirm fee arrangements in advance.

9) Submit and retain records

- Submit the form through the accepted filing channel.

- Save the confirmation, receipt, and a copy of the filed form.

- File the approval and the filed copy in your minute book.

- Update your internal registers and corporate information sheets.

10) Follow-up steps after acceptance

- Notify your teams and advisors of the change: tax, finance, legal, and licensing.

- Update provincial licences or permits that reference your head office address.

- Update insurance certificates, banking resolutions, and audit engagement letters.

- Update letterhead, website, and any regulatory filings that mention the head office.

- If your registered office in B.C. or agent for service also needs an update, file that separately.

Common Mistakes to Avoid

- Using this form to change your B.C. registered office or records office. That is a different filing.

- Entering a B.C. address as the “head office outside the province.” The system will not accept it.

- Listing only a P.O. Box for the physical head office address. Provide a street address.

- Allowing a third party to sign without proper authorization. Keep a resolution or signed authorization on file.

- Setting an effective date that conflicts with your home jurisdiction’s record. Align your filings.

- Missing suite numbers or postal codes, which can delay acceptance or cause misdirected mail.

Who can sign?

- A director or officer of the company can sign.

- An authorized agent can sign if you have granted written authority. Keep that authority with your records.

- Use the same signatory style you use for other statutory filings. Consistency helps if questions arise.

Practical examples

- Intra-province move outside B.C.

Your corporation is incorporated in Alberta and registered in B.C. Your head office moves from 123 Main Street, Calgary to 456 King Street, Edmonton. You complete the form with your company name, B.C. registration number, home jurisdiction “Alberta,” and the new Edmonton address. You set the effective date to the move date and submit. You then update your finance team and licensing contacts.

- Cross-border move

A Washington corporation registered in B.C. relocates its head office to Oregon. You enter the new Oregon street address, confirm the country and ZIP code, and submit. You also check your home state records to ensure the address matches. You notify your registered agent in B.C. that the head office has changed for their records.

- Address normalization

Your Ontario not-for-profit changes only the suite number in Toronto due to a building reconfiguration. Even though the city stays the same, your official head office address changes. You file this form to keep the B.C. record aligned. You attach the internal board resolution to your minute book.

Timing tips

- File promptly after the effective change. Do not wait for year-end housekeeping.

- If your move date is fixed, prepare the form and submit as soon as the system allows.

- If you are coordinating filings across jurisdictions, schedule the B.C. submission to match the home registry’s effective date.

Recordkeeping tips

- Keep a copy of the filed form, the registry confirmation, and proof of payment.

- File the board resolution or officer’s certificate approving the address change.

- Update your corporate profile sheet and distribution lists to prevent missed notices.

What this form does not do?

- It does not change your B.C. registered office or records office address.

- It does not change your agent or attorney for service in B.C.

- It does not change your company name, directors, or jurisdiction of formation.

- It does not update your business addresses used for operations inside B.C.

If you need to make any of those other changes, plan separate filings. Many companies bundle multiple filings during a reorganization, but each change has its own form and fee. Keep a checklist so nothing gets missed.

Bottom line: Use Form 11 – REG 739 to keep your head office address outside British Columbia current on the B.C. Corporate Registry. Gather the correct information, file promptly, and maintain clean records. That keeps you in good standing and avoids unnecessary administrative issues.

Legal Terms You Might Encounter

- Extraprovincial company: This is a company formed outside the province that is registered to carry on business in the province. You use this form to update the registry when your extraprovincial head office address changes outside the province.

- Head office: This is the company’s main administrative location. It is not the same as a registered office in the province. On this form, you report the new head office address located outside the province.

- Registered office: This is the official address for legal notices inside the province. It may stay the same even if your head office changes. Do not list the registered office in the head office field.

- Records office: This is where corporate records are kept in the province. It can differ from both the registered office and the head office. The form does not change your records office.

- Agent for service: This is the individual or firm appointed to receive legal documents in the province. A head office change does not replace your agent for service. Keep those details current in separate filings.

- Recognized jurisdiction: This is the place where your company was formed or primarily governed. Your head office may be in that jurisdiction or another one. The form needs the correct country, state, or province for the new address.

- Effective date of change: This is the actual date your head office changed. Use the real date the company adopted the new address. The registry records this date from the form.

- Delivery address vs. mailing address: A delivery address is a physical location where someone can attend. A mailing address can be a PO Box. If the form asks for a delivery address, do not enter a PO Box.

- Authorized signatory: This is the person who has authority to sign the form for the company. Their title must match your internal authorizations. The registry can reject filings signed by unauthorized individuals.

- Registry identifier: This is your company’s assigned number with the provincial registry. Include it exactly as it appears on your profile. It helps the registry match your filing to the right entity.

- Certificate of status or good standing: This is a document from your home jurisdiction confirming the company is active. You may not need to attach it for this form. Still, keep one current in case the registry requests proof.

FAQs

Do you need to file this form if only your mailing address changed?

Yes, if your head office mailing address changed outside the province, file the form. Use the correct fields for delivery and mailing addresses. If only your provincial registered office changed, use the separate change filing for that.

Do you need to file before or after the head office change takes effect?

File as soon as the decision is final and the address is active. Many corporations set the effective date first, then file promptly. Do not wait until year-end or your next annual filing.

Do you need to attach proof of the new address?

Usually, the registry relies on your certification. It can still request supporting materials. Keep internal records, such as a board resolution or lease, in your minute book.

Do you need a board resolution to support this filing?

Follow your own governing documents. Many companies require a resolution for office changes. Keep the resolution with your records, even if you do not attach it to the form.

Do you need to change your agent for service at the same time?

No. A head office change outside the province does not update your provincial agent for service. File that change separately if needed. Keep your agent informed of the new head office to avoid missed notices.

Do you need to notify your home jurisdiction too?

Likely, yes. Most jurisdictions require you to keep your home records current. Update your home registry if their rules require head office updates.

Do you need to pay a fee?

Yes. The registry charges a prescribed fee for this change filing. Have a payment method ready when you submit.

Do you risk penalties if you do not file the change?

Yes. Late filing can lead to rejection of other filings, late fees, or loss of good standing. It can also complicate service of legal documents and contracts.

Checklist: Before, During, and After the Form 11 – REG 739 – Change of Head Office Outside the Province – Extraprovincial

Before signing: Information and documents you need

- Full legal name of the company as shown on the registry.

- Registry identifier or number for the company.

- Exact new head office delivery address outside the province.

- New mailing address, if different from the delivery address.

- Effective date of the head office change.

- City, state or province, country, and postal or ZIP code.

- Confirmation of internal approval (e.g., board resolution).

- Name and title of the authorized signatory.

- Your current registered office and agent for service (for cross-checks).

- A payment method for the filing fee.

During signing: Sections to verify

- Company name appears exactly as on the registry profile.

- Registry identifier matches your entity record.

- Delivery address is a physical address, not a PO Box.

- Mailing address is complete and accurate, if different.

- City, state or province, country, and postal or ZIP are correct and in standard format.

- Effective date reflects the true date of change and is not left blank.

- Authorized signatory’s name and title are correct and legible.

- You have dated and signed in the designated spaces.

- Any required certifications or declarations are completed.

- You reviewed for typos, missing suite numbers, or transposed postal codes.

After signing: Filing, notifying, and storing

- Submit the form through the registry’s accepted method and pay the fee.

- Watch for the registry’s confirmation or notice of filing.

- If the filing is rejected, correct issues and resubmit promptly.

- Update your minute book with the filed copy and any resolutions.

- Notify your registered office, records office, and agent for service.

- Update tax accounts, business licences, and permits where required.

- Refresh banking, insurance, payroll, and vendor records with the new address.

- Update letterhead, invoices, website, email signatures, and marketing materials.

- Notify major customers, lenders, landlords, and partners.

- Calendar your next compliance dates and confirm consistency across jurisdictions.

Common Mistakes to Avoid

- Listing a provincial address as the head office. This form is only for head offices outside the province. Don’t forget to use a true out-of-province address. Consequence: rejection or correction requests.

- Using the registered office instead of the head office. The head office is your central administrative location. Consequence: misdirected notices and potential compliance issues.

- Leaving out the suite or unit number. Missing unit details cause delivery failures. Consequence: returned mail, delays, or inability to confirm address.

- Choosing the wrong effective date. Some filers pick the signing date instead of the actual move date. Consequence: inaccurate records and potential conflicts with other filings.

- Having an unauthorized person sign. The registry may question authority if titles don’t align. Don’t forget to have an authorized signatory execute the form. Consequence: rejection and rework.

- Not aligning with home records. The head office on your home registry and this filing should match. Consequence: mismatched records and inquiries from regulators.

What to Do After Filling Out the Form

- File the form with the registry and pay the prescribed fee. Use the registry’s accepted filing method. Keep a timestamp or receipt of submission.

- Track the filing status. If the registry issues a correction notice, address it quickly. Resubmit with fixes and note any deadlines.

- Save proof of filing. Keep the registry confirmation, a copy of the form, and your resolution in the minute book. Store them where your officers can access them.

- Update internal systems. Revise accounting, payroll, CRM, and contract templates. Make sure your invoice and letterhead show the new head office.

- Notify key stakeholders. Tell your registered office, records office, and agent for service. Inform lenders, insurers, and major customers. Confirm they updated their records.

- Coordinate with your home jurisdiction. If your home records show a different head office, file an update there as needed. Keep dates and addresses consistent across filings.

- Review related filings. If your registered office or agent for service has also changed, file those changes separately. Do not rely on this form to update them.

- Update public-facing information. Refresh your website, social profiles, and directory listings. Avoid conflicting addresses in different places.

- Check licences and permits. Some licences rely on the head office address. Amend them where required to prevent renewal issues.

- Plan for future changes. If you expect another move, prepare draft resolutions and approval processes. Keep a template and checklist ready to speed up the next filing.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.