Form 02 COR – Corrections for Sole Proprietorship / General Partnership Registration

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration?

Form 02 COR is the official correction filing for business name registrations in British Columbia. You use it to fix errors in a registered sole proprietorship or general partnership record. It updates the public record to reflect what should have been filed on the original date.

You file a correction when the information was wrong at the time of filing. It is not for routine updates that became true later. Think of it as a repair to a filing, not a change to your business.

Who typically uses this form?

Sole proprietors, general partners, and authorized agents. Accountants, paralegals, and law firm staff often file it on behalf of clients. As the owner or partner, you are responsible for its accuracy.

You might need this form if your registration shows a typo or wrong detail. That could be a misspelled business name or an incorrect address. It could be a partner’s legal name entered incorrectly. It could be the wrong filing date or a transposed number in a postal code. The error must have existed on the day you filed the original registration.

Typical usage scenarios

- Your bank flags a mismatch between your business name and your account.

- A licensing officer refuses a permit because your address is wrong in the registry.

- A large customer checks your registration and finds the partners listed incorrectly.

- You discover a clerical error while preparing a renewal or a tax account.

- You realize your trade name was spelled wrong in the record.

A correction filing keeps your public record accurate. It helps you avoid delays with banks, suppliers, insurers, and regulators. It supports clear service of legal documents. It also avoids confusion in due diligence checks. You reduce the risk of missed notices and payment delays tied to mismatched records.

Form 02 COR covers both sole proprietorship and general partnership registrations. You will identify which type you are correcting. The correction is linked to your existing registration number. The corrected information appears in the public system with the appropriate effective date.

Use the correction form only to fix original errors. Do not use it for real changes that happened after filing. For example, a new address after you moved is a change, not a correction. Adding or removing a partner is a change, not a correction. A different owner for a sole proprietorship is not a correction at all. A sole proprietorship cannot be transferred. You end the old registration and start a new one under the new owner.

When Would You Use a Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration?

You use this form when the registered record does not match the facts on the original filing date. The most common case is a typographical error. Maybe you typed “Westcoats Roofing” instead of “Westcoast Roofing.” Maybe your delivery address shows “Suite 120” but should have been “Suite 210.” These are classic correction items.

Another example is a misrecorded legal name. If a partner’s legal surname was entered incorrectly, that is a correction. If your own legal name was truncated or missing a hyphen, you correct it. If the name changed later due to marriage, that is not a correction. That is a change you file later.

Dates and numbers often need corrections. Perhaps the filing shows the wrong registration date, or the wrong postal code. If the recorded date was a system or data entry error, you file a correction. You provide the correct date as it should have appeared at filing.

Address errors are frequent. If the business location or mailing address was wrong on day one, you correct it. If you moved after filing, you do not use a correction. You file a change of address instead.

You also use a correction if the nature of business description was entered wrong. If the description did not match what you actually did on filing day, you correct it. If your business evolved later, that is not a correction. That is a change to reflect a real update.

For a general partnership, partner details matter. If your registration shows the wrong partners due to input errors, you correct it. If the partners changed after filing, you do not use a correction. You file a change notice for partner additions or withdrawals.

Typical users are business owners and partners who manage their own filings. Many businesses engage authorized agents to file on their behalf. Law firms and corporate service providers often handle these tasks. Regardless of who files, you as the owner or partner must ensure accuracy.

You may decide to file a correction after a third party flags a mismatch. For example, your bank cannot open a merchant account due to a name error. A vendor portal rejects your record during onboarding. A licensing officer finds your address inconsistent with your application. Each of these triggers a fast correction to keep operations moving.

File a correction promptly after discovery. Corrections are easier to assess when you act quickly. Delay can cause knock-on effects. Mismatches linger across bank accounts, licenses, and contracts. Prompt filing reduces friction and supports compliance reviews.

Legal Characteristics of the Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration

A correction filing is a statutory record. It updates the public registry for your business name registration. It is legally binding because you certify its truth on submission. The registry relies on your certification to maintain accurate public records.

Enforceability rests on three factors. First, the legislation requires truthful filings. Second, the registry validates form and content. Third, your signature confirms you are authorized and accurate. False statements can attract penalties. They can also undermine your position in a dispute.

A correction does not rewrite history beyond the scope of the error. It aligns the record with what was true at the time you first filed. It is not a tool to backdate business changes. You cannot use it to avoid obligations or alter liability periods. You cannot switch owners of a sole proprietorship using a correction. You cannot add or remove partners through a correction if that change occurred later.

The registry will only accept a correction for proper items. If your request is a real change, the registry may reject the correction. It may direct you to the correct change filing instead. Expect the registry to ask for clarity on ambiguous items. Clear explanations help.

A correction is attached to your registration record. The public can view the corrected information. The system may also display that a correction took place. This maintains transparency and helps third parties interpret your record history.

Accuracy matters for third-party reliance. Banks, insurers, customers, and regulators depend on registry data. The correction ensures your legal name and address are correct. It supports service of documents to the right address. It reduces risk of missed notices or contract disputes caused by identity errors.

Keep documentary support on file. You may need to show how the error occurred. You may need to prove the corrected information was true at the time. Keep copies of IDs, name approvals, and internal notes. This helps if questions arise.

An authorized filer can submit on your behalf. That could be a partner, a lawyer, or a corporate services clerk. Ensure you give clear written authority. Ensure the filer has the exact details and understands the difference between a correction and a change.

There is a filing fee. Fees differ for online or paper methods. Processing times vary. Plan for the time needed if you face a bank or licensing deadline. Submit early and verify the updated public record once processed.

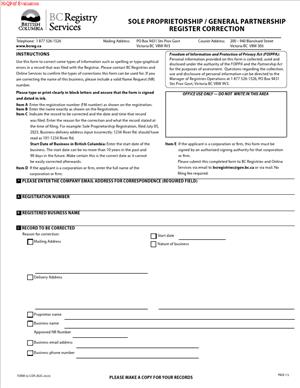

How to Fill Out a Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration

1) Confirm you need a correction, not a change.

- A correction fixes information that was wrong on the filing date. A change updates information that became true after filing. If you moved, that is a change. If you misspelled the original address, that is a correction. If you added a partner, that is a change. If you mis-entered a partner’s name at filing, that is a correction.

2) Gather your key details.

- You need your registration or account number. You need your business or partnership name as currently recorded. You need the original filing date. You need the exact text that is wrong and the exact text that should replace it. Prepare a short reason that explains the error. Keep it factual and neutral.

3) Identify your business type on the form.

- Select sole proprietorship or general partnership. This guides which sections apply to you. It also ensures the correction attaches to the correct record type.

4) Complete the registrant’s legal name information.

- For a sole proprietorship, enter your full legal name. Use the exact legal form, including middle names or hyphens. For a general partnership, list the partnership business name and each partner’s full legal name. Use the names as they were correct on the filing date.

5) Provide the registration identifiers.

- Enter the registration number and any filing number on your receipt. Add the original filing date. This anchors your correction to the proper record.

6) Specify each item to correct using a clear pair.

- Use “Recorded as” and “Should be” for each item. For example: Recorded as: “Westcoats Roofing Ltd.” Should be: “Westcoast Roofing.” If your business name includes a legal element you should not use, flag it. Sole proprietorships and general partnerships do not use corporate legal elements. If you need a different business name entirely, you may need a change filing, not a correction. Confirm availability before you attempt to correct a name.

7) Correct your addresses, if they were wrong at filing.

- The form will ask for delivery and mailing addresses. Delivery addresses should be a physical location. Mailing addresses can be a post office box. If the original address was correct then, but has changed since, do not correct it. File a change of address instead.

8) Correct partner details for a general partnership, as applicable.

- If the partner list was wrong at filing, correct the names and addresses. Do not add new partners through a correction. Only fix errors for partners that should have been listed originally. If you need more space, attach a schedule. The schedule should carry the same heading and include each partner’s full legal name and address.

9) Provide the reason for correction.

- Include a short, clear explanation. Example: “Clerical error on data entry. Legal name omitted hyphen.” Example: “Transposed digits in postal code.” Avoid long narratives or speculation. Stick to the facts.

10) Set the effective date where the form asks.

- Most corrections take effect as of the original filing date. This reflects that the corrected information was true then. If the form requests a specific effective date, choose the filing date. If your situation is unusual, explain the reason in the notes section.

11) Attach supporting documents if needed.

- If you are correcting a legal name, attach proof of the correct name. That could be a government-issued ID copy. If you are correcting a business name spelling, attach your name approval record if you have it. If you are filing as an agent, attach a letter of authorization. Use a schedule page if you need more room for partners or addresses.

12) Review for internal consistency.

- Names must match across sections. Addresses must be complete and consistent. Confirm postal codes and suite numbers. Confirm that the correction aligns with the facts on the filing date. Remove any updates that are really changes.

13) Sign the certification.

- A sole proprietor signs for a sole proprietorship. Any one partner can sign for a general partnership, unless your partnership agreement requires more. An authorized agent can sign if you have explicit authority. The signer certifies that the information is correct and complete. The signer also confirms they have authority to file the correction. Date the form. If filing on paper, use clear, legible printing for names and signatures. If filing online, follow the system’s digital certification process.

14) Pay the filing fee.

- Fees apply to correction filings. If you submit online, you can pay by accepted electronic methods. If you submit in person or by mail, include the required payment. Ensure your payment details are accurate to avoid rejection.

15) Submit the form to the registry.

- Use the provincial filing system for online submission. For paper filings, deliver the form and payment by mail or in person. Keep proof of delivery. Record any transaction or confirmation numbers.

16) Track processing and confirm the update.

- Check the status after submission. When processed, review the public record. Confirm the correction appears exactly as requested. Verify names, addresses, and dates. Save a copy of the corrected record and the filed correction.

17) Notify your stakeholders.

- Provide the corrected details to your bank and payment processors. Update licensing bodies that rely on the registry record. Inform major customers and suppliers if they maintain due diligence files. This avoids delays caused by outdated data.

18) Maintain your records.

- Keep a file with the original registration, the correction, and support. Include internal notes explaining the error and the fix. This helps if questions arise in audits, disputes, or renewals.

Common pitfalls to avoid

- Using a correction to make a real change. If the facts changed after filing, file a change, not a correction.

- Correcting a business name that conflicts with name rules. Ensure the corrected name is allowed for your business type.

- Missing schedules for partner lists. If you have many partners, attach a complete schedule.

- Incomplete addresses. Include suite numbers, city, province, and full postal codes.

- Mismatched legal names. Ensure consistency with identification and internal records.

- Lack of authority. Ensure the signer has clear authority to file.

Real-world examples can help you plan

- You registered “Coastal Timber” as a sole proprietorship. The record shows “Costal Timber.” File a correction to fix the spelling. Provide the corrected name and note the typographical error. Attach your name approval record if needed.

- Your general partnership listed “Jordan Lee” as a partner. The partner’s legal name is “Jordan-Lee Smith.” File a correction to insert the correct legal name. Provide the partner’s full address. Add a brief reason like “name truncated at intake.”

- Your registration shows “123 Main St., Suite 120.” You discover it was Suite 210 when you filed. File a correction to fix the suite number. Explain the transposed digits.

- The postal code appears as V6X 3N1 but should be V6X 3M1. File a correction with the correct code and a short reason.

If the registry queries your filing, respond quickly. Provide any requested support. Clarify that the corrected information reflects the original facts. If you misclassified an update as a correction, prepare to file the proper change instead.

If you discover multiple errors, include them all in one correction filing if allowed. List each “Recorded as” and “Should be” pair. This keeps the record clean and avoids piecemeal updates. If the form limits items, attach a schedule outlining each correction item.

If the business is closing and you find an error, correct first, then file the cessation. This ensures your historical record is accurate. It helps third parties interpret your record after dissolution.

Finally, set an internal control to prevent future errors. Use a checklist and a two-person review before filing. Keep your legal names and addresses in a verified template. These small steps reduce costly follow-up filings.

With Form 02 COR, your goal is simple. Make the public record match the facts that were true on filing day. Keep your explanation concise, your evidence ready, and your details exact. That will speed processing and help you get back to business.

Legal Terms You Might Encounter

- You will see “correction.” A correction fixes an error in your original registration. It does not update current facts. Use it to repair typos, missing details, or wrong data entered at registration. If your business details have changed since registration, that is a “change,” not a correction. Use the proper form for a change.

- “Registration” is the record created when you first filed your sole proprietorship or partnership. Form 02 COR asks the registry to repair that record. It ties your correction back to the original filing. You will need the registration number and filing date to target the right record.

- “Registrant” is the person submitting the form. For a sole proprietorship, that is you, the owner. For a general partnership, it is a partner or authorized agent. The registrant certifies the accuracy of the correction and is responsible for the filing.

- “Firm name” is the business name on the registration. If the firm name was entered incorrectly at registration, you may correct spelling or spacing. You cannot use a correction to adopt a new name. A new or different name is a change, not a correction.

- “Business address” is the physical location where the business operates. “Mailing address” is where you receive mail. On a correction, you fix these only if they were wrong on the original filing. If your office moved after registration, file a change instead.

- “Sole proprietor” means an individual who owns and operates the business. For this form, you confirm the legal name and address of the owner as registered. “General partner” means a partner in a general partnership who is jointly liable. For a correction, you may need all partners’ legal names and addresses as they should have appeared.

- “Effective date of correction” is when the correction takes effect on the public record. It is usually the filing date. In limited cases, the registry may allow an earlier effective date. Use an earlier date only when the original data was wrong on day one.

- “Material error” is a significant mistake that could mislead others. Examples include a wrong legal name, wrong partners, or a wrong business address. Form 02 COR is designed to fix material and non-material errors alike. Be clear and specific about what was wrong and what is correct.

- “Supporting evidence” is proof that the original filing was wrong. You might attach a government ID for a name typo, or a partnership agreement for partner details. The registry may accept a signed declaration if documents do not exist. Provide precise, legible evidence.

- “Declaration” is the statement you sign that the correction is true and complete. You certify that you have authority to file and that the facts are accurate. False declarations can trigger rejection or penalties. Read the declaration closely before you sign.

FAQs

Do you need Form 02 COR or a change form?

Use Form 02 COR when the original registration contains an error. Think typos, wrong dates, or missing partner details. Use a change form when facts have changed after registration. Examples include a new address, a new partner, or a new business name. If you mix them up, your filing may be rejected.

Do you need every partner to approve a correction?

You should secure approval from all partners for corrections affecting them. Some corrections require their signatures or written consent. This is especially true when correcting partner names or addresses. Keep partner consents on file. The registry may request them.

Do you need to attach proof with the form?

Attach proof when an error involves identity or core details. Attach a government ID for name corrections. Provide a partnership agreement page for partner names and roles. Include proof of the original mistake if available, like the original receipt. Label each attachment clearly.

Do you pay a fee for Form 02 COR?

A filing fee usually applies. The amount can vary by filing method or service level. Prepare a valid payment method before you start. You may also see a separate fee for expedited service. Keep the receipt for your records.

Do you need to fix errors within a specific time?

Correct errors as soon as you discover them. Delays can mislead customers or lenders. They can also cause compliance issues. Some errors can trigger penalties if left uncorrected. File promptly and keep proof of submission.

Do you need to re-register if the business name was wrong?

No, not if the error was only in the original entry. Use Form 02 COR to fix a typo or formatting issue in the firm name. If you want a new or different name, file a change instead. That update requires proper name approval steps.

Do you need to notify other parties after a correction?

Yes. Tell your bank, landlord, insurers, suppliers, and key clients. Update licenses and permits that reference your registration. If your tax accounts rely on the registered name or address, update those records. Share the corrected registration confirmation as needed.

Do you need a new registration number after a correction?

No. Corrections update the existing registration record. Your registration number stays the same. Store both the original filing and the correction confirmation. That audit trail helps you answer future questions.

Checklist: Before, During, and After the Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration

Before signing

- Gather the original registration number and filing date.

- Obtain a copy of the original registration details.

- Confirm the exact error and the correct information.

- Collect legal names as they appear on government ID.

- Verify the firm name spelling, punctuation, and spacing.

- Confirm the business address and mailing address as registered.

- For partnerships, list all partners with legal names and addresses.

- Draft a clear explanation of the correction requested.

- Assemble supporting evidence for the error and the fix.

- Obtain written partner approvals if the correction affects them.

- Confirm authority to sign on behalf of the business.

- Prepare a valid payment method for the filing fee.

- Set a realistic effective date for the correction.

- Create a filing folder to store all documents and receipts.

During signing

- Confirm you are using Form 02 COR, not a change form.

- Select the correct business type: sole proprietorship or general partnership.

- Enter the registration number and filing date exactly.

- Enter the firm name exactly as registered (or as corrected if applicable).

- Enter the legal name of the sole proprietor or each general partner.

- Provide the business address and mailing address as originally intended.

- Describe the error and the corrected information in plain language.

- Attach supporting documents with clear labels.

- Review the effective date of correction for accuracy.

- Confirm the signer’s full legal name and title or role.

- Read the declaration carefully before signing.

- Provide a contact email and phone number for any follow-up.

- Review the full form line by line for typos.

- Save a draft and re-check the summary before submitting.

- Record the submission method and any transaction number.

After signing

- Submit the form and pay the fee.

- Save the receipt and submission confirmation.

- Track the filing status until you receive approval.

- Download or print the corrected registration record.

- Share the correction confirmation with partners and stakeholders.

- Update internal records and your compliance calendar.

- Notify banks, insurers, landlords, and key vendors.

- Update licenses, permits, and tax accounts if needed.

- Store the filed form, proof, and confirmation in your records.

- Set a reminder to verify the public record in a week.

- Keep partner consents and identity documents secure.

Common Mistakes to Avoid in Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration

- Using a correction to make a change.

- A correction fixes mistakes in the original filing only. It does not record new facts. Filing the wrong form can cause rejection or an inaccurate record. Don’t forget to use a change form if the facts have changed.

- Missing or incomplete partner information.

- Leaving out a partner’s legal name or address invites delays. It can also misstate liability on the record. Don’t forget to list each general partner exactly as intended at registration.

- Incorrect firm name formatting.

- Small errors in spelling, punctuation, or spacing can cause mismatches with other records. That can lead to banking or licensing issues. Don’t forget to match the exact firm name, character by character.

- No supporting evidence for identity or core data.

- Some corrections need proof, like a government ID for a name. Missing proof can stall or sink your filing. Don’t forget to attach clean, legible documents.

- Wrong effective date.

- Backdating can create conflicts with contracts or permits. A future date can confuse third parties. Don’t forget to use a practical date and explain if needed.

What to Do After Filling Out Form 02 COR – Corrections for Sole Proprietorship and General Partnership Registration

- File the form through the recognized submission method. Pay the fee. Keep your receipt and any transaction number. Save a copy of the completed form and all attachments in a secure folder.

- Watch for confirmation that the correction is accepted. Processing time can vary. Do not assume acceptance until you receive confirmation. If the registry requests more information, respond quickly. Keep a record of every message and upload.

- Once approved, download or print the corrected registration record. Compare it to your request to confirm accuracy. If anything still looks wrong, contact the registry and request a fix. Do not wait. Early follow-up prevents downstream issues.

- Notify the people who rely on your registration details. Share the corrected record with partners, banks, insurers, landlords, and key customers. Ask them to update your account profile. If your licenses or permits display your registered name or address, update those records.

- Review your contracts and policies for references to the registered name or address. If they show the wrong data, issue a short notice to correct the record. Attach the approved correction as support.

- Update tax and accounting systems if they reference the registered name or address. Confirm that invoices, purchase orders, and statements display the corrected data. Align your website, stationery, and email signatures with the corrected firm name.

- Schedule a quick internal audit in one week. Check the public record to confirm the correction appears as expected. Verify that key third parties have updated your profile. Document the audit results and file them with your correction package.

- Maintain a clean audit trail. Keep the original registration, the correction filing, all evidence, and the approval in one place. Note the who, what, and when of the error and fix. This record protects you if questions arise later.

- Build a habit to prevent future errors. Use a standard checklist for all filings. Cross-check legal names against government ID. Use controlled templates for addresses and firm names. Assign a second reviewer for final sign-off before submission. These steps reduce the need for future corrections.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.