Form 7 – Notice of Appointment of Receiver or Receiver Manager

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 7 – Notice of Appointment of Receiver or Receiver Manager?

Form 7 is the statutory notice that records a receiver or receiver manager’s appointment over a British Columbia company. You use it to notify the corporate registry and the public that control over all or part of a company’s assets or business has shifted to the appointed receiver. The notice does not appoint the receiver by itself. It confirms that an appointment has already been made under a security agreement or a court order.

Lenders, insolvency professionals, and their counsel typically use this form. Secured creditors use it after appointing a receiver under a general security agreement or debenture. Court officers use it after a court order appoints a receiver or receiver manager. Companies and directors rarely file it, but they may support or coordinate the filing once the appointment occurs.

You need this form to meet your statutory duty to give public notice of the appointment. Filing creates an official record. It tells suppliers, landlords, employees, and other stakeholders who have the authority to act for the company’s business or assets. It reduces confusion and protects transactions the receiver makes while managing or selling property. It also helps prevent unauthorized dealings with the company’s assets.

Typical usage scenarios include a bank appointing a private receiver after a loan default. An equipment lender may appoint a receiver over a specific piece of collateral. A court may appoint a receiver manager to stabilize a business during litigation or to resolve shareholder deadlock. In each case, the appointment has effect from the instrument or the order. Form 7 is the follow‑up notice that makes the appointment visible to the world.

A receiver is appointed to take custody of assets and realize on collateral. A receiver manager takes a step further by running the business during the receivership. The form supports both roles. It flags whether the appointment covers all assets and undertakings, or only defined property. It lists who appointed the receiver, the legal basis, and the date the appointment took effect.

Timely filing is essential. You should file soon after the appointment takes effect. Doing so limits operational friction. It helps the receiver open bank accounts, sign contracts, and control premises. It also reduces the risk of third parties denying access or refusing to deal with the receiver due to a lack of official notice.

When Would You Use a Form 7 – Notice of Appointment of Receiver or Receiver Manager?

You use Form 7 when a receiver or receiver manager has been appointed over a British Columbia company’s assets or business. This happens in common commercial events. A borrower misses payments and breaches covenants under a secured loan. The lender enforces its security and appoints a receiver under the loan documents. A supplier with a purchase‑money security interest seeks a receiver over financed equipment. Directors resign or the company becomes insolvent, and a court appoints a neutral receiver to protect stakeholders. Shareholders are locked in a dispute that threatens the business, and a court appoints a receiver manager to operate the company while the dispute is resolved.

Secured creditors and their counsel are the typical filers. They often instruct the appointed receiver to file the form once they accept the appointment. Licensed insolvency professionals, trustee firms, and restructuring advisors prepare and file it as part of their first‑day steps. In some cases, the company’s counsel may assist with information needed for accuracy, such as the exact corporate name and incorporation number.

If you are the receiver, you file this notice as soon as you accept the appointment and take possession or control. If you are a lender, you ensure the receiver files it promptly. If a court appointed you, you still file the same form. You include the court order details as the legal authority.

Several timing triggers call for immediate action. You have served a notice of intention to enforce security, and the notice period has run. Appointment occurs, and you must formalize the public record. You attended the premises and took control of the inventory and accounts. You need to show landlords, customers, and banks that you have authority. You plan to continue operations as the receiver manager. You need to sign contracts, hire staff, and sell inventory. The filed notice will back your authority in daily dealings.

You also use the form if the receiver changes. For example, one firm resigns and another accepts appointment under the same security. You file a new notice to update the public record. If the appointment scope expands from specific assets to all assets, you also update the notice or file a new one reflecting the revised scope.

This form is not used for bankruptcy appointments or notices of intention to file a proposal. It is specific to receivership appointments over corporations in British Columbia. If you are enforcing against an individual or filing in another jurisdiction, different rules and forms may apply.

Legal Characteristics of the Form 7 – Notice of Appointment of Receiver or Receiver Manager

Form 7 is a statutory notice. It is not the source of the receiver’s powers. The powers arise from the security agreement, trust deed, debenture, or court order. The notice is legally significant because legislation requires it. Filing the notice helps perfect the public record of the appointment. It gives third parties reliable information about who controls the company’s assets or business.

The form becomes part of the company’s corporate record. Third parties rely on it when dealing with the receiver. This reliance supports the receiver’s ability to bind the company or dispose of assets within the scope of the appointment. If you fail to file, you risk delays and disputes. Counterparties may refuse access or payment. You may face questions on authority or challenges to transactions.

Enforceability rests on three pillars. First, the appointment must be valid under the underlying instrument or order. Second, the notice must be accurate and timely. Third, the receiver must act within the scope stated in the appointment. If the notices and actions align with the instrument or order, courts will respect the receiver’s authority.

The scope of authority matters. A receiver (not a receiver manager) typically realizes on assets but does not operate the business. A receiver manager can carry on the business to preserve value. The form should reflect which role applies. If you are a receiver only, avoid statements that suggest operational control over ongoing business. If you are a receiver manager, ensure the instrument or order grants management powers.

Accuracy is critical. Misstating the company name, incorporation number, or the date of appointment can cause real harm. Misdescribing the property covered can lead to challenges from unsecured creditors or competing secured parties. A vague description can also raise questions when you seek to sell assets. If a court order is the basis, you should match the wording on scope and powers.

You must also consider related legal duties. As a secured party or receiver, you may have to give debtors and other secured parties a notice of intention to enforce security before appointment. Once appointed, you owe duties to act honestly and in good faith. You must obtain market value in asset sales and keep proper records. You must hold proceeds in trust and account to the debtor and other secured creditors according to priorities.

Employment, tax, and environmental issues can arise. If you continue operations as the receiver manager, you may inherit obligations for payroll, source deductions, and workplace safety. You must manage leases, utilities, and insurance. You should review priority claims, including statutory liens and deemed trusts. These obligations do not originate in the form. But without a proper Form 7 on file, your ability to manage them is impaired.

Finally, ceasing to act triggers another filing. When the receivership ends, you file a notice of cessation of the receiver or receiver manager. That closes the public record. Failing to do so may leave you exposed to unwanted inquiries or liability concerns.

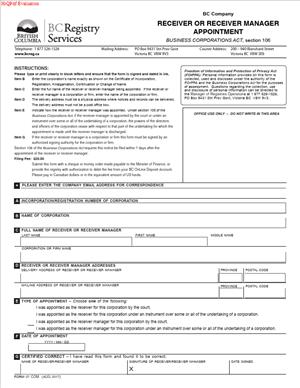

How to Fill Out a Form 7 – Notice of Appointment of Receiver or Receiver Manager

Before you start, gather the key details. Confirm the company’s exact legal name and incorporation number. Check the current registered and records office addresses. Obtain the receiver’s legal name and address for service in British Columbia. Identify the appointing party and the legal authority. If a security agreement applies, have the agreement date and parties. If a court order applies, have the court registry, file number, judge, and order date. Define the scope of the receivership property. Note the exact appointment date and, if relevant, the time.

Follow these steps:

1) Identify the company (the debtor)

- Enter the full legal name of the company, exactly as on the corporate register.

- Include the incorporation number. This ensures unambiguous identification.

- Provide the registered office and records office addresses. Do not use a P.O. Box if a physical address is required.

- If the company has recently changed its name, use the current name and consider noting the former name in a schedule.

2) Identify the receiver or receiver manager

- State whether you are a receiver, a receiver manager, or both.

- Enter the full legal name of the firm or individual appointed.

- Provide a mailing address and an address for service in British Columbia.

- Include a contact person, phone number, and email for operational matters.

3) Appointment details

- Insert the effective date of the appointment. If the time of day matters, include it.

- Name the appointing party. For a private appointment, this is the secured creditor (e.g., the lender under a general security agreement). For a court appointment, the court is the appointing authority.

- Specify the legal basis. For a private appointment, cite the security instrument type and date (e.g., “General Security Agreement dated March 3, 2020, between ABC Bank and the Company”). For a court appointment, cite the order date and court file details.

- If there are multiple security instruments, list the primary instrument and add the others in a schedule.

4) Scope of the receivership property

- State whether the appointment covers all the company’s assets and undertakings, or only specified property.

- If limited, describe the property clearly. Use categories, serial numbers, or legal descriptions as needed.

- Avoid vague phrases like “certain assets” without detail. Third parties must understand what you control.

Example language you can adapt:

- All assets: “All of the present and after‑acquired personal property and undertaking of the Company.”

- Specific equipment: “One Caterpillar 320 Excavator, Serial No. ABC12345, together with attachments and proceeds.”

- Accounts receivable: “All accounts and book debts, including proceeds and returned goods.”

5) Operational status (receiver vs receiver manager)

- If you will operate the business, state that you are appointed as the receiver manager.

- If you will only take possession and realize on assets, state that you are appointed as receiver.

- Align this statement with the instrument or court order. Do not overstate your powers.

6) Court order details (if applicable)

- Provide the court registry location, file number, and the date of the order.

- Summarize any limits on powers if the order contains them.

- If the order appoints you over specific entities in a corporate group, list only the BC company on this Form 7. Use separate notices for each entity as needed.

7) Additional parties and notices

- If multiple receivers are appointed jointly, name each one and state if powers are joint or joint and several.

- If the appointing creditor acts as an agent for a syndicate, name the agent and, if helpful, the syndicate role.

- Consider listing key contacts for banks, landlords, and major counterparties in your internal file. Do not clutter the form with operational details.

8) Attach schedules if needed

- Use a schedule for long property descriptions, serial‑numbered goods, or land legal descriptions.

- Attach a copy or extract of the court order if needed to clarify authority. If you attach extracts, ensure they show the appointing provisions and the style of cause.

- If relying on multiple instruments, attach a summary schedule listing each instrument and date.

9) Review for accuracy

- Cross‑check the company name and number against the corporate register.

- Confirm dates on the security instrument or court order.

- Ensure property descriptions are consistent with the instrument or order.

- Verify addresses for service in British Columbia.

10) Sign and date the form

- An authorized signatory of the receiver signs. Use the receiver’s proper legal name.

- Include the signer’s title (e.g., Licensed Insolvency Trustee, Partner).

- Date the signature. Ensure the signing date is on or after the appointment date.

11) File the notice

- File the completed Form 7 with the corporate registry for British Columbia.

- Submit any required fee with the filing.

- Keep proof of filing, such as a receipt or filing acknowledgment.

12) Serve and communicate

- Send a copy of the filed notice to the company, the appointing creditor, and key stakeholders as needed.

- Provide copies to banks, landlords, major customers, and insurers when you first contact them.

- Use the filed notice when opening a receiver’s bank account or changing control over existing accounts.

13) Maintain records

- Keep a full file with the appointment instrument or court order, the filed notice, and schedules.

- Log all notices sent and parties notified.

- Maintain a receipts and disbursements ledger from day one.

Common pitfalls to avoid:

- Using a trade name instead of the company’s legal name. Always use the exact legal name.

- Omitting the incorporation number. This can cause friction with banks and counterparties.

- Vague property descriptions. If your scope is unclear, you invite challenges.

- Mismatch between the form and the instrument or order. Ensure they align in scope and role.

- Late filing. Delays create operational barriers and risk to transactions.

Practical examples:

- Bank‑appointed receiver over all assets:

You are appointed under a general security agreement. Your plan is to sell inventory and collect receivables. State “receiver manager” if you will operate the store for a short period. Describe “all present and after‑acquired personal property” as the scope. File immediately after taking control.

- Equipment‑specific receivership:

You are appointed over a single crane. You will recover, store, and sell it. List the cranes’ make, model, serial number, and attachments. Identify the purchase‑money security interest as the basis. Do not state that you control the company’s other assets.

- Court‑appointed receiver manager:

The court appoints you to run a chain of restaurants to preserve value. Cite the court order and file number. Note that you are appointed as receiver manager. If the order limits your sale powers without further approval, do not suggest otherwise on the form.

After filing, align your actions with the appointment. If you are a receiver manager, manage payroll, suppliers, leases, and insurance within your powers. If you are a receiver only, focus on securing and selling assets. Send statutory reports and accounts to stakeholders as required. If the scope changes or you resign, make the corresponding filings to update the record.

Use plain, precise language in every field. Match names, dates, and scope to the underlying authority. File without delay. These steps ensure your appointment is clear, your authority is respected, and your work proceeds without avoidable dispute.

Legal Terms You Might Encounter

- Receiver means a person or firm appointed to take control of specific assets. They collect and sell those assets to repay a debt. In Form 7, you state that a receiver has been appointed and name who it is. You also confirm when the appointment took effect.

- Receiver manager has broader authority than a receiver. They can operate and manage the debtor’s business, not just sell assets. On Form 7, you must say if the appointee is a receiver or a receiver manager. That choice signals the scope of control over the business.

- Debtor is the company or person who owes the secured debt. They own or control the assets the receiver will handle. Form 7 requires the debtor’s exact legal name and identifiers. That ensures the notice attaches to the correct party.

- Secured creditor is the party with security over the debtor’s assets. They hold a security interest under a security agreement or related instrument. If a secured creditor appoints the receiver, their details go on Form 7. The form shows who made the appointment and under what authority.

- Security agreement is a contract that grants the creditor rights over collateral. It sets the terms for taking control after a default. Form 7 ties the appointment back to this agreement or to a court order. You identify the basis for the appointment on the form.

- Collateral is the property subject to the security interest. It can include inventory, equipment, accounts, or specific serial-numbered goods. Form 7 should describe the collateral the receiver will control. Clear collateral language prevents confusion and disputes.

- Event of default is the trigger that allows the creditor to enforce the security. It could be missed payments or a breach of covenants. While Form 7 does not detail the default, the appointment presumes one occurred. The date of appointment reflects when enforcement began.

- Court-appointed versus privately appointed refers to how the receiver is engaged. A court appointment comes from a judge’s order. A private appointment comes from the security agreement. Form 7 should say which applies and include court details when a judge appointed the receiver.

- Possession and control describe what the receiver is taking over. Possession can be physical control of assets or bank accounts. Control can also include decision-making power under a receiver manager role. Form 7 helps put third parties on notice of this control.

- Notice of appointment is the formal public notice that a receiver exists. Filing Form 7 creates that notice in the public registry. It alerts other creditors, customers, and suppliers. It also helps protect the receiver’s actions under their mandate.

FAQs

Do you need to file Form 7 if the court appointed the receiver?

Yes. You should still file Form 7 to give public notice of the appointment. The form lets others confirm who the receiver is and when control began. Include key court details on the form so third parties can verify the authority.

Do you need to file if the receiver is appointed under a security agreement?

Yes. If a secured creditor appoints a receiver or receiver manager, you should file Form 7. This puts the market on notice and reduces confusion at banks, warehouses, and with customers. It also helps manage priority and transparency among creditors.

Who files Form 7: the creditor or the receiver?

Either may file, but align on one filer. Often, the receiver files because they need quick recognition to operate. Some creditors prefer to file documents to document their enforcement timeline. Decide early and avoid duplicate filings.

When should you file the notice?

File as soon as the appointment takes effect. Deadlines can be short, and delays pose challenges. Quick filing helps the receiver secure assets without pushback. It also minimizes conflicting claims and operational disruption.

Do you need to serve the debtor or other creditors?

You should promptly notify the debtor. You may also need to notify other known secured parties or stakeholders. Fast, clear communication reduces disputes and preserves value. Keep proof of service and delivery records in your file.

What if you discover an error after filing?

Submit an amendment as soon as possible. Correct names, dates, or collateral descriptions immediately to avoid challenges. Keep a clear audit trail of corrections. Notify key parties of the amendment to prevent reliance on wrong details.

What if the receiver changes during the process?

File an amendment to update the receiver details. Include the new receiver’s legal name and contact information. State the effective date of the change. Advise the debtor and key stakeholders to avoid operational delays.

Does Form 7 let the receiver sell all assets automatically?

No. Form 7 is a notice, not a power by itself. The receiver’s powers flow from the court order or security agreement. The form helps others recognize those powers but does not expand them.

Checklist: Before, During, and After the Form 7 – Notice of Appointment of Receiver or Receiver Manager

Before signing

- Confirm the basis of appointment. Gather the court order or the security agreement and related documents.

- Verify the appointment instrument. Have the receiver’s engagement letter or appointment acceptance on hand.

- Confirm debtor identity. Get the exact legal name, incorporation number, and registered office address.

- Collect trade names. Note any business names the debtor uses.

- List collateral. Prepare a clear description and any serial numbers for specific goods.

- Identify the timing. Confirm the exact appointment date and time.

- Gather receiver details. Confirm full legal name, business address, email, and phone number.

- Identify the appointing party. Confirm the secured creditor’s exact legal name and address.

- Map locations. List key premises, banks, and third-party custodians where assets sit.

- Plan service. Decide how you will notify the debtor and key stakeholders.

During signing

- Check the receiver type. Select a receiver or receiver manager based on the appointment.

- Verify names exactly. Confirm debtor, receiver, and appointing party names match official records.

- Confirm dates and times. Ensure the appointment date is accurate and consistent across documents.

- Review collateral scope. Make sure the description matches the appointment instrument.

- Include court details if applicable. Add the court file number and date of order for court appointments.

- Confirm contact fields. Ensure current addresses, emails, and phone numbers appear correctly.

- Ensure signatory authority. The person signing must have proper authority to sign the notice.

- Review for internal consistency. Names, dates, and collateral should align across all pages.

- Final proofread. Read aloud once to catch small errors before filing.

After signing

- File the form promptly. Use the appropriate registry and retain the filing confirmation.

- Serve the debtor. Send a copy with a clear cover note identifying the receiver and effective date.

- Notify key parties. Inform landlords, banks, insurers, and significant suppliers as needed.

- Update stakeholders. Provide instructions for payment redirection and access protocols.

- Keep records. Store the filed form, proof of service, and any registry acknowledgments.

- Calendar follow-ups. Set reminders for any required amendments or status updates.

- Coordinate public messaging. Align statements with legal documents to avoid confusion.

- Secure insurance. Confirm coverage for assets under receivership and receiver activities.

Common Mistakes to Avoid

- Don’t forget the exact debtor’s legal name. A wrong or incomplete name can undermine the notice. It can also cause bank or registry rejection. Cross-check with the debtor’s formation documents and recent filings.

- Don’t mislabel receiver versus receiver manager. The wrong designation can cause operational roadblocks. Vendors may refuse directions if the authority seems unclear. Confirm the mandate before filing.

- Don’t use vague collateral descriptions. An unclear scope creates disputes and delays access to assets. It can also weaken enforcement steps. Use the same scope as the court order or security agreement.

- Don’t delay filing after the appointment. A late filing invites priority fights and pushback from third parties. It can stall asset control and collections. File right after the appointment takes effect.

- Don’t omit court details for court appointments. Missing file numbers and dates make verification hard. That slows cooperation from banks and counterparties. Include enough information to validate the order quickly.

What to Do After Filling Out the Form

- File the notice with the correct registry. Do this immediately after signing to align the public record with reality. Save the filing confirmation and any registration number. Add both to the receivership file index.

- Serve the debtor and key stakeholders. Provide the filed Form 7 and a short cover letter. State the appointment date and the receiver’s role. Give contact details for urgent coordination.

- Inform custodians and counterparties. Notify banks, landlords, logistics providers, and insurers. Include practical instructions. Tell them where to send payments, who can access sites, and how to confirm directions.

- Stabilize operations. If a receiver manager is appointed, address payroll, insurance, and critical suppliers. Confirm access to systems and premises. Issue a hold notice for records and data.

- Review and amend if needed. If you spot an error, file an amendment right away. Update names, dates, collateral, or receiver details. Notify parties who rely on the notice to prevent confusion.

- Document asset control steps. Record site entries, inventories, lock changes, and account freezes. Keep time-stamped logs and supporting photos or letters. These records support accountability and reporting.

- Coordinate communications. Maintain a single point of contact for inquiries. Use a standard information sheet to reduce repeated questions. Keep tone factual and consistent with the notice.

- Plan for ongoing reporting. Track receipts, disbursements, and material contracts. Prepare to issue status updates as needed. Keep documents organized for later statements.

- Manage disputes early. If someone challenges the receiver’s authority, provide the filed notice and appointment instrument. Escalate only when necessary. Preserve a clear record of each interaction.

- Address the end of the appointment. When the receivership concludes, prepare final statements. Consider filing a termination or discharge notice if required. Notify stakeholders that the receiver’s authority has ended.

- Maintain the file. Store the filed notice, amendments, service proofs, and key correspondence. Keep the record accessible for audits, claims, or later recoveries. Secure both digital and physical copies.

- Align with tax and compliance steps. Coordinate with tax filings and required returns. Confirm payroll and source deductions where relevant. Keep evidence of all remittances.

- Close out banking and systems. Remove receiver access when finished. Return keys, badges, and credentials. Confirm data retention and backups meet your policy.

- Prepare lessons learned. Note process improvements and any friction points. Update internal checklists and templates. Use those insights for future appointments.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.