Form 8 – Notice of Change of Address of Receiver or Receiver Manager

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 8 – Notice of Change of Address of Receiver or Receiver Manager?

Form 8 is the statutory filing you use to tell the British Columbia corporate registry that the receiver or receiver manager’s address has changed for a BC company. It updates the public record so courts, creditors, and other parties can serve documents and send notices to the correct location.

In BC, a receiver or receiver manager may be appointed by a secured creditor under a security agreement, or by a court order. If that receiver acts over all or substantially all of the business property of a company, certain notices must be filed with the corporate registry. The first is the appointment notice. If the receiver’s address later changes, you use Form 8 to update the address on that same record.

Who typically uses this form?

Insolvency practitioners, court‑appointed receivers, firms acting as receiver managers, and their lawyers or corporate services teams. If you are a law firm acting for a lender or receiver, you may prepare and file Form 8 on the receiver’s instructions. If you are the receiver yourself, you file it directly or through your agent.

Why would you need this form?

Because the law expects your address on the corporate register to be current. Service of legal documents, statutory notices, and regulatory communications will go to the address on file. If you move and do not file Form 8, you risk missed deadlines, default judgments, or compliance issues. You also risk administrative penalties for failing to keep statutory records up to date.

Typical usage scenarios

- Your firm relocates and your delivery address changes.

- You shift from a temporary project office used for an appointment to your main office.

- You centralize mail handling and switch to a new mailing address or PO box.

- You appoint a new local agent for service in BC and need to update the delivery address.

- You reorganize after a merger and consolidate receivership addresses.

- You close a regional office that previously received service for the receivership.

Form 8 does not change the scope of the receiver’s powers. It simply keeps the public register accurate about where the receiver can be served and contacted.

When Would You Use a Form 8 – Notice of Change of Address of Receiver or Receiver Manager?

You use Form 8 any time the receiver’s address on the corporate register for a specific company changes. That includes a change to the physical delivery address, the mailing address, or both. If you hold multiple receiverships, you file a separate Form 8 for each company whose record needs updating.

For example, imagine you were appointed as receiver over all or substantially all of a company’s assets and filed the appointment notice with an interim office address. After the first month, you move operations back to your main office. You should file Form 8 to replace the interim address with your permanent address.

If you represent a lender that appointed a private receiver through a general security agreement, your receiver might update their address after a firm-wide move. You would use Form 8 to record that change for every BC company where an appointment notice is on file. Staggered moves are common. The compliance task is the same for each affected company: file a Form 8.

If you are a court‑appointed receiver, the same requirement applies. You may have provided a litigation service address during urgent motions. Once the matter stabilizes, you return service to your commercial address. Use Form 8 to reflect that change so parties do not continue to serve a litigation address that is no longer monitored.

Receivers with co‑receiver arrangements should consider whether each co‑receiver has a separate address on file. If each co‑receiver filed its own appointment notice with a distinct address, each may need to file its own Form 8. If a single address covers the joint appointment, one filing may be enough. In practice, file the update that mirrors the way the original appointment notice was recorded.

Use Form 8 for these users and roles:

- The receiver or receiver manager (individual insolvency practitioner or firm).

- Legal counsel to the receiver, filing as authorized agent.

- Corporate services or regulatory compliance staff within the receiver firm.

Do not use Form 8 to report that the receiver has stopped acting. That requires a different filing (a notice that the receiver or receiver manager has ceased to act). Do not use Form 8 to change the company’s registered or records office. That is the company’s filing, not the receiver’s. Form 8 is narrow. It only updates the receiver’s address information on the receivership record for the company named in the filing.

Timing matters. File promptly after the address change. The expectation is that the public record remains accurate without delay. Treat the update as a priority so service of court materials, demand letters, and statutory notices continues without interruption.

Legal Characteristics of the Form 8 – Notice of Change of Address of Receiver or Receiver Manager

Form 8 is a prescribed statutory filing. You submit it to the corporate registry for British Columbia companies. Once accepted, it becomes part of the company’s public corporate record. That record is relied on by courts, creditors, the company, counterparties, and regulators to determine where to serve and how to contact the receiver or receiver manager.

Is it legally binding?

Yes. The filing is a formal notice under corporate law. When you file a change of address, you are certifying that the information is true and complete. Third parties can rely on that information. Courts treat the address on the register as an address for valid service on the receiver in that role. The record fixed by the registry can be decisive if someone later alleges they could not serve you.

What ensures enforceability?

Three things work together:

- Statutory authority. The legislation and regulations prescribe the content, timing, and effect of the notice. They also make it an offence to provide false or misleading information.

- Official registry record. The registry time‑stamps your filing and publishes the updated information. That record is accessible to the public and functions as a single source of truth.

- Service rules. Litigation and regulatory regimes often allow service at the address on the corporate register. If your address is current, you can be validly served. If it is outdated, you may miss service, but the court may still find service was sufficient if the other party used the public record in good faith.

General legal considerations:

- This form does not validate or expand your appointment. If your appointment has defects, updating your address does not cure them.

- This form does not change the identity of the receiver. If the receiver’s name or capacity changes, a different filing may be required.

- Accuracy matters. Errors in addresses can lead to mis‑service and prejudice. You may face cost consequences if your mistake forces re‑service or delays proceedings.

- Filing deadlines and fees apply. Late filings can draw compliance notices and, in some cases, penalties.

- The record is public. Do not include personal information beyond what is required for delivery and mailing. Use a business address suitable for public disclosure.

- If the receivership relates to a group of companies, each company’s record is separate. You must update each corporate record individually unless the registry explicitly allows consolidation.

In short, Form 8 carries legal effect because it sets the official address for the receiver in the public register. Your certification and the registry’s acceptance make the notice operative.

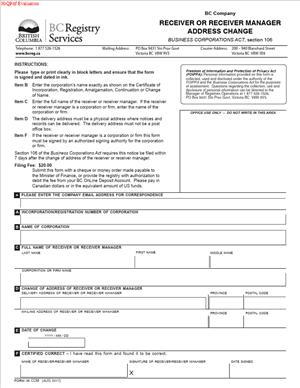

How to Fill Out a Form 8 – Notice of Change of Address of Receiver or Receiver Manager

Follow these steps to complete and file Form 8 accurately.

Step 1: Confirm you have the right form and the right trigger.

- You are changing the receiver or receiver manager’s address for a specific BC company.

- A prior notice of appointment of receiver or receiver manager is already on the record for that company.

- You are not reporting a cessation of the receivership, and you are not changing the company’s registered or records office.

Step 2: Gather the information you will need.

- Company details. Legal name of the company exactly as registered. Incorporation number or registration number (for extraprovincial companies registered in BC). If the company uses a numbered name, use the full number as shown on the register.

- Receiver details. Full legal name of the receiver or receiver manager. If acting as a firm, use the firm’s legal name. Confirm whether you are “receiver,” “receiver manager,” or both, consistent with the appointment notice.

- Existing address on file. Pull the existing record so you can reference the address being replaced. This helps avoid mismatches and helps you confirm the change is necessary.

- New addresses. Delivery address (physical street address) and mailing address. The delivery address must be a street address. Do not use a PO box for delivery. The mailing address can be a PO box and may be the same as the delivery address if you prefer.

- Effective date. The date the change takes effect. If your office change happened on a specific date, use that date. If you are filing in advance, use the date the new address opens for service.

- Contact person. Name, phone number, and email for questions about the filing. This person should be familiar with the receivership and able to confirm details.

- Authorization. The signatory’s name and capacity (receiver, partner, officer, or authorized agent). Have the signing authority confirmed before you prepare the form.

Step 3: Complete the form fields.

While layouts can differ, expect the form to ask for the following:

1) Company Information

- Enter the exact legal name of the company.

- Enter the incorporation or registration number.

- If you are dealing with an extraprovincial company registered in BC, enter its BC registration number.

2) Nature of Appointment

- Indicate whether you are the “receiver,” “receiver manager,” or both, exactly as stated in the appointment notice or court order. Match the terminology previously filed to avoid confusion.

3) Address Change

- Previous delivery address. Enter the current delivery address on the corporate register for the receiver. If unknown, look up the record before filing.

- New delivery address. Enter the new physical address for delivery. Use a street address with unit, city, province, and postal code. Avoid abbreviations that could cause ambiguity.

- Mailing address. If your mailing address differs, enter it. If it is the same as the delivery address, indicate “same as delivery” if the form allows, or repeat the address as required.

4) Effective Date

- Enter the date the address change takes effect. If the move already occurred, enter the actual move date. If the form requires the filing date instead, enter the filing date as required. Keep your internal records of the actual move date for reference.

5) Certification and Signature

- The receiver or an authorized agent must sign. Do not have a company director sign unless they are also authorized by the receiver to do so.

- Print the signatory’s name and title. If you sign as an agent, identify the principal (the receiver) clearly.

- Date the form on the day you sign. If filing electronically, your electronic certification will function as the signature.

6) Attachments or Schedules (if applicable)

- If you manage co‑receivers and the form allows listing multiple receivers, attach a schedule that mirrors the form’s fields. Include each receiver’s address change clearly. If the registry expects one filing per receiver, prepare separate Form 8 filings instead.

- If your address format exceeds the field length, attach a schedule with the full address and summarize it in the field as permitted.

Step 4: Review for accuracy and completeness.

- Confirm the company name and number match the register exactly.

- Confirm the receiver type matches the appointment (receiver vs. receiver manager).

- Confirm the delivery address is a street address. No PO boxes for delivery.

- Verify postal codes and province abbreviations.

- Confirm the effective date is correct and consistent with your internal move date.

- Ensure the signature block is complete and the signatory’s capacity is stated.

Step 5: File the form with the corporate registry.

- File electronically through the corporate registry filing system, or by paper if allowed. Electronic filing is faster and reduces errors.

- A filing fee applies. Have payment ready.

- Keep the submission confirmation, transaction number, and a copy of the filed form.

- If you filed close to a deadline, consider serving key stakeholders with a copy of the filed form and confirmation to avoid service disputes during the transition.

Step 6: Verify the public record.

- After processing, check the company’s public record to confirm the new address appears correctly.

- If you see an error, contact the registry immediately and correct it with an amended filing.

Step 7: Notify stakeholders (good practice).

- Send a short notice to the secured lender, the company’s directors or counsel, and any active litigation service lists confirming your new address for service.

- Update your correspondence templates, letterhead, and email signatures for the receivership file.

- Update addresses in any parallel systems that rely on receiver contact details, such as court lists, creditor notices, or notices to tenants or contract counterparties.

Edge cases and practical tips:

- Multiple companies. If you are a receiver for a corporate group, file a separate Form 8 for each BC company where an appointment notice is on file. Do not assume a single filing updates all entities.

- Out‑of‑province address. A mailing address can be outside BC, but ensure your delivery address is suitable for service and staffed during business hours. If you appoint a local agent for service in BC, use that agent’s physical address as your delivery address and list your firm’s location as the mailing address if that better fits your practice.

- Temporary relocation. If you move to a temporary location during an office renovation, consider whether to file a change now and a second change when you return. If the move lasts more than a short, predictable period, file the change. The public record should reflect where you can be reached in real time.

- Co‑receivers. Coordinate so that the public record presents a coherent picture. If both co‑receivers receive service, ensure both addresses are current. If one address is designated for service on behalf of both, keep that address current and confirm that your court order or appointment documents support that arrangement.

- Names vs. addresses. Form 8 updates address details. If your firm changes its name due to rebranding, that may require a separate step to ensure the receiver’s name on the register matches your current legal name. Address changes do not correct name changes.

- Late filings. If you are late, file as soon as possible. Document why the filing is late and notify key parties directly of the correct address to mitigate the risk of mis‑service.

- Records retention. Save your signed form, filing confirmation, and evidence of internal approvals in your receivership file. If service is later disputed, you will want a clear record of what was filed and when.

Signatures and authority:

- The receiver or receiver manager signs, or an authorized agent signs on their behalf. If an agent signs, ensure you can show written authority.

- Electronic filings usually rely on a certification statement instead of a wet signature. Treat that certification as you would a signature. Only authorized individuals should submit the filing.

- If a court order sets special requirements for how the receiver receives service, comply with the order and still keep the corporate register current with Form 8.

Common mistakes to avoid:

- Listing a PO box as the delivery address. Use a physical street address for delivery.

- Using an address different from the one used in your communications. Keep all channels consistent to avoid confusion.

- Forgetting to update all affected companies in a group receivership. Map your entities before you file.

- Omitting the effective date. Always include it and ensure it aligns with your move.

- Having the wrong person sign. Confirm authority before you file.

The goal is simple: keep your service address accurate on the public record, file quickly after any change, and retain proof. When you follow the steps above, you meet your legal obligation and reduce the risk of missed notices or service disputes.

Legal Terms You Might Encounter

- Receiver: A receiver is someone appointed to take control of certain assets to protect and realize value for a creditor. In this form, you identify the receiver whose address has changed. You confirm who is acting and where they can receive documents, so others know how to reach the receiver.

- Receiver Manager: A receiver manager not only holds assets but also carries on some or all of the business. The distinction matters on the form because you must state whether the change applies to a receiver or a receiver manager. That tells stakeholders the scope of authority connected to the updated address.

- Debtor Company: This is the company whose assets or business are under the receiver’s control. The form ties the address change to that specific company. You need the exact legal name and, if applicable, the incorporation or registration number, so the registry links your notice to the right entity.

- Secured Creditor: A secured creditor holds collateral to secure a debt. They often appoint a receiver under their security. When you file the form, you help ensure the secured creditor and other stakeholders can serve documents on the receiver at the correct place. It prevents disputes over the delivery of notices tied to the security.

- Appointment: An Appointment is the act that gives the receiver or receiver manager authority. It can be under a security agreement or by court order. The form does not re-appoint anyone. It only updates the service details for the person already appointed. The appointment details you provide must align with earlier filings.

- Effective Date: This is the date the new address takes effect. You state it on the form to avoid confusion about where documents should be sent. If the change is immediate, say so. If the change is a future date, set it clearly to prevent misdirected service during the transition.

- Service Address: The service address is where legal documents can be delivered to the receiver. Use a physical address where deliveries can be accepted during business hours. A post office box alone may not satisfy service needs. On the form, set the service address with care so nobody questions later whether the service was valid.

- Mailing Address: The mailing address is where correspondence arrives by post. It can be different from the service address. Some forms provide separate fields for mailing and delivery. If the receiver prefers mail at a different location, provide both addresses so you do not miss notices.

- Registered Office and Records Office: These are the company’s official addresses for legal and records purposes. They are not the same as the receiver’s address. This form updates the receiver’s address only. It does not update the company’s registered or records office. Keep that in mind if you need separate filings for the company’s addresses.

- Notice of Change: A notice of change tells the public and stakeholders that an address has changed. This form is a notice for a receiver or receiver manager. Filing it creates a clear, time-stamped record in the registry so others can rely on the new address for service and communication.

- Court File Number: When a court has appointed the receiver, you may have a court file number. If the form asks for it, include it exactly as it appears in the court file. That connects your address change to the right proceeding and avoids confusion for the court and the parties.

- Delivery and Acceptance: Delivery and acceptance describe how documents reach the receiver and are deemed received. Your form ensures the right location for hand delivery or courier. Use an address staffed during business hours. That reduces the risk of missed deadlines caused by failed delivery attempts.

- Filing Confirmation: Filing confirmation is the proof that the registry accepted your notice. It can be a receipt, a confirmation page, or a certified record. Keep it with your appointment documents. If someone challenges service later, the confirmation helps prove the timing and content of your address change.

- Amendment or Correction: An amendment or correction fixes errors in a prior filing. If you enter the wrong postal code or forget a suite number, you may need to file a corrected notice. The registry may offer a specific form or process for corrections. Act quickly to avoid service problems caused by a faulty address.

FAQs

Do you need to file a notice every time the receiver changes offices?

Yes. You should file each time the receiver’s or receiver manager’s service or mailing address changes. The notice keeps the public record current. It helps ensure that legal documents reach the right place on time.

Do you need to file separate notices if you act for more than one company?

Yes. File a separate notice for each debtor company. A change of address tied to one company does not update the record for another. Keep your filings organized by company name and number to avoid mix-ups.

Do you list a post office box as the service address?

Use a physical address for service. A post office box can be a mailing address, but it often does not work for hand delivery. If the form provides both fields, set the delivery address as a physical location and add the post office box as mailing.

Do you need the debtor company’s consent to file the notice?

No. The receiver or receiver manager files the notice based on their authority. You do not need the debtor’s consent to update where you will accept service. You do need to ensure the information is accurate and consistent with your appointment.

Do you attach the appointment document to this notice?

Not usually. This notice reports the address change only. Your appointment would have been documented in earlier filings or proceedings. If the registry requires supporting documents in special cases, follow the instructions on the form.

Do you file electronically or by paper?

You can usually file electronically. Paper filing may be available, but electronic filing is common and faster. Choose the method that fits your internal process. Keep a copy of the submission and the registry’s confirmation.

Do you pay a filing fee?

Expect a filing fee. Fees can change, so check the current amount before you submit. If you file multiple notices for different companies, budget for each filing.

Do you have to notify anyone after filing?

It is good practice to notify the debtor company, the appointing secured creditor, any known stakeholders, and counsel. If a court is involved, consider filing your updated address in the court file as well. The goal is to avoid missed notices.

Do you need to update other registrations after changing your address?

Often, yes. Review any security registrations, tax accounts, and operational permits tied to the receivership. Update the receiver’s contact details across those systems so mail and service do not go astray.

What if you discover an error after submission?

Act quickly. Check if you can submit a correction or an amended notice. Keep a clear paper trail that shows the original filing and the correction, including dates and times. Notify key stakeholders of the corrected address right away.

What if there are multiple receivers with different addresses?

Identify each receiver clearly and file the correct address for each appointment. If the form only accepts one address, file separate notices as needed or follow the registry’s guidance. Make sure stakeholders know where to serve each receiver.

Does the notice change the receiver’s authority?

No. The notice only updates the address. The receiver’s authority comes from the appointment. Keep your appointment documents and any court orders consistent with your filing records.

Checklist: Before, During, and After the Form 8 – Notice of Change of Address of Receiver or Receiver Manager

Before you sign

- Identify the role: receiver or receiver manager.

- Confirm the debtor company’s exact legal name.

- Have the company’s incorporation or registration number, if available.

- Gather the appointment details and date of appointment.

- Confirm whether the receivership is court-appointed and the court file number.

- Choose a physical service address staffed during business hours.

- Decide if you need a separate mailing address.

- Verify postal code, unit, and street information.

- Confirm the effective date of the address change.

- Confirm who has the authority to sign on behalf of the receiver.

- Collect internal approvals and compliance sign-offs.

- Check for related filings that may also need updates.

While you complete and sign the form

- Select the correct role: receiver or receiver manager.

- Enter the debtor company’s legal name exactly as registered.

- Enter the company number accurately, if applicable.

- Enter the new service address, including unit or suite number.

- Add a mailing address if different from the service address.

- Enter the effective date of the change.

- Include the court file number if a court is involved.

- Review the declaration or certification before signing.

- Ensure the signer’s name and title are correct and legible.

- Date the form at the time of signing.

After you sign

- File the form with the registry using your chosen method.

- Pay the required fee and capture the receipt.

- Save the filing confirmation and a time-stamped copy.

- Notify the debtor company, secured creditor, and key stakeholders.

- Update your address in court materials if applicable.

- Update your address in security registrations and internal systems.

- Update engagement letters, email footers, and letterhead.

- Store the filed form and confirmation in the receivership records.

- Calendar follow-ups to verify acceptance and downstream updates.

Common Mistakes to Avoid

- Using a post office box as the only address: Don’t forget a physical service address. If a process server cannot deliver to a post office box, you risk missed deadlines and contested service.

- Missing or vague effective date: Don’t leave the effective date blank. Without a clear date, parties may serve the wrong address, leading to disputes or delays.

- Inconsistent company or file identifiers: Don’t mistype the company name or number. Mismatches can cause rejection or misfiling, which creates gaps in the public record.

- Wrong role selection: Don’t select the receiver when you act as the receiver manager, or vice versa. The wrong role can mislead stakeholders and raise questions about authority.

- Filing late: Don’t wait to file the change. Delay increases the chance that notices go to the old address. Late filings can trigger compliance issues and extra costs.

- Missing unit or floor number: Don’t omit suite details. Couriers may fail to deliver without them, causing service disputes and rescheduling.

- Unauthorized signature: Don’t let an unapproved team member sign. The registry may reject the filing, and you may need to redo the process under time pressure.

What to Do After Filling Out the Form

- File the notice with the registry promptly. Select the filing method that works for you. Confirm payment and capture the submission reference or receipt. Download or print the acceptance confirmation as soon as it is available.

- Validate acceptance. Check the public record once processed to confirm the new address displays correctly. If anything looks wrong, act fast to correct it. Keep your confirmation with your appointment papers.

- Notify stakeholders. Send the updated address to the debtor company, the appointing secured creditor, counsel, and any known interested parties. If a court is involved, update your address in the court file. If there are time-sensitive proceedings, use a method of delivery that provides proof.

- Update related registrations and accounts. Review and update security registrations, license or account profiles, and operational systems linked to the receivership. Align your address across invoices, statements, banking instructions, and insurance notices to avoid missed correspondence.

- Refresh internal and external materials. Update engagement letters, signature blocks, letterhead, websites you control, and template notices. Train your team on the new address and how to handle service at that location. Ensure reception understands how to accept documents and record deliveries.

- Plan for future changes. If the address changes again soon, set calendar reminders. Develop a standard operating process to record, approve, file, and share address updates. Keep a log of all filings and notices so you can show a clear chain of updates.

- Correct errors or omissions. If you catch a mistake, submit a correction or new notice as allowed. Do not backdate. Explain the correction to key parties to avoid doubt over proper service. Where appropriate, re-serve time-sensitive documents using the corrected details.

- If the appointment ends, when the receiver or receiver manager ceases to act, use the appropriate cessation notice. That closes the loop in the public record and avoids future service at an inactive address.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.