Form 23 – Notice of Ceasing to Act as Liquidator

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 23 – Notice of Ceasing to Act as Liquidator?

Form 23 is the statutory notice that confirms a liquidator has stopped acting for a company. You use it to update the public record when a liquidator resigns, is removed, dies, becomes disqualified, or finishes the winding up. The Business Corporations Act requires this notice under section 329. It keeps the register accurate and tells third parties who is, and who is not, in charge.

A liquidator is the person responsible for realizing assets, paying creditors, and distributing any surplus to shareholders. During a winding up, the liquidator replaces the directors’ authority over the company’s affairs. When that role ends, the register must reflect the change. Form 23 does that in a clear, formal way.

Who typically uses this form?

Liquidators file it as a professional duty. Corporate directors or officers file it when the liquidator can’t. In-house counsel, external counsel, or accountants often prepare it. Insolvency practitioners also use it in their regular practice.

You need this form when you want to avoid confusion or risk tied to an outdated record. If the register still shows an active liquidator who has stepped down, banks, suppliers, and courts may direct matters to the wrong person. That can slow creditor claims, block asset sales, or derail final distributions. Filing Form 23 prevents those issues and reduces exposure to complaints or penalties for non-compliance.

Typical scenarios include the completion of the winding up, followed by dissolution. You may also use it when members or the court replace the liquidator mid-process. It applies if the liquidator resigns due to illness, workload, or conflict of interest. It also applies if the liquidator is disqualified or dies. In some cases, the winding up shifts to another insolvency process. Form 23 closes the liquidator’s role for the company under the corporate statute.

Form 23 is not used to appoint a liquidator. It does not report a change of registered office or directors. It is a targeted notice for one event only: the liquidator has ceased to act. If a new liquidator is appointed, that appointment must be recorded separately. Form 23 can point to the change by confirming the end date for the outgoing liquidator.

The form is short but significant. It triggers updates across systems tied to the public register. It also supports clean handover to a successor liquidator, if one exists. If the winding up has ended, it helps move the company toward its final steps.

When Would You Use a Form 23 – Notice of Ceasing to Act as Liquidator?

You use Form 23 when the liquidator’s authority ends for any reason. The most common event is the completion of the winding up. Once the liquidator files final accounts and obtains member or court approval, the role ends. Form 23 then records the end date on the register. This lets stakeholders know the liquidation phase is over.

You also use it when a liquidator resigns. A liquidator might resign due to personal health, workload, or conflict concerns. They might find the company’s affairs create a professional conflict with another client. A timely Form 23 protects both the company and the former liquidator. It prevents third parties from thinking the former liquidator is still available to accept service or manage assets.

Another trigger is removal or replacement. Members can remove a liquidator and appoint another. A court can also make this change in response to an application. In either case, Form 23 marks the end of the outgoing liquidator’s role. This clears the path for the successor to act without confusion.

In rare cases, the liquidator becomes disqualified or dies. The company or its advisors must act quickly in those cases. You arrange for an interim solution and file Form 23 once the cessation is clear. The form then supports urgent steps, like securing assets and records.

You might also use Form 23 when the company’s process changes. For example, the company may shift from one insolvency process to another. If the liquidator’s role ends at that point, Form 23 signals the change to outsiders. It reduces the risk of duplicate instructions or payments.

Typical users include the liquidator themselves, who understand the timing and legal triggers. Corporate directors use the form if they have the knowledge and authority to certify the facts. In-house counsel and external counsel prepare the notice to keep the record current. Accountants or corporate secretaries complete the filing details and coordinate signatures. Insolvency practitioners handle it as part of their standard file closing procedures.

The key is timing. You should file the notice promptly after the liquidator ceases to act. Do not wait for a later milestone unless the Act allows it. The sooner you file, the less chance of misunderstanding or loss.

Legal Characteristics of the Form 23 – Notice of Ceasing to Act as Liquidator

Form 23 is a statutory notice. It has legal effect because the Business Corporations Act requires it. When filed, it updates the public register. That register gives constructive notice to anyone who deals with the company. Third parties may rely on the register to identify who can act for the company during a winding up.

The form itself does not release the liquidator from all liabilities. A liquidator seeks release through proper approval of final accounts and, where needed, a court order. Form 23 records that the role has ended. It does not replace approvals, distributions, or other obligations tied to the winding up. Think of it as part of closure, not the entire closure.

What makes it enforceable is accurate information, proper authority, and timely filing. The person who signs must have personal knowledge of the facts or be properly informed. They must be authorized to certify the details. The registry may refuse filings that are incomplete or inconsistent. It may also take action if the information is false or misleading.

Completeness matters. The form should state the exact corporate name and incorporation number. It should list the full name and address of the liquidator who ceased to act. It should provide the date the liquidator’s role ended. If a new liquidator has been appointed, the record should show that through the appropriate filing. These details align the register with the company’s real governance.

Failure to file can cause legal and practical issues. Directors may face questions about compliance with the Act. The company may face penalties or administrative holds. Banks, insurers, or courts may refuse to act on instructions due to outdated records. Creditors may misdirect claims. All of this increases cost and delay.

Accuracy is critical. Errors in names, dates, or addresses can mislead stakeholders. They can also trigger rejections. You should cross-check the company’s name and number against your corporate records. You should confirm the cessation date with the liquidator, the approval resolution, or the court order. You should ensure consistency across related filings, such as a successor appointment.

Confidentiality is limited. The register is public. The data you include, such as addresses, may be visible to anyone who searches the company. Provide official mailing addresses, not personal home addresses, unless that is the only option available and you accept the visibility.

Finally, remember the form’s role in the sequence of filings. It often follows final approvals or a removal and replacement step. It may also precede dissolution filings. Filing Form 23 at the right moment helps you keep the lifecycle of the winding up clean and traceable.

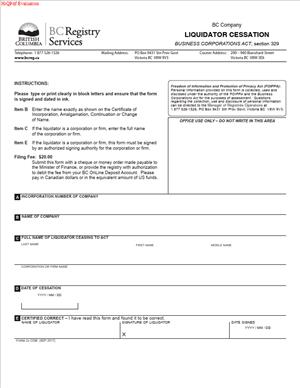

How to Fill Out a Form 23 – Notice of Ceasing to Act as Liquidator

Follow these steps to prepare and file a complete Form 23.

Step 1: Confirm the trigger for cessation.

Identify why the liquidator’s role has ended. Check if it is the completion of the winding up, resignation, removal, death, or disqualification. If there is a resolution or court order, keep it on hand. You may need to refer to it for dates and wording.

Step 2: Verify who should file and sign.

Decide who will sign the form. The outgoing liquidator can sign if available. A director or authorized officer can sign if the liquidator is unable or unavailable. The signer must have knowledge of the facts and the authority to certify.

Step 3: Gather core company details.

Pull the exact corporate name from your records. Use the name exactly as it appears on the register. Retrieve the incorporation number. This number ensures the filing matches the right company. Confirm the jurisdiction is British Columbia.

Step 4: Gather liquidator details.

Record the outgoing liquidator’s full legal name. Include middle names if applicable. Obtain the current mailing address for the liquidator. Use a professional address if one exists. Confirm the date they ceased to act. This date anchors the change on the register.

Step 5: Determine if a successor exists.

If a new liquidator is appointed, collect that person’s details. You will not use Form 23 to appoint them. But you should ensure the appointment filing is ready or already filed. Matching dates across filings prevents gaps in authority.

Step 6: Complete the identification section.

Enter the company’s name and incorporation number. Ensure all characters match your records. Avoid abbreviations not on the register. Check spelling twice. Errors cause rejections.

Step 7: Complete the liquidator section.

Enter the outgoing liquidator’s full name and address. Do not use initials only. List a mailing address where they can receive correspondence. If the liquidator is a firm, enter the firm’s legal name. If the liquidator acted through an individual partner, list the individual as well, if the form allows space.

Step 8: State the cessation date.

Enter the exact date the liquidator stopped acting. Use the date from the resignation, removal resolution, approval of final accounts, or court order. Do not guess at the date. Third parties will rely on it.

Step 9: Indicate the reason for cessation.

If the form presents checkboxes, select the correct reason. If the form requires a description, state it briefly. Examples: resigned; removed by resolution; removed by court order; completed winding up; deceased; disqualified. Keep it factual and neutral.

Step 10: Provide related order or resolution details if needed.

If the cessation arises from a court order or a member resolution, include its date. Include a short reference, such as “Special resolution dated [date].” If the form allows an attachment schedule, use it for longer details. Do not attach confidential exhibits unless required.

Step 11: Include schedules if you need more space.

If there were multiple liquidators ceasing at once, attach a schedule. List each liquidator’s full name, address, and cessation date. Label the schedule clearly. Cross-reference the schedule in the main form where it requests names.

Step 12: Complete the certification.

Enter the signer’s name and capacity. Examples: former liquidator, director, corporate officer, or authorized agent. Confirm the signer understands the content. The signer certifies that the information is true. False statements can lead to penalties.

Step 13: Sign and date the form.

Sign in ink if you will submit a paper form. Use the approved e-sign process if filing electronically. Date the signature. The signature date should not precede the cessation event. Keep a signed copy for your records.

Step 14: Add filing party contact details.

Provide a contact name, email, and phone number for the filing. This helps resolve questions quickly. Use a monitored inbox. This avoids delays if the registry requests a correction.

Step 15: Review for internal consistency.

Check that the company name and number match. Confirm the cessation date aligns with the reason. If there is a successor appointment, ensure dates and names do not conflict. Check spelling and addresses again.

Step 16: File with the provincial corporate registry.

Submit the completed form using the accepted method. Pay the applicable fee if required. File promptly after the liquidator ceases to act. Do not wait for unrelated milestones.

Step 17: Obtain confirmation and store records.

Save the filed copy and any acknowledgment. Store it with the winding-up file. Keep evidence of the trigger event, such as the resolution or court order. Retention helps if questions arise later.

Step 18: Notify key stakeholders.

Tell banks, insurers, major creditors, and tax authorities that the liquidator has ceased to act. Provide the cessation date. Share contact details for the successor, if one exists. This prevents misdirected payments and requests.

Step 19: Align related corporate filings.

If the cessation marks the end of the winding up, plan the next steps. These may include final returns or dissolution filings. Ensure all steps follow the correct order. Consistency avoids rejection and delay.

Step 20: Monitor the public register.

Verify that the register reflects the change within a reasonable time; if it does not, follow up. Provide any requested clarifications. Keep proof of your filing and the registry’s receipt.

Practical tips and common pitfalls:

- Use official names and addresses. Avoid nicknames or shortcuts.

- Do not assume the cessation date. Confirm it in writing.

- Do not attach unnecessary documents. Include only what the form requests.

- Keep personal data minimal. Use business addresses where possible.

- Coordinate with the successor liquidator. Align dates for a clean handover.

- Avoid gaps in authority. Ensure appointment filings are timely.

Example 1: Completion of winding up.

You have approval of the final accounts, and distributions are complete. The liquidator’s role ends on the approval date. You file Form 23 with that date. The register updates to show no active liquidator.

Example 2: Resignation for conflict.

The liquidator discovers a conflict with a new client. They resign effective on a set date. You file Form 23 with that date. If a successor is appointed, you coordinate the appointment filing.

Example 3: Removal by members.

The members pass a special resolution removing the liquidator. A replacement is named. You file Form 23 for the outgoing liquidator. You also ensure the appointment of the new liquidator is recorded.

Example 4: Death or incapacity.

The liquidator dies unexpectedly. A director signs Form 23 with the date of death. You then proceed to appoint a new liquidator and secure the company’s records.

Form 23 is concise but critical. It protects the integrity of the register. It reduces confusion and risk. It also supports a smooth conclusion or transition in the winding up. If you prepare carefully, check details, and file on time, you will meet your duty under the Act and make the process easier for everyone involved.

Legal Terms You Might Encounter

- Liquidator means the person in charge of winding up the company. You manage assets, pay debts, and distribute what remains. This form tells the registry you stopped being that person.

- Cease to act means you no longer perform the liquidator’s duties. It could be because you resigned, were removed, became disqualified, or were discharged. The form records the exact date this change took effect.

- Resignation means you voluntarily step down as liquidator. You typically give written notice to the company or court, if applicable. The form confirms your role ended and when.

- Removal means someone with authority ended your appointment. It could be the company by resolution or a court by order. The form captures the fact and date of removal.

- Discharge means you are officially released from the liquidator role after fulfilling your duties. This can happen after your final account is accepted. The form documents that you are no longer acting.

- Successor liquidator means the person who takes over after you. If there is a successor, you hand over records and property to them. The form does not appoint the successor; it only reports your end date.

- Effective date is the actual date you stopped acting. It controls your responsibility window. Be precise. Don’t guess. Use the true date you ceased to act.

- Registered office is the official address of the company on the register. You should use the exact current address on the register in any references. It’s where formal notices go.

- Company records are the books, registers, files, and data about the company and its liquidation. They include accounting records, creditor lists, and correspondence. You must safeguard and then transfer them when you cease to act.

- Statement of account is the summary of money and property you handled as a liquidator. It covers receipts, disbursements, fees, and balances. You should finalize it and deliver it when you stop acting.

FAQs

Do you need a reason to file this form?

No. The form records that you stopped acting and the effective date. A reason can appear in your resignation letter or a resolution, but the form usually does not require it. Keep the supporting paperwork in your file in case anyone asks later.

Do you need to file immediately after you stop acting?

File as soon as possible. The public record should reflect who is responsible at any given time. Filing quickly reduces confusion with creditors, courts, and stakeholders. It also helps set a clear end date for your duties.

Do you need to appoint a successor before you file?

Not always. The company or court may appoint a successor after you cease to act. Your duty is to give accurate notice that you are no longer acting. If a successor is in place, prepare to hand over records and assets without delay.

Do you need to attach supporting documents?

The form usually stands alone. You may need to have internal documents ready, such as a resignation letter, a company resolution, or a court order. Keep those in your records and be prepared to provide them if requested. Only attach documents if the registry instructions require it.

Can you backdate the effective date?

No. Use the actual date you stopped acting. Backdating creates risk and can misstate your responsibility. If there was a gap between your cessation and the filing date, that is fine. The public record will still show the correct end date.

Do you need to tell creditors directly?

You should plan to inform key stakeholders. Creditors, shareholders, and professionals working with the company should know who to contact. The form updates the public record, but it does not notify everyone for you. Send brief notices where needed.

What if you filed with the wrong date or made a typo?

Correct it as soon as you discover the error. Prepare an amendment or a new filing per registry practice. Keep your correction memo and proof of the updated record. Use the company number, not just the name, to avoid duplicate errors.

Who can sign and submit the form?

An authorized filer can submit on your behalf. That may be you, another liquidator, a director, or an authorized agent. Ensure the signer’s name and contact details are correct. The signer certifies that the information is true and complete.

Checklist: Before, During, and After the Form 23 – Notice of Ceasing to Act as Liquidator

Before signing

- Confirm the company’s exact legal name and incorporation number.

- Verify the current registered office address on the public register.

- Identify the precise effective date you ceased to act.

- Collect your resignation letter, discharge confirmation, or removal resolution, if applicable.

- Confirm whether a successor liquidator has been appointed.

- List the records, funds, and property under your control for handover.

- Confirm who will file the form and pay any fee.

- Prepare your final account of receipts and disbursements.

- Note contact details for directors, officers, and any successor liquidator.

- Draft a simple stakeholder notice for creditors and advisors, if needed.

During signing

- Double-check that the company name matches the register exactly.

- Verify the incorporation number is correct and belongs to the same company.

- Enter the correct effective date. Don’t estimate or round.

- Use your full legal name as currently recorded in the liquidation file.

- Confirm the address and contact information for the signer.

- Ensure the signer has authority to certify the filing.

- Review the form for missing fields, inconsistent dates, or misspellings.

- If filing by paper, use black or dark blue ink and print legibly.

- If filing electronically, preview the submission and save a draft before sending.

After signing

- File the form with the provincial corporate registry through the current accepted channel.

- Pay the required fee and retain proof of payment.

- Request and save the confirmation or receipt of filing.

- Verify the public record shows you as “ceased to act” with the correct date.

- Notify directors, officers, creditors, and key service providers of the change.

- If a successor is appointed, coordinate an orderly handover.

- Deliver all company records, funds, and property to the proper recipient.

- Provide your final account and obtain written acknowledgment of receipt.

- Store a complete file: the form, evidence of filing, and handover documents.

- Set calendar reminders for any post-filing follow-ups or outstanding tasks.

Common Mistakes to Avoid Form 23 – Notice of Ceasing to Act as Liquidator

Using the wrong effective date

- Don’t forget to enter the actual date you stopped acting. A wrong date can extend your apparent responsibility and confuse creditors. It may also raise questions about actions taken after you ceased to act.

Mismatch between the company name and the number

- Don’t rely on the name alone. Name variations and name changes happen. A mismatch can lead to a rejected filing or, worse, an update to the wrong company.

Missing or unauthorized signature

- Don’t assume anyone can sign. If the signer lacks authority, the registry can reject the filing. Even if accepted, the record could be challenged later.

Failing to hand over records and property promptly

- Don’t wait for conflict to resolve itself. Delays can disrupt creditor payments, increase costs, and create liability risk. Prepare an organized transfer with an inventory and receipts.

Not informing stakeholders

- Don’t expect the registry filing to reach everyone. If creditors, advisors, or institutions still send queries to you, the estate can stall. Send short notices so incoming inquiries go to the right person.

What to Do After Filling Out the Form 23 – Notice of Ceasing to Act as Liquidator

File the form promptly

- Submit the signed form through the accepted filing channel.

- Pay any fee and obtain the submission confirmation.

- Save a PDF or scanned copy and the payment receipt.

Confirm the public record

- Check the updated record to confirm the correct effective date appears.

- Verify your name no longer shows as the current liquidator.

- If anything is wrong, prepare and file a correction without delay.

Coordinate the handover

- If a successor liquidator exists, set a transfer date and method.

- Deliver records, funds, securities, and other property by inventory.

- Obtain written acknowledgment from the recipient for each category of items.

- Provide passwords, keys, and access credentials in a secure way.

- Share a contact for questions during a short transition period.

Finalize your account

- Prepare your final receipts and disbursement statement through the cessation date.

- Provide supporting schedules for bank balances and outstanding transactions.

- Identify any unresolved claims, disputes, or contingent liabilities.

- Deliver the final account to the appropriate party for review and approval.

Close out controls

- Cancel or transfer any signing authority you held over bank or investment accounts.

- Transfer control of email accounts, digital storage, and software used for the liquidation.

- Update forwarding instructions for mail and courier packages.

- If you had insurance related to the role, adjust or cancel coverage as appropriate.

Notify stakeholders

- Send concise notices to directors, officers, and key creditors stating you ceased to act and, if applicable, who the successor is.

- Notify professional advisors, landlords, and service providers who interact with the liquidation.

- Instruct them to direct future inquiries and documents to the successor or designated contact.

Handle expenses and retainers

- Reconcile your fees and expenses to the cessation date.

- Return any unused retainer funds or obtain approval for final invoices.

- Document any fee approvals or objections and keep proof of settlement.

Address disputes or information requests

- If anyone challenges your cessation date or requests documents, respond with copies of the filed form and your handover records.

- Escalate complex disputes through the designated channels for the liquidation.

- Keep a log of requests and responses for your protection.

Plan for record retention

- Keep copies of all liquidation records you created or received, to the extent allowed.

- Follow retention periods that apply to corporate and financial records.

- Store documents securely and restrict access to protect confidentiality.

Correcting errors after filing

- If you discover an error, prepare an amendment or follow the registry’s correction process.

- Notify affected stakeholders if the error could mislead them.

- Keep the original form, the correction, and proof that the registry updated the record.

When no successor exists

- Deliver assets and records to the party authorized to receive them until a successor is appointed.

- Provide a clear inventory and status report to ensure continuity.

- Remain available for limited questions about your final account, but do not act beyond your cessation date.

Wrap up your involvement

- Confirm there are no funds, records, or access rights left in your control.

- Send a closing note to the company contact that your role has ended.

- Archive your file with the submission receipt and any acceptance notices.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.