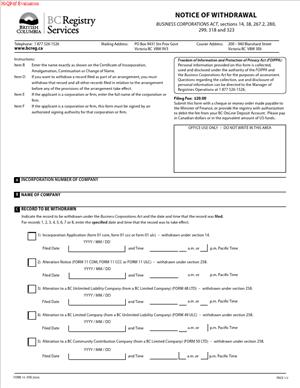

Form 19 – Notice of Withdrawal

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 19 – Notice of Withdrawal?

Form 19 – Notice of Withdrawal is a statutory notice. You use it to cancel a corporate filing or application that is still pending with the provincial corporate registry. In simple terms, it tells the registrar, “Stop processing that filing. Do not proceed.”

This form sits under the Business Corporations Act. It is used with filings that fall within sections 14, 38, 267.2, 280, 299, 318, and 323. Those sections cover core corporate events. They include incorporations, alterations, amalgamations, continuations, dissolutions, and restorations. The form lets you pull back your filing before the registrar completes it. It does not undo a filing that is already registered.

Who typically uses this form?

Company directors, officers, and authorized agents. Incorporators use it too. So do lawyers and paralegals acting for a company. In some cases, a liquidator or authorized representative will file it. If more than one company is involved, each company may need to consent. For example, both amalgamating companies often need to sign.

Why would you need this form?

Plans change. You might discover an error after you submit a filing. A deal can collapse. A shareholder vote may fail. Creditors may object. You might find a tax issue that needs attention first. Or you submitted the wrong company number by accident. If the registrar has not completed the registration, Form 19 allows you to withdraw the pending filing and avoid an unwanted result.

Typical usage scenarios

You filed an incorporation, then realized the share structure was wrong. You filed a name change, then found a conflict or branding issue. You started an amalgamation, then a key party backed out. You initiated a continuation out of British Columbia, then the transaction paused. You filed to dissolve, then discovered active contracts or assets. You applied to restore a dissolved company, then resolved the underlying issue without a restoration. In each case, you want the registrar to halt the current application so you can reassess or refile correctly.

Think of Form 19 as a brake pedal for corporate filings. It only works while the car is still rolling. Once the registrar registers the filing, the event has legal effect. A withdrawal can no longer be reversed. You would then need a different corrective filing or legal step.

When Would You Use a Form 19 – Notice of Withdrawal?

You use this form when a filing is pending and you no longer want it processed. The common thread is timing. The registrar must not have issued the relevant certificate or notice yet. If the filing is complete, a withdrawal is too late. You would need a new plan to address the result.

Consider a pending incorporation. You spot a share class error after you click submit. You withdraw to stop the incorporation before it produces a certificate. You then fix the documents and refile. That saves time and avoids a corrective alteration later.

Consider a planned name change. Marketing flags a trademark risk the day after filing. You withdraw the name change before it registers. You avoid rebranding and the cost of reversing a change that never needed to happen.

Consider an amalgamation. Two companies plan to merge. At the last minute, due diligence reveals an undisclosed liability. The boards decide not to proceed. A withdrawal prevents the registrar from issuing the amalgamation certificate. Both entities stay separate. You can renegotiate, restructure, or walk away.

Consider a continuation out of British Columbia. A buyer wants the company to continue in another jurisdiction. A lender refuses consent. With a withdrawal, you pause the move until consents are in place. You avoid a cross-jurisdiction problem that could be costly to unwind.

Consider a voluntary dissolution. The company files to wind up, then discovers unassigned intellectual property. You withdraw to keep the company alive while you transfer or license the IP. That protects the assets and the chain of title.

Consider a restoration. You apply to restore a struck company. Then you find that a different entity holds the assets. A withdrawal avoids restoring a company needlessly. You save fees and ongoing compliance costs.

Typical users include directors, officers, incorporators, and authorized agents. In a multi-party filing, each party may need to approve the withdrawal. That is common with amalgamations. It can also arise with continuations. For dissolutions and restorations, the company or the authorized applicant would sign. If a court order is in play, further steps may be required. A withdrawal does not cancel a court order. It only stops the registry from acting on the pending registry application.

The best time to use the form is as soon as your decision changes. Delay raises the risk that the registrar completes the filing. Once registered, different remedies apply. Those remedies may be slower, more complex, or more expensive than a timely withdrawal.

Legal Characteristics of the Form 19 – Notice of Withdrawal

This form is a statutory notice, not a contract. It is legally effective because the Act recognizes it for certain filings. The registrar has the authority to accept a withdrawal before a filing is completed. When accepted, the underlying pending application stops. It does not proceed to registration. No certificate or related change is issued.

Enforceability rests on a few pillars. First, proper authority. The person withdrawing must have the authority to act for the applicant company. If multiple companies filed the pending application, the registrar can require consent from each. Second, timing. The registrar must receive and accept the withdrawal before completing the pending filing. Third, clear identification. The withdrawal must identify the company and the specific filing. Transaction numbers, dates, and filing types matter. That precision prevents confusion and ensures the right application is halted.

The form does not erase a filing that already took effect. It only prevents an incomplete filing from being processed further. If the registrar has already issued a certificate, the status has changed in law. A withdrawal cannot reverse that. You would need another statutory step. That could be a new alteration, a fresh court process, or another remedy allowed by law. The right approach depends on the event and its status.

A withdrawal also does not cancel obligations under other laws or contracts. If you signed an agreement to amalgamate, that agreement still exists. You may have rights and duties under it. The withdrawal only stops the registrar’s processing. It does not resolve the contract. The same holds for shareholder approvals or regulatory consents. Those remain governed by their own rules.

The registrar can also refuse or return a withdrawal if it is incomplete or late. If the authority of the signatory is unclear, you may be asked for proof. For example, a board resolution or a signed authorization. If the withdrawal relates to a multi-party filing, consents may be required from all parties. That ensures fairness and avoids prejudice to other applicants.

Finally, be aware of fees and processing results. A withdrawal does not guarantee a fee refund. In many cases, fees are not refundable after submission. Also, some filings are time-bound. Withdrawing can cause you to miss a deadline. Plan for the knock-on effects of a pause. If you intend to refile, build in time for reviews and approvals.

How to Fill Out a Form 19 – Notice of Withdrawal

Follow these steps to complete the form accurately and avoid delays:

1) Confirm the filing is still pending

- Check the status of your application. Ensure the registrar has not completed it.

- If a certificate or notice has been issued, do not use this form. Plan a corrective filing instead.

2) Gather key details

- Full legal name of the company.

- Incorporation number (or registration number).

- The exact filing you want to withdraw.

- The filing transaction or reference number.

- The date you submitted the original filing.

- Your basis of authority to withdraw.

3) Identify the applicant company

- Enter the company’s full legal name exactly as on record.

- Include the incorporation number. If the filing involves multiple companies, list each one.

- For a continuation, include the current company name and identification in its home jurisdiction.

4) Identify the filing to be withdrawn

- State the filing type precisely. Examples: incorporation, alteration (name change or share change), amalgamation, continuation, dissolution, or restoration.

- Add the transaction or reference number. This helps the registrar match the withdrawal to the correct application.

- Add the date you submitted the filing. Include any internal reference or file number if you have one.

- If several filings are pending, withdraw only the one you list. File a separate Form 19 for each application you want to cancel.

5) State the statutory basis (if requested on the form)

- If the form asks for the statutory section, select or enter the proper section from the list provided on the form.

- If you are unsure, match the section shown on your original filing confirmation. Keep the entry consistent with the original application.

6) Provide your authority to withdraw

- Select your role: director, officer, incorporator, authorized agent, or other authorized person.

- If you are an agent, confirm you hold written authority from the company. Keep that document in your records.

- For multi-party filings (like an amalgamation), prepare signatures from each participating company. The registrar may require consent from all applicants.

7) Add a brief reason (optional but helpful)

- Use a short, clear statement. Examples:

- “Error discovered in share terms; will refile.”

- “Stakeholder approval withdrawn.”

- “Transaction postponed; not proceeding at this time.”

- Avoid confidential details. The reason helps processing, but need not be long.

8) Attach supporting documents if needed

- Board or shareholder resolutions, if internal approval is required.

- Written authorization if an agent is signing.

- Consents from other applicant companies, if applicable.

- Any court direction, if the filing stems from a court process, and the form requests it.

9) Complete the contact section

- Provide the name, email, and phone number for the person the registrar should contact.

- This person should be able to answer questions quickly and supply any missing information.

10) Sign and date the form

- A current director or authorized officer should sign for the company.

- For agent filings, attach or retain proof of authority.

- For multi-party filings, obtain signatures from each company as required.

- Use the signature format that the form accepts. If electronic filing is allowed, follow those instructions.

- Date the form on the day you sign.

11) Review for accuracy

- Check the company name and number.

- Confirm the transaction number and filing type.

- Ensure the authority and signatures are correct and complete.

- Make sure attachments are included if required.

12) File the form and pay any fee

- Submit the form using the accepted method. Follow the instructions on the form.

- Pay the required fee, if applicable. Fees may be non-refundable.

- Keep proof of submission. Save a copy of the form and any payment receipt.

13) Monitor for confirmation

- Watch for confirmation that the withdrawal has been accepted.

- Until you receive acceptance, assume the original filing remains pending.

- If you have not heard back in a reasonable time, check the status. Respond quickly to any registrar request.

14) After acceptance, update your records

- Save the confirmation with your corporate records.

- Notify internal stakeholders and advisors as needed.

- If you plan to refile, schedule time to address the issues that led to the withdrawal. Build in time for approvals or consents.

Practical tips to avoid issues:

- Act quickly. Once a filing is completed, you cannot withdraw it.

- Be specific. The registrar must match your withdrawal to a single pending filing.

- Align your authority. The signatory should be obvious and verifiable.

- Coordinate among parties. In multi-party filings, circulate the form early to gather all signatures.

- Keep a clean paper trail. Save confirmations, resolutions, and authorizations.

What if you need to stop only part of a multi-step plan?

Withdraw the pending filing that is up next in the sequence. Then reassess the plan. If other filings depend on that step, pause them too. Avoid mixed statuses that can be hard to reconcile.

What if you miss the window and the filing completes?

Plan a corrective path. For example, you might file a new alteration to reverse a change. Or you might seek a court order where the statute permits. The right fix depends on the event, timing, and stakeholders. The key is to address the resulting status, not to rely on a withdrawal that no longer applies.

Form 19 helps you prevent a mistake from becoming a legal reality. Use it to pause, correct, and proceed on your terms. File it early, complete it clearly, and keep your records in order.

5. Legal Terms You Might Encounter

- Notice of Withdrawal means the form you use to cancel a filing you started but no longer want. You submit it to the corporate registry before the original filing takes effect.

- Pending filing means a filing you submitted that is not yet effective or registered. You can usually withdraw a pending filing. Once it is effective, withdrawal is no longer available.

- Effective date is the date and time a filing takes legal effect. Many filings take effect when accepted. Some have a future effective date. You need to act before that date if you want to withdraw.

- Transaction number (or submission number) is the unique number the registry assigns to your filing. You use it on Form 19 to identify the exact filing you want to withdraw. You can find it on your receipt or confirmation email.

- Authorized signatory is the person who has the authority to sign Form 19 for the company. This can be a director, an officer, or an authorized agent. If you use an agent, make sure your internal approval covers that authority.

- Company name and number are the official identifiers for your company on the registry. You must enter both exactly as they appear on the registry to avoid misdirecting the withdrawal.

- Registered office and records office are the official BC addresses for your company. The registry uses these addresses for notices. Keep these addresses current. If they changed as part of the pending filing, confirm which address applies.

- Resolution means the formal decision by directors or shareholders that approves the withdrawal. Some withdrawals are routine and need only officer sign-off. Others should be supported by a board or shareholder resolution. Keep the resolution with your records.

- Extraprovincial company is a corporation formed outside BC that registers to carry on business in BC. If you submitted a filing for an extraprovincial company in BC, you may also use Form 19 to withdraw that pending filing.

- Public record means the registry’s searchable record for your company. When you withdraw a filing, the registry record may still show the withdrawn attempt. That visibility supports transparency. Do not expect the original attempt to disappear.

FAQs

Do you need a reason to withdraw?

Some versions of the form ask for a reason. Keep it brief and factual. For example: “Change in plan” or “Filed in error.” If the form does not ask, a reason is not required.

Do you get a refund of the fees you already paid?

You generally should not expect a refund. Filing fees cover processing and system costs. If a refund is possible, it is often rare and limited. Plan as if no refund will be issued.

Do you need a board or shareholder resolution?

You should document internal approval at the same level as the original filing. If directors approved the original filing, get a board resolution to withdraw it. If shareholders approved it, document shareholder approval to withdraw. Keep these approvals in your minute book.

Can you withdraw after the filing is effective?

Usually no. Withdrawal is a pre‑effectiveness remedy. After effectiveness, you need a corrective filing or other legal step. Act early if you intend to withdraw.

Can an agent or law firm file Form 19 for you?

Yes, if you authorize them. Make sure they have your company number, the transaction number, and any resolutions. The agent should also list a direct contact for registry questions.

Can you re‑file later after you withdraw?

Yes, in most cases. Withdrawal does not block a future filing. If there were deadlines or time‑sensitive rights, you will need to meet them again when you re‑file.

How long does a withdrawal take to process?

Processing depends on the registry queue and the filing type. Some withdrawals update quickly. Others may take longer if staff must review them. Monitor your company profile until the status changes.

Does a withdrawn filing disappear from the public record?

No. The record may show a withdrawn filing and the date. The goal is clarity for anyone reviewing your company’s history. Your final legal position is what matters, not the attempt.

Checklist: Before, During, and After the Form 19 – Notice of Withdrawal

Before signing

- Confirm the filing is still pending.

- Note the effective date or scheduled date, if any.

- Locate the transaction/submission number for the filing.

- Confirm the exact filing type you want to withdraw.

- Gather your company name and company number as they appear on the registry.

- Identify the authorized signatory. Confirm their title and authority.

- Obtain internal approval: board or shareholder resolution, if needed.

- Check for third‑party impacts. Consider lenders, counterparties, or regulatory bodies.

- If the pending filing changes addresses or directors, confirm current details.

- Decide on your short reason statement, if the form asks for one.

- Confirm the correct registry account or filing method you will use.

- Arrange payment method if a fee applies.

During signing

- Verify that the company name and company number match the registry exactly.

- Confirm the filing type you are withdrawing (e.g., name change, amalgamation).

- Enter the transaction number without typos.

- State clearly that you withdraw the pending filing. Do not add extra conditions.

- Include the filing date and any scheduled effective date, if requested.

- Add a brief reason if the form asks for one. Keep it factual.

- Review the signatory’s name, title, and contact details.

- Date the form. Use the same time zone as the registry, if applicable.

- Attach resolutions or authorizations if required.

- Review for consistency: names, numbers, dates, and filing type.

- Save a copy of the completed form before submission.

After signing

- File the form using the registry’s accepted channel.

- Pay any fee and obtain a receipt or confirmation.

- Wait for acceptance. Check your company profile for status changes.

- If the registry requests corrections, respond promptly and resubmit.

- Notify internal stakeholders: directors, officers, and staff with action items.

- Notify external parties who rely on the pending filing, if appropriate.

- Update your minute book with the filed Form 19 and any resolutions.

- Reverse related operational steps triggered by the pending filing.

- Calendar any new deadlines if you plan to re‑file later.

- Store all confirmations and correspondence with the registry.

Common Mistakes to Avoid Form 19 – Notice of Withdrawal

Withdrawing after the filing has taken effect

- Consequence: The registry will likely reject the withdrawal. You may need a corrective filing, which can cost more time and money. Don’t wait if you plan to withdraw.

Using the wrong transaction number

- Consequence: The registry cannot match your request. Processing stalls or fails. Double‑check the number from your receipt or confirmation before you submit.

Missing internal approval

- Consequence: You may face internal governance issues. The registry could question authority if challenged. Get a board or shareholder resolution when the original filing required it.

Incorrect company name or number

- Consequence: The form may be rejected or misapplied. That can delay time‑sensitive withdrawals. Copy identifiers exactly from the registry record.

Assuming fees will be refunded

- Consequence: Budget surprises and disputes. Plan for no refund. If a refund occurs, treat it as an exception.

What to Do After Filling Out the Form 19 – Notice of Withdrawal

- Submit the form and pay any fee. Keep the receipt and submission confirmation.

- Track status in your registry profile. Look for a status change to withdrawn or cancelled.

- If the registry rejects the form, fix errors quickly. Resubmit with corrected details.

- Once accepted, notify directors, officers, and managers. Confirm that related tasks stop.

- Inform advisors and counterparties who relied on the pending filing. Share confirmation if needed.

- Update your minute book: Form 19, resolutions, confirmation, and any related emails.

- Reverse operational steps linked to the pending filing. Examples include:

- Stop planned name changes in marketing and systems.

- Cancel scheduled address updates and mail redirects.

- Halt director/officer onboarding linked to the pending filing.

- Review downstream dependencies. Adjust bank mandates, contracts, or regulatory notices that assumed the pending filing.

- Decide whether to re‑file. If you plan to re‑file:

- Confirm the correct filing type and timing.

- Refresh any approvals that may have gone stale.

- Prepare clean versions of documents to avoid repeat errors.

- Close the loop with your teams. Confirm that calendars, project plans, and checklists reflect the withdrawal.

- Keep a short lessons‑learned note. Capture what caused the withdrawal and how to prevent similar issues.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.