DM4407449 – Application for Exemption from Professional Liability Indemnification

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

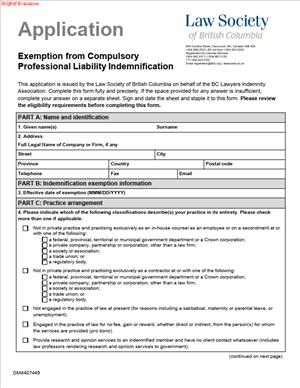

What is a DM4407449 – Application for Exemption from Professional Liability Indemnification?

This form lets you request an exemption from the mandatory professional liability indemnification program for lawyers in British Columbia. In simple terms, it is how you confirm you will not provide legal services to the public and therefore do not require the regulator’s indemnification coverage for a period of time. You make declarations about your role, your practice activities, and your plans. You also accept ongoing duties to notify the regulator if your situation changes.

You typically use this form if you are called in British Columbia and hold membership in good standing, but you work in a role that does not require indemnification coverage. Common examples include government counsel roles, in-house counsel for a single employer, teaching roles without public legal services, or periods when you are not practising. The form is the formal way to confirm your eligibility and to request the exemption for all or part of the policy year.

You may need this form if you are moving out of private practice, taking a leave, or shifting into an employment setting where you advise only your employer. You also use it if you practise solely outside British Columbia and carry equivalent insurance in that jurisdiction. The exemption helps you avoid paying the indemnification assessment for times when you have no exposure to claims through practice for the public. It also avoids confusion about coverage limits, scope, and responsibilities while you are not practising in a way that requires the program.

Typical usage scenarios include a lawyer who leaves a firm to become corporate counsel and advises only one employer. Another is a lawyer who accepts a full‑time role with a public body and no longer provides services to the public. A faculty member who teaches law and does not advise the public would also apply. So would a lawyer on parental leave who suspends all legal services to clients. A lawyer who relocates outside the province and does not serve BC clients may use this form if they have coverage where they practise. In each scenario, you confirm you will not provide legal services to the public in British Columbia while exempt.

The application is more than a simple checkbox. You must describe your role, your scope of work, and the date your exemption should take effect. You usually attach supporting documents, such as a job description or a letter from your employer. You also must agree to notify the regulator before you resume any work that could be considered practice for the public. The declarations are serious. If you provide legal services to anyone outside the permitted scope during an exemption, you risk regulatory action and personal exposure to claims without coverage.

When Would You Use a DM4407449 – Application for Exemption from Professional Liability Indemnification?

You use this form when your practice circumstances shift so that you no longer need the mandatory indemnification coverage. The most common trigger is a change in employment. If you join a government department as counsel, you are often indemnified by your employer and do not serve the public. In that case, you would apply effective the date you start the government role. If you become in-house counsel and advise only a single corporate employer, the same logic applies. Your work is for one employer, not the public, and you do not need the regulator’s indemnification program while in that role.

You also use the form when you move to a non‑practising phase. If you take parental leave or a sabbatical from practice, you can apply for an exemption for the period you will not be practising. If you retire or hold a retired or non‑practising membership status, you generally cannot provide legal services to the public. The form documents that status and ensures the regulator’s records match your practice activities. It also helps prevent accidental coverage gaps or retroactive assessments if you later return to practice.

If you teach, conduct research, or work in policy roles and do not provide legal services to the public, you would use this form. Many legal academics or policy analysts still hold membership. If you do not act for external clients, you can apply. You may also apply if you serve as an adjudicator or tribunal member and your role does not involve providing legal services to clients or the public.

Another scenario is practice outside British Columbia. If you relocate and practise only in another jurisdiction, you can apply for an exemption while maintaining your BC membership. You need to confirm you do not serve BC clients and that you hold appropriate coverage where you practise. If you split your time between jurisdictions or keep a BC client base, you likely still need the indemnification program. In that case, you would not use the exemption form.

The key theme is who your client is. If your only client is your employer, and you do not advise the public or separate legal entities outside your employer group, you may qualify. If you give any advice to the public, including friends, family, or affiliates not covered by your employer arrangement, the exemption likely does not apply. Volunteer legal advice is still legal practice. Even one pro bono matter could disqualify you. If there is any chance you will take external files, you should not file this exemption. Keep coverage in place instead.

Legal Characteristics of the DM4407449 – Application for Exemption from Professional Liability Indemnification

This application is a regulatory filing. It is legally binding because you certify facts about your practice that determine whether you must hold compulsory indemnification coverage. The regulator relies on your declarations to administer a protection program that safeguards the public and the profession. When you sign, you confirm that your statements are true and complete. You also accept duties to update the regulator if your situation changes. That continuing duty is critical. The exemption is not a one‑time decision you can ignore. If you resume practice for the public, you must notify the regulator and rejoin the indemnification program before you act.

Enforceability rests on the regulator’s statutory authority to set and enforce professional requirements. The indemnification program is mandatory unless you qualify for exemption under specific categories. The application is the mechanism to claim that status. If you misstate facts or fail to notify changes, the regulator can revoke your exemption, assess unpaid indemnification fees retroactively, and take disciplinary action. You may also face personal liability exposure for any legal services you provided while exempt. Because the program does not respond during an exemption, there is no coverage if a claim arises from work you were not allowed to do.

There are general legal considerations as you prepare this filing. First, be precise about your employer and who you advise. If you are in-house counsel, confirm whether your work covers only your employer, or also subsidiaries, affiliates, or third parties. If you advise separate legal entities, your in-house status may not fit the exemption category unless the arrangement meets specific criteria. Second, clarify any volunteer or advisory roles. Serving on a board can drift into legal advice. If you provide legal advice in that capacity, you may be practising for the public. Third, confirm effective dates. Exemptions are date‑sensitive, often linked to payroll or practice transitions. You want the exemption to start on the correct date to avoid gaps or overpayments. Fourth, understand the consequences. During an exemption, you cannot act for clients outside the allowed scope. If an emergency arises, you must reinstate coverage before you act.

The application often includes an undertaking. You promise to cease all practice for the public and to notify the regulator before resuming any such work. That undertaking is enforceable. Many exemptions are time‑limited or tied to employment. If the employment ends, the exemption usually ends. You must reapply or return to coverage before taking any external file.

How to Fill Out a DM4407449 – Application for Exemption from Professional Liability Indemnification

Follow these steps to complete the form accurately and avoid delays.

1) Confirm your eligibility category.

Before you fill anything out, confirm which exemption fits your situation. Common categories include:

- Government or public sector employment with no services to the public.

- Corporate or in-house counsel for a single employer with no external clients.

- Non‑practising or retired status with no legal services to the public.

- Academic, policy, or tribunal roles without client legal services.

- Practising exclusively outside British Columbia with appropriate coverage elsewhere and no BC clients.

If your situation does not fit one of these, stop and reconsider. You may still need coverage.

2) Complete the applicant identification section.

Provide your full name, member number, and current contact information. Use your professional email and mailing address. If you are moving roles, list the address where you can receive notices during and after the transition. If the form asks for your call date or membership class, add those details as they appear on your membership record.

3) State your current status and the requested exemption period.

Identify the date you want the exemption to start. Align it with your first day in the new role, your first day of leave, or the day you ceased serving the public. If you are applying mid‑year, confirm whether the start date is retroactive or prospective. Do not backdate without a clear basis. State the anticipated end date if known. If the exemption is tied to employment, you can write “until further notice” if the form allows, but be prepared to update the regulator when employment ends.

4) Describe your role and scope of work.

This narrative is where you show why you qualify. Keep it clear and specific. If you are in-house, state your employer’s legal name and describe your duties. Confirm you will advise only your employer and not the public. Clarify whether you advise affiliates or subsidiaries and, if so, on what basis. If you are in government, identify your branch and role. Confirm that you provide no services to the public. If you teach or do policy work, describe those duties and confirm you do not provide legal services to clients. If you practise outside BC, name the jurisdiction, confirm you serve no BC clients, and state that you hold equivalent coverage there.

5) Confirm no practice for the public.

Most forms include a direct question or declaration. Answer it clearly. State that you will not provide legal services to the public while the exemption is in place. If the form asks about pro bono or volunteer work, state that you will not engage in any legal work for external clients. If you expect to do any, you should not apply for the exemption.

6) Add employer verification if required.

Many exemptions require a letter from your employer. The letter should confirm:

- Your job title and start date.

- That you provide legal services only to your employer.

- That you provide no legal services to the public.

- If applicable, whether your work extends to affiliates and how those entities are related.

- Whether the employer provides indemnification for your legal work as an employee.

Attach your official job description if available. If you are in government, attach a confirmation from HR or legal operations. If you are in academia, attach a letter from your dean or HR.

7) Provide proof of alternative coverage if applicable.

If you practise exclusively outside British Columbia, attach proof of coverage in that jurisdiction. Include the insurer or indemnifier name, policy or program year, and limits. Attach a certificate of insurance or an official confirmation. If the form requires, include a statement that you will not serve BC clients during the exemption period.

8) Declare any additional roles.

If you sit on boards, volunteer with clinics, or hold appointments, disclose them. State whether any of those roles involve providing legal services. If they do, you likely do not qualify. If you serve in a non‑legal capacity, state that clearly. The regulator will assess whether those roles affect your eligibility.

9) Review the declarations and undertakings.

Read the declarations at the end of the form. You will confirm the truth of your statements and agree to notify the regulator of changes. Pay attention to the clause that requires you to reinstate coverage before you provide any legal services to the public. If the form includes a privacy notice, review it so you understand how your information will be used.

10) Sign and date the application.

Sign with your usual signature. Date the form on the day you sign. If the form allows digital signatures, follow those instructions. If your employer must sign or certify, obtain that signature as well. Do not submit without required signatures. If a commissioner or witness is required, arrange that step before filing.

11) Attach schedules and supporting documents.

Treat your attachments as schedules. Label them clearly. Common schedules include:

- Schedule A: Employer letter and job description.

- Schedule B: Proof of alternative coverage (if outside BC).

- Schedule C: Statement of non‑practice or leave details.

- Schedule D: List of external roles with confirmation of no legal services.

Make sure each schedule references your name and member number. If the form has a checklist, confirm you have included each required item.

12) Submit the application using the required method.

Some regulators accept secure online submission. Others require email or mail. Follow the instructions on the form. Keep a copy of everything you submit. If you are changing employment on a fixed date, submit at least several business days before the change. If you are on a tight timeline, note that in a cover note.

13) Monitor for confirmation and effective date.

The exemption is not effective until the regulator approves it. Watch for a written confirmation that states your exemption category and effective date. Check that the date matches your request. If it does not, contact the regulator promptly to resolve the difference. Until you have written confirmation, do not assume you are exempt.

14) Update your records and billing.

Once approved, update your internal systems. If your firm or employer pays assessments on your behalf, notify them of the change. If you paid an assessment that should now be adjusted, follow the instructions for credits or refunds if available. Keep the approval letter in your compliance file.

15) Keep your ongoing obligations in mind.

During the exemption, you must not provide legal services to the public. If your circumstances change, notify the regulator before you act. Common triggers include taking a side file for a friend, advising an affiliate that is not within the allowed group, or accepting a short‑term contract outside your employer. In each case, stop and seek reinstatement of coverage before you do any legal work.

Practical examples can help you apply these steps. Suppose you move from a firm to an in-house role on July 1. Submit your application in mid‑June with a letter from your new employer. Ask for an effective date of July 1. Confirm you will advise only your employer. If that employer has multiple subsidiaries, identify which ones you will advise and how they relate. Attach your job description. Once approved, you are exempt from July 1. Do not accept any external engagements while exempt.

Consider a parental leave starting March 15. You plan not to practise for six months. You can apply with a requested effective date of March 15 and an end date of September 14. In your declaration, confirm you will not provide any legal services to the public during the leave. If you return early, notify the regulator to reinstate coverage before taking files.

If you relocate to another province or country and practise only there, attach proof of coverage from that jurisdiction. Confirm you will not serve BC clients. Request the exemption effective the date you stop serving BC clients. If you later accept BC work, you must reinstate coverage before starting.

Finally, if you teach full‑time in a law faculty and do not advise the public, explain your role and attach a letter from the institution. Confirm no client work. If you occasionally speak at clinics, be careful. If your participation involves providing legal advice, the exemption may not apply. Either avoid advice or keep the indemnification program in place.

Treat the application like any professional filing. Be accurate, concise, and complete. Align your requested dates with your actual practice activities. Keep your commitments. If in doubt, err on the side of maintaining coverage. The cost of an uncovered claim is far higher than an assessment you could have avoided.

Legal Terms You Might Encounter

- You will see specific terms in the DM4407449 – Application for Exemption from Professional Liability Indemnification. Knowing them helps you complete the form accurately and avoid delays.

- Professional liability indemnification refers to financial protection for claims from legal services. On this form, you confirm whether you need this protection for your current activities.

- Exemption means a formal release from the indemnification requirement. With this form, you ask the regulator to confirm that release.

- Practising status describes whether you provide legal services to the public. If you do, you usually need coverage and cannot claim an exemption.

- Non-practising status means you do not provide legal services to the public. The form often asks you to confirm this status and the date it started.

- In-house practice means you provide legal services only to your employer. The form may ask whether your role fits this category and whether you interact with the public.

- Effective date is the date the exemption starts. The form will ask you to choose or confirm this date.

- Material change is any change that affects your exemption. The form requires you to agree to report any change within a set time.

- Attestation is your sworn confirmation that your statements are true. You sign to attest that you meet the criteria for exemption.

- Extended reporting period, often called “tail coverage,” protects you against late-reported claims. The form may ask if you have or will obtain this protection.

- Supporting documentation includes proof that backs up your answers. You may need employment letters, role descriptions, or prior coverage confirmations.

- Claims-made coverage responds to claims made during the policy period. The form may refer to this when it asks about tail coverage.

- Retroactive date is the date from which your prior acts are covered. If you have other insurance, the form may ask about this date.

- Good standing means your membership is current and compliant. The form may require you to confirm your standing before exemption is granted.

- Declarations are statements you make in the form. They confirm your activities, your status, and your understanding of the rules.

FAQs

Do you qualify for an exemption if you only do unpaid pro bono work?

You may not qualify if you still provide legal services to members of the public. Some approved programs offer separate protection. The DM4407449 asks you to confirm that you do not engage in activities that require indemnification. If you provide any public-facing services, you likely need coverage.

Do you need tail coverage after you stop practicing?

Yes, if your prior work was covered under a claims-made policy. Claims can arise after you stop. The DM4407449 may ask whether you have or will maintain an extended reporting period. Arrange tail coverage before your coverage ends to avoid gaps.

How long does the exemption last?

It typically lasts only for the period stated in the approval. It does not automatically renew. You must reapply or confirm your status before the next coverage year. The DM4407449 will state the period or ask you to confirm it.

Can you apply mid-year?

Yes. You can apply when your role changes and you no longer need coverage. The effective date is usually the date of approval or a date you request. It is rarely backdated. The DM4407449 asks for your requested effective date.

What if your situation changes after approval?

You must notify the regulator and reinstate coverage if needed. The DM4407449 includes a duty to report material changes. Report changes promptly. Failure to report can lead to uncovered claims and regulatory issues.

Is there a fee with the DM4407449?

There may be an administrative fee. The form or payment page will indicate the amount and options. Have payment details ready if requested. If no fee is required, you will see no payment section.

Can you keep trust signing authority while exempt?

Usually not. Exemption generally means you do not engage in activities requiring coverage. Trust handling often requires indemnification. The DM4407449 will ask you to confirm the nature of your activities. Remove yourself from trust access if you are exempt.

What happens if the DM4407449 is denied?

You will receive a decision with reasons. You can correct issues and resubmit. If you provide services in the meantime, secure coverage to avoid gaps. Ask what evidence is missing, fix it, and reapply.

Checklist: Before, During, and After the DM4407449 – Application for Exemption from Professional Liability Indemnification

Before signing: Information/documents needed

- Membership or identification number.

- Full legal name, current contact details, and preferred email.

- Current status: practising, non-practising, in-house, government, academic, or other.

- Your employer’s name and a brief role description, if employed.

- Confirmation that you do not provide services to the public.

- Requested exemption effective date and, if relevant, end date.

- Description of activities you will continue to perform, if any.

- Confirmation of no client trust handling, if applicable.

- Details of any other professional insurance, if applicable.

- Extended reporting (tail) coverage details, if applicable.

- Evidence of employment, if needed (offer letter or HR confirmation).

- Confirmation of file transfers and client notifications, if relevant.

- Prior and pending claims information, if any.

- Any regulatory conditions that affect your status.

- Payment method, if a fee applies.

During signing: Sections to verify

- Your name, membership number, and contact information.

- Practice category selected matches your actual role.

- Effective date is correct and not backdated without approval.

- Declarations about activities are clear and accurate.

- Confirmation that you do not provide public-facing legal services.

- Confirmation about trust account and trust signing authority.

- Confirmation of alternative coverage or tail coverage, if cited.

- Attachments listed match what you have uploaded or enclosed.

- Signature, date, and any required witness or attestation.

- Consent to receive notices by email, if you choose that option.

- Acknowledgment to report material changes promptly.

- All pages completed, with no blank mandatory fields.

After signing: Filing, notifying, storing instructions

- Submit the DM4407449 through the approved channel (portal or mail).

- Pay any fee if required. Save proof of payment.

- Wait for written confirmation of approval or next steps.

- Do not resume public-facing legal services without coverage.

- Notify your employer of your exemption and effective date.

- Remove trust access and update internal roles as needed.

- Update your website, letterhead, and email signature if status changes.

- Complete file transfers and client notices, if relevant.

- Store a full copy of the form and attachments in your compliance file.

- Calendar renewal or review dates to avoid lapses.

- Keep tail coverage evidence with your records.

- Monitor your contact email for follow-up requests.

Common Mistakes to Avoid DM4407449 – Application for Exemption from Professional Liability Indemnification

Applying while still providing legal services to the public

- Consequence: Denial, regulatory concerns, and uncovered claims risk.

- Don’t forget: Stop public-facing services before you apply.

Backdating the effective date without approval

- Consequence: Coverage gaps and disputes over claim periods.

- Don’t forget: Use a realistic effective date you can support.

Selecting the wrong practice category

- Consequence: Delays, extra questions, and possible refusal.

- Don’t forget: Match your selection to your actual role and duties.

Omitting proof of employment or role scope

- Consequence: Requests for more information and processing delays.

- Don’t forget: Attach letters or role descriptions when you rely on them.

Ignoring the duty to report changes

- Consequence: Exemption revocation, discipline, and claim exposure.

- Don’t forget: Report any change in activities or employment promptly.

What to Do After Filling Out the Form DM4407449 – Application for Exemption from Professional Liability Indemnification

- Submit the form and confirm receipt. If you filed online, check your account status within a few days. If you mailed it, track delivery, then follow up if you hear nothing.

- Pause any public-facing legal services. Wait for written approval before you proceed under an exempt status. If you must provide services, reinstate or maintain coverage.

- Arrange tail coverage if you had prior claims-made coverage. Put coverage in place before your prior policy ends. Keep the certificate and retroactive date on file.

- Notify your employer or partners. Share your effective date and any limits on your activities. Confirm you will not handle trust funds or client money.

- Update communications and operations. Adjust your website, letterhead, and email signature to reflect your status if needed. Remove yourself from trust signing authority.

- Complete file transfers and client notices. If you are exiting practice, move active matters to a covered lawyer. Notify clients and document their consent where required.

- Respond to any regulator requests. Provide missing documents quickly. Clarify any ambiguous role descriptions or dates.

- Track your approval. Save the approval letter or email with the DM4407449. Confirm the exact start and end dates for your exemption period.

- Calendar your renewal or review date. Exemptions often reset annually. Set reminders 30 and 60 days before the renewal date.

- Keep thorough records. Retain a copy of the form, approval, tail coverage, and any supporting documents. Store them in a secure compliance file.

- Update your status if your role changes. If you return to public-facing services, reinstate coverage before you start. File an amendment or new form if required.

- If denied, address the reasons and reapply. Add missing documents or correct dates. Consider a temporary reinstatement of coverage while you resolve the issue.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.