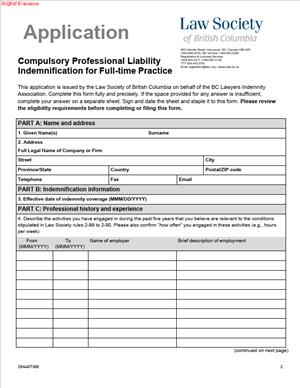

DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time Practice

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice?

This form is the official application for primary professional liability indemnification. It is designed for lawyers in full-time private practice in British Columbia. You complete it to activate mandatory coverage before you provide legal services to the public. It collects your identity, practice details, risk information, and payment instructions. It also records your declarations and consent to the terms of coverage.

The form serves two key purposes. First, it confirms that you are eligible and require full-time coverage. Second, it gives the insurer the underwriting facts it needs. Those facts include your practice areas, firm structure, prior coverage, and claims history. The form also confirms the start date for your coverage. That date must match your entry into full-time practice.

Who typically uses this form?

Newly called lawyers entering full-time private practice. Lawyers moving from part-time or exempt status to full-time. Lawyers returning from leave who will resume full-time practice. Lawyers transferring from another province and starting full-time work in British Columbia. Sole practitioners launching a new firm. Partners or associates joining a firm as full-time fee earners. Corporate counsel who will also serve the public through a separate practice. Limited license holders who must carry primary indemnity for full-time work.

You need this form if you plan to provide legal services to clients for a fee on a full-time basis. In this context, “full-time” means the majority of your working time. The regulator treats private practice differently from in-house or government roles. If you serve the public, you usually need this coverage. The form confirms your status and sets the effective date. It also ensures you receive a certificate of indemnification if one is issued.

Typical usage scenarios

- You are called to the bar and start with a firm next month.

- You file this application to ensure coverage begins on your start date.

- You were non-practising last year, and now you will return full-time.

- You file the form to convert your status and re-activate coverage.

- You practised part-time while caring for family.

- You will increase to full-time next quarter.

- You submit the form to update your coverage and premium.

- You relocate from another province and will join a local firm.

- You apply so your BC coverage starts when you begin work.

- You leave an in-house role and open a sole practice.

- You use the form to register, pick options, and pay your premium.

The form is not only administrative. It forms part of your contract of indemnification. Your answers affect your coverage, including exclusions and deductibles. Incomplete or inaccurate answers can delay or limit coverage. Accurate information helps you avoid gaps and disputes later.

When Would You Use a DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice?

You use this application when you move into full-time private practice and must carry primary indemnification. This includes the day you begin articling as a temporary call that provides public services, if coverage is required. It also includes your first day as an associate, partner, or sole practitioner. If you are rejoining practice after a break, file before your return date. If you change from part-time to full-time, file before the change takes effect. If you transfer from another jurisdiction, submit it before you start serving BC clients. If you change firms and remain full-time, update your details to ensure continuity.

Typical users include individual lawyers, sole practitioners, and firm administrators. A firm administrator may prepare the form on your behalf, but you must review and sign. Directors of a law corporation may also sign where required. Coordinators in medium and large firms often manage multiple applications for new joiners. Sole practitioners handle their own filings. In-house counsel with a side private practice use the form to activate coverage for that public work. Visiting counsel on a limited license may also need to file, if they meet full-time thresholds.

You may also use the form when you need to adjust coverage mid-year. For example, your practice expands, and you move from part-time to full-time hours. You must update your status to full-time and pay any pro-rated premium. You would also use the form to align your retroactive date if you had prior coverage elsewhere. You may need to disclose prior acts, claims, or known circumstances. Those details affect your coverage and deductibles.

You should file well before your planned start date. Processing can take time. Late filing can leave you uninsured on your first day. If you will work on client matters, do not wait. Submit the form as soon as your start date is firm. If the regulator requires proof of coverage to issue or change your status, build in extra time.

Legal Characteristics of the DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice

This application has legal effect. It forms part of the contract of indemnification issued to you. Your statements are declarations of fact. The insurer relies on those statements to set terms and accept risk. If your statements are false or misleading, coverage can be denied. If you omit material facts, the insurer may rescind coverage. You also confirm your duty to update the insurer if facts change before issuance. For example, if a claim arises between filing and your start date, you must disclose it.

The form also contains consents and acknowledgements. You consent to the collection and use of your personal information for underwriting. You authorize the insurer to obtain information from the regulator and your past insurers. You confirm that you understand the nature of the coverage. Primary indemnification is usually provided on a claims-made basis. That means the claim must be made and reported during the policy period. Retroactive coverage may apply for past acts, subject to conditions. Known claims or circumstances are typically excluded. You must disclose any such matters at the time of application.

Enforceability rests on several features. The coverage is required by the regulator for full-time practice. You must have it to offer services to the public. The insurer issues a certificate of indemnification once you meet all conditions. The policy wording sets out limits, deductibles, and exclusions. Your signed application is incorporated by reference. Premiums are due under the terms set out in the form. Non-payment can result in cancellation or regulatory action. The insurer may also recover amounts under indemnity in certain cases, such as fraud.

General legal considerations are practical. Keep copies of the signed application and attachments. Ensure the effective date matches your first day of practice. Confirm the retroactive date if you have prior coverage. Review your deductible and available options. Some defendants seek assignment of policy rights in settlements. Understand your duties to report claims and potential claims promptly. Late reporting can prejudice your coverage. If you join a firm, confirm whether the firm funds the premium and deductible. Confirm any “innocent insured” protection in the primary program. If you hold a law corporation, ensure the corporation is included as an insured entity where appropriate.

How to Fill Out a DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice

Follow these steps to complete the form accurately and avoid delays.

1) Confirm you need full-time coverage.

- Determine if you will provide legal services to the public.

- Confirm your work will be full-time, not occasional.

- If you are unsure, ask your firm administrator or the regulator.

- If you remain in-house with no public services, do not use this form.

- If you will do both in-house and public work, you likely need it.

2) Gather your information.

- Your full legal name and member number.

- Your contact details and preferred email.

- Your firm or business name and address.

- Your planned start date for full-time practice.

- Your past insurers and retroactive date, if any.

- Your claims history and any known circumstances.

- Your practice areas and percentage allocations.

- Your entity details, such as a law corporation.

- Your payment method and billing contact.

3) Complete the Applicant Details section.

- Enter your full name as licensed.

- Provide your member number to match records.

- Add your current mailing address and phone.

- Include your preferred practice email. Use a monitored inbox.

- Confirm you are applying for full-time coverage.

4) Specify your practice status and effective date.

- Select “New to full-time practice” or “Change to full-time.”

- Enter the date you will begin full-time practice.

- If you are joining a firm, match the employment start date.

- If you are returning from leave, use your return date.

- If you are transferring from another province, use your BC start date.

5) Provide firm or employer information.

- Enter the legal name of your firm or business.

- Include the main office address and phone.

- Identify your office location if different.

- Name a firm contact for billing and certificates.

- Indicate your role: associate, partner, or sole practitioner.

6) Identify your business structure.

- Select individual, partnership, law corporation, or other.

- If you have a law corporation, provide its legal name.

- Include registration or incorporation numbers if asked.

- If you are a director or shareholder, disclose your role.

- Confirm whether the firm will pay the premium.

7) Describe your practice areas.

- List main areas and estimated percentages.

- Include high-exposure work, if any.

- Examples include litigation, real estate, corporate, or wills.

- Be accurate. Do not guess wildly.

- This section informs underwriting and risk assessment.

8) Disclose trust account and client fund handling.

- State whether you handle trust funds.

- Provide trust account details if requested.

- Confirm controls and signatories if asked.

- If you will not handle trust, state that clearly.

9) Provide prior coverage details.

- List your previous professional liability insurers.

- Provide your prior policy numbers if known.

- Indicate your retroactive date for past acts.

- Attach proof of continuous coverage if you want prior acts covered.

- Explain any gaps in coverage, even short ones.

10) Report claims and circumstances.

- Disclose past claims, complaints, and disciplinary findings.

- State dates, allegations, and outcomes in summary form.

- Include reserves or paid amounts if you know them.

- Disclose any known circumstances that could lead to a claim.

- If more space is needed, attach a claims supplement.

11) Answer conduct and licensing questions.

- Confirm your good standing status.

- Disclose any licence restrictions or conditions.

- Report any criminal convictions that must be disclosed.

- Provide explanations for any “Yes” answers.

- Attach supporting documents where required.

12) Choose coverage options, if offered.

- Primary limits may be fixed for all insureds.

- Some programs offer optional excess coverage.

- You may be able to select a higher deductible.

- Confirm if “innocent insured” protection is standard or optional.

- Align options with your firm’s risk appetite.

13) Calculate premium and fees.

- Review the stated annual premium for full-time status.

- Premiums may be pro-rated by month for mid-year starts.

- Confirm taxes or fees, if applicable.

- If your firm pays, list the firm as payor.

- If you pay, choose pre-authorized debit or card if allowed.

14) Provide payment authorization.

- Complete banking or card details as required.

- If paying by the firm, include the firm’s authorization.

- Confirm the billing contact and email for invoices.

- Acknowledge automatic debits if you opt in.

- Keep a record of your authorization for your files.

15) Read the declarations carefully.

- You confirm all statements are true and complete.

- You agree to report changes before coverage starts.

- You consent to collection and exchange of information.

- You acknowledge the claims-made nature of coverage.

- You accept the policy terms, limits, and deductibles.

16) Sign and date the application.

- Sign with your legal name as licensed.

- Include the signing date and city.

- If you have a law corporation, sign in both capacities if asked.

- If the firm pays, an authorized firm signatory may also sign.

- Electronic signatures are accepted if the form allows.

17) Attach required documents.

- Include a claims supplement for any disclosed matters.

- Attach proof of prior coverage and retroactive date, if needed.

- Add corporate documents if a law corporation is named.

- Provide any requested certificates of standing.

- Label each attachment with your name and member number.

18) Review for consistency.

- Check names and dates across all sections.

- Confirm the start date matches your employment letter.

- Verify your email and phone for accuracy.

- Ensure attachments align with your answers.

- Correct typos that could slow processing.

19) Submit the application.

- Use the designated portal or email if instructed.

- If submitting by mail, keep a tracked copy.

- Note the submission date for your records.

- Do not delay if your start date is near.

- Ask for confirmation of receipt if not automated.

20) Monitor and respond.

- Watch for follow-up questions from underwriting.

- Respond promptly with any extra details.

- Provide clarifications on claims or gaps if asked.

- Confirm the issued effective date and any conditions.

- Request a certificate of indemnification if one is provided.

21) After issuance, confirm your obligations.

- Note your duty to report claims or potential claims promptly.

- Keep copies of the policy and your application.

- Track your deductible and billing schedule.

- Update your details if your role or firm changes.

- Calendar renewal and reporting deadlines.

22) Common pitfalls and how to avoid them.

- Do not guess about prior coverage dates. Verify them.

- Do not omit small claims. Disclose all claims and incidents.

- Do not backdate your start date. Use the real date.

- Do not rely on the firm to file without checking. Review it.

- Do not assume part-time rules apply. This is for full-time work.

23) If your situation changes before approval.

- Notify underwriting if you delay your start date.

- Report any new claim or complaint at once.

- Update your practice areas if your role shifts.

- Adjust payment details if the firm payor changes.

- Request a revised effective date if needed.

24) If you maintain coverage from another jurisdiction.

- Disclose that coverage and its retroactive date.

- Clarify whether you seek prior acts recognition.

- Provide contact details for your past insurer.

- Confirm if you will cancel or keep that policy.

- Align reporting duties to avoid missed notices.

25) If you are a sole practitioner.

- Ensure your business name matches your registration.

- Confirm your trust account and signing controls.

- Consider optional excess coverage if available.

- Plan for the deductible in your cash flow.

- Keep written engagement terms to manage risk.

26) If you join a firm with a group process.

- Use the firm’s intake checklist to speed approval.

- Confirm who pays the premium and deductible.

- Confirm any internal reporting protocols.

- Sync your start date with HR and conflicts checks.

- Ensure your name appears on the firm’s insured roster.

Parties. The parties are you, as the applicant insured, and the indemnifier that issues coverage. If you practice through a law corporation, it may be a named insured or additional insured. Your firm is not a party unless it funds or guarantees payment. However, a firm signatory may consent to billing and deductibles.

Clauses. Key clauses include your declarations, consent to information exchange, and agreements on reporting duties. Payment terms and cancellation conditions are also set out. Coverage is subject to a master policy. Your application is incorporated into that policy. Any misrepresentation can affect validity.

Signatures. You must sign and date the form. A firm or corporate signatory may also sign billing and authorization sections. Electronic signatures may be accepted. Use the signature method specified on the form.

Schedules. You may need to attach schedules for claims, prior insurers, or practice areas. Use the provided templates if available. Number each page and include your name and member number. Ensure every schedule ties back to the relevant question on the form.

By following these steps, you reduce delays and avoid coverage gaps. File early, answer completely, and keep records. If issues arise, respond quickly and in writing. That approach protects your practice and your clients from day one.

Legal Terms You Might Encounter

- Claims-made coverage means the program responds to claims first made and reported during the coverage period. On DM4407368, you confirm your practice dates so the administrator can align your coverage window. If you receive a demand after your effective date, you must report it within the required time.

- Retroactive date, sometimes called prior acts date, marks how far back your coverage reaches for past work. The form may ask for your earliest continuous coverage date and evidence. If you leave this blank or guess, you risk losing protection for earlier matters.

- Limit of indemnity is the maximum the program will pay per claim and in total for the year. DM4407368 may fix these limits or ask you to select an option. Always confirm the per-claim and aggregate limits match your risk profile and firm expectations.

- Deductible is the portion you pay on each claim before indemnity applies. The form may ask you to acknowledge the deductible or choose from set amounts. If you select a higher deductible, understand the cash impact before you sign.

- Full-time practice describes your work status for eligibility. DM4407368 focuses on full-time practice in British Columbia. You confirm hours or primary occupation to qualify. If you split time with non-legal roles, review how the form defines full-time.

- Vicarious liability is your responsibility for work done by others under your supervision or direction. The form may ask about staff, contractors, or supervised students. Accurate information helps confirm that the correct parties fall within coverage.

- Exclusions are activities not covered by the program. DM4407368 includes declarations to confirm whether you engage in excluded work, such as certain business roles or non-legal services. Disclose these activities so the administrator can advise on fit.

- Material change is any significant shift in your practice that affects risk, like a new firm, new area of practice, or a change to full-time hours. The form requires you to certify that you will report material changes. Keep this duty in mind after filing.

- Endorsement is a change to your coverage terms after issuance. If you need to add a trade name, update a retroactive date, or reflect a new role, the administrator may issue an endorsement. DM4407368 starts the record the endorsement will amend.

- Notice of circumstance is early notice of a potential claim, even before a formal demand. The form asks if you are aware of any incidents that could lead to a claim. If you say yes, be ready to provide details so the administrator can assess timely notice.

FAQs

Do you need to submit DM4407368 if you are switching from part-time to full-time?

Yes. When your status changes to full-time practice in British Columbia, you complete this application to confirm eligibility and ensure continuous indemnification. File before your full-time start date to avoid a gap.

Do you list every practice location or only your primary office?

List your primary office and any other locations where you provide legal services. If you work remotely or on client sites, describe that setup in the space provided. The administrator needs a complete picture of your practice footprint.

Do you need to disclose past claims, potential claims, or complaints?

Yes. Disclose all claims, incidents that could lead to claims, and regulatory or client complaints related to your practice. Provide dates, a short description, and status. Non-disclosure can delay, limit, or void coverage for those matters.

Do you have to provide proof of prior coverage to keep your retroactive date?

Usually, yes. If you want prior acts recognized, include proof such as a prior certificate or a letter showing continuous coverage and the retroactive date. Without proof, your retroactive date may reset to the new effective date.

Do you need to include pro bono or uncompensated work in your practice description?

Yes. Describe pro bono, clinic, or volunteer legal work if you perform it. The form captures all legal services you provide, whether paid or not. This helps confirm the scope of your risk.

Do you need to include trade names or incorporated entities you use?

Yes. List all legal entities and trade names under which you practice. If you form a new entity mid-year, notify the administrator. Alignment between your business names and your application prevents coverage gaps.

Do you need to submit payment with the application?

Follow the payment instructions on the form or invoice. Some programs collect payment at filing; others bill after review. If a deadline or effective date is near, confirm how payment timing affects activation.

Do you need a new application if you change firms mid-year?

Not always, but you must report the change. Many programs allow mid-term changes through a notice or endorsement rather than a new application. Use the contact details on the form to request the correct process and timeline.

Checklist: Before, During, and After the DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice

Before signing: gather information and documents

- Your full legal name, any prior names, and contact details.

- Professional identification number and current status confirmation.

- Start date of full-time practice in British Columbia.

- Primary firm name, entity type, address, and main contact.

- Secondary offices or remote practice arrangements.

- Areas of practice with realistic percentage breakdowns.

- Whether you handle trust funds, large transactions, or high-risk files.

- A list of all trade names and incorporated entities you use.

- Prior coverage proof showing continuous coverage and retroactive date.

- Claims history for the past years requested, with dates and outcomes.

- Details of any potential claims or complaints you are aware of.

- Supervisory roles, staff count, and use of contract lawyers or students.

- Risk controls, such as docketing, conflict checks, and file review steps.

- Payment method and any reference or account numbers needed.

- Government-issued ID if identity verification is required.

During signing: verify sections carefully

- Names and identifiers: ensure exact matches to your license and IDs.

- Practice status: confirm you are applying for full-time practice.

- Effective date: align with your first day of full-time work.

- Retroactive date: confirm and attach proof of prior coverage.

- Firm details: verify address, entity name, and contact email.

- Practice description: confirm accuracy of areas and services.

- Trade names: ensure all names appear, spelled correctly.

- Claims disclosures: confirm completeness and clear timelines.

- Deductible and limits: check options or acknowledgments, if applicable.

- Declarations: review honesty statements and duty to report changes.

- Privacy consent: ensure you understand information-sharing permissions.

- Signature and date: sign in the correct place and use the correct date.

- Attachments: label and cross-reference each supporting document.

After signing: file, notify, store

- Submit the application through the specified channel.

- If payment is due, complete it and keep the receipt.

- Request confirmation of receipt and the expected activation date.

- Watch for follow-up questions and respond quickly.

- Obtain and save your confirmation or certificate of coverage.

- Share proof of coverage with your firm administrator or accountant.

- Update engagement letters to reflect your coverage details if needed.

- Record your retroactive date and effective date in your calendar.

- Set a reminder for renewal and for reporting any future changes.

- Store the application and attachments in a secure, backed-up folder.

Common Mistakes to Avoid DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice

Omitting prior claims or known incidents

- Don’t forget to list every claim or potential claim you know about. Missing items can lead to denied coverage for those matters or policy rescission.

Guessing your retroactive date without proof

- Don’t estimate. Attach prior certificates or letters. A wrong date can strip prior acts coverage and leave earlier work unprotected.

Understating high-risk activities

- Don’t minimize work like large transactions or complex litigation. If a claim arises from undisclosed activities, coverage can be narrowed or delayed.

Leaving out trade names or new entities

- Don’t assume your main firm name covers all. If you use a different brand or incorporated entity, list it. Omissions can create gaps.

Misstating full-time status or effective date

- Don’t round up hours or backdate. Inaccurate status or dates can create a coverage gap between roles and trigger compliance issues.

What to Do After Filling Out the Form DM4407368 – Application for Compulsory Professional Liability Indemnification for Full-time practice

- Submit the form using the method indicated. If mailed, use a trackable option and note the date. If online, download the confirmation page.

- Pay any required fees on time. Match your payment reference to your application number so posting is smooth.

- Watch your inbox for questions from the administrator. Respond within the requested timeframe. Keep your files open until you receive written confirmation.

- Confirm your coverage dates. Verify your effective date and retroactive date on the confirmation or certificate. If something is wrong, request a correction or endorsement.

- Distribute proof of coverage. Send the certificate to your firm’s operations lead, bookkeeper, or managing partner. Update any internal registers that track coverage.

- Update your practice documents. Check that your engagement letters and email disclaimers reflect your coverage status if your firm uses those references.

- Plan for amendments. If you change firms, add a trade name, or shift areas of practice, notify the administrator promptly. Ask whether an endorsement or a new filing is needed.

- Maintain your recordset. Keep the signed DM4407368, attachments, proof of prior coverage, payment receipt, and confirmation together. Store them securely with backups.

- Calendar key obligations. Set reminders for renewal, quarterly change reviews, and internal audits of conflict checks and docketing. This supports accurate disclosures next cycle.

- Know how to report a claim or circumstance. Keep the reporting email and phone number handy. If something happens, report early and follow the instructions you receive.

- If your status changes away from full-time, tell the administrator. Ask how to adjust coverage and whether run-off or tail coverage options exist. Align dates to avoid gaps.

- If you withdraw or delay your start, request to hold or amend the application. Confirm how long the administrator will keep your file open and what updates they need.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.