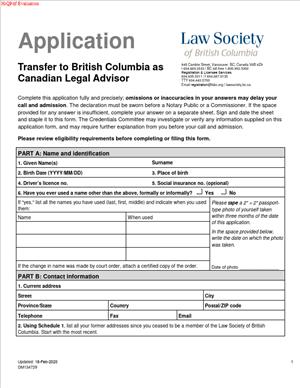

DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor?

This is the formal application you complete to obtain Canadian Legal Advisor (CLA) status in British Columbia. It is used by lawyers who are already licensed in another Canadian jurisdiction and want authority to provide limited, defined legal services in BC without becoming fully called and admitted as a BC lawyer.

Canadian Legal Advisor status is a restricted licence. It lets you practise law in BC within a narrow scope tied to your home jurisdiction’s law, federal law, and related international matters. It does not confer full BC lawyer status. You cannot hold yourself out as a BC barrister and solicitor, and your practice rights are limited by rule.

Who typically uses this form?

Licensed lawyers in good standing in another Canadian province or territory who plan to work in BC on a sustained basis but do not need full transfer. That commonly includes in-house counsel relocating to BC for a national employer, government counsel with federal mandates, and private-practice lawyers whose work centres on their home jurisdiction’s law or federal law delivered to BC-based clients. It may also be used by lawyers who previously practised in BC as visiting counsel under temporary mobility but now need an enduring authorization without full call.

Why would you need this form?

You need it if you are moving to BC or serving BC clients and want a clear, ongoing authority to deliver legal services within the CLA scope. It lowers the administrative burden compared to maintaining repeated temporary mobility periods, and it avoids the commitments of full transfer and call. If your day-to-day work does not require full BC practice rights (like appearing as counsel in BC courts or giving unrestricted advice on BC provincial law), CLA status is often the right fit.

Typical usage scenarios

- You are an Ontario-qualified lawyer joining a Vancouver in-house legal team for a national company. Most of your work involves federal regulatory compliance and the law of Ontario as it applies to operations in BC. You do not need full BC call for this work, but you need an ongoing right to practise within limits.

- You are an Alberta energy lawyer seconded to a BC project office to advise on federal pipeline regulation and Alberta commercial contracts that affect BC assets. You want the stability of an enduring authorization, not just a visiting lawyer regime.

- You are a Quebec lawyer supporting national litigation strategy focused on federal law issues. You will coordinate BC-based discovery and advise on federal statutes, but you will not appear as counsel in BC courts.

- You are a Saskatchewan lawyer working remotely from BC while continuing to advise on Saskatchewan law, with occasional advice on federal employment standards for a national employer.

In each case, this application is the gateway to obtaining CLA status and operating within its defined scope under BC regulation.

When Would You Use a DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor?

You use this form when you are already a lawyer in good standing in another Canadian jurisdiction and you need an enduring, regulated presence in BC without the full rights and obligations of a BC call. It is the right choice when your work in BC will be ongoing or indefinite, your practice fits within the CLA scope, and you do not need to litigate in BC courts or give broad, stand-alone advice on BC provincial law.

Consider a corporate counsel moving to BC for personal reasons while keeping a national role. You handle federal privacy law, competition matters, and contracts governed by your home province. CLA status covers your day-to-day advice in BC, so you can operate without interruption and without breaching unauthorized practice rules.

Consider a government or tribunal counsel role based in BC that focuses on federal statutes and interprovincial issues. You are not taking on BC court appearances. This application provides the correct licence for sustained practice in BC within those mandates.

Consider a private-practice lawyer with a national client who wants you physically present in BC to manage a file that turns on federal law and your home jurisdiction’s law. You will coordinate with local BC counsel for pure BC law opinions or court work. The CLA route allows you to serve the client from BC while staying within scope.

You might also use this form after you have reached or exceeded temporary mobility thresholds or when your practice plan in BC requires opening a BC office address, obtaining BC-specific insurance confirmation, or being listed in regulatory directories for compliance and conflict screening.

Who are the typical users? In-house counsel, government lawyers, tribunal counsel, and private-practice lawyers handling national files. Law firm leaders also initiate this process for lateral hires who will sit in BC but primarily advise on non-BC law or federal law.

Legal Characteristics of the DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

This application triggers a licensing decision by the regulator. It is legally binding because you provide statutory declarations, undertakings, and consents that the regulator relies on to grant and maintain your authorization. By signing, you confirm facts about your identity, professional status, discipline history, criminal history, and insurance. You also agree to practise within the CLA scope and to comply with the Legal Profession Act and the rules and policies that apply to CLAs in BC.

What ensures enforceability?

Several things. First, the regulator has statutory authority to admit, restrict, suspend, or cancel licences. Second, the application includes your explicit undertakings and consents, including consent to information sharing with your home law society and to verification checks. Third, misrepresentation or omission is professional misconduct. It can result in denial of your application, revocation of your status, and reciprocal discipline in your home jurisdiction. Fourth, once authorized, you are subject to audits, practice inspections, and complaints processes in BC to the extent they relate to your authorized practice.

There are important legal considerations tied to scope. A Canadian Legal Advisor may advise on the law of the lawyer’s home jurisdiction, on federal law of Canada, and on public or private international law. Any advice on BC provincial law must be incidental and necessary to advice properly given on your home jurisdiction’s law or federal law. You cannot hold yourself out as a BC barrister and solicitor. You cannot appear as counsel in BC courts except where permitted by legislation or specific leave. If your practice requires BC court appearances or stand-alone advice on BC provincial law, you need full transfer and call.

Insurance is also part of enforceability. You must maintain acceptable professional liability insurance for services you will provide from BC. The regulator may require proof that your policy extends to services rendered in BC, meets minimum limits, and is issued by an approved insurer. If you are in-house counsel who does not serve the public, you may fall under different insurance arrangements. You are responsible for ensuring continuous coverage.

Trust handling is restricted. Unless specifically authorized and compliant with applicable trust rules, a CLA should not receive or disburse client trust funds in BC. If your role contemplates handling client property, you need to confirm what is permitted and what reporting or account structure is required. Many in-house roles do not touch trust funds, which simplifies compliance.

Fees and ongoing compliance apply. You will pay application fees and annual fees. You must keep your contact and employment information current, meet any continuing professional development requirements that apply to your licence class, and renew your status as required. The regulator may impose conditions, such as reporting obligations, scope clarifications, or practice restrictions based on your disclosures.

Privacy and consent are integral. By applying, you authorize background checks, including certificates of standing from your home law society, claims history from insurers, and, when required, criminal record screening. You consent to reciprocal information exchange between regulators for admissions and discipline purposes.

In short, the application is more than a form. It is a sworn record and a set of undertakings that attach enforceable rights and responsibilities to your practice in BC within the CLA category.

How to Fill Out a DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

Follow these steps to complete the application accurately and avoid delays. Read each step before you start. Gather documents early, because some items take time to obtain.

1) Confirm you are eligible

- You must be a lawyer in good standing in another Canadian jurisdiction. That means you hold an active practising certificate or equivalent and you are not suspended, disbarred, or subject to conditions that would prevent you from practising within the CLA scope.

- Review your recent practice history. Be prepared to disclose any gaps, restrictions, or conditions on your licence.

- Confirm your intended work in BC fits the CLA scope: advice on your home jurisdiction’s law, federal law, and related international law. If you need to appear as counsel in BC courts or provide stand-alone BC law advice, pursue full transfer instead.

2) Prepare identity and name documents

- Have government-issued photo ID available (passport or driver’s licence).

- If your legal name has changed, prepare supporting documents (marriage certificate, name change certificate).

- Ensure your name on the application matches your home law society records.

3) Obtain a current certificate of standing

- Request a certificate of standing from your home law society. It should confirm your admission date, current status, any conditions, and discipline history.

- Many regulators require that the certificate be issued within a recent period (often 30–60 days) and sent directly to the BC regulator. Ask for the proper format and delivery method. Order it early.

4) Gather professional liability insurance evidence

- Obtain proof of insurance that will cover your services rendered from BC. Include the insurer name, policy number, effective dates, per-claim and aggregate limits, deductibles, and whether coverage extends to services in other provinces.

- If you are in-house counsel and covered under a corporate policy, request a confirmation letter detailing limits and scope of coverage, including territorial scope.

- If you are relying on your home law society’s mandatory insurance, confirm its interprovincial applicability in writing.

5) Prepare employment and BC contact information

- Provide your BC business address and telephone number. If you will work remotely from BC, list the BC location where you will primarily work.

- Identify your employer or firm, with full legal name and address. If you are sole practice as a CLA (permitted in limited contexts), ensure you understand and meet all requirements that apply to client-facing services.

- Name a responsible contact at your employer (e.g., General Counsel or Managing Partner) who can confirm your role and scope.

6) Complete personal history and disclosures

- Practice history: Outline your jurisdictions of admission, dates, and practice areas.

- Discipline and conduct: Disclose investigations, charges, findings, sanctions, or undertakings in any jurisdiction. Provide dates and outcomes. Full disclosure is required.

- Criminal history: Disclose charges and convictions. Include absolute and conditional discharges where required. Provide court documents if available.

- Financial responsibility: Disclose bankruptcies, proposals to creditors, and unsatisfied judgments. Provide details and rehabilitation steps.

- Claims history: Disclose professional liability claims or circumstances that could lead to a claim. Attach insurer reports if requested.

7) Describe your intended scope of practice in BC

- Briefly state the legal areas you will handle (e.g., federal privacy law, competition law, securities matters governed by your home jurisdiction, Quebec civil law advice to BC business units).

- Confirm you will not provide stand-alone opinions on BC provincial law and will not appear as counsel in BC courts unless permitted by law.

- If your work might incidentally touch BC law, state how you will manage it (e.g., coordinate with a BC lawyer for pure BC law issues).

8) Address trust funds and client property

- Indicate whether your role involves receiving, holding, or disbursing client funds. Most CLAs should not handle trust funds in BC without explicit authorization and full compliance.

- If you are in-house counsel, confirm you do not handle client trust funds.

- If any handling is anticipated, consult the regulator in advance and be ready to outline your proposed controls and compliance with trust rules.

9) Complete consents and authorizations

- Sign the consent allowing the BC regulator to contact your home law society, insurers, employers, and references.

- Sign the privacy notice and consent related to the collection and use of your personal information.

- If a criminal record check is required, follow the instructions for the designated process and submit the necessary identifiers.

10) Provide references if requested

- Some applications require professional references who can speak to your competence and character. Choose individuals who know your work well, ideally lawyers or judges, and confirm their availability to respond promptly.

- Provide accurate contact details and your relationship to each reference.

11) Execute the statutory declaration

- Review the declaration carefully. It typically confirms that your statements are complete and true, and that you understand the scope and restrictions of CLA status.

- Sign before a commissioner for oaths, notary public, or other authorized officer. Ensure names, dates, and locations are correct. Use ink signatures if required.

12) Review your title and communications plan

- Confirm how you will describe your status. Use a clear title such as “Canadian Legal Advisor (authorized in [Home Province/Territory])” or other approved formulation.

- Update your email signature, letterhead, website bio, and engagement letters to reflect CLA status and avoid implying you are a BC barrister and solicitor.

13) Calculate and pay fees

- Include the application fee. If annual fees are due on approval, be ready to pay promptly. Fees may be prorated based on the date of approval.

- If there is a separate insurance assessment or contribution, confirm whether it applies to CLAs in your situation.

14) Assemble and submit your package

- Attach all required documents: identity copies, certificate of standing, insurance proof, employment confirmation, disclosure schedules, references, and the signed statutory declaration.

- Use the specified filing method. If originals are required, send them by trackable courier and keep copies.

15) Respond to follow-up requests

- Monitor your email and phone. The regulator may ask for clarifications, updated certificates, or additional documents.

- Respond quickly and completely. Delays in response are the most common cause of stalled applications.

16) Approval, conditions, and start of practice

- If approved, you will receive a confirmation outlining the terms of your CLA status, effective date, and any conditions.

- Do not commence practice in BC until you receive written confirmation that your status is active and all conditions (including insurance) are met.

- Calendar renewal and reporting deadlines. Keep your contact information current.

17) Maintain compliance after approval

- Practise within the stated scope. When your role changes, assess whether you still fit the CLA category or should seek full transfer.

- Maintain continuous insurance coverage and notify the regulator of any changes or claims.

- Complete any required continuing professional development. Record your hours and be ready for audit.

- Keep accurate records of your BC work and how you manage BC-law issues, including referrals or collaborations with BC lawyers.

Common pitfalls to avoid

- Submitting an outdated certificate of standing or one addressed “To Whom It May Concern.” Request the exact format and delivery method required.

- Assuming your insurance automatically covers services from BC. Obtain written confirmation of territorial scope and limits.

- Using titles that imply full BC call, such as “Barrister and Solicitor, BC.” Use “Canadian Legal Advisor” and identify your home jurisdiction.

- Giving stand-alone advice on BC provincial law. When BC law is central, involve BC counsel.

- Handling trust funds without explicit authorization and compliance. If in doubt, do not accept funds.

Practical example

- Applicant: Alberta lawyer, called in 2015, in good standing.

- Role: Vancouver-based in-house counsel for a national retailer; primary work is federal privacy, competition, and contracts governed by Alberta law.

- Documents: Alberta certificate of standing issued within 30 days, insurer letter confirming $2M per-claim coverage extending to services from BC, employer letter confirming duties and no public practice, clean criminal record check, full disclosures with “nil” statements where applicable, notarized declaration.

- Outcome: Approved as a CLA with a condition to report any change to public practice or court appearances and to maintain insurance at or above current limits.

If you reach any point where your planned activities exceed the CLA scope—such as taking carriage of a BC litigation file, issuing BC-law opinions, or opening a trust account—pause and reassess. You may need to pursue a full transfer and call to the BC bar.

Legal Terms You Might Encounter

- Applicant means you—the person completing DM134729. You’re asking the regulator in British Columbia to recognize you under the Canadian Legal Advisor category. On the form, you confirm your identity, your current licensing status elsewhere in Canada, and the scope of work you plan to do in British Columbia.

- Transfer in this context means a change in your status to practice in British Columbia as a Canadian Legal Advisor. It is not the same as being called to the bar in British Columbia. On DM134729, you confirm you are transferring your credentials for a limited practice category, not seeking full admission as a lawyer in the province.

- Canadian Legal Advisor is a specific, limited licensing category. It allows you to give advice on certain areas of law that align with your home-jurisdiction license and set restrictions. On DM134729, you acknowledge those restrictions and confirm you understand what you can and cannot do in British Columbia under this category.

- Good standing refers to your current status with your home regulator. It means your licence is active, your fees are paid, and you face no suspension. The form asks for details and usually requires you to authorize a certificate or letter of standing so the regulator can verify your status directly.

- Certificate of standing (sometimes called letter of good standing) is an official confirmation from your home regulator of your current status, admission date, and discipline history. DM134729 typically requires you to consent to the regulator obtaining this document, or you may need to arrange for it to be sent directly.

- Character and fitness is the regulator’s assessment of your integrity and suitability to hold the Canadian Legal Advisor licence. On the form, you answer questions about discipline, criminal charges or convictions, and any past professional misconduct. You also give permission for background checks to verify your responses.

- Practice restrictions are the limits on what you can do as a Canadian Legal Advisor in British Columbia. They often relate to the type of law you can advise on and where you can appear. DM134729 requires you to acknowledge that you understand these boundaries and will comply with them.

- Professional liability insurance (sometimes called errors and omissions coverage) protects you and your clients if something goes wrong in your legal work. On DM134729, you may need to confirm you will maintain appropriate coverage for your limited practice or verify coverage through your employer.

- Trust account refers to a client money account with special handling rules. As a Canadian Legal Advisor, you may face restrictions around receiving or holding client funds. In DM134729, you confirm whether you will handle trust funds and, if allowed, how you will comply with the rules.

- Undertaking is a formal promise to the regulator. On DM134729, you may be asked to give undertakings—for example, not to practice outside your authorized scope, to report changes in your status, and to notify the regulator of any issues that affect your eligibility.

FAQs

Do you need to be licensed elsewhere in Canada to apply with DM134729?

Yes. This category is for lawyers who already hold a current licence in another Canadian jurisdiction. You confirm your licensing details in the form and authorize verification through a certificate of standing. If your home licence is inactive or suspended, you won’t meet the good standing requirement.

Do you need to live in British Columbia to qualify?

No. Residency is not the decisive factor. What matters is that you meet eligibility criteria, agree to the practice restrictions, and properly register your contact details. On DM134729, you provide your primary and BC contact information, including any planned business address in the province.

Do you need a job offer in British Columbia before applying?

Not always. Some applicants apply first and secure work later. If you already have an employer or plan to work in-house, the form asks for those details. If you plan to be independent, you disclose that as well. Be precise, because your insurance and practice arrangements depend on your work setting.

Do you need professional liability insurance before you submit?

You typically need to confirm you will be covered for your intended practice. If your coverage will be through an employer, note that on the form. If you will obtain insurance independently, state your plan and start date. Do not begin practice until you have confirmation of both your status and coverage.

Do you need to pass an exam for this category?

An exam is not usually required for transfer as a Canadian Legal Advisor. The focus is on your current Canadian licence, good standing, and character and fitness. DM134729 captures those elements and your consent to verification. If the regulator needs more information, they will contact you.

Do you have to disclose past discipline or criminal matters?

Yes. Full and accurate disclosure is mandatory. DM134729 includes questions about charges, convictions, regulatory complaints, bankruptcies, and similar issues. You can attach explanations and supporting documents. A past issue does not automatically disqualify you, but non-disclosure often does.

Do you need to resign your current bar membership after transfer?

No. The Canadian Legal Advisor category assumes you keep your home-jurisdiction licence active. Your ongoing eligibility depends on remaining in good standing there. If your status changes, you must notify the British Columbia regulator promptly, as you confirm in your undertakings on the form.

Do you need to renew every year?

Yes. Annual renewal and fees are typical. You also confirm ongoing compliance with practice restrictions and insurance. After you first submit DM134729 and are approved, add renewal reminders to your calendar and keep your contact information current to avoid administrative suspension.

Checklist: Before, During, and After the DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

Before signing

- Government-issued photo ID details that match your legal name on the form.

- Current licence number and jurisdiction details for your home regulator.

- Full employment history for at least the last five years, with dates and locations.

- Details of your intended practice in British Columbia: employer name (if any), role, start date, and whether you will advise clients independently.

- Professional liability insurance information: current policy or employer coverage details, planned effective date for BC work.

- Discipline and conduct records: any past or pending matters, with supporting documents and explanations.

- Criminal record information: details of any charges or convictions, and court documents if applicable.

- Education history: degree(s), institution(s), and dates; include any name changes to match records.

- Contact details: primary address, BC business address (if known), email, and phone number.

- References, if requested: names, roles, and contact information of professional referees who know your work.

- Consent forms: be ready to authorize the regulator to obtain your certificate of standing and conduct checks.

- Fee payment method: ensure the required application fee is available and authorized.

During signing

- Verify your legal name matches exactly across ID, the form, and supporting documents.

- Confirm your home-jurisdiction licence number, admission date, and current status.

- Review your employment history for gaps; if there are gaps, explain them briefly in an attachment.

- Check the scope-of-practice acknowledgments for the Canadian Legal Advisor category. Make sure you understand them and agree to comply.

- Review the character and fitness questions. Answer each one fully and honestly. If “yes,” attach a clear explanation and documents.

- Confirm your professional liability insurance plan. State whether coverage is employer-provided or independent, and include the effective date for BC.

- Ensure your contact information is complete, including a mailing address where you can receive time-sensitive notices.

- Read the undertakings section carefully. You are making formal promises about your conduct and reporting duties.

- Make sure your consent to obtain a certificate of standing and records is signed and dated.

- Check that every required attachment is labeled and referenced in the form.

- Verify the fee amount and payment authorization, including any taxes and processing details.

- Sign and date the declaration in all required places. If a witness is required, arrange one who meets the stated criteria.

After signing

- File the application: submit DM134729 with all attachments and the fee using the accepted method. Keep a timestamp or receipt for your records.

- Calendar follow-ups: note a reminder two weeks after submission to confirm receipt if you have not heard back.

- Be responsive: if the regulator requests more information, reply promptly and supply complete documents to avoid delays.

- Do not practice yet: wait for written confirmation of approval before starting any Canadian Legal Advisor work in British Columbia.

- Set up insurance: arrange coverage to start on or before your anticipated approval date; keep proof ready in case of audit.

- Update your employer: provide them with your anticipated approval timeline and any practice restrictions that apply to your role.

- Record retention: store a full copy of your application package, receipt, and correspondence in a secure, searchable folder.

- Name and contact changes: if anything changes after filing—address, employer, or legal name—notify the regulator in writing.

- Plan for renewal: list annual renewal deadlines and required reporting so you don’t miss them once approved.

Common Mistakes to Avoid DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

- Don’t under-disclose discipline or criminal history. Omitting a past complaint, caution, or charge can lead to delays, rejection, or future disciplinary action for misrepresentation. Full disclosure with context often resolves concerns; non-disclosure rarely does.

- Don’t assume your home coverage carries over automatically. Some policies exclude work in other provinces or in different licensing categories. If you practice without proper coverage, you risk personal liability and regulatory penalties. Confirm your policy terms and effective dates.

- Don’t use the wrong name or mismatched personal details. Inconsistent names across ID, degrees, and licences trigger verification problems. This can stall your application. Provide proof of name changes and ensure the same spelling across documents.

- Don’t begin practice before written approval. Starting early—even for internal advice—can breach regulatory rules. That can jeopardize your application, expose you to fines, and complicate future renewals.

- Don’t skip the scope-of-practice acknowledgments. If you overlook these, you might accept work outside your authorization. That can lead to complaints, claims, and potential suspension. Read and confirm you understand the limits tied to the Canadian Legal Advisor category.

What to Do After Filling Out the Form DM134729 – Application for Transfer to British Columbia as Canadian Legal Advisor

- Submit the complete package and fee. Use one consistent method of delivery and keep proof of submission. If the form requires original signatures, send the original and keep a scanned copy.

- Wait for acknowledgment and any requests. Most applications receive a file number and a contact point. If you don’t receive acknowledgment within the expected timeframe, follow up with the admissions office using your receipt details.

- Arrange for your certificate of standing. If you authorized the regulator to obtain it, confirm they have what they need. If you must request it yourself, do so immediately. Ask your home regulator to send it directly as required.

- Prepare for supplementary questions. You might be asked to clarify employment timelines, insurance details, or a disclosure response. Keep your supporting documents organized so you can respond within a few days.

- Set your insurance start date. Coordinate coverage to begin no later than your anticipated approval date. If your employer provides coverage, confirm you are named or otherwise included for the Canadian Legal Advisor role.

- Hold off on client work and titles. Do not present yourself as authorized in British Columbia until you have written approval. Update your email signature and profiles only after you receive confirmation.

- On approval, review the terms. Check the approval letter for any conditions, such as reporting requirements, supervision parameters, or limits on accepting funds. Save the letter and any certificate in your permanent records.

- Notify your employer and relevant teams. Share your approval and any conditions. If you work in-house, advise compliance and risk teams. If you’re independent, inform clients of your authorized scope and confirm your insurance.

- Update your contact details and business listings. Ensure your mailing address, business address, and email are accurate in the regulator’s records. Add calendar reminders for renewal dates and any mandatory reporting.

- Plan for amendments. If your role, insurer, or practice scope changes, file an amendment or notice as required. Use the same care and completeness you used for DM134729. Keep confirmations for each change.

- Maintain ongoing compliance. Keep your home-jurisdiction licence in good standing, pay annual fees in both jurisdictions as applicable, and complete any continuing requirements tied to your status. Promptly report any conduct or status changes that could affect your eligibility.

- Distribute copies appropriately. Provide your employer or client engagement teams with your approval confirmation and insurance proof, but avoid sharing sensitive personal data beyond what is necessary. Store a clean, redacted version for internal use when possible.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.