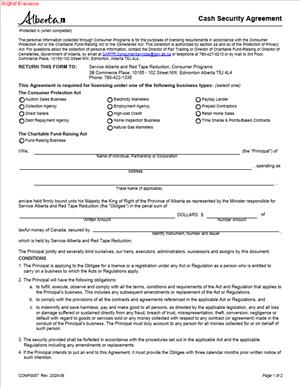

CONP0057 – Cash Security Agreement

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is a CONP0057 – Cash Security Agreement?

A CONP0057 – Cash Security Agreement is a short, practical contract that lets you provide cash as security for your obligations on a project or transaction in Alberta. Instead of giving a surety bond or letter of credit, you deposit cash. The agreement sets out how the funds are held, when they can be drawn, and how and when you get them back.

You use this form when an owner, landlord, or other counterparty requires security and accepts cash. In construction, this often covers bid security, performance security, and warranty or maintenance periods. In other sectors, you might use it for supplier prepayments, equipment rentals, or commercial leases where the counterparty prefers cash over a guarantee.

The agreement names the parties, identifies the project or contract, states the security amount, and explains the rules. It confirms where the cash sits, who controls it, when it can be used, and how interest is handled. It also defines default events and gives the holder the right to draw on the funds if you fail to meet your obligations. It then explains the release process once obligations are met.

Who typically uses this form?

Owners and contractors use it on public and private construction projects in Alberta. Developers may require it from general contractors. General contractors may adapt it for security from key subcontractors. Outside construction, landlords, equipment lessors, and large buyers may use it to secure payment or performance. Lenders sometimes use similar structures to hold cash collateral for small credit facilities.

You would need this form if you want to post security quickly without arranging a bond or letter of credit, or if the tender or contract specifies cash as an accepted option. Some bidders prefer cash to avoid surety underwriting delays. Some owners prefer cash for simplicity and speed if there is a default. If you are a successful bidder and must provide performance security within a short timeframe, a cash security agreement can bridge the gap while you finalize other instruments.

Typical usage scenarios

- A bidder provides a fixed cash deposit as tender security, to be forfeited if the bidder refuses to sign the contract upon award.

- A contractor provides a cash deposit equal to a percentage of the contract price as performance security, held until substantial performance or final completion.

- A contractor provides a smaller cash amount to cover warranty obligations during the maintenance period.

- A subcontractor posts cash security to a general contractor for a critical package.

In leasing, a tenant posts a cash security deposit to the landlord under a commercial lease, documented with draw and release terms similar to this form.

This form protects both sides. It gives the holder clear rights to use the cash after a defined default process. It gives you certainty that funds will be returned when you meet your obligations. It also reduces arguments later, because the draw triggers and release milestones are in writing.

When Would You Use a CONP0057 – Cash Security Agreement?

You would use this form when a contract or tender requires security, and cash is accepted or preferred. In a construction tender, the instruction to bidders may allow security by certified cheque or wire transfer. If you choose that route, you attach this agreement so the rules are clear. When you win an award and need to post performance security quickly, a cash security agreement is often the fastest route. The owner holds the funds and releases them at completion milestones defined in the contract.

On a design-bid-build project, the owner may require a fixed amount as bid security. You deposit the cash with the owner’s procurement unit before the bid deadline. The agreement confirms that the owner can forfeit it if you withdraw your bid early or refuse to execute the contract. If you are not selected, the agreement explains how and when the owner will return the funds.

For performance security, the owner may require security equal to a percentage of the contract price. You deposit the cash before the start date, and the agreement ties release to milestones such as substantial performance, delivery of as-built documents, completion of deficiencies, and expiry of the warranty period. If you default on performance or do not correct defective work after notice, the owner can use the cash to pay completion costs or damages, up to the amount held.

In a design-build or fast-track contract, you may use this form for interim security while final surety bonds are arranged. The agreement can set a sunset date when bonds replace the cash and the deposit is returned. This lets the project start on time while keeping the owner protected.

General contractors may use a similar form with key subcontractors. For example, a glazing subcontractor might post cash security to assure delivery of custom materials. The general contractor holds the funds in a segregated account and draws only if the subcontractor fails to meet defined obligations. Release occurs after installation and acceptance.

Outside construction, landlords often want a security deposit. A cash security agreement spells out how you pay, how the landlord holds it, and what happens on default under the lease. It also defines when and how the landlord returns the deposit at lease end, after deducting unpaid rent or repair costs if allowed.

You also use this form to secure other commercial obligations: prepayments to a supplier, equipment rentals where damage or loss risk is high, or short-term advances to a vendor. The structure is the same: deposit, holding terms, draw triggers, and release conditions.

In short, you use it when the other party needs financial comfort, you can provide cash, and you want a clear roadmap for holding, using, and returning that cash.

Legal Characteristics of the CONP0057 – Cash Security Agreement

This agreement is legally binding when properly completed and signed by authorized representatives of each party. It contains clear promises from both sides: you deposit funds, and the holder manages and returns them under defined conditions. The cash deposit itself is consideration. The holder’s promises to safeguard, use only as permitted, and return the funds are the corresponding consideration. That mutual exchange makes the agreement enforceable.

What ensures enforceability?

Enforceability depends on clarity and control. The agreement should state the exact amount, purpose of the security, and the conditions for draw and release. It should identify the custodian and define how the funds are held. It should confirm that the funds are segregated and not commingled. It should explain how interest is handled. It should also outline notice and cure periods before any draw. If the holder must give written notice of default and a chance to remedy, that process reduces disputes and supports fairness.

Control of the funds matters. If the holder keeps the cash in its possession, the holder has straightforward control. If the funds are placed in a bank account, you should include a bank acknowledgement that the holder controls the account and the funds cannot be withdrawn except under the agreement. That acknowledgement prevents third parties from claiming the funds and supports priority in an insolvency scenario.

The agreement should avoid penalty language. It should connect draw rights to actual costs, damages, or amounts due under the primary contract. If you include liquidated damages, tie them to a reasonable estimate of likely loss at the time of contracting. Clear, proportionate draw rights help the agreement withstand scrutiny.

Because the holder is taking custody of funds, duties apply. The holder must act honestly and in good faith, keep funds secure, follow the agreement’s terms, and account for transactions. The agreement should impose recordkeeping and allow you to request a statement of the balance. If funds accrue interest, the agreement should state who gets the interest and on what schedule. If no interest is payable, the agreement should say that plainly.

The agreement should include standard contract provisions: governing law of Alberta, exclusive venue for disputes, severability, entire agreement, amendments in writing, assignment limits, and counterparts. Execution by digital signature is common and should be permitted. Signing authority is important. The person signing for a corporation must have actual authority. If you are not sure, attach a copy of a corporate resolution or proof of authority as a schedule.

This agreement must also align with the primary contract or tender documents. If the contract has a payment holdback or trust requirements, your security agreement should not conflict with them. The release milestones should align with the project’s certification process. If the agreement allows set-off, make sure that matches the set-off rights in the primary contract. Consistency across documents avoids uncertainty and reduces the risk of a dispute.

In insolvency, well-drafted control and segregation provisions improve the holder’s position and protect you from unintended loss of funds to third-party claims. Clear identification of the funds as security for defined obligations, held in a segregated account, and controlled by the holder helps keep the funds out of your general assets. That reduces the risk that other creditors claim them.

Finally, procurement rules apply in public projects. The agreement should not give any bidder an unfair advantage. It should set the same terms for all bidders who choose cash security. Processing timelines for return of deposits to unsuccessful bidders should be stated and followed to maintain fairness and transparency.

How to Fill Out a CONP0057 – Cash Security Agreement

Follow these steps to complete the form accurately and avoid delays.

1) Confirm the purpose and amount of security.

- Identify why the security is required: bid, performance, warranty, or other. Check the tender or contract.

- Determine the amount. If it is a percentage, calculate it against the current contract value. If it is a fixed sum, write the exact number.

- Decide whether interest will accrue and to whom it will be paid.

2) Identify the parties with legal names.

- For the holder, use the exact legal name of the owner, landlord, or contractor, including any suffix like “Inc.” or “Ltd.”

- For the depositor, use your corporation’s full legal name. Include your Alberta corporate number if available.

- Add addresses for notice. Use a physical address and an email address that is monitored daily.

3) Describe the underlying project or contract.

- Insert the project name, site address, and a brief description of the work or transaction.

- Reference the tender number or contract number if one exists.

- If this is bid security, state the bid submission date and the form of procurement.

4) State the security amount and form of funds.

- Write the amount in numbers and words.

- Specify the form: certified cheque, bank draft, or wire transfer. If wire, add the currency.

- If paying by wire, include a wire instruction schedule with bank name, transit, account, SWIFT, and reference details.

5) Define who holds the funds and where.

- Choose the custodian: the owner, an escrow agent, or a named financial institution.

- State that the funds will be held in a segregated account. Include the account name and that it is dedicated to this security.

- If a bank will hold the funds, attach a bank acknowledgement schedule confirming the holder’s control of the account and withdrawal restrictions.

6) Set the conditions for draw.

- List the events that allow a draw. Examples: failure to execute the contract after award, failure to perform, failure to correct defects after notice, non-payment of amounts due under the contract.

- Include a notice and cure period for each event. For instance, 5–10 business days after written notice of default.

- State that the holder may draw only to the extent of actual, reasonable costs or amounts due, up to the security amount.

7) Explain release milestones and timing.

- Tie release to clear milestones: bid award or rejection, substantial performance, final completion, or the end of the warranty period.

- For partial releases, define percentages (for example, release 50% at substantial performance, balance at final completion).

- Include processing time for release (for example, within 10 business days after the milestone and receipt of all required documents).

8) Address interest on the funds.

- Decide if funds accrue interest. If yes, state the rate or that the funds will be placed in an interest-bearing account.

- State who gets the interest and when it is paid (for example, paid to the depositor on release of principal).

- If interest is not payable, say “no interest will accrue” to avoid disputes.

9) Include top-up and replenishment obligations.

- If the holder draws funds, require the depositor to top up to the original amount within a set period if the contract is ongoing.

- Clarify that failure to top up is a default and may allow further remedies.

10) Set the term of the agreement.

- Start the term on the deposit date.

- End the term on the final release of funds or earlier replacement by an accepted bond or letter of credit.

- If a replacement instrument will be used, include a process and timeline to exchange and return the cash.

11) Add representations and covenants.

- Confirm that the depositor owns the funds and they are free of third-party claims.

- Confirm authority and that signing is duly authorized.

- Require the holder to safeguard the funds, keep them segregated, and use them only as permitted.

12) Define notices.

- Provide mailing and email addresses for each party.

- State how notice is delivered: personal delivery, courier, or email.

- Include when notice is deemed received (for example, same day by email if sent before a cutoff time, next business day otherwise).

13) Include general legal terms.

- Confirm governing law of Alberta and venue for disputes.

- Add entire agreement, amendments in writing, assignment limits, severability, and counterparts.

- Allow electronic signatures. If corporate seals are used, provide space, but do not make them mandatory.

14) Prepare schedules and attachments.

- Schedule A: Project or Contract Summary, with key dates and reference numbers.

- Schedule B: Bank and Holding Details, including account designation and any escrow instructions.

- Schedule C: Release Milestones and Percentages.

- Schedule D: Bank Acknowledgement of Control and Withdrawal Restrictions, signed by the bank if applicable.

- Schedule E: Receipt for Funds, signed by the holder when funds are received.

- Schedule F: Evidence of Signing Authority, such as a resolution or incumbency certificate.

15) Gather signatures.

- Insert the full legal names and titles of signatories for each party.

- If your signing policy requires two officers, provide both signature lines.

- Add witness lines if your internal policy requires it, though it is not always necessary for corporations.

- Date the agreement, and ensure the deposit occurs on or after the date of signing.

16) Deliver the deposit and confirm receipt.

- If paying by certified cheque or bank draft, deliver it with the signed agreement. Get a signed receipt (Schedule E).

- If wiring funds, send the wire and obtain a confirmation from your bank. Ask the holder to countersign the receipt once funds clear.

- Keep proof of payment with the agreement package.

17) Align with the primary contract or tender.

- Cross-check draw triggers and release milestones against the contract or tender.

- Make sure the amounts match what the procurement or contract documents require.

- If the primary contract changes, update the schedules and get both parties to sign an amendment.

18) Keep records and track dates.

- Maintain a ledger of the deposit, any interest, and any draws.

- Calendar release milestones and notice periods.

- Request periodic balance statements from the holder, especially on long projects.

19) Plan for replacement or expiry.

- If you will replace the cash with a bond or letter of credit, set the date and process now.

- Add a condition that the holder will return the cash within a defined time after accepting the replacement instrument.

- Coordinate with your surety or bank early to avoid gaps in security.

20) Final review before submission.

- Check names, numbers, and dates for accuracy.

- Confirm that the amount in words matches the amount in numbers.

- Verify all schedules are attached and signed where needed.

If you follow these steps, you create a clear, enforceable framework for cash security. You protect the holder’s right to draw when justified and your right to a timely release. You also reduce the risk of disputes, because the essential details—amount, custody, triggers, and timing—are all documented up front.

Legal Terms You Might Encounter (CONP0057 – Cash Security Agreement)

- Cash collateral means money you post as security. The agreement sets rules for how that money is held, used, and returned. You should see where the money sits, who controls it, and what happens to interest.

- A security interest is the legal right over the cash granted to the secured party. When you sign, you give that right so they can apply the funds if you default. The agreement must say when and how they can use the cash.

- The secured party is the person or organization receiving the cash as security. They hold the right to apply the cash against your obligations. The agreement should define their duties while holding the funds.

- The grantor (also called the pledgor) is you, the party posting the cash. You promise to keep your other obligations, like paying amounts due. If you break those obligations, the secured party may apply the cash.

- Obligations are the specific debts or duties the cash secures. The agreement should list them clearly. It might include future amounts, fees, and costs. Only secure what you intend to cover.

- Perfection is the process that makes the secured party’s rights effective against others. It can involve control, notice, or registration. The agreement may require you to support any steps the secured party takes.

- Control refers to who can direct the money’s use. It often means the secured party can order transfers from the holding account. The agreement should explain who can give instructions and when.

- Release conditions are the events that trigger return of the cash. The agreement should use objective, dated, or measurable triggers. Add timelines for review and return to avoid delays.

- Set-off is when the secured party applies the cash to amounts you owe. The agreement should explain calculation, notice, and order of application. It should also address any surplus and how it will come back to you.

- Interest is the return earned on the cash while held. The agreement should say whether interest accrues, the rate or method, and who receives it. It should also address related tax reporting.

- Priority explains whose claim ranks first if others also claim the cash. The agreement may address priority, consents, and subordination. Ask whether any other party could claim the funds.

- A stakeholder or trustee is a neutral holder of the funds. The agreement may use a third party to reduce conflict. The stakeholder’s duties and liabilities should be clear and limited.

- Default is when you fail to meet obligations under either agreement. The default terms should be specific. Include cure periods, notices, and what happens if the default continues.

FAQs (CONP0057 – Cash Security Agreement)

Do you need witnesses or a notary for the CONP0057?

Check your signing block. Many forms accept standard signatures with a witness. Some parties require notarization for added assurance. If a company is signing, confirm the signer’s authority. Add a corporate resolution or evidence of role if requested.

Do you have to register a cash security agreement?

Cash is often perfected by control. That said, some secured parties still want registration to protect priority. Ask whether they need a filing and what information they require. If a filing is needed, confirm who files, when, and who pays any fees.

Where will your cash be held and who can touch it?

Your agreement should say where the cash sits and in whose name. It should state who can give instructions and in what situations. Ask about account type, eligible institutions, and insurance coverage levels. Request a written receipt after deposit.

Do you earn interest on the cash?

That depends on the agreement. Some keep interest for the secured party. Others credit it to you after fees and taxes. Ask for the rate, how often it accrues, and how it is paid. Confirm any withholding and which party handles tax reporting.

Can you replace the cash with other security later?

Some agreements allow substitution. For example, you may swap cash for different collateral if the secured party agrees. The form should state the rules for substitution, notice, and approval. Get consent in writing before moving funds.

How do you get your cash back when your obligations end?

Follow the release conditions in the agreement. Often you must give a written request and supporting proof. The secured party may need time to confirm that all claims are resolved. Add a deadline for review and release to keep things moving.

What happens if you default?

The secured party can apply the cash to the amounts you owe. The agreement sets the order of application and notice process. You may have a short cure period before they act. After application, you usually owe any shortfall.

Do you need to top up the cash if your exposure grows?

Some agreements require top-ups if exposure exceeds the posted amount. Others set a fixed cap. Ask how the exposure is measured, how often, and who calculates it. If top-ups apply, define the timeline and method for funding.

Who signs the CONP0057 for a corporation or partnership?

An authorized signing officer or partner signs. Attach proof of authority if asked, such as a resolution or registry printout. If multiple entities post cash, each should sign and accept liability as agreed. Align signatures with the defined obligations.

Can the secured party charge fees on the cash?

They may charge holding, administration, or transfer fees. Your agreement should list possible charges and who pays them. Ask for a cap on fees and a schedule of rates. Clarify when fees can be deducted from the cash.

Checklist: Before, During, and After the CONP0057 – Cash Security Agreement

Before signing

- Confirm legal names, addresses, and registration numbers for all parties.

- Identify the obligations the cash will secure. List them in plain language.

- Decide the cash amount and currency. Align it with your exposure.

- Gather proof of authority for signers. Include resolutions if needed.

- Collect banking details for deposit and for return of funds.

- Agree on where the cash will be held and the account type.

- Set interest terms. Rate, accrual method, and who receives it.

- Define release conditions with objective triggers and timelines.

- Clarify default and set-off rules. Include notices and cure periods.

- Decide on substitution rights. Outline conditions for replacements.

- Confirm fee responsibility. Holding, transfer, and administration costs.

- Plan for taxes. Withholding, reporting, and information slips.

- Check for existing claims or pledges that could affect priority.

- Decide whether any registration or control steps are required.

- Prepare required schedules. Amount schedule, account details, and notices.

- Agree on dispute steps. Notice addresses and service method.

During signing

- Verify the correct version of the CONP0057 is in front of you.

- Check that all defined terms match the rest of the form.

- Confirm the secured obligations are complete and not overbroad.

- Review the cash amount in figures and words. They must match.

- Verify account details for deposit and release are accurate.

- Confirm who can give instructions over the funds and when.

- Check interest, fee, and tax clauses. Ensure they reflect your deal.

- Review release conditions and deadlines for response.

- Confirm default, cure period, and set-off order.

- Review top-up triggers and calculation method if included.

- Ensure any required consents or waivers are attached.

- Confirm who handles registration steps, if any.

- Check notice addresses and the method of delivery.

- Ensure schedules and attachments are initialed and complete.

- Verify execution blocks. Names, titles, and witness lines.

- Date the agreement. Use the same date across all signatures.

After signing

- Transfer the cash as instructed. Keep payment proof.

- Obtain a written receipt showing the amount and date received.

- Confirm the holding account details in writing.

- If required, complete any registration or control steps promptly.

- Send notices to related parties who need to know.

- Store the executed agreement and all receipts in one place.

- Set calendar reminders for review dates and maturity.

- Monitor exposure and any top-up requirements.

- Track interest accrual and confirm periodic statements.

- Keep contact information current for both parties.

- Prepare a release request template for quick use later.

- If terms change, execute a short amendment with both parties.

- At release, confirm any discharge steps and get final receipts.

Common Mistakes to Avoid in CONP0057 – Cash Security Agreement

- Vague release conditions. If you do not set objective triggers, your cash can remain tied up. Don’t forget to add specific events and timelines for review and return.

- Misnaming parties or wrong account details. Errors can stall deposits or releases and cause disputes. Double-check legal names, numbers, and banking information before funding.

- Omitting interest and fee terms. If you skip these, unexpected charges can consume your return. Specify who earns interest, who pays fees, and any caps or schedules.

- Skipping perfection steps. If protection requires steps like control or registration and you ignore them, you risk losing priority to others. Confirm and complete all required steps.

- Overbroad secured obligations. If you secure “all obligations” without limits, you may tie up far more cash than intended. Define exactly what the cash covers and where it stops.

What to Do After Filling Out CONP0057 – Cash Security Agreement

- Execute the agreement. Ensure all parties sign and date. Include witnesses if required by the form.

- Fund the security. Transfer the cash using the method in the agreement. Keep the transfer confirmation.

- Get a receipt. Ask for written confirmation of the amount, date, and account holding the funds.

- Lock in control or registration. If the deal requires control or filing, complete those steps now. Keep copies of all confirmations.

- Send notices. Provide copies to internal teams, counterparties, or advisors who rely on the security.

- Track interest and fees. Confirm the accrual method, statement frequency, and any charges deducted.

- Monitor exposure. Review whether top-ups are required as your obligations change. Keep the calculation transparent and documented.

- Update contacts. Make sure notice addresses and email contacts remain current. Notify the other party if they change.

- Prepare for release. Keep a checklist of documents you will need to request release. Include proof that obligations are satisfied.

- Request release promptly. When conditions are met, send a written request with supporting evidence. Ask for a timeline and method of return.

- Confirm discharge. If there was any registration, request discharge or termination after release. Store proof.

- Archive your records. Keep the executed agreement, amendments, receipts, statements, and release documents. Retain them for your record retention period.

- Review annually. Even if nothing changes, schedule a yearly check of obligations, exposure, and contact details.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.