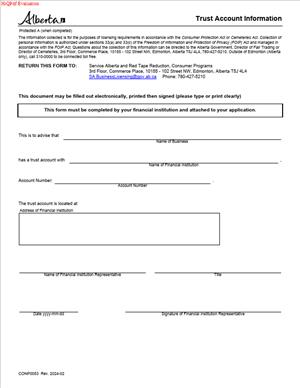

CONP0053 – Trust Account Information

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is a CONP0053 – Trust Account Information?

The CONP0053 – Trust Account Information is a regulatory form. You use it to report the details of your business trust account to the provincial authority. It captures where you bank, the type of trust funds you hold, and who controls the account. It confirms that client money is segregated and protected. It also gives the regulator the information they need to monitor compliance.

When do you typically uses this form?

- You complete this form if your business holds money in trust for others. That can include deposits, rent, retainers, prepayments, or sale proceeds. Many regulated businesses must do this as part of licensing. Examples include brokerages, property management firms, condominium managers, collection agencies, and travel sellers. If you handle client money that is not yours, you likely need a trust account. The form records that account in a standard format.

- You would use this form when you first apply for a licence. You also use it when you open a new trust account. You file it again when any trust account detail changes. That includes a new bank, new signing authorities, or a business name change. You also file it when you close a trust account. The form helps the regulator match your licence to your trust banking. It supports audits and complaint investigations.

Typical scenarios

- You are launching a property management company. You need to hold tenant deposits and monthly rent for landlords. You open a trust account at your bank. You complete the form to record the account number and branch. You list the people who can sign and any dual-signature rules. You attach a bank letter that confirms the trust designation. You sign a declaration that the information is correct.

- You operate a brokerage that takes buyer deposits on offers. You switch banks or add a second trust account for a new branch. You complete a new form to update the regulator. You include an updated bank confirmation. You list the new signing authority who joined the firm. You keep your licence in good standing and ready for audit.

- You close your travel agency or stop taking prepayments. You close the trust account and return funds. You submit the form to show the closure date. You attach the final bank statement. You confirm there are no trust balances left. You avoid issues at renewal by demonstrating a clean close-out.

Who typically uses this form inside your organization?

The brokerage owner, the designated managing partner, or the responsible officer. The compliance manager or controller may prepare it. Your external accountant may help gather attachments. The financial institution signs the banking section if required. The authorized signatory signs the declaration at the end. Your team should retain a copy for audit files.

This form matters because trust money is sensitive. Clients expect their funds to be safe and available. The regulator must ensure those funds are segregated and traceable. The form is one of the main tools to do that. It aligns your licence with your actual banking setup. It reduces the risk of commingling and improper withdrawals. It signals to your bank that the account is for trust funds. That protects you if the bank tries to set off debts against the trust balance.

When Would You Use a CONP0053 – Trust Account Information?

You use this form at key milestones in your business. You file it during your initial licence application before you handle any trust money. You use it again when your business structure changes. You also use it for routine updates when your banking details shift.

If you are a brokerage owner, you use it when you open a new trust account for deposits. If you are a property manager, you use it to set up accounts for rent and security deposits. If you are a condominium manager, you use it for operating and reserve trust accounts as required. If you are a collection agency, you use it to hold client remittances before payout. If you are an auction business, you use it to hold seller proceeds until settlement. These are typical users and use cases. Tenants, landlords, buyers, and sellers do not complete the form. The regulated business that holds their money does.

You also use this form when you add a branch or service line. For example, you expand into a new city. You open a separate trust account to keep funds organized by location. You file the form for that new account. You also file it when you change your legal name or trade name. You update the trust account title at your bank. Then you update the form to match.

If you change your bank or branch, you use the form. You confirm the new transit and account numbers. You confirm the trust designation is on the new account. You add or remove signing authorities based on staff changes. You file the form when a director or partner leaves and loses signing access. You also file it if you change your internal controls. For example, you move from single to dual signatures on withdrawals. You let the regulator know through the form.

If you close a trust account, you should file the form. You include the closure date and final balance. You explain where any remaining funds went. You do this even if you close the business. This helps you finish your licensing obligations cleanly.

Finally, you may be asked to submit the form during a routine audit or a targeted review. The regulator may request a current copy with bank confirmation. Respond fast. Keep your attachments ready.

Legal Characteristics of the CONP0053 – Trust Account Information

This form is part of your licensing and compliance record. It is not a contract with clients. It is a regulatory filing that carries legal weight. When you sign it, you certify the information is true. You also acknowledge your duties for handling trust money. False statements can trigger enforcement. So can failure to update the form when facts change.

What makes it enforceable?

Your licensing statute and the conditions of your licence. The regulator can require you to maintain trust accounts and report them. The form is the practical way to collect that data. Your signature binds the business to the declarations in the form. If the form includes a bank acknowledgement, the bank signature matters too. It confirms the account is labelled as a trust account. It confirms that the bank knows the funds are held for others. That label helps protect the funds from set-off or seizure for your own debts.

What ensures enforceability?

Enforceability is supported by your records. You should keep the bank letter that confirms the trust designation. You should keep copies of the form and attachments. You should keep monthly reconciliations that match the account. You may be asked to produce them at any time. If your form and records do not match, you may face penalties. That can include fines, licence suspension, or conditions on your licence. It can also affect your professional standing and insurance.

There are general legal considerations you should note. You must keep trust funds separate from your operating funds. The account title should include the word “trust.” Withdrawals should be for authorized purposes only. You should keep a clear audit trail from deposit to disbursement. You should reconcile the trust account monthly. You should not pledge or encumber trust funds. You should not allow your bank to set off your debts against trust balances. You should not transfer funds between clients without written authority. If you detect a shortage, you must address it right away and report as required.

Some businesses must hold interest on trust funds in a specified way. Others must use non-interest-bearing accounts. Follow your licence conditions. If the form asks where interest is directed, answer with care. If you are not sure, seek advice before you choose. Your selection must match the law that applies to your licence class.

Privacy also matters. The form contains personal information about signers and owners. You should verify who can see and share that data. You should use secure methods to send the form and attachments. You should store copies in your compliance files with access controls. Retain records for the period required by law.

Finally, timing matters. Many rules require you to file updates within a set number of days. For example, after opening or closing a trust account. Or after changing a signer. Do not wait for renewal to update. File as soon as the change takes effect. This reduces audit risk and prevents licence issues.

How to Fill Out a CONP0053 – Trust Account Information

Before you start, gather your documents. You will need your business legal name, licence or application number, and trade names. You will need your bank name, branch address, transit and account numbers. You will need the full list of signing authorities. You may also need a bank letter that confirms the trust designation. Have a recent bank statement if requested. Have corporate records that show who has authority to sign.

1) Identify the applicant

Enter the full legal name of your business. Use the exact name on your licence or application. Include your trade name if you use one. Select your business type. Indicate whether you are a corporation, partnership, or sole proprietor. Add your business number if you have one. Include your licence or application number so the record links to your file.

2) Provide contact details

Enter your business address, phone, and email. List a contact person who can answer questions about the trust account. Use a direct email and phone number. This helps the reviewer reach you fast.

3) Describe the trust purpose

Explain why you hold trust funds. Use plain terms, such as “buyer deposits,” “security deposits,” “rent,” or “client prepayments.” If you operate more than one trust purpose, describe each. This helps the regulator assess risk and the number of accounts you need.

4) Enter financial institution information

Provide the bank name and branch address. Enter the transit number and account number. Double-check the digits. Errors here delay approval. Confirm the account title includes the word “trust.” If the form has a box to check for “trust designation,” check it. If there is space to copy the account title, write it as it appears at the bank.

5) Indicate account type and currency

State whether the account is chequing or savings. Confirm the currency is Canadian dollars unless you are authorized otherwise. Most trust accounts must be in Canadian dollars. If you use a pooled trust account with sub-ledgers, note that.

6) Identify signing authorities

List each person who can sign on the trust account. Include full legal names and titles. Provide contact details for each signer. Indicate any limits, such as dual signatures required for withdrawals over a set amount. If the form provides a table for limits, complete it. If there is not enough space, attach a schedule.

7) Confirm internal controls

The form may ask about controls. You may need to confirm monthly reconciliations, segregation of duties, and dual signatures. Answer clearly. If you have a written policy, note that it exists. Do not overstate controls you do not use. Your answer should match your practice.

8) Interest and fees

Indicate whether the account earns interest. If interest must be directed to a specific recipient, state that. Confirm that bank fees are not paid from client funds unless allowed. If you pay fees from operating funds, note that. If the bank offsets fees against interest, disclose that.

9) Multiple accounts and branches

If you have more than one trust account, list each one. Use a separate line for each account. Include branch, purpose, and account number. If the form allows, include an attached schedule for additional accounts. If you use a branch-based account structure, explain the allocation.

10) Bank acknowledgement

Some versions of the form require a bank signature or stamp. This confirms the account is set up as a trust account. It may also confirm there is no right of set-off against your debts. Contact your branch to arrange for signature. Bring the form and identification. Ask for a letter on bank letterhead that repeats the confirmation. Attach the letter if requested.

11) Authorization to verify

You may be asked to authorize the regulator to contact your bank. Read the authorization language. It allows the reviewer to verify the account details. It may also allow them to obtain copies of statements for audits. Sign the authorization if required.

12) Attachments

Attach the required documents.

- A void cheque or direct deposit form for the trust account.

- A bank letter confirming the trust designation and account title.

- A recent bank statement showing the account number and name.

- A corporate resolution naming signing authorities, if applicable.

- Identification for signers if your rules require it.

Ensure all attachments are current and legible. Redact account balances if not requested.

13) Declarations and certification

Read the declaration carefully. It states that your information is true and complete. It confirms you will update the regulator when facts change. It may state that you understand your trust obligations. Only an authorized person should sign. That is usually the owner, director, partner, or designated officer.

14) Signature and date

Sign in ink if you submit a paper form. Use an approved e-signature if the form is online. Date the form. Print your name and title. Make sure the signatory’s authority matches your corporate records.

15) Submission

Submit the form as instructed. If it is part of a licence application, upload it with your other documents. If it is an update, use the update channel. Keep a copy of everything you submit. Save a PDF to your compliance folder. Note the submission date and any reference number.

After you submit

Watch for follow-up. Respond to questions within two business days if possible. If the reviewer asks for a corrected account number or clearer letter, provide it. Approval often depends on small details.

Common mistakes to avoid

- Do not list an operating account instead of a trust account.

- Do not forget to include “trust” in the account title.

- Do not submit a bank letter that omits the account number or title.

- Do not list former employees as signers.

- Do not leave off the branch transit number.

- Do not claim dual signatures if you do not have them with the bank.

Your controls on paper should match your banking mandate.

Practical examples

- You manage rent for 120 units. You collect rent and deposits on behalf of multiple landlords. You open a pooled trust account titled “ABC Property Management Inc. Trust.” You set dual signatures for any withdrawal over $5,000. You reconcile monthly by tenant and landlord. On the form, you list the account details. You state “rent and security deposits” as the purpose. You list two managers as signers. You attach the bank letter and a corporate resolution. You sign the declaration as the director. You submit the form with your licence application. You receive a request to confirm whether interest is paid. You respond that it is a non-interest-bearing account. Your licence proceeds without delay.

- You run a brokerage that takes deposits and holds them until conditions are met. You open two trust accounts. One for deposits, one for broker fee holds. You complete the form for each account. You state the purpose for each. You list the same two signers. You attach one bank letter that lists both account numbers and confirms the trust designation. You check your details twice. You submit, receive approval, and start operations.

If you need to update the form due to a change, act quickly. Suppose your controller leaves the company. Remove them from signing authority at the bank the same day. Complete an updated form. Attach an updated resolution. Submit the update. Save the bank confirmation of the signer change. Keep your trust funds secure during the transition.

If you close an account, complete a closure update. Include the closure date. Attach the final statement. Explain where funds were transferred. If you opened a replacement account, include its new details. This creates a clear chain for audit.

Keep your calendar set for reviews. At licence renewal, confirm your form still matches reality. Cross-check your signers, bank branch, and account title. Make updates before you renew. This avoids back-and-forth that can delay approval.

Your goal is simple. Show that client money is safe, separate, and controlled. The form helps you prove it. Fill it out accurately. Keep it current. Retain the supporting records. This makes audits smoother and protects your clients. It also protects you.

Legal Terms You Might Encounter

- Trust account means a separate bank account you hold only for client money. It keeps client funds apart from your firm’s money. On CONP0053 – Trust Account Information, you identify each trust account you operate, including account numbers and where the account is held.

- General account is your firm’s operating account. You use it for fees you have earned and firm expenses. It must not hold client money. The form often asks you to confirm the difference between your trust and general accounts so there is no confusion.

- Retainer is money a client pays you in advance. If you have not yet earned it, it belongs in your trust account. On the form, you may confirm that you deposit unearned retainers into trust and only transfer them once earned.

- Pooled trust account is a single trust account that holds funds for multiple clients. Each client’s balance is tracked in your records. The form may ask if you maintain pooled trust accounts and how you keep client ledgers.

- Separate interest‑bearing trust account is opened for one client to earn interest on their funds. You may need to disclose when and how you open these accounts. The form can capture that you can set up separate accounts when required.

- Trust reconciliation means matching your trust bank balance to your internal trust records and to total client ledgers. You usually do this monthly. The form may ask who performs reconciliations, how often, and who reviews them.

- Authorized signatory is a person you have approved to sign trust cheques or authorize electronic payments. The form asks for their names and roles. It confirms who has authority to move client funds.

- Electronic funds transfer (EFT) is a payment made electronically from or to your trust account. This includes wires and e‑transfers. The form may request details on how you authorize EFTs and what controls you use.

- Residual or dormant trust balance is a small or unclaimed amount left in trust after you complete a matter. The form may ask how you handle these funds and your process for locating clients or dealing with unclaimed amounts.

- Client identification and verification is the process of confirming who your client is and, when required, verifying identity with reliable documents. The form can ask you to confirm your procedures to ensure trust deposits and withdrawals match identified clients and matters.

FAQs

Do you need to list every trust account on CONP0053 – Trust Account Information?

Yes. List each active trust account, including pooled and separate interest‑bearing accounts. Include the financial institution, branch, transit, and account numbers. If you have multiple office locations with trust accounts, list each one separately. If an account is dormant but still open, include it and note the status.

Do you have to include closed trust accounts?

Include accounts that closed during the current reporting period, with open and close dates. If the form allows, mark them as closed. If the form does not have a specific field, add a comment in the designated notes area. Keep supporting closure documents with your records.

Who should sign the form?

An individual with authority and knowledge of your trust operations should sign. This is often the responsible lawyer, designated principal, or another authorized person who oversees trust accounting. If your firm requires multiple signatures, follow that internal policy and the form’s signature rules.

Can you submit the form if a new trust account is not yet fully active?

If you have the account number and confirmation from the bank, include it. Note the expected activation date if needed. If the account is only planned and not yet opened, do not list it as active. Instead, file an update once the account opens and funds can be deposited.

Do you need to attach bank letters or void cheques?

Some versions of the form request supporting banking documents. If the form includes a field for attachments, include bank confirmations, void cheques, or account opening letters as requested. If attachments are not requested, keep them in your records in case the regulator asks.

Can you use online‑only banks for trust accounts?

You can, provided the account meets your regulator’s rules for trust accounts. The account must allow proper statements, detailed transaction records, and reconciliation. You also need reliable controls for signing and EFT approvals. If your bank cannot meet these needs, choose a different institution.

What if you change banks or account numbers after filing?

File an amended CONP0053 – Trust Account Information as soon as possible. Update the account details and add the date the change took effect. Keep evidence of the old account’s closure and the new account’s opening. Document how you transferred client funds and reconciled both accounts.

Do you need to report interest earned on trust balances?

You should disclose whether trust funds can accrue interest and how you handle interest, including separate interest‑bearing accounts. The form may ask you to confirm your practice for managing interest where applicable. Keep records that show how you allocate interest to the client or as required.

Checklist: Before, During, and After the CONP0053 – Trust Account Information

Before you sign

- Gather firm details: legal name, operating name, business address, and contact information.

- List all trust accounts: institution name, branch, transit, and full account numbers.

- Confirm account types: pooled trust, separate interest‑bearing, and any specialized sub‑accounts.

- Identify authorized signatories: names, positions, signature method (wet ink, digital), and any dual‑signature rules.

- Document EFT controls: who initiates, who approves, and how you verify recipient details.

- Prepare reconciliation evidence: most recent monthly trust bank statement, reconciliation reports, and client trust listing.

- Verify opening and closing dates for any accounts opened or closed during the period.

- Collect supporting documents: account opening letters, void cheques, and signing resolutions, if applicable.

- Review internal trust policies: deposits, transfers to general, disbursements, residual balances, and record retention.

- Confirm client identification and verification procedures relevant to trust transactions.

- Check whether you need to identify each office location that uses trust accounts.

- Assign a knowledgeable person to complete the form and answer questions.

During signing

- Verify the firm name and registration number match your regulator’s records.

- Double‑check each account number and transit number for accuracy.

- Confirm the account type is correct for each entry (pooled vs separate).

- Ensure all authorized signatories are listed and current. Remove former staff.

- Review EFT procedures for clarity and segregation of duties.

- Confirm the date range covered by the report matches your reconciliation period.

- Check that your trust reconciliation status is accurate as of the reporting date.

- Ensure closed accounts show close dates and that active accounts show open dates.

- Use the comments field to explain unusual situations, such as migrated accounts or merger impacts.

- Read the declarations carefully. Make sure the signatory understands their responsibility.

- If an attachment is required, verify it’s legible and matches the listed account.

After signing

- File the form using the required method. Note the submission date and time.

- Save a PDF copy of the filed form and any attachments in your trust accounting folder.

- Create a dated memo summarizing what you filed and why, including any exceptions.

- Calendar the next reporting deadline and any required interim updates.

- Notify internal teams about changes to accounts or signatories. Update your procedures manual.

- Verify receipt or confirmation number from the regulator. Follow up if you don’t receive confirmation.

- Reconcile your trust accounts for the month of filing. Confirm the filed details match your records.

- Store bank confirmations, signed resolutions, and proof of submission in a secure location.

- If you opened or closed accounts, capture the final and initial reconciliations and statements.

- Train new signatories on trust rules and your approval workflow before they process transactions.

Common Mistakes to Avoid

Leaving out a trust account

- Don’t forget to list every active trust account, including separate interest‑bearing accounts. Missing an account can trigger follow‑up, delays, or an audit inquiry. It can also raise concerns about unreported client funds.

Listing outdated signatories

- Remove staff or partners who no longer work with you or no longer have authority. Keeping old signatories can open the door to unauthorized transactions and questions about your controls.

Mixing general and trust details

- Keep your general account information separate and clear. Misstating account types can look like you are co‑mingling funds, even if you are not. That can lead to compliance reviews.

Using incorrect account numbers or transit details

- Enter full and accurate numbers. A single digit error can cause bank confirmations to fail and delay your filing. It also complicates reconciliations and audit trails.

Not updating after changes

- If you switch banks, close an account, or add a signatory, update CONP0053 – Trust Account Information promptly. Delayed updates can create gaps in your compliance history and may draw follow‑up from the regulator.

What to Do After Filling Out the Form

Submit and confirm

- File the completed CONP0053 – Trust Account Information by the required method.

- Capture a submission confirmation number or screenshot.

- If you do not receive confirmation within a reasonable time, follow up.

Align your records

- Match the filed details to your internal trust ledger, bank statements, and reconciliation reports.

- If you spot a mismatch, correct your records and, if needed, file an amendment.

- Document any corrections with a dated note.

Notify your team

- Inform your accounting, billing, and intake teams about any changes to accounts or approvals.

- Update your trust procedures manual and training materials.

- Provide signatory updates to your bank so it mirrors what you filed.

Strengthen controls

- Re‑confirm dual‑authorization for EFTs and cheque signing.

- Test your monthly reconciliation process. Assign preparer and reviewer roles.

- Review your process for handling residual balances and unclaimed funds.

Manage amendments

- If you open or close a trust account, file an updated CONP0053 promptly.

- Note the effective date of each change. Attach supporting documents if requested.

- Keep a log of amendments with reasons and approvals.

Distribute copies

- Save the signed form and attachments in your trust compliance folder.

- Provide a copy to your managing lawyer or principal.

- Share relevant sections with your bookkeeper or accountant.

Plan ahead

- Calendar your next reporting deadline and reconciliation review dates.

- Schedule a quarterly internal check on signatories and EFT controls.

- Keep contact details for your financial institution current to avoid delays in confirmations.

Prepare for review

- Organize bank statements, reconciliations, client trust listings, and proof of deposits and withdrawals.

- Ensure each trust transaction has a corresponding client matter and authorization.

- Be ready to show how your filed information matches your day‑to‑day records.

Close the loop after major changes

- If you moved to a new bank, retain final statements and reconciliations from the old account.

- Document how you transferred client funds. Include dates, amounts, and authorizations.

- Verify that each client’s trust sub‑ledger reflects the transfer and final balance.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.