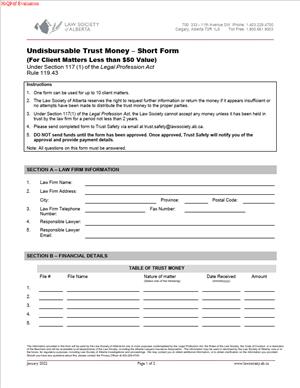

Undisbursable Trust Money – For Client Matters Less Than $50 Value

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is an Undisbursable Trust Money – For Client Matters Less Than $50 Value?

This form records and authorizes the transfer of small client trust balances you cannot return. It applies to client matters where the remaining trust amount is less than $50. It documents why the money cannot be disbursed and where you will send it. It also confirms that you tried to find and pay the right person but were not able to do so.

You typically use this form when trust funds remain after a file closes. The amount is too small to justify further searches. Or the client cannot be found. Or the client refuses payment, or the cost to deliver is more than the amount. It may also cover stale-dated trust cheques that were never cashed. The form creates a clear record for your trust books. It allows you to move the money out of your pooled trust account in a compliant way.

Who usually completes this form?

Lawyers responsible for the trust account. Law firm administrators. Bookkeepers and accounting staff who support the responsible lawyer. You are the one certifying the facts, so you must review all entries and supporting records. Even if a staff member prepares the form, the responsible lawyer usually signs it.

Why would you need this form?

You need it to keep your trust ledger accurate. It helps you reconcile trust accounts. It shows that you handle client money with care. It helps you pass a trust compliance review or audit. It reduces the risks of holding small, inactive balances. It prevents trust account clutter and avoids repeated bank fees tied to dormant funds. It also shows that you followed required steps before removing funds from trust.

Typical usage scenarios

- A closed real estate file with a $14 overpayment.

- A litigation file with a $23 courier refund after settlement.

- A corporate retainer with a $32 leftover after final billing.

- A legal aid file where a client moved and left no forwarding address, leaving a $17 balance.

- A stale trust cheque for $40 that the client never deposited and now cannot be reissued.

In each case, you tried to refund the money. You could not, despite reasonable efforts, so you complete this form to resolve the balance.

When Would You Use an Undisbursable Trust Money – For Client Matters Less Than $50 Value?

You use this form when a client matter has a small trust balance you cannot return despite your efforts. The amount must be under $50 for that client matter. The file is closed or effectively inactive. You have no ongoing instructions for the funds. You have tried to contact the client or payee using the last known details. Those attempts failed or were not practical given the amount.

You might use it after you sent a trust refund cheque for $28 that was returned. You attempted email and phone calls and received no response. You checked your file and billing system for updated details. You also checked online directories or other reasonable sources. You still could not find the client. At that point, the funds are undisbursable. This form allows you to document the facts and remove the amount from trust.

You also use it for stale-dated cheques under $50. For example, you issued a $37 trust refund that was never cashed. You contacted the client and the address is no longer valid. You reissued once and that cheque also expired. You now treat the amount as undisbursable and use the form to transfer it out of trust.

It is also relevant when the delivery cost is disproportionate. For instance, a client balance is $11. You need registered mail to a remote area costing more than $11. The client cannot receive e-transfer without verified identity. The cost and risk outweigh the amount. You record your efforts and use the form.

Typical users

- Sole practitioners

- Small and mid-size firms

- Corporate legal departments that hold trust funds.

The person completing the form is often the responsible lawyer or trust clerk. The audience for the finished document includes your internal trust accounting team, your reviewer, and your regulator during an audit. The form becomes part of your permanent trust records.

You do not use this form for amounts of $50 or more. Larger amounts follow a different process. You also do not use it where you still have a valid method to disburse funds. If the client gives new instructions or a valid address, you must pay them directly. You also do not use it for disputed funds, lien claims, or holdbacks that remain subject to conditions. Those require resolution before any transfer.

Legal Characteristics of the Undisbursable Trust Money – For Client Matters Less Than $50 Value

This form is a legal declaration about client trust funds. It is binding because you certify facts within your professional duties. You state that the funds belong to a client or third party. You confirm that the amount is under $50 for the client matter. You confirm that you performed reasonable efforts to disburse the money. You state why the funds are undisbursable. You authorize a transfer out of trust based on those facts. Your signature carries legal and professional weight.

What ensures enforceability?

First, the underlying trust rules require accurate records and proper disbursement of funds. Those rules allow a specific process for small undisbursable amounts. The form aligns with those rules. It captures the details needed to justify the transfer. Second, your trust ledgers and reconciliation reports back up the amount. The documentation attached to the form shows your search efforts. Third, the form includes a certification by the responsible lawyer. False statements expose you to discipline or other consequences. That risk encourages accuracy and good faith.

General legal considerations apply. You must act as a fiduciary for client money. That includes prompt disbursement and careful recordkeeping. You must not use the form to remove balances that are still payable to the client by reasonable means. You must not split a higher amount into several entries to fit under $50. The threshold applies per client matter, not per cheque. You should also avoid treating trust errors as undisbursable money. If a balance exists due to your billing delay or misposting, correct it at source.

Privacy rules apply to the information you include. Share only what is required to identify the client matter and the funds. Redact sensitive information not needed for the record. Keep supporting documents secure. Retain the form and attachments in your trust records for the required period. This protects you in audits and in any later inquiry.

Do not use the form to resolve contested entitlements. If two parties claim the funds, hold them in trust until the dispute is resolved. If you know the rightful owner but cannot reach them, the form may apply once other steps fail. If you owe the funds to a third-party payee, document that fact in the form. State why the funds cannot be delivered to that payee.

After you transfer the funds out of trust, you should update the client ledger to zero. Your reconciliation should show the matching outflow. Your file should contain the approved form, proof of transfer, and all supporting notes. If the rightful owner later appears, you may be able to request repayment from the holding destination, subject to their process. Keep your records so you can do that.

How to Fill Out an Undisbursable Trust Money – For Client Matters Less Than $50 Value

Before you start, gather your records. Pull the client trust ledger, bank statements, reconciliation, and the file. Collect returned mail, email logs, call notes, and any search results. Confirm that the balance is less than $50 for the client matter. Confirm that the money is undisbursable despite reasonable efforts.

1) Identify the responsible lawyer and firm details.

- Enter the firm name, address, and contact details.

- Enter the responsible lawyer’s full name and membership number if requested.

- Provide a direct phone and email in case of questions.

2) Specify the trust account.

- List the pooled trust account name and bank branch.

- Include the account number and transit where requested.

- Confirm the account appears on your most recent reconciliation.

3) Describe the client matter.

- Enter the client or payee’s full name as shown on your ledger.

- Add the file number or matter reference. Keep it consistent with your system.

- State the type of matter (for example, real estate sale, civil settlement).

- Add the date the funds were first received into trust for this matter, if known.

4) State the amount and currency.

- Enter the exact undisbursable amount to two decimals.

- Confirm it is less than $50.

- Confirm the currency is Canadian dollars unless your records show otherwise.

5) Explain why the funds are undisbursable.

- Provide a short, clear reason. Examples: returned mail, stale-dated cheque, no current contact, cost of delivery exceeds funds, client declined refund.

- Include key facts. For example: “Refund cheque of $34.27 issued on April 3, not cashed. Mail returned. No response to two emails and one phone call.”

- Avoid long stories. Focus on dates and outcomes.

6) Summarize your efforts to disburse.

- List the steps taken to contact or pay the owner. Include dates where possible.

- Examples: letters sent, emails sent, calls made, alternate address search, reissued cheque, attempted e-transfer.

- If you used an online search or directory, note the attempt in general terms. Do not include unnecessary personal information.

7) Confirm the matter is closed or inactive.

- State that there are no open instructions for these funds.

- Note the file closure date if applicable.

- Confirm there are no known competing claims.

8) Attach supporting documents.

- Attach the client trust ledger for the matter.

- Include copies of returned mail or email bounce notices.

- Include a copy of the stale-dated cheque and any reissue attempt.

- Include ledger entries showing the original receipt and any partial disbursements.

- If internal approval is needed, attach that sign-off.

9) Authorize the transfer.

- Complete the authorization clause allowing the funds to be removed from trust.

- Confirm the destination and method (cheque or electronic transfer as permitted).

- If the form requests a remittance summary, complete it and attach payment.

10) Complete the certification.

- Read the declaration carefully.

- Confirm that the facts are true to the best of your knowledge.

- Sign and date the form. If a witness or second signature is required, obtain it.

- If the form allows digital signatures, follow the stated process.

11) List multiple matters on a schedule if needed.

- If you have several small balances, use the schedule page.

- Provide one line per matter. Include client name, file number, amount, and reason.

- Ensure the total matches your remittance amount.

12) Reconcile and file.

- Post the trust journal entry to remove the funds from trust.

- Update the client ledger so the balance is zero.

- Reconcile your trust account and verify that totals match.

- File the approved form, schedule, and proof of transfer with your trust records.

13) Retain records.

- Keep the form and attachments for your retention period.

- Store records securely and in a searchable format.

- Cross-reference the form in your month-end reconciliation package.

Practical tips and common mistakes to avoid

- Verify the amount. Run a fresh client ledger report the day you prepare the form. Small fees or interest adjustments can change the figure. Ensure the amount is truly under $50 and relates to that single matter.

- Do not bundle unrelated files. If two files exist for the same client, treat each file separately. The threshold applies per matter, not per client across all matters.

- Do not use the form to clean up posting errors. If a balance exists because a bill was not posted, fix the billing. If a deposit was miscoded, correct the ledger entry. Only use the form for true undisbursable funds.

- Document search efforts proportionate to the amount. For a $12 balance, you may have fewer steps than for $48. Still, show reasoned attempts. Record dates, methods, and results.

- Use clear reasons. Avoid vague wording like “cannot pay.” Instead, write “no current address; mail returned undeliverable on June 10 and July 3.”

- Keep privacy in mind. Include only the details needed to explain the situation. Do not attach full client files.

- Align the timing with your internal policy. Ensure the file has been inactive long enough to justify the transfer. If your firm sets a wait period, note that you met it.

- Check the payee. If the funds belong to a third party, identify that party in the form. Explain why you cannot deliver to them.

- Plan for later claims. Keep a clean trail so you can pay the rightful owner if they contact you later. The form, ledger, and proof of transfer are key.

Real-world examples

- You close a civil litigation file with a $29.45 trust surplus. You issue a refund cheque to the client’s last known address. The cheque expires. You send a follow-up letter and email. The mail returns. The email bounces. You call the number on file with no success. You confirm no alternate contact in the file or systems. You decide the funds are undisbursable. You complete the form, list the client name, file number, and amount. You write a short reason and list your attempts. You attach the trust ledger and a copy of the expired cheque. You sign the certification. You issue a remittance for $29.45 as directed in the form. You post the trust entry, reconcile, and file the records.

- Your firm holds $9.10 after a house sale due to a minor payout adjustment. The client moved abroad and uses a new bank that cannot accept e-transfers from Canada without extra verification. Courier cost would exceed the balance. You note your attempts to arrange a no-cost method. No feasible option exists. You complete the form, explain the facts, and transfer the $9.10 out of trust using the process set out in the form. You document everything and close the ledger.

If you later locate the client, you can guide them on how to request the funds from the holding destination. Your file, including this completed form, will help prove entitlement and amount. That is another reason to be precise and complete when you fill it out.

The form is straightforward. Keep your language clear and factual. Provide the basics: who, what, when, why, and how much. Attach the proof. Sign with care. Then update your trust records.

Legal Terms You Might Encounter

- Undisbursable trust money is a narrow concept. These plain-language terms help you read and complete the form with confidence.

- Trust account means the bank account you use to hold client money separate from your firm’s funds. On this form, you identify the matter and the small balance that remains in trust. You confirm you cannot send it to the client or a payee.

- Client matter means the specific file or case tied to a client and a discrete legal issue. The form applies to the residual balance in that single matter. It does not apply to a client’s total relationship with your firm.

- Residual balance means a small amount left in trust after you complete work and pay known disbursements. On this form, the balance must be under $50 for that matter. You use the form to deal with that leftover amount.

- Undisbursable means you cannot pay the funds to the client or any other person entitled to them despite reasonable efforts. The form asks you to confirm your efforts. It also asks you to document why the money cannot be paid out.

- Disbursement means an expense you pay on a client’s behalf, such as a filing fee or courier. When you complete the form, you confirm all known disbursements for the matter are already posted. The amount you list is not meant to pay a future expense.

- Due diligence means the steps you took to locate and pay the person who should receive the funds. The form turns your due diligence into a record. You should have notes or proof of searches, mail returns, emails, and calls before you sign.

- Trust ledger (or trust ledger card) means the detailed accounting for one client matter in your trust system. It shows deposits, withdrawals, and the current balance. The form relies on this ledger to show the exact residual amount you want to clear.

- Stale-dated cheque means a trust cheque that was issued but never cashed and is now too old to be negotiated by the bank. If a stale-dated cheque created the residual balance, you record that in your file. The form helps you resolve that leftover amount.

- Three-way reconciliation means you match the trust bank balance, the book balance, and the total of all client ledgers each month. When you complete the form, the residual amount must appear on your reconciliation reports. You should reconcile it the month you process the form.

- General account means your firm’s operating account. Depending on regulator direction, you may be allowed to transfer undisbursable funds there after approval and documentation. The form is part of that documentation. You still must record the transfer on the matter ledger.

- Interest on trust funds means any interest earned on money in trust. Check your regulator’s rules for who receives interest. The form deals with principal amounts under $50. It does not change how you handle any interest earned under your bank or regulator program.

- Unclaimed funds means money that remains unpaid because the owner cannot be found. The form addresses a specific type of unclaimed funds: small trust balances under $50 tied to a single matter. It is not a general unclaimed property process for larger sums.

- Authorization means the person at your firm who has authority to approve trust withdrawals signs the form. This signature confirms your records are accurate. It also confirms you will record the transfer exactly as stated.

FAQs

Do you have to try to contact the client before using the form?

Yes. You should make reasonable efforts first. Use the last known email, phone, and mailing address. Try alternate channels on file, such as a new address given during the matter. Document each attempt and outcome. Keep returned mail, bounced emails, and call logs. The form should reflect that you tried to disburse the funds and could not. Without those efforts, the money is not “undisbursable.”

Do you apply the “less than $50” limit per matter or per client?

Per matter. Each matter has its own trust ledger and balance. If one client has three matters with small residuals, you assess each matter on its own. Do not pool matters or net balances across files. The form should list one matter and one residual amount.

Do you need to wait a set period before submitting the form?

You should allow reasonable time for payment attempts to succeed. That usually means waiting for returned mail, banking rejections, or email replies. There is no single fixed period for every case. The key is to show you tried in good faith and that payment remains unworkable. Document timing in your file notes and attach proof to your form package.

Do you move the funds to your general account after approval?

Follow your regulator’s instructions. In many cases, once you complete the form and record the entry, you can transfer the small balance to the designated destination. That may be your general account or another approved destination. Record the transfer on the matter trust ledger. Cross-reference the form and your monthly reconciliation.

Do you need partner approval or can staff sign?

Use your firm’s signing authorities for trust transactions. If your policy requires a lawyer or manager to approve trust withdrawals, follow that process. The person who signs takes responsibility for the accuracy of the information. They confirm the balance is under $50, undisbursable, and supported by records. Keep the signed form as part of the matter file.

Do you need to reissue a stale-dated trust cheque instead of using this form?

Start by trying to pay the correct payee. If you can confirm a current address or new payment method, reissue the cheque. If you cannot locate the payee or the client, and the residual is under $50, the form helps you close it out. Tie the stale-dated cheque number to your documentation so the audit trail is clear.

Do you use this form if there is a trust shortage or disputed balance?

No. Do not use this form for shortages, disputes, or unresolved claims. Fix any shortages immediately using allowed methods. Resolve disputes with the client or third party first. The form is only for small, positive residual balances that you cannot pay out after reasonable efforts.

Do you need to notify the client after you process the form?

If you have a working address or email, send a short notice. Tell the client you tried to pay the balance and how you resolved it under the small-residue process. Keep a copy of the notice in the file. If you cannot reach the client at all, your documented attempts stand as your record.

Do you need to update your monthly reconciliation the same month?

Yes. Process the withdrawal and complete the entry so your reconciliation reflects the new zero balance for that matter. Cross-reference the form in your reconciliation support. This keeps your reports clean and prevents the same residue from appearing next month.

Do you need to do anything if the client resurfaces after you process the form?

Yes. If the client later asks for the funds, review your file. If the funds were transferred to the approved destination, you can pay the client from your general account or follow your regulator’s direction to correct it. Document the reversal, the payment, and the link to the original form.

Checklist: Before, During, and After the Undisbursable Trust Money – For Client Matters Less Than $50 Value

Before signing

- Confirm the matter-specific trust balance is under $50.

- Review the trust ledger for the matter. Ensure all intended disbursements are posted.

- Verify there are no outstanding undertakings, liens, or third-party claims on the funds.

- Gather proof of due diligence: returned mail, emails, call logs, and search notes.

- Check for stale-dated trust cheques tied to the balance. Note cheque numbers.

- Reconcile the balance to your latest trust reconciliation and bank statement.

- Confirm no pending invoices or write-offs rely on the trust balance.

- Identify internal signing authorities and any required approvals.

During signing

- Enter the exact matter name, file number, and client identifier. Match your ledger.

- Record the precise trust amount to the cent. Confirm it equals the ledger residue.

- Describe the due diligence steps taken. Include dates and outcomes in clear terms.

- State the reason the funds are undisbursable (e.g., client unlocatable, payee unknown).

- Confirm the funds are not needed for any known disbursement or fee.

- Identify where you will transfer the funds, as allowed by your regulator.

- Obtain the required signature(s). Date the form on the day of execution.

- Cross-check the form against the reconciliation support. Ensure consistency.

After signing

- Post the withdrawal in your trust accounting system. Reference the form number.

- Transfer funds to the approved destination. Keep the bank proof with the form.

- Update the trust ledger to show a zero balance. Add a clear narrative note.

- Include the form and support in your next three-way reconciliation package.

- Send a final notice to the client, if you have workable contact details.

- Mark the matter for file closure once all trust and billing steps are complete.

- Store the signed form and all supporting documents with the matter file.

- Retain records in line with your regulator’s record-keeping period.

- If the client later claims the funds, document the reversal and repayment steps.

Common Mistakes to Avoid

- Using the form for balances of $50 or more

- Don’t forget: the limit is strictly under $50 per matter. Using it for $50 or more can breach trust rules. It can also trigger reconciliation variances and audit findings.

- Skipping due diligence steps

- Avoid completing the form without contact attempts. If you skip emails, letters, or calls, you cannot show the funds are undisbursable. The consequence is a rejected process or required reversal.

- Combining multiple matters or clients

- Do not net balances across files or clients. Each matter stands alone. Pooling amounts hides the true trail and creates reconciliation errors that are hard to fix.

- Posting the transfer without support

- Never move money first and “paper it” later. If you transfer without the completed form and ledger notes, you risk audit exceptions and internal control breaches.

- Ignoring stale-dated cheques and timing issues

- Do not treat a stale-dated cheque as “gone” without proof. Record the original cheque, its expiry, and why reissue failed. Missing this step can lead to duplicate payments or unresolved variances.

What to Do After Filling Out the Form

- Record the transaction the same day. Post the trust withdrawal on the matter ledger with the form reference. Enter the narrative so anyone can understand the reason and authority.

- Transfer the funds to the approved destination. Follow your regulator’s direction for small residuals. Keep a copy of the bank confirmation or internal transfer record.

- Update your reconciliation. Include the form and supporting proof in the current month’s reconciliation package. Check that the matter now shows a zero trust balance.

- Notify the client if possible. Send a short message describing your attempts to pay and the resolution under the small-balance process. File a copy of the notice.

- Close the trust side of the matter. Confirm no further trust deposits are expected. If new funds arrive later, open a fresh ledger for that purpose.

- Set a reminder for possible follow-up. If you expect a new address may appear soon, set a diary note to check. A quick search can prevent future questions.

- Prepare for a later client claim. If the client resurfaces, be ready to pay the residual from your general account or follow your regulator’s correction process. Keep a clear link back to the original form and transfer.

- Conduct a brief root-cause review. Note why the residue arose (rounding, bank fee reversals, stale cheque). Adjust workflows to reduce future residuals, such as issuing final bills earlier or confirming payee details before issuing cheques.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.