Undisbursable Trust Money – For Client Matters Greater Than $50 Value

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is an Undisbursable Trust Money – For Client Matters Greater Than $50 Value?

This form is the regulator’s required application to transfer client trust funds you cannot disburse to the rightful owner, where the balance is more than $50. “Undisbursable” means you hold funds in trust for a client or third party, but you cannot pay them out despite reasonable efforts and a proper legal basis to do so. You complete this form to request approval to remit those funds to the regulator, who then holds the money so a rightful owner can claim it in the future.

You typically use this form when a client has vanished, a payee cannot be identified or located, a cheque has gone stale without response, a corporate client has dissolved, a beneficiary remains unknown, or instructions no longer exist and cannot be recreated. The form captures who the money belongs to, why it cannot be paid, what efforts you made to fix the issue, and the trust accounting proof supporting the balance. Once accepted, you remit the money to the regulator and close the file in your books.

Who typically uses this form?

Responsible lawyers, firm administrators, trust safety officers, bookkeepers, and legal operations staff who maintain the firm’s trust accounts. Sole practitioners also use it to clear aged trust balances when a matter is finished and funds cannot be returned. In short, anyone responsible for trust compliance in an Alberta practice will eventually need this form.

Why would you need it?

Because you cannot leave stranded balances in trust. Trust rules require you to safeguard client property, pay it out as instructed, and resolve residual balances promptly. Leaving idle money in trust creates reconciliation headaches, increases audit risk, and can mask errors. This form gives you a compliant path to remove balances you cannot disburse, while protecting client rights. It also lets you close the trust ledger, complete file closure, and keep your monthly reconciliations clean.

Typical usage scenarios

- A closed file with a leftover retainer where the client does not respond to multiple outreach attempts.

- It also includes a settlement distribution where the client’s bank rejected the transfer and the client cannot be found.

- It covers stale-dated trust cheques to experts or vendors who have moved and cannot be located.

- It applies to funds received in error that no one claims despite notices.

- It applies to a dissolved corporation’s remaining trust balance when no authorized signatory responds.

- It can also apply to unknown beneficiaries in estates or to real estate holdbacks that outlive their purpose and have no reachable payee.

In all of these, you would document diligent efforts to pay the funds and then use this form to remit the balance for safekeeping with the regulator.

When Would You Use an Undisbursable Trust Money – For Client Matters Greater Than $50 Value?

You use this form after you have exhausted reasonable steps to pay the funds to the rightful owner but remain unable to do so. The classic case is a retainer surplus after a file is complete and billed. You send the refund letter, email, and follow-up reminders. You phone the last known numbers and get no answer. You mail a cheque to the last address and it returns. You cannot locate the client with reasonable searches. At that point, the funds are undisbursable, and the form is appropriate.

Another common case is a stale-dated cheque you issued to a third party, such as an expert, mediator, or vendor. You learn the cheque expired because it was never negotiated. You attempt to reissue and reach the payee without success. You confirm the services are not disputed and the payee has no updated address. The money sits in trust with nowhere to go. The form allows you to transfer that amount once you document your outreach.

You may also see this after a wire or deposit lands without enough detail to match it to a file or rightful owner. You attempt to trace the source through the bank, your internal records, and counterparties involved in recent matters. No one claims the funds and you cannot confidently assign ownership. After documenting the investigation, you use the form to move the balance out of trust under the regulator’s processes.

Estate and family matters create their own examples. A trust account holds funds for an unidentified or unresponsive beneficiary. You search for contact details, publish notices if appropriate, and engage the instructing party, but you still lack a payee who can receive the money. You then apply using the form to transfer the balance for safekeeping until a beneficiary appears.

Corporate dissolutions also trigger undisbursable funds. You act for a corporation that later dissolves. No one with authority responds to you. No successor or liquidator claims the balance. After reasonable searches and notices, the funds qualify as undisbursable. The form is your path to remit and close the ledger.

Real estate holdbacks can become undisbursable when conditions have long since passed, you hold a small residual, and neither side responds to finalize release directions. You confirm the underlying obligations are fulfilled or discharged, but you still have no instructions and cannot reach either party. The form then becomes appropriate to resolve the balance.

Typical users include lawyers of record, responsible lawyers, trust safety officers, office managers, senior bookkeepers, and legal accountants. If you own or manage trust accounts in a small or mid-sized firm, you are the audience for this form.

Legal Characteristics of the Undisbursable Trust Money – For Client Matters Greater Than $50 Value

The form is part of a binding regulatory process. You sign declarations about the facts, your investigations, and the funds. You request permission to transfer client property from your trust account to the regulator’s custody. The legal force comes from your trust obligations and the regulator’s authority to direct the disposition of client funds when they cannot be disbursed.

What ensures enforceability?

Enforceability rests on accurate records, proper client identification, and a clear audit trail. Your trust ledger must tie exactly to the amount you propose to remit. Your bank reconciliation must show the money exists and is intact. Your file notes must log dates and methods of contact attempts, the addresses used, and the results. You must confirm there are no outstanding undertakings, liens, or court orders affecting the funds. If any competing claim or dispute exists, you cannot use this process until you resolve it through proper channels.

Transferring funds under this process changes custody, not ownership. The money remains the client’s or payee’s property. The regulator holds it so the owner can claim it later. Your obligations shift once the transfer is approved and paid. You no longer hold the funds in trust, but you must keep the records for the required retention period. If the owner resurfaces, you direct them to the regulator, not your firm.

You cannot self-help by netting fees from undisbursable funds unless you have clear written authority or a legal right to do so and your trust rules allow it. Absent that, you remit the entire undisbursable amount. If you assert fees, your records must show client authorization to transfer from trust or a finalized statement of account that was properly delivered and not disputed, consistent with trust rules. When in doubt, do not deduct fees from undisbursable funds.

Interest treatment depends on how the funds were held. If the money was in a pooled trust account, you do not calculate or remit interest. If the money was in a separate interest-bearing account for the client, you include the accumulated interest with the principal, less any bank fees properly chargeable to that separate account. Your accounting schedules must show the calculation.

Privacy and confidentiality remain in force. Provide only the personal information the form requires. Secure your attachments. Do not include sensitive documents unrelated to the funds. Your declaration typically affirms compliance with privacy laws and that the funds are not proceeds of unlawful activity.

Finally, accuracy matters. Submitting incomplete or inaccurate information can delay approval or trigger further review. If the regulator requests more information, respond promptly and completely. Your trust file should stand on its own and support every statement you make in the form.

How to Fill Out an Undisbursable Trust Money – For Client Matters Greater Than $50 Value

Follow these steps. Keep your sentences clear and your documents organized. Treat this as a mini-audit file.

Step 1: Confirm the funds are truly undisbursable

- Start by reviewing the matter file and trust ledger. Confirm the funds are client property or third-party funds you hold in trust. Identify the legal basis you had to receive and hold the money. Check for any undertakings, liens, holdbacks, judgments, garnishments, or court orders. Resolve or release anything that restricts payment. If any dispute exists about entitlement to the funds, pause and address that dispute first.

- Verify that you have tried to pay the funds to the rightful owner and failed. You should have objective reasons why payment cannot occur. Examples include returned mail, inactive phone numbers, bounced emails, and unclaimed cheques. If you have not yet attempted contact across multiple channels, do that now before you complete the form.

Step 2: Complete a diligent search and document it

- Make reasonable, layered attempts to locate the client or payee. Use the last known email, phone, and address. Send a letter that explains you hold funds and request updated instructions. If mail returns, keep the envelope. Try alternate contact details found in your file or engagement records. Reach out to former counsel or counterparties if appropriate and permitted.

- Search openly available information. Check corporate registries for corporate clients. Look for obituary notices if you suspect the client has died. If there is an estate, contact the personal representative you can identify. For third-party payees such as experts, try business directories or professional registers. Record every attempt with dates, methods, addresses used, and results.

- Create a search log. It should show a sequence of attempts over time, not a single burst on one day. The goal is to show you did not give up too soon. Include any returned mail, email bounce-backs, and notes of phone calls. You will summarize this in the form and attach the log.

Step 3: Gather your trust accounting documents

- Print the matter trust ledger showing the full history, from receipt to the current balance. Include the date and amount of each deposit and disbursement. Reconcile the ledger balance to your latest monthly trust reconciliation. Include the relevant bank statement pages that show the funds in the account.

- If the undisbursable amount relates to a stale-dated cheque, include a copy of the cheque and the stop-payment confirmation, if applicable. If the funds came in by wire, include the bank advice. If the funds sat in a separate interest-bearing trust account, include the interest calculation and statements.

- If you issued a final bill and believe you had authority to withdraw fees, include the statement of account and proof of delivery to the client. If you lack clear authority, do not net fees from the remittance amount. The safest path is to remit the full undisbursable balance.

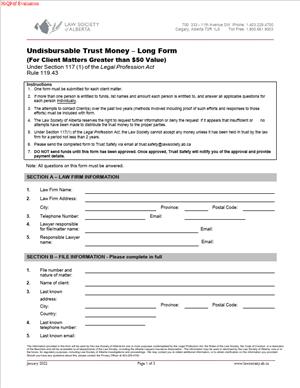

Step 4: Fill in the applicant and matter details

- Complete the firm information first. Enter the firm name, address, and primary contact. Identify the responsible lawyer or trust safety officer. Include any required regulator or member numbers. Provide a direct phone and email for questions.

- Enter the matter details. Use the client’s full legal name. If the funds belong to a third-party payee, list that payee as the owner and note the relationship to the matter. Add the internal file number and a short matter description, such as “real estate sale holdback” or “litigation settlement refund.”

- Record the amount to be remitted and the currency. For separate interest-bearing accounts, provide the principal and accrued interest. For pooled trust, provide the ledger balance only.

- Provide the date and source of the funds. Describe how you received them, such as “client retainer by e-transfer on [date]” or “settlement proceeds from insurer on [date].” If the source is unclear, explain the steps you took to identify it and why it remains unknown.

Step 5: Explain why the funds are undisbursable

Draft a clear, factual summary of the problem. Use short sentences. State who is owed, why payment cannot be made, and what you did to try. Include the date you first attempted contact and the last attempt date. Reference the search log. If a cheque went stale, include the cheque number and issue date. If the owner’s identity is unknown, explain why your tracing failed.

Confirm there are no outstanding obligations tied to the funds. State that no undertakings, liens, or court orders restrict the funds. If there were restrictions, show how and when they were satisfied or released.

Step 6: Attach the required schedules

Prepare labeled attachments. Include:

- Schedule A: Matter trust ledger.

- Schedule B: Latest monthly trust reconciliation and bank statement pages showing the balance.

- Schedule C: Correspondence and search log with dates and outcomes.

- Schedule D: Proof of returned mail or undeliverable emails.

- Schedule E: Any relevant documents, such as a copy of the stale-dated cheque, deposit advice, corporate dissolution record, or estate information.

- Schedule F: Statement of account and authorization, if you assert any right to fees.

Each schedule should be legible and complete. Do not redact amounts on accounting documents. Redact sensitive data that is not needed, such as unrelated personal identifiers, but do not obscure facts about the funds.

Step 7: Complete declarations and signatures

- Review the declarations carefully. You will confirm that the funds are undisbursable, the information is true, and you hold the funds in trust. You may also confirm that there is no known dispute about entitlement and that the money is not connected to unlawful activity. Sign as the responsible lawyer or trust safety officer. Date the form. If a statutory declaration is required, sign before a commissioner or other authorized witness, and attach that declaration.

- If your firm uses an internal approval sheet, include it in your file, even if it is not part of the submission. It shows oversight and helps during an audit.

Step 8: Submit the form and remit the funds

- Submit the form through the prescribed channel. Follow the instructions for remitting the money. You will typically send a trust cheque or electronic funds transfer payable as directed. Reference the file number and the owner’s name in the payment memo. Keep proof of delivery or transfer.

- Do not remove the funds from trust until you have submission confirmation or approval, depending on the process. Once remitted, post the journal entry to clear the matter ledger and reference the submission ID or approval number.

Step 9: Close out your accounting and file records

- Update the matter status to “closed” or “UTM remitted.” File the approved form, payment proof, and correspondence together. Tick your month-end reconciliation to reflect the cleared entry. Maintain the records for the required retention period. If the owner contacts you later, direct them to the regulator with the submission reference.

Step 10: Handle special scenarios

- Unidentified deposits: If you cannot identify the owner after reasonable tracing, document each step with dates. Describe the most likely sources and why they were ruled out. Use the form once you have a defensible record that the owner cannot be identified.

- Deceased clients: If you learn the client has died, try to identify the personal representative. Contact them with proof of authority. If you cannot find one, document your searches and use the form.

- Dissolved corporations: Search corporate registries, reach out to last directors or the registered office. If no one responds, include registry evidence with your schedules and apply.

- Joint retainers: If multiple clients are entitled but some are unreachable, assess whether partial disbursement is possible and permitted. If not, document your efforts and use the form for the undisbursable share.

- Foreign currency: Convert to Canadian dollars if required and note the conversion details in your schedules. Keep the bank advice for your records.

- Separate interest-bearing trust: Include the interest calculation and account closure documents. Remit principal and interest together unless instructed otherwise.

Step 11: Avoid common errors

- Do not rely on a single outreach attempt. Use multiple methods and allow time between attempts. Do not net fees from undisbursable funds without clear written authority. Do not remit if a dispute exists. Do not submit without a trust ledger and reconciliation that match the amount. Do not forget to stop payment on stale cheques before you account for the balance. Do not remit pooled trust “interest,” because pooled interest is not the client’s property. Keep your statements aligned to facts you can prove.

Step 12: Keep a workable timeline

- Start your undisbursable review as part of monthly trust reconciliation. Flag balances that look dormant. Begin outreach early. If contact fails after repeated attempts, prepare the form and schedules. Build a 30–60 day internal timeline from first outreach to submission, allowing for reasonable follow-up. This keeps your trust accounts clean and your compliance strong.

- By following these steps, you can complete the Undisbursable Trust Money – For Client Matters Greater Than $50 Value form with confidence. You will meet your trust obligations, protect client rights, and keep your reconciliations tidy. Your future self—and your next trust audit—will thank you.

Legal Terms You Might Encounter

- Trust money means funds you hold for a client. You do not own the funds. You must follow trust rules and proper authorization. This form deals with trust money you cannot disburse.

- Undisbursable trust money means money you cannot pay out. You may not locate the client or an authorized payee. Or there is a dispute or missing direction. This form records and remits those funds over $50.

- Client matter file means the set of records for one legal matter. It includes retainer terms, invoices, and notes. It also includes the trust ledger and correspondence. You will cite this file to support your form.

- Trust ledger card means the detailed accounting for a single client matter. It shows money in, money out, and the balance. You use it to confirm the undisbursable amount. Attach excerpts to the form as proof.

- Residual balance means a small leftover trust amount after work concludes. It often results from rounding or fee adjustments. When over $50 and unclaimed, it becomes undisbursable trust money. This form addresses that situation.

- Disbursements means third‑party costs you pay for the client. Examples include filing fees or couriers. Do not confuse disbursements with fees for your time. Your form must state which part of the balance is which.

- Authorization and direction means written client permission to pay trust funds. It can be in a retainer or separate instruction. If you lack valid authorization, you cannot pay out. The form explains why you cannot disburse.

- Trust reconciliation means matching trust records to bank statements. You confirm each matter’s balance. You also resolve timing differences. You will rely on your latest reconciliation to verify the amount on the form.

- Interest on trust funds means any interest earned on the money. Some accounts credit interest to a central body. Others may accrue to the client. The form should state whether interest applies to the remitted amount.

- Unclaimed property remittance means transferring funds to an authorized holder. You remit when you cannot reach the client after proper efforts. The form documents those efforts and the final transfer. Keep proof for your records.

FAQs

Do you need to try to contact the client first?

Yes. Make reasonable, documented efforts before you complete this form. Use the last known address, email, and phone. Check alternate contacts and referral sources. Review your file for updated details. Keep a log of all attempts and dates.

Do you include interest in the amount?

Include any interest attributable to the client, if applicable. Confirm the treatment in your trust account setup. Recalculate interest through the remittance date. Show your calculation or attach the bank statement. Note the interest figure on the form.

Do you need to zero the trust ledger for the matter?

Yes, after remittance is confirmed and posted. Record the remittance as a trust withdrawal to the designated payee. Cross-reference the form and payment details. The matter ledger should then show a $0.00 trust balance.

Do you submit one form per client or per matter?

Complete one form per matter with an undisbursable balance. If a client has multiple matters, complete separate forms. Each matter must reconcile to its own ledger. This reduces errors and eases future tracing.

Do you need a partner or responsible lawyer’s signature?

A lawyer with trust signing authority should sign. Follow your firm’s internal policy for approvals. Many firms require two signatures for trust events. Record who reviewed and who signed. Keep the approval trail with the file.

Do you need to attach supporting documents?

Yes. Include the trust ledger, last reconciliation page, and client search log. Attach the retainer authorization or direction, if any. Include invoices and statements sent to the client. Add any returned mail or undeliverable notices.

How long does processing take?

Processing timelines vary. Budget a few weeks from submission to completion. Build in mailing and review time. Do not close your internal task until you confirm posting. Monitor for queries from the receiving authority.

What happens if the client returns later?

You still must pay the client their funds. Provide proof of identity and entitlement. Then seek reimbursement from the holder of the funds. Use your form reference number and remittance proof. Document the refund in your records.

Checklist: Before, During, and After the Undisbursable Trust Money – For Client Matters Greater Than $50 Value

Before signing

- Identify the matter and confirm the balance exceeds $50.

- Review the retainer for payout terms and directions.

- Confirm you have no outstanding invoices to issue or adjust.

- Complete a fresh trust reconciliation for the matter.

- Prepare a client search log with dates and methods.

- Gather the last known contact details and alternate contacts.

- Print the trust ledger and bank statement page showing the balance.

- Decide who will sign and who will review the form.

- Confirm whether interest applies and calculate it.

- Check if any third‑party lien or hold affects the funds.

- Verify the correct payee authority for remittance.

- Assign a file number and task owner for tracking.

During signing

- Verify the client’s full legal name and matter description.

- Confirm the trust account name and number on the form.

- Enter the exact undisbursable amount, including interest if applicable.

- State the reason the funds are undisbursable in plain terms.

- Describe your client search efforts with dates and results.

- List all attachments in the form’s attachment section.

- Confirm the remittance payee name matches the authority.

- Check the certification statements match your situation.

- Ensure the signing lawyer has trust signing authority.

- Date the form and initial any corrected entries.

- Obtain any required internal countersignature.

After signing

- Create a scanned PDF of the signed form and all attachments.

- Submit the form to the designated authority as required.

- If a payment must accompany, prepare and send it.

- Record the submission date, method, and reference number.

- Post the trust withdrawal to the matter ledger once accepted.

- Cross-reference the ledger entry to the form and payment.

- Confirm the matter trust balance shows $0.00.

- Update the monthly reconciliation with the withdrawal.

- Notify the supervising lawyer and accounting of completion.

- Send a final letter to the last known client address.

- Store the complete package in the matter file.

- Set a diary note for any follow‑up or audit checks.

Common Mistakes to Avoid

Using the wrong threshold

- Do not use this form for amounts of $50 or less. The process may differ. Using the wrong form can cause rejection. You may also delay your reconciliation.

Skipping a diligent client search

- Do not file without documented search efforts. You risk non‑compliance findings. The authority may return the form. You could face audit issues later.

Mixing multiple matters on one form

- Do not combine matters for one client. You increase the risk of errors. Tracing later becomes difficult. Keep one form per matter.

Deducting administrative fees without authority

- Do not net off fees from trust funds without consent. Unauthorized deductions breach trust rules. You may need to repay and report.

Omitting key attachments

- Do not forget the trust ledger, reconciliation page, and search log. Missing documents stall processing. Expect requests for more information. You lose time and audit clarity.

What to Do After Filling Out the Form

- Submit the form and any required payment to the designated authority. Use a trackable method. Keep proof of delivery and any reference numbers.

- Wait for confirmation of acceptance. Watch for questions and respond quickly. Do not post the trust withdrawal until acceptance is clear, if your policy requires that.

- Post the trust withdrawal to the matter ledger. Use the correct payee name and date. Add the form reference in the memo. Ensure the ledger shows a zero balance.

- Update your next monthly trust reconciliation. Match the withdrawal to the bank statement. Resolve any timing differences. File the reconciliation with this package.

- Notify internal stakeholders. Tell the responsible lawyer and accounting lead. Confirm the matter’s trust balance is closed. Decide whether to keep the matter open or close it.

- Send a final letter to the last known client address. State that you have remitted the undisbursable funds. Include the date and the authority you sent it to. Keep a copy with the file.

- If you discover an error, prepare an amendment. Correct the amount or client details as needed. Re‑send the revised form with a cover note. Update your ledger and reconciliation entries.

- If the client later appears, verify identity and entitlement. Provide a receipt when you pay them. Apply to the authority for reimbursement. Include your form and payment proof. Record the refund in your books.

- Archive the complete package. Include the signed form, attachments, proof of submission, and ledger entries. Store per your retention schedule. Tag the file for any future audit.

- Plan periodic reviews. Run a report of small residual balances. Clear them before they become undisbursable. Tighten your closing routine to prevent new residuals.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.