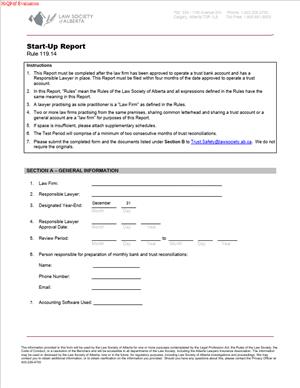

Start-Up Report

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is a Start-Up Report?

A Start-Up Report is a practical, closing-stage document that captures the facts at the start of occupancy or operations. You use it when you take possession of space or start a new facility, particularly under a lease or license. It records who the parties are, when possession happens, what work is complete, what remains, and what conditions you rely on to open safely and legally. It also lists the details that make the first weeks go smoothly: utility setup, access, keys, life-safety systems, contacts, and initial meter readings.

Think of it as your launch record. It does not replace your lease, construction contract, or permits. It sits beside them and captures the “day one” reality. It confirms key dates, notes deficiencies, and assigns responsibilities with target dates.

Who typically uses this form?

Commercial tenants, landlords, and property managers use it most. Business owners, franchisees, and head office teams rely on it to coordinate opening tasks. General contractors and trades contribute technical data on system start-up, like HVAC performance and fire alarm testing. In industrial or specialized spaces, commissioning agents provide test results and sign-offs. In multi-tenant properties, building operators use it to align building services with your occupancy.

Why would you need this form?

You need it to reduce risk at the start. It prevents disputes about when rent starts, what the landlord delivered, and what defects were present. It helps you prove the condition of the premises. It shows that safety systems were tested and that you had insurance in place. It also helps you get utility accounts active, set up access permissions, and brief your staff on emergency procedures. If your lender or insurer asks for proof of readiness, this report is your package.

Typical usage scenarios include

- You are taking possession of a retail unit. You need to confirm the possession date, list any punch-list items, and capture the status of signage and storefront work. You also need keys, alarm codes, and life-safety instructions.

- You are moving into an office floor. The landlord’s work is complete. Your fit-out is finished. You must verify commissioning data for HVAC, elevator access, and after-hours procedures, and record initial meter readings.

- You are opening an industrial bay with specialized equipment. You must document equipment start-up, lockout procedures, ventilation tests, and any outstanding items that affect safety or regulatory compliance.

- You are assuming a sublease. You want a clear record of the space condition, existing deficiencies, transfer of keys and fobs, and confirmation of the rent commencement date under the sublease.

- You are re-opening after a major renovation. You need to show that critical systems were re-tested, that updated drawings and manuals were delivered, and that any temporary measures were removed or made safe.

In Alberta, weather and seasonal conditions matter. The report helps you record heating performance in winter and cooling performance in summer. It also captures snow and ice responsibilities, loading dock procedures in cold weather, and any temporary heat used before permanent systems were online.

When Would You Use a Start-Up Report?

You use a Start-Up Report at the moment you transition from construction to operations or from a prior occupant to you. Most commonly, you complete it on or just before possession under a commercial lease. That moment triggers many obligations, including rent, operating costs, insurance, and security. A well-prepared report fixes the facts that trigger those obligations.

Use it when a landlord delivers premises under a lease that includes a fixturing period. During fixturing, you record when you actually got access, what base building work was complete, and what was still pending. If your rent starts after an opening condition is met, the report shows whether the condition was met on time. This avoids debates later.

Use it when a tenant improvement project wraps. The general contractor provides test results and manuals. You add those as schedules to the report. If you negotiated performance criteria for HVAC, water pressure, lighting levels, or power availability, the report records the results. If you negotiated a punch list, include it with target dates and who is responsible.

Use it when you take over a space from another user. A sublease, an assignment, or a temporary license often comes with unknowns. The report becomes your record of the starting condition. You can document existing wear and tear, note any items that do not comply with your head lease, and confirm the transfer of building access.

Use it when the landlord changes, or property management switches hands. You can reconfirm contacts, emergency procedures, and any outstanding items that were promised. This is useful in larger complexes where multiple teams handle operations.

Use it when you open a new site in a portfolio. Your head office may require a standard package at opening. The report provides consistency: contacts list, insurance certificates, permits, and safety information all in one place. It speeds onboarding of staff and reduces back-and-forth with the landlord.

Use it when your space contains regulated activities or equipment. You should record any required start-up checks, staff training dates, and system alarms tested. If you rely on ventilation, fire suppression, or backup power, the report captures test dates and results so you can prove readiness.

Typical users

- Tenants and landlords

- Authorized representatives

- Property managers coordinate the information flow.

- Contractors and consultants supply technical data for the schedules.

- Business owners or franchisees sign for the operational side.

Each plays a role, but the person who signs should be someone with authority to bind their organization.

Legal Characteristics of the Start-Up Report

Is a Start-Up Report legally binding? It can be, depending on how your lease or contract treats it. If your lease says the parties will sign a start-up or commencement certificate that confirms key dates, then the report is part of the bargain. By signing, you fix important facts, like possession, commencement of rent, and acceptance of the premises, subject to any listed deficiencies. Courts and arbitrators generally treat such signed acknowledgements as strong evidence of what happened at the start.

Even if your lease does not mention a Start-Up Report, a signed record still carries weight. It is a contemporaneous account of conditions and agreements. If it includes clear promises, deadlines, or allocations of responsibility, those terms can be enforceable as a separate agreement or as evidence of how the lease is applied. The key is clarity: who agreed to do what, by when, and on what terms.

What ensures enforceability?

Three things help. First, authority: the signatories must have authority to bind their organizations. Use full legal names and job titles. Second, consistency: the report must align with the lease and any construction contracts. If there is a conflict, state that the lease governs unless the parties intend to modify it. Third, specificity: list dates, meter readings, test results, and deficiency items with clear responsibility and target dates. Attach photos and mark them with dates and locations.

You should also include a statement about acceptance. You can accept the premises as-is, accept subject to listed deficiencies, or refuse acceptance until critical items are fixed. Use simple language. If something affects safety, occupancy, or your ability to open, say so and flag it as a precondition. If you accept subject to deficiencies, set a reasonable timeline for correction and a process for follow-up.

Include a non-waiver statement. This clarifies that signing the report does not waive rights under the lease except as clearly stated. If the lease requires notice to exercise certain rights, follow those notice rules as well.

Consider privacy. The report often includes personal contact information for staff and contractors. Limit it to what is necessary for operations and emergencies. Store the completed report securely. Share it only with those who need it.

Digital signatures are acceptable if your lease allows electronic execution or if both parties agree. Use a system that records the date and identity of the signer. Keep a copy of the executed document and all schedules. Number the pages and initial them if you sign on paper. Date-stamp photos and test reports.

Finally, remember scope. A Start-Up Report is not a substitute for professional inspection, certified test reports, or permits. Use it to collect and reference those documents, not to replace them. If the lease or regulations require a dedicated certificate or approval, attach it as a schedule and identify it clearly.

How to Fill Out a Start-Up Report

Follow these steps. Keep your sentences short and your facts exact. If a section does not apply, write “Not applicable” and explain why.

1) Title and header

- Use the title “Start-Up Report.”

- Add the property name and address.

- State the jurisdiction as Alberta, Canada.

- Add the report date and the intended possession or start date.

2) Parties and roles

- List the full legal name of the landlord and the tenant.

- Include addresses for notice, email, and phone numbers.

- Identify the property manager and building operator, if different.

- State roles: landlord, tenant, property manager, contractor, commissioning agent.

- Confirm each signatory’s authority and title.

3) Lease or agreement reference

- Cite the lease or license date and any amendments.

- Include the unit number, floor, and rentable area if relevant.

- State the intended use of the premises.

- If this is a sublease or assignment, reference the head lease and the transfer document.

4) Purpose and scope

- Write a short purpose statement. Example: “This report records possession, condition, and readiness for operations, and lists any outstanding items.”

- Confirm whether this report will set the rent commencement date or other trigger dates.

5) Key dates

- Record the access date for measurements and fixturing.

- Record the possession date.

- Record the rent commencement date (if confirmed) or the condition that will trigger it.

- Record the opening date if known.

- If there are delays, state the cause and the new target dates.

6) Conditions precedent and deliverables

- Confirm that required insurance is in place. Attach a certificate that meets the lease requirements.

- Confirm that the security deposit or other financial assurance is delivered.

- Confirm applicable permits or approvals are issued. List permit numbers if permitted by your internal policy.

- If any critical document is outstanding, list it and set a target date.

7) Premises condition

- Describe the space at possession. Note finishes, cleanliness, and any visible damage.

- Record the condition of floors, walls, ceilings, storefront, doors, and windows.

- Note any water ingress, leaks, or moisture concerns.

- Attach dated photos. Label each with location and description.

- If the premises are delivered “as-is,” state that. If delivered “turnkey,” list the delivered features.

8) Deficiency list and responsibility

- List each deficiency as a separate line. Describe it clearly.

- Assign responsibility to landlord, tenant, or contractor.

- Set a target completion date for each item.

- If a deficiency affects safety or opening, mark it as critical.

- Include a process for access and scheduling to fix items. Example: “Repairs scheduled outside business hours with 48 hours’ notice.”

9) Base building systems start-up

- HVAC: record air temperature and airflow readings at representative points. Confirm controls and thermostats function.

- Electrical: confirm panel labeling, breaker capacity, and available power at main disconnects.

- Plumbing: confirm hot water availability and fixture operation.

- Life-safety: confirm fire alarm devices, pull stations, and annunciation tested. Record test dates and who attended.

- Fire suppression: confirm sprinkler visual inspection, valve positions, and main drain test if performed.

- Elevators (if applicable): confirm floor access, card reader programming, and call buttons function.

- Record any alarms, faults, or pending re-tests. Attach the test reports.

10) Utilities and meters

- List utility services applicable to the space.

- Record initial meter readings with date and time.

- Confirm that utility accounts are set up in the correct name.

- Note any shared meters and the method of allocation.

- If sub-metering is used, record meter IDs and reading method.

11) Access and security

- List keys, fobs, and access cards issued. Provide numbers or codes where safe to do so.

- Record alarm codes, monitoring setup, and any temporary bypasses.

- Describe loading dock procedures and hours.

- Record after-hours access policies and contacts for emergencies.

- Note any security cameras or systems handed over or installed.

12) Cleaning and waste

- Confirm initial cleaning completion or schedule.

- Record waste and recycling procedures, bin locations, and collection days.

- Note any hazardous waste or special disposal needs related to your operations.

13) Tenant improvements and manuals

- Summarize tenant improvements completed.

- Attach as-built drawings, specifications, and operation manuals.

- Include maintenance requirements for installed equipment.

- Identify warranty periods and contact points for warranty calls.

14) Health, safety, and orientation

- Record that an on-site safety orientation was completed.

- List emergency exits, muster points, and fire warden roles.

- Confirm lockout procedures for equipment where applicable.

- Note any training delivered to staff before opening.

15) Insurance and risk

- List insurance coverages maintained by each party as required by the lease.

- Confirm that certificates name the required parties as additional insured, if required.

- Record policy periods and renewal dates.

- Note any special risk controls (e.g., temporary heaters, water sensors) in place at opening.

16) Environmental and indoor conditions

- Record indoor temperature and humidity at handover, if relevant to your use.

- Note any environmental testing performed or pending.

- If there were previous spills or remediation, reference the report in a schedule.

17) Contacts and notices

- Provide a contact list for daily operations, emergencies, and maintenance.

- Include names, roles, phone numbers, and emails for both parties.

- Add vendor contacts for critical systems (HVAC, alarms, elevators).

- Confirm the process for routine service calls and after-hours emergencies.

18) Financial triggers and adjustments

- Confirm base rent, operating costs, and any opening abatements as per the lease.

- Note any prorations for partial months and how they will be calculated.

- If rent starts on a condition, restate the condition and method for confirming satisfaction.

19) Schedules and attachments

- Schedule A: Photos of premises condition.

- Schedule B: Deficiency list with target dates and responsibility.

- Schedule C: Test reports and commissioning data.

- Schedule D: Insurance certificates.

- Schedule E: As-built drawings and manuals.

- Schedule F: Contact list and emergency procedures.

- Number each page of each schedule. Reference them in the body of the report.

20) Declarations and acknowledgements

- Include a clear statement of acceptance. Choose one:

- Accepted as-is.

- Accepted subject to listed deficiencies.

- Not accepted pending correction of critical items listed.

- State that the report does not waive rights under the lease unless expressly stated.

- If this report sets the rent commencement date, state it clearly and unambiguously.

21) Signatures

- Provide signature blocks for authorized representatives of landlord and tenant.

- Include printed names, titles, and the date of signature.

- Provide a signature line for the property manager if they are a party to operational obligations.

- If you use electronic signatures, include a statement that electronic signatures are acceptable and binding.

22) Distribution and retention

- State who receives a copy: landlord, tenant, property manager, contractor if relevant.

- Store the executed report with your lease and project records.

- Calendar follow-up dates for deficiencies and re-tests. Assign an owner for tracking.

Practical tips

- Be precise with dates and times. Possession at 9:00 a.m. is different from possession at 5:00 p.m.

- Use photos to avoid arguments. Take them from multiple angles. Include close-ups for defects. Add a simple label: location, description, date.

- Separate “cosmetic” items from “critical” items. Critical items affect safety, compliance, or the ability to open. Cosmetic items do not stop occupancy but still deserve a target date.

- Align language with your lease. If your lease uses “Commencement Date,” use the same term in the report.

- Do not assume responsibilities. If there is any doubt who fixes an item, state “Responsibility to be determined” and escalate to the lease administrators for a quick decision.

- Keep the report readable. Short sentences and clear headings help non-technical readers understand.

- Confirm authority before signing. If your signer lacks authority, you risk disputes later.

- Share drafts in advance. Circulate a draft report to the other side and to contractors before the walk-through. That speeds consensus on facts.

- Close the loop. After signing, track deficiencies to closure. Issue a brief follow-up memo when all items are complete. Attach it to the report.

By following these steps, you create a Start-Up Report that is clear, complete, and usable. You will have a reliable record for Alberta conditions, protect your position under the lease, and support a smooth opening.

Legal Terms You Might Encounter

- Incorporator means the person who formed the company. You include the incorporator only if the form asks for formation details. If it does, match the incorporator’s legal name to your formation documents. Do not switch to a business name here.

- Registered office is the official physical address of your company. Couriers and government mail must be able to reach it. Many Start-Up Reports ask for a street address, not a P.O. box. Use an address where someone can receive documents during business hours.

- Records address is where you keep minute books and registers. Some forms split this from the registered office. If your records sit with an external service provider, list that address if allowed. If they sit at your office, repeat the registered office.

- Mailing address is where you receive mail. It can be a P.O. box if the form allows it. If the form shows both registered office and mailing address, enter both. Keep them consistent with your internal records to avoid missed notices.

- Director is a person on the board with legal oversight duties. The Start-Up Report often asks for full legal names and residential addresses for each director. Confirm director consent before you list anyone. If the form requires effective dates, enter them for each director.

- Officer is someone appointed by the board to manage daily operations. Titles may include CEO, President, or Treasurer. Some forms ask for officers, some do not. Only include officers if the form requests them. Use exact titles as set in your board resolutions.

- Shareholder is a person or entity that owns shares. The Start-Up Report may ask you to list shareholders or confirm share issuance. If it does, report the number of shares issued to each shareholder. Use legal names that match your subscription agreements.

- Share class defines a category of shares with specific rights. Common examples are voting and non-voting shares. The Start-Up Report may ask you to describe each class or confirm authorized classes. Use the same names and rights language used in your articles.

- Authorized shares are the maximum shares your company can issue under its articles. Issued shares are the shares you have actually given to shareholders. The Start-Up Report may ask for one, both, or neither. If asked, align these figures with your corporate registers.

- Beneficial owner is the person who truly owns or controls shares, even if another name appears on the register. Some forms ask for beneficial ownership details. If this form does, gather accurate information and verify it with each registered holder.

- Effective date is the date your change or confirmation takes effect. The Start-Up Report may let you select a past, present, or future date. Use a date that matches your resolutions and other filings. A wrong date can create gaps in your records.

- Resolution is a formal board or shareholder decision. You rely on resolutions to appoint directors, issue shares, or set officers. While the Start-Up Report collects the facts, resolutions prove authority. Keep copies with your minute book in case of an audit.

- Attestation means you confirm the information is true. The Start-Up Report will often include a declaration or certification section. Read it carefully. Once you attest, you accept responsibility for accuracy.

- Agent or authorized filer is the person you allow to prepare and submit the form. This can be a director, officer, or service provider. If the Start-Up Report asks for the filer’s details, confirm they have authority to act for the company.

- Correction or amendment refers to a change you file after you submit the Start-Up Report. If you discover an error, use the proper amendment process. Do not create conflicting records. Your corporate registry should show one clear, current picture of your company.

FAQs

Do you need to list your home address as a director?

You may need to list a residential address if the form requires it. Some forms accept a service address. If a residential address is required, use your true home address. Avoid using a P.O. box if the form forbids it. If privacy is a concern, explore if a service address is allowed before filing.

Do you need to issue shares before you file the Start-Up Report?

You should align the Start-Up Report with your corporate records. If the form asks for share issuance details, record issued shares accurately. If you have not issued shares yet, state that no shares are issued. Then update the registry when you complete the first issuance.

Do you need consent from directors before listing them?

Yes. You need each director’s consent to act. Confirm consent in writing. Some forms require you to certify that each director has consented. Keep the consent with your minute book. Do not list a director who has not agreed to serve.

Do you need to attach your articles or resolutions?

The Start-Up Report usually does not require full attachments unless it says so. It may, however, require schedules or addenda for extra directors or share details. If you need more space, follow the form’s attachment rules. Label each attachment clearly and reference the correct section.

Do you need wet ink signatures, or are digital signatures allowed?

Check the signature section of the form. Many registries accept digital signatures or electronic submissions. If an original signature is required, sign in ink and keep the original on file. When in doubt, follow the form’s instructions exactly.

Do you need to update banks and tax accounts after filing?

Yes. Your bank, tax authorities, and key vendors may rely on this data. After filing, share relevant updates with them. Provide a copy of the filing confirmation if requested. This avoids account holds or mismatched records.

Do you have to list beneficial owners?

If the form asks for beneficial ownership, you must provide accurate details. If it does not, you still need to maintain internal ownership records. Beneficial ownership tracking supports due diligence, audits, and certain regulatory disclosures.

Do you need to refile if you make a mistake after submission?

If you spot an error, submit a correction or amendment as the form allows. Do this as soon as possible. Keep a clear paper trail with corrected dates. Update your minute book and registers to match the amended filing.

Checklist: Before, During, and After the Start-Up Report

Before signing: gather information and documents

- Legal name of the company, exactly as formed.

- Corporate identifier or number, if issued.

- Formation date and jurisdiction of formation.

- Registered office address (physical street address).

- Records address, if different from registered office.

- Mailing address, if different from registered office.

- Full legal names of directors, with residential addresses.

- Officer titles and names, if requested by the form.

- Share classes authorized in the articles, with rights.

- Issued shares by shareholder, if already issued.

- Shareholder legal names and contact details, if required.

- Beneficial ownership details, if the form asks for them.

- Effective date for the report or changes.

- Board and shareholder resolutions supporting appointments and issuances.

- Director consents to act, signed and dated.

- Any required schedules or addenda for extra entries.

- Your minute book and registers for cross-checking.

- Formation documents to verify names and share terms.

- Payment method for filing fees.

- Government-issued ID if identity verification is needed.

- Authority proof for your filer or agent, if applicable.

During signing: verify entries and authority

- Confirm the legal name matches formation documents.

- Check the corporate number and formation date.

- Verify the registered office is a physical address.

- Confirm records and mailing addresses are correct.

- Ensure each director’s legal name and residential address are exact.

- Confirm director consents are on file and current.

- Review officer titles and dates against resolutions.

- Match share classes to the articles verbatim.

- Align issued share numbers with your securities register.

- Confirm shareholder names match subscription agreements.

- Verify any beneficial ownership details are precise.

- Check the effective date is correct and supported.

- Attach all required schedules in the right format.

- Review the attestation or declaration wording carefully.

- Confirm the signer’s authority and title.

- Ensure all dates and signatures are consistent.

- Remove placeholders, drafts, and internal notes.

- Proofread for spelling errors in names and addresses.

- Save a locked PDF copy before submission.

After signing: file, notify, store

- File the form through the accepted submission channel.

- Pay the filing fee and obtain a receipt.

- Download or request the stamped or confirmed copy.

- Calendar any follow-up or renewal deadlines.

- Update your minute book with the filed report.

- Update the register of directors and officers.

- Update the securities register and share ledgers.

- Prepare and issue share certificates, if applicable.

- Send copies to directors and officers for their records.

- Provide a copy to your accountant for tax setup.

- Inform your bank of any changes to directors or addresses.

- Notify key vendors, insurers, and your landlord if needed.

- Update your website, letterhead, and invoice footer addresses.

- Store the filing confirmation in secure, backed-up storage.

- Set reminders for future change filings and annual updates.

Common Mistakes to Avoid

- Using a P.O. box for the registered office

- Don’t forget a physical address is usually required for the registered office. Using a P.O. box can trigger a rejection. It can also delay bank setups and service of legal documents.

- Listing nicknames or trade names instead of legal names

- Use full legal names for the company, directors, and shareholders. Nicknames and shortened names cause identity issues. They can lead to mismatches with banks and registries.

- Mismatching share details with your articles and registers

- Align share classes, rights, and issued numbers with your articles and securities register. Inaccurate share data can cause compliance problems. It can also derail deals and financing.

- Forgetting director consent or wrong director addresses

- Get written consent from each director. Use true residential addresses when required. Missing consents or wrong addresses can invalidate filings. They may lead to penalties or rejections.

- Choosing the wrong effective date

- Make the effective date match your resolutions and business needs. A wrong date can create gaps in board authority. It can also confuse banks and tax accounts.

- Leaving out required schedules or attachments

- If you need extra space for directors or shareholders, attach the required schedules. Missing attachments can delay approval. You may need to refile and pay again.

What to Do After Filling Out the Form

- File the Start-Up Report promptly. Use the accepted channel and pay the fee. Keep the confirmation number and receipt.

- Update your corporate records the same day. Place the filed report in the minute book. Update the register of directors and officers. Update the securities register to mirror the filing.

- Record board and shareholder approvals. Keep minutes and resolutions supporting each change. If you issued shares, prepare certificates and delivery receipts. Log certificate numbers in your register.

- Notify key third parties. Share the confirmed filing with your bank, accountant, and insurer. Update addresses with tax authorities. Notify your landlord and major vendors if your address or signing authority changed.

- Align internal systems. Update your invoicing header, purchase orders, and email signatures with the correct address. Check that contract templates show the right corporate name and details.

- Set compliance reminders. Calendar future change filings and annual updates. Track director terms and officer changes. Review the registered office address at least quarterly.

- Correct any errors fast. If you spot a mistake, file an amendment as the form allows. Update your minute book and registers to match the correction. Share the amended filing with affected third parties.

- Plan for future changes. When you appoint or remove a director, update the registry quickly. When you issue new shares, confirm the reporting impact. Keep your corporate snapshot current at all times.

- Distribute the final documents. Send copies to directors, officers, and key shareholders. Provide a copy to your accountant for year-end work. Keep a signed, time-stamped version in secure storage.

- Review privacy and access. Know who can access the registered office and records. Limit access to authorized staff. Set a process to handle official mail and service of documents.

- Prepare for transactions. Lenders and buyers will ask for proof of current status. A clean, consistent Start-Up Report supports due diligence. It reduces closing delays and requests for corrections.

- Conduct a quarterly check. Compare registry data to your minute book and registers. Confirm the addresses, directors, and share details still match. Fix gaps before they cause issues.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.