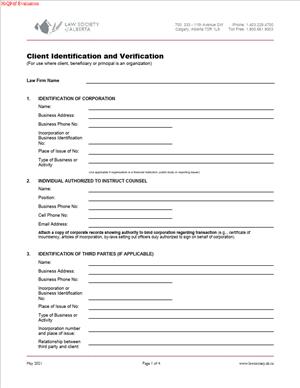

Client Identification and Verification – Organizations

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is a Client Identification and Verification – Organizations?

This form collects and confirms key details about your organization. Law firms use it to identify who you are and verify that your organization exists. It also records who is giving instructions and who owns or controls the organization. The goal is to meet professional rules and prevent unlawful activity. It protects both you and the firm.

You will see two linked parts in this process. Identification collects basic information about your organization at the start of a retainer. Verification confirms that information when the firm handles funds for you. Verification uses reliable documents or data to prove your organization exists. For organizations, it may also confirm the identity of the person who gives instructions during a transaction.

Who typically uses this form?

Lawyers, paralegals, and legal staff use it at intake. Corporate clients, partnerships, trusts, and non-profits complete it. The person who fills it out is often a director, officer, partner, trustee, or a senior manager. In-house counsel may also complete it. The firm may also ask your accountant or corporate agent for records you authorize.

You would need this form any time you retain a law firm in Alberta. If you only need advice and no funds change hands, the firm must still identify you. If funds will be received, paid, or transferred, the firm must also verify your details. This includes most real estate, corporate finance, and settlement matters. It also covers trust account deposits, wire transfers, and payment of sale proceeds.

Typical usage

- Corporate purchases or sales.

- You will complete the form before a share purchase closes.

- You will do the same before a loan advance or a new credit facility.

- In real estate deals, you complete it before deposits or payouts move.

- In litigation, you complete it before the firm receives settlement funds.

- For a trust or non-profit, you complete it at formation or first retainer, and then update it for any later funds movement.

The form becomes part of the firm’s client record. It supports conflict checks, matter setup, and risk management.

The form asks for your legal name, business address, and formation details. It asks for your incorporation number or registration number. It records your jurisdiction of formation and date of formation. It asks what you do as a business and why you hired the firm. It asks who gives instructions and confirms that person’s authority. It also seeks beneficial ownership details. That includes the people who own or control 25% or more of the organization, or who otherwise control it. If no one meets the threshold, it records your senior managing official. It also records the source and purpose of funds for relevant matters.

This is not a marketing exercise. It is a regulatory requirement. The firm cannot proceed without this information. If the form is incomplete, the firm may pause your file. If information changes later, the firm must update its records. You may be asked to confirm details more than once, especially for long matters.

When Would You Use a Client Identification and Verification – Organizations?

You use this form at the start of any new engagement. The firm must identify your organization before it provides legal services. You complete the identification part even if no funds will move. You provide your legal name, business address, formation details, and nature of business. You also name the person who will give instructions.

You use the verification part when funds are involved. This includes receiving, paying, or transferring money related to your matter. Examples include a wire transfer of purchase price, a deposit into trust, or payment of loan proceeds. Verification must occur before or at the time of the transaction. The firm must confirm your organization’s existence using reliable records. The firm may also verify the identity of the person instructing on the funds. If only professional fees and disbursements are paid, full verification may not be required. The firm will still identify you.

Corporate users include private corporations and their subsidiaries. This arises in share deals, asset deals, and corporate reorganizations. You complete the form before closing payments are sent or received. Partnerships use it for partner buy-ins, capital calls, and distributions. Trusts use it before receiving settled funds or making payouts. Non-profits use it before grant funds are received or disbursed. Professional corporations use it before handling retainers or settlements.

If you are a landlord receiving deposits through the firm, you use the form. If you are a tenant wiring rent abatements, you use it. If you are a developer receiving purchaser deposits, you use it. If you are a lender funding a loan, you use it. If you are a borrower giving security and receiving funds, you use it. If you are a vendor receiving sale proceeds, you use it. If you are a plaintiff receiving settlement money, you use it. If you are a defendant paying settlement money through trust, you use it.

In-house counsel often completes the form for multi-entity groups. Each entity that is a client must be identified. Each entity that will handle funds must be verified. If you have a standing retainer, the firm may rely on prior records. It will still confirm that no details have changed. If beneficial owners change, you must update the form. The form may be refreshed each year for ongoing matters.

Remote matters need this form too. If you are outside Alberta, verification can be done at a distance. The firm may use video verification or a local agent. You still need to provide formation documents and ownership details. Timelines matter. Build in time to collect corporate records and ownership charts.

Legal Characteristics of the Client Identification and Verification – Organizations

This form is part of the firm’s regulatory compliance. It is not a contract for legal services. It does not replace a retainer agreement. It supports the firm’s duty to know its clients and manage risk. The firm must complete this process to comply with professional rules. These rules apply to every Alberta law firm. They require identification for all clients and verification for financial transactions.

Is it legally binding? The form records statements of fact. You sign to confirm the information is true and complete. Your signature or certification carries legal effect. False statements may lead to consequences. The firm relies on your declarations to proceed with transactions. If you fail to provide accurate information, the firm may withdraw. The firm may also report as required by professional obligations.

What ensures enforceability?

The firm’s policies align with binding professional rules. Lawyers must maintain records and follow set procedures. They must verify when handling funds, subject to narrow exceptions. They must keep records for a set period after the matter ends. They must monitor for changes. They must pause or stop work if they cannot comply. These obligations are enforced by regulators. Audits and practice reviews test compliance.

General legal considerations apply. The firm will collect, use, and protect your information under privacy laws. The form will explain how the firm handles your data. It will state why the information is collected. It will state where it is stored and for how long. It will state who may access it within the firm. It may also state when information may be shared. Examples include audits, conflict checks, or legal requirements. You may be asked to consent to electronic verification methods. You may be asked to permit the firm to get records from public registries.

The firm must take reasonable steps to confirm beneficial ownership. This may include reviewing share registers or agreements. It may include asking for an organizational chart. It may include confirming voting control. If the firm cannot confirm beneficial owners, it must record what it tried. It must also record the source of the information you provided. The firm may then record the senior managing official.

The firm must confirm the authority of the person giving instructions. A corporate title alone may not be enough. The firm may ask for a resolution or a certificate of incumbency. It may ask for a letter from your corporate secretary. It may ask for trust or partnership documents showing authority. If the person changes, the firm will update the record and verify the new person if needed.

Sensitive situations need extra care. Complex ownership through holding companies must be unpacked. Foreign ownership may need translations or certified records. Urgent closings still require verification. The firm cannot skip mandatory steps. Build this work into your timeline. Early preparation prevents closing delays.

How to Fill Out a Client Identification and Verification – Organizations

Step 1: Confirm the client type

- State the legal form of your organization. Choose corporation, partnership, trust, or unincorporated association. If you are a non-profit or professional corporation, indicate that. Identify any parent entity if you are a subsidiary. If you operate under a trade name, list it as well.

Step 2: Provide the full legal name and addresses

- Enter the exact legal name as shown in formation documents. Include any French or numbered elements. Provide your head office address. Provide your principal place of business if different. Include mailing address if mail is sent elsewhere. Use a physical address, not only a P.O. Box.

Step 3: Give formation and registration details

- Provide the jurisdiction of formation. State the date of incorporation or formation. Provide the incorporation or registration number. If extra-provincially registered, list those registrations. If you recently continued or amalgamated, note the date.

Step 4: Describe the nature of business

- Describe what your organization does in plain terms. Keep it specific enough to understand risk. For example, “residential homebuilding,” not “construction.” If you have multiple lines, list the main ones. If you are pre-revenue, describe the planned activity.

Step 5: Explain the purpose of the retainer

- State why you hired the firm. For example, “purchase of commercial property,” or “Series A financing.” Mention expected funds flow if known. This helps the firm plan verification steps. It also supports conflict and risk screening.

Step 6: Identify the instructing individual

- Provide the name and title of the person giving instructions. Include direct contact details and business email. Describe their role and relationship to the client. Confirm they have authority to bind the organization. If needed, attach a resolution or certificate.

Step 7: Verify the existence of the organization

- Provide one or more reliable records. A certificate of status is preferred for corporations. A current corporate profile from a public registry also works. For partnerships, provide the partnership agreement or registration. For trusts, provide the trust deed or an extract showing key terms. For unincorporated bodies, provide a constitution or similar record. If documents are not in English, provide a translation. The firm will record document names, dates, and issuers.

Step 8: List directors, officers, or trustees

- Provide the current directors and officers for corporations. For trusts, provide the trustees and the settlor’s name. For partnerships, list the partners and the managing partner. Include business addresses and titles. Attach a current register if available.

Step 9: Disclose beneficial ownership and control

- Identify individuals who own or control 25% or more. This can be direct or through other entities. List each person’s full name, address, and occupation. State the percentage owned or the control method. If no one meets the threshold, identify the senior managing official. If ownership is through layers, attach an organizational chart. If you cannot obtain full details, explain why and what you did to try.

Step 10: Determine if a third party is involved

- Answer whether anyone else directs the transaction. This includes a lender, a private investor, or a silent partner. If yes, name the third party and explain their role. Provide their address and relationship to you. The firm will assess if more checks are needed.

Step 11: Describe the source and purpose of funds

- Explain where transaction funds come from. Use a high-level description, not account numbers. For example, “operating cash,” “bank loan,” or “sale proceeds.” Explain why the funds are moving. For example, “purchase price for asset acquisition.” This helps the firm meet verification rules.

Step 12: Verify the identity of the instructing individual (when required)

- If funds will be received, paid, or transferred, this step applies. The instructing person must verify their identity. They can present government-issued photo ID in person. Remote options may also be available. The firm may use an electronic method or a local agent. The firm will record the method used and details. For ID, the firm records document type, number, issuer, and expiry. For electronic methods, the firm records the data sources used. Expired ID is not acceptable for verification.

Step 13: Provide evidence of authority to act

- Attach proof that the instructing person has authority. Acceptable proof includes board resolutions or officer certificates. For partnerships, attach an authority clause or resolution. For trusts, attach trustee authority provisions. If authority is clear in formation documents, note the section.

Step 14: Add contact information for key people

- Provide contacts for finance and legal teams. Include names, titles, emails, and phone numbers. These contacts help with wire instructions and closings. They also help with follow-up questions on ownership.

Step 15: Attach supporting schedules

- Attach a certificate of status or public registry printout. Attach your share register or a cap table. Attach an organizational chart if ownership is layered. Attach partnership or trust documents as needed. Attach any resolutions or certificates of incumbency. Label each attachment clearly. Cross-reference attachments in the form.

Step 16: Review exceptions with the firm

- Ask whether your transaction fits an exception. If only professional fees are paid, full verification may not be needed. If funds come from a highly regulated institution, fewer steps may apply. The firm will decide which rules apply. Do not assume an exception without confirmation.

Step 17: Confirm accuracy and completeness

- Read the entire form before signing. Check names, numbers, and dates. Confirm that ownership and control details are current. Confirm that all attachments are included. Correct any typos or inconsistencies. Initial any manual changes if required.

Step 18: Sign and date the certification

- An authorized signing officer should sign the form. Include the printed name and title. Date the form and note the location of signing. If you sign electronically, follow the firm’s method. The certification confirms the information is true and complete.

Step 19: Provide consent for verification methods

- You may be asked to consent to electronic verification. You may be asked to permit the firm to obtain public records. If a local agent will verify identity, consent to share data as needed. Confirm that you understand how your information will be used.

Step 20: Return the form securely

- Send the form and attachments using a secure method. Use the firm’s portal if offered. Avoid sending identification by unsecured email. Ask for confirmation of receipt. Keep your own copy in a secure folder.

Step 21: Respond to follow-up requests

- Be ready to answer clarification questions. The firm may need an updated registry profile. It may need a newer certificate of status. It may need extra details on an owner or controller. Prompt responses prevent closing delays.

Step 22: Update the firm if information changes

- Notify the firm if your ownership changes. Notify the firm if directors or officers change. Notify the firm if your instructing person changes. For long matters, the firm may request periodic updates. Provide updates before any new funds movement.

Step 23: Keep your internal records aligned

- Ensure your share register matches what you provided. Ensure your corporate minute book is current. Ensure your partnership or trust records are current. Align your internal records before closings. This reduces verification issues.

Step 24: Plan for timing

- Collect documents early in the matter. Request registry documents before deadlines. Allow time for translations if needed. Schedule identity verification well before closing. Build this into your transaction checklist.

Step 25: Ask for help if unsure

- If a question is unclear, ask the firm. The rules are precise, but the process is practical. The firm can suggest acceptable documents. It can also coordinate with your other advisors. Clear communication saves time and cost.

By following these steps, you complete the form accurately and on time. You set the file up for smooth closings. You also meet your own governance standards. Most of the work is gathering reliable documents. Once those are in place, updates are easy.

Legal Terms You Might Encounter

- Organization means any non-individual client. It includes corporations, partnerships, trusts, societies, and associations. On this form, you confirm the type of organization and its legal name. You also record how it was created, and who controls it. This sets the scope for all other sections.

- Beneficial owner means the real people who own or control the organization. They may own shares, hold voting rights, or exercise control through other means. On this form, you list each beneficial owner and explain how they control the organization. If no single person qualifies, you record senior managers instead.

- Directing mind means a person who makes key decisions for the organization. They can bind the organization through their actions. On this form, you identify any directing minds. This helps you understand who gives lawful instructions and who you must vet for risk.

- Authorized signatory means the individual who signs the form on the organization’s behalf. They must have authority to instruct your firm. On this form, you record how this person gets their authority. You may also need proof, such as a resolution or letter of authorization.

- Constituting documents means the paperwork that creates and governs the organization. For a corporation, this includes formation documents and current bylaws. For a partnership or trust, this includes the agreement or deed. On this form, you note which documents you reviewed. You also record key details, such as dates and registration numbers.

- Registered office and principal place of business are two different addresses. The registered office is the legal address on public records. The principal place of business is where operations occur. On this form, you record both, if they differ. This helps confirm identity and avoids confusion in notices or billing.

- Politically exposed person (PEP) and international organization head refer to people with prominent public roles. Family members and close associates may also fall in scope. On this form, you ask if any beneficial owner, director, or signatory is a PEP or similar. If yes, your firm may need more checks and approvals.

- Third-party determination asks if the organization acts for someone else. This may include agents, nominees, or intermediaries. On this form, you confirm whether the client is instructing for another party. If yes, you identify that party and explain the relationship. This helps avoid hidden interests.

- Verification method describes how you confirm identity. Documentary methods use reliable records, such as government IDs and formation papers. Non-documentary methods use independent data or corroboration. On this form, you state which method you used and why. You also keep copies or references to what you relied on.

- Ongoing monitoring means you keep client records current. It is not a one-time exercise. On this form, you set the review triggers and next review date. You also state which changes will require an update. This keeps your file accurate over the life of the matter.

FAQs

Do you need to verify every director?

You must identify the organization and its key people. This usually includes directors for corporations. You also identify beneficial owners and the authorized signatory. You verify the identity of the signatory and anyone else your policy requires. You do not always verify every director’s identity. Focus on those who instruct you and those who own or control the client.

Do you accept digital scans or photos of ID?

Yes, if they are clear, current, and readable. Your firm may also require a live video call to match the person to the ID. If the scan is unclear, ask for a better copy or use another method. Always record how you verified identity and what you relied on. Keep copies in the client file.

Do you need to meet the client in person?

Not always. You can often verify identity remotely with extra steps. This may include a video call and additional documents. It may also require two independent sources. Follow your firm’s policy for remote verification. Note the method used and why you chose it. Keep a record of the call if your policy requires it.

What if no one meets the beneficial ownership threshold?

Record that no single person qualifies as a beneficial owner. Then identify the organization’s senior management. List their names and roles. Note the basis for your conclusion. Keep any ownership charts or explanations that support your analysis. Ensure the signatory still has authority to instruct you.

What if the organization is a partnership or trust?

Collect and review the partnership agreement or trust deed. Identify the partners or trustees and anyone who controls decisions. Identify the beneficiaries if required by your policy. Verify the identity of the signatory and other key people. Record the nature of the business and the purpose of the retainer. Keep copies of the governing documents.

Do you need to re-verify for each new matter?

You need to confirm that the information is still current. If nothing has changed, you can note the confirmation in the new matter file. If something has changed, update the form and re-verify as needed. Set a review date and follow your firm’s refresh cycle. Do not assume last year’s records are still valid.

What if the signatory refuses to provide ID?

Explain that verification is mandatory for onboarding. Offer remote options that meet your policy. If they still refuse, escalate to a supervisor. You may not be able to open the file or accept funds. Record the refusal and the steps you took. Protect your firm by following your policy strictly.

How long does the process take?

It can be fast if the documents are ready. Many files complete in under an hour. Complex ownership or remote verification can take longer. Delays often come from missing documents or unclear authority. Set expectations with the client early. Provide a short list of required documents to speed things up.

Checklist: Before, During, and After the Client Identification and Verification – Organizations

Before signing

- Legal name of the organization, exactly as registered.

- Alternate names, trade names, and former names.

- Formation documents and any amendments.

- Current bylaws or governing agreement, if applicable.

- Registration or business numbers, if any.

- Registered office and principal place of business.

- Organizational chart or ownership description.

- List of directors, partners, trustees, or equivalent.

- List of beneficial owners and their control basis.

- Authorized signatory’s full name and title.

- Proof of the signatory’s authority to instruct.

- Clear, current ID for the signatory.

- IDs for other individuals, if policy requires.

- Nature of business and purpose of the retainer.

- Expected types of work and key jurisdictions involved.

- Whether the client acts for a third party.

- Whether any key person is a PEP or similar.

- Source of funds for retainers or deposits, if relevant.

- Reliable source to confirm existence of the organization.

- Contact details for verification follow-ups.

During signing

- Confirm the legal name matches the constituting documents.

- Confirm registration numbers match supporting records.

- Match addresses to documents or reliable sources.

- Review the authority of the signatory. Capture proof.

- Verify the signatory’s identity using your approved method.

- Record beneficial ownership and control clearly.

- Note any gaps in information and how you will close them.

- Complete the third-party determination fully.

- Document the purpose of the retainer in plain language.

- Assess risk factors and note any enhanced steps taken.

- Record the verification method and date.

- Ensure signatures and dates are on all required pages.

- Initial any corrections. Avoid blanks or strikeouts.

- Add your name, role, and time of review.

- If using remote verification, record the process used.

After signing

- Save the form and all supporting documents to the client file.

- Store ID images and verification evidence securely.

- Restrict access to those who need it.

- Calendar a review or refresh date per firm policy.

- Notify intake, the responsible lawyer, and accounting of completion.

- Note any pending items and who will obtain them.

- If discrepancies exist, pause onboarding and escalate.

- Do not process funds until verification is complete per policy.

- Record any exceptions and the approvals received.

- Prepare a short summary of risk and next steps for the team.

Common Mistakes to Avoid in Client Identification and Verification – Organizations

- Using a trade name instead of the legal name.

- Consequence: You may open the file under the wrong entity. This creates billing problems and conflict mismatches. Don’t forget to cross-check the exact legal name against formation records.

- Skipping proof of the signatory’s authority.

- Consequence: You could act on instructions from an unauthorized person. This risks disputes and void actions. Don’t forget to collect a resolution, appointment letter, or other authority evidence.

- Overlooking indirect beneficial ownership.

- Consequence: You may miss control through holding companies or agreements. This leads to non-compliance and audit issues. Don’t forget to ask how decisions are made and who controls voting power.

- Accepting expired or unreadable ID.

- Consequence: Your verification can fail an audit. You will need to re-verify and delay onboarding. Don’t forget to check expiry dates and image clarity before you file.

- Failing to update when facts change.

- Consequence: Your records go stale and increase risk. You may miss issues tied to new owners or managers. Don’t forget to refresh the file when the structure or signatories change.

What to Do After Filling Out the Form Client Identification and Verification – Organizations

- Confirm completion with the responsible lawyer. Share a brief intake summary. Include the client type, authority, ownership, and any risk notes.

- File all supporting documents with the form. Keep them in the correct client and matter folders. Follow your firm’s naming conventions so others can find them.

- Notify accounting if you expect retainers or disbursements. Confirm whether verification is fully complete. If not, state what remains and the expected date.

- Address any gaps immediately. Ask for missing documents with a clear deadline. If unresolved, escalate and pause onboarding if required.

- Set a review date to refresh the file. Use a calendar reminder. Triggers include changes in ownership, signatories, addresses, or business activities.

- If the client opens a new matter later, re-confirm the information. If nothing changed, record the confirmation and date. If changes exist, update the form and re-verify as needed.

- If the organization is part of a group, note related entities. Link the files in your system. This supports conflict checks and consistent monitoring.

- When closing the matter, store records per your retention policy. Ensure access remains restricted. Note the final review date and any ongoing monitoring if the client stays active.

- If you discover a material discrepancy later, correct the form. Add an amendment or updated version. Include the date, the reason, and your initials. Tell the team about the change.

- Keep a short intake playbook handy for your team. It should list the approved verification methods, risk flags, and escalation contacts. This ensures consistent, fast onboarding.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.