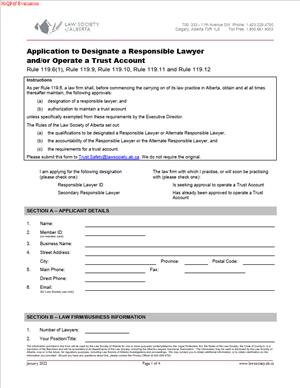

Application to Designate a Responsible Lawyer and/or Operate a Trust Account

Fill out nowJurisdiction: Canada | Province: Alberta

What is an Application to Designate a Responsible Lawyer and/or Operate a Trust Account?

This application is the formal request to your provincial regulator to recognize who is accountable for your firm’s trust safety and to authorize your firm to operate a client trust account. It tells the regulator who will serve as the Responsible Lawyer for trust compliance and outlines how your firm will handle client money. If you plan to accept retainers, settlements, real estate proceeds, or any client funds, you submit this application and wait for approval before you accept or disburse funds.

You use this form to do one or both things. First, designate or change the Responsible Lawyer for your firm or office. Second, open and operate a trust account under your firm’s name. Many firms file the two parts together. Some firms file only the designation when their Responsible Lawyer changes and they already have approved trust accounts.

The Responsible Lawyer takes personal responsibility for the trust safety program. That includes records, reconciliations, controls, and reporting. The role is more than a title. It carries real accountability. The application asks for information that shows your firm can safeguard client money. You describe your banking, controls, policies, and who can sign trust cheques. You also sign undertakings to follow professional rules.

Sole practitioners, new firms, and existing firms all use this application. A sole practitioner uses it when launching a practice or when adding trust capacity. A growing firm uses it when opening a new office with its own trust account. A firm also uses it when changing banks or appointing a new Responsible Lawyer because of a departure, leave, or restructure.

You may need this form even if you are not ready to bank client funds today. If your practice model may require trust deposits soon, you file now to avoid delays later. You also file if you want approval for specific trust account types, such as pooled trust or separate interest-bearing trust accounts. The regulator expects your firm to match your account setup to your practice needs. The application documents that plan.

Typical usage scenarios

- A new real estate practice that needs a pooled trust account to close deals.

- A litigation boutique that holds settlement funds uses it as well.

- An estate practice that collects estate assets in trust uses it to manage those funds safely.

- A corporate practice that takes evergreen retainers also needs trust authority if it will hold unearned fees in trust.

- If your firm will never handle client funds, you may still file the designation portion if your regulator requires a Responsible Lawyer for your firm profile.

In short, this application is the gateway to handling client money in Alberta. It identifies the person on point and confirms your systems can protect clients. It is a compliance document, a control plan, and a personal undertaking rolled into one.

When Would You Use an Application to Designate a Responsible Lawyer and/or Operate a Trust Account?

You use this application at key points in your firm’s life cycle. The first is firm startup. Before you open your doors, you define whether your services require a trust account. If yes, you file the application to designate the Responsible Lawyer and to operate a trust account. You wait for approval before you accept client funds.

You also use it when your practice expands. If you add a new office that will receive client funds, you file for that office’s trust account and confirm who will be accountable on site. If your firm adds a new practice area that relies on trust funds, you update your trust plan and account structure through this process.

You use it when your Responsible Lawyer changes. That could be due to a partner leaving, a parental leave, or a transition in leadership. You file promptly so there is no gap in accountability. If you delay, you risk compliance issues, even if your staff keep good records.

You use it when you change banks or account numbers. Banks sometimes consolidate branches or platforms. You may also move for better treasury support. You file to register the new account details and to authorize the bank to share confirmations with the regulator. You confirm cheque stock, deposit processes, and signatories. You should not move client funds without ensuring the new account is approved for trust use.

You use it when you revamp your trust controls. If you are introducing new software, changing who signs cheques, or moving to remote deposits, you reflect these changes in your application materials. The regulator needs to see that your controls still meet standards in your new setup.

Typical users

- Sole practitioners

- Professional corporations

- Partnerships

- Limited liability partnerships

Office managing partners often lead the filing for multi-office firms. Operations managers and bookkeepers help gather details, but the Responsible Lawyer and a firm principal sign the undertakings. In every scenario, you file before any trust activity begins under the new structure.

Legal Characteristics of the Application to Designate a Responsible Lawyer and/or Operate a Trust Account

This application is not a contract between private parties. It is a regulatory filing that carries binding obligations under professional legislation and rules. By signing, you give undertakings that the regulator can enforce. You also consent to oversight of your trust accounts, records, and systems. That includes audit rights and the right to verify information directly with your bank.

The application is legally significant for three reasons. First, it links you and your firm to duties set in statute and rules. Those duties exist whether or not you later accept funds. Second, it identifies the individual who is responsible for trust safety. That person must meet eligibility requirements and remains accountable for day-to-day compliance. Third, it creates a record that the regulator can rely on when monitoring your firm. The details you provide inform audit scope and follow-up.

What ensures enforceability?

Enforceability comes from the regulator’s statutory authority. The regulator can impose conditions, request records, and restrict or revoke approval if risks arise. The regulator can also discipline lawyers who breach undertakings or rules. False or misleading information in the application can be professional misconduct. The form’s declarations and signatures anchor that accountability.

Your bank cooperation forms part of enforceability. You authorize the bank to confirm account details to the regulator. You also agree to keep the bank from allowing changes that break trust requirements. Your cheques must identify the account as trust. Your bank profile should include view-only access for your auditor. These controls reduce risk and support oversight.

General legal considerations arise from client protection principles. You must keep trust money separate from your firm’s money. You deposit retainers to trust until earned and billed. You disburse trust funds only for authorized purposes. You perform regular three-way reconciliations within the required timelines. You maintain complete trust ledgers, journals, and supporting records. You retain records for the period the rules require.

The Responsible Lawyer cannot offload accountability. You can delegate tasks but not responsibility. If you use a bookkeeper or external accountant, you still supervise. You ensure reconciliations are timely, accurate, and reviewed. You also ensure any shortages are reported promptly and resolved.

Privacy and confidentiality intersect with trust safety. You collect client identification and verification as required. You document source-of-funds inquiries when appropriate. You store banking and identity records securely. You limit access to trust systems to authorized staff. You review user permissions quarterly and after staff changes.

Finally, your approval to operate a trust account can include conditions. Examples include completing education, adding a second signing control, or upgrading your software security. Conditions are binding. You comply and document compliance in your trust safety plan.

How to Fill Out an Application to Designate a Responsible Lawyer and/or Operate a Trust Account

1) Confirm eligibility and scope.

- Decide if you are filing for designation only, trust operation only, or both. Ensure your designated Responsible Lawyer holds active practising status in Alberta. Confirm they meet any experience or training requirements set by the regulator. If they need education, complete it before filing or as directed.

2) Map your practice needs.

- List the kinds of client funds you expect to hold. Note average balances, transaction volumes, and any peak periods. Decide whether you need a pooled trust account, separate interest-bearing accounts, or both. Confirm which offices will handle trust money and which will not.

3) Choose your bank and setup.

- Select a Canadian financial institution with experience in law firm trust accounts. Confirm it can flag the account as “Trust” on statements and cheques. Confirm cheque security features and online banking limits. Arrange read-only access for auditors. Ensure the bank can provide confirmations to the regulator on request.

4) Define your signing authorities and controls.

- Decide who will sign trust cheques and electronic payments. Follow the regulator’s signing rules. Use dual authorization if required or appropriate for your risk level. Prohibit self-dealing disbursements without a second reviewer. Document escalation steps for exceptions and emergencies.

5) Draft your trust safety plan.

- Write a concise policy that covers intake, deposits, receipts, transfers, billing, disbursements, and reconciliations. Include client identification and verification steps. Set deposit deadlines after receipt. Describe how you approve payouts and who reviews supporting documents. Explain how you handle retainers, fee transfers, and chargebacks. Include your three-way reconciliation process and review cadence. Define how you manage unclaimed trust funds and closed files. Add access controls, backups, and data security practices.

6) Prepare your accounting framework.

- Select software that supports three-way reconciliations. Set up client ledgers, a trust receipts journal, a trust disbursements journal, and a trust control account. Configure numbering for cheques and receipts. Lock prior periods after reconciliation. Set alerts for negative balances, stale-dated cheques, and unreconciled items.

7) Gather firm and lawyer details.

- Assemble your firm’s legal name, trade names, legal structure, registration numbers, and addresses. List all Alberta offices. Prepare the Responsible Lawyer’s contact details and member number. Include their training completion date, if applicable. Identify an alternate contact who can respond during absences.

8) Compile bank and account information.

- Obtain the branch address, transit number, and account numbers for each trust account. If you are opening new accounts, coordinate timing with filing. Prepare a letter authorizing the bank to share information with the regulator. Request sample void cheques marked “Trust.” Obtain the bank’s written confirmation that the account is set up as a law firm trust account, if available.

9) Assemble required attachments.

- Include your trust safety plan or policy summary. Attach any training certificates for the Responsible Lawyer. Provide copies of sample cheques and deposit slips. Include your signing authority resolution. Provide your accounting system summary and reconciliation template. Attach your client identification and verification checklist.

10) Complete the form’s firm information section.

- Enter your firm’s identity as registered with the regulator. List every place of business in Alberta. Note whether each location will accept client funds. Indicate the firm’s main contact for trust audits. Provide your general account details for context, but keep the focus on trust accounts.

11) Complete the Responsible Lawyer designation section.

- Provide the Responsible Lawyer’s full name, member number, and contact details. Confirm their practising status. Confirm that they accept responsibility for trust safety. If you have multiple offices, state whether this designation applies to all offices or to specified locations. If you appoint an alternate or assistant for coverage, name them and define their scope.

12) Complete the trust account section. List each trust account by institution, branch, and account number. Indicate whether it is pooled or separate interest-bearing. Describe who has signing authority for each account. Explain any electronic payment tools and controls. Note any planned trust investment accounts and the conditions for use.

13) Describe your controls and procedures.

- Summarize your deposit process, including timing and documentation. Explain your disbursement process, including approvals and supporting records. Describe how you transfer earned fees from trust to general. Outline your reconciliation process and review steps. Note how you prevent and address shortages. Include how you restrict access to trust systems.

14) Make the required declarations and undertakings.

- The Responsible Lawyer must declare that the information is true and complete. They undertake to comply with trust accounting and trust safety rules. A firm principal usually confirms firm-level support for the controls described. Read these clauses carefully. If you cannot comply, fix your systems before you sign.

15) Review and sign.

- Check every field for accuracy and consistency. Verify account numbers and addresses. Confirm that names match firm registrations. Sign where indicated. The Responsible Lawyer signs. A managing partner or director signs. Add dates and print names clearly. If the bank needs to sign a confirmation, obtain that signature as well.

16) Submit the application.

- File the form and attachments through the regulator’s submission method. Keep a full copy of everything you send. Do not accept or disburse trust funds until you receive approval. If timing is tight, communicate your expected file openings and plan accordingly.

17) Respond to follow-up requests.

- The regulator may ask for clarifications, extra documents, or changes. Reply quickly and completely. If conditions are imposed, meet them and confirm completion in writing. Document any training, system changes, or added controls.

18) Prepare for go-live.

- Once approved, confirm your bank has the right settings. Order cheques with “Trust” printed on them. Lock down online banking roles and limits. Test your reconciliation process with a zero-balance test. Train all staff on your trust safety plan and their specific tasks.

19) Maintain ongoing compliance.

- Reconcile monthly using a proper three-way method. Review and sign off on reconciliations. Clear reconciling items promptly. Review stale-dated cheques and unclaimed balances. Keep your policy current. Update the regulator if you change banks, signatories, or the Responsible Lawyer.

20) Avoid common pitfalls.

- Do not delay filing when leadership changes. Do not let non-lawyer staff control trust disbursements without proper approvals. Do not transfer fees from trust without a bill or clear written authorization. Do not allow negative client ledger balances. Do not use trust accounts for firm expenses.

Parties and roles appear clearly in the application. Your firm is the applicant. The Responsible Lawyer is the individual designee who accepts trust safety accountability. The regulator is the approving authority. The bank is a cooperating third party for confirmations and controls. Make sure each role is identified and documented.

Clauses to watch include undertakings, consent to audit, bank authorization, and conditions on approval. Signatures must be original or as permitted by the regulator. Dates, names, and roles must be legible and consistent. Attachments act as schedules to your application. Label each schedule clearly. Cross-reference them in the main form.

With a complete, accurate filing, approval is straightforward. You show that you understand the risks and have controls in place. You set your firm up to handle client funds safely, with confidence and accountability.

Legal Terms You Might Encounter

- Responsible Lawyer: This is the lawyer you name to take primary responsibility for the firm’s trust safety and related compliance. On the Application to Designate a Responsible Lawyer and/or Operate a Trust Account, you identify this person and confirm their authority, experience, and eligibility. If you are a sole practitioner, you are often the Responsible Lawyer by default, but you still need to formally designate yourself.

- Designation: Designation is the act of officially naming the Responsible Lawyer and, if applicable, confirming you intend to operate a trust account. In the form, designation ties your role to specific obligations. Once you submit the designation, you become the point person for audits, reconciliations, and reporting tied to the trust account.

- Trust Account: A trust account is a separate bank account used only for client funds. You cannot treat it like your firm’s operating account. The form collects core details about your trust account, including where it is held, how it will be used, and who can sign on it. You are attesting that you will only move funds in and out as permitted by professional rules and client instructions.

- Operating (General) Account: This is your firm’s day-to-day account for fees earned and firm expenses. The application may ask you to distinguish between trust and operating accounts because client funds must never flow into the operating account until earned and withdrawable. Clarity on both accounts helps the regulator assess your controls.

- Pooled Trust Account: This is a single trust account that holds funds for multiple clients at once, with individual client ledgers kept separately in your records. The form may ask whether you will hold pooled funds and how you will track them. You remain responsible for ensuring each client’s money is accounted for individually.

- Client Trust Ledger: This is the record you keep for each client showing every trust receipt, disbursement, and balance. While you won’t submit ledgers with the application, the form implies you will keep complete ledgers and be able to produce them. If you check boxes or make statements about reconciliation and systems, you are confirming you will maintain these ledgers accurately.

- Reconciliation: Reconciliation matches your bank statement to your trust records and client ledgers, typically monthly. The form often asks you to confirm you understand and will complete reconciliations on time. As Responsible Lawyer, you may need to certify that reconciliations will be done, reviewed, and retained.

- Signatory Authority: This is formal permission to sign cheques or authorize electronic payments from the trust account. The application will ask who has signatory authority and how payments are approved. You are telling the regulator which individuals can move client funds and what safeguards exist.

- Trust Receipt and Trust Disbursement: A trust receipt is when you deposit client money into trust. A trust disbursement is when you pay out or transfer client money from trust. The application expects you to know the difference and to confirm that disbursements will be made only for proper purposes, with documentation and client authorization.

- Trust Shortage: A shortage occurs when the trust bank balance is less than the total of your client trust ledgers. The form may ask about your procedures to prevent and respond to shortages. By designating a Responsible Lawyer, you accept the duty to address any shortage immediately and report as required.

- Undertaking: An undertaking is a promise you give in the course of legal work that you must honor. While undertakings are not a dedicated section on the form, your role as Responsible Lawyer includes overseeing how undertakings tied to trust funds are managed. The form’s confirmation of your responsibilities covers adherence to undertakings that affect client money.

FAQs

Do you need a trust account to hold client retainers?

Yes, if you are holding advance retainers or settlement funds that are not yet earned or payable to you, you generally need a trust account. If you only bill after work is completed and never hold client funds in advance, you may not need one. Review your practice model honestly before you complete the application.

Do you need to designate a Responsible Lawyer if you do not operate a trust account?

Yes, most firms still need a Responsible Lawyer for regulatory and practice oversight, even if they do not handle trust funds. The Responsible Lawyer remains the point of contact for compliance matters. If you later open a trust account, you update your designation.

Do you need pre-approval before opening or using a trust account?

In many cases, you need approval before you deposit client money or disburse from trust. Some regulators require confirmation of your authorization and account details first. Do not accept or move client funds until you receive notice that you are authorized to operate the account.

Do you need special training to be a Responsible Lawyer?

Many regulators expect the Responsible Lawyer to complete specific training on trust accounting and practice management. If you have not completed it, your application can be delayed or approved conditionally. Check your training status before you submit the form and schedule any required courses.

Do you have to reconcile the trust account every month?

Yes. Monthly trust reconciliations are a standard requirement. As Responsible Lawyer, you ensure reconciliations are prepared on time, reviewed, and signed off. You also retain the reconciliation packages, including bank statements and ledgers.

Do you need to list all signatories on the application?

Yes. Include every person who can sign or approve disbursements on the trust account, whether by cheque or electronically. If you add or remove signatories later, you must notify the regulator and update your internal controls.

Do you have to notify anyone when you close a trust account or change banks?

Yes. You typically must notify the regulator when you open, move, or close a trust account. You should also coordinate with your financial institution to finalize outstanding cheques, interest, and statements. Update the designation form if your Responsible Lawyer or account details change.

How long does approval take?

Processing times vary. You can speed up approval by submitting a complete application with accurate bank details, signatory information, and proof of training. Respond promptly to any follow-up requests. Avoid starting trust activity until you receive written authorization.

Checklist: Before, During, and After the Application

Before signing: Gather information and documents

- Names, contact details, and bar numbers for all lawyers at your firm.

- Identification of the Responsible Lawyer and any alternate if applicable.

- Confirmation of professional liability insurance and status in good standing.

- Training records for the Responsible Lawyer and any staff who will handle trust funds.

- Bank name, branch address, transit and account numbers for trust and operating accounts (or your chosen bank if not yet opened).

- Sample cheque or letter from your financial institution confirming account style and that it is a trust account (if available).

- Internal controls summary: who prepares, signs, and reviews trust payments; dual-authorization steps; electronic payment controls.

- Reconciliation process outline: who prepares, who reviews, and where records are stored.

- Templates for client trust ledgers, deposit records, and cheque requisitions (for your own use; do not attach unless requested).

- Written procedures for handling retainers, withdrawals on account of fees, and client refunds.

- List of signatories and their roles, including any non-lawyer staff with authority.

- Plan for segregating duties (e.g., no single person controls end-to-end trust transactions).

- Evidence of bank-compatible controls (e.g., cheque stock security, online banking permissions, view-only access for preparers).

- Calendar reminders for monthly reconciliations and annual filings.

During signing: Verify critical sections

- Responsible Lawyer details: full legal name, contact information, and membership number entered correctly.

- Scope of designation: confirm whether you are designating only the Responsible Lawyer, or also seeking authorization to operate a trust account.

- Account details: exact account numbers, account style including the word “trust,” and branch information.

- Signatory list: every authorized individual is listed, and their authority level is accurate.

- Controls and reconciliations: check boxes or attestations reflect your real process and capacity.

- Banking confirmations: attach any requested proof of account type or agreements, if the form requests them.

- Training attestations: verify course names, dates, and completion status for all required individuals.

- Effective date: ensure the start date aligns with your planned opening or assumption of responsibility.

- Consent and declarations: confirm you understand the duties and consequences of non-compliance.

- Signature blocks: sign and date where required; include the firm’s signing authority if separate.

After signing: Filing, notifying, and storing

- File the application as instructed by your regulator. Keep a copy of all materials submitted.

- Do not accept or disburse client funds until you receive written authorization to operate the trust account.

- Notify your financial institution of any conditions in your authorization and confirm account style is correct.

- Enter the Responsible Lawyer’s role and trust controls into your firm’s policies and procedures manual.

- Set up monthly reconciliation workflows and assign preparer, reviewer, and backup.

- Create secure folders for trust records: bank statements, client ledgers, reconciliation packages, deposit slips, and disbursement approvals.

- Brief all staff and signatories on controls, documentation standards, and reporting duties.

- Calendar periodic internal audits and annual filings required by your regulator.

- If anything changes (Responsible Lawyer, signatories, bank accounts, branch), submit an amendment promptly and confirm receipt.

- Retain final approval letters and any conditions attached to your authorization.

Common Mistakes to Avoid

- Leaving out a signatory or listing the wrong authority.

- Don’t forget to list every person who can authorize a trust payment, including electronic approvals. If you leave someone off, you may have to refile. If you list authority levels incorrectly, you risk control failures or regulatory findings.

- Submitting incomplete bank information.

- Don’t guess at account numbers or branch details. Inaccurate information delays approval and may result in you opening the wrong account type. Confirm the account style includes “trust” and matches what you put on the form.

- Underestimating the Responsible Lawyer’s duties.

- Don’t accept the designation without the time and systems to meet it. The Responsible Lawyer must oversee reconciliations, approvals, and reporting. If you fall behind, you risk audits, conditions, or restrictions on your trust account.

- Failing to confirm training requirements.

- Don’t assume past experience replaces mandatory training. If training is required and you have not completed it, approval can be delayed or denied. Book the course and include proof of completion or enrollment as requested.

- Using the trust account before authorization.

- Don’t deposit or disburse client funds until you receive written authorization. Early use can trigger compliance action and force you to reverse transactions.

What to Do After Filling Out the Form

- Submit your application and wait for authorization.

- File the Application to Designate a Responsible Lawyer and/or Operate a Trust Account using the regulator’s required method. Keep proof of submission. If you are opening a trust account, do not accept funds until you receive written approval.

- Confirm your bank setup matches your authorization.

- Once approved, verify the trust account title, cheque stock, and online banking permissions. Ensure dual-authorization or other controls are in place. Restrict access for non-signatories to view-only if your system allows.

- Implement internal controls and documentation.

- Adopt written procedures that reflect what you attested to in your application. Define who prepares payments, who approves them, and how supporting documents are stored. Set up client trust ledger templates and deposit/disbursement checklists for daily use.

- Schedule monthly reconciliations.

- Create a standing calendar event to reconcile the trust account every month. Assign a preparer and a reviewer. Keep reconciliation packages complete: bank statement, book balance, client listings, and explanations for any reconciling items.

- Educate your team.

- Brief all lawyers and staff handling client funds on your trust process, authorization limits, and documentation standards. Confirm they understand who the Responsible Lawyer is and how to escalate issues such as errors, shortages, or unusual transactions.

- Start with low-risk, well-documented transactions.

- When you first operate the account, focus on clean, straightforward deposits and disbursements. Use written client directions and keep supporting documents with each entry. Review the first few reconciliations carefully to validate your workflow.

- Monitor and report changes.

- If your Responsible Lawyer changes roles, leaves the firm, or delegates duties differently, file an amendment without delay. Do the same if you add or remove signatories, open a new trust account, or close an existing one. Keep your records and the regulator’s records aligned.

- Prepare for reviews.

- Your authorization can include conditions and routine reviews. Keep your trust records organized so you can produce ledgers, bank statements, and reconciliations quickly. Address any findings promptly and document your corrective actions.

- Close or transition a trust account properly.

- If you decide to stop operating a trust account, plan the wind-down. Clear outstanding payments, return client funds, finalize reconciliations, and notify the regulator. Keep final statements and approval letters with your permanent records.

- Update firm policies as you grow.

- As your practice changes, revisit your controls. Add segregation of duties as your team expands. Update procedures for electronic payments and interest calculations as your banking tools evolve. Align your day-to-day practices with what you’ve certified in your application.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.