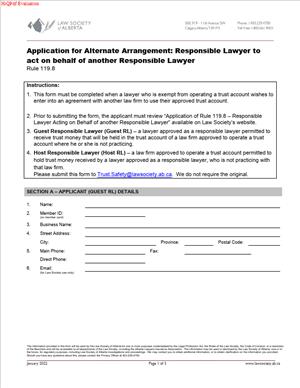

Application for Alternate Arrangement – Responsible Lawyer to act on behalf of another Responsible Lawyer

Fill out nowJurisdiction: Country: Canada | Province or State: Alberta

What is an Application for Alternate Arrangement – Responsible Lawyer to act on behalf of another Responsible Lawyer?

This application asks the provincial regulator to approve a temporary coverage plan. One designated Responsible Lawyer agrees to act for another Responsible Lawyer. The focus is trust safety and practice oversight. The form documents who will act, for how long, and on what accounts. It also sets out controls, reporting, and authority limits.

Law firms in Alberta must have a designated Responsible Lawyer. That person oversees trust accounting, books and records, and compliance. Firms cannot leave trust accounts unsupervised. If the primary Responsible Lawyer will be unavailable, you need a formal plan. The application is the way you ask for that approval.

Who typically uses this form?

Sole practitioners use it often. So do small and mid-sized firms with one or two trust accounts. Larger firms use it to cover regional offices or niche practice groups. Firm administrators help prepare it. Managing partners sign off. The primary Responsible Lawyer and the alternate Responsible Lawyer both sign.

Why would you need this?

You may have a parental leave coming up. Illness can strike without warning. You might lead a long trial or arbitration. You could have travel that limits access to records. Your firm may be onboarding a new Responsible Lawyer. You may want dual coverage to support electronic fund transfers. In every case, you need clear authority and continuity.

Typical usage scenarios

- A sole practitioner leaving for six weeks. The alternate steps in to review reconciliations and sign trust cheques.

- A two-partner firm shares coverage during trial blocks. Each lawyer acts as alternate for the other on a rotating schedule.

- A regional office’s Responsible Lawyer moves firms. Another experienced Responsible Lawyer covers during recruitment.

- A firm transitions to electronic transfers. It appoints an alternate to co-approve EFTs for three months.

The application is not a generic delegation. It is a defined arrangement with fixed dates and scope. It confirms the alternate’s authority over listed accounts and tasks. It sets the rules for how the alternate will supervise staff and bookkeepers. It explains how the alternate will handle reconciliations and exceptions. It records how the firm will restrict and monitor access to trust systems. It outlines what the alternate can and cannot sign. It confirms all parties understand their duties.

Your goal is simple. You want no gap in oversight. You want clear lines of responsibility. You want evidence of approval if anyone asks. The application gives you that clarity.

When Would You Use an Application for Alternate Arrangement – Responsible Lawyer to act on behalf of another Responsible Lawyer?

Use this application when the designated Responsible Lawyer will be away. It covers planned and unplanned absences. It also fits situations where you need shared oversight for a short time. The most common trigger is a scheduled leave. Think parental leave, medical treatment, or extended travel. You also see it before long trials or heavy litigation blocks. The Responsible Lawyer may be present but unable to supervise daily trust work.

Sole practitioners rely on this application to manage vacations. It lets you step away without risking non-compliance. Small firms use it during busy quarters. The alternate reviews reconciliations when the primary is in court. Multi-office firms use it during staffing transitions. If a Responsible Lawyer departs, the alternate can bridge until a replacement is named.

You should also use it when you change payment methods. Many firms adopt electronic fund transfers for trust. Dual authorization is a common control. An alternate arrangement supports that control. It ensures a second Responsible Lawyer is available to co-approve EFTs. The arrangement can be time-limited while you roll out new procedures.

Consider it when the Responsible Lawyer cannot access systems. Rural practices may face connectivity issues. A storm can close an office. A cyber incident can isolate a machine. The alternate arrangement ensures someone else can step in. The plan defines how to maintain continuity.

Use it when you are onboarding a new Responsible Lawyer. The outgoing Responsible Lawyer may mentor the new person. The alternate arrangement sets authority limits while training completes. It gives structure to handover and review.

Do not use it to avoid naming a permanent Responsible Lawyer. If the primary has resigned or is no longer eligible, this may not fit. You likely need a replacement designation, not a temporary alternate. The regulator decides what fits. Always be clear about the reason and the duration. The arrangement should be temporary and targeted.

Typical users include the primary Responsible Lawyer, the alternate Responsible Lawyer, and the managing partner. The firm’s accountant or bookkeeper helps with data and controls. The firm administrator coordinates signatures and attachments. Everyone should know who holds authority on any given day.

Legal Characteristics of the Application for Alternate Arrangement – Responsible Lawyer to act on behalf of another Responsible Lawyer

The application is a regulatory filing. When approved, it carries legal effect. It allows the named alternate to exercise the duties of a Responsible Lawyer. The approval is limited to the scope stated in the application. It applies to listed accounts, locations, and dates. It does not cover tasks outside that scope.

It is binding because the regulator imposes trust safety obligations. Law firms must follow those obligations. The Responsible Lawyer has defined responsibilities. Those duties cover balancing and reconciling trust accounts. They cover approving withdrawals and transfers. They cover recordkeeping and monthly reporting. The alternate arrangement extends those duties to another eligible lawyer. The approval defines how that transfer works during the stated period.

What ensures enforceability?

Enforceability rests on several factors. The application is signed by the primary and alternate. The firm confirms the plan, controls, and resources. The regulator approves the arrangement in writing. This creates a clear chain of authority. Banks may require updated signing mandates. Your accounting system needs updated user rights. Staff need written instructions. These system and bank updates show the arrangement is real and active.

General legal considerations apply. Delegation does not erase responsibility. The primary may remain responsible for outcomes. The alternate accepts responsibility for actions taken. The firm carries its own oversight duties. The regulator can audit the arrangement. Both lawyers must be active and in good standing. They must be competent in trust accounting. Insurance and conflicts rules still apply.

Confidentiality remains critical. The alternate may access client trust details. The firm must control access with care. Use role-based permissions and two-factor authentication. Keep audit trails. Avoid shared passwords. Limit access to the duration of coverage. Remove access when the arrangement ends.

Conflicts of interest can arise. The alternate should not act where conflicts exist. If a conflict is unavoidable, propose controls. You can segment files and assign a second alternate for specific matters. Document any exception.

The arrangement should respect client directions. The alternate must follow the same trust rules as the primary. Obtain client instructions for withdrawals when required. Keep all supporting documents in the trust file. The arrangement does not change client rights.

Recordkeeping is vital. Keep the approval, the application, and all attachments. Retain monthly reconciliations, exception logs, and approvals. Keep bank confirmations of signing authority changes. Keep screenshots or reports showing updated user access. These records will help in any future review.

Finally, time limits matter. The approval is only valid for the period stated. If you need more time, apply for an extension. If the primary returns early, close the arrangement. Notify the regulator of any changes that affect the plan.

How to Fill Out an Application for Alternate Arrangement – Responsible Lawyer to act on behalf of another Responsible Lawyer

Follow these steps to complete the form and assemble a clean package.

1) Confirm eligibility and timing.

- Ensure both lawyers are active and in good standing.

- Confirm the alternate is familiar with trust accounting.

- Pick dates that reflect real coverage needs. Build in a buffer.

2) Gather core information.

- Firm name, firm ID, and mailing address.

- Office locations covered by the arrangement.

- Accounting system name and version.

- Trust and general bank names and branch locations.

3) Identify the primary Responsible Lawyer.

- Provide full name, member number, email, and phone.

- State current designation and scope (which accounts).

- Describe planned unavailability in one or two lines.

4) Identify the alternate Responsible Lawyer.

- Provide full name, member number, email, and phone.

- Confirm role at the firm and years of call.

- Confirm recent trust accounting experience.

5) Define the effective dates.

- State the start date and end date.

- If the start depends on approval, say so.

- If you expect to extend, explain why and for how long.

6) Describe the reason for the arrangement.

- Keep it factual and brief (for example, parental leave).

- Note whether the absence is full-time or partial.

- Note time zone or location issues if relevant.

7) List the accounts covered (Schedule A).

- List each trust account with bank, branch, and account number.

- Include pooled and separate interest-bearing trust if applicable.

- State whether the general account is included for signing tasks.

- Attach recent bank confirmation letters if available.

8) State the scope of authority.

- Confirm the alternate can approve trust withdrawals.

- Confirm authority over electronic fund transfers.

- State cheque signing authority and thresholds.

- State who reviews and signs monthly reconciliations.

- Address approval of client-to-client transfers and file-to-file transfers.

9) Set financial controls and limits.

- Require dual authorization for EFTs above a set amount.

- Require two signatures on trust cheques above a set amount.

- Prohibit cash withdrawals from trust.

- Prohibit third-party online banking without named users.

- Require documented client authorization for each withdrawal.

10) Describe supervision and review.

- Set a weekly or biweekly check-in between both lawyers.

- Require the alternate to review exception reports.

- Require monthly review of three-way reconciliations.

- Confirm who signs off and where records are stored.

- Commit to immediate escalation of any trust shortage.

11) Explain access and systems.

- Describe how the alternate will access accounting software.

- Detail user roles, permissions, and two-factor settings.

- Confirm who grants and removes access.

- Confirm the retention of audit logs and backups.

12) Outline staff and bookkeeper roles.

- Name the bookkeeper or accounting clerk.

- Describe who prepares deposit slips, receipts, and disbursements.

- Confirm the alternate will review supporting documents.

- State who controls cheque stock and EFT templates.

13) Address conflicts and file exclusions.

- Identify any files or clients excluded from the alternate’s scope.

- Explain substitute coverage for those files if needed.

- Confirm how exclusions are flagged in the system.

14) Attach policies (Schedule B).

- Attach your trust accounting policy.

- Attach your EFT policy and dual authorization procedure.

- Attach your monthly reconciliation checklist.

- Include your records retention policy.

15) Provide a coverage calendar (Schedule C).

- Show who covers which days or weeks.

- Note statutory holidays and office closures.

- Note the response time standard for urgent approvals.

16) Include bank mandate updates (Schedule D).

- Prepare bank letters adding the alternate as a signer.

- Attach sample signature cards if required by the bank.

- Confirm the date you will deliver mandate changes.

17) Include training and orientation evidence (Schedule E).

- Note recent training in trust safety for the alternate.

- Attach any certificates or internal training records.

- Describe a short handover plan and shadow period.

18) Add acknowledgements and undertakings.

- The primary acknowledges ongoing duties during the term, if applicable.

- The alternate accepts trust safety responsibilities in scope.

- Both agree to follow firm policies and the regulator’s rules.

- Both agree to notify the regulator of any material change.

19) Add firm authorization.

- The managing partner or authorized signatory approves the plan.

- Confirm the firm provides resources and access to records.

- Confirm insurance coverage and cyber safeguards are in place.

20) Review for clarity and completeness.

- Check dates, names, and account numbers for accuracy.

- Ensure schedules align with the main form.

- Avoid vague language. Use measurable controls and limits.

21) Signatures and dates.

- The primary Responsible Lawyer signs and dates.

- The alternate Responsible Lawyer signs and dates.

- The firm signatory signs and dates.

- Use wet signatures or approved e-signatures as required.

22) Submission and confirmation.

- Submit through the required channel.

- Keep a copy of the full package with all schedules.

- Note the expected processing time in your calendar.

23) Prepare for implementation.

- Do not act until approval is granted.

- After approval, update bank mandates on the stated date.

- Update user permissions in all systems.

- Notify staff and bookkeepers of the effective date and controls.

24) Maintain records during the term.

- Keep a coverage log of actions taken by the alternate.

- Save monthly reconciliations and signoffs.

- Document any exceptions and how you resolved them.

25) Close the arrangement.

- On the end date, remove the alternate’s system access.

- Update bank mandates to remove temporary signing.

- File a completion memo and final reconciliation signoff.

- Notify the regulator if required by the approval.

Practical tips help your application move faster

- Be precise about dates and scope.

- Avoid open-ended authority.

- Show you have working controls.

- Provide a simple org chart if roles are complex.

- Use schedules to list details cleanly.

- Keep explanations short and factual.

- You can reference your internal policies rather than rewrite them.

- Make sure the alternate has real access to do the job. That includes user rights, training, and time.

Finally, build a back-up to your back-up. Name a secondary contact for urgent issues. Document who can release payroll or vendor payments if needed. Trust safety thrives on clarity. Your application should make that clarity obvious.

Legal Terms You Might Encounter

- Responsible Lawyer means the lawyer designated to oversee a law firm’s trust and financial compliance. In this application, you either are the Responsible Lawyer or you are agreeing to act in that role for someone else, within the limits set in the form.

- Alternate Arrangement is the temporary plan that allows one Responsible Lawyer to act on behalf of another. The arrangement exists only for the dates, scope, and authority you specify. The application documents that plan so others can rely on it.

- Designate is the lawyer stepping in under the alternate arrangement. If you are the designate, you accept defined authority to perform specific tasks for the other Responsible Lawyer, such as trust approvals or sign-offs.

- Scope of Authority describes the exact powers granted to the designate. In the form, you outline what the designate can do and what they cannot do. Clear scope prevents overreach and confusion.

- Effective Date is the date the arrangement starts. It matters for timing access, bank signatory changes, and compliance reporting. The form should state this date clearly so everyone knows when responsibility shifts.

- End Date is when the arrangement stops. It could be a fixed date or tied to an event, such as a return from leave. The form should capture this to ensure authority does not linger beyond what is needed.

- Trust Account refers to client funds held in trust. The application should state whether the designate gains trust signing authority, review powers, and reconciliation oversight. Precision here protects client property and your firm.

- General Account refers to the firm’s operating funds. The arrangement may include authority for general account transactions that relate to client disbursements and office operations. The form should say so if needed.

- Conflict of Interest is a situation where duties to different clients or lawyers may clash. If any conflict could arise in acting for the other Responsible Lawyer, the form should limit or exclude the designate’s role. A short note in the scope section helps manage this risk.

- Undertaking is a solemn promise by a lawyer to perform an act. If the designate must honour an existing undertaking of the other Responsible Lawyer, the form should make this explicit. If not, clarify that undertakings remain with the original lawyer unless transferred in writing.

- Supervision describes oversight of staff and processes. The form may grant the designate authority to supervise trust processes, approve exceptions, or direct accounting staff. If supervision is included, say how it works and who the designate can direct.

- Reporting Obligation means who must report what, and by when. The form can specify that the designate will review reconciliations or compliance reports during the term and confirm completion. That clarity avoids missed deadlines.

- Client Property includes funds, documents, and records. If the designate will control or access any client property, the form should describe how. Include any limits, such as read-only access to certain files.

- Signatory Authority is the power to sign on bank accounts or approve transactions. The application should state which accounts and limits apply, such as per-transaction caps or two-signature rules. This prevents unauthorized payments.

- Certification is your confirmation that the information is true and complete. When you sign the application, you certify accuracy. If you are the designate, you also confirm you accept the obligations described.

FAQs

Do you need client consent for the alternate arrangement?

You usually do not need client consent to appoint an alternate Responsible Lawyer, since this concerns firm oversight and trust compliance. You may need to notify affected clients if the arrangement will change who approves trust withdrawals on their file or who handles sensitive client property. Use your risk lens. When in doubt, provide a brief notice to clients with active trust funds.

Do you need to update bank signing authority?

Yes, if the designate will sign on trust or general accounts. Confirm bank requirements early. Some banks need in-branch ID and updated resolutions. Others accept a letter with the signed application. Do not leave this to the effective date. Your approvals could stall payments, closings, or refunds.

Do you need to change access to your accounting system?

If the designate must review or approve transactions, you need to grant the right access. Set role-based permissions consistent with the scope. Make access time-limited to match the arrangement. Remove the access on the end date. Keep an audit trail of changes.

Do you need to run a conflicts check on the designate?

Yes, perform a reasonable conflicts check. The designate may access client information and trust funds. Confirm they have no conflicting roles or personal interests with key clients or matters. If a conflict exists, limit the scope or select a different designate.

Do you have to name a backup if the designate becomes unavailable?

You are not required to, but it is smart. You can include a short clause naming a backup or giving authority to appoint one. If you cannot name a backup, state how urgent approvals will be handled, such as two-partner sign-off or a hold on non-urgent payments.

Do you need to include an end date?

Yes. Always include an end date or trigger event. Open-ended authority invites confusion and risk. If the period may extend, set an end date and add a simple renewal process. A short addendum can extend the dates later.

Do you need to file the application anywhere?

You should follow your regulator’s requirements. Many firms keep the signed application on file and produce it if asked. Some require notice or filing when trust signatory authority changes. Check your obligations before the start date, and keep proof of compliance.

Checklist: Before, During, and After the Application

Before You Sign

- Identify the designate. Confirm standing, experience, and availability for the full period.

- Confirm the scope. List tasks the designate will handle and those they will not.

- Set dates. Choose a clear effective date and end date or trigger.

- Gather firm details. Firm name, address, and contact person for accounting.

- Gather lawyer details. Full names, member numbers, and contact information for both lawyers.

- Map trust activity. List active trust accounts, banks, and typical approval volumes.

- Review two-signature rules. Note which accounts need dual signatures and who the second signer is.

- Prepare bank materials. Bring ID, resolutions, and bank forms if signatory changes are required.

- Prepare accounting access. Set up user permissions and approvals aligned with the scope.

- Run a conflicts check. Screen for client or matter conflicts involving the designate.

- Review undertakings. Identify any undertakings that may be affected during the term.

- Plan reporting. Decide who will review reconciliations, when, and how issues escalate.

- Draft notices. Prepare brief notices for staff, banks, insurers, and clients if needed.

- Confirm insurance coverage. Ensure your coverage extends to the designate’s actions under the arrangement.

- Set document control. Decide where the signed application and related memos will live.

During Signing

- Verify names. Match full legal names and membership numbers for accuracy.

- Confirm firm details. Check the firm’s legal name matches banking and insurance records.

- Check effective and end dates. Ensure they align with travel, leave, or planned absences.

- Review scope language. Make it specific. Include approvals, limits, and exclusions.

- Confirm trust authority. List accounts and any signing limits per transaction.

- Confirm general account access. State whether the designate can approve disbursements.

- Specify supervision. Name the staff the designate may direct and the boundaries.

- Set reporting duties. Identify who completes and who reviews monthly reconciliations.

- Include conflict safeguards. Add limits if any conflict risks exist.

- Add backup steps. Include a process if the designate becomes unavailable.

- Read declarations. Ensure both lawyers accept the obligations and limits.

- Sign and date. Use correct signature blocks for each lawyer and, if used, a firm sign-off.

- Initial changes. Initial any handwritten edits to avoid later disputes.

After You Sign

- File as required. Follow your regulator’s instructions for filing or retention.

- Update banks. Submit signatory updates and provide specimen signatures if needed.

- Update accounting systems. Activate permissions and test approval workflows.

- Notify staff. Explain who can approve what and how to escalate issues.

- Notify clients if needed. Send a short notice for matters with pending trust activity.

- Notify your insurer if required. Confirm any notification obligations tied to role changes.

- Store documents. Save the signed application, approvals, and confirmations in a secure folder.

- Calendar key dates. Add the end date and any reconciliation deadlines.

- Test controls. Run a small-value test transaction to confirm approvals work.

- Monitor early activity. Review the first week of trust transactions for accuracy.

Common Mistakes to Avoid

- Don’t leave the scope vague. Consequence: The designate may overstep or hesitate. That can delay payments or risk non-compliance. Use clear, task-based authority with limits.

- Don’t forget to set an end date. Consequence: Authority may continue longer than intended. That increases risk and complicates reporting. Always include an end date or a clear trigger.

- Don’t skip the bank update. Consequence: The designate cannot sign when needed. Closings or refunds may stall. Contact the bank right after signing and confirm activation.

- Don’t overlook accounting access. Consequence: The designate cannot see or approve transactions. Workarounds undermine controls. Set proper permissions before the effective date.

- Don’t ignore conflicts. Consequence: The designate may access sensitive client data despite a conflict. Limit the scope or assign a different designate. Record your check.

What to Do After Filling Out the Form

- Confirm accuracy. Read the completed application once more. Pay special attention to names, dates, and scope. Make any corrections now.

- Get signatures. Arrange signatures from both lawyers. If your firm requires a managing lawyer’s sign-off, obtain it at the same time.

- Prepare an internal memo. Summarize the arrangement: scope, dates, authority, and contacts. Keep it short and share it with relevant staff.

- Contact your bank. Submit signatory updates for trust and general accounts. Ask for written confirmation of activation and any limits.

- Update systems. Grant the designate access to accounting, records, and relevant folders. Use least-privilege access. Add an automatic expiry on the end date.

- Notify your team. Tell accounting, file owners, and reception who can approve trust activity. Provide a simple escalation path for urgent items.

- Notify clients where appropriate. Send a brief note to clients with active trust funds or imminent transactions. Explain the temporary nature and impact, if any.

- Confirm insurance notices. If your policy requires notice of changes in trust authority, send it. Keep proof of delivery.

- Start a monitoring routine. For the first month, review weekly trust reports. Address any anomalies fast.

- Calendar key events. Add the end date, reconciliation cycles, and any renewal decision points. Include a reminder two weeks before the end date.

- Plan for extension or early end. If you may extend, prepare a short addendum form now. If the Responsible Lawyer returns early, be ready to revoke access and signatory status.

- Close the arrangement at the end date. Notify the bank to remove signatory authority. Revoke system access. Send a short wrap-up note to staff and, if needed, clients.

- Document the file. Save copies of the application, bank confirmations, access logs, notices, and the closing memo. Keep them in your compliance folder for your retention period.

- Review lessons learned. Note what worked and what to change next time. Update your checklist so the next arrangement is smoother.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.