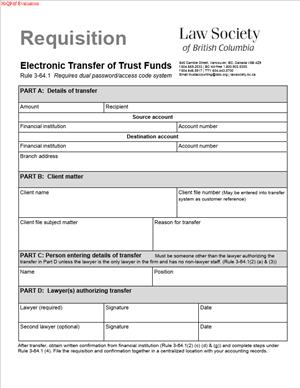

Requisition – Electronic Transfer of Trust Funds

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Requisition – Electronic Transfer of Trust Funds?

A Requisition – Electronic Transfer of Trust Funds is an internal authorization form. You use it to approve and instruct an electronic withdrawal from your law firm trust account. It records who the payee is, why the payment is proper, how much will be sent, and how it will be sent. It identifies the client matter, confirms available and cleared trust funds, and sets the transfer method. It also captures the approvals needed to release funds electronically.

It works alongside your bank’s platform. The requisition is not the transfer itself. It is the instruction and audit trail that make the transfer compliant and defensible. It replaces a trust cheque when you need to send funds through wire or direct electronic banking.

Who Typically Uses This Form?

You will see this form in law firms that hold client funds in British Columbia. Typical users include lawyers, managing partners, trust accountants, bookkeepers, conveyancers, legal assistants, and office managers. Only those with a trust signing authority should approve it. Support staff often draft the requisition and assemble the backup. Authorized signers review, approve, and release the transfer.

Why You Might Need This Form

You need a formal requisition when you move trust money electronically. Trust withdrawals must meet strict rules. Cheques are one option. Electronic transfers are allowed if you meet specific safeguards. The requisition provides those safeguards. It documents your authority to pay. It confirms that the payment matches the client’s instructions and a permitted purpose. It also shows that you followed required controls, such as dual authorization and segregation of duties.

An electronic transfer can be faster and safer than a cheque. A payee may require a wire for closing or settlement. A lender may only accept a wire. You may need to meet a same‑day deadline. You may want to reduce the risk of lost or altered cheques. The requisition lets you move the funds by wire or direct bank‑to‑bank transfer while staying compliant.

Typical Usage Scenarios

You use this form in many common situations. Real estate conveyancing is a frequent one. On completion, you must wire net sale proceeds to a client, another law firm, or a lender. You may also pay strata arrears, taxes, or discharge fees by wire. Each electronic payment out of trust needs a requisition.

- Litigation and personal injury files often use electronic transfers. You may pay settlement funds to a client, a subrogated insurer, or an expert. You may wire to a third party under a release or court order. You keep the requisition with the settlement documents and ledger.

- Corporate and commercial files also need this form. You may fund closings, pay purchase prices, or send retainers to agents. You might wire to a foreign account, if permitted. The requisition records the required details, including any currency conversion.

- Family and estate matters use it too. You may refund unused retainers. You may pay beneficiaries or transfer funds to a trust company. You may also pay mediator fees or other disbursements by electronic transfer.

- Finally, you use this form when moving earned fees from the trust to your general account electronically. You must have delivered an invoice first. You must match the transfer to the billed amount. The requisition ties the invoice, ledger, and transfer together.

When Would You Use a Requisition – Electronic Transfer of Trust Funds?

You use this form whenever you plan to move money electronically from a trust account. The key trigger is the method: wire or direct bank‑to‑bank transfer. If you would otherwise write a trust cheque, but you need speed or the payee demands a wire, you use a requisition instead.

Real estate conveyancers use it on completion day. You may need to send payout funds by a bank cut‑off. A requisition lets your firm approve and release a wire in time. It reduces courier and cheque risks. It supports precise routing to the beneficiary account.

Litigators use it when paying settlements or court‑ordered amounts. A plaintiff may need immediate access to funds. An insurer or defendant counsel may require a wire. The requisition ensures the transfer aligns with the release, direction to pay, or order.

Corporate and securities lawyers use it for closing funds. Targets and escrow agents often require same‑day value. The requisition sets out payee bank coordinates and any reference fields. It also notes any currency and conversion details.

Family and estate practitioners use it to refund a client retainer or distribute assets. A bank transfer reduces delays and minimizes the risk of uncashed cheques. It also helps when clients live out of province.

Firm owners and bookkeepers use it to move earned fees from the trust to the general. This occurs after you render an invoice. The requisition ties the invoice to the client trust ledger. It shows that only earned amounts were moved.

Across all practices, you may choose an electronic transfer to reduce fraud risk. Cheques can be intercepted or altered. A wire or direct transfer, when verified, lowers that risk. The requisition provides the control framework to do that safely.

Legal Characteristics of the Requisition – Electronic Transfer of Trust Funds

This requisition has legal weight inside your firm and with your bank. It is an internal authorization and a direction for a trust withdrawal. It demonstrates compliance with professional trust accounting rules in British Columbia. It shows that you had the authority to move the funds for a permitted purpose.

Is it legally binding?

Yes, in two ways. First, it binds your firm and its authorized signers. It records approvals under your bank mandate and firm policy. Second, it serves as the written instruction that your financial institution relies on. When combined with the bank’s transfer confirmation, it forms a complete record of the transaction. It is not a contract with the payee. The client’s underlying direction to pay remains the source of authority for the disbursement.

What ensures enforceability?

Several features do. The requisition names the client matter and identifies the trust account. It states the purpose for the withdrawal. It confirms that funds are available and cleared. It captures two approvals by authorized trust signers. It separates duties between the preparer, approver, and releaser. It attaches proof of authority, such as a written client direction, a payout statement, an invoice, or a court order. It is dated and signed. It is matched to a bank confirmation with a trace number. Taken together, these components create a defensible audit trail.

General legal considerations apply. You must only withdraw for a proper purpose. You need written authority for third‑party payments, unless a court order governs. You must have delivered an invoice before moving funds to your general account. You must not overdraft a client trust ledger. You must not deduct bank fees from client trust funds, unless permitted and documented. You must ensure deposited funds have cleared before disbursing. You must keep complete records for the required retention period.

You should protect client information. The requisition will list the payee bank details, which are sensitive. Store it securely. Limit access to trust records to those who need it. Use secure methods to receive and confirm payee banking information. Verify bank details through an independent call‑back to a known number. Do not rely on unverified email changes.

Timing matters. Banks have wire cut‑off times. International transfers may take longer and may face compliance screening. Currency conversion can affect amounts received. Set a value date that matches your closing timeline. Confirm whether funds will arrive net of intermediary fees. Build these facts into your requisition and your undertakings.

Finally, be ready for an audit. Your regulator may review trust withdrawals. Auditors look for a complete file. The requisition, approvals, supporting documents, and bank confirmation should tell one clear story. If it is not in writing, it did not happen. This form helps you put it in writing.

How to Fill Out a Requisition – Electronic Transfer of Trust Funds

Follow these steps to complete the requisition accurately and efficiently. Treat each step as a control point. Keep sentences and entries clear and specific. Avoid gaps and abbreviations that can create confusion.

1) Identify the parties and the matter.

Enter the client’s full name and the file or matter number. Add a concise matter description, such as “Sale of 123 Main Street” or “Smith v. ABC Insurers – Settlement.” This ties the transfer to the correct client trust ledger. It also helps reviewers match the transfer to the file.

2) Specify the source trust account.

State the trust account name as it appears at the bank. Include the institution number, transit, and account number. Identify whether it is a pooled trust account or a separate interest‑bearing trust account. Note the currency of the account. If you hold funds in a separate trust for a client, use that account’s details.

3) Name the payee and role.

Enter the legal name of the payee. Add the role, such as “client,” “seller’s lawyer,” “lender,” “expert,” or “firm general account.” If paying another law firm, include the firm name and file reference. If transferring to your general account, clearly state “Transfer of earned fees to general – see invoice attached.”

4) Record payee banking details.

Collect precise bank coordinates. For domestic wires, include the institution number, transit, and account number. For international wires, add the SWIFT/BIC and any required routing codes. Include the beneficiary bank name and address. Confirm whether an intermediary bank is needed. Use information supplied in writing and verified through a known contact. Do not accept last‑minute changes by email without verification. Record who verified the details, how, and when.

5) State the amount and currency.

Enter the exact amount to be sent. State the currency. If there are multiple payees, you can attach a schedule of payments. Cross‑reference the schedule in this section, such as “See Schedule A for payee list and amounts.” If a currency conversion is needed, set out the source currency, the expected rate, and who bears conversion costs. If bank fees will be charged, confirm they will be paid from your firm’s general account, not from client trust funds, unless permitted and documented.

6) Describe the purpose of the transfer.

Use plain language. Examples: “Net sale proceeds per Statement of Adjustments,” “Settlement funds per release dated [date],” “Payout of mortgage per discharge statement,” “Transfer of earned fees to general per Invoice #12345 dated [date],” or “Refund of unused retainer to client.” This statement should match the supporting documents and the trust ledger narrative.

7) Confirm funds are available and cleared.

Check the client trust ledger. Confirm that the balance covers the requested transfer and any pending items. Note the deposit date and hold expiry, if applicable. State “Funds cleared on [date].” Do not release until you confirm clearance. Record the ledger balance before and after the transfer. This helps prevent an inadvertent overdraft.

8) Attach supporting documents as schedules.

Attach all documents that prove authority and purpose.

Examples include:

- The client signed the direction to pay.

- Statement of Adjustments or payout statements.

- Court order or settlement agreement.

- Invoice delivered to the client, if transferring fees to the general.

- Trust ledger printout.

Label each attachment as a schedule (Schedule A, B, C, etc.). Reference the schedules in the body of the requisition. This creates a complete package.

9) Choose the transfer method and timing.

Select “wire” or “electronic funds transfer through online banking,” as your bank supports. Enter the requested transfer date and time. Consider bank cut‑off times and any value date. If time sensitive, mark “Urgent” and add the reason. If the transfer relates to a closing, note the closing date and undertakings that depend on timing.

10) Set remittance details and references.

Enter the reference text that should appear to the recipient. Include your file number or the client name, as allowed by privacy rules. Avoid including sensitive personal data. Provide any special instructions required by the receiving bank.

11) Complete internal approvals and segregation of duties.

Name the preparer. The preparer should sign and date the requisition. Identify the two authorized trust signers who will approve the transfer. Each signer should review the entire package and sign with the date and time. The person who releases the transfer in the bank system should be someone other than the preparer. Keep segregation of duties in place. Document each role on the form.

12) Perform independent verification before release.

Carry out a documented call‑back to a trusted contact for the payee. Confirm the bank account details and the purpose. Use a known phone number, not one from a recent email. Record the name, number dialed, date, time, and confirmation notes on the requisition. If the payee is your client, confirm through the client’s verified contact method.

13) Release the transfer and capture confirmation.

Once approved, release the transfer through your bank platform. Print or save the bank confirmation. The confirmation should show date, time, amount, currency, destination account details, and any trace or reference number. Attach the confirmation as a schedule. Initial it and write “Attached to requisition.” Circle the amount for clarity.

14) Update trust records and notify stakeholders.

Post the transaction to the client trust ledger. Reconcile the ledger to the bank confirmation. File the requisition and schedules in your trust records. Send a remittance advice to the client or payee, as appropriate. For fee transfers to general, match the receipt in general to the bank confirmation. Keep a cross‑reference of entries.

15) Signatures and certifications.

Ensure signatures match the bank mandate and your firm’s policy.

Each approver should certify that:

- The transfer is for a permitted purpose.

- Funds are available and cleared.

- Supporting documents are complete.

- Payee details were independently verified.

Include a certification block on the form if not preprinted. Keep the language plain and specific. Date and time-stamp each signature.

16) Common clauses and statements to include.

Your requisition should include several standard statements. These are not lengthy legal clauses. They are clear confirmations that support compliance:

- Authority statement: “We are authorized trust signers for the source account.”

- Purpose statement: “This withdrawal is for the stated client matter and permitted purpose.”

- Verification statement: “Payee banking details were verified by [name] on [date] via call‑back.”

- Clearance statement: “Funds cleared on [date]; ledger balance sufficient.”

- Fee statement: “Any bank fees will be paid from the firm’s general account unless otherwise permitted.”

These statements reduce ambiguity. They guide staff and inform auditors.

17) Handling multiple payees or staged payments.

If you must send to several payees, use a schedule listing each payee, amount, currency, and bank details. Number each payment for tracking. If payments will occur on different dates, prepare a separate requisition for each date. This keeps timing, approvals, and confirmations clean.

18) Corrections and cancellations.

If you need to amend a requisition before release, strike through, initial, and date the change. Do not use correction fluid. If you must cancel after release, contact your bank immediately. Start a recall process if available. Document every step, including who you spoke with and when. Add the cancellation or recall confirmation to the file.

19) Retention and audit readiness.

File the completed requisition with all schedules and bank confirmations. Retain it with your trust accounting records for the required period. Make sure the file tells a complete story from instruction to confirmation. That includes the client direction, approvals, transfer, and posting entries. A complete file supports you in any review or audit.

By following these steps, you will complete the form correctly and safely. You will meet professional trust accounting standards in British Columbia. You will also reduce operational and fraud risk while supporting timely client service.

Legal Terms You Might Encounter

- Trust account means a bank account that holds client money separate from your firm’s funds. On this form, you identify which trust account will send the money and confirm the client matter it relates to.

- General account is your firm’s operating account for fees and expenses. If you move funds from a trust to a general account, the form must show the billed amount, the client file, and the reason.

- Requisition is your written instruction to transfer money from a trust by electronic means. It records who gets paid, how much, why, and which authorizers approved it.

- Electronic funds transfer (EFT) is a bank-to-bank transfer within the same country. On the form, you choose EFT when sending domestically and include the account number and branch details.

- Wire transfer is an international or same-day bank transfer using routing codes like SWIFT or IBAN. On the form, you enter the payee’s full banking details and any intermediary bank information.

- Payee (or beneficiary) is the person or entity receiving the funds. The form must show the exact legal name, address, and account details to reduce rejection risk.

- Client matter (or file number) ties the payment to a specific client and case. You must enter the correct file so the transfer posts to the right trust ledger.

- Dual authorization means two authorized signers approve the transfer. The form captures both names and signatures or electronic approvals to meet control requirements.

- Cleared funds are deposits that have passed bank holds and are available to send. The form reflects that you checked the ledger and that the transfer will not create a trust shortage.

- Trust conditions are obligations attached to receiving or disbursing funds. If conditions apply, note them on the form and attach supporting documents that show they were satisfied.

FAQs

Do you always need two authorizers to approve the transfer?

Yes, in most cases you do. Dual authorization is a key control for trust safety. Use the form to record both approvals. If your structure allows a single approver in limited cases, document your internal policy and why it applies. When in doubt, get a second authorization.

Do you need client authorization before transferring trust funds?

Yes. Keep written client instructions or settlement terms that permit the payment. Attach them to the form or cross-reference where they are stored. The form should show the purpose of the payment and the client matter it serves.

Do you use this form to move funds from a trust to your general account?

Yes. Complete the form with the billed amount, client file, and invoice reference. Confirm the trust ledger has enough cleared funds. Only transfer the amount you are entitled to. Keep the supporting billing documentation with the form.

Can you send funds internationally using this form?

Yes. Choose wire transfer and provide all required details. Include the payee’s legal name, address, bank name, branch address, account number or IBAN, and SWIFT/BIC. Add intermediary bank details if required by the payee. Expect foreign exchange charges and bank fees.

Do you need to verify bank details before sending?

Yes. Always confirm account details using an independent channel. Do not rely only on an unverified email. Call a known number or use a secure method your firm has approved. Note on the form how you verified the instructions and by whom.

What if funds have not cleared yet—can you still submit the form?

Wait until the deposit clears. Submitting before clearance risks a trust shortage and transfer rejection. Check hold periods on cheques and drafts. Confirm the ledger shows cleared, available funds for the client matter.

What if you discover an error after submitting the requisition?

Act fast. Contact your bank immediately to request an amendment or recall. Document what changed, who approved the change, and when you notified the bank. Update the form package with the correction and keep all confirmations.

Checklist: Before, During, and After the Requisition – Electronic Transfer of Trust Funds

Before signing

- Confirm the client’s written authority to pay these funds.

- Verify the purpose of the payment matches the client matter.

- Check the client trust ledger for cleared, available funds.

- Confirm trust conditions (if any) are satisfied and documented.

- Obtain the payee’s legal name and address as shown on their bank account.

- Secure bank details from a trusted source: institution, transit, and account number for EFT; IBAN and SWIFT for wire.

- Independently verify bank details by phone or another approved method.

- Decide the transfer type: EFT (domestic) or wire (international or urgent).

- Confirm currency, amount, and who bears bank fees.

- Note any reference text required on the transfer (file number, invoice, or property address).

- Gather supporting documents: invoice, statement of adjustments, direction to pay, or trust release.

- Schedule around bank cut-off times and any internal approval deadlines.

- Ensure two authorized signers are available and have access to the required systems.

- Prepare any intermediary bank information if the destination requires it.

- Check whether a callback or secondary verification step is required by your bank.

During signing

- Review the payee name and ensure it matches the bank account name.

- Confirm the client matter or file number is correct.

- Verify the amount in numbers and, if used, in words.

- Select the correct trust account as the source.

- Confirm the transfer type: EFT or wire, and the currency.

- Enter the full bank details: institution, transit, account, or IBAN and SWIFT.

- Include the payee’s bank address and any intermediary bank details.

- Add a clear payment reference that the payee will recognize.

- Note who verified the banking instructions and when.

- Attach required documents and label them clearly.

- Complete the authorizer information and obtain both signatures or approvals.

- Initial any corrections. Avoid overwriting original entries.

- Date and time-stamp the requisition.

- Check that the total amount will not create a trust shortage.

After signing

- Submit the requisition through your approved banking process.

- Obtain the bank’s submission confirmation or transaction number.

- Save the confirmation with the form and supporting documents.

- Notify the client and payee of the amount, date, and reference details.

- Update the client trust ledger and any transfer registers.

- Record any bank fees and how they were handled.

- Monitor for completion or errors. Follow up on any bank queries.

- If funds are returned, record the reason and next steps.

- Reconcile the transfer in your next trust reconciliation.

- File the full package in your trust records with a clear index.

Common Mistakes to Avoid

Sending funds before they clear

- Don’t forget to wait for clearance on deposits. Sending early can cause a trust shortage and a failed transfer. It may also trigger internal compliance issues.

Relying on unverified banking instructions

- Never accept changed bank details by email alone. Call a known number to confirm. A fraud-induced payment is often hard to recover and can harm your client.

Missing the second authorization

- Do not skip dual approval. Missing a required authorizer can breach trust controls. The bank may reject the transfer, and internal audits will flag it.

Using the wrong payee name or account number

- Check the legal name and account figures carefully. A mismatch can cause delays, rejections, or funds going to the wrong party. Recovery may be slow or impossible.

Failing to record the file reference and purpose

- Always include the client matter and reason for payment. Missing context complicates reconciliation and audits. It can also delay answers to client queries.

What to Do After Filling Out the Form

- Obtain final approvals. Make sure both authorizers have reviewed the payee, amount, and purpose. Confirm there are no pending trust conditions.

- Submit the transfer. Use your approved banking method. Enter the requisition details exactly as shown on the form.

- Capture confirmation. Save the bank’s transaction number, date, time, and any FX rate used. Attach these to the form package.

- Notify stakeholders. Tell the client and payee the amount sent, date, and reference information. Provide expected timing based on transfer type.

- Record fees and exchange. Note any fees deducted by your bank or intermediary. If the client bears fees, adjust the payout or invoice accordingly.

- Update ledgers. Post the disbursement to the correct client trust ledger. Update any central register of electronic transfers.

- Monitor completion. Track the transfer’s status. If funds do not arrive as expected, contact the bank and the payee. Keep a record of all follow-ups.

- Handle amendments or recalls. If an error occurred, request a correction or recall at once. Keep written approvals for any change and all bank responses.

- Reconcile and file. Reflect the transfer in your next reconciliation. File the requisition, confirmations, and attachments in your trust records. Use a consistent naming convention for quick retrieval.

- Review and improve. After completion, review any hiccups. Update your checklist or templates to prevent repeat issues.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.