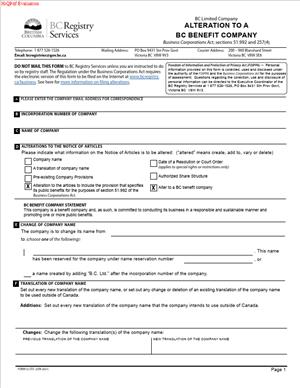

Form 52 – Alteration to a BC Benefit Company

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a Form 52 – Notice of Alteration: from B.C. Company to B.C. Benefit Company?

Form 52 is the filing you use to change an existing B.C. company into a B.C. benefit company. You file it with the corporate registry to alter your notice of articles. The alteration adds a required benefit company statement under the Business Corporations Act. You also adopt updated articles that include benefit company provisions.

A benefit company is a for-profit company with a broader purpose. It commits to conducting business in a responsible and sustainable way. It also commits to promote one or more public benefits named in its articles. The benefit is specific to your company. It can relate to the environment, community, employees, or other stakeholders. You define it in your articles.

Who typically uses this form?

You do if you are a director, officer, owner, or corporate secretary of a B.C. company. In-house counsel and paralegals often prepare it. Outside counsel and registered records offices also handle it for clients. You do not use this form to start a new benefit company. You only use it to convert an existing B.C. company.

You would need this form when your board and shareholders choose to adopt a dual mission. You want to lock a public benefit into your constitution. You also want the legal status of a benefit company. That status creates a clear mandate for directors. It also triggers annual reporting duties about your public benefit. You may use this form to signal your values to investors, employees, and customers. Some impact investors require benefit status before funding. Some procurement programs value companies with formal benefit commitments.

Typical usage scenarios include founder-led companies formalizing their mission. You may convert before financing to show long-term intent. You may convert during a reorganization to align entities. You may convert as part of a succession plan that protects the purpose. You may convert to meet board direction or stakeholder requests. You may also convert to align with ESG policies and reporting.

The form does not change your company name by itself. It changes your legal status and constitutional documents. Your company remains a B.C. company under the Act. It now has beneficial duties added in law and the articles. Your notice of articles will now state that the company is a benefit company. Your articles will now include benefit commitments and your named public benefits.

When Would You Use a Form 52 – Notice of Alteration: from B.C. Company to B.C. Benefit Company?

You use Form 52 when the company is already incorporated in B.C. You now want to become a benefit company. You have identified one or more public benefits. You are ready to adopt benefit provisions in your articles. Your directors support the change. Your shareholders are willing to pass a special resolution.

You use it when a special resolution has been approved for the alteration. You might pass the resolution at a meeting. You might pass it by written consent. Your articles may set the vote threshold. The Act sets a baseline of at least two-thirds of votes cast. Your company could require more in its articles.

You file the form when you want the change to take legal effect. You can choose to file for immediate effect. You can also set a future effective date and time. A future date is common when you coordinate with a closing. It helps you align with financing, tax, or contractual milestones.

Typical users include business owners running private companies. You may be the sole shareholder and director. You also include boards of venture-backed companies. You include in-house legal teams and corporate secretaries. You include paralegals who manage corporate records and filings. You include external counsel acting as the registered and records office.

You use Form 52 if you incorporated earlier as a standard company. You do not use it when you form a brand-new benefit company. A new benefit company sets its status at incorporation. The incorporation sets the statement in the notice of articles on day one. You use Form 52 only to alter an existing notice of articles.

You use it when your timeline matters. For example, you want a benefit status in place before issuing preferred shares. You want it before signing a supply contract that references impact goals. You want it before a grant or program deadline. You want it before you publish your next annual report.

You use it after you finish the internal analysis. You have checked investor consent rights. You have checked the lease and loan agreements that reference corporate changes. You have checked insurance policies and permits. Most agreements do not restrict this change. Still, you should confirm any required consents. Filing at the right time avoids breaching covenants.

You use Form 52 again if you once ceased benefit status and want to restore it. You follow the same steps. You pass a new special resolution. You alter your notice of articles again. You adopt benefit provisions again in your articles.

Legal Characteristics of the Form 52 – Notice of Alteration: from B.C. Company to B.C. Benefit Company

The filing is legally binding because it alters your company’s notice of articles and articles. The Act governs alterations. Section 51.992 requires a benefit company statement in the notice of articles. Section 257(4) makes the alteration effective only when filed. Your company does not become a benefit company until the registry accepts the filing. The time and date stamp on the filing control effectiveness.

Enforceability comes from compliance with the Act and your articles. You need a valid shareholder authorization. You need a special resolution that approves the alteration. You must adopt benefit provisions in your articles. Those provisions must include two core commitments. You must commit to conducting business in a responsible and sustainable manner. You must commit to promoting one or more public benefits. You must describe those benefits in your articles. The description should be clear enough to guide decisions and reporting.

Your updated notice of articles serves as public records. The registry issues an updated notice of articles. You must keep your minute book updated with the special resolution and new articles. If the filing is deficient, the registry may reject it. If your special resolution is invalid, the alteration may be vulnerable. You reduce risk by keeping clean records and using precise drafting.

Shareholder approval is central. A special resolution must pass in the form your articles require. If your article changes affect a particular class of shares, you may need a class vote. Check your share structure and rights before drafting. You can often avoid class impacts by limiting changes to benefit provisions. Still, you should confirm with your share terms.

Directors’ duties expand for benefit companies. Directors must act in the best interests of the company. For benefit companies, that includes consideration of the public benefits and stakeholders. You must consider employees, the environment, and other affected parties. You must balance those interests in good faith. The Act does not require you to prioritize profit over the public benefit. It also does not shield you from accountability to shareholders. Your decisions should reflect the dual purpose set in your articles.

Benefit companies must prepare an annual benefit report. The report explains how you pursued your public benefits. It explains how you operated in a responsible and sustainable way. It includes an assessment against a chosen standard if your articles require one. You deliver the report to shareholders. You also make it publicly available, often by posting it. You must keep the report in your records. You should plan for the report before you file Form 52. You will need data and metrics to report on.

Enforcement of benefit duties is limited. The Act restricts who can bring claims. Claims focus on compliance and reporting, not damages to the public. This reduces litigation risk from the public at large. Shareholders may still hold directors to account. Your clear articles and reports support defensible decisions.

Changing to a benefit company does not create a new legal entity. Your contracts, permits, CRA accounts, and bank accounts remain in place. You should still notify key counterparties. Some systems track your status. You may need to update internal registers and compliance calendars. You should add the benefit report deadline to your calendar. You should add a board review of the report each year.

If you later want to stop being a benefit company, you must alter again. That requires another special resolution. It also requires a filing to remove the benefit company statement. You must also remove benefit provisions from your articles. That process uses a different selection in the notice of alteration. Plan your steps to avoid back-and-forth filings.

How to Fill Out a Form 52 – Notice of Alteration: from B.C. Company to B.C. Benefit Company

Step 1: Confirm the decision and scope.

Align the board on becoming a benefit company. Define your public benefits. Decide whether you will change anything else at the same time. Keep this filing focused if possible. Simpler filings process faster.

Step 2: Draft your benefit provisions for the articles.

Include the two mandatory commitments. Commit to conducting business in a responsible and sustainable way. Commit to promoting your named public benefits. Describe each public benefit in clear, specific terms. Avoid vague goals. Use language that supports measurement. Add any governance terms you want. You can set how often the board reviews benefit progress. You can set stakeholder advisory input. You can identify a standard you will use to assess performance. Keep the articles practical and enforceable.

Step 3: Prepare the shareholder special resolution.

State that shareholders approve the alteration to become a benefit company. Reference the addition of the benefit company statement to the notice of articles. Reference adoption of the new or amended articles with benefit provisions. Include the text of any new provisions in an attached schedule. Set the effective date if you want a future time. Keep the resolution precise and concise.

Step 4: Review consent and notice requirements.

Check your articles and any shareholders’ agreement. Confirm notice periods for meetings, if you will hold one. Confirm whether written consents will suffice. Confirm any drag-along or veto rights. Plan your timing to respect all rights. Build in time for questions and education.

Step 5: Circulate meeting materials or consent packages.

Send the special resolution and draft articles to shareholders. Provide a plain-language summary. Explain what a benefit company is. Explain the annual report obligation. Explain how the change affects directors’ duties. Answer questions before the vote.

Step 6: Pass the special resolution.

Hold the meeting or collect executed written consents. Ensure the required voting threshold is met. Record the vote results in minutes. If any class vote is needed, hold those votes as well. Save signed consents and minutes for your records.

Step 7: Finalize the articles for filing.

Create a clean, consolidated set of articles. Insert the benefit provisions exactly as approved. Check cross-references and definitions. Number sections consistently. Prepare a PDF for filing. Label it clearly for your records.

Step 8: Complete Form 52 details.

Enter your company’s name exactly as on record. Enter your incorporation number. Select the alteration that changes the status to a benefit company. Confirm that you will add the benefit company statement to your notice of articles. This satisfies section 51.992. Enter the date the special resolution passed. Choose an effective date and time if you want a future effect. If not, the filing takes effect when accepted under section 257(4).

Step 9: Describe the alteration accurately.

State that the notice of articles will include a statement that the company is a benefit company. State that the articles are altered to add benefit provisions. You do not need to restate the full article’s text here. You will attach it.

Step 10: Attach schedules and supporting documents.

Attach the full text of your altered or restated articles as Schedule A. Include any other related alterations as separate schedules. For example, attach a share structure change only if you are doing one. Most conversions do not need share changes. Keep schedules organized and labeled.

Step 11: Identify the parties and the signatory.

The company is the filing party. The registrar is the recipient. An authorized signatory must certify the filing. Use a director, officer, or authorized filing agent. Enter the signatory’s full name and position. Confirm the signatory has authority to certify accuracy.

Step 12: Complete the certification.

Review every entry for accuracy. Confirm the date of shareholder authorization. Confirm the attachment matches the approved articles. Certify that the information is correct and complete. False statements can lead to rejection or penalties.

Step 13: Provide contact information.

Enter an email and phone for filing questions. Enter the registered and records office address if prompted. This helps the registry reach you if issues arise. Make sure someone monitors the inbox.

Step 14: Pay the filing fee.

Have a valid payment method ready. Fees are due at submission. Keep the receipt for your records. Record the transaction number for tracking.

Step 15: Submit the filing.

File electronically through the registry system. Upload the article’s attachment when prompted. Submit and wait for confirmation. Do not assume approval until you receive acceptance.

Step 16: Track acceptance and effective time.

You will receive a confirmation and an updated notice of articles. Check the effective date and time on the confirmation. Verify that the notice of articles now includes the benefit company statement. Save the documents to your records.

Step 17: Update your corporate records book.

Insert the new notice of articles and articles. File the special resolution and minutes. Update the directors’ consent to act if you have changed the board. Record the effective date on your registers. Keep a clean index of documents.

Step 18: Notify stakeholders and align operations.

Tell your board, management, and employees about the new duties. Add the annual benefit report to your compliance calendar. Assign responsibility for data collection and reporting. Update your website to host the report when ready. Update policies to reflect responsible and sustainable practices. Update investor materials and pitch decks to reflect benefit status.

Step 19: Plan your first annual benefit report.

Select a reporting framework if your articles refer to one. Identify metrics for each public benefit. Set quarterly checkpoints to track progress. Draft a board charter for benefit oversight if helpful. Prepare a plain-language report template.

Step 20: Avoid common filing errors.

Do not file without a valid special resolution. Do not forget to attach the articles with benefit provisions. Do not use vague benefit descriptions. Do not omit the effective date if you need one. Do not certify if you have not verified every detail. Fix errors before submission to avoid rejection.

Practical drafting tips for your benefit provisions help the filing succeed. Name each public benefit clearly. For example, “Reduce total greenhouse gas emissions intensity year-over-year.” Tie benefits to your business model where possible. Avoid promises you cannot measure. Keep discretion for the board to refine methods. Require an annual board review of benefit performance. Require the company to publish the benefit report. Allow the board to select or change an assessment standard if needed. Record these details in your articles, not in separate policies.

If you pair this change with other alterations, plan the order. Many companies file the benefit conversion on their own. This reduces the risk of a rejection that delays a closing. If you must combine changes, ensure each change has proper approval. Include separate schedules for clarity.

If you run into timing issues, consider a future effective time. You can pass the resolution today, but make the filing effective later. This helps you coordinate with financing or tax events. Remember that the Act makes the alteration effective on the registry’s time stamp. Build a buffer into your closing checklist.

Your final goal is simple. You want an accepted filing, an updated notice of articles, and clean articles. You want clear records of shareholder approval. You want a ready plan to meet benefit duties. Follow the steps above, and you can file with confidence.

Legal Terms You Might Encounter

- Benefit company: This is a B.C. company that commits in its articles to conduct business in a responsible and sustainable way and to promote one or more public benefits. Form 52 is the filing that updates your public company record to show this new status.

- Benefit provision: This is the exact clause you add to your articles to become a benefit company. It states your commitment to responsible and sustainable business and describes your chosen public benefits. You pass a special resolution to add it, then file Form 52 to update the public record.

- Public benefit: This is the specific social, environmental, or community benefit you choose to pursue. It must be for the benefit of a class of persons, communities, or the environment, not a narrow private interest. Your benefit provision should describe this clearly.

- Articles: These are your internal rules. They include share rights, director powers, and now your benefit provision. When you convert, you alter the articles by special resolution. You keep the amended articles in your records book.

- Notice of Articles: This is the public-facing summary of key company information. It includes your name, incorporation number, addresses, share structure, and now your benefit company status. Form 52 updates the Notice of Articles to reflect the change.

- Special resolution: This is a higher-threshold shareholder approval used to alter the articles. You usually need at least a two‑thirds or three‑quarters vote, depending on your articles. You use a special resolution to adopt the benefit provision before you file Form 52.

- Alteration: This is the legal change you make to your corporate records, such as adding the benefit provision to your articles. Form 52 is the notice of that alteration for the public record.

- Effective date and time: This is when your alteration takes effect. You can usually choose “immediate” or a future date and time. The effective moment matters for when your benefit company duties begin.

- Directors’ duties: In a benefit company, directors must balance promoting the chosen public benefits and conducting business responsibly with generating value for shareholders. This balancing duty starts at the effective date you set through Form 52.

- Benefit report: This is your annual report on how you pursued your stated public benefits. You approve it at the board level and share it as required. Converting Form 52 starts the cycle for producing this report each year.

FAQs

Do you need a special resolution to file Form 52?

Yes. You adopt the benefit provision by special resolution before filing. Without that approval, your alteration is not properly authorized. Keep a signed copy of the resolution in your records.

Do you need to change your company name to add “Benefit Company”?

No. Your legal name does not need to change. The benefit company status appears on your public company record. If you want a new name, that is a separate name change process.

Who can sign Form 52?

An authorized signatory signs. That is typically a director or officer. Ensure your signer’s name and title match your corporate records. If an agent signs, have written authority on file.

Can you choose a future effective date for the conversion?

Yes, you can usually set a future effective date and time. Pick a date that aligns with board oversight, reporting cycles, or stakeholder communications. If you need the change immediately, choose “immediate.”

Does converting affect your tax status?

The conversion by itself does not change your corporate tax classification. It adds governance and reporting commitments. If you have tax concerns, confirm them with your advisors.

Do you need to update existing contracts or licenses?

The conversion usually does not change your existing obligations. Review your key contracts for any clauses on corporate status changes. Notify counterparties if a contract requires it or if notice would be prudent.

Can you revert to a standard company later?

Yes. You can remove the benefit provision by special resolution and file a new notice of alteration. Consider the impact on stakeholders and your public commitments before you do so.

How long does the filing take, and are fees involved?

A filing fee applies. Processing is often fast once submitted. Confirm acceptance by downloading the updated Notice of Articles and saving your filing confirmation in your records.

Checklist: Before, During, and After the Form 52 – Notice of Alteration: from B.C. Company to B.C. Benefit Company

Before signing: information and documents you need

Company details:

- Legal name and incorporation number.

- Current registered office and records office addresses.

- Up-to-date director information.

Governance approvals:

- Draft special resolution to adopt the benefit provision.

- Final text of the benefit provision for your articles.

- Signed special resolution, with the date and vote results.

Records readiness:

- Current articles and any prior alterations.

- Minute book updated and accessible.

- Signing authority evidence for the person who will sign the form.

Planning items:

- Clear description of your public benefits.

- Internal owners for benefit governance and reporting.

- Proposed effective date and time for the alteration.

- Communication plan for directors, shareholders, lenders, and key partners.

- Calendar entry for the first benefit report cycle and board approval.

Practical tip: Draft your benefit provision in plain language. Make it specific enough to guide action, but flexible enough to remain relevant as your business evolves.

During signing: sections to verify

Company identity:

- Legal name spelled exactly as on record.

- Incorporation number entered correctly.

Benefit company selection:

- The option indicating “benefit company” status is selected where required.

- No unintended changes to other fields.

Effective date and time:

- Confirm “immediate” or your chosen future date/time.

- Align the timing with your board and communications plan.

Articles alteration basis:

- Ensure you have the signed special resolution on file.

- Confirm the resolution date and that it authorizes the benefit provision.

Signatory details:

- Signer’s name, title, and authority match internal records.

- Contact information is accurate for any follow‑up.

Final review:

- Cross-check entries against your minute book and resolution.

- Verify that registered and records office addresses are current.

- Save a pre-submission copy or screenshot of the completed form.

Practical tip: If the system shows a summary preview, read it line by line. Correct typos before you submit to avoid amendments later.

After signing: filing, notifying, and storing

Filing and confirmation:

- Submit the form and pay the fee.

- Download the filing confirmation and updated Notice of Articles.

- Record the transaction or confirmation number in your records.

Corporate records:

- Insert the signed special resolution into your minute book.

- Update your articles to include the benefit provision and file the updated set in your records book.

- Replace the prior Notice of Articles with the updated version.

Internal alignment:

- Brief the board and management on the new duties and reporting cycle.

- Update board charters and management mandates to reflect benefit oversight.

- Add the benefit report to your annual compliance calendar.

Stakeholder communications:

- Notify shareholders, lenders, insurers, and key partners as appropriate.

- Share a concise internal announcement with staff.

- Update your website or materials to reflect the new status, if desired.

Ongoing compliance:

- Plan metrics and methods to assess your public benefits.

- Set a review schedule for the benefit provision and reporting process.

- Train relevant teams on data collection for the benefit report.

Practical tip: Create a one-page “benefit governance” brief. List your benefit commitments, metrics, owners, and reporting dates. Circulate it to the board and leadership.

Common Mistakes to Avoid

Not passing a proper special resolution

- Why it happens: You assume a simple board approval is enough.

- Consequences: The alteration lacks valid shareholder approval. A stakeholder could challenge it, and you may need to re‑file.

- Friendly warning: Don’t forget to get the right shareholder vote and keep signed records.

Vague or aspirational benefit provision

- Why it happens: You want flexibility, but keep it too broad.

- Consequences: It becomes hard to measure progress or draft a credible benefit report. You risk credibility and confusion.

- Friendly warning: Describe concrete public benefits. Use clear verbs and avoid vague promises.

Incorrect effective date or timing gaps

- Why it happens: You pick a default date without planning.

- Consequences: Misalignment with board oversight, public announcements, or contractual timing. You may need another filing to fix errors.

- Friendly warning: Set a date that matches your governance and communications plan.

Wrong or unauthorized signatory

- Why it happens: An internal admin signs without formal authority.

- Consequences: Rejection, delays, or questions about validity.

- Friendly warning: Have a director or authorized officer sign. Keep evidence of authority on file.

Forgetting to update the minute book and compliance calendar

- Why it happens: You rely on the public record and skip internal updates.

- Consequences: Incomplete records and missed benefit report deadlines. This can lead to compliance issues and reputational risk.

- Friendly warning: File the amended articles in your records and schedule your annual benefit report now.

What to Do After Filling Out the Form

1) Submit and pay

- File the completed Form 52 through the corporate filing system you use. Pay the filing fee. If you set a future effective date, note it on your calendar.

2) Confirm acceptance

- Download the filing confirmation and updated Notice of Articles. Verify that your company now shows as a benefit company and that the effective date/time is correct.

3) Update your minute book

- Insert the signed special resolution adopting the benefit provision.

- Replace the old articles with the amended articles that include the benefit provision.

- Insert the updated Notice of Articles and file the confirmation page.

4) Notify stakeholders

- Share a concise notice with directors, officers, and shareholders.

- Review key agreements for any notice requirements. Provide notice where prudent.

- Inform your insurance broker or lender if your covenants or disclosures require it.

5) Align governance and operations

- Assign a board lead and a management owner for benefit oversight.

- Set clear goals and metrics linked to your public benefits.

- Add benefit reporting and board review to your annual meeting agenda.

6) Prepare your first benefit report

- Decide on the timeframe, metrics, and data sources.

- Collect baseline data now to track year‑over‑year progress.

- Plan board approval, publication, and distribution logistics.

7) Update public materials

- If you wish, update your website and corporate materials to reflect your benefit company status and stated public benefits.

- Keep language consistent with your benefit provision to avoid confusion.

8) Train your team

- Brief finance, legal, operations, HR, and marketing on what the conversion means.

- Explain how decisions should reflect both business goals and public benefits.

- Set up a simple review process to flag decisions with significant impact.

9) Monitor and refine

- Schedule quarterly internal check‑ins on progress toward public benefits.

- Adjust your metrics or initiatives if you are off track.

- Consider independent input or frameworks to strengthen reporting, if useful.

10) If you need to correct or change something

- For clerical errors, prepare a fresh filing to correct the record.

- To modify your benefit provision, pass a new special resolution and file another notice of alteration.

- Keep each change documented in your minute book with dates and approvals.

Practical tip: Treat the first year as your pilot. Start with a few strong metrics, build your data flows, and expand as your reporting matures. Tighten your processes before your first benefit report deadline.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.