Form 11 COM – Notice of Alteration

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

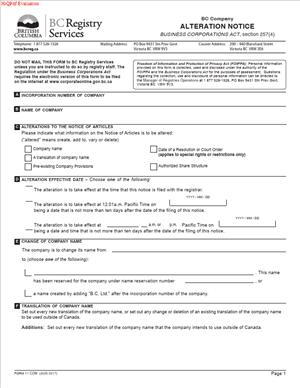

What is a Form 11 COM – Notice of Alteration?

Form 11 – Notice of Alteration is the filing you use to formally change a British Columbia company’s foundational information on the public register. You file it to update the company’s Notice of Articles and, if needed, to reflect related changes to the company’s articles. It is the statutory way to change core corporate attributes such as the company name, the authorized share structure and special rights, share transfer restrictions, the number of directors (or the minimum/maximum range), and certain designations (for example, becoming a benefit company or community contribution company).

You typically use this form if you are a director, officer, founder, corporate secretary, or a professional agent acting on a company’s behalf. Law firms and corporate service providers file it regularly for clients. If you manage a private BC company and need to update anything that appears in the Notice of Articles, this is the form you look to.

You would need this form when your company rebrands and wants a new legal name, when you plan a financing and must create or modify share classes, when you tighten or loosen share transfer restrictions to match your investor strategy, or when you change the size of your board. It also applies if your company is adopting a special status that the legislation recognizes, such as a benefit company or community contribution company, which requires precise wording and public disclosure.

In practice, the Notice of Alteration keeps the public record aligned with what your shareholders approve. For example, if you create a new class of preferred shares with dividend and redemption rights, you do not just amend the articles internally. You also file the Notice of Alteration so the authorized share structure and rights are stated on the public register. The form ensures banks, investors, counterparties, and regulators can see an authoritative snapshot of your company’s key characteristics.

Typical scenarios include a startup adding a Class A preferred share class before a seed round, a mature company consolidating multiple legacy share classes into a simpler structure, or a family-owned company imposing stronger transfer restrictions to maintain control within the family. It can be as simple as a name change following a rebrand, or as complex as converting to a community contribution company, which carries public benefit and asset lock requirements.

Because the Notice of Articles is public, filing Form 11 is not just a paperwork step. It is how you make your changes legally effective against the world. Your internal resolutions matter, but without the public filing, the change is not complete.

When Would You Use a Form 11 COM – Notice of Alteration?

You use a Notice of Alteration when a corporate change affects what appears in your company’s Notice of Articles. The most common trigger is a name change. If you reserve a new name and your board or shareholders approve it, you still need to file the Notice of Alteration so the Registrar records the new legal name. Until then, your old name remains in force.

You also use it any time you modify the authorized share structure. Suppose you start with a single class of common shares. Before bringing in investors, you decide to create two classes of preferred shares with specific dividend, liquidation, and redemption rights. That change adds new classes and special rights that must be set out in the Notice of Articles. Form 11 is the vehicle for that update. It also covers removing classes you no longer need, adjusting the maximum number of shares for a class, or revising the special rights and restrictions attached to any class.

Many private companies include a clause that restricts share transfers. This helps maintain “private issuer” status and control over the shareholder base. If you strengthen or relax those transfer restrictions, you file a Notice of Alteration to update the Notice of Articles accordingly. That way, a prospective transferee and their counsel can verify that the restriction exists and see its wording.

If you change the board size, you update the Notice of Articles if it specifies a fixed number of directors or a minimum and maximum range. For example, if your Notice of Articles says a minimum of three and a maximum of seven directors, and you want to move to a range of one to five, you alter that clause using the form.

Some companies adopt special statuses recognized by the statute. Converting to a benefit company requires specific language in the articles and a corresponding statement in the Notice of Articles. The Notice of Alteration records that status publicly. Similarly, a conversion to a community contribution company includes name, purpose, and distribution constraints that must be disclosed through the form.

Typical users include founders and directors of private companies, in-house counsel, corporate secretaries, paralegals at law firms, accountants serving as corporate recordkeepers, and investors coordinating pre- or post-closing cleanups. If you are a lender with a covenant tied to board size or share structure, you may also ask the company to file a Notice of Alteration as a condition of funding. If you run a closely held business and want to keep transfers under control, you may use this form to add a stronger transfer restriction to the Notice of Articles before onboarding a new shareholder.

This is not the form for every change. You do not use it to change the registered office, mailing address, or directors’ identities and addresses. You use other filings for those. Think of Form 11 as the one you use for structural changes rather than contact or management details.

Legal Characteristics of the Form 11 COM – Notice of Alteration

A Notice of Alteration is legally binding because it is the prescribed statutory filing that amends your company’s Notice of Articles on the public register. The Business Corporations framework in British Columbia treats the Notice of Articles as authoritative. When you file and the Registrar accepts the alteration, the revised Notice of Articles takes effect, and third parties can rely on it.

Enforceability depends on two things: corporate authority and proper filing. First, the company must approve the alteration through the correct internal process. Most alterations to the articles or share structure require a special resolution of shareholders. A special resolution usually needs a higher threshold than an ordinary resolution. Some changes also require separate approval by each affected class of shares voting as a class. For example, if you change or vary the rights attached to a class, you may trigger class approval. A name change can be approved by directors if the articles allow it, but many companies choose to pass a shareholder resolution as well to avoid disputes. Always align the approval route with your articles and the legislation.

Second, you must file the Notice of Alteration in the prescribed form. The filing includes standardized fields for the name, share classes, transfer restrictions, and director number or range. If you are altering share rights, you must include the complete and precise wording of the special rights and restrictions. Vague or incomplete terms can cause rejection or, worse, uncertainty later. Once the Registrar processes the filing, the changes are effective as of the filing time unless you have set a permissible future effective date.

Because the filing is public, counterparties can verify your status, share structure, and restrictions. Banks often require a recent copy of the Notice of Articles reflecting the current name and share classes before opening accounts or closing financing. Investors review the special rights wording to confirm that dividend priority, liquidation preferences, and redemption mechanics match the term sheet. If the public record is out of date, you introduce unnecessary risk and may breach covenants that require you to maintain accurate corporate records.

There are also procedural and minority protections to consider. Altering share rights or imposing new restrictions can give dissenting shareholders certain remedies. To reduce the risk of challenge, communicate clearly, ensure notice requirements are met, and secure any required class approvals. Check for unanimous shareholder agreements or investor rights agreements that grant vetoes or consent rights. Lenders may also have consent rights under security or credit documents. Obtaining those consents before you file helps avoid later disputes.

Finally, keep your minute book complete. File the Notice of Alteration and then update your internal records: the articles (if changed), the central securities register, directors’ and shareholders’ resolutions, and any share certificates. The public filing and the internal records should match. If they diverge, you may face delays in audits, financings, or exits.

How to Fill Out a Form 11 COM – Notice of Alteration

1) Confirm what you are altering and why.

Decide exactly what needs to change in the Notice of Articles. Common alterations are a name change, updates to the authorized share structure (including special rights), revisions to share transfer restrictions, and changes to the number or range of directors. If you are adopting a special status, such as a benefit company or community contribution company, confirm the requirements and exact wording your articles must contain to support that status.

2) Gather core company details.

You will need the company’s current legal name, incorporation number, and the names of directors and officers for internal approvals. If you are changing the name, secure a valid name reservation number that matches the new name you plan to file. Have your corporate access information ready so you can file electronically.

3) Prepare and approve the internal resolutions.

Draft the required resolutions. For most alterations, prepare a special resolution of shareholders. If your articles allow directors to change the name, a board resolution may suffice. When you change share rights or add new classes, assess whether class approval is needed. Provide proper notice of meetings or secure unanimous written consents. If investor agreements or lender covenants require consent, obtain those in writing. Keep signed originals for your minute book.

4) Draft the exact text of any new or revised share rights.

If you are creating or amending share classes, write out the special rights and restrictions in full.

Include details such as:

- Dividend rights (cumulative or non-cumulative, fixed rate or discretionary).

- Liquidation preference (preference amount, participation, and ranking).

- Redemption and retraction terms (who may initiate, timing, price formula).

- Conversion rights (ratio, anti-dilution features, triggers).

- Voting rights (full, limited, or non-voting; class votes on specified matters).

- Priority and ranking among classes.

Use clear, consistent, defined terms. Cross-check that the new wording does not conflict with existing provisions in your articles. Investors and lenders will rely on this text, so precision matters.

5) Decide on the board size or range, if applicable.

If you want to change the number of directors or the minimum/maximum range, settle the new number or range before you file. Ensure it aligns with any shareholders’ agreement or investor rights that specify board composition.

6) Finalize share transfer restrictions, if applicable.

If you want to maintain tight control over your shareholder base or support private issuer status, include a clear share transfer restriction. For example, require board approval for any transfer or impose a right of first refusal. If you loosen restrictions, confirm you are not undermining any exemption strategy or agreement. Put the final wording in your Notice of Alteration where the form requests it.

7) Complete the form’s identification section (the “parties”).

Enter the company’s current legal name and incorporation number exactly as they appear on the register. The “party” to this filing is the company. Identify the authorized signatory who will certify the filing, such as a director, officer, or authorized filing agent. If you are changing the name, also enter the new approved name and the reservation number.

8) Select the type(s) of alteration.

Check the boxes or select the options that match your change.

Typical selections include:

- Name change.

- Change to authorized share structure.

- Change to special rights or restrictions.

- Change to share transfer restrictions.

- Change to the number of directors or the minimum/maximum.

- Adoption of a status (for example, benefit company or community contribution company).

If more than one alteration applies, select all that apply and complete each related section.

9) Complete the name change section (if applicable).

Enter the proposed new name exactly as approved. Include any required designation (for example, “Ltd.”, “Inc.”, “Corp.”, “ULC” if converting to an unlimited liability company, or “C3” if converting to a community contribution company). If you are adopting both an English and French form or a translation, insert it where the form allows. Confirm the name reservation is still valid on the day you file.

10) Complete the share structure section.

Provide the full authorized share structure after the alteration takes effect.

For each class, state:

- The class name (for example, “Class A Preferred Shares”).

- Whether there is a maximum number or the shares are without a maximum.

- Whether the shares have par value or no par value.

- The complete special rights and restrictions for the class.

If you are removing a class, make sure you are not leaving any shares of that class outstanding. If any are outstanding, exchange or redeem them first in accordance with your articles and resolutions, or keep the class and adjust its rights. The Registrar expects the public record to reflect only classes that can exist given your actual issued shares.

11) Complete the transfer restriction section.

If your company has a transfer restriction, include the precise wording. A common approach is to require the directors’ consent before any share transfer is effective. You can also include rights of first refusal or co-sale rights in your articles, but the Notice of Articles typically carries the headline restriction. Keep the wording short and clear so it fits the public form and aligns with your articles.

12) Complete the directors section.

If your Notice of Articles specifies a fixed number of directors, enter the new number. If it uses a range, enter the new minimum and maximum. Ensure your current board composition fits within the new range upon filing, or plan board changes immediately after.

13) Include any special designation details.

If you are converting to a benefit company or community contribution company, confirm that your articles include the required statements and constraints, and select the relevant alteration on the form. Update your proposed name to include any required designation and ensure the Notice of Articles reflects the new status.

14) Choose the effective date/time if permitted.

Most filings take effect when accepted by the Registrar. If the form allows you to set a future effective date/time, choose one that works with your transaction timeline. This can help you coordinate closings, share issuances, or name change rollout. Make sure your resolutions contemplate the effective time.

15) Review for consistency and completeness.

Cross-check the form against your resolutions and the articles. Confirm:

- The new name matches the reservation and resolutions.

- The share rights text matches your resolutions and is internally consistent.

- Transfer restrictions are clear and consistent with your article provisions.

- The director’s number or range is correct.

- Any required consents are in your file.

Small drafting errors can cause rejection or future disputes. A second pair of eyes helps.

16) Sign and certify.

An authorized person certifies the filing. This is usually a director or officer. Your certification confirms the company approved the alteration in accordance with the legislation and the articles. Make sure the signer’s name and capacity are correct.

17) File and pay the fee.

Submit the form electronically and pay the government fee. Keep the confirmation and receipt. If the filing is rejected, correct the issues identified and resubmit promptly. If it is accepted, download the updated Notice of Articles.

18) Update your minute book and stakeholders.

Insert the altered Notice of Articles in your minute book. Replace the old version to avoid confusion. File your signed resolutions and any consents. If you changed the name, update your bank, insurers, key contracts, and invoicing. If you changed the share structure, update the central securities register, share certificates, option plans, and cap table. If you adjusted the board size, record any related director appointments or resignations.

19) Keep transaction records aligned.

If your alteration relates to a financing or reorganization, align all documents. Share purchase agreements, investor rights agreements, option plans, and warrants should use the new class names and rights. Mismatches create closing delays.

20) Plan for the next filings, if any.

A Notice of Alteration can trigger follow-on filings. For example, after a name change, you may need to file updated business name registrations or trade name filings. After adding share classes and issuing new shares, you may need to make securities filings. Map these steps so you do not miss deadlines tied to your transaction.

Real-world example 1: You plan a seed round. You create Class A Preferred Shares with a non-cumulative 8% dividend, a 1x non-participating liquidation preference, and conversion to common on a qualified financing. Your shareholders approve the new class by special resolution and class vote if required. You file the Notice of Alteration with the full text of the Class A rights. The Registrar accepts it. You then issue the preferred shares under the new class, update the securities register, and deliver share certificates that reference the new class.

Real-world example 2: You rebrand. You reserve “North Shore Robotics Inc.” Your directors pass a resolution approving the name change. You file the Notice of Alteration with the new name and reservation number. After acceptance, you download the updated Notice of Articles, notify your bank and key customers, update your invoices, and change your signage.

Real-world example 3: You tighten control. You add a share transfer restriction requiring board approval for any transfer and aligning with your articles’ right of first refusal. You pass a special resolution, file the Notice of Alteration with the transfer restriction text, and then onboard a new employee shareholder. The restriction is now visible to anyone reviewing your corporate record.

Filling out Form 11 is about accuracy and alignment. Align your internal approvals, the text in your articles, and the public record. When the three match, your change is effective, enforceable, and easy for others to trust.

Legal Terms You Might Encounter

Form 11 uses terms that matter in practice. Here is what they mean for you.

- Notice of Articles refers to the public snapshot of your company’s key facts. It shows your name, share structure, and other core items. Form 11 changes the parts of that snapshot that the registry tracks. You update it when you change those tracked items.

- Articles are your internal rules. They set the director’s powers, meetings, and share rights if not in the notice. You usually alter your articles by special resolution before you file Form 11. You then keep the amended articles in your records.

- Alteration means a formal change to your company’s constitutional details. That can include the company name or share structure. Form 11 records that change with the registry. It becomes your official record once accepted.

- Special resolution is a shareholder approval with a higher voting threshold. You usually need one for altering your articles or share structure. You record the resolution date on Form 11 if the form calls for it. Keep the signed resolution in your minute book.

- Authorized share structure is the full set of shares your company may issue. It lists classes, maximum numbers if any, and any par value. Form 11 asks for the updated authorized structure. You must include rights or restrictions for each class as required.

- Share class groups share the same rights. Classes can differ on votes, dividends, or liquidation rights. When you alter classes, you must state the exact class names and rights on Form 11. Use consistent names across your records.

- Share transfer restrictions limit who can acquire your shares. It can require director or shareholder approval before a transfer. Many private companies include one. Form 11 lets you add, change, or remove this restriction in the notice.

- Company name alteration changes your legal name. It may require a prior name reservation. Form 11 records the approved new name. Make sure your designation, like Limited or Corporation, matches your rules and the name approval.

- Translation name is a name in another language used alongside your English name. If allowed, you can set or change it with an alteration. Form 11 captures the new translation name if you use one. Use the exact characters and spelling.

- Effective date is when the alteration takes effect. It may be immediate on acceptance. Some filings allow a future effective date. If the form offers that field, use it only when you have clear reasons. Align contracts and notices to that date.

- Incorporation number is your unique company identifier. The registry uses it to match your record. You include it on Form 11 to avoid mix-ups. Always confirm it against your last registry confirmation.

- Registered records mean your minute book and statutory registers. They include your central securities register and resolutions. You must update these after the alteration. Form 11 does not replace your duty to maintain records.

FAQs

Do you need shareholder approval before filing Form 11?

Yes, in most cases. Altering share structure or rights usually needs a special resolution. Changing the company name may also require it under your articles. Check your articles and any unanimous shareholder agreement. Record the approval date and keep the signed resolution.

Do you need to reserve a new name before a name change?

Often, yes. Many registries require a name reservation before you file the change. This helps prevent rejection for conflicts or formatting issues. Confirm the approved name exactly as reserved, including the corporate designation. Attach or reference the reservation details if the form asks.

Do you file the altered articles with Form 11?

Usually, no. The registry records changes to the notice, not the full text of your articles. You still adopt the altered articles by special resolution. Then you store the updated articles in your records. Make sure your articles align with the notice details you file.

Do you show only the changes or the full share structure on Form 11?

You typically show the full, updated authorized structure. State each class and its rights as required. Do not submit partial snippets. The registry wants a clean, complete statement after the alteration. This avoids confusion about what remains in force.

Do you need to file a different form for address changes?

Often, yes. Address changes usually use a separate filing type. Form 11 targets alterations to the notice, like name or share structure. If you also moved offices, complete the correct address change filing. Keep the effective dates aligned across filings.

Do you pick an effective date, or is it immediate?

If the form allows a future effective date, you can choose one. If not, the change takes effect on acceptance. Use a future date only if you need time to update contracts or notify stakeholders. Avoid backdating. It can cause compliance issues.

Do you need to notify banks, insurers, and partners after the change?

Yes. Update counterparties after acceptance. Provide the updated notice or registry confirmation if requested. For name changes, update stationery, digital assets, and licenses. Align your internal registers and accounting systems. Keep copies of notices sent.

Do you need a court order for some alterations?

It is uncommon, but possible in complex rights changes. If an alteration affects class rights in a disputed way, risks increase. Get advice if you expect objections from security holders. Do not file if your approvals are incomplete or contested.

Checklist: Before, During, and After the Form 11 COM – Notice of Alteration

Before signing

- Confirm the exact change you plan to make.

- Obtain required board and shareholder approvals.

- Draft the special resolution text in clear, exact terms.

- If changing name, secure a name reservation if needed.

- Compile your incorporation number and current legal name.

- Prepare the full updated share structure and class rights.

- Decide if you will include or change transfer restrictions.

- Pick an effective date, if the form allows one.

- Verify any translation name, including correct characters.

- Align the language of the articles with what you will file in the notice.

- Prepare internal registers for updates after acceptance.

- Confirm signing authority for the form.

- Set payment method for filing fees.

- Schedule notices to stakeholders after acceptance.

During signing

- Check your incorporation number and legal name for accuracy.

- Select the correct alteration type(s) on the form.

- Enter the approved new name exactly as reserved if changing the name.

- State the full authorized share structure after the alteration.

- Include class names and precise rights or restrictions.

- Tick the transfer restriction box only if you truly have one.

- List the resolution date if the form asks for it.

- Use a future effective date only if supported by the form.

- Verify that names, punctuation, and capitalization match your approvals.

- Review for internal cross-references that could cause conflicts.

- Confirm the signer’s name, title, and authority.

- Check all mandatory fields and attachments.

- Save a clean draft and a signed final version.

After signing

- File the form with the corporate registry and pay the fee.

- Wait for acceptance or correction requests.

- If rejected, fix the cited issues and resubmit promptly.

- Once accepted, download or request the confirmation.

- Update your minute book with the resolution and altered articles.

- Update the central securities register to match the new structure.

- Reissue share certificates if class names or rights have changed.

- Update ledgers, cap table, and any internal databases.

- Notify lenders, insurers, payroll providers, and key partners.

- Update licenses, permits, and program registrations as needed.

- For a name change, update contracts, invoices, and bank profiles.

- Replace seals, stamps, and stationery using the new information.

- Store the filing confirmation with your corporate records.

- Calendar any follow-up filings tied to this alteration.

Common Mistakes to Avoid Form 11 COM – Notice of Alteration

- Filing without the right approvals. Don’t forget the special resolution when required. Consequence: rejection or an invalid alteration. You may face disputes or need to reverse the change.

- Submitting only the change, not the complete share structure. Don’t provide fragments. Consequence: registry rejection or unclear rights. You risk misalignment between the notice and the articles.

- Using a new name that is unreserved or non-compliant. Don’t assume the name will pass. Consequence: name change refusal and lost time. You may need to pay fees again.

- Backdating or misaligning the effective date. Don’t set dates that conflict with approvals. Consequence: non-compliance and contract confusion. You may need to re-execute documents.

- Forgetting to update internal registers and certificates. Don’t stop at acceptance. Consequence: audit issues and investor concerns. Your records must match the public notice.

What to Do After Filling Out the Form 11 COM – Notice of Alteration

- File the form and pay the fee. Use the current version and the correct filing channel. Keep a copy of what you submitted.

- Monitor the filing status. Watch for acceptance, corrections, or rejection. Respond to correction requests quickly. Fix only what the registry flags unless you choose to withdraw and refile.

- Once accepted, secure your confirmation. Save the updated notice or summary issued after acceptance. File it in your minute book. Mark the effective date in your records.

- Update your internal documents. Insert the signed special resolution. Replace the prior articles with the altered articles. Keep a clear audit trail showing the old and new versions.

- Align your registers. Update the central securities register to reflect new classes or rights. Reissue share certificates if class names or terms have changed. Record any cancellations or exchanges.

- Coordinate dependent filings. If you also need an address or director change, file those using the correct forms. Keep dates consistent across filings. Avoid gaps that could confuse third parties.

- Notify stakeholders. Send tailored notices to lenders, insurers, payroll providers, and major partners. For a name change, update bank profiles and merchant accounts. Provide a copy of the updated notice if requested.

- Refresh operational materials. Update your website footer, invoices, and email signatures. Order new stationery if needed. Update seals or stamps to the current company name.

- Review contracts and policies. Check for clauses that reference your name or share classes. Amend as required. Use the effective date to coordinate amendments.

- Update compliance calendars. Note review dates for share structures and governance documents. Schedule a records audit to confirm accuracy. Train your team on the new details.

- Document everything. Keep proof of filing, acceptance, and notices sent. Store electronic and paper copies in your records. Set backups and access controls.

- If the filing was rejected and you no longer plan to proceed, record that decision. Void any draft certificates. Notify stakeholders not to rely on the proposed change.

- If you need to correct an accepted alteration, prepare a new resolution if necessary. Then file another alteration to fix the record. Explain the correction to stakeholders to avoid confusion.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.