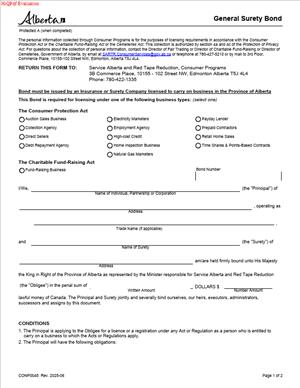

CONP0045 – General Surety Bond

Fill out nowJurisdiction: Canada | Province: Alberta

What is a CONP0045 General Surety Bond?

A CONP0045 General Surety Bond is a standard Alberta bond form used to secure a business’s legal and financial obligations to the province and to consumers. It is a three‑party agreement. You, as the licensed business (the principal), promise to follow Alberta law and meet your obligations. A regulated surety company (the surety) promises the Government of Alberta (the obligee) that it will cover valid claims up to a set amount if you fail to comply. If the surety pays a claim, you must reimburse the surety.

Think of it as a compliance guarantee. You purchase the bond. The surety underwrites your risk and stands behind your obligations within the penal sum. The Government of Alberta holds the bond for the benefit of people who may suffer losses because you break the rules, such as consumers or clients.

Who Typically Uses This Form?

Businesses that must be licensed or permitted by Alberta and are required to post a surety bond. This often includes businesses regulated under consumer protection and marketplace legislation. Examples include direct sellers, collection agencies, debt repayment agencies, prepaid contractors, payday lenders, and other provincially licensed service providers. The form is “general” because it supports multiple licence types. The licensing program sets the bond amount and any special conditions.

Why would you need this form?

You need it to obtain or renew your provincial licence or authorization when a bond is mandatory. Without a properly executed bond in the correct amount, your licence can be refused, suspended, or cancelled. The bond also helps you signal credibility. It shows you have been underwritten by a licensed surety and can meet payouts for valid claims.

Typical usage scenarios

- You are applying for a new licence and the application checklist requires a surety bond in a set amount.

- You are renewing a licence and must file a continuation certificate or replacement bond before the current one is cancelled.

- You changed your legal name or corporate structure and must file a rider or a new bond.

- You acquired a business and need a bond in your name to avoid a licensing gap.

- You were ordered to increase your bond amount due to risk or complaint history and must file an amended bond.

In each case, you or your broker complete and submit the CONP0045 General Surety Bond to the provincial program that oversees your licence.

When Would You Use a CONP0045 General Surety Bond?

You use this form when the regulator tells you a bond is required as part of licensing, registration, or ongoing compliance. If you run a business that sells to consumers in Alberta and your licence category requires bonding, you will complete this form with your surety. A direct selling company that takes deposits might need a $25,000 or higher bond. A collection agency handling client funds may need a bond sized to the regulation. A debt repayment agency negotiating with creditors will also face a bonding requirement. If you offer services where consumers prepay or where you handle trust funds, a bond is commonly required.

You also use the form if you are replacing a cash security or letter of credit with a surety bond. Many businesses prefer a bond to free up working capital. The form is also used when your surety changes. For example, your previous bond is being cancelled and you must put a new CONP0045 bond in place before the cancellation date to keep your licence active.

If your business restructures—say you convert from a partnership to a corporation, merge with another company, or change your legal name—you will either file a rider or issue a new bond on the CONP0045 form. The regulator will insist that the bond matches your exact legal name. If your licence covers multiple trade names or branches, you may be asked to attach a schedule listing them so the bond clearly covers your operations.

You might also use the form when the regulator has assessed risk issues. If there have been substantiated complaints, unpaid judgments linked to your operations, or trust reconciliation issues, the Registrar can require a higher bond. In that case, you file an amended CONP0045 reflecting the increased penal sum.

Typical users

- Business owner or director signing on behalf of the company

- Licensing coordinator or compliance manager who assembles filings

- Insurance broker or surety broker who arranges the bond

- Surety’s attorney‑in‑fact who executes the bond on behalf of the surety company.

Law firms often review the bond to ensure names, authority, and conditions align with the licence file.

Legal Characteristics of the CONP0045 General Surety Bond

A CONP0045 General Surety Bond is a legally binding suretyship contract. It is binding because there is consideration (your premium and the surety’s risk), clear parties, a definite penal sum, and written conditions that tie the bond to compliance with Alberta law and your licence obligations. The surety executes the bond under seal through an attorney‑in‑fact. The power of attorney evidencing signing authority is attached. The principal signs the bond through an authorized officer. The obligee, the Government of Alberta or its designated Registrar, relies on the bond for the benefit of claimants.

Enforceability rests on several features. The form uses standard conditions aligning the bond with statutes and regulations that prescribe bonding. The surety must be duly licensed to write surety in Alberta. The principal’s legal name must match corporate and licensing records. The penal sum is stated in Canadian dollars and is clear in figures and words. The bond is usually a continuous obligation that stays in force until it is cancelled by the surety giving advance written notice to the Registrar, often 30 to 60 days. That notice window lets the regulator take steps to protect the public and often requires you to file a replacement bond to avoid licence interruption.

The bond is not insurance for your benefit. It is credit extended by the surety. If the surety pays a valid claim, you are obligated to reimburse the surety, along with costs. You sign a separate indemnity agreement when you obtain the bond. The bond’s liability is capped at the penal sum. Most CONP0045 bonds are aggregate, meaning the surety’s total liability for all claims does not exceed the penal sum, regardless of the number of claimants or policy periods. If the bond specifies otherwise, follow the express language.

Claims flow through the regulator or directly to the surety, depending on the licence program. A claimant must show a breach of the statute, regulation, licence condition, or bond condition that caused their loss. The surety investigates. If the claim is valid, the surety pays up to the bond limit. The regulator may direct payment priorities when there are multiple claimants. Claims often have a time limit tied to the date of the transaction or the bond period. Keep records to respond to any inquiry.

The bond does not eliminate other remedies. The Registrar can still refuse, suspend, or cancel your licence. Consumers can still sue. The bond may be called even if you dispute the underlying facts, subject to the claim process and the bond terms.

Accuracy matters. If you misstate your legal name, use an unlicensed surety, alter the form improperly, or fail to attach the power of attorney, the regulator can reject the bond. Material misrepresentation to the surety can void coverage and lead to licence action. Assigning the bond is usually prohibited. If you sell your business, the buyer will need its own bond.

How to Fill Out a CONP0045 General Surety Bond

Here is a practical, step‑by‑step process to complete and submit the bond correctly the first time.

Step 1: Confirm your exact licensing requirement.

- Verify the bond amount, the statute or regulation that applies to your licence category, and the correct obligee name. Check your licence approval letter or application checklist. Note any special conditions, such as higher bond amounts for multiple locations or trust obligations.

Step 2: Gather your legal and business information.

- You will need your exact legal name as registered, your Alberta corporate access number if incorporated, your trade names, your principal business address, branch addresses if applicable, and your licence file number if assigned. If you recently changed your name or structure, have your corporate documents ready.

Step 3: Engage a licensed surety through a broker.

- Provide financial statements, ownership details, and your licence requirement. The surety will underwrite your risk and prepare the bond on the CONP0045 form. Do not attempt to change the pre‑printed legal text. Alberta regulators expect the form to be intact.

Step 4: Complete the parties section.

- Principal: Enter your exact legal name, including “Inc.” or “Ltd.” as registered. If you are a partnership or sole proprietor, enter the full legal name used on the licence. If the form provides a spot for operating names or a schedule, list all trade names covered by the licence. Address: Use your principal place of business in Alberta, or as the licence requires.

- Surety: The surety company’s full corporate name and head office address will be entered. Confirm the surety is licensed in Alberta. The surety’s attorney‑in‑fact name will appear on the signature block.

- Obligee: This will identify the Government of Alberta, often referencing the Registrar responsible for your licence program. Use the exact wording on the form. Do not substitute a program name or the name of an individual official.

Step 5: Set the penal sum.

- Insert the bond amount in Canadian dollars in both words and figures. Match the amount to your licence requirement. If the regulator raised your bond mid‑term, use the new amount. If you operate multiple branches and the program requires a higher bond, reflect the aggregated amount as directed.

Step 6: Effective date and term.

- Enter the effective date of the bond. Many programs require the bond to be continuous until cancelled. If the form contemplates a fixed expiry date, confirm whether your licence aligns with an annual cycle, and set the date accordingly. If you are replacing an expiring bond, coordinate dates to avoid any gap.

Step 7: Conditions and coverage.

- The CONP0045 form includes a condition clause tying the bond to compliance with applicable Alberta legislation and your licence. Some versions allow you to identify the specific licence type or statute in a blank field. Complete that field exactly as instructed by your regulator or broker. Do not broaden or narrow the scope on your own. If the regulator requires coverage for trust monies, deposits, or prepaid funds, ensure the form and any rider reflect that requirement.

Step 8: Schedules and riders.

- If your licence covers multiple trade names or branch offices, attach a schedule listing each name and address. If you are increasing the bond amount or changing your legal name, your surety may issue a rider. Attach riders to the bond and reference them in the form if there is a designated field. Ensure each schedule or rider is signed and sealed by the surety.

Step 9: Execution by the principal.

- Have an authorized signing officer sign the bond. Print the name and title below the signature. If your corporation uses a seal, affix it if the form provides a location, although a seal may not be mandatory. If you are a partnership or sole proprietor, follow the signature requirements on the form. Some regulators require a witness signature for the principal; if so, use an adult witness who is not the signatory.

Step 10: Execution by the surety.

- The surety’s attorney‑in‑fact signs the bond and affixes the surety’s corporate seal. The power of attorney authorizing that individual to sign must be attached to the bond. The power of attorney should be current as of the bond’s execution date and reference the surety.

Step 11: Check for internal consistency. Verify that:

- The principal’s legal name matches your licence records exactly.

- The bond amount is correct in words and figures.

- The effective date aligns with your licence issue or renewal date.

- Addresses are correct and complete.

- Any schedules or riders are attached and referenced.

- The surety’s name on the bond matches the name on the power of attorney.

- All signatures and dates are present. No blank fields remain.

Step 12: Avoid alterations.

- Do not cross out or rewrite pre‑printed clauses. If a correction is unavoidable, re‑issue a clean original. Handwritten changes can lead to rejection. If your regulator allows electronic execution, follow its rules; otherwise, provide original ink signatures.

Step 13: File the original bond.

- Submit the original, fully executed bond to the designated Alberta program office or Registrar as instructed. Courier delivery is preferred to avoid loss. Keep a scanned copy and a certified copy in your records. If your licence renewal deadline is approaching, file early to allow for processing.

Step 14: Maintain the bond.

- Pay the annual bond premium when due. Monitor any cancellation notices. A surety can cancel a continuous bond by giving advance written notice to the Registrar. If your surety issues a cancellation notice, immediately arrange a replacement bond to avoid licence suspension. If you make corporate changes, notify both your regulator and your surety so the bond can be endorsed or re‑issued.

Practical examples help. Suppose you run a collection agency with two branches in Edmonton and Calgary. Your licence requires a bond in a prescribed amount. You will list your corporation as the principal, include your corporate access number if requested, attach a schedule listing both branches, and set the penal sum required for your class of licence. Your surety executes the bond and attaches the power of attorney. You file the original with your renewal package. If you later open a Red Deer branch, the Registrar may require an increased bond. You work with your broker to issue a rider increasing the penal sum and add the new branch to the schedule.

Consider a direct seller taking deposits for in‑home sales. Your sales volume increases and the regulator requires a higher bond due to risk. You replace the original bond with a new CONP0045 showing the new amount and a seamless effective date to prevent a gap. You return the original if requested and file the replacement bond.

Common mistakes

- Do not list your trade name as the principal when your licence is held by the corporation.

- Do not use a bond amount from a prior year if the regulation changed.

- Do not submit a bond signed by a surety not licensed in Alberta.

- Do not forget the power of attorney.

- Do not send a copy when the regulator requires an original.

- Do not allow a cancellation notice to lapse without a replacement—your licence will be at risk.

If a claim arises, cooperate with the surety and the Registrar. Provide contracts, invoices, trust records, and correspondence. The surety will assess liability under the bond conditions. If payment is made, expect the surety to seek reimbursement from you under your indemnity. Strengthen your internal controls to avoid repeat issues.

In short, the CONP0045 General Surety Bond is the province’s standard vehicle to secure your compliance obligations. Complete it carefully, match it to your licensing facts, and coordinate with your surety and regulator. When executed and filed correctly, it keeps your licence in good standing and protects consumers without tying up your working capital.

Legal Terms You Might Encounter

- Principal means the party that makes the promise under the bond. In this form, you are usually the Principal. You promise to perform or pay as required by a contract or obligation.

- Obligee means the party that benefits from the bond. The Obligee requires the bond before work starts or an award is issued. If you default, the Obligee can claim on the bond.

- Surety means the bonding company that backs your promise. The Surety issues the CONP0045 and signs it through an attorney-in-fact. The Surety’s liability is limited to the bond amount and terms.

- Bond or Penal Sum means the maximum amount the Surety may owe. The sum appears as a fixed amount or a percentage. Make sure it matches the contract or instruction you received.

- Effective Date means the date the bond coverage starts. It should align with the contract award or start date. Wrong dates can delay acceptance or limit coverage.

- Conditions means the rules that control when a claim is valid. These appear in the body of the form or any attached terms. Read them so you know what triggers liability.

- Default means a failure to meet your bonded obligation. Default can include non-performance or non-payment. The bond can respond once default is declared and notice is given.

- Notice of Claim means the written notice the Obligee must send to the Surety. The form usually lists where to send notices. Deadlines often apply, so ensure addresses are correct.

- Power of Attorney means the document authorizing someone to sign for the Surety. It must be valid on the signing date and attached to the bond. Without it, the bond may be rejected.

- Rider or Endorsement means a signed amendment to the bond. Riders change items like amount, time, or names. Use a rider instead of altering the original bond after issue.

- Joint and Several Liability means the Principal and Surety can each be responsible for the full amount. The Obligee can pursue either party for recovery up to the bond limit.

- Aggregate Liability means the total cap on the Surety’s payments. It can apply across multiple claims under the same bond. Once reached, no further coverage remains.

FAQs

Do you need original signatures on the CONP0045 General Surety Bond?

Many Obligees require wet-ink originals. Some accept secure digital signatures. Confirm the required format before you sign. If originals are needed, submit the original bond with the Surety’s original Power of Attorney. Keep a scanned copy for your records.

Do you need a corporate seal on the bond?

Some forms include a seal block. If your company uses a seal, apply it where indicated. If you do not have a seal, type “No corporate seal” next to your signature. Follow any instructions from the Obligee on seals.

Do you attach the Power of Attorney for the Surety?

Yes. Attach the Surety’s Power of Attorney that matches the signing attorney’s name. Check that the Power of Attorney was valid on the signing date. Include the Surety’s corporate seal if provided with the Power of Attorney.

Do you need the bond to match the contract exactly?

Yes. Match the legal names, addresses, contract title, and any reference numbers. Match the bond amount and currency. Misalignment is a common reason for rejection. Cross-check the effective date and any completion or expiry terms.

Do you pay the bond premium once or annually?

It depends on the obligation. Some bonds are one-time and tied to a fixed term. Others continue until released and may renew annually. Ask your broker or Surety how your premium applies. Note any renewal or continuation terms in your calendar.

Do you change the bond if the contract amount changes?

Use a rider to adjust the penal sum when the contract increases. Get the rider signed by the Surety. The Obligee may require originals and a specific format. Do not alter the original bond by hand.

Do you need to notify the Surety about project changes?

Yes. Notify the Surety about change orders, time extensions, or scope changes. Unreported changes can restrict coverage or delay claim responses. Send updates in writing and keep proof of delivery.

Do you need a bond number?

Yes. The bond number helps all parties track the bond. It should appear on the form and any riders. Use the same number on all correspondence.

Checklist: Before, During, and After the CONP0045 General Surety Bond

Before signing: gather information and documents

- Legal name of Principal, exactly as registered.

- Legal name of Obligee, as shown in the contract or request.

- Contract title, number, and a brief description of the work or obligation.

- Bond amount and currency, including percentage if applicable.

- Contract price and any options that could change the price.

- Effective date and anticipated completion or expiry terms.

- Addresses for both parties, including notice addresses.

- Contact name and email for the Obligee for delivery and questions.

- Surety’s name, address, and bond number.

- Approved attorney-in-fact who will sign for the Surety.

- Power of Attorney for the Surety, valid on the signing date.

- Any required seals, witnesses, or certifications.

- Instructions on originals versus digital submission.

- Deadline for submission and delivery method.

- Internal approval to proceed and premium confirmation.

During signing: verify the form line by line

- Confirm the Principal’s legal name matches registration records.

- Confirm the Obligee’s legal name matches the contract language.

- Insert the correct contract or reference number.

- Confirm the bond amount and currency match instructions.

- Check the effective date aligns with the contract start or award.

- Review the conditions and confirm any referenced schedules.

- Confirm the notice address for the Surety is complete and correct.

- Enter the bond number on every page, if space allows.

- Ensure no blanks remain that could be filled by others.

- Initial any authorized strikeouts or corrections by all signers.

- Sign with full name and title as an authorized officer of the Principal.

- Apply the corporate seal if used; otherwise note “No corporate seal.”

- Ensure the Surety’s attorney-in-fact signs and dates the bond.

- Attach the Surety’s Power of Attorney behind the executed bond.

- Verify the Power of Attorney matches the signing attorney’s name.

- Confirm the Power of Attorney includes the Surety’s seal and date.

- Add witness signatures if the form or Obligee requires them.

- Count pages and mark them 1 of X, 2 of X, etc., if needed.

- Create a clean PDF scan of the complete package for your files.

After signing: file, notify, and store

- Deliver the bond by the required method and deadline.

- If hand delivery is needed, get a stamped receipt page.

- If couriered, track delivery and save proof of receipt.

- If portal upload is allowed, confirm the format and file size.

- Ask the Obligee to confirm acceptance in writing.

- Save the acceptance email or receipt in your project folder.

- Update your bond register with number, amount, and expiry.

- Calendar key dates: renewals, time extensions, and close-out.

- Share a copy with project management, legal, and finance.

- Store the original in a secure, fireproof location.

- Record how to give notice of claims and who will send it.

- Set a reminder to request bond release at completion.

- Notify the Surety of any change orders or time extensions.

- Reconcile the premium invoice with the bond details.

Common Mistakes to Avoid

- Using a trade name instead of the legal name. The Obligee may reject the bond. Don’t forget to use the exact registered name from your records.

- Listing the wrong Obligee. Payment under a claim could fail. Confirm the Obligee’s full legal name from the contract before you sign.

- Stating the wrong bond amount or currency. Under-coverage can leave you exposed. Over-coverage can trigger higher premiums. Match the amount and currency to the requirement.

- Forgetting the Power of Attorney or using an expired one. The bond may be invalid. Attach the current Power of Attorney that matches the signer.

- Leaving blanks or un-initialed changes. This invites tampering concerns. Fill every field and initial any edits by all signers.

- Mismatched dates and terms with the contract. The bond may not activate when needed. Align the effective date and conditions with the contract.

- Submitting a scan when an original is required. Your submission could be rejected. Confirm if the Obligee needs a wet-ink original and deliver it.

- Failing to notify the Surety of contract changes. Coverage may not apply to new terms. Send written notice for all material changes and keep proof.

What to Do After Filling Out the Form

- Confirm acceptance. Ask the Obligee to confirm the bond is accepted as issued. Save a copy of the confirmation.

- Update internal records. Record the bond number, amount, term, and contract reference in your bond register.

- Distribute copies. Send the executed bond to your project manager, finance, and legal contact. Ensure everyone knows the claim notice steps.

- Monitor changes. Track change orders and time extensions. Request riders from the Surety for any material changes.

- Manage renewals. If the bond renews, calendar the renewal date. Start the extension or continuation process early.

- Keep proof of delivery. Store courier receipts or portal acknowledgments. File them with the bond package.

- Prepare for claims. Identify who will send claim notices if needed. Keep the Surety contact details handy.

- Close out properly. At contract completion, request release or return of the original bond. Obtain a written release from the Obligee.

- Archive securely. Store the original bond, riders, and release in a secure location. Keep digital backups with restricted access.

- Review lessons learned. Note any issues with names, amounts, or timing. Update your checklist to prevent repeats.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.