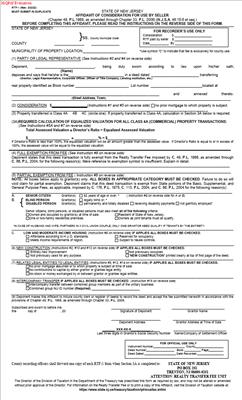

RTF 1 – Affidavit Of Consideration For Use By Seller

Fill out nowJurisdiction: Country: United States | Province or State: New Jersey

What is an RTF 1 – Affidavit Of Consideration For Use By Seller?

The RTF 1 is New Jersey’s Affidavit of Consideration for use by the seller. You complete it when you transfer real property by deed in New Jersey. It certifies the actual consideration for the deed and shows the Realty Transfer Fee you owe, or the exemption you claim. You sign it under oath and record it with the deed at the County Clerk’s office.

Most sellers must file this affidavit. The County Clerk uses it to confirm the fee calculation, the property class, and any exemptions. Without a complete and signed RTF 1, the deed will not be recorded.

Who typically uses this form?

You do, if you are the grantor. Your attorney, title agent, or settlement company often prepares it, but you are responsible for its truth and completeness. Executors and trustees use it when they deed estate or trust property. Corporate officers use it when a company sells property. Anyone conveying a deed with a fee or exemption uses this form.

Why would you need it?

Two reasons. First, New Jersey imposes a Realty Transfer Fee on most deeds. The seller typically pays it. The RTF 1 documents the consideration and the fee. Second, the affidavit records your claim to a full or partial exemption. If you qualify for an exemption, the form is how you assert it and avoid overpaying.

Typical usage scenarios include:

- A homeowner sells a single-family house. You report the contract price and pay the fee based on the tiers.

- Parents deed a home to a child for $1. You claim a full exemption because it is a qualifying family transfer with nominal consideration.

- An executor deeds a house to a beneficiary. You claim a full exemption as a transfer by an estate fiduciary to an heir.

- A senior seller (62 or older) sells an owner-occupied two-family home. You claim the partial reduction available to senior, blind, or disabled sellers on Class 2 residential property.

- A deed conveys a deed-restricted affordable housing unit. You claim the partial reduction available for low and moderate income housing.

- A deed corrects a legal description error from a prior recording. You claim a full exemption for a corrective deed.

The RTF 1 is not the buyer’s affidavit. The buyer may have separate obligations, but this form covers the seller’s side only. Your RTF 1 must accompany the deed at recording, with the fee or evidence of exemption, or the clerk will reject the recording.

When Would You Use an RTF 1 – Affidavit Of Consideration For Use By Seller?

You use the RTF 1 whenever you record a deed that is subject to the New Jersey Realty Transfer Fee, or when you claim a full or partial exemption from that fee. If you are selling, gifting, or otherwise conveying New Jersey real estate, the form likely applies.

You use it in routine home sales. For example, you sell a condo in Hudson County for $525,000. You report $525,000 as the total consideration. You compute the fee using the current schedule and pay it at recording. The RTF 1 documents the calculation.

You use it in family transfers. If you deed a house to your adult child for $10 and love and affection, you claim a full exemption as a qualifying parent-to-child transfer for nominal consideration. The RTF 1 is the vehicle to claim that exemption.

You use it for estate and trust distributions. An executor transferring title from an estate to a beneficiary completes the form and claims the fiduciary-to-beneficiary exemption. The executor signs as the legal representative under oath.

You use it after divorce. If one spouse deeds the marital home to the other to implement a divorce settlement, you claim the spousal transfer exemption. The form records that basis for exemption.

You use it for corporate or entity conveyances. If your LLC sells a warehouse, you report the consideration. If the transfer is part of a legal merger that qualifies for exemption, you state that and attach proof of the merger.

You use it for affordable housing. If the property is a deed-restricted low or moderate income unit, you claim the partial reduction. You must confirm the property class and the restriction.

Typical users:

- Individual sellers

- Estate fiduciaries

- Trustees

- Divorcing spouses

- Business owners

- Title agents acting for sellers

Landlords selling rental property use it. Developers conveying new homes use it. Even transfers for $0 consideration often still require the affidavit to claim the exemption.

If you are unsure whether your deed is exempt, you still complete the RTF 1 and explain the basis. The County Clerk will rely on the affidavit and collect any fee due.

Legal Characteristics of the RTF 1 – Affidavit Of Consideration For Use By Seller

The RTF 1 is a sworn affidavit. It is legally binding because you sign under oath before a notary or other authorized officer. You certify the truth of the consideration, the property details, and the exemption or reduction you claim. False statements can lead to penalties, interest, and other consequences.

Enforceability comes from three points. First, the State requires payment of the Realty Transfer Fee as a condition of recording a deed, unless a statutory exemption applies. Second, the County Clerk must have a complete affidavit to accept the deed for recording in most transactions. Third, the sworn nature of the affidavit carries legal weight. If a later audit shows underpayment, the State can assess additional fee, interest, and penalties.

The affidavit becomes part of the public record. Expect the form to be scanned and accessible with the deed. Do not include Social Security numbers or unrelated personal data. Use legal names and business titles. Keep attachments limited to what supports the fee calculation or exemption.

“Consideration” means the total value given for the property. It includes cash, the amount of any mortgage or lien the buyer assumes, and anything else of value exchanged. It excludes the Realty Transfer Fee itself. If personal property is included in the sale, you may exclude it only if you can show a reasonable, itemized allocation. Built-in appliances are typically treated as part of realty. Freestanding personal property needs a credible separate value to exclude it from consideration.

The fee applies to most deeded transfers of New Jersey real property. Exemptions are specific. Common full exemptions include nominal consideration transfers under $100, qualifying family transfers (spouses, parent and child, grandparent and grandchild), deeds between former spouses incident to divorce, corrective or confirmatory deeds with no new consideration, certain transfers by executors or administrators to heirs, and certain corporate reorganization transfers. Partial reductions apply in limited cases, most often to Class 2 residential property sold by a qualifying senior, blind, or disabled seller, and to deed-restricted low and moderate income housing units. The exemption or reduction must fit the statutory criteria.

Do not confuse the seller’s fee with any separate tax or fee that may apply to the buyer. Those are handled on separate paperwork and do not change your obligation to complete the RTF 1.

How to Fill Out an RTF 1 – Affidavit Of Consideration For Use By Seller

Follow these steps. Have your deed, contract, settlement statement, and any supporting documents handy. Write clearly and use consistent names.

1) Identify the property and recording county.

- Enter the County where you will record the deed. This is the county where the property sits.

- Enter the municipality, property street address, and ZIP.

- Enter the tax map details: Block, Lot, and any Qualifier or Unit number. You can find these on the tax bill, the deed, or the title report.

- Enter the property class code. Class 2 is one- to four-family residential. Class 3A and 3B are farm-related. Class 4A is commercial, 4B industrial, and 4C apartment. Choose the class that matches the assessor’s classification, not how you personally use it.

2) Name the parties.

- List the Grantor(s) exactly as they appear on the deed. If a trust or estate is the seller, use the full legal name and the trustee or executor’s name and title.

- List the Grantee(s) exactly as they appear on the deed.

- Provide mailing addresses for both parties. Use a physical address, not a P.O. Box, for property location. Use a reliable mailing address for future tax mailings.

3) State the consideration.

- Enter the total consideration for the transfer. Use the contract price if it reflects the true value and includes assumed debt.

- Add the amount of any mortgage or lien the buyer assumes. If the buyer takes subject to an existing mortgage, include the unpaid balance as part of consideration.

- Do not include the Realty Transfer Fee itself. Do not subtract your closing credits or seller concessions. Those are separate from consideration.

- Example: You sell for $450,000. The buyer assumes a $50,000 second mortgage. Total consideration is $500,000.

4) Disclose personal property, if any.

- If the price includes removable personal property, list it and its reasonable value. Attach a bill of sale or itemized list.

- Only exclude personal property from consideration if you document it. For example, you sell the house for $400,000 including a $5,000 hot tub and $3,000 furniture. Attach the allocation. Consideration for the fee may be $392,000 if the allocation is credible.

5) Choose the fee status: full fee, partial reduction, or full exemption.

- Full fee: You pay the standard fee based on the consideration. This is typical for most arms-length sales.

- Partial reduction: You claim a reduced fee because you qualify as a senior (62 or older), blind, or disabled seller, and the property is Class 2 residential. You also may claim a reduction for a deed-restricted low or moderate income housing unit. You must occupy the property as your principal residence for the senior, blind, or disabled reduction. Check the applicable box and be ready to show proof of age or disability and occupancy. For low or moderate income housing, be ready to show the recorded restriction.

- Full exemption: You pay no fee because a statutory exemption applies. Examples include:

- Consideration less than $100, with no mortgage payoff or assumption.

- Deed between spouses, including transfers to effect a divorce.

- Deed from parent to child or grandparent to grandchild for nominal consideration.

- Deed from an executor or administrator to a beneficiary.

- Corrective or confirmatory deed with no new consideration.

- Transfer that is part of a statutory merger or consolidation with no consideration beyond stock or ownership interests.

- If you claim a full exemption, select the reason and describe it in the space provided. Attach supporting documents as needed, such as a divorce judgment, Letters Testamentary, or a merger certificate.

6) Calculate the Realty Transfer Fee if due.

- Use the current New Jersey fee schedule. The fee is tiered and applies per $500 (or part) of consideration. It includes State and County portions and supplemental amounts.

- Apply any partial reductions first, where allowed. Senior, blind, or disabled sellers receive reduced State portions on qualifying Class 2 owner-occupied property. The County portion still applies.

- Example: Total consideration is $525,000. You are not exempt. You multiply each tier of the consideration by the corresponding rate and add the supplemental and County portions. The result is the total fee due at recording.

- If you claim a senior, blind, or disabled reduction on a $350,000 sale of your owner-occupied two-family home, calculate the reduced State portion per the schedule, then add the County portion.

7) Identify the deed type and purpose.

- Indicate whether this is a bargain and sale deed, quitclaim deed, executor’s deed, trustee’s deed, or other deed.

- If the deed is corrective or confirmatory, explain the error being corrected and state that there is no new consideration.

8) Provide occupancy and property use information, if needed.

- For senior, blind, or disabled reductions, you must confirm that the property is Class 2 residential and that you occupied it as your principal residence at the time of sale.

- If the property is multi-family, state the number of units and confirm owner occupancy where required.

- If you claim a low or moderate income housing reduction, identify the recorded deed restriction or program and the unit designation.

9) Sign and notarize.

- The affidavit must be signed by the grantor or the grantor’s legal representative. Each seller should sign. If only one signs, that signer must have authority to bind all sellers.

- If you sign as an executor, trustee, guardian, corporate officer, or LLC manager, include your title and attach proof of authority (e.g., Letters Testamentary, trust certification, corporate resolution, or operating agreement excerpt).

- Sign in the presence of a notary or other authorized officer. The notary will complete the jurat, including the date, venue (State and County), and identification of the signer. Make sure your name and title in the signature block match the deed.

10) Assemble and submit with the deed.

- Attach the original, notarized RTF 1 to the original deed.

- Include a copy of any supporting documents for exemptions or reductions.

- Provide a check for the total fee due, payable as required by the County Clerk. If you claim a full exemption, you still submit the affidavit with the deed.

- Record in the county where the property is located. Confirm the recording fee and any county-specific requirements in advance to avoid rejection.

Practical tips and examples:

- Multiple grantors. If you and your sibling sell inherited property, list both as grantors. Both should sign. If one cannot attend, use a valid power of attorney and attach it.

- Mortgage assumptions. You sell for $300,000. The buyer takes the property subject to your $40,000 mortgage. You receive $260,000 cash at closing, but consideration is $300,000. You calculate the fee on $300,000.

- Correcting a deed. Last month’s deed misstated the lot number. You now record a corrective deed that fixes the lot and repeats the prior consideration of $0. You claim the corrective deed exemption. State “Corrects lot number; no new consideration” on the RTF 1.

- Senior reduction. You are 68 and sell your owner-occupied two-family home for $425,000. Class is 2. You claim the senior reduction on the State portion. Bring a copy of a government-issued ID to verify your age and confirm owner occupancy in the affidavit.

- Affordable housing reduction. You sell a deed-restricted moderate income condo. Provide the recorded deed restriction reference. Claim the low/moderate income housing reduction on the State portion.

Common mistakes to avoid:

- Reporting the net cash to seller rather than the total consideration. Always include assumed debt.

- Omitting Block and Lot or using the wrong property class. Use the tax records and title report to confirm.

- Claiming a family exemption that does not qualify. For example, a deed between siblings does not qualify for the parent-child or spousal exemption.

- Forgetting to notarize. Unsigned or unnotarized affidavits will be rejected.

- Misusing personal property allocations. Exclude only well-documented, reasonable amounts. Avoid inflated values meant to reduce the fee.

What to do if facts change at closing:

- If the price changes, update the consideration on the RTF 1 and the deed. Recalculate the fee before recording.

- If you decide to gift instead of sell, update the affidavit to claim the appropriate exemption. State the nominal or no-consideration status.

- If a partial exemption was checked in error, correct the form before signing. If already recorded, consult your title company about filing a corrected affidavit or seeking a refund or additional payment as needed.

Recordkeeping:

- Keep a copy of the signed RTF 1, the deed, the settlement statement, and any supporting documents. Retain them with your tax records. The State can review the transaction later.

Coordination with your closing team:

- Share the draft RTF 1 with your attorney or title agent before closing. Confirm the property class, the consideration, and the exemption basis.

- Verify names and titles match across the contract, deed, affidavit, and ID. Inconsistencies can delay recording.

- Confirm funds for the fee. The closing agent usually collects and remits the fee at recording.

Bottom line: Treat the RTF 1 as part of the deed itself. State the consideration accurately. Claim exemptions or reductions only when you meet the criteria. Sign under oath and record it with the deed. Doing this cleanly ensures your deed records without delay and your seller fee is correct.

Legal Terms You Might Encounter

- Consideration: This is the total value you receive for the property. It includes cash, the buyer’s assumption of your mortgage, and any liens paid off at closing. The form uses this number to set the transfer fee.

- Grantor and Grantee: You are the grantor because you are the seller. The buyer is the grantee. The form will ask for both names exactly as they appear on the deed.

- Realty Transfer Fee: This is a state-imposed fee that you, as the seller, pay when the deed is recorded. The fee is based on consideration. The affidavit supports the fee calculation or an exemption claim.

- Deed: This is the legal document that transfers ownership. You submit the deed with this affidavit. The property details on the affidavit should match the deed.

- Block, Lot, and Qualifier: These are the map references for the property. You will find them on the tax records or the deed. The affidavit needs these to identify the parcel you sold.

- Class 2 Residential: This label covers most one- and two-family homes. The form asks if the property is Class 2 because fee rates can differ by property type. Mark it correctly to avoid miscalculation.

- Exemption: Some transfers are exempt from the fee or qualify for reduced rates. You use the affidavit to state and support any exemption. You also attach proof if you claim one.

- Assumption of Mortgage: The buyer may agree to take over your mortgage. That assumed debt is part of the consideration. Include it on the form even if you receive less cash.

- Personal Property: These are items not fixed to the home, like furniture or appliances not built-in. Personal property is not real estate. Exclude its value from consideration if it is separately agreed.

- Recording: This is the process of filing the deed and affidavit with the county office. Recording makes the transfer part of the public record. The affidavit must be complete and signed to record.

- Notary Acknowledgment: You must sign the affidavit under oath before a notary or authorized officer. The notary confirms your identity and your sworn statements. Missing this step will block recording.

- New Construction: This means a property that has not been previously occupied. The form asks about new construction because certain buyer affidavits or fee rules may apply. Answer accurately to avoid delays.

- Arms-Length Transaction: This is a sale between unrelated parties acting in their own interest. The form may reference this to confirm a fair market deal. If the sale is not arms-length, you still disclose the true consideration.

- Adjustments: These are prorations for taxes, utilities, or association fees. Adjustments do not usually change consideration. Consideration focuses on the agreed property price and assumed debts.

FAQs

Do you need to file this affidavit for every deed recording?

Yes. You file the seller’s affidavit with the deed at recording. The county uses it to set the transfer fee or confirm an exemption. Skipping it can cause a rejection or delay.

Do you include your mortgage payoff in the consideration?

Yes, if the buyer assumes or pays off your mortgage or liens. That payoff or assumed amount counts as consideration. Add it to the cash you receive to show the total value you got.

Do you include personal property in the consideration?

No, not if it is separate and not part of the real estate. List personal property in your contract if you want it excluded. Keep records that show the separate value.

Do you need to notarize the affidavit?

Yes. You must sign under oath before a notary or authorized officer. The county will reject an unsigned or unsworn affidavit.

Do you need a buyer’s affidavit too?

Sometimes. The buyer may need a buyer affidavit for certain fee rules or new construction. Your seller affidavit does not replace any buyer form the recorder requires.

Do you need to file if the consideration is nominal?

Yes. You still submit the affidavit. If the transfer is exempt or for nominal value, the affidavit documents that status. It also helps the recorder classify the deed.

Do you need evidence to claim an exemption or reduction?

Yes. Bring proof that supports your claim. The recorder will not accept unchecked boxes without backup. Attach the documents the form requests.

Do you need a new affidavit if the closing terms change?

Yes, if the consideration or exemption changes before recording. Update the form and resign before a notary. Use the final numbers that match the deed and settlement figures.

Checklist: Before, During, and After the RTF 1 – Affidavit Of Consideration For Use By Seller

Before signing

- Confirm the exact seller names as shown on the current deed.

- Confirm the buyer’s legal name and entity type.

- Gather the property address, block, lot, and qualifier.

- Verify the municipality and county where the deed will be recorded.

- Review your sale contract for the purchase price and terms.

- List all mortgages, liens, and assessments tied to the property.

- Determine if the buyer will assume any debt.

- Get the final settlement figures from the closing statement.

- Identify any personal property with a separate value.

- Decide if any exemptions or reductions may apply.

- Collect proof for any exemption you claim.

- Confirm whether the property is Class 2 residential.

- Schedule a notary for your affidavit signature.

- Prepare payment for the transfer fee and recording charges.

- Confirm county recording requirements for packaging and checks.

- If an agent will sign, obtain a valid power of attorney.

During signing

- Check that the seller’s name on the affidavit matches the deed.

- Verify the buyer’s name is accurate and complete.

- Confirm the property address and map references are correct.

- Ensure the consideration equals cash plus assumed or paid liens.

- Exclude personal property value that is separately agreed.

- Verify the property type and any “new construction” answer.

- Review each checked exemption and attach proof as required.

- Confirm the notary block is filled out and legible.

- Sign in the notary’s presence. Do not pre-sign.

- Initial any corrections. Avoid cross-outs that are unclear.

- Keep the affidavit consistent with the deed and closing statement.

After signing

- Assemble the deed, this affidavit, and any buyer affidavit.

- Include any exemption documents or riders the county requires.

- File the deed package with the county recording office.

- Pay the transfer fee and recording charges at submission.

- Obtain a receipt or submission confirmation.

- Track the recording status until the deed is accepted.

- Request a conformed copy with the recording stamp.

- Give copies to the buyer, your broker, and your closing team.

- Store the original or conformed copy in your records.

- Keep all supporting documents and the closing statement.

- Update your files for tax reporting and financial records.

- Verify that post-closing notices go to the correct address.

Common Mistakes to Avoid RTF 1 – Affidavit Of Consideration For Use By Seller

- Understating consideration. Don’t forget the assumed mortgage or liens paid at closing. If you understate, the recorder may reject the deed or assess back fees and penalties.

- Claiming an exemption without proof. Don’t check a box and skip the documents. The office can deny the claim, charge the higher fee, or hold recording.

- Listing the wrong property identifiers. Don’t guess at block and lot. Errors can misfile your deed or cause delays and rejections.

- Skipping notarization or using an expired notary. Don’t sign without proper acknowledgment. The package will be rejected, costing time and extra trips.

- Mixing in personal property value. Don’t include furniture or other non-real items in consideration. You may overpay the fee or invite questions about your number.

What to Do After Filling Out the Form RTF 1 – Affidavit Of Consideration For Use By Seller

- Align your numbers. Match the affidavit to the deed and final settlement statement. Fix any mismatch before recording.

- Complete your deed package. Include the deed, the seller affidavit, any buyer affidavit, and any exemption proof. Add any required cover sheets or forms for recording.

- Coordinate payment. Prepare checks for the transfer fee and recording charges. Confirm payee names and amounts with the recording office or your closing team.

- Record promptly. Submit the package to the county recording office without delay. Recording secures the buyer’s title and finalizes your fee obligation.

- Confirm acceptance. Track the package until you see a recording stamp. Ask for a conformed copy and a receipt that shows the fees paid.

- Handle corrections quickly. If the deed or affidavit has an error, prepare a corrective affidavit or corrected deed as needed. Re-execute before a notary and resubmit.

- Distribute copies. Give copies to the buyer and your advisors. Keep a complete set with your closing statement and payoff letters.

- Retain records. Store the affidavit, proof of exemptions, settlement statement, and recordings. Keep them for your required retention period and for tax reporting.

- Monitor follow-up items. Watch for property tax changes, association transfers, or utility final bills. Make sure mail and notices go to the right address.

- Review tax impacts. Coordinate with your tax professional on reporting the sale. Use your records to support basis, consideration, and expenses.

- Close the loop with the escrow or title team. Confirm that all liens were paid and releases were sent for recording. Request final confirmations for your file.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.