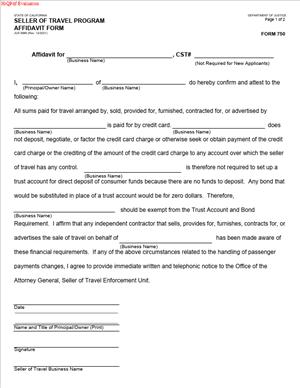

Form 750 – Seller of Travel Program Affidavit Form

Fill out nowJurisdiction: Country: US | Province or State: California

What is a Form 750 – Seller of Travel Program Affidavit Form?

Form 750 is a sworn affidavit you file as part of California’s Seller of Travel registration process. The affidavit confirms the facts you provide to the state about your travel business. It also records the compliance choices you make, such as using a client trust account or a surety bond. By signing, you attest, under penalty of perjury, that the information is true and complete.

You use this affidavit when you register as a seller of travel in California, renew your registration, or report a material change. The affidavit attaches to your registration record. It becomes the state’s basis for granting, renewing, or updating your registration. It also becomes a reference for any audit, inquiry, or complaint review.

Who typically uses this form?

Travel agencies, tour operators, cruise resellers, and online travel sellers who do business with California consumers. Owners, officers, or managing members sign the form. If you operate as a sole proprietor, you sign it yourself. If you are a corporation or LLC, an authorized officer or manager signs it. If you work as an independent travel advisor under your own brand and take client funds, you likely need it. If you act only under another registered seller’s control and do not take client funds yourself, your principal may include you on their schedules instead.

Why would you need this form?

California requires registration before you sell or advertise travel to California consumers. Registration hinges on sworn disclosures. The state wants to know who owns the business, how you safeguard client money, and how customers can reach you. The affidavit is the formal statement that you comply with consumer protection rules. It records your promise to use a trust account or bond. It also records your promise to give required disclosures, keep proper records, and update the state when details change.

Typical usage scenarios include first-time registration for a new travel business, annual renewal, or a change in ownership or structure. If you switch from a trust account to a bond, you use the affidavit to document the change. If you add branch locations or independent advisors, you update the schedules through the affidavit. If you move offices, adopt a new DBA, or change bank accounts, you file an amended affidavit to keep your record current.

In short, Form 750 is the sworn backbone of your seller of travel file. It tells the state who you are, how you operate, and how you protect clients’ funds.

When Would You Use a Form 750 – Seller of Travel Program Affidavit Form?

You use Form 750 at the start, at renewal, and whenever key facts change. Say you launch a new online travel agency that sells packaged tours to California residents. Before any sales, you complete the registration application and this affidavit. The affidavit shows whether you will hold client payments in trust or maintain a bond. It also lists owners, managers, and business locations.

You also use the form each year when you renew. The state expects your sworn confirmation that the information remains accurate. If you added a new branch or new senior officer during the year, you disclose that in your renewal affidavit. If you changed banks or bond carriers, you update those details and attach proof.

You use the form after a material change. For example, you convert from a sole proprietorship to an LLC with a new federal tax ID. That change requires a new registration record. You submit an affidavit for the new entity. Another common change is moving your main office. You must update the address on the affidavit and identify a current agent for service of process. If your product mix shifts, you amend the affidavit to reflect new offerings, such as cruises or certificate-based vacations.

Independent travel advisors use this form in two ways. If you transact under your own seller of travel number and accept funds, you file your own affidavit. If you sell only under a principal’s registration and all payments run through the principal, your principal lists you on their schedules. In that case, the principal’s affidavit covers the relationship and oversight.

Tour operators and consolidators use the form when they start to bundle travel components for sale to consumers. If you package air, hotel, and ground services and market to California residents, the affidavit is part of your registration. It shows how you will handle deposits and when you disburse funds to suppliers.

You also use the form when you wind down or transfer ownership. If you sell your business, the buyer files a new affidavit for their registration. You use the form to notify the state that you ceased operations or that control changed. That protects consumers and clarifies who is responsible for funds and refunds.

In practice, use Form 750 whenever your business identity, control, safeguarding method, or reach to California consumers changes. If you are unsure, file an amendment. The risk of waiting is higher than the cost of an update.

Legal Characteristics of the Form 750 – Seller of Travel Program Affidavit Form

Form 750 is a sworn statement. It is legally binding because you sign it under penalty of perjury under state law. By signing, you certify that the facts are true and complete. False statements can lead to denial, revocation, fines, and criminal exposure. The affidavit also binds the business entity. When an officer signs within their authority, the statements apply to the company as a whole.

Enforceability rests on clear identification, proper authority, and required attachments. The form must show your legal business name, tax ID, and structure. It must show the signer’s title and authority. If you are a corporation or LLC, the signer should be an officer or manager with legal authority. If the form requires notarization, you must follow the notary instructions exactly. Some versions require notarization for certain changes or for out-of-state signers. Missing notarization where required can delay or void processing.

Your safeguarding choice also affects enforceability. California allows two main methods to protect consumer funds: a dedicated client trust account or a surety bond. Your affidavit records which method you use. If you use a trust account, you must title it as a client trust account and limit withdrawals to permitted purposes. If you use a surety bond, it must meet the required coverage amount and effective dates. You attach proof, such as a bank letter or bond certificate. The state may rely on your affidavit to confirm claims and audit trails. In a dispute, the affidavit helps prove what method was in effect and when.

Consumer disclosures are another legal element. The affidavit includes your promise to provide required disclosures to customers. Those disclosures include your registration number and how consumers can seek refunds and remedies. The state uses the affidavit to confirm that you know and accept those duties. If a complaint arises, the affidavit becomes part of the evidence of your commitments.

Timeliness also has legal weight. You must update your record when material facts change. Changes in ownership, business address, bank accounts, bond coverage, or branch locations must be reported promptly. Failure to update can count as a violation. It can also weaken your defense if a consumer claims harm. The state can take action based on late or inaccurate affidavits.

In summary, Form 750 is not a formality. It is a sworn, enforceable record. Treat every line as a statement you can prove with documents and consistent conduct.

How to Fill Out a Form 750 – Seller of Travel Program Affidavit Form

Follow these steps. Keep copies of everything you submit.

1) Gather your records

- Legal business name and any DBAs.

- Federal tax ID or Social Security Number, as applicable.

- Exact business structure and formation details.

- Main office and mailing addresses.

- Direct business phone and email.

- Current registration number, if renewing or amending.

- List of all owners and officers, with titles and percentages.

- Trust account information or bond certificate.

- List of branch locations and independent advisors, if any.

- Agent for service of process, with a California street address.

- Any prior disciplinary or criminal disclosures and explanations.

- Proof of authority for the signer, such as a corporate title.

2) Complete the Business Identification section

- Enter your legal name exactly as on your formation records.

- List every DBA you use in advertising or contracts.

- Provide your main office address. Use a physical location, not a P.O. Box.

- Add a mailing address if different.

- Provide your phone, email, and website if you have one.

- If you already have a registration number, include it. If not, write “New”.

3) State your Business Structure and Tax Details

- Check the correct structure: sole proprietor, partnership, corporation, or LLC.

- Provide your state of formation and formation date.

- Enter your federal tax ID. Sole proprietors may use SSN if allowed.

- If the business recently changed structure, say so. Attach transition documents.

4) Identify Owners, Officers, and Control Persons

- List all owners with direct or indirect control. Include percentages.

- List officers and managing members with titles.

- Provide each person’s business address and contact.

- If any owner is an entity, disclose its owners until you reach individuals.

- Attach a schedule if you need more space. Label it “Schedule A – Ownership.”

5) Describe Your Business Operations

- State the date you began or will begin selling to California consumers.

- Identify the types of travel you sell. Examples: air, hotel, cruise, tours, packages.

- Note whether you sell directly to consumers, through advisors, or both.

- State if you accept client funds or if all client payments go to a principal.

- Describe how and when you transmit funds to suppliers.

6) Choose Your Consumer Funds Safeguard

- Elect one: client trust account or surety bond.

- If trust account:

- Provide the bank name and branch city.

- Provide the titled name of the account. Include “Client Trust Account” in the title.

- Provide only the last four digits of the account number for privacy.

- Attach a bank letter confirming the account title and signers.

- Confirm you will deposit client funds promptly and withdraw only as allowed.

- If bond:

- Provide the bond carrier and bond number.

- State the coverage amount and effective dates.

- Name the principal and business as shown on the bond.

- Attach the original bond or continuation certificate.

- Confirm the bond will remain in force while you sell travel.

7) Acknowledge Consumer Disclosures and Receipts

- Confirm you will display your registration number in ads and on receipts.

- Confirm you will give written terms, including cancellation and refund policies.

- Confirm that receipts will show your business name, address, and registration number.

- Confirm you will keep records for the required retention period.

8) Restitution Fund and Assessments

- Acknowledge that you will pay required assessments when invoiced.

- If a specific product category is exempt from an assessment, explain why.

- Attach any required supporting statement.

9) Branch Offices and Independent Advisors

- List every branch office with address, phone, and on-site manager.

- Confirm each branch follows your safeguard method.

- If you use independent advisors:

- List their names and business addresses.

- Confirm they sell under your supervision.

- Confirm client funds from their sales flow into your trust or through your bonded pipeline.

- Attach “Schedule B – Branches” and “Schedule C – Independent Advisors” as needed.

10) Agent for Service of Process

- Designate a person or entity at a California street address.

- Provide the full name, street address, and phone.

- Confirm they consent to act. Keep proof of consent in your records.

11) Criminal, Civil, and Regulatory History

- Answer the yes/no questions about prior convictions or regulatory actions.

- If yes, provide full details. Include dates, case numbers, and outcomes.

- Attach “Schedule D – Disclosure Explanations” with supporting documents.

12) Banking and Payment Controls

- If using a trust account, state who can sign. Limit signers to authorized staff.

- Confirm your process for reconciling the trust monthly.

- Confirm your rule for disbursement timing. For example, after ticketing or supplier payment.

- If using a bond, describe controls to ensure prompt supplier payment.

13) Advertising and Marketing Practices

- Confirm you will not advertise travel you cannot deliver.

- Confirm you will avoid false or misleading statements.

- Confirm all ads will show your registration number clearly.

- Confirm promotions match the terms provided to clients.

14) Refunds, Cancellations, and Supplier Failure

- Describe your refund process and timeframe.

- Confirm you will inform clients promptly if a supplier fails.

- Confirm you will process refunds according to your policy and applicable rules.

- If you offer travel certificates, describe how funds are safeguarded until redemption.

15) Affirmation and Signature

- Read the perjury statement carefully. It sets the legal standard.

- Sign with ink if filing on paper, or with approved e-sign if allowed.

- Print your name and title. Date and place of signing.

- If notarization is required, appear before a notary and complete the notary block.

- The signer must be an owner, officer, or authorized manager.

16) Attachments Checklist

- Schedule A – Ownership and Control.

- Schedule B – Branch Offices.

- Schedule C – Independent Advisors.

- Schedule D – Disclosure Explanations (if any “Yes” answers).

- Schedule E – Trust Account Bank Letter or Bond Certificate.

- Any DBA filings or formation amendments supporting name changes.

17) Final Review and Submission

- Check every entry for accuracy and consistency.

- Names must match your formation records exactly.

- Addresses must be current and complete.

- Registration number must be correct if renewing or amending.

- Attach the filing fee as directed by the instructions.

- Submit in the manner the form instructions allow. Keep proof of delivery.

18) After You File

- Wait for confirmation. Do not sell to California consumers until registered.

- Once assigned, display your registration number on your website, ads, and receipts.

- Calendar your renewal deadline. Start renewal several weeks before expiration.

- Update the state within 10 days of any material change.

- Keep copies of filed forms, attachments, bank letters, and bonds.

- Reconcile your trust account monthly and keep records on hand.

Practical tips:

- Use the exact account title “Client Trust Account” or the exact bond name used in the bond. Small mismatches can delay approval.

- Do not over-disclose personal data on the form. Follow the form’s privacy guidance. Use last four digits for account numbers where requested.

- If any answer requires context, provide a concise, factual explanation on a schedule. Clarity reduces follow-up questions.

- If you are changing your safeguarding method, overlap coverage. Keep the trust account open until the bond is active, or vice versa.

- Train staff and advisors on receipt content and disclosure placement. The affidavit commits you to these practices.

If you complete each section with care, Form 750 is straightforward. Stay consistent with your corporate records and your safeguarding documents. Sign only when everything is true, current, and backed by your files.

Legal Terms You Might Encounter

- Affidavit means a signed statement of facts you swear are true. On Form 750, you confirm your business details and compliance. You sign under penalty of perjury. That raises the stakes for accuracy.

- Declarant is the person who signs the affidavit. You must have authority to bind the business. If you are the owner or an officer, you are usually the declarant.

- Seller of travel refers to a business that sells or arranges travel for a fee. Form 750 ties your identity to this role. Your registration number and business names should match across all filings.

- Fictitious business name (DBA) is any trade name you use that is not your legal name. Form 750 must list every DBA you use in advertising or contracts. Missing a DBA can cause mismatches with your marketing.

- Control person is any owner, officer, partner, or manager with decision-making power. Form 750 asks for their information. Background disclosures often track to control persons.

- Surety bond is a financial guarantee from a bonding company. It covers certain customer claims if you violate the law. If you use a bond, Form 750 typically needs the bond number, amount, and surety.

- Trust account is a separate bank account to hold customer funds. It protects prepaid money until you deliver the travel. If you use a trust account, Form 750 will ask for bank and account details.

- Customer funds are money you take before providing travel. Form 750 focuses on how you protect these funds. You disclose whether you use a bond, a trust account, or both.

- Gross sales means your total amounts charged for travel sales. Some affidavits ask for past or projected volume. Be consistent with your books and any prior filings.

- Penalty of perjury means you can face legal penalties if you lie on the form. Your signature certifies the truth of the affidavit. Double-check every fact before you sign.

- Change in ownership is any shift in who controls the business. Form 750 usually requires you to update the program when this happens. You may need a new affidavit after changes.

- Residency agent or service of process is a person or company that accepts legal papers for your business. If the form asks for it, list the correct agent name and address. That ensures you receive notices.

FAQs

Do you need a surety bond to complete Form 750, or can you use a trust account?

You can usually protect customer funds with a surety bond, a trust account, or both. The affidavit will ask which method you use. If you use a bond, you provide the bond number and amount. If you use a trust account, you provide bank details. Choose the method that matches your business model and cash flow.

Do sole proprietors need to file the same affidavit as corporations?

Yes, the affidavit requirements apply to all seller of travel businesses. Sole proprietors, partnerships, LLCs, and corporations complete the same core certifications. The ownership section will reflect your structure. Sole proprietors provide their legal name and any DBAs. Corporations list their officers and registered entity information.

Do you need a notary for Form 750?

Many affidavits do not require notarization if you sign under penalty of perjury. Some versions or attachments may call for a notary. Check the signature block instructions. If a notary is required, sign in the notary’s presence. If not, sign and date with your printed name and title.

Do you need a separate affidavit for each branch office?

If you operate multiple locations under one registration, you usually disclose each location on the affidavit or an attachment. Some programs require separate addenda for branch locations. Follow the form instructions. Use the same registration number. Keep addresses and DBAs aligned across all documents.

Do independent contractors or hosted agents need to be listed?

If they sell under your registration or your DBAs, you may need to list them or disclose the relationship. The focus is who sells travel under your authority. If contractors operate under their own registrations, you generally do not list them. Clarify your selling structure and contract terms before you complete the affidavit.

Do you need to update the affidavit if your business changes?

Yes. Material changes often require an update or amended affidavit. Examples include ownership changes, new DBAs, address changes, bond replacements, or switching from trust to bond. Do not wait until renewal if the instructions call for prompt updates. Late updates can cause penalties or suspensions.

Do you need to attach bank statements or bond certificates?

You often attach proof of your financial protection. For a bond, include the bond certificate or declarations page. For a trust account, include a bank letter or statement showing the account is separate and titled correctly. Attach any exhibits the form requests. Label each attachment clearly and reference it on the affidavit.

Do you need to estimate gross sales on the affidavit?

Some affidavits ask for prior-year or expected sales volume. Use conservative, supportable estimates if asked. Align estimates with your budget and accounting records. If you later exceed your estimate, update related items that depend on sales volume, such as bond amounts if that becomes relevant.

Checklist: Before, During, and After the Form 750 – Seller of Travel Program Affidavit Form

Before signing: gather information and documents

- Legal business name and entity type.

- Registration number and any prior filing numbers.

- All DBAs you use in marketing or contracts.

- Principal office address and mailing address.

- Branch locations and sales locations, if any.

- Name, title, and contact of the authorized signatory.

- Owner, officer, and control person names and roles.

- Federal tax ID or SSN, if the form requests it.

- Surety bond details: company name, bond number, and bond amount.

- Trust account details: bank name, account title, and account number suffix.

- Recent bank letter or statement for the trust account.

- Bond certificate or declarations page, if applicable.

- Customer funds handling procedures and refund timelines.

- Prior year gross sales and current-year projections, if requested.

- Advertising disclosures you use in sales materials.

- Any disciplinary history or pending actions, if the form asks for it.

During signing: verify the content and execution

- Confirm the legal name matches your formation documents.

- Confirm DBAs match your marketing assets and contracts.

- Verify branch addresses and phone numbers are current.

- Check the registration number for accuracy.

- Confirm the bond amount and number match the certificate.

- Confirm the trust account is titled as a trust account, not operating.

- Review owner and officer names for spelling and titles.

- Ensure the declarant has authority to sign for the entity.

- Date and sign where indicated, using your printed name and title.

- Do not leave required fields blank; use “N/A” where allowed.

- If a notary is required, sign in front of the notary.

- Reference each attachment by title and page count.

- Initial any corrections if handwritten changes are permitted.

After signing: filing, notifying, and storing

- Submit the affidavit using the required method and format.

- Include all attachments and any required payment or receipt.

- Obtain a submission confirmation or proof of delivery.

- Save a complete, signed copy with all exhibits.

- Store proof of bond or trust account with the affidavit.

- Update your internal compliance calendar for renewals and updates.

- Notify your team about any new disclosures or procedures.

- Review and align your advertising with the affidavit statements.

- Set up alerts to detect changes that trigger an amendment.

- Keep records organized for potential audits or inquiries.

Common Mistakes to Avoid

Missing or mismatched DBAs

- Consequence: Your filing may be rejected or your marketing may be out of compliance.

- Friendly warning: Don’t forget to list every trade name you use anywhere.

Trust account titled incorrectly

- Consequence: Customer funds may be unprotected and you may face penalties.

- Friendly warning: Make sure the account title shows it is a trust account.

Wrong or outdated bond information

- Consequence: Delays, rejection, or a lapse in financial protection.

- Friendly warning: Verify the bond number, amount, and surety before you file.

Unauthorized signer

- Consequence: The affidavit may be invalid and require re-execution.

- Friendly warning: Have an owner or authorized officer sign. Attach authority if needed.

Leaving blanks or missing attachments

- Consequence: Processing delays or rejection.

- Friendly warning: Use “N/A” where allowed and label every exhibit clearly.

What to Do After Filling Out the Form

- Submit the affidavit with all attachments.

- Follow the program’s filing method and format.

- If a fee is required, pay it using the accepted method. Keep proof of submission and payment.

- Confirm receipt. Watch for a confirmation or follow up if you do not receive one.

- Record the date of filing and any reference number.

- Update your compliance file.

- Store the signed affidavit, bond proof, and trust documents together.

- Include a copy of your registration and any prior affidavits. Keep digital and paper copies.

- Align your operations.

- Train staff on disclosures and refund practices you confirmed in the affidavit.

- Update scripts, invoices, and confirmations.

- Ensure your customer funds handling matches your statement.

- Review your advertising.

- Confirm your registration number and disclosures appear where required.

- Check that every DBA in ads is listed on the affidavit. Remove or update any outdated references.

- Set monitoring and reminders.

- Calendar your renewal and any interim reporting.

- Monitor for events that trigger updates, such as ownership changes, address updates, new DBAs, or bond replacements.

- Prepare an amended affidavit when needed.

- Maintain financial protections.

- If you use a trust account, reconcile it regularly. Keep customer funds separate from operating funds.

- If you use a bond, track the bond term and renewal date. Avoid coverage lapses.

- Coordinate with partners.

- If you use independent contractors or hosted agents, confirm that they sell under the correct name and registration.

- Update agreements and training to reflect your current affidavit.

- Prepare for inquiries or audits.

- Keep organized records of deposits, disbursements, client confirmations, and refunds.

- Be ready to show how you protect customer funds.

- Keep bank letters and bond certificates current.

- Handle corrections promptly.

- If you spot an error after filing, prepare an amendment. Use a clean copy of the form.

- Show the corrected information clearly.

- Include updated attachments if the change affects them.

- Communicate changes internally.

- Notify finance, sales, marketing, and operations about updates tied to the affidavit.

- Assign a responsible person for ongoing compliance.

- Add the affidavit to your onboarding checklist for new managers.

- Close out with a compliance review.

- After filing, run a short internal audit against the affidavit.

- Confirm your practices match what you certified.

- Fix any gaps.

- Document the review for your records.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.